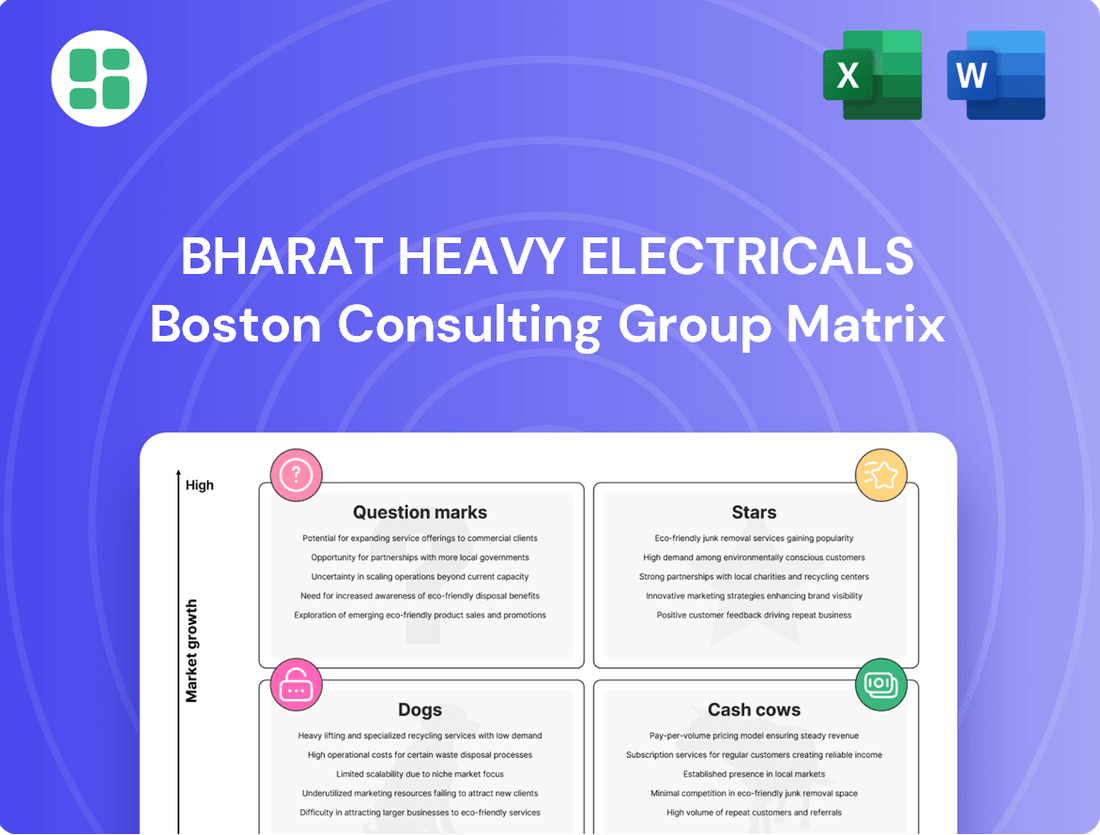

Bharat Heavy Electricals Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bharat Heavy Electricals Bundle

Unlock the strategic potential of Bharat Heavy Electricals by understanding its position within the BCG Matrix. See which segments are driving growth and which require careful management.

This glimpse into BHEL's product portfolio is just the start. Purchase the full BCG Matrix to receive a comprehensive analysis, including detailed quadrant placements, growth projections, and actionable strategies for optimizing BHEL's market performance.

Don't miss out on the complete picture. Get the full BCG Matrix report to gain a clear understanding of BHEL's market share and growth rate for each business unit, empowering you to make informed investment decisions.

Stars

BHEL's Thermal Power Equipment (New Capacity) segment is a clear Star in the BCG Matrix. The company commands a massive 85% market share in India's thermal power equipment sector, a position solidified by its recent success in securing power sector orders totaling ₹81,349 crore in FY 2024-25. This strong performance is driven by the government's ambitious target to add 80GW of new thermal capacity by FY32, indicating substantial future growth potential.

This segment is a cornerstone of BHEL's impressive order book, which reached a record ₹1,95,922 crore by the close of FY 2024-25. The sustained demand for thermal power equipment, coupled with BHEL's dominant market position, positions this business unit for continued high growth and profitability.

