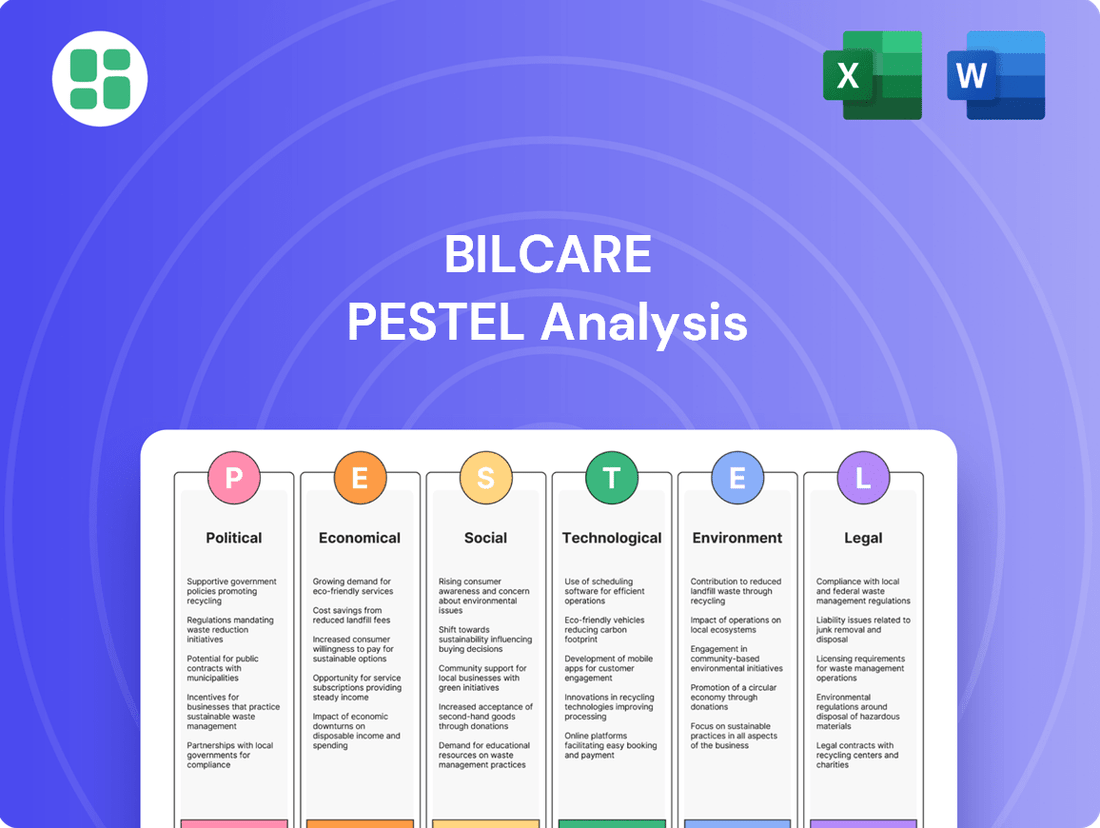

Bilcare PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bilcare Bundle

Unlock the strategic advantages within Bilcare's operating environment with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping its trajectory. Equip yourself with actionable intelligence to navigate market complexities and secure your competitive edge. Download the full analysis now for immediate insights.

Political factors

The Indian government's commitment to bolstering its domestic pharmaceutical industry, through programs like 'Make in India' and production-linked incentives, significantly impacts the demand for pharmaceutical packaging solutions. These policies are designed to foster a supportive ecosystem for companies like Bilcare, especially as they explore revitalizing niche healthcare services. For instance, the production-linked incentive (PLI) scheme for pharmaceuticals, with an outlay of ₹15,000 crore (approximately $1.8 billion USD) for 2021-2022, aims to increase domestic production and exports, thereby driving demand for associated packaging materials.

Regulatory encouragement for local manufacturing can lead to a reduced dependence on imported packaging components and strengthen the domestic supply chain. This shift benefits companies with a strong local presence, potentially improving cost efficiencies and lead times for Bilcare's operations in India. The government's focus on quality and compliance within the pharmaceutical sector also necessitates advanced and reliable packaging, aligning with Bilcare's expertise in specialized pharmaceutical packaging solutions.

The pharmaceutical industry operates under a stringent regulatory framework, demanding high standards for drug safety, quality, and efficacy. This directly impacts packaging choices, requiring sophisticated solutions that ensure product integrity throughout the supply chain. For companies like Bilcare, navigating these regulations is paramount for market entry and continued success, particularly in export markets.

In India, the Ministry of Health and Family Welfare, along with agencies like the Central Drugs Standard Control Organisation (CDSCO), sets rigorous guidelines. Internationally, bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose equally demanding standards. Bilcare's commitment to adhering to these evolving regulations, including those concerning serialization and track-and-trace, is crucial for maintaining its competitive edge and ensuring global market access.

Governments globally are intensifying efforts against counterfeit pharmaceuticals, with India leading the charge through stricter legislation and advanced tracking technologies. This aligns perfectly with Bilcare's established expertise in anti-counterfeiting solutions.

