Bharat Heavy Electricals PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bharat Heavy Electricals Bundle

Navigate the complex external landscape impacting Bharat Heavy Electricals with our comprehensive PESTLE analysis. Understand the political stability, economic fluctuations, and technological advancements that are shaping its operational environment. Gain actionable intelligence to inform your investment decisions and strategic planning. Download the full PESTLE analysis now to unlock critical insights and secure your competitive advantage.

Political factors

BHEL's status as a Public Sector Undertaking (PSU) with substantial government ownership means it enjoys considerable backing and is strategically aligned with India's national development objectives. This government support is crucial for its operations and growth.

The Indian government's ongoing focus on enhancing energy security and bolstering infrastructure, covering thermal, nuclear, and renewable energy sectors, directly fuels BHEL's order book and ensures policy support. This commitment translates into tangible benefits for the company.

Fiscal incentives for significant projects and strategic alliances, like the joint venture with NTPC for an 800 MW advanced ultra-supercritical thermal power plant highlighted in the Budget 2024-25, underscore this governmental commitment and provide BHEL with vital strategic advantages.

India's energy policy is a significant driver for Bharat Heavy Electricals Limited (BHEL). The nation has set an ambitious target of achieving 500 GW of non-fossil fuel-based energy capacity by 2030. This presents a substantial opportunity for BHEL to supply equipment for renewable energy projects.

However, the energy landscape also includes a continued reliance on thermal power for grid stability. The government plans to add approximately 80 GW of new thermal capacity by FY32. This dual focus ensures that BHEL's expertise in conventional power equipment remains relevant, even as it expands its offerings in the renewable energy sector.

The Indian government's 'Make in India' and 'Aatma Nirbhar Bharat Abhiyan' (Self-Reliant India Campaign) are significant political drivers for Bharat Heavy Electricals Limited (BHEL). These initiatives strongly promote domestic manufacturing and technological advancement, directly benefiting BHEL's operations in crucial sectors such as power, defense, and transportation. This policy focus encourages reduced import dependence and strengthens indigenous capabilities, particularly in advanced power generation and emerging areas like green hydrogen.

Regulatory Environment and Compliance

The regulatory landscape for India's power and industrial sectors significantly shapes Bharat Heavy Electricals Limited's (BHEL) operational environment. This includes stringent environmental norms, evolving project clearance processes, and dynamic procurement policies that BHEL must navigate. For instance, the Ministry of Power's directives on renewable energy integration and thermal power plant efficiency directly influence BHEL's product development and order pipelines.

Adaptability to regulatory shifts is crucial for BHEL. Changes in emission standards, such as those being progressively tightened for thermal power plants, require BHEL to invest in cleaner technologies and retrofitting solutions. Similarly, government policies favoring domestic manufacturing, like the Production Linked Incentive (PLI) schemes, can create opportunities but also necessitate compliance with specific local content requirements. The Ministry of Heavy Industries actively monitors BHEL's adherence to these evolving mandates.

- Environmental Regulations: Compliance with India's increasingly strict emission standards for thermal power plants, impacting the design and retrofitting of equipment.

- Procurement Policies: Adherence to government procurement preferences for domestic manufacturers and specific tender conditions, influencing BHEL's order book.

- Project Clearances: Navigating the complex and often lengthy process of obtaining environmental and statutory clearances for large infrastructure projects where BHEL is a key supplier.

- Energy Transition Policies: Responding to government mandates and incentives promoting renewable energy sources, which affects BHEL's strategic focus and product diversification.

Geopolitical Stability and International Relations

India's evolving geopolitical stance significantly impacts BHEL's international business prospects. Strong diplomatic ties and trade agreements can unlock new export markets for BHEL's power generation and transmission equipment. For instance, India's increasing engagement with Southeast Asian nations and African countries, particularly through initiatives like the India-Africa Forum Summit, presents potential growth avenues for BHEL's overseas projects. Stable international relations also facilitate access to critical components and advanced technologies, crucial for BHEL's manufacturing and R&D efforts, thereby enhancing its competitive edge.

While BHEL's primary revenue stream originates from the domestic Indian market, a robust international presence is vital for long-term diversification and risk mitigation. As of fiscal year 2023-24, BHEL's order book included a notable portion from international projects, underscoring the importance of global stability. Positive international relations foster an environment conducive to securing new overseas contracts and forming strategic partnerships, which are essential for BHEL to expand its global footprint and reduce its reliance on a single market.

