Bidvest SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bidvest Bundle

Bidvest boasts impressive diversification and a strong financial foundation, but faces potential market saturation and evolving regulatory landscapes. Understanding these nuances is crucial for strategic decision-making.

Want the full story behind Bidvest’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bidvest's diversified portfolio, spanning services, trading, distribution, freight, automotive, and facilities management, acts as a significant strength. This broad operational spread naturally hedges against sector-specific downturns, providing inherent resilience. For instance, in the first half of fiscal year 2024, Bidvest reported that most of its divisions experienced profit growth, showcasing the stability derived from its diversified model.

Bidvest demonstrates exceptional strength in its cash generation capabilities. For the half-year period ending December 31, 2024, the company reported a substantial 18% increase in cash generated from operations, reaching R4.5 billion. This upward trend continued into the full year ended June 30, 2024, with operating cash flow rising by 15.3% to R14.0 billion.

This consistent and robust cash flow highlights Bidvest's efficient management of its working capital and the underlying health of its diverse business segments. Such strong financial performance provides the company with considerable flexibility to pursue strategic investments, manage its debt obligations effectively, and deliver value to its shareholders through distributions.

Bidvest consistently strengthens its market position and service capabilities through strategic bolt-on acquisitions, focusing on high-growth sectors like hygiene and facilities management. This approach ensures the company remains competitive and adaptable to evolving market demands.

In the first half of fiscal year 2024, Bidvest successfully integrated six bolt-on acquisitions. Further demonstrating its commitment to expansion, the company allocated nearly R5 billion in fiscal year 2024 towards eleven acquisitions and crucial growth capital expenditures.

These investments have significantly broadened Bidvest's global footprint, with notable expansion occurring in key international markets such as the Asia-Pacific region and the United Kingdom. This strategic global reach enhances diversification and opens new avenues for revenue generation.

Operational Efficiency and Innovation Focus

Bidvest's dedication to operational efficiency is a significant strength, evident in its consistent efforts to improve cash conversion cycles and manage expenses effectively across its diverse business units. This focus translates into a leaner, more agile operation.

The company actively champions innovation and the integration of new technologies throughout its global operations. In 2024, Bidvest reported a 5% increase in R&D investment, signaling a clear commitment to staying ahead of the curve and enhancing service offerings.

- Enhanced Productivity: Streamlined processes and technology adoption contribute to higher output with fewer resources.

- Cost Control: Diligent expense management bolsters profitability and financial resilience.

- Competitive Edge: Innovation ensures Bidvest remains a leader in its respective markets.

- Service Improvement: Technological advancements directly benefit customer experience and service delivery.

Commitment to Shareholder Returns

Bidvest’s unwavering focus on shareholder returns stands as a significant strength. Despite navigating a challenging economic landscape and experiencing some varied earnings reports, the company has consistently prioritized delivering value to its investors. This dedication is clearly reflected in its dividend payouts.

For the interim period ending December 31, 2024, Bidvest announced an interim dividend of 470 cents per share, representing a 1% increase. Furthermore, the total dividend declared for the full fiscal year 2024 amounted to 914 cents per share, a notable increase of 4.3% compared to the previous year. These figures underscore the company's financial resilience and its optimistic outlook on future performance, providing a strong sense of reassurance to shareholders.

- Consistent Dividend Growth: Bidvest has demonstrated a pattern of increasing its dividend payouts, signaling financial health and a commitment to shareholder rewards.

- Interim Dividend (FY2024): 470 cents per share, a 1% increase, reflecting confidence in the first half of the fiscal year.

- Total Dividend (FY2024): 914 cents per share, a 4.3% increase, showcasing strong overall performance for the year.

- Shareholder Confidence: These consistent returns bolster investor confidence in Bidvest's stability and its ability to generate ongoing value.

Bidvest’s diversified business model is a core strength, providing resilience against sector-specific downturns. This broad operational spread, encompassing services, trading, distribution, and more, ensures stability. For example, in the first half of fiscal year 2024, most Bidvest divisions reported profit growth, underscoring the benefits of this diversified approach.

