Bharat Petroleum PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bharat Petroleum Bundle

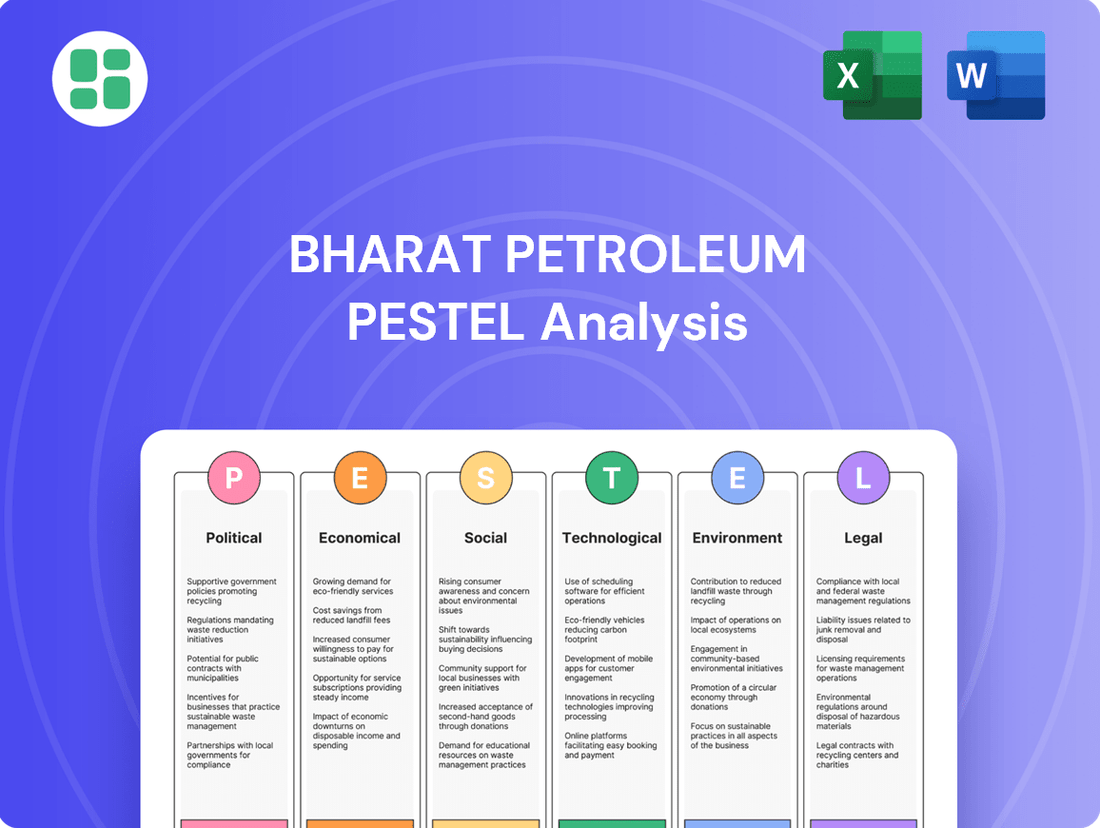

Discover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Bharat Petroleum's trajectory. Our expertly crafted PESTLE analysis provides a vital roadmap for understanding the external forces driving change in the energy sector. Gain the strategic advantage you need to navigate this dynamic landscape.

Whether you're an investor, strategist, or industry analyst, our comprehensive PESTLE analysis of Bharat Petroleum offers actionable intelligence. Understand the opportunities and threats presented by global shifts, regulatory changes, and technological advancements. Download the full report to unlock invaluable insights and make informed decisions.

Political factors

Government policies on fuel pricing, including subsidies and taxes, directly impact Bharat Petroleum Corporation Limited's (BPCL) revenue and profitability. For instance, the excise duty on petrol and diesel has been a significant revenue source for the government, influencing the final retail prices.

Recent decisions on petrol and diesel prices, often influenced by electoral cycles and inflation concerns, can compress marketing margins for companies like BPCL. In 2023-24, while global crude prices fluctuated, domestic retail prices remained relatively stable, impacting the under-recoveries for Public Sector Undertakings (PSUs) like BPCL.

The government's stance on market-determined pricing versus consumer protection plays a crucial role in BPCL's financial health. While the aim is often to shield consumers from extreme price volatility, this can lead to situations where oil marketing companies absorb a portion of the price difference.

The Indian government's stance on the disinvestment of public sector undertakings like Bharat Petroleum Corporation Limited (BPCL) directly influences its strategic path and future investment capabilities. Recent pronouncements suggest that BPCL's divestment is no longer on the agenda, offering a degree of operational stability.

This shift away from privatization implies that the government intends to retain significant control, which can affect BPCL's access to capital markets and its autonomy in decision-making. For instance, if privatization were to proceed, it could unlock substantial capital for expansion and modernization, as seen in other successful PSU divestments.

