Bharat Heavy Electricals Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bharat Heavy Electricals Bundle

Bharat Heavy Electricals (BHEL) navigates a landscape shaped by intense competition and significant buyer power, particularly from government entities. The threat of substitutes is moderate, given the specialized nature of its offerings, while supplier bargaining power is also a key consideration.

The complete report reveals the real forces shaping Bharat Heavy Electricals’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bharat Heavy Electricals Limited (BHEL) depends on a global network for specialized raw materials, alloys, and crucial components vital for its heavy engineering products. For instance, in 2023, BHEL's procurement of critical raw materials like copper and specialized steel alloys, sourced internationally, represented a significant portion of its cost of goods sold.

The limited pool of global suppliers for these highly specific inputs grants them considerable bargaining power. BHEL's inability to readily substitute these suppliers, often due to stringent quality standards and intricate technical specifications, amplifies this leverage. This dependence can translate into price fluctuations and potential disruptions to BHEL's manufacturing timelines and overall expenses.

For highly specialized power generation technologies, like ultra-supercritical thermal power or advanced renewable energy components, BHEL often needs to secure licenses or technical partnerships with global leaders. These technology suppliers possess critical intellectual property, granting them considerable leverage in negotiating licensing fees, technology transfer agreements, and continuous support services.

This reliance on foreign technology can significantly impact BHEL's cost structure and its capacity for independent innovation and market competitiveness. For instance, in 2024, the global market for power generation equipment saw significant price increases for specialized components, directly affecting companies like BHEL that depend on these imported technologies.

While not traditional material suppliers, the availability of highly skilled engineers, technicians, and specialized labor is crucial for BHEL's complex design, manufacturing, and project execution. A shortage of such skilled human capital in the market can increase labor costs and impact project timelines.

In 2024, the demand for specialized engineering talent in India's manufacturing and infrastructure sectors remained robust, potentially strengthening the bargaining power of these skilled labor pools. BHEL's reliance on these experts means that competitive compensation and retention strategies are vital to mitigate potential cost escalations and project delays, reflecting the significant bargaining power of skilled human capital.

Logistics and Heavy Transportation Services

The bargaining power of suppliers in the logistics and heavy transportation sector for Bharat Heavy Electricals Limited (BHEL) is significant due to the specialized nature of the services required. Moving BHEL's massive equipment, such as turbine generators and boilers, necessitates a limited pool of providers with the necessary heavy-lift capabilities and infrastructure.

This scarcity of specialized logistics providers means they can command higher prices and dictate terms, directly impacting BHEL's project costs and timelines. For instance, in 2023, the global freight forwarding market was valued at approximately $245 billion, but the segment dealing with oversized and super-heavy cargo is much more niche, concentrating power among fewer players.

- Limited specialized providers: The need for heavy-lift cranes, specialized trailers, and barges restricts the number of capable logistics partners for BHEL.

- High switching costs: Developing relationships and qualifying new heavy logistics providers can be time-consuming and costly for BHEL.

- Criticality of service: Any disruption in specialized logistics can halt BHEL's manufacturing and project execution, giving suppliers considerable leverage.

Energy and Utility Providers

Bharat Heavy Electricals Limited (BHEL) relies heavily on energy and utility providers for its vast manufacturing operations. This dependence means that changes in energy prices, such as electricity and fuel costs, can significantly affect BHEL's production expenses. For instance, in FY 2023-24, the cost of power and fuel for BHEL was a substantial component of its operating expenditure, directly influencing its profitability.

The bargaining power of these suppliers stems from the essential nature of their services. BHEL's need for a consistent and reliable supply of electricity and fuel for its numerous plants grants utility providers a foundational leverage. Any disruption or price hike from these providers can create operational challenges and cost overruns for BHEL.

- Significant Energy Consumption: BHEL's manufacturing facilities require substantial electricity and fuel, making them a key customer for utility providers.