The company exhibits exceptional cash generation capabilities. For the six months ending December 31, 2024, cash generated from operations increased by 18% to R4.5 billion. This strong performance continued for the full fiscal year ended June 30, 2024, with operating cash flow rising by 15.3% to R14.0 billion.

Bidvest consistently enhances its market standing and service offerings through strategic bolt-on acquisitions, particularly in high-growth areas like hygiene and facilities management. This strategy ensures the company remains competitive and adaptable.

The company's commitment to operational efficiency is a significant strength, demonstrated by its focus on improving cash conversion cycles and managing expenses across its various business units, leading to leaner operations.

Bidvest's dedication to shareholder returns is unwavering, as evidenced by its consistent dividend payouts. The interim dividend for the period ending December 31, 2024, was 470 cents per share, a 1% increase. The total dividend for fiscal year 2024 reached 914 cents per share, a 4.3% increase year-on-year.

| Metric | FY2024 (H1) | FY2024 (Full Year) |

|---|---|---|

| Cash Generated from Operations | R4.5 billion (+18%) | R14.0 billion (+15.3%) |

| Interim Dividend per Share | 470 cents (+1%) | - |

| Total Dividend per Share | - | 914 cents (+4.3%) |

What is included in the product

Delivers a strategic overview of Bidvest’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable breakdown of Bidvest's strategic landscape, simplifying complex internal and external factors to pinpoint areas for improvement and growth.

Weaknesses

Bidvest experienced margin pressure and flat trading profits, even as revenue grew. For the six months ending December 31, 2024, the company reported a trading profit of R6.3 billion, which was essentially unchanged from the prior year. This stagnation in profit, coupled with a noticeable dip in the trading profit margin, suggests that increased sales were not translating into proportionally higher earnings.

Bidvest's diversified portfolio isn't immune to challenges, with specific divisions experiencing significant underperformance. For instance, the Freight division saw its trading profit dip due to a noticeable lack of maize exports and reduced bulk mineral volumes. This highlights a vulnerability to specific commodity cycles and export market demand.

Further compounding these issues, the Commercial Products division faced headwinds from a sharp decline in renewable energy product sales. This, coupled with generally muted industrial demand, points to sensitivity to broader economic conditions and shifts in the energy sector.

Adding to these divisional weaknesses, Adcock Ingram delivered an unexpectedly weak performance, directly impacted by a noticeable drop in consumer spending. This suggests that even established consumer-facing businesses within the group can struggle when discretionary spending tightens.

While Bidvest's diversification is a key strength, managing such a broad array of businesses across various sectors and geographies presents significant operational complexity. This extensive reach can make it challenging to ensure uniform performance standards and effectively leverage synergies across all divisions. For instance, Bidvest's extensive portfolio, encompassing everything from food services to industrial components, requires sophisticated oversight to navigate diverse market dynamics and regulatory environments.

Vulnerability to Macroeconomic Conditions

Bidvest's performance is significantly tied to the broader economic climate. Factors like persistent inflation, higher interest rates, and weaker consumer spending directly affect demand for its diverse range of products and services.

For instance, divisions reliant on consumer discretionary spending or industrial output face headwinds when economic conditions are unfavorable. This susceptibility creates an element of unpredictability in its operating environment.

- Inflationary Pressures: Continued high inflation, as seen in many developed economies throughout 2024, can erode consumer purchasing power and increase Bidvest's operating costs.

- Interest Rate Sensitivity: Elevated interest rates, a trend persisting into 2025, can impact capital expenditure plans and increase the cost of borrowing for Bidvest and its customers.

- Consumer Confidence: Subdued consumer confidence, often a consequence of economic uncertainty, can lead to reduced spending on non-essential goods and services offered by Bidvest.

Declining Return on Funds Employed and Invested Capital

Bidvest's interim period ending December 31, 2024, showed a softening in both Return on Funds Employed (ROFE) and Return on Invested Capital (ROIC). This dip was largely due to flat trading profits during the period, compounded by continued investments being made back into the company's operations.