The Indian government's strong emphasis on energy security, a key political factor, directly shapes Bharat Petroleum Corporation Limited's (BPCL) strategic direction. This involves a dual approach: diversifying crude oil import sources and bolstering domestic exploration and production efforts. For instance, India's crude oil imports in FY23 reached approximately 225.7 million tonnes, a slight increase from the previous year, highlighting the ongoing reliance on global markets and the importance of strategic sourcing relationships.

Political relationships with major oil-producing nations are paramount. India's efforts to reduce dependence on any single region directly influence BPCL's crude procurement strategies, aiming for a more resilient supply chain. This is particularly evident in the evolving geopolitical landscape, where India's increased imports of Russian oil, driven by attractive discounts, have also brought geopolitical considerations into play, with potential implications for future sourcing decisions under international political pressures.

Regulatory Framework for Hydrocarbons

India's regulatory framework for hydrocarbons is undergoing significant modernization, with recent legislative reforms like the Oilfields (Regulation and Development) Amendment Bill, 2024, poised to reshape the sector. These changes are specifically designed to streamline licensing processes and incorporate investor-friendly provisions, aiming to boost capital infusion into exploration and production activities, which could positively impact BPCL's upstream operations.

The government's commitment to establishing a unified petroleum lease regime, coupled with enhancements in dispute resolution mechanisms, is fostering a more stable and predictable operational landscape. This enhanced predictability is crucial for companies like BPCL, enabling more confident long-term strategic planning and investment in a sector often characterized by long project cycles and substantial capital requirements.

- Modernized Legal Framework: The Oilfields (Regulation and Development) Amendment Bill, 2024, simplifies licensing.

- Investor Attraction: New clauses aim to attract greater investment in oil and gas exploration and production.

- Unified Lease Regime: A move towards a single petroleum lease system enhances operational consistency.

- Improved Dispute Resolution: Better mechanisms for resolving disputes contribute to a more predictable business environment.

Geopolitical Stability and International Relations

Global geopolitical events, such as the ongoing conflict in Eastern Europe and tensions in the Middle East, directly impact crude oil supply chains and price volatility. These disruptions create significant risks for Bharat Petroleum Corporation Limited (BPCL) by affecting the cost and availability of its primary raw material. For instance, in 2024, continued supply chain uncertainties stemming from these conflicts contributed to Brent crude oil prices fluctuating between $75 and $90 per barrel.

India's diplomatic engagement is crucial for BPCL's operational stability. Maintaining robust relationships with diverse energy-producing nations helps secure reliable and cost-effective crude oil supplies. Navigating international sanctions, like those imposed on certain oil-producing countries, requires careful diplomatic maneuvering to avoid impacting BPCL's procurement strategies and import costs.

The complex political landscape is further underscored by international trade relations. For example, in late 2023, discussions around potential tariffs or trade restrictions related to countries involved in geopolitical conflicts could indirectly influence BPCL's sourcing options and overall operational expenses. These external political factors necessitate a proactive and adaptable approach to international sourcing and risk management for BPCL.

- Geopolitical Risk Impact: Fluctuations in crude oil prices due to global conflicts directly affect BPCL's refining margins and profitability.

- Diplomatic Importance: India's foreign policy directly influences BPCL's ability to secure stable and affordable crude oil imports from various regions.

- Trade Relations: International trade policies and sanctions can create both challenges and opportunities for BPCL's sourcing strategies.

- Market Volatility: Geopolitical instability is a primary driver of volatility in the global oil market, impacting BPCL's financial planning.

The Indian government's energy policies, including its stance on disinvestment and focus on energy security, significantly shape BPCL's operational environment and strategic direction. The decision to halt BPCL's privatization provides stability, while the drive for diversified crude imports and domestic exploration, supported by legislative reforms like the Oilfields (Regulation and Development) Amendment Bill, 2024, aims to bolster the sector. These political factors create a framework that influences BPCL's capital access, decision-making autonomy, and long-term investment strategies.

| Political Factor | Impact on BPCL | Supporting Data/Context |

| Government Ownership & Disinvestment Policy | Provides operational stability and influences capital access. | BPCL's divestment is currently off the government's agenda, offering a predictable ownership structure. |

| Energy Security Initiatives | Drives diversification of crude sourcing and focus on domestic E&P. | India's crude oil imports in FY23 were around 225.7 million tonnes, highlighting the need for strategic sourcing. |

| Regulatory Reforms | Streamlines licensing and encourages investment in exploration. | The Oilfields (Regulation and Development) Amendment Bill, 2024, aims to improve the ease of doing business in the E&P sector. |

| Fuel Pricing Policies | Affects revenue, profitability, and marketing margins. | Domestic retail prices remained relatively stable in 2023-24 despite global crude price fluctuations, impacting PSU margins. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Bharat Petroleum, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within the dynamic Indian energy sector.

Provides a concise version of Bharat Petroleum's PESTLE analysis, distilling complex external factors into actionable insights for streamlined strategic planning and risk mitigation.