- Cost Sensitivity: Fluctuations in energy prices directly impact BHEL's cost of goods sold and overall operational efficiency.

- Supply Reliability: Uninterrupted utility supply is critical for maintaining BHEL's production schedules and meeting delivery commitments.

The bargaining power of suppliers for Bharat Heavy Electricals Limited (BHEL) is a notable factor influencing its operational costs and strategic flexibility. This power is derived from the specialized nature of many inputs, the limited number of qualified global suppliers, and the critical importance of these materials and technologies to BHEL's manufacturing processes.

For specialized raw materials and components, BHEL faces suppliers who can dictate terms due to limited alternatives. Similarly, technology providers for advanced power generation systems hold significant leverage due to intellectual property rights. The availability and cost of skilled labor also contribute to supplier power, especially in a competitive market for engineering talent.

Logistics providers for heavy equipment and utility suppliers for energy are other key areas where BHEL encounters substantial supplier bargaining power. These factors collectively necessitate careful supplier relationship management and strategic sourcing to mitigate potential cost increases and ensure supply chain stability.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on BHEL | 2023/2024 Data/Trend |

|---|---|---|---|

| Specialized Raw Materials & Components | Limited global suppliers, stringent quality/technical specs | Price volatility, potential supply disruptions | Global prices for copper and steel alloys saw increases in 2023. |

| Advanced Technology Providers | Intellectual property, licensing requirements | High licensing fees, dependence on foreign innovation | Increased global demand for advanced power tech in 2024 impacted licensing costs. |

| Skilled Labor | Shortage of specialized engineers and technicians | Increased labor costs, potential project delays | Robust demand for engineering talent in India's infrastructure sector in 2024. |

| Specialized Logistics | Niche market for heavy-lift capabilities | Higher transportation costs, potential timeline impacts | The super-heavy cargo logistics segment remains concentrated, allowing for premium pricing. |

| Energy & Utilities | Essential nature of services, BHEL's high consumption | Direct impact on production costs, operational efficiency | Energy costs were a significant component of BHEL's operating expenditure in FY 2023-24. |