The geopolitical landscape directly influences BHEL's ability to tap into global supply chains and technological advancements. For example, disruptions caused by international conflicts or trade disputes can affect the timely procurement of specialized components, impacting project timelines and costs. Conversely, periods of geopolitical calm and cooperation can lead to more predictable supply chains and easier access to cutting-edge technologies through collaborations or licensing agreements, benefiting BHEL's product development and manufacturing efficiency.

- India's Act East Policy: This policy aims to strengthen economic and strategic ties with ASEAN countries, potentially opening up new markets for BHEL's power plant exports and infrastructure development projects in the region.

- Bilateral Trade Agreements: Favorable trade agreements, such as those with countries in the Middle East and Africa, can reduce import duties and streamline customs procedures, making BHEL's offerings more competitive in these regions.

- Global Technology Partnerships: Geopolitical stability encourages collaborations with international technology providers, allowing BHEL to integrate advanced solutions in areas like renewable energy and smart grids into its product portfolio.

- Export Credit Support: India's strong diplomatic relations can facilitate access to export credit and financing from international financial institutions, supporting BHEL's large-scale overseas project bids.

Government policies are a cornerstone for BHEL, given its PSU status. Initiatives like the 'Make in India' campaign and the push for self-reliance directly bolster BHEL's domestic manufacturing capabilities. The government's ambitious renewable energy targets, aiming for 500 GW by 2030, coupled with continued investment in thermal power, ensure a robust demand for BHEL's diverse product portfolio.

The Union Budget 2024-25 highlighted fiscal incentives for significant projects, including an 800 MW advanced ultra-supercritical thermal power plant joint venture with NTPC, underscoring direct government backing. Furthermore, BHEL's adherence to evolving environmental regulations and procurement policies, such as those favoring domestic manufacturers, is critical for its order book and operational strategy.

India's geopolitical engagements, particularly its Act East Policy and trade agreements with regions like the Middle East and Africa, are opening new export markets for BHEL. Stable international relations also facilitate access to critical components and advanced technologies, enhancing BHEL's competitive edge in global projects.

| Policy/Initiative | Impact on BHEL | Key Data/Target |

|---|---|---|

| Make in India / Aatma Nirbhar Bharat | Boosts domestic manufacturing, reduces import dependence | Focus on power, defense, transportation sectors |

| Renewable Energy Targets | Increases demand for renewable energy equipment | 500 GW non-fossil fuel capacity by 2030 |

| Thermal Power Capacity Addition | Sustains demand for conventional power equipment | Approx. 80 GW new thermal capacity by FY32 |

| Budget 2024-25 Incentives | Provides strategic advantages for key projects | JV for 800 MW ultra-supercritical plant |

| Act East Policy | Opens new export markets in ASEAN | Strengthens economic ties with Southeast Asia |