Helps support discussions on external risk and market positioning during planning sessions by offering a clear overview of the political, economic, social, technological, environmental, and legal forces impacting Bharat Petroleum.

Economic factors

Fluctuations in international crude oil prices are a primary economic factor for Bharat Petroleum Corporation Limited (BPCL), directly influencing its refining margins and input costs. For instance, during fiscal year 2023-24, crude oil prices saw considerable movement, with Brent crude averaging around $82 per barrel, impacting the cost of raw materials significantly.

High volatility can lead to inventory losses and negatively affect profitability, whereas stable or declining prices generally benefit the company by lowering operational expenses. India's substantial reliance on imports for its crude oil needs, often sourcing over 85% of its requirement, makes BPCL particularly susceptible to global price swings and geopolitical events affecting supply.

India's economy has shown remarkable resilience, with projections indicating continued robust growth through 2024 and into 2025. This expansion, fueled by increasing urbanization and a vibrant industrial sector, directly translates into higher demand for petroleum products. BPCL benefits from this, seeing increased sales volumes for everything from gasoline and diesel to LPG and lubricants.

The nation's overall energy demand is on a steep upward trajectory, expected to rise significantly in the coming years, largely mirroring the pace of economic development. A strong economy means more vehicles on the road, more manufacturing output, and greater household consumption of cooking gas, all of which are positive indicators for BPCL's market presence and revenue streams.

Inflationary pressures in India have presented a dual challenge for Bharat Petroleum Corporation Limited (BPCL). Rising costs for raw materials and logistics directly impact operational expenses. For instance, the average Brent crude oil price hovered around $82.50 per barrel in the first half of 2024, a significant factor influencing BPCL's procurement costs.

Concurrently, elevated inflation can erode the disposable income of Indian consumers. This reduction in purchasing power directly affects demand for petroleum products, particularly automotive fuels and Liquefied Petroleum Gas (LPG). With retail inflation in India averaging around 5.5% in early 2024, consumers may cut back on non-essential travel or opt for more fuel-efficient alternatives, impacting BPCL's sales volumes.

The broader economic environment, shaped by inflation, also influences consumer spending habits. When disposable incomes are squeezed, discretionary spending, including fuel for personal vehicles, often sees a decline. This can lead to a more cautious approach from consumers, potentially affecting the overall demand trajectory for BPCL's product portfolio.

Government Subsidies and Taxation

Bharat Petroleum Corporation Limited (BPCL) is directly impacted by government policies on subsidies for essential fuels like Liquefied Petroleum Gas (LPG) and kerosene. For instance, the government's approach to subsidy rationalization, as seen in the gradual reduction of LPG subsidies for non-exempted consumers, affects the affordability of these products and, consequently, demand patterns. This policy directly influences BPCL's revenue streams and the need for government support to manage under-recoveries.

The structure of excise duties and Value Added Tax (VAT) on petroleum products significantly shapes BPCL's pricing flexibility and overall profitability. For example, in the fiscal year 2023-24, central excise duty on petrol and diesel remained relatively stable, but state-level VAT rates vary considerably, creating regional price disparities. These duties are a substantial component of the final retail price, impacting consumer purchasing power and BPCL's profit margins.

Changes in these fiscal policies can rapidly alter market dynamics and BPCL's competitive standing. For example, a sudden increase in excise duty on petrol could dampen demand, while a reduction in VAT by a particular state might boost sales for BPCL in that region relative to competitors. The government's revenue requirements frequently dictate taxation levels on fuels, directly influencing consumer prices and the overall demand for petroleum products.

- Subsidy Impact: The government's policy on LPG subsidies, which aims for gradual reduction for eligible consumers, directly affects BPCL's revenue and cost structure.

- Taxation Influence: Excise duties and VAT on petroleum products, for example, the excise duty on petrol and diesel in FY 2023-24, are critical determinants of BPCL's pricing power and profitability.

- Market Dynamics: Fiscal policy shifts can alter consumer demand and BPCL's competitive position, as seen with varying state VAT rates impacting regional sales.

- Revenue Needs: Government revenue objectives often lead to fuel taxation adjustments, thereby influencing consumer prices and overall market demand for BPCL's products.

Exchange Rate Fluctuations

Bharat Petroleum Corporation Limited (BPCL), as a significant importer of crude oil, faces considerable risk from exchange rate fluctuations, primarily the Indian Rupee's performance against the US Dollar. For instance, in early 2024, the Rupee saw periods of volatility, trading around 83 INR to the USD, which directly impacts the cost of imported crude. A weaker Rupee means BPCL must spend more Indian Rupees to acquire the same amount of US Dollar-denominated crude oil.

This depreciation directly inflates the company's cost of goods sold. For example, if crude oil prices remain stable but the Rupee weakens by 5%, BPCL's import costs effectively rise by that same percentage, squeezing profit margins. This was a notable concern throughout 2023 and into early 2024, with the INR experiencing downward pressure due to global economic factors and domestic inflation concerns.