What is included in the product

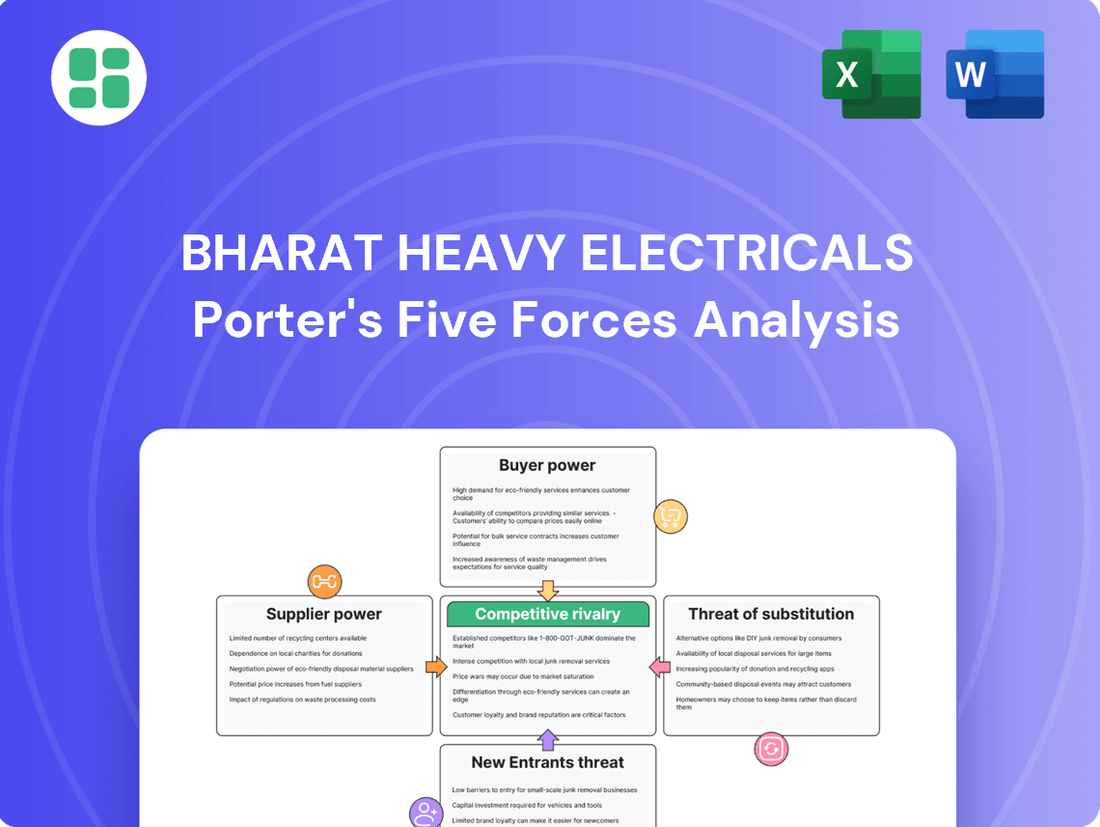

This Porter's Five Forces analysis for Bharat Heavy Electricals dissects the competitive intensity within the heavy electrical equipment industry, examining supplier and buyer power, the threat of new entrants and substitutes, and the overall competitive rivalry.

Instantly identify and address competitive threats with a clear visualization of BHEL's Porter's Five Forces, enabling proactive strategy adjustments.

Customers Bargaining Power

The dominance of government and public sector clients significantly amplifies the bargaining power of customers for Bharat Heavy Electricals Limited (BHEL). A substantial portion of BHEL's revenue, particularly from large-scale power and infrastructure projects, originates from these entities. For instance, in the fiscal year 2023-24, government orders and PSU procurements formed a critical revenue stream, enabling these consolidated buyers to leverage their significant purchasing volume.

These large buyers frequently engage in competitive bidding processes. This structured procurement method inherently grants them considerable leverage over pricing, contract specifications, and payment terms. The sheer scale of their orders means BHEL must often concede to buyer-driven conditions to secure these vital projects, thereby diminishing BHEL's pricing power.

The nature of Bharat Heavy Electricals Limited's (BHEL) business, which centers on large-scale, complex projects like power plants, significantly influences customer bargaining power. These projects are inherently long-duration and require substantial capital outlay.

Because BHEL typically engages with a limited number of customers for these massive undertakings, each client represents a considerable portion of the company's order book. For instance, in fiscal year 2023-24, BHEL secured orders worth ₹24,790 crore, with a significant portion coming from large infrastructure projects.

This concentration of business with individual, high-value customers grants them considerable leverage. They can negotiate more aggressively on pricing, payment terms, and project specifications, knowing their business is crucial to BHEL's revenue streams.

The infrastructure and power sectors in India are intensely competitive, featuring numerous domestic and international companies. This robust competition significantly amplifies customer bargaining power, particularly in tender-based procurement processes.

Customers in these sectors exhibit high price sensitivity. They frequently award contracts to the bidder offering the lowest price that satisfies all technical specifications. For instance, in 2023-24, many large power project tenders saw bids come in with very narrow margins, demonstrating this price-driven decision-making.

This focus on the lowest bid directly translates to increased bargaining power for customers, enabling them to exert downward pressure on BHEL's pricing and, consequently, its profit margins. This dynamic forces BHEL to constantly optimize its cost structures to remain competitive.

Customization and Project-Specific Requirements

While BHEL is known for its broad range of offerings, many large-scale projects necessitate substantial customization. Customers requiring highly specific or unique technical solutions may have a slightly diminished influence over the exact specifications, but they retain considerable leverage in negotiating the overall project cost and delivery schedules, recognizing BHEL's significant investment in tailoring its solutions.