What is included in the product

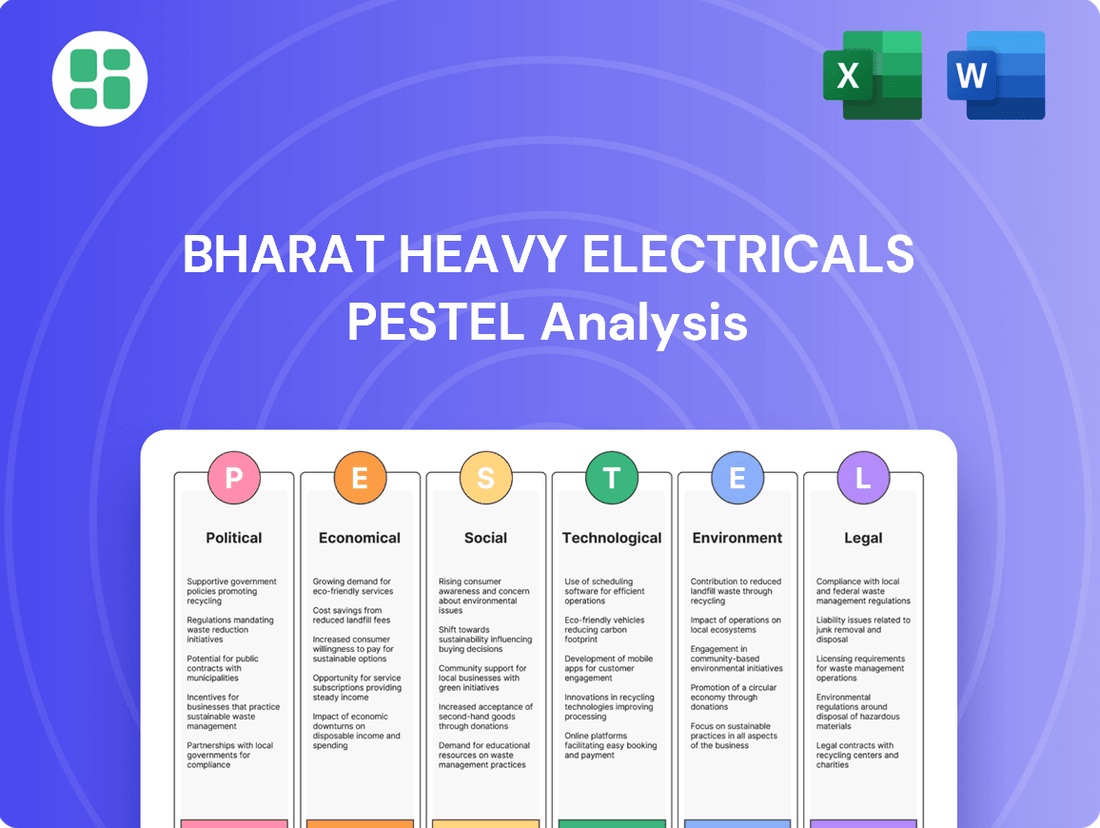

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Bharat Heavy Electricals, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities within the company's operating landscape.

A PESTLE analysis for BHEL offers a clear, summarized view of external factors, acting as a pain point reliever by highlighting potential challenges and opportunities for strategic planning.

This analysis, segmented by PESTEL categories, provides a quick interpretation of the external landscape, relieving the pain of sifting through complex data for actionable insights.

Economic factors

The Indian government's commitment to infrastructure development is a major tailwind for Bharat Heavy Electricals Limited (BHEL). The Union Budget 2024-25 allocated a substantial ₹11,11,111 crore, representing 3.4% of GDP, towards capital expenditure.

This significant outlay, focused on critical sectors like roads, railways, and power, directly fuels BHEL's order book. Increased government spending on these projects translates into a higher demand for BHEL's power generation equipment, transmission systems, and transportation solutions, driving revenue growth.

India's consistent economic expansion and accelerating industrialization are key drivers for BHEL, directly fueling demand for its power generation and industrial equipment. This trend is evident in the company's strong financial results for FY 2024-25, where a significant 19% revenue increase was reported.

The robust economic climate has translated into record order inflows for BHEL, underscoring the heightened demand across both the power and broader industrial sectors. This performance highlights BHEL's strategic positioning to capitalize on India's growth trajectory.

Inflationary pressures continue to be a significant concern for Bharat Heavy Electricals Limited (BHEL). Fluctuations in the cost of key raw materials like steel, copper, and aluminum directly impact BHEL's profitability. For instance, steel prices saw considerable volatility in late 2023 and early 2024, with some benchmarks experiencing increases of over 10% year-on-year, directly affecting the cost of manufacturing power equipment.

Managing these rising input costs is paramount for BHEL to maintain healthy margins on its large-scale projects. The company's ability to implement efficient procurement strategies and explore hedging mechanisms for commodities will be critical. This proactive approach helps mitigate the impact of price volatility and ensures competitive bidding for new orders, especially as the company navigates the economic landscape of 2024-2025.

Interest Rates and Access to Finance

Interest rates significantly influence the financial capacity of BHEL's clients, particularly in the power and infrastructure sectors, to commit to new projects. Higher borrowing costs can deter large-scale investments, directly impacting BHEL's order pipeline. For instance, a rise in the Reserve Bank of India's (RBI) repo rate, which stood at 6.50% as of early 2024, can translate to increased financing costs for utilities and state governments, potentially delaying or scaling down capital expenditure plans.

The availability of accessible and affordable finance is crucial for BHEL's growth. Government initiatives and financial institutions play a vital role in providing credit lines for infrastructure development. For example, the availability of concessional loans from bodies like the India Infrastructure Finance Company Limited (IIFCL) or government-backed schemes for state discoms can directly boost demand for BHEL's products and services. In 2023-24, India continued to focus on capital expenditure, with the central government's capex outlay increasing substantially, signaling a supportive environment for infrastructure financing.

- Interest Rate Impact: Higher interest rates, such as the prevailing repo rate of 6.50% in early 2024, increase the cost of capital for BHEL's customers, potentially slowing down project approvals.

- Financing Availability: Access to government-backed loans and financial support from institutions like IIFCL is critical for stimulating investment in sectors served by BHEL.

- Government Spending: The Indian government's increased capital expenditure for fiscal year 2023-24, exceeding ₹10 lakh crore, demonstrates a commitment to infrastructure development, which benefits BHEL.

- Customer Investment: The ability of state governments and public sector undertakings to secure financing directly correlates with their capacity to place orders with BHEL for power plants and equipment.