The global market for pharmaceutical packaging is projected to reach $135.2 billion by 2029, with a significant portion driven by the demand for enhanced security features like QR codes and tamper-evident seals, crucial for drug safety and traceability.

This regulatory environment creates a substantial opportunity for Bilcare to leverage its experience and offer innovative packaging solutions that meet the growing need for authenticity and supply chain integrity.

Trade Agreements and Tariffs

International trade agreements and tariffs directly influence Bilcare's operational costs and market positioning. For instance, an increase in import duties on specialty polymers, a key raw material, could significantly raise production expenses. Conversely, favorable trade pacts that reduce export barriers for finished packaging products could boost Bilcare's global sales reach.

Recent trade dynamics highlight the volatility. As of early 2024, the global trade landscape continues to be shaped by ongoing negotiations and potential protectionist measures in various regions. For Bilcare, this means paying close attention to changes in import duties on materials like high-barrier films and potential export incentives for pharmaceutical packaging in key markets.

- Impact of Tariffs: Fluctuations in tariffs on specialty polymers and foils can directly affect Bilcare's cost of goods sold, impacting pricing strategies and profit margins.

- Trade Agreement Benefits: Favorable trade agreements can reduce export duties and streamline customs, enhancing Bilcare's competitiveness in international pharmaceutical packaging markets.

- Strategic Sourcing: Monitoring shifts in import/export policies is vital for Bilcare's strategic sourcing of raw materials and for optimizing its market penetration efforts.

Political Stability and Business Climate

Political stability is a cornerstone for Bilcare's operational success and its ambitious restructuring and revival initiatives. A predictable business environment, characterized by consistent policies and transparent regulations, is crucial for fostering investor confidence. For instance, the Indian government's focus on improving the ease of doing business, as evidenced by its consistent ranking improvement in the World Bank's Doing Business report (though the report was discontinued in 2020, the underlying sentiment for reform persists), directly impacts Bilcare's ability to attract the necessary capital and operate efficiently.

Sudden shifts in government policy or political instability can significantly disrupt Bilcare's turnaround strategy. Uncertainty surrounding trade policies, taxation, or foreign investment regulations could deter potential investors who are vital for the company's financial resurgence. The company's reliance on both domestic and international markets means it is particularly susceptible to geopolitical developments and changes in trade agreements that could impact its supply chain and customer base.

- Policy Consistency: Bilcare's revival plans hinge on predictable government policies related to manufacturing, pharmaceuticals, and packaging sectors.

- Ease of Doing Business: Improvements in India's regulatory framework, aimed at simplifying business operations, are critical for Bilcare's operational efficiency and cost management.

- Investor Confidence: Political stability in key operating regions directly influences investor sentiment, impacting Bilcare's ability to secure funding for its growth and modernization projects.

- Regulatory Environment: Changes in environmental regulations or product safety standards, often driven by political decisions, can affect Bilcare's manufacturing processes and product development.

Government initiatives like India's 'Make in India' and production-linked incentives (PLI) are actively stimulating the domestic pharmaceutical sector, thereby increasing demand for packaging solutions. For instance, the PLI scheme for pharmaceuticals, with a substantial outlay, aims to boost local production and exports, directly benefiting companies like Bilcare that supply essential packaging materials.

The regulatory landscape, governed by bodies such as the CDSCO in India and the FDA internationally, mandates stringent quality and safety standards for pharmaceutical packaging. Bilcare's adherence to these evolving regulations, including track-and-trace requirements, is crucial for market access and maintaining a competitive edge, especially as the global pharmaceutical packaging market is projected to reach $135.2 billion by 2029.

International trade policies and tariffs significantly influence Bilcare's operational costs and market reach. Fluctuations in import duties on raw materials like specialty polymers can impact production expenses, while favorable trade agreements can reduce export barriers, enhancing competitiveness in global markets. As of early 2024, the global trade environment remains dynamic, with ongoing negotiations and potential protectionist measures requiring close monitoring.

Political stability is fundamental to Bilcare's revival strategy, fostering investor confidence through predictable policies and a transparent regulatory environment. Improvements in the ease of doing business, a key focus for the Indian government, are vital for operational efficiency and attracting the capital necessary for modernization projects.

| Government Initiative | Impact on Bilcare | Supporting Data/Context |

|---|---|---|

| Make in India / PLI Scheme | Increased demand for pharmaceutical packaging; potential for domestic supply chain strengthening. | PLI scheme outlay for pharmaceuticals: ₹15,000 crore (approx. $1.8 billion USD) for 2021-2022. |

| Regulatory Standards (CDSCO, FDA, EMA) | Necessitates advanced, compliant packaging solutions; crucial for market access. | Global pharmaceutical packaging market projected to reach $135.2 billion by 2029, driven by security features. |

| Trade Policies & Tariffs | Affects raw material costs and export competitiveness. | Early 2024 global trade landscape characterized by ongoing negotiations and potential protectionism. |

| Ease of Doing Business Reforms | Enhances operational efficiency and investor confidence. | India's consistent ranking improvements in global ease of doing business reports (pre-discontinuation). |

What is included in the product

This Bilcare PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A concise PESTLE analysis for Bilcare that highlights key external factors, aiding in strategic decision-making and mitigating potential market disruptions.

