Bidvest PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bidvest Bundle

Unlock the strategic blueprint of Bidvest with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and socio-cultural trends are shaping its operational landscape. Don't just react to change; anticipate it. Purchase the full analysis now to gain actionable insights and secure your competitive advantage.

Political factors

Bidvest's extensive operations, particularly in South Africa, make it highly sensitive to political stability and the direction of government policy. A stable political climate in key markets like South Africa, where Bidvest has substantial interests, is vital for maintaining investor confidence and ensuring predictable regulatory environments essential for long-term strategic planning and capital allocation.

Changes in government priorities, such as potential shifts towards nationalisation or alterations in public procurement regulations, could directly affect Bidvest's diverse business segments. For instance, divisions like Bidvest Facilities Management and Bidvest Freight, which often rely on government contracts and infrastructure development projects, are particularly exposed to these policy shifts.

In 2024, South Africa's upcoming general elections highlight the potential for policy shifts. For example, discussions around state-owned enterprise reform and the future of government tenders could influence Bidvest's revenue streams and operational strategies in the coming years.

Bidvest's extensive freight and distribution operations are highly sensitive to shifts in global trade policies. For instance, the implementation of tariffs, such as those seen in US-China trade disputes, can directly inflate the cost of goods and transportation for Bidvest's clients, potentially dampening demand. The World Trade Organization (WTO) reported that global trade growth slowed to an estimated 0.6% in 2023, a stark contrast to previous years, highlighting the impact of geopolitical tensions and protectionist tendencies on international commerce.

Bidvest navigates a complex web of regulations across its diverse operations, including financial services, freight, and facilities management in numerous countries. For instance, in South Africa, the Financial Sector Regulation Act of 2017 continues to shape the landscape for financial service providers, demanding robust compliance frameworks. Changes in these industry-specific rules, licensing mandates, or adherence standards can force substantial operational shifts and require significant capital outlay, impacting profitability and strategic direction.

Geopolitical Tensions and International Relations

Global geopolitical tensions, such as the ongoing conflicts in Eastern Europe and the Middle East, significantly impact international supply chains. For a diversified group like Bidvest, this translates to potential disruptions in sourcing raw materials and finished goods, affecting sectors from food services to industrial supplies. For instance, the war in Ukraine has continued to affect global grain and energy prices, indirectly influencing Bidvest's food and distribution segments through increased operational costs.

These tensions also create economic uncertainty, dampening consumer and business spending. Bidvest's travel and tourism-related businesses, like Bidvest Car Rental, are particularly sensitive to travel advisories and reduced international mobility stemming from geopolitical instability. Economic volatility can lead to currency fluctuations, impacting the profitability of Bidvest's international operations when repatriated.

Furthermore, the risk of sanctions or trade restrictions poses a direct threat to Bidvest's global reach. Such measures could limit access to key markets or suppliers, forcing the company to re-evaluate its operational footprint and strategic partnerships. Bidvest's extensive international presence, spanning over 20 countries, necessitates robust risk management strategies to navigate these political shocks effectively.

- Supply Chain Vulnerability: Geopolitical events in 2024 continue to highlight the fragility of global supply chains, with an estimated 80% of companies reporting disruptions according to a recent survey.

- Impact on Travel: International tourist arrivals, a key indicator for Bidvest's travel services, are projected to reach 1.4 billion by the end of 2024, but are highly susceptible to geopolitical events causing travel warnings.

- Economic Uncertainty: Global economic growth forecasts for 2025 are being revised downwards by institutions like the IMF due to ongoing geopolitical risks, potentially affecting Bidvest's revenue streams across its diverse business units.

- Trade Restrictions: The implementation of new trade barriers or sanctions in key economic blocs could directly impact Bidvest's import/export activities and market access.

Anti-Corruption and Governance Frameworks

Bidvest's operations are significantly impacted by the strength of anti-corruption and governance frameworks in its various markets. Robust laws and enforcement, like those seen in South Africa's Companies Act and the Prevention and Combating of Corrupt Activities Act, can level the playing field. For instance, Transparency International's 2023 Corruption Perception Index ranked South Africa 42 out of 180 countries, indicating a moderate level of perceived corruption that necessitates diligent compliance.

Adherence to these regulations is not just about avoiding penalties; it directly affects Bidvest's operational costs and public image. Companies with strong governance structures often experience lower transaction costs and greater investor confidence. Conversely, operating in environments with weak oversight, such as certain emerging markets, can expose Bidvest to risks of unfair competition and significant reputational damage.

- Regulatory Scrutiny: Bidvest must navigate varying levels of anti-corruption enforcement across its global footprint, impacting compliance costs and operational flexibility.

- Reputational Risk: Weak governance in any operating region can lead to reputational damage, affecting stakeholder trust and market access.

- Competitive Landscape: Strong governance frameworks can reduce the prevalence of illicit practices, fostering fairer competition for businesses like Bidvest.

- Compliance Investment: Significant resources are allocated by Bidvest to ensure adherence to evolving global anti-corruption standards and corporate governance best practices.