Investment in Renewable Energy

The Indian government's significant investment and policy push towards renewable energy, particularly solar, wind, and green hydrogen, are creating substantial economic opportunities for Bharat Heavy Electricals Limited (BHEL). This strategic focus is designed to accelerate the nation's transition to cleaner energy sources, directly benefiting companies like BHEL that are equipped to participate in this expansion.

BHEL's collaborations, such as those with the Indian Renewable Energy Development Agency (IREDA), are crucial for fast-tracking renewable energy project development. Furthermore, BHEL's commitment to developing indigenous green hydrogen technology signifies a proactive approach to capturing market share in this nascent but rapidly growing sector. By aligning with national priorities, BHEL is positioning itself to be a key player in India's green energy future.

- India's renewable energy capacity target for 2030 is 500 GW, with significant growth expected in solar and wind power.

- The National Green Hydrogen Mission, launched in 2023, aims to make India a global hub for green hydrogen production and export, with an initial outlay of INR 19,744 crore.

- BHEL has secured orders for solar power projects totaling over 1.5 GW, showcasing its active participation in the sector.

- The company is also focusing on developing advanced technologies for wind turbines and energy storage solutions to complement its renewable energy portfolio.

India's sustained economic growth, projected to be around 7% for FY 2024-25, directly bolsters demand for BHEL's core offerings in power generation and infrastructure. This robust economic environment fuels increased capital expenditure by both public and private sectors, translating into higher order inflows for the company.

Inflationary pressures, particularly concerning raw materials like steel and copper, continue to pose a challenge, impacting BHEL's profit margins. For instance, global steel prices saw an average increase of approximately 8-12% in the latter half of 2023 and early 2024, necessitating careful cost management by BHEL.

Interest rate policies, with the RBI maintaining a repo rate of 6.50% as of early 2024, influence the financing costs for BHEL's clients. While stable, any upward revisions could potentially dampen investment in large infrastructure projects, a key revenue driver for BHEL.

| Economic Factor | Data Point (2024-2025) | Impact on BHEL |

|---|---|---|

| GDP Growth Projection | ~7% (FY 2024-25) | Positive: Fuels demand for power and infrastructure projects. |

| Inflation (Raw Materials) | Steel prices +8-12% (H2 2023-2024) | Negative: Increases input costs, potentially squeezing margins. |

| Repo Rate | 6.50% (Early 2024) | Neutral to Slightly Negative: Affects client financing costs. |

| Government Capex | ₹11.11 lakh crore (Union Budget 2024-25) | Highly Positive: Drives significant order opportunities. |

Same Document Delivered

Bharat Heavy Electricals PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Bharat Heavy Electricals PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. Understand the comprehensive overview of BHEL's external landscape.

Sociological factors

Bharat Heavy Electricals Limited (BHEL) relies heavily on a workforce possessing specialized engineering and manufacturing skills to manage its vast operations. The company’s commitment to continuous skill enhancement and training programs is paramount for retaining its market leadership and responding effectively to technological advancements, especially in areas like advanced power generation and the burgeoning renewable energy sector.

BHEL's investment in talent development is evident in its various training centers and collaborations with academic institutions. For instance, in FY 2023-24, BHEL continued its focus on upskilling its existing workforce, with thousands of employees undergoing specialized training modules designed to align with emerging industry trends and the company's strategic growth areas.

Bharat Heavy Electricals Limited (BHEL) actively pursues Corporate Social Responsibility (CSR) as mandated by the Companies Act, 2013. Their initiatives span critical areas like skill development, healthcare, sanitation, education, and environmental conservation, directly benefiting local communities.

In fiscal year 2023-24, BHEL reported spending ₹245.13 crore on CSR activities, demonstrating a significant commitment to societal upliftment. These efforts not only improve community well-being but also solidify BHEL's social license to operate, fostering goodwill and strong stakeholder relationships.

Bharat Heavy Electricals Limited (BHEL), as a major public sector undertaking, finds its public perception deeply tied to its role in India's industrial growth and energy security. Recent government initiatives emphasizing green energy and sustainable development directly impact how BHEL is viewed, particularly concerning its environmental stewardship. For instance, BHEL's commitment to renewable energy projects, such as its participation in solar power installations, contributes positively to its brand image in 2024.

Maintaining a robust brand image is crucial for BHEL's operational success. A strong reputation for delivering high-quality, reliable power generation equipment, as evidenced by its consistent order book, fosters public trust and attracts skilled professionals. In fiscal year 2023-24, BHEL secured orders worth over ₹24,000 crore, reflecting continued confidence in its capabilities and further solidifying its standing.