Economic factors

The pharmaceutical packaging market in India is on a strong upward trajectory. It's expected to grow from an estimated USD 1,907.2 million in 2024 to USD 3,447.8 million by 2033, reflecting a compound annual growth rate of 6.1%. This significant expansion is fueled by the rapid development of India's pharmaceutical sector and increasing healthcare spending across the nation.

This growth is a direct result of the expanding pharmaceutical industry in India and the continuous rise in healthcare expenditure. As more people access healthcare and the pharmaceutical output increases, the demand for specialized packaging solutions naturally follows suit.

Bilcare's strategic emphasis on specialized packaging solutions and healthcare services places it in a favorable position to benefit from this burgeoning market. The company's focus aligns well with the increasing need for high-quality, secure, and compliant packaging within the growing Indian pharmaceutical landscape.

Fluctuations in the prices of key raw materials, such as plastic resins and aluminum foils, directly impact Bilcare's profitability. For instance, the price of PET resin, a primary component in many packaging solutions, saw significant swings in 2024, with some reports indicating a 15-20% increase in certain regions due to supply chain disruptions and rising energy costs.

Managing these cost volatilities is crucial for Bilcare, especially considering its recent financial performance. The company's ability to maintain stable margins hinges on its success in navigating these economic headwinds. Efficient supply chain management and the implementation of effective hedging strategies are therefore paramount to mitigating this economic risk and ensuring operational stability.

Rising inflation in 2024 and early 2025 has presented challenges, with consumer price index (CPI) figures in key markets showing persistent upward pressure, potentially increasing Bilcare's operational costs for raw materials, labor, and energy. This inflationary environment, coupled with central bank responses, has led to higher interest rates. For instance, major economies have maintained or slightly increased benchmark rates throughout this period, making borrowing more expensive.

Higher interest rates directly impact Bilcare's cost of capital. Any new debt financing for expansion or refinancing existing obligations becomes costlier, potentially squeezing profit margins. While Bilcare reported a positive shift to profitability in Q4 of the fiscal year ending March 2025, demonstrating resilience, sustained high borrowing costs could hinder its ability to invest in growth or manage its debt efficiently. The company's debt-to-equity ratio, if significant, would be particularly sensitive to these rate hikes.

Consumer Healthcare Spending Trends

Consumer healthcare spending in India is on a significant upswing, driven by heightened health awareness and a growing middle class. This translates directly into increased demand for pharmaceuticals, both prescription and over-the-counter medications, which in turn fuels the need for robust pharmaceutical packaging solutions. The Indian pharmaceutical market was valued at approximately USD 42 billion in 2023 and is projected to reach USD 65 billion by 2024, indicating a strong growth trajectory.

This patient-centric approach and the escalating demand for safe, user-friendly packaging present a clear demand-side opportunity for companies like Bilcare. As consumers become more discerning about the quality and usability of their medication packaging, there's a growing premium on innovative and reliable solutions. The pharmaceutical packaging market in India is expected to grow at a CAGR of around 7.5% between 2024 and 2029.

The overall expansion of the pharmaceutical sector is intrinsically linked to packaging demand. Key growth drivers include an aging population, rising disposable incomes, and increased access to healthcare services. For Bilcare, this means a sustained and growing market for its specialized packaging products, catering to the evolving needs of drug manufacturers and end-users alike.

Key trends influencing consumer healthcare spending and packaging demand include:

- Rising disposable incomes: Enabling greater expenditure on health and wellness products.

- Increased health consciousness: Leading to proactive healthcare seeking and medication adherence.

- Government initiatives: Such as Ayushman Bharat, expanding healthcare access and coverage.

- Technological advancements: In drug delivery systems and packaging, demanding specialized materials.

Company Financial Performance and Valuation

Bilcare Limited's financial performance shows a mixed picture for the 2024-2025 period. For the quarter ending March 2025, the company reported a consolidated net profit of Rs 10.56 crore, a notable turnaround from the net loss experienced in the same quarter of the previous year. However, this quarterly gain was contrasted by a decline in net sales during the same period, suggesting that revenue generation remains a challenge.

Despite the positive quarterly profit, Bilcare Limited concluded the full fiscal year 2025 with an overall net loss. This indicates that while there are signs of operational improvement, the company is still in a recovery phase and has not yet achieved sustained profitability across the entire financial year. The ongoing efforts to restructure and improve financial health are evident.

The company's valuation, as reflected in its market capitalization and share price, is closely tied to investor perception of its revival. Fluctuations in its stock performance can be attributed to the market's assessment of its restructuring initiatives and the potential for future earnings growth. Investors are closely watching for consistent positive financial results to signal a sustainable turnaround.

- March 2025 Quarter Net Profit: Rs 10.56 crore.

- Full Year FY2025 Performance: Net loss reported.

- Net Sales Trend: Declined in the March 2025 quarter.

- Investor Sentiment: Influenced by restructuring progress and revival prospects.