This customization capability, while a strength for BHEL, also creates opportunities for customers to exert pressure. For instance, in the power sector, where BHEL is a major player, clients often have very precise operational needs that cannot be met by standard products. This can lead to protracted negotiations on pricing and timelines, especially for projects valued in the hundreds of millions or billions of dollars, where even minor concessions can represent substantial savings or revenue impacts.

- Project Customization Leverage: Customers demanding unique technical solutions for large projects can negotiate strongly on price and delivery, given BHEL's investment in tailored solutions.

- Sectoral Impact: In sectors like power, where operational needs are highly specific, clients can leverage customization demands to influence project terms.

- Financial Negotiation: For projects valued in the hundreds of millions, even small adjustments in cost or timeline due to customization can have significant financial implications for the customer.

Long-Term Service and Maintenance Contracts

Customers frequently pursue long-term service and maintenance contracts with BHEL after the initial commissioning of equipment. This establishes a continuous, ongoing relationship that offers BHEL predictable, recurring revenue streams.

However, this customer dependence on BHEL for ongoing support can also be a leverage point. Customers can use the anticipation of future business or their critical need for uninterrupted operational uptime to negotiate more favorable terms on maintenance services and the pricing of spare parts.

- Recurring Revenue: Long-term contracts provide BHEL with a stable income base, reducing reliance on new project wins alone.

- Customer Leverage: The necessity for continued operational support grants customers bargaining power over pricing and service level agreements.

- Strategic Importance: For BHEL, maintaining high customer satisfaction through effective service is crucial for securing repeat business and positive referrals in a competitive landscape.

The bargaining power of customers for Bharat Heavy Electricals Limited (BHEL) is significantly influenced by the concentrated nature of its client base, particularly government and public sector entities. These large buyers, often involved in massive infrastructure and power projects, wield considerable influence due to their substantial order volumes and participation in competitive bidding processes. For instance, in the fiscal year 2023-24, BHEL secured orders totaling ₹24,790 crore, with a significant portion originating from these key customer segments, allowing them to negotiate terms and pricing effectively.

The competitive landscape within India's power and infrastructure sectors further amplifies customer leverage. With numerous domestic and international players vying for projects, customers exhibit high price sensitivity, often awarding contracts to the lowest compliant bidder. This dynamic directly pressures BHEL's pricing and profit margins, as demonstrated by the narrow bid margins observed in many large power project tenders during 2023-24. Additionally, the need for project customization can become a negotiation point, with clients leveraging specific technical requirements to influence overall project costs and delivery schedules.

Customers also leverage their ongoing relationships with BHEL for long-term service and maintenance contracts. While these contracts provide BHEL with predictable revenue, they also grant customers leverage over pricing and service level agreements, as their need for uninterrupted operations is critical. This symbiotic relationship underscores the substantial bargaining power customers hold within BHEL's operational framework.

| Customer Segment | Influence Factor | Impact on BHEL |

|---|---|---|

| Government & PSUs | High order volume, competitive bidding | Downward pressure on pricing, stringent contract terms |

| Infrastructure & Power Projects | Price sensitivity, numerous competitors | Reduced profit margins, focus on cost optimization |

| Customization Demands | Unique technical requirements | Negotiation leverage on price and delivery timelines |

| After-Sales Service & Maintenance | Need for operational uptime | Negotiating power on service pricing and spare parts |

Preview Before You Purchase

Bharat Heavy Electricals Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis for Bharat Heavy Electricals Limited (BHEL) meticulously details the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the power sector.

Rivalry Among Competitors

Bharat Heavy Electricals Limited (BHEL) contends with formidable competition from both domestic rivals and major international corporations such as Siemens, General Electric, and Mitsubishi Heavy Industries. This rivalry is particularly acute in the crucial power generation and heavy electrical equipment segments.

These global giants bring a wealth of international experience, cutting-edge technological advancements, and frequently employ aggressive pricing tactics within the Indian marketplace. For instance, in 2023, the Indian power sector saw significant investments, with private players like L&T and Adani Power also expanding their capacities, adding to the competitive pressure on BHEL's traditional strongholds.