Consequently, managing foreign exchange exposure is a critical component of BPCL's financial strategy. The company employs various hedging instruments to mitigate the impact of adverse currency movements. These strategies are vital for maintaining financial stability and ensuring predictable profitability in an environment where global commodity prices and currency markets are inherently volatile.

- Impact of Rupee Depreciation: A 1% depreciation of the Indian Rupee against the US Dollar can increase BPCL's crude oil import costs by approximately 0.5-0.7% of its total revenue, depending on the prevailing crude oil prices and import volumes.

- Hedging Strategies: BPCL utilizes financial derivatives like forward contracts and options to lock in exchange rates for future crude oil purchases, aiming to insulate its margins from currency volatility.

- 2023-2024 Trend: Throughout 2023 and the first half of 2024, the Indian Rupee generally traded in a range of 81.50 to 83.50 against the US Dollar, presenting ongoing challenges for import-heavy industries like oil refining.

- Profitability Sensitivity: The company's net profit after tax can be significantly impacted by exchange rate movements, with analysts estimating that every 1% adverse currency movement can affect earnings per share by a notable margin.

India's robust economic growth, projected to continue through 2024-2025, fuels a rising demand for petroleum products, directly benefiting BPCL. This expansion, driven by urbanization and industrial activity, translates to increased sales volumes for fuels, LPG, and lubricants. The nation's energy demand is set to rise significantly, mirroring economic development and presenting a strong market for BPCL's offerings.

Full Version Awaits

Bharat Petroleum PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Bharat Petroleum's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Bharat Petroleum.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the external forces shaping Bharat Petroleum's strategic landscape.

Sociological factors

India's rapid urbanization, with over 35% of its population now residing in cities as of 2023, directly fuels demand for Bharat Petroleum's core products. This migration to urban centers means more vehicles on the road, increasing the need for transportation fuels like petrol and diesel. Furthermore, the adoption of modern lifestyles in these growing cities translates to a higher consumption of Liquefied Petroleum Gas (LPG) for cooking and other domestic uses, expanding BPCL's customer base significantly.

This demographic shift presents both opportunities and challenges for BPCL. As urban populations swell, the company must strategically expand its fuel retail network and LPG distribution infrastructure to meet this escalating demand. For instance, the number of LPG connections in India crossed 300 million by early 2024, highlighting the scale of this growth and the need for BPCL to ensure efficient supply chains to these expanding urban markets.

Consumer preferences are shifting, with a notable increase in environmental consciousness. This is driving a gradual but significant move towards electric vehicles (EVs) and alternative fuels, directly impacting BPCL's future product strategy and infrastructure investments. For instance, by the end of 2024, India's EV market is projected to see substantial growth, necessitating BPCL's proactive adaptation.

These evolving mobility trends require BPCL to diversify its energy offerings beyond traditional fuels. The company is actively addressing this by expanding its EV charging infrastructure network across India, aiming to capture a share of this burgeoning market and align with changing consumer choices.

Growing public awareness concerning air pollution and the health implications of fossil fuels is a significant driver for Bharat Petroleum Corporation Limited (BPCL). This heightened societal consciousness directly pressures BPCL to allocate greater investment towards cleaner refining technologies and the development of more environmentally friendly products. For instance, in 2024, India's air quality index (AQI) frequently exceeded safe levels in major cities, intensifying public demand for cleaner energy solutions.

BPCL's operational framework is heavily influenced by the imperative to uphold stringent safety standards. These standards are crucial not only for safeguarding its workforce but also for protecting the well-being of communities located near its facilities. Compliance with these regulations impacts operational procedures and necessitates ongoing capital expenditure on safety infrastructure and training, with significant investments made in 2024 to upgrade safety protocols across its refineries.

The overarching societal concern for environmental sustainability is actively steering BPCL's strategic direction. This societal pressure is a key catalyst for the company's increasing focus on adopting more sustainable operational practices and exploring investments in cleaner energy alternatives, such as biofuels and electric vehicle charging infrastructure, aligning with India's broader renewable energy targets for 2025.

Employment and Skill Development

As a major public sector undertaking, Bharat Petroleum Corporation Limited (BPCL) is a significant contributor to employment in India's energy landscape. In FY 2023-24, BPCL directly employed over 21,000 individuals, with its extensive operations also generating substantial indirect employment across its value chain, from refining and marketing to retail outlets and logistics.

BPCL’s commitment to skill development is evident in its continuous investment in training programs. For instance, in the fiscal year ending March 2024, the company invested heavily in upskilling its workforce, focusing on areas like digital transformation and advanced refinery technologies to meet evolving industry demands and enhance operational efficiency.

The company's role extends to fostering local economic growth through its employment initiatives. BPCL's presence in various regions often leads to the development of ancillary industries and service providers, creating a multiplier effect on job creation and economic activity in those areas.