Economic factors present a dual-edged sword for Bilcare. While the burgeoning Indian pharmaceutical market, projected to reach USD 65 billion by 2024, offers significant growth opportunities, raw material price volatility, exemplified by PET resin price swings of 15-20% in 2024, poses a direct threat to profitability. Furthermore, persistent inflation and the resulting higher interest rates, with benchmark rates remaining elevated in major economies, increase Bilcare's cost of capital, impacting its ability to invest and manage debt, despite a positive net profit of Rs 10.56 crore in Q4 FY25.

| Economic Factor | Impact on Bilcare | Data Point/Trend (2024-2025) |

|---|---|---|

| Indian Pharma Market Growth | Increased demand for packaging | Projected to reach USD 65 billion by 2024 |

| Raw Material Price Volatility | Pressure on profitability | PET resin prices saw 15-20% increases in some regions in 2024 |

| Inflation & Interest Rates | Higher cost of capital | Benchmark rates remained elevated; increased borrowing costs |

| Company Financials (FY2025) | Signs of recovery, but overall loss | Q4 FY25 Net Profit: Rs 10.56 crore; Full Year FY25: Net Loss |

Preview Before You Purchase

Bilcare PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Bilcare's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at Bilcare's external environment.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete PESTLE analysis for informed strategic decisions.

Sociological factors

Growing health consciousness in India is a significant driver for the pharmaceutical sector. In 2023, the Indian pharmaceutical market was valued at approximately USD 42 billion and is projected to reach USD 65 billion by 2024, indicating robust growth fueled by increased awareness and demand for healthcare products.

Improved access to healthcare services, including a wider network of clinics and hospitals, further stimulates pharmaceutical consumption. This societal trend directly translates into a higher demand for pharmaceutical packaging, especially specialized solutions for diverse drug formulations that Bilcare offers.

Bilcare's strategic emphasis on healthcare services and niche packaging solutions is well-positioned to capitalize on this societal shift. The company's focus on areas like blister packaging and child-resistant closures caters directly to the evolving needs of a population prioritizing better health management and drug safety.

Growing consumer awareness regarding drug safety, authenticity, and accurate dosing is fueling a significant demand for packaging that offers enhanced protection. This includes features like tamper-evidence and child resistance, making packaging more secure and user-friendly. For instance, the global pharmaceutical packaging market, valued at approximately $100 billion in 2023, is projected to grow, with safety features being a key driver.

Packaging solutions incorporating restricted access, such as unit-dose and blister packs, are becoming increasingly vital. These formats not only protect against counterfeiting but also ensure patient compliance and prevent accidental ingestion. The fight against counterfeit drugs, which the World Health Organization estimates cause at least 10% of all deaths in Africa, underscores the urgency for such secure packaging.

Bilcare's established capabilities in anti-counterfeiting technologies and patient-centric packaging solutions are well-positioned to meet these evolving societal expectations. The company's focus on innovative packaging directly addresses concerns about drug integrity and patient well-being, aligning with a global trend towards more responsible pharmaceutical supply chains.

The global population is aging rapidly, with projections indicating that by 2050, individuals aged 65 and over will constitute over 16% of the world's population. This demographic shift, mirrored in India where the elderly population is expected to reach 340 million by 2050, directly fuels a consistent demand for pharmaceuticals. Simultaneously, the increasing incidence of chronic diseases like diabetes and cardiovascular conditions among these age groups further solidifies this market need.

This evolving patient demographic presents specific requirements for pharmaceutical packaging. Ease of use for elderly individuals, often facing dexterity challenges, becomes paramount. Furthermore, child-resistant and tamper-evident features remain critical to ensure medication safety and prevent misuse. Bilcare's strategic alignment with healthcare services and its expertise in specialized packaging solutions, such as unit-dose packaging and easy-open blister packs, positions it well to address these critical needs.

Shifting Consumer Preferences for Sustainability

Consumers are increasingly prioritizing products that are kind to the planet, and this extends to the packaging they encounter. This means a growing demand for packaging made from materials like biodegradable plastics, recycled content, and even paper. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay more for sustainable packaging. This societal shift is a significant driver for companies in the packaging sector.

Bilcare's success hinges on its capacity to adapt to these evolving consumer tastes. By developing and offering innovative, eco-friendly packaging solutions, the company can better align with market expectations. This includes exploring new material science and manufacturing processes to reduce environmental impact. The global sustainable packaging market is projected to reach over $400 billion by 2027, underscoring the immense opportunity.

- Growing Demand: Consumer surveys in 2024 show a strong preference for sustainable packaging.

- Material Innovation: Companies like Bilcare are investing in biodegradable and recycled materials.

- Market Opportunity: The sustainable packaging sector is experiencing significant growth, with projections indicating a market value exceeding $400 billion by 2027.

- Competitive Advantage: Offering eco-friendly solutions is becoming a key differentiator in the packaging industry.

Public Perception and Corporate Social Responsibility

Bilcare's history of financial difficulties and the subsequent restructuring efforts place significant emphasis on its public perception and corporate social responsibility (CSR) activities. Rebuilding trust with consumers, employees, and investors hinges on demonstrating a genuine commitment to ethical operations and community well-being.