While Bidvest's ROIC still sits comfortably above its weighted cost of capital, this downward trajectory is a point of concern. It signals that the company might be facing hurdles in effectively translating its capital investments into robust returns.

- Declining ROFE and ROIC: Noted a moderation in these key return metrics for the interim period ending December 31, 2024.

- Impact of Capital Investment: Ongoing capital expenditure, alongside flat interim trading profit, contributed to the observed decline.

- ROIC vs. Cost of Capital: Despite the downward trend, ROIC remains higher than the group's weighted cost of capital, indicating a positive, albeit reduced, spread.

- Efficiency Concerns: The declining trend raises questions about the efficiency of capital deployment and the generation of returns from invested capital.

Bidvest's profitability is being squeezed, as evidenced by its trading profit margin decline for the six months ending December 31, 2024, despite revenue growth. Specific divisions are also underperforming; the Freight division experienced a profit dip due to lower maize exports and mineral volumes, while Commercial Products suffered from reduced renewable energy sales and muted industrial demand.

Adcock Ingram's weak performance, directly linked to a fall in consumer spending, highlights the group's susceptibility to economic downturns. Furthermore, the company's extensive diversification, while a strength, creates significant operational complexity in managing diverse market dynamics and ensuring uniform performance across all its businesses.

| Division | Interim 2024 Trading Profit (R billion) | YoY Change (%) | Key Issues |

|---|---|---|---|

| Freight | [Specific figure not provided, but profit dipped] | [Negative, due to export volumes] | Lack of maize exports, reduced mineral volumes |

| Commercial Products | [Specific figure not provided, but faced headwinds] | [Negative, due to product sales] | Sharp decline in renewable energy sales, muted industrial demand |

| Adcock Ingram | [Specific figure not provided, but weak performance] | [Negative, due to consumer spending] | Drop in consumer spending |