- Employment Generation: BPCL directly employed over 21,000 people in FY 2023-24, significantly boosting job opportunities.

- Indirect Employment: The company's vast network of refineries, pipelines, and retail outlets creates substantial indirect employment.

- Skill Enhancement: BPCL actively invests in training programs to equip its employees with skills relevant to technological advancements in the energy sector.

- Economic Impact: BPCL's operations contribute to local economies by fostering ancillary businesses and creating a ripple effect of job growth.

Corporate Social Responsibility (CSR)

Bharat Petroleum Corporation Limited (BPCL) places significant emphasis on Corporate Social Responsibility (CSR), recognizing its importance for social license and brand reputation. The company actively engages in initiatives focused on health, education, and community development, aiming to address societal needs and foster positive public perception.

BPCL's commitment is evidenced by its recognition through awards, including those for its impactful Lifeline Express project and broader sustainability efforts. These programs not only contribute to societal well-being but also reinforce BPCL's standing as a responsible corporate citizen.

- Community Development: BPCL's CSR activities often target local communities, focusing on improving living standards and providing essential services.

- Health Initiatives: Programs like the Lifeline Express, a hospital on wheels, demonstrate BPCL's dedication to improving healthcare access in underserved areas.

- Educational Support: The company invests in educational infrastructure and programs to enhance learning opportunities for students, contributing to human capital development.

Societal expectations regarding environmental responsibility are increasingly shaping BPCL's operational and strategic decisions. Growing public awareness of climate change and pollution is driving demand for cleaner energy sources and sustainable practices. BPCL's proactive investments in EV charging infrastructure and cleaner fuel technologies, for instance, reflect an adaptation to these evolving societal values.

Technological factors

BPCL's commitment to advanced refining technologies is evident in its strategic investments aimed at boosting crude oil processing efficiency and maximizing the output of high-value products like gasoline and diesel. This focus on modernization directly translates to enhanced operational flexibility and a stronger competitive edge in the market.

The company is actively expanding its refining capacity, with a significant project underway at its Kochi Refinery, which is expected to increase its processing capacity by 6 million metric tons per annum. Furthermore, BPCL is investing heavily in new petrochemical projects, such as the Propylene Derivative Petrochemical Project (PDPP) at Kochi, which will leverage advanced technologies to produce a range of specialized chemicals, further diversifying its product portfolio and capturing higher margins.

Bharat Petroleum Corporation Limited (BPCL) is significantly leveraging digital transformation and automation to streamline its operations. The company is actively adopting technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), and advanced data analytics across its value chain, from optimizing its supply chain to enhancing retail customer experiences and implementing predictive maintenance strategies. This digital push aims to boost operational efficiency and reduce costs.

BPCL is exploring and implementing cutting-edge technologies like digital twins, robotics, and augmented/virtual reality within its refinery operations. These innovations are designed to improve process efficiency, enable more accurate predictive maintenance, and ultimately minimize costly downtime. For instance, the adoption of digital twins allows for real-time monitoring and simulation of complex refinery processes, leading to better decision-making and operational control.

The burgeoning electric vehicle (EV) market in India presents a significant technological shift, compelling Bharat Petroleum Corporation Limited (BPCL) to invest in and expand its EV charging infrastructure. This expansion is crucial for BPCL to diversify its revenue streams beyond conventional fuels and align with evolving consumer mobility preferences.

BPCL has committed to establishing a substantial number of EV charging stations by 2026, a strategic move to capture a share of the rapidly growing EV ecosystem. The company has already initiated this by awarding contracts for the deployment of fast DC chargers, signaling a proactive approach to meeting future energy demands.

Renewable Energy Integration and Biofuels

Bharat Petroleum Corporation Limited (BPCL) is actively embracing technological advancements in renewable energy integration and biofuels to align with the global energy transition. This strategic pivot involves significant investments in solar and wind power generation to reduce its carbon footprint. For instance, BPCL is developing substantial renewable energy capacities, aiming to contribute meaningfully to India's sustainability goals.

The company is also a key player in advancing biofuel production, particularly ethanol blending in petrol and the development of compressed biogas (CBG) and biodiesel. These initiatives are crucial for meeting national energy security objectives and reducing reliance on imported fossil fuels. BPCL's commitment to a net-zero target underscores the importance of these technological shifts in its long-term operational strategy.

- Renewable Energy Capacity: BPCL is targeting significant growth in its renewable energy portfolio, with plans to establish a substantial capacity in solar and wind power by 2025.

- Ethanol Blending: The company is a major contributor to India's ethanol blending program, with the national target for E20 (20% ethanol blending) driving increased demand for biofuels.

- Biofuel Investments: BPCL is investing in compressed biogas (CBG) and biodiesel projects, leveraging technology to convert agricultural waste and other organic matter into valuable fuels.

- Net-Zero Commitment: BPCL has set a net-zero target, necessitating a technological transformation towards cleaner energy sources and sustainable fuel production.