Demographic Shifts and Urbanization

India's burgeoning population, projected to reach 1.4 billion by mid-2024, fuels an escalating demand for electricity and robust infrastructure. This demographic reality directly translates into a sustained growth outlook for Bharat Heavy Electricals Limited (BHEL), as the nation requires continuous upgrades and expansions of its power generation and transmission capabilities.

The rapid pace of urbanization, with over 35% of India's population residing in urban areas as of 2023, further intensifies the need for reliable energy supply and modern infrastructure development. This trend plays directly into BHEL's strengths, positioning the company to benefit from increased project pipelines in power, transmission, and transportation sectors.

- Population Growth: India's population is expected to surpass China's in 2024, creating a vast consumer base for energy services.

- Urbanization Rate: The urban population in India is growing at an estimated 2.5% annually, driving demand for concentrated power solutions.

- Infrastructure Investment: Government initiatives like the National Infrastructure Pipeline aim to invest significantly in power and related sectors, creating opportunities for BHEL.

Safety and Labour Relations

BHEL places a strong emphasis on maintaining rigorous safety standards across its manufacturing facilities and project sites, recognizing its direct impact on operational continuity and employee well-being. In 2023-24, the company reported a significant reduction in its Lost Time Injury Frequency Rate (LTIFR), achieving a rate of 0.15 per million man-hours worked, a notable improvement from the previous year's 0.22. This focus on safety is crucial for preventing costly accidents and ensuring project timelines are met.

Fostering positive labor relations is another cornerstone of BHEL's operational strategy. The company engages in continuous dialogue with its workforce and various trade unions to address concerns and promote a collaborative environment. As of March 2024, BHEL had active Memoranda of Understanding (MoUs) with 14 recognized trade unions, facilitating structured communication and dispute resolution mechanisms.

- Safety First Culture: BHEL's commitment to safety is underscored by its consistent efforts to minimize workplace incidents, aiming for zero harm.

- Employee Engagement: Proactive engagement with employees and unions helps maintain industrial harmony and boosts productivity.

- Reduced Downtime: Effective safety management and labor relations directly contribute to minimizing operational disruptions and associated financial losses.

- Reputational Integrity: A strong track record in safety and labor practices safeguards BHEL's public image and stakeholder trust.

BHEL's workforce requires specialized engineering and manufacturing skills, with continuous training programs crucial for adapting to advancements in areas like renewables. In FY 2023-24, thousands of employees underwent upskilling to align with industry trends.

The company's Corporate Social Responsibility (CSR) spending in FY 2023-24 reached ₹245.13 crore, focusing on skill development, healthcare, and education, which enhances its social license to operate and stakeholder relations.

India's growing population and rapid urbanization, with over 35% urban residents in 2023, drive demand for BHEL's power generation and infrastructure solutions, creating a sustained growth outlook.

BHEL prioritizes safety, achieving a Lost Time Injury Frequency Rate (LTIFR) of 0.15 in 2023-24, a significant improvement that minimizes disruptions. Proactive engagement with 14 recognized trade unions as of March 2024 fosters industrial harmony and productivity.

Technological factors

Bharat Heavy Electricals Limited (BHEL) is heavily invested in enhancing thermal power generation efficiency. The company is a key player in developing and deploying high-efficiency supercritical and ultra-supercritical technologies. These advancements are crucial for meeting stringent environmental regulations and improving the overall cost-effectiveness of power production.

A prime example of this focus is the 800 MW advanced ultra-supercritical (AUSC) plant, a collaborative effort between BHEL and NTPC. This project showcases BHEL's commitment to cutting-edge technology, aiming for significantly reduced fuel consumption and lower carbon emissions per unit of electricity generated. Such initiatives are vital for India's energy transition goals.

BHEL is significantly enhancing its renewable energy portfolio. This includes a substantial push into solar manufacturing, aiming to bolster India's domestic solar supply chain. The company is also at the forefront of developing technologies crucial for green hydrogen production, a key area for future energy solutions.

A notable development is BHEL's strategic partnership with the Bhabha Atomic Research Centre (BARC) to develop indigenous electrolyser systems. This collaboration is a critical move towards achieving self-reliance in hydrogen production technology, aligning with national goals for energy independence.

BHEL is increasingly integrating digitalization and automation, embracing Industry 4.0 principles to streamline its manufacturing and operations. This strategic shift is aimed at boosting efficiency, cutting operational expenses, and ensuring smoother project completions. For instance, the company is focusing on smart grid solutions and advanced monitoring technologies to optimize energy management and system performance.