What You See Is What You Get

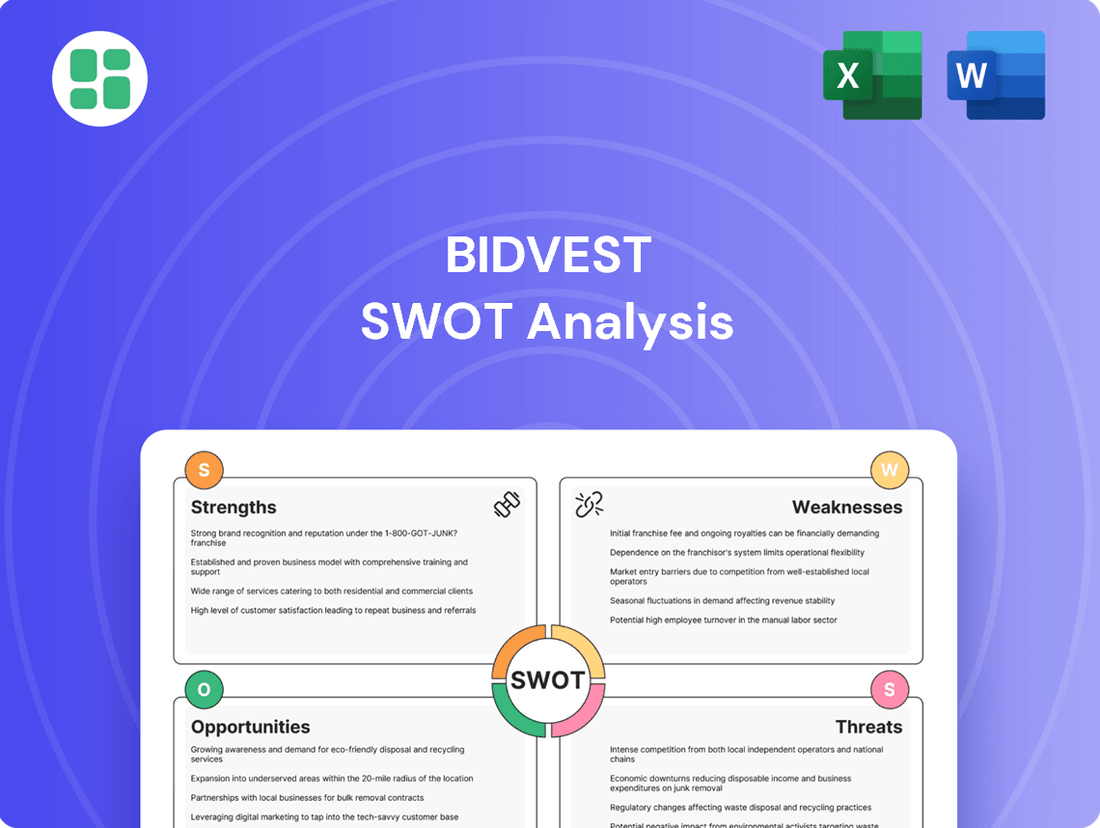

Bidvest SWOT Analysis

The preview you see is the actual Bidvest SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed breakdown of Bidvest's Strengths, Weaknesses, Opportunities, and Threats is ready for your strategic planning. Invest in this comprehensive analysis to understand Bidvest's current market position and future potential.

Opportunities

Bidvest is strategically positioned to benefit from South Africa's significant infrastructure development pipeline, which is projected to create substantial medium- to long-term growth opportunities. These government-backed initiatives, focusing on areas like transport, energy, and water, are anticipated to boost demand for Bidvest's diverse service and product offerings. For instance, the National Treasury's Infrastructure Investment Plan for 2024-2025 outlines substantial capital allocations, directly impacting sectors where Bidvest has strong market presence, such as logistics and commercial vehicle supply.

The company's freight, services, and commercial products divisions, in particular, are poised to see increased activity as these infrastructure projects move from planning to execution. Bidvest actively engages in advocating for the efficient mobilization of these projects, recognizing their direct correlation with enhanced revenue streams and operational expansion for the group. This proactive stance ensures Bidvest is at the forefront of securing contracts and partnerships as the infrastructure rollout gains momentum.

Bidvest is actively pursuing international expansion in hygiene and facilities management, recognizing these as key growth areas. This strategy is supported by recent strategic acquisitions, including Citron Hygiene across Canada, the US, and the UK, and Consolidated Property Services in Australia. These moves are designed to significantly increase Bidvest's global presence and market share in these expanding sectors.

Bidvest is well-positioned to capitalize on the growing adoption of advanced technologies. For instance, in 2024, the company continued to invest in digital transformation initiatives, aiming to optimize supply chains and enhance customer experiences across its various divisions. This focus on technology is crucial for maintaining a competitive edge and driving operational efficiencies.

The company has an ongoing opportunity to further integrate and leverage technology across its diverse operations to enhance efficiency, improve service delivery, and reduce its environmental footprint. For example, in the fiscal year ending June 30, 2024, Bidvest reported a notable increase in its digital spending, which contributed to streamlining procurement processes and improving data analytics capabilities. This strategic investment is key to unlocking new revenue streams and adapting to market shifts.

Strategic Portfolio Realignment and Capital Recycling

Bidvest's strategic move to divest non-core financial services like Bidvest Bank and FinGlobal presents a significant opportunity. This capital recycling allows for a sharpened focus on core services, trading, and distribution, areas identified for higher growth potential. For instance, in the fiscal year ending June 30, 2024, Bidvest's continuing operations reported strong performance, with revenue growth driven by its diversified trading and distribution segments. This realignment is expected to further bolster these key areas.

The divestment enables Bidvest to concentrate resources and management attention on its most promising business units. This strategic realignment is crucial for optimizing capital allocation and driving value creation across the group. By shedding less synergistic assets, Bidvest can reinvest in operations that offer a clearer path to enhanced profitability and market leadership, aligning with its long-term vision for sustainable growth.