Green Hydrogen and Carbon Capture Technologies

Bharat Petroleum Corporation Limited (BPCL) is actively exploring and investing in green hydrogen production and Carbon Capture, Utilization, and Storage (CCUS) technologies. These advancements are fundamental to BPCL's long-term strategy for reducing its carbon emissions and achieving its net-zero targets. The company's commitment to these emerging technologies underscores its dedication to a sustainable future in the energy sector.

BPCL's investments in green hydrogen are geared towards developing cleaner fuel alternatives and decarbonizing its operations. Similarly, CCUS technologies are being pursued to capture CO2 emissions from its industrial processes, thereby mitigating environmental impact. These strategic moves position BPCL to navigate the evolving energy landscape and meet stringent environmental regulations.

- Green Hydrogen Investments: BPCL is focusing on pilot projects and collaborations to establish large-scale green hydrogen production facilities.

- CCUS Technology Adoption: The company is evaluating and implementing CCUS solutions at its refineries and petrochemical plants to reduce direct emissions.

- Net-Zero Targets: These technological advancements are crucial for BPCL to meet its ambitious goal of achieving net-zero carbon emissions by 2040.

- R&D Focus: Significant resources are allocated to research and development in these areas to foster innovation and cost-effectiveness.

BPCL is actively integrating advanced technologies to enhance its refining capabilities, including digital twins for process optimization and predictive maintenance, aiming to boost efficiency and reduce downtime. The company is also making substantial investments in petrochemical projects, like the Propylene Derivative Petrochemical Project (PDPP) at Kochi, to diversify its product offerings and capture higher margins.

The company is strategically expanding its electric vehicle (EV) charging infrastructure, with plans to establish a significant number of charging stations by 2026, responding to the growing EV market. Furthermore, BPCL is investing in renewable energy sources like solar and wind power, targeting substantial capacity by 2025 to reduce its carbon footprint and align with sustainability goals.

BPCL is a key player in India's biofuel initiatives, focusing on ethanol blending and developing compressed biogas (CBG) and biodiesel. These efforts are critical for national energy security and reducing reliance on imported fossil fuels, with the company aiming for net-zero emissions by 2040. Investments in green hydrogen and Carbon Capture, Utilization, and Storage (CCUS) technologies are also central to its decarbonization strategy.

| Technology Area | Key Initiatives | Target/Status |

|---|---|---|

| Refining & Petrochemicals | Digital Twins, AI, IoT, PDPP Project | Increased efficiency, diversified product portfolio |

| Electric Mobility | EV Charging Station Deployment | Significant number by 2026 |

| Renewable Energy | Solar & Wind Power Capacity | Substantial capacity by 2025 |

| Biofuels | Ethanol Blending, CBG, Biodiesel | Major contributor to national targets |

| Decarbonization | Green Hydrogen, CCUS | Net-zero by 2040 |

Legal factors

Bharat Petroleum Corporation Limited (BPCL) faces stringent environmental regulations that shape its operations. These include strict air and water quality standards, comprehensive waste management rules, and increasingly rigorous emission norms. For instance, India's commitment to reducing its carbon footprint, as highlighted in its Nationally Determined Contributions (NDCs) under the Paris Agreement, translates into tighter emission standards for refineries and fuel products. BPCL's compliance efforts in 2024 and 2025 are heavily focused on upgrading technologies to meet these evolving requirements.

These regulations necessitate substantial capital expenditure for pollution control equipment and advanced operational practices. The Oilfields (Regulatory and Development) Amendment Bill, 2024, further reinforces these environmental safeguards, potentially increasing compliance costs and operational complexities for BPCL. The company's strategic planning must therefore integrate these legal mandates to ensure sustainable operations and avoid penalties.

Changes in direct and indirect taxation laws significantly impact Bharat Petroleum Corporation Limited's (BPCL) financial performance and pricing. For instance, any alteration in corporate tax rates directly affects BPCL's net profits. The evolving fiscal policies, including excise duties and other levies on petroleum products, which remain outside the Goods and Services Tax (GST) framework, introduce complexity into their pricing strategies and revenue streams.

Bharat Petroleum Corporation Limited (BPCL) must strictly adhere to India's comprehensive labor laws, encompassing fair wages, safe working conditions, and robust industrial relations. For instance, the Code on Wages, 2019, aims to simplify wage-related regulations, potentially impacting BPCL's payroll structures and benefit packages.

Shifts in employment regulations, such as those concerning contract labor or employee benefits, can directly influence BPCL's operational expenses and its approach to human capital management. Navigating these evolving legal landscapes is critical for maintaining smooth operations and employee satisfaction.

As a significant employer, BPCL’s ability to adapt to and comply with new or amended labor legislation, including those related to social security and worker safety, is paramount. This proactive approach ensures continued operational efficiency and minimizes legal risks.