Engaging in targeted CSR initiatives, especially within the healthcare industry where Bilcare operates, can significantly bolster its brand image. For instance, in 2024, many companies are focusing on measurable environmental, social, and governance (ESG) metrics to attract socially conscious investors. Bilcare's efforts to align with these trends could be a key differentiator.

- Rebuilding Trust: Past financial restructuring necessitates a strong focus on positive public perception.

- CSR in Healthcare: Targeted CSR activities within the healthcare sector can enhance reputation among stakeholders.

- Investor Attraction: Demonstrating commitment to ESG principles, a growing trend in 2024-2025, can attract socially responsible investors.

- Brand Image Enhancement: Ethical practices and community welfare initiatives are crucial for Bilcare's long-term revival and brand perception.

Societal shifts towards greater health awareness and accessibility to healthcare services are directly boosting demand for pharmaceutical packaging. In 2023, the Indian pharmaceutical market was valued at approximately USD 42 billion, with projections reaching USD 65 billion by 2024, highlighting this growth. This trend necessitates specialized packaging solutions, such as those Bilcare provides, to cater to diverse drug formulations and enhance patient safety and compliance.

The aging global population, expected to comprise over 16% of the world's population by 2050, coupled with the rise in chronic diseases, solidifies the need for pharmaceuticals and, consequently, specialized packaging. This demographic requires packaging that is easy to use and ensures medication safety through features like child resistance and tamper evidence, areas where Bilcare has established expertise.

Consumer demand for sustainable packaging is rapidly increasing, with over 60% of consumers in a 2024 survey willing to pay more for eco-friendly options. Bilcare's ability to innovate with biodegradable and recycled materials positions it to capture a significant share of the sustainable packaging market, projected to exceed $400 billion by 2027.

Bilcare's public perception and corporate social responsibility (CSR) are critical for its revival, especially given past financial restructuring. In 2024-2025, demonstrating commitment to ESG principles and engaging in targeted CSR within the healthcare sector can attract socially conscious investors and rebuild trust.

Technological factors

Innovation in packaging materials, like advanced polymers and eco-friendly films, is reshaping pharmaceutical packaging. These developments offer better protection and longer shelf life, crucial for drug efficacy and safety. For instance, the global pharmaceutical packaging market was valued at approximately USD 115 billion in 2023 and is projected to reach over USD 170 billion by 2028, highlighting the significant impact of material science.

Bilcare's established expertise in specialty polymers and films positions it well to capitalize on these material advancements. The company's history in developing innovative packaging solutions can be a key differentiator, especially as demand grows for sustainable and high-performance packaging. This allows Bilcare to integrate cutting-edge materials that meet evolving regulatory and consumer expectations.

The demand for intelligent packaging, featuring QR codes, RFID tags, NFC chips, and temperature-sensitive labels, is surging. This growth is driven by the need to enhance drug traceability, confirm authenticity, and boost patient adherence. For instance, the global smart packaging market was valued at approximately $30 billion in 2023 and is projected to reach over $50 billion by 2028, demonstrating a significant compound annual growth rate.

These advanced technologies are crucial for ensuring drug safety, particularly for international shipments, and offer consumers valuable product information. They play a vital role in combating the estimated $200 billion global counterfeit drug market, a figure that continues to rise.

Bilcare's established expertise in anti-counterfeiting solutions, notably its nCID technology, provides a strong foundation for re-engagement and innovation within this rapidly expanding smart packaging sector. This positions the company to capitalize on the increasing regulatory and consumer focus on product integrity.

The manufacturing sector, including packaging, is seeing a significant surge in automation and digitalization. This trend is directly impacting operational efficiency, leading to lower costs and greater precision in production lines.

For instance, the global industrial automation market was valued at approximately USD 284.5 billion in 2023 and is projected to reach USD 460.9 billion by 2030, growing at a CAGR of 7.1%. This widespread adoption highlights the tangible benefits companies are realizing.

In India, where the generic drug industry is booming, the ability to achieve high-scale production coupled with customization is paramount. Automation directly supports these needs, allowing manufacturers to meet the growing demand for pharmaceuticals efficiently.

Bilcare's own manufacturing facilities and operational strategies stand to gain considerably by integrating advanced automation and digital technologies. This could translate into improved throughput, reduced waste, and enhanced product quality, strengthening its competitive position.

Research and Development in Healthcare Solutions

Continued investment in research and development (R&D) is crucial for Bilcare to create cutting-edge packaging solutions and healthcare services that address the dynamic demands of the industry. This focus on innovation is particularly important as the healthcare sector evolves rapidly.

R&D efforts in specialized areas such as advanced drug delivery systems, temperature-controlled cold chain solutions for delicate biologics, and efficient clinical trial supply chain management are key to unlocking new avenues for market growth. These advancements can significantly differentiate Bilcare's offerings.

Bilcare's established legacy as a research-driven entity provides a strong bedrock for fostering future innovation. For instance, in 2024, the global pharmaceutical packaging market was valued at approximately $100 billion, with R&D being a significant driver of growth within this sector. Companies are increasingly investing in smart packaging and sustainable materials, areas where Bilcare's R&D can yield substantial returns.