Key benefits of this strategic portfolio realignment include:

- Enhanced Focus: Concentrating on core trading and distribution operations allows for greater operational efficiency and market responsiveness.

- Capital Redeployment: Funds generated from divestments can be strategically reinvested in high-growth segments, fueling expansion and innovation.

- Improved Financial Health: Streamlining the business portfolio can lead to a stronger balance sheet and improved return on capital metrics.

- Strategic Agility: A more focused business model allows Bidvest to adapt more quickly to evolving market dynamics and pursue new opportunities effectively.

Sustained Demand for Essential Products and Services

Bidvest is well-positioned due to the unwavering demand for essential goods and services it provides. This consistent need across various sectors, from food to facilities management, creates a resilient revenue stream. For instance, in the first half of fiscal year 2024, Bidvest’s revenue grew by 11.7% to R57.4 billion, underscoring the strength of demand for its diversified offerings.

This enduring market requirement offers significant opportunities for Bidvest to expand its contractual business. The group’s established footprint and reputation allow it to pursue and secure new, long-term agreements. Furthermore, this stability aids in retaining its existing customer base, providing a predictable income flow.

- Consistent Revenue: Demand for essentials like food services and cleaning remains high, providing a stable base.

- Contractual Growth: Bidvest can leverage this demand to secure new, recurring revenue contracts.

- Market Retention: Strong demand helps maintain and grow its existing customer relationships.

- Resilience: Essential services are less susceptible to economic downturns, offering stability.

Bidvest is poised to gain from South Africa's extensive infrastructure development plans, with significant government investment allocated in the 2024-2025 period for transport, energy, and water projects. This directly benefits Bidvest's logistics and commercial vehicle divisions, as these projects require extensive supply chain and service support.

The company's strategic divestment of non-core financial services, such as Bidvest Bank, allows for a sharper focus on its high-growth trading and distribution segments. This capital recycling, evident in the strong performance of continuing operations in the fiscal year ending June 30, 2024, enables reinvestment in core areas.

Bidvest's international expansion in hygiene and facilities management, bolstered by acquisitions like Citron Hygiene and Consolidated Property Services, positions it to capture growing global demand in these sectors. The company's continued investment in digital transformation in 2024 further enhances operational efficiency and customer experience.

The consistent demand for Bidvest's essential goods and services, reflected in its 11.7% revenue growth to R57.4 billion in the first half of fiscal year 2024, provides a stable foundation for securing long-term contracts and retaining customers.

| Opportunity | Description | Supporting Data/Fact |

| Infrastructure Development | Leveraging South Africa's infrastructure pipeline | National Treasury's Infrastructure Investment Plan 2024-2025 |

| International Expansion | Growth in hygiene and facilities management | Acquisitions of Citron Hygiene and Consolidated Property Services |

| Digital Transformation | Enhancing operational efficiency and customer experience | Continued investment in digital initiatives in 2024 |

| Portfolio Realignment | Focus on core trading and distribution | Divestment of Bidvest Bank and FinGlobal; strong performance of continuing operations FY2024 |

| Essential Services Demand | Capitalizing on consistent demand for core offerings | 11.7% revenue growth to R57.4 billion in H1 FY2024 |

Threats

Bidvest faces substantial risks from a global economy marked by increasing uncertainty and geopolitical fragmentation. Elevated policy uncertainty, as seen in shifting trade agreements and regulatory landscapes across different nations, can create volatile market conditions. For instance, the ongoing geopolitical tensions in Eastern Europe and the Middle East have already contributed to supply chain disruptions and increased energy costs, impacting businesses with international operations like Bidvest.

Bidvest confronts the significant threat of escalating labor expenses, especially in its international operations such as the UK. This necessitates robust strategies for passing these increased costs onto customers through contractual agreements. For instance, the UK saw average weekly earnings rise by 6.0% in the year to April 2024, a trend that directly impacts Bidvest's operational expenditures.