Competition Law and Market Regulations

Bharat Petroleum Corporation Limited (BPCL) navigates a dynamic market shaped by competition law and stringent market regulations. The company must consistently adhere to anti-trust provisions and guidelines governing fair trade practices in the petroleum sector. This includes regulations concerning pricing, marketing, and the distribution of fuel and lubricants, ensuring a level playing field.

The Indian government's recent policy shifts, particularly those encouraging infrastructure sharing, are designed to foster greater competition. For BPCL, this means adapting to new operational frameworks that promote efficient resource utilization and potentially open up new avenues for collaboration and market access. For instance, the push for shared fuel station infrastructure could impact traditional retail strategies.

- Adherence to Competition Act: BPCL must comply with the Competition Act, 2002, which prohibits anti-competitive agreements and abuse of dominant position.

- Regulatory Compliance: The company is subject to regulations set by bodies like the Petroleum and Natural Gas Regulatory Board (PNGRB) for fair market practices.

- Infrastructure Sharing Mandates: New regulations promoting shared retail outlet infrastructure aim to increase competition and reduce operational costs for all players.

- Market Access Rules: BPCL operates under rules that govern market entry and expansion, ensuring transparency and preventing monopolistic tendencies.

Land Acquisition and Project Clearances

Legal complexities surrounding land acquisition for Bharat Petroleum Corporation Limited's (BPCL) infrastructure, such as new refineries and pipelines, can lead to significant delays. Navigating these processes, alongside obtaining crucial environmental and regulatory clearances, directly impacts project timelines and overall cost management. For instance, BPCL's ongoing assessment for a new refinery location highlights the critical need for efficient legal and administrative processes to ensure timely project execution.

Timely approvals are paramount for BPCL’s expansion strategies. Delays in securing land and necessary permits, such as environmental impact assessments and forest clearances, can add substantial costs and push back revenue generation. The company’s strategic objective to expand its refining capacity, a key focus for 2024-2025, is heavily contingent on successfully navigating these legal hurdles.

- Land Acquisition Challenges: BPCL faces potential delays in acquiring land for new retail outlets and pipeline projects due to existing land laws and local disputes, impacting network expansion targets.

- Regulatory Approvals: Obtaining environmental clearances from bodies like the Ministry of Environment, Forest and Climate Change (MoEFCC) for new projects can be a lengthy process, often requiring detailed studies and public consultations.

- Project Execution Impact: Delays in clearances for projects, such as the proposed new refinery, can escalate capital expenditure and defer the project's return on investment, affecting BPCL's financial performance.

- Legal Framework Compliance: BPCL must adhere to a complex web of national and state-level laws governing land use, environmental protection, and industrial operations, ensuring all projects are legally compliant.

Bharat Petroleum Corporation Limited (BPCL) operates under a robust legal framework that mandates strict adherence to environmental protection laws, including emission standards and waste management. For instance, India's updated Nationally Determined Contributions (NDCs) are driving stricter emission norms for refineries in 2024-2025, requiring significant technological upgrades. The Oilfields (Regulatory and Development) Amendment Bill, 2024, further solidifies these environmental safeguards, potentially increasing compliance costs for BPCL.

Taxation laws, particularly changes in corporate tax rates and excise duties on petroleum products, directly influence BPCL's profitability and pricing strategies. The company must also navigate complex labor laws, such as the Code on Wages, 2019, which impacts payroll and benefits, alongside regulations for safe working conditions and industrial relations.

Competition law and market regulations, overseen by bodies like the Petroleum and Natural Gas Regulatory Board (PNGRB), are critical for BPCL's fair trade practices. New policies promoting infrastructure sharing aim to increase competition, requiring BPCL to adapt its retail strategies. Land acquisition for infrastructure projects, like new refineries, also presents legal challenges, with delays in obtaining environmental and regulatory clearances impacting project timelines and costs, a key concern for BPCL's expansion plans in 2024-2025.

Environmental factors

The global imperative to address climate change, coupled with India's ambitious target of net-zero emissions by 2070, directly shapes Bharat Petroleum Corporation Limited's (BPCL) strategic direction. This commitment necessitates a fundamental shift in operational paradigms and investment priorities for the energy sector.

BPCL has proactively responded by setting its own goal to achieve net-zero carbon emissions from its operations by 2040. This requires significant capital allocation towards developing and integrating green technologies, including renewable energy sources and advanced carbon capture solutions, to meet these evolving environmental mandates.

The company's investment in energy transition initiatives, such as expanding its petrochemical portfolio and exploring biofuels and hydrogen, is a direct consequence of these decarbonization pressures. For instance, BPCL has announced plans to invest approximately $1.5 billion in renewable energy projects by 2025, aiming to diversify its energy mix and reduce its carbon footprint.

Concerns about air pollution from refinery emissions and vehicle exhausts, alongside water usage and discharge from industrial activities, are pushing BPCL towards cleaner technologies and more sustainable operations. Effective management of these resources is vital for long-term viability and meeting regulatory standards.