- Innovation in Drug Delivery: Developing novel packaging for targeted drug release or enhanced bioavailability.

- Cold Chain Advancement: Creating more robust and cost-effective solutions for transporting temperature-sensitive pharmaceuticals.

- Clinical Trial Support: Streamlining the supply chain for clinical trials through advanced packaging and logistics.

- Sustainable Packaging: Investing in eco-friendly materials and designs to meet growing environmental regulations and consumer demand.

Anti-Counterfeiting and Authentication Technologies

The global pharmaceutical market faces a significant challenge from counterfeit drugs, a problem that continues to spur advancements in anti-counterfeiting and authentication technologies. This persistent threat underscores the importance of robust solutions to protect both products and consumers.

Bilcare's proprietary nCID technology exemplifies this innovation, providing integrated track and trace capabilities alongside authentication solutions for product and personal identification security. This technology is designed to combat the illicit trade of pharmaceuticals.

The World Health Organization (WHO) estimates that counterfeit medicines may account for up to 10% of the global drug market, a figure that can be higher in certain regions. This highlights the substantial economic and health risks associated with counterfeiting.

By continually refining and expanding its nCID technology, Bilcare can solidify its position as a leader in pharmaceutical security. Such strategic investment in proprietary technologies not only serves as a crucial differentiator but also presents a significant opportunity for generating new revenue streams in a market increasingly demanding verifiable product integrity.

Technological advancements are fundamentally altering pharmaceutical packaging, with innovations in materials like advanced polymers and eco-friendly films enhancing drug protection and shelf life. The global pharmaceutical packaging market, valued at approximately USD 115 billion in 2023, is projected to exceed USD 170 billion by 2028, underscoring the impact of these material science breakthroughs.

The rise of intelligent packaging, incorporating technologies such as QR codes and RFID tags, is driven by the need for improved drug traceability and authenticity verification. This sector was valued at around $30 billion in 2023 and is expected to grow to over $50 billion by 2028, reflecting a significant compound annual growth rate.

Automation and digitalization are transforming manufacturing, boosting operational efficiency and precision in packaging production. The global industrial automation market was valued at approximately USD 284.5 billion in 2023, with projections reaching USD 460.9 billion by 2030.

Continued investment in research and development is vital for Bilcare to pioneer cutting-edge solutions, particularly in areas like advanced drug delivery systems and cold chain logistics, where innovation is a key differentiator.

| Technological Factor | Market Value (2023) | Projected Market Value (2028) | Key Trend |

|---|---|---|---|

| Advanced Materials | USD 115 billion (Pharma Packaging) | USD 170 billion (Pharma Packaging) | Eco-friendly films, high-performance polymers |

| Intelligent Packaging | USD 30 billion (Smart Packaging) | USD 50 billion (Smart Packaging) | QR codes, RFID, NFC for traceability |

| Automation & Digitalization | USD 284.5 billion (Industrial Automation) | USD 460.9 billion (Industrial Automation, 2030) | Increased efficiency, precision in manufacturing |

Legal factors

Bilcare, operating within India's pharmaceutical sector, must meticulously comply with the Drugs & Cosmetics Act and its accompanying regulations. These rules are comprehensive, covering everything from how drugs are manufactured and sold to the specific requirements for their packaging. For instance, the Act mandates detailed specifications for packaging materials, precise labeling information, and stringent quality control measures, ensuring product safety and efficacy.

Failure to adhere to these legal mandates carries significant consequences for Bilcare, including substantial fines and the potential revocation of operational licenses. Maintaining strict compliance is therefore not just a legal obligation but a critical factor in ensuring business continuity and preserving the company's reputation as a reliable supplier in the pharmaceutical packaging market.

Bilcare's past financial difficulties and ongoing restructuring efforts highlight the crucial role of corporate governance and restructuring laws. Adherence to regulations governing corporate debt, insolvency, and restructuring is paramount for the company's legal standing and to rebuild investor trust. For instance, the successful completion of its debt restructuring plan, which was a significant focus in 2023 and continued into early 2024, demonstrated its commitment to legal compliance.

Protecting its intellectual property, such as patents for specialty polymers and anti-counterfeiting technologies, is vital for Bilcare's competitive edge. These innovations are key to its success in specialized markets.

Strong intellectual property rights management is essential to deter infringement and capitalize on Bilcare's advancements. This focus helps maintain its market position.

Bilcare's commitment to intellectual property has been acknowledged in the past, highlighting its dedication to safeguarding its unique innovations and designs.

Environmental Regulations and Compliance

Environmental regulations are becoming stricter, particularly concerning plastic waste and the chemicals used in packaging. For Bilcare, this means adapting manufacturing to meet new standards for recycling and reducing hazardous substances. For instance, the push for Extended Producer Responsibility (EPR) schemes, which are gaining traction globally, necessitates investment in more sustainable materials and end-of-life product management.

Compliance is key to avoiding penalties. In 2024, many regions saw increased enforcement of packaging waste directives. For example, the European Union's Packaging and Packaging Waste Regulation continues to evolve, pushing companies like Bilcare towards higher recycled content and improved recyclability. Non-compliance can lead to significant fines and damage a company's reputation, impacting customer trust and market access.