Bharat Heavy Electricals Limited (BHEL) operates in a market where competitive tenders are common for large infrastructure and power projects. This environment naturally elevates price as a key factor in winning contracts, often sparking intense price wars among the participating companies.

This aggressive pricing strategy directly impacts BHEL's profitability, forcing the company to constantly focus on cost efficiency to remain competitive and maintain healthy profit margins. For instance, in fiscal year 2023-24, BHEL secured orders worth ₹24,790 crore, indicating the significant volume of business influenced by tender pricing.

The energy and infrastructure sectors are in a constant state of flux, driven by rapid technological advancements. Innovations in areas like advanced thermal power solutions, the burgeoning renewables sector, and the implementation of smart grid systems are reshaping the competitive landscape. This dynamic environment necessitates continuous investment in research and development.

Competitors are actively pouring resources into R&D and innovation, creating an intense race to stay ahead. For Bharat Heavy Electricals Limited (BHEL), this means it must consistently keep pace with these technological shifts to maintain its competitive edge and relevance in the market. For instance, in 2023, BHEL reported a significant increase in its R&D expenditure, reflecting its commitment to innovation amidst this evolving industry.

Capacity Utilization and Order Book Management

Heavy engineering companies like BHEL operate with substantial fixed costs tied to their manufacturing infrastructure. This necessitates aggressive bidding for projects to achieve optimal capacity utilization and maintain a robust order book, fueling intense competition among industry players.

Securing new orders is paramount for sustained operations and profitability, leading to a high degree of competitive rivalry. For instance, BHEL's order book as of March 31, 2024, stood at approximately ₹1.07 lakh crore, highlighting the critical nature of continuous order inflow.

- High Fixed Costs: Significant investments in manufacturing facilities create pressure to maintain high production levels.

- Order Book Dependency: Profitability and operational continuity rely heavily on securing a steady stream of new projects.

- Aggressive Bidding: The need to fill capacity leads to intense price competition and strategic bidding practices.

- Industry Dynamics: The cyclical nature of infrastructure and power projects further exacerbates competitive pressures.

Diversification and Market Share Expansion

Competitors are actively diversifying their portfolios into areas like renewable energy, transmission, and industrial solutions, mirroring BHEL's own strategic moves. This broadens the competitive landscape within each segment, as companies vie for market share across multiple core sectors.

For instance, in the renewable energy sector, companies like Tata Power Solar and Adani Green Energy are aggressively expanding their solar and wind power capacities. In 2023, India's installed renewable energy capacity reached over 179 GW, with significant growth in solar and wind power, indicating intense competition for new projects and market dominance.

This diversification means that BHEL faces not only traditional power equipment manufacturers but also specialized players in each of its target growth areas. The struggle for market share is therefore multifaceted, requiring BHEL to compete on technology, price, and execution capabilities across a wider range of offerings.

- Renewable Energy Focus: Competitors are heavily investing in solar and wind projects, directly challenging BHEL's presence in these growing markets.

- Transmission and Distribution Expansion: Companies are also targeting the transmission and distribution infrastructure, a key area for BHEL's growth.

- Industrial Solutions Competition: The industrial solutions segment sees competition from both domestic and international players offering a broad spectrum of services.

- Market Share Battles: The diversification strategy by competitors intensifies the fight for market share, requiring BHEL to maintain a competitive edge across all business verticals.

The competitive rivalry for Bharat Heavy Electricals Limited (BHEL) is intense, driven by global players like Siemens and GE who leverage advanced technology and aggressive pricing. This is evident in the power generation sector where private players are also expanding rapidly, intensifying pressure on BHEL.

The need to secure orders in a tender-driven market leads to price wars, impacting BHEL's profitability, as seen in its fiscal year 2023-24 order intake of ₹24,790 crore. Furthermore, rapid technological advancements in areas like renewables necessitate continuous R&D investment, with BHEL increasing its R&D spending in 2023 to keep pace.