Bidvest's extensive operations are significantly influenced by government policies and political stability, particularly in its primary market, South Africa. The upcoming 2024 South African general elections could lead to policy shifts impacting public procurement and state-owned enterprises, areas crucial for divisions like Bidvest Facilities Management and Bidvest Freight.

Global geopolitical tensions, including conflicts and trade disputes, continue to disrupt supply chains and create economic uncertainty, affecting Bidvest's diverse segments from food services to travel. For example, the World Trade Organization noted a significant slowdown in global trade growth in 2023, a trend influenced by these geopolitical factors.

Bidvest must also contend with varying regulatory environments and anti-corruption frameworks across its international operations. Strong governance and compliance, as exemplified by South Africa's Companies Act, are essential for mitigating risks and ensuring fair competition, with Transparency International's 2023 Corruption Perception Index highlighting the need for diligent oversight.

| Factor | Impact on Bidvest | 2024/2025 Relevance |

|---|---|---|

| Political Stability (South Africa) | Investor confidence, regulatory predictability | Key to strategic planning ahead of 2024 elections |

| Government Policy Shifts | Affects public procurement, infrastructure projects | Potential changes in tender regulations post-election |

| Global Geopolitical Tensions | Supply chain disruptions, economic uncertainty | Continued impact on sourcing and consumer spending |

| Trade Policies & Tariffs | Increased costs for freight and distribution | Ongoing risk due to protectionist tendencies |

| Regulatory Compliance | Operational costs, reputational risk | Adherence to evolving financial and anti-corruption laws |

What is included in the product

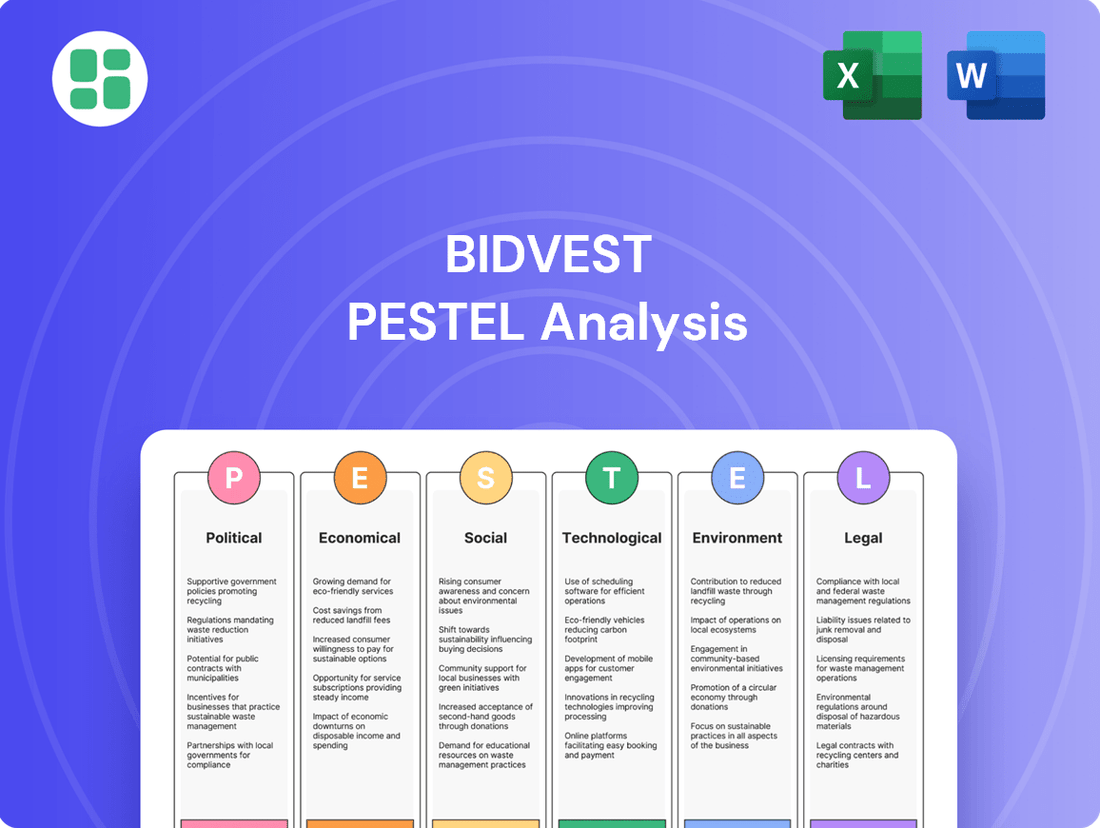

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Bidvest, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats for Bidvest.

The Bidvest PESTLE analysis acts as a pain point reliever by providing a clear, summarized version of the full analysis for easy referencing during meetings or presentations, streamlining strategic discussions.

Economic factors

Bidvest's varied business portfolio, spanning financial services, logistics, automotive, and property management, is closely tied to global and regional economic expansion. Strong economic growth in its primary markets, such as South Africa, Europe, and Australia, typically boosts demand for Bidvest’s offerings, leading to higher revenues and profits.