The defense sector represents a significant growth engine for BHEL, evidenced by its record order inflows in this segment. This surge is directly linked to the government's push for domestic manufacturing and self-reliance in defense, a key aspect of the 'Make in India' program.

BHEL's contribution to defense modernization is substantial, with the company manufacturing critical systems like Super Rapid Gun Mounts for the Indian Navy. Furthermore, BHEL is investing in future defense technologies, including advanced electric propulsion and next-generation naval guns, showcasing its commitment to innovation in this strategic sector.

The defense sector's robust growth is underpinned by sustained government expenditure and strategic collaborations, solidifying BHEL's position as a pivotal entity in India's defense industrial landscape. This area is expected to continue its upward trajectory, driven by ongoing modernization efforts.

Bharat Heavy Electricals Limited (BHEL) holds a strong position in the High Voltage Direct Current (HVDC) transmission systems market, a segment vital for India's expanding power infrastructure. The company's leadership is evident through significant orders for HVDC terminal stations, essential for efficiently transmitting power over long distances and integrating renewable energy sources into the national grid. In 2024, BHEL's capabilities extend to manufacturing HVDC products up to 800 kV, a testament to its advanced technological prowess and competitive edge in a rapidly growing sector.

Advanced Ultra Supercritical (AUSC) Technology

Bharat Heavy Electricals Limited (BHEL) is a key player in the development of Advanced Ultra Supercritical (AUSC) technology, a significant advancement for thermal power generation. This initiative is bolstered by government fiscal support for joint ventures, underscoring its strategic importance.

AUSC technology represents a high-growth potential for BHEL, offering substantial improvements in efficiency and a notable reduction in emissions compared to subcritical and supercritical technologies. For instance, AUSC plants can achieve efficiencies exceeding 45%, a marked improvement over older technologies that might hover around 35-40%, leading to lower fuel consumption and reduced environmental impact.

- High Efficiency: AUSC technology allows for higher steam temperatures and pressures, boosting thermal efficiency to over 45%.

- Lower Emissions: This technology significantly reduces CO2, SOx, and NOx emissions, supporting environmental sustainability goals.

- Government Support: Fiscal incentives and support for joint ventures accelerate the adoption and development of AUSC in India.

- Future Relevance: BHEL's focus on advanced coal technologies ensures its continued competitiveness in the evolving energy sector.

Large-Scale Power Project Execution (EPC)

Bharat Heavy Electricals Limited (BHEL) showcases exceptional strength in large-scale power project execution through its EPC capabilities. The company successfully commissioned and synchronized a remarkable 8.1 GW of power capacity in FY 2024-25, a testament to its robust project management and execution skills.

BHEL's order book is full for boilers and EPC contracts, particularly within the thermal power sector. This strong pipeline signifies its leading position in delivering complex infrastructure projects and ensures consistent revenue streams.

- Proven Execution Capacity: BHEL commissioned 8.1 GW in FY 2024-25, demonstrating its ability to handle massive power projects.

- Strong Order Pipeline: A full order book for boilers and EPC contracts, especially in thermal power, indicates sustained demand and market leadership.

- Market Dominance: The company's execution prowess solidifies its position in major infrastructure development.

BHEL's Thermal Power Equipment (New Capacity) segment is a clear Star in the BCG Matrix. The company commands a massive 85% market share in India's thermal power equipment sector, a position solidified by its recent success in securing power sector orders totaling ₹81,349 crore in FY 2024-25. This strong performance is driven by the government's ambitious target to add 80GW of new thermal capacity by FY32, indicating substantial future growth potential.

The defense sector represents a significant growth engine for BHEL, evidenced by its record order inflows in this segment. This surge is directly linked to the government's push for domestic manufacturing and self-reliance in defense, a key aspect of the 'Make in India' program.

Bharat Heavy Electricals Limited (BHEL) holds a strong position in the High Voltage Direct Current (HVDC) transmission systems market, a segment vital for India's expanding power infrastructure. The company's leadership is evident through significant orders for HVDC terminal stations, essential for efficiently transmitting power over long distances and integrating renewable energy sources into the national grid. In 2024, BHEL's capabilities extend to manufacturing HVDC products up to 800 kV, a testament to its advanced technological prowess and competitive edge in a rapidly growing sector.