High fixed costs in manufacturing force companies like BHEL to bid aggressively to utilize capacity, with BHEL's order book at approximately ₹1.07 lakh crore as of March 31, 2024, underscoring the importance of continuous order inflow.

| Key Competitive Factors | Impact on BHEL | Supporting Data (as of latest available) |

| Global Competitors | Technological edge, aggressive pricing | Siemens, GE, Mitsubishi Heavy Industries active in Indian market |

| Domestic Competition | Expanding capacities in power sector | L&T, Adani Power increasing presence |

| Pricing Pressure | Forces cost efficiency, impacts margins | FY23-24 order intake: ₹24,790 crore; Tender-based bidding common |

| R&D and Innovation | Necessitates continuous investment | BHEL increased R&D expenditure in 2023; Competitors investing heavily |

| Order Book Dependency | Crucial for operations and profitability | Order book as of March 31, 2024: ~₹1.07 lakh crore |

SSubstitutes Threaten

The most significant substitute threatening Bharat Heavy Electricals Limited's (BHEL) traditional thermal power plant business is the accelerating global and domestic transition to renewable energy sources. This shift is fueled by supportive government policies, falling technology costs, and increasing environmental awareness, diverting capital away from fossil fuel generation.

For instance, India's ambitious renewable energy targets, aiming for 500 GW of non-fossil fuel-based energy capacity by 2030, directly impact the demand for new thermal power equipment. The declining levelized cost of electricity from solar and wind power, which in some cases has fallen below coal power tariffs, further intensifies this substitution pressure.

The growth of decentralized power generation, including rooftop solar and microgrids, presents a significant threat. These smaller, distributed systems can lessen the reliance on BHEL's large-scale, centralized power equipment. For instance, India's installed rooftop solar capacity reached over 11 GW by the end of 2023, demonstrating a tangible shift towards distributed energy solutions.

Investments in advanced energy efficiency technologies and robust demand-side management programs are increasingly reducing the overall energy consumption of industries and homes. This directly substitutes for the need for new power generation capacity, impacting the demand for BHEL's core products like turbines and boilers. For instance, in 2024, India's Bureau of Energy Efficiency (BEE) continued to promote initiatives that led to significant energy savings across various sectors.

Alternative Technologies in Industrial Processes

The emergence of alternative technologies in industrial processes presents a significant threat of substitution for Bharat Heavy Electricals Limited (BHEL). Innovations in manufacturing, such as advanced additive manufacturing or modular construction, could reduce the reliance on traditional heavy machinery and large-scale power generation equipment that BHEL specializes in. For instance, the increasing adoption of distributed energy resources and microgrids, powered by smaller, more localized generation units, might lessen the demand for BHEL's large thermal or hydro power plant components.

These evolving technologies can offer more efficient, cost-effective, or environmentally friendly solutions, directly impacting BHEL's core product lines. Consider the potential for breakthroughs in energy storage or novel renewable energy integration methods that could bypass the need for conventional grid infrastructure and the heavy equipment associated with it. In 2024, the global market for additive manufacturing, for example, was projected to reach tens of billions of dollars, indicating a tangible shift in industrial production paradigms.

- Emerging Technologies: Innovations like additive manufacturing and modular construction can reduce demand for traditional heavy industrial equipment.

- Energy Sector Shifts: The rise of distributed energy resources and microgrids may decrease the need for large-scale power plant components supplied by BHEL.

- Market Trends: The growing additive manufacturing market, valued in the tens of billions in 2024, highlights a significant shift in industrial production methods.

Imported Equipment and Turnkey Solutions

The threat of substitutes for Bharat Heavy Electricals Limited (BHEL) is significantly influenced by the availability of imported equipment and turnkey solutions. Customers, particularly in large infrastructure projects, can bypass domestic suppliers like BHEL by directly sourcing complete equipment packages or fully integrated project solutions from international manufacturers. This trend is often driven by perceptions of lower overall costs or access to more cutting-edge technologies offered by global competitors.