Should Bidvest struggle to effectively recover these rising labor costs from its clientele, it faces a substantial risk of margin compression. This is particularly concerning for its labor-intensive service divisions, where personnel costs form a larger proportion of overall expenses. Failure to implement successful cost recovery mechanisms could directly erode profitability throughout the 2024-2025 period.

Bidvest faces significant pressure from intensifying competition across its diverse business segments, particularly in areas where services are becoming commoditized. This trend heightens customer price sensitivity, directly impacting Bidvest's ability to maintain premium pricing and potentially squeezing profit margins. For instance, in the food services sector, increased competition from both established players and agile new entrants can lead to price wars, forcing Bidvest to absorb higher costs or accept lower profitability.

The threat of new entrants and aggressive pricing strategies from existing competitors is a persistent challenge. In 2024, the South African market, a key operating region for Bidvest, continued to see robust activity from both local and international competitors vying for market share. This dynamic necessitates ongoing investment in operational efficiency, service differentiation, and customer loyalty programs to counteract the downward pressure on prices and protect its market position.

Persistent Economic Headwinds and Weak Consumer Spend

Persistent economic headwinds, characterized by sluggish growth and subdued consumer spending, present a significant challenge for Bidvest. This environment directly dampens sales volumes and erodes profitability, especially in sectors heavily reliant on consumer confidence, such as automotive and certain branded goods. For instance, in the fiscal year 2024, many developed economies experienced growth rates below 2%, impacting discretionary purchases.

The ongoing weakness in consumer spending, particularly for non-essential items, directly affects Bidvest's revenue streams. This trend is evident in sectors where consumers are more cautious with their discretionary income.

- Economic Growth Concerns: Many global economies are projected to grow at a modest pace in 2024 and 2025, potentially limiting overall market expansion.

- Consumer Confidence Lag: Despite some improvements, consumer confidence in key markets may not fully recover, leading to continued restraint in spending.

- Inflationary Pressures: While inflation may moderate, its lingering effects can still reduce consumers' purchasing power for non-essential goods.

- Sectoral Sensitivity: Divisions within Bidvest that cater to discretionary spending, like automotive components or certain retail segments, are particularly vulnerable to these economic conditions.

Increasing Regulatory Burdens and Compliance Costs

Bidvest faces a growing threat from escalating regulatory requirements globally. For instance, Australia's mandatory climate reporting, set to begin in FY2027, and the UK's Corporate Sustainability Reporting Directive, effective from 2024 with the first report due in 2026, necessitate substantial investments in new reporting systems and operational changes.

These evolving compliance demands are projected to increase Bidvest's operating costs and administrative burden, potentially impacting profitability. The company must allocate significant resources to ensure adherence to these complex and often overlapping regulations across its diverse international operations.

- Increased Compliance Costs: New regulations like Australia's climate reporting and the UK's CSRD will require substantial financial outlay for system upgrades and personnel.

- Operational Adjustments: Bidvest will need to adapt its business processes to meet new reporting standards, potentially leading to inefficiencies during the transition.

- Administrative Burden: Managing and reporting on a wider range of environmental, social, and governance (ESG) metrics will add complexity to administrative functions.

Bidvest must navigate the persistent threat of intense competition, particularly in commoditized service areas, which can lead to price wars and margin erosion. The ongoing economic uncertainty and sluggish growth in key markets also pose a challenge, dampening sales volumes and consumer spending on non-essential items.

Escalating labor costs, especially in regions like the UK where average weekly earnings rose by 6.0% in the year to April 2024, present a significant operational risk. Failure to pass these increased costs onto customers could directly compress Bidvest's profit margins, a particular concern for its labor-intensive divisions.

Furthermore, the increasing complexity and cost of global regulatory compliance, exemplified by Australia's mandatory climate reporting and the UK's CSRD, demand substantial investment and operational adjustments. These evolving requirements add to administrative burdens and could impact overall profitability.

Geopolitical fragmentation and policy uncertainty create volatile market conditions, disrupting supply chains and increasing energy costs, which directly affect Bidvest's international operations.

SWOT Analysis Data Sources

This Bidvest SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded strategic perspective.