For instance, South Africa's GDP growth was projected to be around 1.5% in 2024, a moderate but positive figure. Similarly, Australia's economy was anticipated to grow by approximately 2.0% in 2024. These growth rates directly influence consumer spending and business investment, key drivers for Bidvest's diverse operations.

Conversely, a slowdown in these economies, as seen during periods of recession, can significantly dampen demand. Reduced consumer confidence and lower corporate spending directly impact Bidvest’s sales volumes and profit margins across its various sectors, highlighting the critical link between economic health and the company’s performance.

High inflation in 2024 and projected into 2025 directly impacts Bidvest's operational costs. Expect increases in expenses for labor, raw materials, and energy, which can squeeze profit margins if not passed on. For instance, South Africa's inflation rate hovered around 5.1% in early 2024, a significant factor for businesses like Bidvest.

Rising interest rates, a common response to inflation, will increase Bidvest's borrowing costs and potentially affect customer spending. Higher financing expenses can reduce profitability, while elevated rates may dampen demand for Bidvest's financial services and automotive products. The South African Reserve Bank has maintained its repo rate at 8.25% as of mid-2024, reflecting this concern.

Bidvest's recent financial performance, showing flat trading profits despite revenue increases, illustrates these margin pressures. Navigating these inflationary and interest rate environments is crucial for maintaining profitability and growth in the coming periods.

As a global entity, Bidvest's financial results are significantly influenced by currency exchange rate fluctuations. For instance, a stronger South African Rand (ZAR) in 2024 could make Bidvest's exports pricier for international buyers, potentially dampening sales in its trading segments, while simultaneously lowering the cost of imported goods for its distribution businesses.

These currency swings also directly affect how Bidvest's overseas profits are reported in its primary currency, the ZAR. A depreciating foreign currency against the ZAR would translate to lower reported earnings from those international operations, impacting the group's overall financial performance and investor perception.

To navigate this inherent volatility, Bidvest employs various hedging instruments. These strategies aim to mitigate the impact of adverse currency movements on its revenues and costs, ensuring greater financial predictability and stability. For example, forward contracts might be used to lock in exchange rates for future transactions.

Consumer Confidence and Disposable Income

Consumer confidence and disposable income are critical drivers for Bidvest's diverse operations. When consumers feel secure about their financial future and have more money to spend, it directly boosts demand in sectors like automotive, travel, and retail. For instance, South Africa's consumer confidence index, which has seen fluctuations, directly correlates with spending patterns in these areas.

In 2024, South Africa's disposable income levels are a key consideration. While economic pressures can constrain household budgets, leading to cautious spending on non-essential items, any uptick in real disposable income can translate into increased sales for Bidvest's consumer-facing businesses. This dynamic is particularly relevant for their automotive division, where vehicle purchases are often discretionary.

- South Africa's consumer confidence index experienced a slight recovery in early 2024, though remained below pre-pandemic levels.

- Disposable income growth in South Africa for 2024 is projected to be modest, influenced by inflation and employment figures.

- Reduced consumer spending due to economic headwinds can significantly impact Bidvest's revenue from its automotive and travel segments.

- An increase in consumer confidence generally leads to higher spending on discretionary goods and services offered by Bidvest.

Labor Market Conditions and Wage Inflation

Bidvest's operations, particularly in service sectors like facilities management and logistics, are highly sensitive to labor market dynamics. The availability of skilled workers directly influences operational efficiency and the ability to meet service level agreements. For instance, a shortage of qualified technicians in facilities management can strain service delivery.

Wage inflation presents a significant cost pressure. In South Africa, for example, average wage growth has been observed, and any acceleration in this trend directly impacts Bidvest's labor-intensive cost base. Managing these rising labor costs is crucial for maintaining profit margins, especially when Bidvest faces competition that might have different labor cost structures.

The ability to attract and retain talent is paramount. A competitive labor market, characterized by high demand for specific skills, can drive up wages and recruitment expenses. Bidvest's strategies for employee training, development, and maintaining positive labor relations are therefore critical for mitigating these risks and ensuring consistent service quality.

- Skilled Labor Availability: A persistent challenge in sectors like South African logistics, where a shortage of truck drivers and skilled warehouse personnel can impact operational capacity.

- Wage Inflation Trends: South African average wage settlements in 2024 have hovered around the inflation rate, but specific sectors with high demand for skills may see higher increases, directly affecting Bidvest's operational expenses.

- Labor Relations: Maintaining constructive relationships with labor unions and employees is vital to prevent disruptions and ensure productivity, especially during periods of economic uncertainty.

Economic growth is a primary driver for Bidvest, with its diverse portfolio benefiting from expansion in key markets like South Africa, Europe, and Australia. For example, South Africa's projected GDP growth of around 1.5% for 2024 and Australia's anticipated 2.0% growth in the same year directly influence consumer spending and business investment, crucial for Bidvest's revenue streams.