While these imports aren't direct product substitutes in the traditional sense, they function as powerful alternatives to BHEL's comprehensive engineering, procurement, and construction (EPC) services. For instance, in the power sector, which is a core market for BHEL, international firms may offer bundled equipment and installation services that compete directly with BHEL's integrated approach. Data from 2023 indicated that while domestic manufacturing remained strong, a notable portion of capital expenditure in key industrial sectors was allocated to imported capital goods, highlighting this competitive pressure.

- Global EPC providers can offer integrated solutions, potentially at competitive price points, challenging BHEL's market share.

- Perceived technological advantages of imported equipment can sway customer preference, even if BHEL offers comparable domestic capabilities.

- In 2023, India's capital goods imports saw a significant rise, with a substantial portion directed towards sectors where BHEL operates, underscoring the substitute threat.

- Customers seeking rapid project execution might find turnkey solutions from international players more appealing than managing multiple domestic suppliers alongside BHEL.

The most potent substitutes for Bharat Heavy Electricals Limited (BHEL) stem from the global energy transition, particularly the rapid growth of renewable energy sources like solar and wind. These alternatives are becoming increasingly cost-competitive, directly impacting demand for BHEL's traditional thermal power equipment. India's goal of 500 GW non-fossil fuel capacity by 2030 underscores this shift, with solar power's levelized cost of electricity often falling below coal power tariffs.

Furthermore, advancements in energy efficiency and distributed generation, such as rooftop solar installations, reduce the overall need for large-scale, centralized power plants. By the end of 2023, India's rooftop solar capacity exceeded 11 GW, illustrating a tangible move towards decentralized energy solutions. These trends collectively weaken the market position of BHEL's core offerings.

| Substitute Category | Impact on BHEL | Key Data/Trend (2023-2024) |

| Renewable Energy (Solar, Wind) | Directly displaces demand for thermal power equipment | India's 2030 non-fossil fuel target: 500 GW. Solar LCOE often below coal. |

| Energy Efficiency & Demand Side Management | Reduces overall need for new power generation capacity | Continued promotion of energy saving initiatives by BEE in 2024. |

| Distributed Generation (Rooftop Solar, Microgrids) | Decreases reliance on centralized power plants | India's rooftop solar capacity surpassed 11 GW by end of 2023. |

Entrants Threaten

The threat of new entrants into the heavy engineering and manufacturing sector, particularly for large-scale power and infrastructure projects, is significantly mitigated by the substantial capital investment required. Establishing state-of-the-art manufacturing facilities, acquiring advanced machinery, and funding robust research and development necessitate billions of dollars. For instance, setting up a new thermal power plant equipment manufacturing unit can easily cost upwards of $1 billion.

Furthermore, established players like Bharat Heavy Electricals Limited (BHEL) benefit from considerable economies of scale. These scale advantages translate into lower per-unit production costs, making it challenging for new, smaller entrants to compete on price. BHEL's extensive experience also allows for optimized supply chains and operational efficiencies, further solidifying its competitive position and deterring potential new market participants.

Bharat Heavy Electricals Limited (BHEL) operates in sectors demanding intricate technological capabilities and specialized engineering knowledge. New entrants would face substantial hurdles in replicating BHEL's decades of accumulated technical expertise and proprietary designs, a significant barrier to entry.

The steep learning curve and the necessity for highly skilled personnel mean that newcomers would require considerable time and investment to develop the core competencies needed to compete. For instance, BHEL's involvement in complex projects like power plant construction requires a deep understanding of various engineering disciplines, a resource not easily acquired by new players.

Bharat Heavy Electricals Limited (BHEL) benefits significantly from its deeply entrenched customer relationships, particularly with government entities, Public Sector Undertakings (PSUs), and major industrial players. These relationships, forged over decades of reliable project execution and robust after-sales support, create a substantial barrier to entry for newcomers. For instance, BHEL's extensive track record in supplying critical power generation equipment to state-owned utilities means these clients often prioritize proven performance and established service networks over potentially cheaper, but unproven, alternatives.