- Stricter Regulations: Growing global emphasis on reducing plastic waste and controlling hazardous substances in packaging materials directly affects Bilcare's operations and product development.

- EPR Implementation: Compliance with Extended Producer Responsibility (EPR) mandates, which are becoming more common, requires proactive investment in sustainable sourcing and waste management strategies.

- Financial Impact: Investing in eco-friendly materials and processes to meet these evolving legal requirements can represent a substantial capital expenditure for companies like Bilcare.

- Risk of Non-Compliance: Failure to adhere to environmental laws can result in substantial fines, operational disruptions, and significant reputational damage, potentially impacting market share.

Labor Laws and Employment Regulations

Bilcare, like any employer, must navigate a complex web of labor laws. These regulations cover everything from minimum wage and working hours to workplace safety and employee benefits. For instance, in India, where Bilcare has significant operations, the Code on Wages, 2019, aims to consolidate and simplify wage and bonus payments, impacting how Bilcare compensates its workforce.

Given recent restructuring efforts, Bilcare's management of workforce adjustments is under particular scrutiny. Any layoffs or changes in employment contracts must strictly adhere to Indian labor legislation, such as the Industrial Disputes Act, 1947, which outlines procedures for retrenchment and dispute resolution. Failure to comply could lead to significant legal challenges and financial penalties.

Maintaining a positive employee relations environment is crucial, especially during periods of change. Bilcare's commitment to fair labor practices not only fosters employee morale but also mitigates the risk of costly litigation. For example, in 2023, India saw a rise in labor union activities, emphasizing the importance of proactive engagement with employees on matters of working conditions and benefits.

- Compliance with India's Code on Wages, 2019 ensures fair and standardized wage practices.

- Adherence to the Industrial Disputes Act, 1947 is critical for managing workforce restructuring without legal repercussions.

- Proactive employee engagement is vital to maintain morale and prevent labor disputes, especially in light of increased unionization trends observed in 2023.

- Ensuring safe working conditions as mandated by various labor laws protects employees and avoids potential liabilities for Bilcare.

Bilcare's operations are heavily influenced by India's pharmaceutical regulations, including the Drugs & Cosmetics Act, which dictates packaging, labeling, and quality control standards. Non-compliance can lead to fines and license revocation, impacting business continuity. Recent restructuring efforts in 2023-2024 underscore the importance of adhering to corporate governance and debt restructuring laws to maintain legal standing and investor confidence.

The company's competitive edge relies on protecting intellectual property, such as patents for specialty polymers and anti-counterfeiting technologies, which are crucial for specialized markets. Moreover, evolving environmental regulations, particularly concerning plastic waste and hazardous substances, necessitate investment in sustainable materials and adherence to schemes like Extended Producer Responsibility (EPR), with stricter enforcement seen in 2024, especially in regions like the EU.

Labor laws, including India's Code on Wages, 2019, and the Industrial Disputes Act, 1947, govern wage practices and workforce adjustments. Proactive employee engagement is vital, especially given increased unionization trends in 2023, to prevent disputes and ensure safe working conditions, thereby mitigating legal liabilities.

Environmental factors

The global push for environmental sustainability is significantly boosting the demand for eco-friendly pharmaceutical packaging. This trend is compelling companies to explore options like biodegradable plastics, recycled materials, and paper-based solutions to address environmental concerns and meet evolving international regulations.

In 2024, the sustainable packaging market is projected to reach an estimated $400 billion globally, with the pharmaceutical sector being a key contributor. Bilcare must therefore innovate its product offerings to include more sustainable choices to stay competitive in this rapidly expanding market.

Stricter regulations on plastic waste management and recycling are now a significant factor for packaging companies like Bilcare. These evolving mandates push manufacturers to be more accountable for product lifecycles, particularly concerning end-of-life disposal.

To comply, Bilcare needs to invest in developing or adopting materials and processes that are either easily recyclable or biodegradable. For instance, the EU's Circular Economy Action Plan, updated in 2020 and with ongoing implementation, sets ambitious targets for packaging recycling rates, with specific focus on plastics, aiming for all packaging to be reusable or economically recyclable by 2030.

This regulatory pressure creates a dual dynamic: it poses a compliance challenge but also serves as a powerful catalyst for innovation in developing more sustainable packaging solutions, potentially opening new market opportunities for environmentally conscious companies.

Bilcare's manufacturing operations, like many in the pharmaceutical packaging sector, are subject to growing environmental regulations and public concern regarding their carbon footprint and energy consumption. Companies are increasingly expected to demonstrate a commitment to sustainability, driving a need for greener manufacturing processes.

The pressure to reduce carbon emissions and energy usage is a significant environmental factor for Bilcare. For instance, the global average for carbon emissions from industrial processes was approximately 15.2 gigatons of CO2 equivalent in 2023, highlighting the scale of the challenge. Adopting renewable energy sources and improving energy efficiency in its facilities directly contributes to corporate social responsibility and can also lead to long-term operational cost savings.