Inflationary pressures, with South Africa's rate around 5.1% in early 2024, increase Bidvest's operational costs for labor and materials, potentially squeezing profit margins. Rising interest rates, with the South African Reserve Bank's repo rate at 8.25% as of mid-2024, also increase borrowing costs and can dampen consumer demand, impacting sectors like automotive and financial services.

Currency fluctuations significantly impact Bidvest's global earnings. A stronger Rand, for instance, can make exports more expensive, while affecting the reported value of overseas profits. Bidvest utilizes hedging strategies to mitigate these currency risks and ensure financial stability.

Consumer confidence and disposable income are vital, especially for Bidvest's automotive and travel segments. While modest disposable income growth is projected for South Africa in 2024, any increase in consumer confidence can lead to higher spending on discretionary items offered by the company.

| Economic Factor | 2024 Projection/Observation | Impact on Bidvest | Key Data Point |

| GDP Growth (South Africa) | ~1.5% | Boosts demand for Bidvest's services and products. | Moderate economic expansion supports consumer and business spending. |

| Inflation Rate (South Africa) | ~5.1% (early 2024) | Increases operational costs, potentially reducing profit margins. | Higher input costs for labor, materials, and energy. |

| Interest Rates (South Africa) | Repo Rate: 8.25% (mid-2024) | Increases borrowing costs and can dampen consumer spending. | Higher financing expenses and potential reduction in demand for financed goods. |

| Consumer Confidence | Slight recovery, below pre-pandemic levels | Influences spending on discretionary items. | Directly correlates with sales in automotive and travel sectors. |

Preview Before You Purchase

Bidvest PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Bidvest PESTLE analysis provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You can confidently purchase knowing you're getting the complete, professionally structured report.

Sociological factors

Consumers increasingly prioritize convenience, seeking readily available products and streamlined services. Bidvest's diverse operations, from food services to logistics, must cater to this by enhancing accessibility and efficiency. For example, the growing demand for ready-to-eat meals and on-demand delivery services directly impacts its food divisions.

Personalization is another key trend, with customers expecting tailored experiences and products. This means Bidvest needs to leverage data analytics to understand individual needs across its various sectors, whether it's customized catering or personalized travel packages. In 2024, the global personalized products market was valued at over $30 billion and is projected to grow significantly.

Sustainability is no longer a niche concern; it's a mainstream expectation. Bidvest faces pressure to offer eco-friendly options and adopt sustainable practices throughout its supply chains, from sourcing to waste management. By 2025, it's estimated that over 70% of consumers will consider sustainability when making purchasing decisions, a clear signal for Bidvest to integrate greener solutions across its portfolio.

Demographic shifts, like an aging population and changing household sizes, directly influence the types of services Bidvest needs to offer. For instance, as more people live alone or in smaller family units, demand for certain catering or cleaning services might change.

Urbanization is a significant driver for Bidvest's business. As more people move to cities, there's a greater need for services like facilities management, efficient logistics for goods delivery, and infrastructure maintenance. South Africa's urban population was projected to reach 68% by 2023, indicating a growing urban market for Bidvest's diverse service portfolio.

Bidvest's strategic planning benefits greatly from understanding these demographic trends. By recognizing where populations are growing and what services are in demand in those areas, the company can better allocate resources and identify new market opportunities, ensuring continued growth and relevance.

The evolving nature of work, with a significant rise in remote and hybrid models, presents both opportunities and challenges for Bidvest's talent acquisition and management. For instance, in 2024, surveys indicated that over 60% of employees preferred flexible work arrangements, a trend Bidvest must integrate into its human capital strategy to remain competitive in attracting skilled professionals.

The demand for specialized skills, particularly in areas like digital transformation and advanced customer service, is a critical factor. Bidvest's ability to identify and bridge these skills gaps through targeted training and development programs will directly influence its operational efficiency and capacity for innovation in 2025.

Health, Safety, and Hygiene Consciousness

The post-pandemic era has undeniably amplified global consciousness around health, safety, and hygiene. This heightened awareness directly translates into a robust demand for sophisticated solutions in these areas, creating a significant tailwind for companies like Bidvest, particularly its hygiene solutions and facilities management segments. For instance, the global market for hygiene products and services was projected to reach over $700 billion by 2025, with a significant portion driven by institutional and commercial demand. Bidvest is well-positioned to leverage this trend by focusing on innovation and marketing its comprehensive range of cleaning, sanitization, and air quality management services.

Bidvest’s hygiene division, which offers everything from cleaning chemicals to specialized disinfection services, is a direct beneficiary of this societal shift. The company's facilities management arm also benefits as businesses and public spaces prioritize enhanced cleaning protocols and improved indoor environmental quality. This increased focus on well-being is not just a temporary trend; it represents a structural change in consumer and corporate behavior. Reports from 2024 indicate continued strong growth in spending on commercial cleaning and sanitization services, with many organizations allocating larger budgets to ensure safe environments for employees and customers. Bidvest's ability to offer integrated solutions, from product supply to service delivery, gives it a competitive edge in meeting this evolving demand.