Research and Development (R&D) Investment

Bharat Heavy Electricals Limited (BHEL) prioritizes developing technology within India, dedicating around 2.4% of its revenue to Research and Development (R&D). This focus on homegrown innovation is crucial for creating products that meet future demands and maintaining a competitive edge.

BHEL's R&D investment helps it branch out into promising new sectors. These include areas with significant growth potential such as electric vehicles, defense systems, and aerospace technologies.

- Indigenous R&D Focus: BHEL invests approximately 2.4% of its revenue in R&D to foster domestic technological advancement.

- Future-Ready Products: This investment is key to developing innovative solutions and staying ahead in evolving markets.

- Diversification Strategy: R&D efforts support BHEL's expansion into high-growth sectors like EVs, defense, and aerospace.

Emerging Technologies (e.g., Hydrogen, EV Charging)

Bharat Heavy Electricals Limited (BHEL) is strategically expanding into burgeoning technological sectors, notably the hydrogen economy. This diversification includes establishing a Centre of Excellence dedicated to electrolyzers and developing Type IV hydrogen storage cylinders, crucial components for hydrogen fuel applications. This move positions BHEL to capitalize on the global shift towards cleaner energy sources.

Furthermore, BHEL is actively developing a digital application to manage a pan-India network of electric vehicle (EV) charging stations. This initiative underscores the company's commitment to supporting the growth of green mobility and leveraging digital solutions for infrastructure management. The Indian government's push for EVs, with targets like the National Electric Mobility Mission Plan, provides a strong tailwind for such ventures.

- Hydrogen Value Chain Investment: BHEL is investing in the hydrogen value chain, including electrolyzer manufacturing and hydrogen storage solutions.

- EV Charging Network App: Development of a digital platform for a nationwide EV charging infrastructure is underway.

- Government Support for Green Mobility: These initiatives align with India's ambitious goals for electric vehicle adoption and renewable energy integration.

- Market Potential: The global hydrogen market is projected to reach significant figures, with the EV charging infrastructure market also experiencing rapid expansion, offering substantial growth opportunities for BHEL.

BHEL's technological advancements are central to its strategy, particularly in high-efficiency thermal power and renewable energy. The company's investment of approximately 2.4% of its revenue in R&D fuels innovation across sectors like solar and green hydrogen. This commitment is evident in projects like the 800 MW advanced ultra-supercritical plant and collaborations for indigenous electrolyzer systems, positioning BHEL for future energy demands.

| Technology Area | Key Initiatives/Products | Impact/Goal |

|---|---|---|

| Thermal Power Efficiency | 800 MW Advanced Ultra-Supercritical (AUSC) Plant | Reduced fuel consumption, lower carbon emissions |

| Renewable Energy | Solar Manufacturing, Green Hydrogen Electrolyzers | Domestic supply chain enhancement, energy independence |

| Digitalization & Automation | Industry 4.0 integration, Smart Grid Solutions | Increased operational efficiency, cost reduction |

| R&D Investment | ~2.4% of Revenue | Development of future-ready products, diversification |

Legal factors

India's stringent environmental laws and tightening emission standards, particularly for thermal power plants, are a significant factor for BHEL. The company must continually invest in advanced technologies, such as Selective Catalytic Reduction (SCR) systems, to ensure its projects comply with these regulations. For instance, the Central Pollution Control Board (CPCB) has been progressively lowering permissible emission limits for particulate matter and SOx, directly impacting the design and retrofitting of BHEL's equipment.

As a Public Sector Undertaking (PSU), Bharat Heavy Electricals Limited (BHEL) is subject to a stringent regulatory framework set by the Indian government. This includes adherence to specific directives concerning its operations, procurement processes, and corporate governance standards. For instance, the Public Procurement Policy for Micro and Small Enterprises (MSEs) mandates preference for domestic manufacturers, impacting BHEL's supply chain strategies.

Compliance with these regulations is not optional; it's a fundamental requirement for BHEL's continued operation and market participation. This includes navigating evolving corporate governance norms, such as those introduced by SEBI for listed PSUs, and ensuring transparency in all dealings, especially in public procurement where preferential treatment for domestic content is often a key factor.

Bharat Heavy Electricals Limited (BHEL) navigates a landscape where its expansive, multi-billion dollar projects are meticulously governed by intricate contractual agreements. These aren't just standard business deals; they are often bespoke legal frameworks tailored to the unique demands of power generation, transmission, and industrial projects. For instance, major power plant contracts, which can run into thousands of crores, stipulate precise delivery schedules, performance guarantees, and penalties for delays, directly impacting BHEL's revenue recognition and profitability.