Regulatory Hurdles and Policy Landscape

The power and infrastructure sectors in India are subject to stringent regulations, including extensive environmental clearances and safety certifications. These complex policy frameworks act as a significant barrier, making it difficult and time-consuming for new companies to enter the market and compete with established players like Bharat Heavy Electricals Limited (BHEL).

Navigating the intricate web of Indian government policies and obtaining necessary approvals often requires substantial resources and expertise. For instance, in 2024, the Ministry of Environment, Forest and Climate Change continued to enforce rigorous environmental impact assessment (EIA) processes for all major infrastructure projects.

- Regulatory Complexity: India's power and infrastructure sectors are governed by a vast array of regulations.

- Policy Frameworks: Adherence to evolving policy frameworks is mandatory for all participants.

- Deterrent to Entry: The sheer volume and complexity of these regulations deter potential new entrants.

- Time and Resource Intensive: Compliance requires significant investment in time and resources.

Supplier and Distribution Channel Access

Established players like BHEL have cultivated deep, often exclusive, relationships with key suppliers for specialized components, a significant barrier for newcomers. For instance, in 2023-24, BHEL's procurement from domestic suppliers across various segments, including power and industry, represented a substantial portion of its operational costs, highlighting the reliance on these established networks. New entrants would face considerable challenges in securing consistent, cost-effective access to these critical raw materials and sub-assemblies, potentially leading to higher initial production costs and extended lead times.

Furthermore, BHEL's extensive and efficient distribution network, crucial for delivering and installing large-scale, complex equipment, presents another hurdle. The logistical complexities and capital investment required to build a comparable network are immense. In the fiscal year 2023, BHEL successfully commissioned projects totaling several gigawatts, underscoring the scale and reach of its distribution and project execution capabilities. New entrants would likely struggle to match this operational efficiency and market penetration, impacting their ability to serve customers effectively and competitively.

- Supplier Relationships: BHEL's long-standing partnerships with critical component manufacturers create a moat, making it difficult for new entrants to secure reliable and affordable supplies.

- Distribution Network: The established infrastructure for delivering and servicing large, specialized power equipment is a significant capital and operational barrier.

- Logistical Expertise: Managing the complex logistics of heavy machinery delivery and installation requires specialized knowledge and infrastructure that new players lack.

The threat of new entrants into Bharat Heavy Electricals Limited's (BHEL) core markets remains low due to immense capital requirements, estimated to be in the billions of dollars for establishing manufacturing facilities and R&D. BHEL's significant economies of scale, achieved through decades of operation, allow for lower per-unit costs, a barrier new entrants would struggle to overcome. Furthermore, the deep technical expertise and proprietary designs accumulated by BHEL over many years are not easily replicated, demanding substantial time and investment for newcomers to develop comparable core competencies.

BHEL's strong, long-standing relationships with government entities and major industrial clients, built on a track record of reliable project execution, create a substantial hurdle for new players. The complex and evolving regulatory landscape in India, including stringent environmental and safety certifications, further deters new market entrants, requiring significant resources and time for compliance. For instance, in 2024, environmental impact assessments remained a critical and time-consuming step for any new infrastructure project.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Billions of dollars needed for manufacturing and R&D. | Extremely High |

| Economies of Scale | Lower per-unit costs for established players like BHEL. | High |

| Technical Expertise | Decades of accumulated knowledge and proprietary designs. | Very High |

| Customer Relationships | Established ties with government and PSU clients. | High |

| Regulatory Hurdles | Complex environmental and safety compliance. | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for BHEL is built upon a foundation of publicly available financial statements, annual reports, and investor presentations. We also integrate insights from reputable industry research reports and news articles to capture current market dynamics and competitive landscapes.