- Increased Demand: Global spending on hygiene solutions is projected to exceed $700 billion by 2025, reflecting heightened post-pandemic awareness.

- Bidvest's Advantage: The company's hygiene and facilities management divisions are poised to capitalize on this trend through advanced cleaning and sanitization services.

- Market Growth: 2024 data shows sustained growth in commercial cleaning and sanitization budgets, indicating a long-term shift in corporate priorities.

- Innovation Focus: Bidvest can further strengthen its position by continuing to innovate and promote its health-centric offerings.

Social Responsibility and Ethical Consumerism

Societal expectations for corporate social responsibility are rapidly evolving, with consumers and investors alike demanding ethical sourcing and sustainable business practices from companies like Bidvest. This heightened scrutiny directly impacts brand reputation and consumer trust. For instance, a 2024 survey indicated that over 60% of consumers consider a company's ethical practices when making purchasing decisions.

Bidvest's commitment to Environmental, Social, and Governance (ESG) targets, alongside initiatives promoting diversity and community engagement, is therefore paramount. These efforts are not just about good corporate citizenship; they are critical for maintaining legitimacy and attracting a growing segment of socially conscious consumers and investors. In 2024, ESG-focused funds saw significant inflows, highlighting this trend.

Key areas influencing Bidvest's social standing include:

- Ethical Sourcing: Ensuring fair labor practices and responsible supply chains.

- Environmental Impact: Reducing carbon footprint and promoting circular economy principles.

- Community Investment: Supporting local communities through job creation and social programs.

- Diversity and Inclusion: Fostering an equitable workplace and reflecting societal diversity.

Societal shifts toward convenience and personalization are reshaping consumer expectations, pushing Bidvest to enhance service accessibility and tailor offerings across its diverse sectors. The growing emphasis on health, safety, and hygiene, amplified post-pandemic, directly benefits Bidvest's hygiene and facilities management divisions, with global hygiene market growth projected to exceed $700 billion by 2025.

Furthermore, evolving work models, like remote and hybrid arrangements, necessitate strategic adjustments in talent acquisition and management, as over 60% of employees in 2024 preferred flexible work. Increasingly, consumers and investors expect strong corporate social responsibility, with over 60% of consumers in 2024 considering ethical practices in purchasing decisions, making Bidvest's ESG commitments crucial.

| Sociological Factor | Impact on Bidvest | Relevant Data/Trend |

| Convenience & Personalization | Increased demand for tailored, accessible services | Global personalized products market valued over $30 billion in 2024 |

| Health, Safety & Hygiene | Growth in hygiene and facilities management services | Global hygiene market projected over $700 billion by 2025 |

| Evolving Work Models | Need for flexible talent strategies | Over 60% of employees preferred flexible work in 2024 |

| Corporate Social Responsibility | Importance of ethical practices and ESG | Over 60% of consumers considered ethical practices in 2024 |

Technological factors

Bidvest is navigating a period of significant digital transformation, affecting sectors from financial services to logistics and facilities management. This shift presents opportunities for efficiency gains through automation and AI.

The adoption of AI and data analytics offers a clear path to cost reduction and service enhancement. For instance, AI can optimize delivery routes, a critical factor in Bidvest's logistics operations, potentially leading to fuel savings and faster delivery times.

In facilities management, automation of routine tasks can free up human resources for more complex problem-solving. Bidvest's investment in digital solutions is projected to yield operational improvements, with many companies reporting a 10-20% increase in efficiency through targeted automation in 2024.

The relentless expansion of e-commerce is fundamentally altering Bidvest's freight and commercial products operations. This shift necessitates significant investment in last-mile delivery capabilities and advanced inventory management systems to satisfy evolving customer demands for speed and convenience. For instance, global e-commerce sales are projected to reach $7.4 trillion by 2025, underscoring the scale of this transformation.

Bidvest's increasing reliance on digital platforms for financial services, logistics, and operations makes it vulnerable to cybersecurity threats. Data breaches can severely damage client trust and lead to substantial financial penalties, especially with regulations like South Africa's Protection of Personal Information Act (POPIA) and the EU's General Data Protection Regulation (GDPR) in effect.

In 2023, the global average cost of a data breach reached $4.45 million, a 15% increase over two years, highlighting the significant financial implications for companies like Bidvest. Investing in advanced cybersecurity measures and ensuring strict compliance with data protection laws is therefore critical for safeguarding sensitive information and maintaining operational integrity.

Advancements in Smart Technologies and IoT

The facilities management sector, a core area for Bidvest, is being reshaped by smart technologies and the Internet of Things (IoT). These innovations, including smart building systems and predictive maintenance, allow for continuous asset monitoring and optimized energy usage. For instance, the global IoT in smart buildings market was projected to reach over $70 billion by 2024, highlighting the significant investment and adoption in this space.

These advancements directly translate into tangible benefits for clients by enabling proactive maintenance and reducing operational costs. Bidvest can capitalize on this trend by integrating these solutions into its service offerings, thereby enhancing its competitive edge and delivering greater value. The ability to predict equipment failures before they occur, for example, can prevent costly downtime and repairs.