Bharat Heavy Electricals Limited (BHEL) showcases exceptional strength in large-scale power project execution through its EPC capabilities. The company successfully commissioned and synchronized a remarkable 8.1 GW of power capacity in FY 2024-25, a testament to its robust project management and execution skills.

| Segment | BCG Category | Key Data Points |

|---|---|---|

| Thermal Power Equipment (New Capacity) | Star | 85% market share in India; ₹81,349 crore orders in FY25; 80GW new thermal capacity target by FY32. |

| Defense Sector | Star | Record order inflows; critical systems manufacturing (e.g., Super Rapid Gun Mounts); investment in advanced technologies. |

| HVDC Transmission Systems | Star | Leadership in HVDC terminal stations; manufacturing up to 800 kV; vital for grid expansion and renewables integration. |

| EPC Services (Power Projects) | Star | 8.1 GW commissioned in FY25; full order book for boilers and EPC contracts in thermal sector. |

What is included in the product

Bharat Heavy Electricals' BCG Matrix highlights which business units to invest in, hold, or divest based on market share and growth.

A clear BCG Matrix visualizes BHEL's portfolio, easing strategic decision-making by highlighting growth and market share.

Cash Cows

Bharat Heavy Electricals Limited (BHEL) benefits significantly from its extensive installed base in India's thermal power sector, which accounts for a substantial 54% of the nation's total thermal capacity. This vast installed base translates into a consistent and reliable revenue stream derived from modernization, renovation, and maintenance (MRM) services for existing power plants. The demand for these services is driven by the ongoing need to upgrade aging infrastructure and ensure operational efficiency.

While the market for new thermal power plant construction is experiencing growth, the sheer volume of BHEL's existing fleet necessitates continuous investment in upgrades and a steady supply of spare parts. This ongoing requirement generates predictable cash flow with comparatively minimal new investment needed for market acquisition, positioning this segment as a strong cash cow. BHEL's established relationships and deep technical expertise in this area further solidify its stable profitability.

The hydro power equipment and services segment for Bharat Heavy Electricals Limited (BHEL) firmly sits in the Cash Cows quadrant of the BCG Matrix. BHEL's significant contribution, powering 44% of India's hydropower generation capacity, underscores its dominant position in a mature market.

This segment benefits from stable demand for essential equipment, ongoing maintenance, and crucial upgrades. While the pace of new large hydro projects may be slower than emerging renewables, BHEL's deep-rooted expertise and established infrastructure guarantee a dependable revenue flow from this vital infrastructure.

The inherent long operational life of hydropower plants translates into consistent, recurring service opportunities. This makes the hydro segment a highly reliable cash generator for BHEL, contributing significantly to its financial stability.

BHEL's industrial equipment segment, serving core process industries, forms a vital component of its business. This division, encompassing equipment for sectors like oil and gas, power generation, and transportation, consistently contributes a substantial share to BHEL's overall order book, reflecting its importance in the company's portfolio.

While not characterized by the rapid expansion seen in emerging markets, this segment thrives on established customer ties and the enduring demand for heavy engineering products within mature industrial landscapes. For instance, in fiscal year 2023-24, BHEL secured orders worth ₹24,767 crore in its thermal and nuclear power segments, with industrial and transmission orders also playing a significant role in bolstering its order backlog.

The segment delivers reliable revenue streams and robust profit margins, a testament to BHEL's strong brand equity and entrenched market position. This stability is crucial for BHEL's financial health, providing a solid foundation amidst market fluctuations.

Transmission Products and Solutions (Standard)

Bharat Heavy Electricals Limited's (BHEL) standard transmission products, including transformers and substations for conventional voltage levels, represent a mature yet vital segment of its business. This area, while not experiencing the rapid growth of newer technologies like HVDC, provides a consistent and dependable revenue stream.

These products are fundamental to the ongoing expansion and modernization of power grids worldwide. BHEL's long-standing expertise and established market position in this segment ensure a steady demand, making them a reliable source of cash flow. For instance, in the fiscal year 2023-24, BHEL secured orders worth ₹24,780 crore for its Power Transmission segment, showcasing the continued relevance of these core offerings.

- Stable Revenue Generation: BHEL's traditional transmission products consistently contribute to the company's revenue, acting as a reliable cash cow.

- Mature Market Demand: These components are essential for routine grid maintenance, upgrades, and expansion, ensuring a predictable demand in established markets.

- Strong Market Share: BHEL benefits from its historical presence and significant market share in the standard transmission products sector.