BPCL's commitment to environmental stewardship is evident, with its Kochi Refinery notably receiving an 'Eco-Refinery Award' for its efforts in reducing specific carbon emissions. This recognition highlights the company's proactive approach to environmental challenges.

The global and domestic push towards renewable energy, particularly solar and wind power, presents a significant long-term challenge for Bharat Petroleum's (BPCL) traditional fossil fuel business. BPCL needs to strategically diversify its operations into green energy sectors and decrease its dependence on conventional hydrocarbons to remain competitive.

India is demonstrating substantial progress in clean energy adoption, with the government setting aggressive targets for increasing the share of non-fossil fuel sources in its electricity generation mix. As of early 2024, India's renewable energy capacity has surpassed 179 GW, underscoring the rapid transition underway.

Biodiversity and Ecosystem Protection

Bharat Petroleum Corporation Limited's (BPCL) extensive operations, from oil and gas exploration to its widespread retail network, inevitably interact with local environments. These activities, including pipeline construction and refinery operations, carry the potential to affect biodiversity and ecosystems. For instance, BPCL's commitment to environmental stewardship involves rigorous environmental impact assessments for all new projects, ensuring that potential disruptions to flora and fauna are identified and mitigated.

The company is increasingly focused on minimizing its ecological footprint. This involves implementing best practices in land management and actively participating in conservation initiatives. BPCL's strategy includes responsible sourcing of materials and investing in technologies that reduce emissions and waste, thereby safeguarding natural habitats. In 2023-24, BPCL continued its focus on biodiversity conservation, with specific projects aimed at protecting endangered species in areas adjacent to its operational sites.

BPCL's approach to biodiversity and ecosystem protection is integrated into its business strategy, recognizing the long-term value of healthy ecosystems. Key initiatives include:

- Implementing Environmental Management Systems (EMS) across all operational facilities to monitor and control environmental impacts.

- Conducting biodiversity surveys and impact assessments prior to undertaking new exploration or infrastructure development projects.

- Investing in afforestation and habitat restoration programs in areas affected by its operations.

- Adhering to national and international environmental regulations and standards for ecosystem protection.

Waste Management and Circular Economy

Bharat Petroleum Corporation Limited (BPCL) faces increasing regulatory and societal pressure to enhance its waste management strategies. This includes addressing hazardous waste generated from its refining operations and the growing concern around plastic waste from packaging materials. The company is actively exploring the integration of circular economy principles, focusing on reducing waste generation, promoting reuse, and implementing robust recycling programs to minimize its environmental footprint.

BPCL's commitment to sustainability is further underscored by its efforts in resource recovery. For instance, in the fiscal year 2023-24, the company reported significant progress in its waste-to-value initiatives, diverting over 75% of its non-hazardous waste from landfills. This aligns with the broader national push towards a circular economy, aiming to transform waste into valuable resources.

Key initiatives include:

- Implementing advanced technologies for hazardous waste treatment and disposal, ensuring compliance with stringent environmental norms.

- Exploring partnerships for plastic waste recycling and the development of biodegradable packaging alternatives.

- Investing in research and development to identify new avenues for resource recovery from industrial by-products.

- Enhancing operational efficiencies to minimize waste generation at the source across all its facilities.

India's net-zero target by 2070 and BPCL's own 2040 net-zero operational goal are driving significant investment in green technologies and operational shifts. The company is actively diversifying into renewables, biofuels, and hydrogen, with plans to invest around $1.5 billion in renewable energy projects by 2025 to reduce its carbon footprint.

BPCL is also addressing environmental concerns related to air and water pollution from its refining activities by adopting cleaner technologies and sustainable practices. Its commitment is recognized through awards like the 'Eco-Refinery Award' for its Kochi Refinery, highlighting efforts in emission reduction.

The company's strategy increasingly incorporates biodiversity conservation, with environmental impact assessments for new projects and investments in afforestation programs. In fiscal year 2023-24, BPCL achieved over 75% diversion of non-hazardous waste from landfills through waste-to-value initiatives, underscoring a move towards a circular economy.

BPCL's environmental performance in key areas for fiscal year 2023-24 demonstrates its commitment to sustainability:

| Environmental Metric | Performance | Target/Initiative |

|---|---|---|

| Renewable Energy Investment | ~ $1.5 billion planned by 2025 | Diversification into solar, wind, biofuels, hydrogen |

| Net-Zero Operational Goal | Target: 2040 | Focus on emission reduction technologies |

| Waste Diversion (Non-Hazardous) | > 75% diverted from landfills | Waste-to-value initiatives, circular economy principles |

| Carbon Emission Reduction | Kochi Refinery recognized for specific reductions | Eco-Refinery initiatives |

PESTLE Analysis Data Sources

Our Bharat Petroleum PESTLE Analysis is meticulously constructed using data from official Indian government publications, reputable economic forecasting agencies, and leading industry associations. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape affecting the company.