- Real-time asset tracking and performance monitoring

- Enhanced energy efficiency through smart grid integration

- Predictive maintenance reducing operational disruptions

- Development of data-driven service models

Innovation in Green Technologies and Solutions

Technological advancements in sustainable and green solutions present significant opportunities for Bidvest. Innovations in areas like alternative fuels for its extensive logistics operations, energy-efficient equipment for its diverse facilities, and the development of eco-friendly hygiene products can drive differentiation. For instance, the global market for green logistics is projected to reach over $2.5 trillion by 2027, indicating a substantial growth area.

By investing in and adopting these green technologies, Bidvest can effectively reduce its environmental footprint, aligning with its sustainability targets. This proactive approach also enhances its appeal to an increasingly environmentally conscious client base. Companies that prioritize sustainability often see improved brand reputation and customer loyalty, which can translate into tangible financial benefits.

- Green Logistics Market Growth: The global green logistics market is expected to exceed $2.5 trillion by 2027, offering Bidvest a significant opportunity to leverage sustainable transportation solutions.

- Energy Efficiency Investments: Upgrading facilities with energy-efficient equipment can lead to substantial operational cost savings, with many businesses reporting a 10-20% reduction in energy bills after implementing such technologies.

- Sustainable Product Development: The demand for eco-friendly products is rising, with consumers willing to pay a premium for sustainable options, creating a market advantage for Bidvest's hygiene and cleaning divisions.

- Circular Economy Initiatives: Embracing technologies that support a circular economy, such as advanced recycling and waste-to-energy solutions, can further bolster Bidvest's environmental credentials and operational efficiency.

Technological advancements are reshaping Bidvest's operational landscape, driving efficiency and creating new service opportunities. The integration of AI and data analytics is key for optimizing logistics and facilities management, with companies reporting 10-20% efficiency gains through automation in 2024.

The rise of e-commerce necessitates robust last-mile delivery and inventory systems, as global sales approach $7.4 trillion by 2025. Bidvest's digital reliance also heightens cybersecurity risks, with data breaches costing an average of $4.45 million globally in 2023, a 15% increase.

Smart technologies and IoT are transforming facilities management, with the global market for IoT in smart buildings projected to exceed $70 billion by 2024, enabling predictive maintenance and energy savings.

Sustainable technologies offer growth avenues, particularly in green logistics, a market expected to surpass $2.5 trillion by 2027. Bidvest's adoption of eco-friendly solutions enhances its brand and appeals to environmentally conscious consumers.

| Technological Trend | Impact on Bidvest | 2024/2025 Data/Projection |

|---|---|---|

| AI & Data Analytics | Operational efficiency, cost reduction | 10-20% efficiency gains from automation (2024) |

| E-commerce Growth | Demand for advanced logistics, inventory management | Global e-commerce sales to reach $7.4 trillion (2025) |

| Cybersecurity | Risk of data breaches, financial penalties | Global data breach cost: $4.45 million (2023) |

| IoT in Smart Buildings | Enhanced facilities management, energy efficiency | IoT in smart buildings market > $70 billion (2024) |

| Green Technologies | Sustainability, market differentiation | Green logistics market > $2.5 trillion (2027) |

Legal factors

Bidvest navigates a complex web of industry-specific regulations across its diverse sectors like financial services, freight, and automotive. Strict adherence to these laws, from banking acts to transport safety standards, is paramount. For example, the 2023 disposal of Bidvest Bank involved extensive regulatory approvals, highlighting the critical role of compliance in strategic maneuvers.

Bidvest, as a significant player across numerous sectors, must navigate a complex web of competition and antitrust regulations. These laws are designed to prevent market dominance and ensure a level playing field, directly influencing Bidvest's strategies for expansion through mergers and acquisitions. For instance, in 2024, regulatory bodies globally, including the European Commission and the US Federal Trade Commission, continued to scrutinize large corporate combinations, with a particular focus on sectors where market concentration is already high.

Failure to adhere to these regulations can result in substantial penalties. In 2023 alone, antitrust fines worldwide exceeded $7 billion, underscoring the financial risks associated with non-compliance. Bidvest's proactive approach to understanding and integrating these legal requirements into its business planning is therefore paramount to safeguarding its operations and growth trajectory.

South Africa's Protection of Personal Information Act (POPIA) and Europe's General Data Protection Regulation (GDPR) are key legal factors affecting Bidvest. These regulations mandate stringent data privacy and protection measures for customer and employee information. Failure to comply can result in substantial fines, with GDPR penalties reaching up to 4% of global annual turnover or €20 million, whichever is higher, and POPIA fines up to R10 million.

Labor Laws and Employment Regulations

Bidvest's global operations mean it navigates a complex web of labor laws, impacting everything from minimum wage requirements to employee rights and collective bargaining agreements. For instance, in South Africa, the Basic Conditions of Employment Act sets standards for working hours and leave, while the Labour Relations Act governs union recognition. These regulations directly influence Bidvest's operational costs and human resource strategies across its diverse business units.