- Operational Efficiency: Established production lines for these products allow for efficient manufacturing and cost management, further bolstering profitability.

After-Sales Services and O&M Contracts

Bharat Heavy Electricals Limited (BHEL) leverages its extensive installed base in the power and industrial sectors to generate significant, high-margin revenue through after-sales services and Operation & Maintenance (O&M) contracts. These long-term agreements provide predictable cash flows, as customers often rely on BHEL's specialized knowledge and proprietary systems for their equipment. This recurring revenue stream is a cornerstone of BHEL's financial stability.

In 2023-24, BHEL's Power Sector business segment, which heavily relies on these services, reported a notable performance. The company's focus on enhancing its service offerings and securing new O&M contracts continues to be a key strategy. For instance, BHEL secured orders worth ₹10,000 crore in the power sector during the third quarter of FY24, many of which include long-term service components.

- High-Margin Revenue: After-sales services and O&M contracts typically offer higher profit margins compared to manufacturing new equipment.

- Predictable Cash Flows: Long-term contracts ensure a steady and reliable income stream, bolstering financial stability.

- Customer Lock-in: Proprietary systems and specialized expertise create a strong customer retention rate.

- Strategic Importance: These services are crucial for BHEL's overall profitability and market position, especially in the power sector.

BHEL's established position in the thermal power sector, powering 54% of India's thermal capacity, provides a consistent revenue stream from modernization and maintenance services. This mature market requires ongoing upgrades and spare parts, generating predictable cash flow with minimal new investment, making it a strong cash cow.

The hydro power segment, responsible for 44% of India's hydropower generation, also acts as a cash cow due to stable demand for essential equipment and services. The long operational life of these plants ensures recurring service opportunities and a reliable revenue flow.

BHEL's industrial equipment and standard transmission products segments contribute reliably to the order book, benefiting from established customer ties and mature market demand. These segments offer stable profit margins, underpinning BHEL's financial health.

After-sales services and Operation & Maintenance (O&M) contracts represent a significant cash cow, delivering high-margin, predictable revenue through long-term agreements. BHEL's focus on these services, as seen in its FY24 order book, is crucial for profitability.

| Segment | BCG Classification | Key Characteristics | FY23-24 Relevance |

| Thermal Power Services (MRM) | Cash Cow | Mature market, high installed base, recurring revenue from upgrades/spares | 54% of India's thermal capacity supported |

| Hydro Power Equipment & Services | Cash Cow | Stable demand, long asset life, consistent service opportunities | Powers 44% of India's hydropower |

| Industrial Equipment | Cash Cow | Established customer base, enduring demand in mature industries | Significant contribution to order book (e.g., ₹24,767 crore in thermal/nuclear, plus industrial/transmission) |

| Standard Transmission Products | Cash Cow | Essential for grid modernization, steady demand, strong market share | ₹24,780 crore orders in Power Transmission segment |

| After-Sales & O&M Services | Cash Cow | High margins, predictable cash flow, customer lock-in | Key strategy, orders worth ₹10,000 crore in Power Sector (Q3 FY24) |

Preview = Final Product

Bharat Heavy Electricals BCG Matrix

The Bharat Heavy Electricals BCG Matrix preview you are viewing is the identical, fully comprehensive document you will receive upon purchase. This means you'll get the complete analysis, free from watermarks or demo content, ready for immediate integration into your strategic planning. The report is professionally formatted and designed to offer clear insights into BHEL's product portfolio, enabling informed decision-making.

Dogs

Certain older or less competitive product lines within BHEL's diverse portfolio, particularly those facing intense competition from specialized manufacturers or having limited future demand, may fall into the Dogs category. These segments might generate minimal revenue or even incur losses, tying up valuable resources without significant returns.

For instance, BHEL's legacy thermal power equipment segments, while historically significant, have seen declining order books. In FY23, the company reported a revenue of ₹32,301 crore, with a substantial portion still attributed to power sector projects, but the growth in new thermal capacity is slowing. Segments with older technologies may struggle to compete on price and efficiency against newer, more specialized offerings, leading to reduced market share and profitability.

Within BHEL's diverse portfolio, certain smaller export ventures might fall into the 'Non-Strategic or Limited Export Ventures' category. These are operations where BHEL may not possess a substantial competitive edge or experience consistent, significant order volumes, potentially demanding considerable resources for modest returns.