The absolute adherence to these contractual clauses, from the initial design phase through to commissioning and handover, is paramount for BHEL's financial health. A single dispute over project scope, quality, or timelines can lead to significant financial liabilities, impacting cash flow and potentially leading to costly arbitration or litigation. In the fiscal year 2023-24, BHEL's order book, a key indicator of future revenue, stood at approximately ₹1.05 trillion, underscoring the sheer volume of contractual obligations it manages.

Labor Laws and Industrial Relations

BHEL must strictly adhere to India's comprehensive labor laws, covering aspects like fair wages, working conditions, and occupational safety. This compliance is critical given its vast network of manufacturing facilities and project locations, ensuring smooth operations and avoiding legal penalties. For instance, the Code on Wages, 2019, aims to simplify wage and bonus payments, impacting BHEL's payroll processes.

Maintaining positive industrial relations is paramount for BHEL to prevent work stoppages and ensure productivity. The company's engagement with its workforce and trade unions directly influences its ability to execute projects efficiently. In 2023-24, BHEL reported a significant employee strength, underscoring the importance of these relations.

- Compliance with labor laws: BHEL navigates a complex web of regulations including the Industrial Disputes Act, 1947, and the Factories Act, 1948, to ensure fair employment practices and safe working environments across its diverse operations.

- Industrial harmony: Proactive engagement with employee unions and adherence to fair industrial practices are key to mitigating labor disputes and ensuring uninterrupted production and project execution.

- Employee welfare and safety: BHEL's commitment to worker safety is reflected in its adherence to safety standards and regulations, crucial for its heavy manufacturing and engineering activities.

- Wage and benefit structures: The company's compensation policies are designed in alignment with statutory requirements and market benchmarks, impacting its operational costs and employee morale.

Intellectual Property Rights (IPR)

Protecting Bharat Heavy Electricals Limited's (BHEL) intellectual property (IP) is paramount, particularly as it drives indigenous technology development and engages in strategic collaborations. Adherence to intellectual property rights (IPR) laws ensures that BHEL's innovations are secure and can be effectively commercialized, safeguarding its competitive edge in the global market.

BHEL actively manages its IP portfolio, which includes patents, trademarks, and designs, to protect its technological advancements. The company's commitment to R&D, evidenced by its significant investments, directly correlates with the generation of new IP. For instance, in FY2023, BHEL reported R&D expenditure of INR 1,100 crore, leading to the filing of numerous patents and the development of proprietary technologies across its diverse business segments.

- Patent Portfolio Growth: BHEL consistently files new patents to protect its inventions in areas like power generation, transmission, and renewable energy.

- Technology Licensing: The company leverages its IP through licensing agreements, generating revenue and facilitating technology transfer.

- Counterfeit Prevention: BHEL's trademarks are registered and protected to prevent the misuse of its brand and ensure product authenticity.

- Compliance with Global IPR Standards: BHEL ensures its IP practices align with international treaties and national laws to safeguard its innovations worldwide.

BHEL's operations are heavily influenced by government regulations, including environmental standards and public procurement policies favoring domestic manufacturers, as seen with the Public Procurement Policy for MSEs. The company must also adhere to evolving corporate governance norms, such as those from SEBI, ensuring transparency and compliance in its dealings, especially concerning its substantial order book of approximately ₹1.05 trillion as of FY2023-24.

The company's extensive project contracts, often valued in thousands of crores, are governed by precise legal frameworks dictating delivery schedules and performance guarantees. Strict adherence to these contractual clauses is vital for BHEL's financial health, as disputes can lead to significant liabilities. For instance, in FY2023, BHEL’s R&D expenditure was INR 1,100 crore, underscoring its commitment to innovation and the need to protect this intellectual property through patents and trademarks, aligning with global IPR standards.

Environmental factors

India's pledge to reach net-zero carbon emissions by 2070, coupled with aggressive renewable energy goals, directly shapes BHEL's environmental approach. This national commitment is compelling BHEL to channel investments into sustainable technologies, lower its operational carbon footprint, and increasingly focus on green energy projects.

For instance, India aims to achieve 500 GW of non-fossil fuel-based energy capacity by 2030. This policy direction encourages BHEL to bolster its offerings in solar, wind, and other renewable energy equipment and services, aligning its business development with national climate objectives.

India's ambitious target of achieving 500 GW of non-fossil fuel-based energy capacity by 2030, coupled with initiatives like the PM Surya Ghar Muft Bijli Yojana, is significantly accelerating the shift towards renewable energy sources. This policy direction directly impacts Bharat Heavy Electricals Limited (BHEL), necessitating a strategic pivot.