Changes in employment regulations can significantly alter Bidvest's financial landscape. For example, an increase in minimum wage in a key operating region could lead to higher payroll expenses. Similarly, new regulations on working conditions or employee benefits might necessitate investments in infrastructure or updated HR policies, potentially impacting profitability.

Maintaining robust labor relations is paramount for Bidvest's stability and efficiency. The company's commitment to fair employment practices and compliance with regulations helps mitigate the risk of labor disputes, which can disrupt operations and damage its reputation. As of early 2024, many countries are reviewing or implementing updates to their labor laws, focusing on areas like gig economy worker rights and flexible working arrangements, which Bidvest will need to monitor closely.

- Compliance Burden: Bidvest must adhere to varying national labor laws, including minimum wage, working hours, and employee protection standards, across its international operations.

- Cost Implications: Fluctuations in labor regulations, such as mandated wage increases or enhanced benefits, directly impact Bidvest's operational expenditures and profitability.

- Risk Management: Proactive management of labor relations and strict adherence to employment laws are critical to preventing costly labor disputes and maintaining operational continuity.

- Evolving Landscape: Ongoing legislative changes globally, particularly concerning worker classification and flexible work, require continuous adaptation of Bidvest's HR policies and practices.

Environmental Regulations and Standards

Bidvest faces increasing scrutiny under evolving environmental laws, impacting its freight and facilities management sectors. For instance, South Africa's carbon tax, implemented in 2019 and adjusted upwards, directly affects transport-intensive operations. The latest adjustments in 2024/2025 will likely increase compliance costs for businesses like Bidvest.

Compliance with these mandates, such as enhanced emissions controls and waste management protocols, necessitates significant capital expenditure. Bidvest's commitment to sustainability, including potential investments in electric vehicles or more efficient logistics, will be crucial. Failure to adapt can result in substantial penalties, as seen with growing environmental fines globally.

- Evolving Emissions Standards: South Africa's carbon tax continues to rise, impacting fuel consumption across Bidvest's logistics.

- Waste Management Compliance: Stricter regulations on waste disposal and recycling require operational adjustments.

- Resource Use Efficiency: Growing focus on water and energy conservation necessitates investment in sustainable technologies.

- Climate Reporting: Mandatory climate-related disclosures, becoming more prevalent in 2024/2025, demand robust data collection and reporting frameworks.

Bidvest must navigate a complex and evolving legal landscape, encompassing everything from financial services regulations to data privacy laws like POPIA and GDPR. Compliance with these varied statutes is critical to avoid significant penalties, which can amount to substantial percentages of global turnover. The company's proactive approach to understanding and integrating these legal requirements is essential for its continued growth and operational stability.

Environmental factors

Bidvest is navigating an increasingly stringent global regulatory landscape concerning climate change. For instance, by 2024, many nations are tightening carbon emission targets and enhancing reporting mandates, directly affecting sectors like Bidvest's freight and industrial operations. This means stricter oversight on how much carbon the company emits.

The company is under pressure to actively reduce its carbon footprint. This involves adopting cleaner fuels and implementing more energy-efficient practices across its diverse business units. For example, in 2023, many logistics companies began investing in electric vehicle fleets, a trend Bidvest is likely following to meet these evolving standards.

Compliance with these evolving regulations is no longer optional. Mandates in key markets, such as Australia and the United Kingdom, require businesses to demonstrate tangible progress in decarbonization. Failure to comply can lead to significant penalties and reputational damage, making proactive adaptation crucial for Bidvest's long-term sustainability.

Growing environmental concerns about waste generation and resource depletion are pushing companies like Bidvest to integrate sustainable waste management and circular economy principles. This is especially critical for their facilities management and distribution arms, which deal with substantial amounts of consumables and waste daily.

For instance, in 2024, the global waste management market was valued at approximately $1.6 trillion, highlighting the significant economic implications of effective waste handling. Bidvest's commitment to implementing robust recycling programs, waste reduction initiatives, and sustainable procurement is therefore not just an environmental imperative but also a strategic business advantage, potentially leading to cost savings and enhanced brand reputation.

The escalating scarcity of key natural resources, coupled with a growing global demand for ethically and sustainably sourced materials, presents a significant challenge for companies like Bidvest. This trend directly influences the cost and availability of raw materials essential for various business operations, potentially leading to price fluctuations and disruptions in supply chains. For instance, increased competition for water resources in certain regions could impact food and beverage processing, a core area for Bidvest.

To navigate these environmental pressures, Bidvest must prioritize the development and implementation of robust, resilient, and sustainable sourcing strategies. This proactive approach is crucial for mitigating the risks associated with resource volatility and ensuring the continuity of its operations. By focusing on long-term supplier relationships and exploring alternative, more sustainable inputs, Bidvest can better insulate itself from market shocks and uphold its commitment to responsible business practices.