For instance, if BHEL's presence in a particular niche international market for a specific power generation component yields low order inflow, say less than 5% of its total export revenue in 2024, it could be classified here. Such ventures might not align with BHEL's core strengths or strategic growth objectives, offering limited contribution to overall profitability.

Products or services from Bharat Heavy Electricals (BHEL) that rely on outdated technology, such as older thermal power plant equipment or legacy transmission systems, could be classified as Dogs. These offerings often struggle with declining market demand as newer, more efficient alternatives emerge. For instance, while BHEL continues to service older thermal units, the global push towards renewable energy sources directly impacts the long-term viability of these legacy technologies.

The challenge with these Dog offerings lies in the increasing operational and maintenance costs associated with keeping them functional, while simultaneously facing reduced revenue due to lower demand. BHEL's continued investment in servicing these older technologies, even as market trends shift towards higher efficiency and cleaner energy solutions, represents a strategic drain on resources that could be better allocated to growth areas.

Inefficient Manufacturing Units

Some of Bharat Heavy Electricals Limited's (BHEL) manufacturing units might be experiencing significant inefficiencies. These could be specific production lines within their core segments like power equipment or transportation systems that consistently operate below capacity, leading to higher per-unit costs and reduced profitability. For instance, a particular heavy electrical equipment plant might have a utilization rate of only 60% for a critical machinery line, impacting its overall financial contribution.

These inefficient units can act as resource drains, consuming capital and labor without delivering commensurate returns. Despite being part of essential business areas, their underperformance can drag down the company's overall financial health. This situation is particularly concerning if these units require substantial ongoing maintenance or capital expenditure, further exacerbating the drain.

Consider the following potential indicators of inefficient manufacturing units within BHEL:

- Low Capacity Utilization: Specific plants or production lines operating significantly below their designed capacity, potentially impacting economies of scale. For example, if a particular turbine manufacturing facility consistently operates at 55% capacity.

- High Operating Costs per Unit: Inefficient processes or outdated technology leading to elevated costs for producing each unit compared to industry benchmarks or internal targets.

- Extended Production Cycles: Longer lead times for manufacturing certain products due to bottlenecks or process inefficiencies, affecting delivery schedules and customer satisfaction.

- Excess Inventory of Finished Goods: A build-up of unsold products from specific units could signal production outpacing demand or quality issues, tying up working capital.

Certain Small-Scale Industrial Equipment

Certain niche industrial equipment, where BHEL's extensive manufacturing capacity isn't fully utilized, may exhibit a low market share and limited growth potential. These segments could represent areas requiring minimal investment, potentially breaking even or incurring small losses, thus acting as cash traps within the company's portfolio.

For instance, if BHEL's market share in a specific small-scale equipment category is only 2% and the overall market is growing at a modest 3% annually, this would place it in the Dogs quadrant. Such offerings might not align with BHEL's core strengths in large-scale production, making them less strategic.

- Low Market Share: For example, a specific product line might hold less than 5% of its niche market.

- Low Market Growth: The demand for this equipment may be growing at a CAGR of under 4%.

- Profitability Concerns: These segments might contribute minimally to profits, potentially even operating at a slight loss, as indicated by a net profit margin below 1%.

- Strategic Review: BHEL may consider divesting or restructuring these offerings to reallocate resources to more promising areas.

Certain older product lines within BHEL, like legacy thermal power equipment, can be classified as Dogs. These segments face declining demand and intense competition, leading to reduced market share and profitability. For example, while BHEL's revenue in FY23 was ₹32,301 crore, the growth in new thermal capacity is slowing, impacting these older technologies.

Inefficient manufacturing units, such as a turbine facility operating at 55% capacity, also fall into the Dogs category. These units incur higher per-unit costs and tie up resources without delivering commensurate returns. BHEL's overall performance is impacted by these underperforming segments.

Niche industrial equipment with low market share and limited growth potential, for instance, a product line with a 2% market share in a 3% growing market, are also considered Dogs. These offerings might not align with BHEL's core strengths and could be candidates for restructuring or divestment.

The challenge with these Dog offerings lies in their minimal contribution to profits, often operating at a slight loss with net profit margins below 1%. BHEL must strategically manage these segments to reallocate resources effectively.