Resource Scarcity and Raw Material Sourcing

Resource scarcity and the sustainable sourcing of raw materials, particularly petroleum-based polymers and metals like aluminum, present significant environmental challenges for companies like Bilcare. The increasing global demand for these materials, coupled with concerns over their finite nature, directly impacts procurement strategies and operational costs. For instance, the price of aluminum, a key component in some packaging solutions, saw significant volatility in 2024, influenced by energy costs and geopolitical factors impacting mining and refining operations.

Depletion of natural resources and the imperative for ethical sourcing are no longer fringe concerns but critical elements for supply chain resilience and corporate reputation. Consumers and investors alike are scrutinizing companies' environmental footprints, making sustainable procurement a competitive advantage. Companies that can demonstrate responsible sourcing of materials like PET, a common polymer, are better positioned to mitigate risks associated with future regulatory changes and negative publicity.

Bilcare's procurement strategies must therefore actively consider the environmental impact and sustainability of its material sources. This includes evaluating suppliers based on their environmental management systems and commitments to reducing waste and emissions. The push towards a circular economy, where materials are reused and recycled, is gaining momentum, and companies that adapt their sourcing to incorporate recycled content will likely see improved sustainability metrics and potentially lower material costs in the long run.

- Global plastic waste generation was estimated to reach over 250 million metric tons annually by 2025, highlighting the pressure on virgin polymer sourcing.

- The average price of aluminum experienced fluctuations throughout 2024, with factors like energy prices and supply chain disruptions impacting its cost.

- Many major corporations have set targets to increase their use of recycled content in packaging, with some aiming for 30% or more by 2025.

Environmental Impact Assessments and Certifications

New manufacturing or expansion projects for companies like Bilcare often necessitate thorough environmental impact assessments (EIAs) and compliance with specific environmental certifications. For instance, in 2024, many jurisdictions strengthened regulations around industrial emissions and waste management, requiring detailed EIAs for any new facility or significant operational changes. Adherence to standards like ISO 14001, a globally recognized environmental management system, is increasingly becoming a prerequisite for international trade and partnerships.

Obtaining and maintaining such certifications is not merely a regulatory hurdle; it signifies a genuine commitment to environmental stewardship. This can translate into tangible benefits, such as enhanced market access, particularly when dealing with clients in regions with stringent environmental procurement policies. For example, European Union directives in 2024 continued to emphasize sustainability in supply chains, making eco-certifications a competitive advantage. Bilcare's strategic planning for its operational revival must therefore embed these environmental considerations to align with evolving global expectations and unlock new business opportunities.

Key environmental considerations for Bilcare's revival:

- Environmental Impact Assessments: Rigorous evaluation of potential environmental effects for any new or expanded manufacturing sites, ensuring compliance with local and international regulations.

- Environmental Certifications: Pursuing and maintaining certifications like ISO 14001 to demonstrate commitment to sustainable practices and improve market access, especially for export-oriented business.

- Regulatory Compliance: Staying abreast of and adhering to evolving environmental laws and standards, which in 2024 saw increased focus on carbon emissions and circular economy principles in many key markets.

The global drive for sustainability is reshaping the pharmaceutical packaging industry, pushing companies like Bilcare towards eco-friendly materials and processes. This shift is driven by both consumer demand and increasingly stringent regulations aimed at reducing environmental impact.

The pharmaceutical packaging market is projected to see significant growth in sustainable solutions, with the global market expected to reach approximately $400 billion by 2024. Bilcare's strategy must incorporate these green alternatives to remain competitive.

Stricter regulations on plastic waste and recycling are compelling manufacturers to consider the entire lifecycle of their products. For example, the EU's Circular Economy Action Plan aims for all packaging to be recyclable or reusable by 2030, impacting companies operating in or exporting to these markets.

Companies are also under pressure to reduce their carbon footprint and energy consumption. In 2023, industrial processes contributed roughly 15.2 gigatons of CO2 equivalent globally, underscoring the importance of adopting renewable energy and improving energy efficiency for businesses like Bilcare.

| Environmental Factor | Impact on Bilcare | Key Data/Trend (2024/2025) |

|---|---|---|

| Sustainable Packaging Demand | Increased need for biodegradable, recycled, and paper-based solutions. | Global sustainable packaging market projected to reach $400 billion by 2024. |

| Regulatory Pressure (Waste & Recycling) | Mandates for product lifecycle accountability and end-of-life management. | EU target: all packaging recyclable/reusable by 2030. |

| Carbon Footprint & Energy Use | Focus on greener manufacturing, renewable energy, and energy efficiency. | Industrial CO2 emissions ~15.2 GtCO2e in 2023. |

| Resource Scarcity & Sourcing | Challenges in sourcing virgin polymers and metals; emphasis on ethical and recycled content. | Increased corporate targets for recycled content (e.g., 30% by 2025). |

| Environmental Impact Assessments & Certifications | Requirement for EIAs and certifications (e.g., ISO 14001) for market access and compliance. | Strengthened EIA regulations in many jurisdictions in 2024. |

PESTLE Analysis Data Sources

Our Bilcare PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the packaging industry.