Environmental Impact of Logistics and Freight

Bidvest's significant logistics and freight operations, a cornerstone of its diverse business, inherently generate environmental impacts. These include contributions to air pollution from vehicle emissions and noise pollution, affecting local communities and ecosystems. The sheer volume of goods moved across its network necessitates a focus on mitigating these effects.

Increasingly stringent environmental regulations and growing stakeholder demands are compelling a shift towards greener transport solutions. This includes the adoption of electric vehicles (EVs) for last-mile delivery and the implementation of advanced route optimization software to reduce fuel consumption and mileage. For instance, the global logistics industry is seeing a surge in EV adoption, with projections indicating millions of electric trucks on the road by 2030, a trend Bidvest will likely need to align with.

To ensure long-term viability and bolster its corporate reputation, Bidvest must prioritize investments in sustainable logistics and transport infrastructure. This commitment to green practices is not merely about compliance but also about operational efficiency and future-proofing its supply chain. Companies actively investing in sustainable logistics are often perceived more favorably by consumers and investors alike, potentially leading to competitive advantages.

- Air Pollution: Vehicle emissions from freight transport contribute to poor air quality, impacting public health and the environment.

- Noise Pollution: Heavy vehicle traffic in logistics hubs and along transport routes can create significant noise disturbances.

- Regulatory Compliance: Growing international and national regulations on emissions standards and environmental performance directly affect logistics operations.

- Stakeholder Expectations: Investors, customers, and employees increasingly expect businesses to demonstrate strong environmental responsibility in their supply chains.

Stakeholder Pressure for ESG Reporting and Performance

Stakeholder pressure for robust Environmental, Social, and Governance (ESG) reporting and performance is increasingly shaping business strategy. Investors, in particular, are channeling significant capital towards companies demonstrating strong ESG credentials. For instance, global sustainable investment assets reached an estimated $37.8 trillion by the end of 2022, according to the Global Sustainable Investment Alliance, highlighting this trend.

Bidvest's proactive engagement with its ESG framework, which includes setting ambitious targets for environmental impact reduction and adhering to internationally recognized reporting standards, is crucial. This commitment not only facilitates access to capital markets but also reinforces its social license to operate, a vital component for long-term business sustainability.

Furthermore, this focus on ESG directly influences Bidvest's brand perception and competitive positioning. Companies that effectively communicate their sustainability efforts often experience enhanced brand loyalty and a stronger competitive edge in the marketplace. In 2024, for example, companies with high ESG ratings were observed to outperform their peers in certain market segments.

- Investor Demand: Sustainable investment assets are projected to continue their upward trajectory, with many institutional investors now mandating ESG integration into their portfolios.

- Customer Expectations: Consumers are increasingly favoring brands that demonstrate environmental responsibility, influencing purchasing decisions and brand loyalty.

- Regulatory Landscape: While not explicitly stated, evolving regulations globally are pushing for greater transparency in ESG disclosures, making proactive reporting a necessity.

- Competitive Advantage: Strong ESG performance can differentiate Bidvest, attracting talent, fostering innovation, and building resilience against future environmental and social risks.

Bidvest faces increasing pressure to reduce its carbon footprint and adopt greener operational practices. For example, by 2024, many nations have tightened carbon emission targets and reporting mandates, directly impacting sectors like Bidvest's freight and industrial operations, necessitating stricter oversight on carbon emissions.

The company must integrate sustainable waste management and circular economy principles due to growing environmental concerns about waste generation and resource depletion. This is particularly critical for its facilities management and distribution arms, which handle substantial daily volumes of consumables and waste, with the global waste management market valued at approximately $1.6 trillion in 2024.

Bidvest's logistics operations contribute to air and noise pollution, requiring a focus on mitigating these effects. The increasing adoption of electric vehicles (EVs) in the logistics industry, with projections of millions of electric trucks on the road by 2030, indicates a necessary shift towards greener transport solutions.

Stakeholder pressure for robust Environmental, Social, and Governance (ESG) reporting is significant, with global sustainable investment assets reaching an estimated $37.8 trillion by the end of 2022. Bidvest's commitment to its ESG framework, including environmental impact reduction targets, is crucial for capital market access and social license to operate.

| Environmental Factor | Impact on Bidvest | Key Data/Trend |

|---|---|---|

| Climate Change Regulations | Increased compliance costs, need for emission reduction strategies. | Stricter carbon emission targets and reporting mandates implemented by many nations in 2024. |

| Waste Management & Resource Scarcity | Need for sustainable practices, potential supply chain disruptions. | Global waste management market valued at ~$1.6 trillion (2024); growing demand for ethically sourced materials. |

| Pollution (Air & Noise) | Reputational risk, operational adjustments required. | Millions of electric trucks projected on roads by 2030, indicating a shift in logistics. |

| ESG Stakeholder Pressure | Enhanced access to capital, improved brand perception. | Global sustainable investment assets estimated at $37.8 trillion by end of 2022. |

PESTLE Analysis Data Sources

Our Bidvest PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial institutions like the World Bank and IMF, and leading industry-specific market research reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors affecting Bidvest's operations.