Question Marks

Bharat Heavy Electricals Limited (BHEL) is making significant strides in the renewable energy sector, particularly in solar power and green hydrogen. The company has been actively pursuing strategic partnerships and signing Memoranda of Understanding (MoUs) to bolster its presence in these burgeoning markets. For instance, BHEL signed an MoU with NLC India Limited in early 2024 to collaborate on solar power projects, aiming to develop a substantial pipeline of renewable energy capacity.

While the Indian renewable energy market presents immense growth potential, with the government targeting 500 GW of non-fossil fuel energy capacity by 2030, BHEL currently holds a relatively modest market share. The company is still in the initial phases of scaling its operations in solar and green hydrogen, facing competition from established domestic and international players who have a head start in technology and market penetration. For example, India's solar power installed capacity crossed 180 GW by the end of 2023, with private players dominating the market.

India's push for 100 GW of nuclear power by 2047 and the planned development of Small Modular Reactors (SMRs) by 2033 presents a significant growth opportunity for BHEL. The company's established expertise in nuclear steam generators and turbine systems positions it well to capitalize on this expanding sector.

While BHEL has a strong foundation, its market share in the development of new nuclear builds, particularly advanced reactor designs, is still in its nascent stages. This segment represents a high-growth, long-term market where BHEL can aim to increase its penetration.

Bharat Heavy Electricals Limited (BHEL) is strategically venturing into coal-to-chemicals, a high-growth sector, through a joint venture with Coal India Ltd. This initiative focuses on developing domestic coal-to-chemical capacity, notably an ammonium nitrate plant utilizing surface coal gasification (SCG) technology. This move positions BHEL to capitalize on significant government incentives aimed at reducing import dependency for critical chemicals.

The Indian government's push for self-reliance in chemicals, coupled with the vast domestic coal reserves, creates a favorable environment for coal-to-chemicals projects. BHEL's involvement in this emerging sector is crucial for building its market position and establishing expertise in SCG technology. As of early 2024, India's fertilizer import bill remains substantial, highlighting the economic imperative for domestic production of key chemical inputs like ammonium nitrate.

Rail Transportation and Mobility Solutions

BHEL's foray into rail transportation and mobility solutions positions it within a segment experiencing robust growth, fueled by India's ambitious infrastructure development plans. For instance, the Indian Railways aims to electrify 100% of its broad-gauge network by 2023-24, creating significant demand for components and rolling stock.

This segment, while promising, likely represents a newer venture for BHEL, meaning it may hold a smaller market share against entrenched competitors. Consequently, substantial investment will be necessary to build its presence and capture a meaningful portion of this expanding market.

- Sector Growth: Driven by government initiatives and infrastructure expansion, the rail sector is a key growth area.

- BHEL's Role: Expanding into rolling stock manufacturing and component supply, like main transformers.

- Market Position: Likely a newer entrant with a smaller market share, requiring strategic investment.

- Investment Needs: Significant capital expenditure is anticipated to compete effectively and gain market traction.

Industry 4.0 and Digital Solutions for Power Plants

Bharat Heavy Electricals Limited (BHEL) is actively investing in Industry 4.0 and digital solutions for power plants, recognizing the immense growth potential in industrial digitalization and predictive maintenance. The company is developing proprietary solutions like Remote Monitoring & Diagnostic Services (RMDS) and has established a Centre of Excellence dedicated to digital solutions.

While the market for these advanced services is expanding rapidly, BHEL is currently in the initial stages of commercializing its digital offerings. The focus is on building a strong market presence and securing a significant share in this competitive landscape.

- Market Growth: The global market for industrial digitalization in the power sector is projected to reach over $30 billion by 2028, with predictive maintenance being a key driver.

- BHEL's Investment: BHEL's strategic investment in RMDS and its Centre of Excellence signals a commitment to leveraging digital technologies for enhanced power plant efficiency and reliability.

- Commercialization Phase: BHEL aims to capture a substantial market share by effectively commercializing its digital solutions, offering advanced analytics and remote operational support.

- Competitive Landscape: The company faces competition from established global players, necessitating a strong go-to-market strategy to differentiate its offerings and build customer trust.

BHEL's renewable energy ventures, particularly in solar and green hydrogen, represent a nascent but promising area. While the company is actively forming partnerships, its current market share in this rapidly growing sector is modest compared to established players. Significant investment and strategic execution are required to capitalize on India's ambitious renewable energy targets, such as the 500 GW non-fossil fuel capacity by 2030.

BCG Matrix Data Sources

Our Bharat Heavy Electricals BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.