BHEL must actively diversify its product portfolio beyond traditional thermal power equipment. The company is increasingly focusing on developing and manufacturing components and systems for solar power, wind energy, and emerging green hydrogen technologies to align with these national renewable energy mandates and capture growth opportunities in the evolving energy landscape.

India faces significant challenges with water scarcity and pollution, directly impacting industries like BHEL. In 2023, the Central Water Commission reported that over 60% of India's groundwater blocks are over-exploited, highlighting the critical need for efficient water use. This necessitates BHEL to prioritize robust water resource management strategies across its manufacturing facilities.

BHEL's commitment to environmental protection means developing and implementing technologies that reduce water consumption and effectively treat wastewater. For instance, advanced effluent treatment plants are crucial for minimizing the discharge of pollutants, aligning with stricter environmental regulations expected to be enforced more rigorously in the coming years.

Waste Management and Circular Economy Initiatives

Bharat Heavy Electricals Limited (BHEL) demonstrates a strong commitment to environmental sustainability through robust waste management and a growing focus on circular economy principles. These efforts are integral to reducing its overall environmental impact.

BHEL has actively pursued initiatives such as achieving 'Single Use Plastic Free' status across its townships, a significant step in curbing plastic waste. Furthermore, the company promotes extensive recycling programs, aiming to reintegrate materials back into the production cycle and minimize landfill dependency.

Key highlights of BHEL's environmental initiatives include:

- Single Use Plastic Free Townships: Successfully implemented measures to eliminate single-use plastics in its residential and operational areas.

- Recycling and Resource Recovery: Ongoing programs focused on recycling various waste streams, including metals, plastics, and paper, to conserve resources.

- Circular Economy Integration: Exploring and implementing strategies to design products for longevity, repair, and recyclability, aligning with circular economy goals.

- Waste Reduction Targets: Setting and working towards specific targets for reducing hazardous and non-hazardous waste generation across its manufacturing facilities.

Environmental Compliance and Sustainability Reporting

Bharat Heavy Electricals Limited (BHEL) demonstrates a strong commitment to environmental stewardship, a core element of its operational strategy. This commitment is clearly articulated through its regular sustainability reports, which detail its efforts in environmental protection and resource management. For instance, BHEL's sustainability report for the fiscal year 2022-23 highlighted a significant reduction in its carbon footprint across various operations.

BHEL's proactive approach to environmental compliance is further underscored by its pursuit and achievement of GreenCo certifications for its manufacturing facilities. These certifications, often awarded by independent bodies like the Green Building Council, signify adherence to rigorous environmental standards. As of early 2024, several of BHEL's key manufacturing units have retained or achieved these coveted green credentials, reflecting ongoing investments in eco-friendly technologies and practices.

The company places a high priority on adhering to evolving environmental regulations, both domestic and international, ensuring its business activities are conducted responsibly. This includes meticulous tracking and reporting of its environmental performance indicators. BHEL's transparency in this regard is crucial for stakeholder trust and for navigating the increasingly stringent environmental governance landscape.

- Sustainability Reporting: BHEL's latest sustainability report (FY 2022-23) details its progress on environmental goals, including emissions reduction targets.

- GreenCo Certifications: Multiple BHEL manufacturing units hold GreenCo certifications, affirming their commitment to sustainable practices and resource efficiency.

- Regulatory Adherence: The company actively monitors and complies with national and international environmental laws, ensuring responsible operations.

- Environmental Performance: Transparent reporting on key environmental metrics, such as water consumption and waste generation, is a cornerstone of BHEL's operations.

India's commitment to net-zero by 2070 and ambitious renewable energy targets, such as 500 GW non-fossil fuel capacity by 2030, are driving BHEL's strategic shift. This necessitates BHEL to invest in green technologies and expand its offerings in solar, wind, and hydrogen power to align with national climate objectives.

Water scarcity in India, with over 60% of groundwater blocks over-exploited as of 2023, mandates BHEL to implement efficient water management and wastewater treatment across its operations. The company actively pursues waste reduction and circular economy principles, exemplified by its 'Single Use Plastic Free' townships and extensive recycling programs.

BHEL's environmental stewardship is evident in its sustainability reporting, with the FY 2022-23 report detailing carbon footprint reductions. Furthermore, multiple BHEL units have achieved GreenCo certifications, underscoring their adherence to rigorous environmental standards and efficient resource utilization.

PESTLE Analysis Data Sources

Our Bharat Heavy Electricals PESTLE Analysis is grounded in comprehensive data from reputable sources including government reports, economic indicators from institutions like the World Bank and IMF, and industry-specific market research. We ensure each factor is supported by current and verifiable information.