Bharat Petroleum Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bharat Petroleum Bundle

Bharat Petroleum navigates a dynamic energy landscape, where the bargaining power of buyers and the threat of substitutes significantly shape its market. Understanding these forces is crucial for strategic planning. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bharat Petroleum’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Bharat Petroleum Corporation Limited (BPCL) faces substantial bargaining power from crude oil suppliers due to the commodity's inherent global price volatility. This volatility, influenced by geopolitical events and OPEC+ decisions, directly impacts BPCL's procurement costs.

India's increasing reliance on imported crude oil, with production seeing a dip in 2024-25, further amplifies supplier leverage. The nation's crude oil import bill surged to $144.2 billion in 2024-25, underscoring the critical need for robust sourcing strategies and diversification to mitigate this supplier power.

The bargaining power of suppliers for Bharat Petroleum Corporation Limited (BPCL) is significantly influenced by the limited number of major crude oil suppliers globally. This concentration means BPCL, like its peers, faces fewer options when sourcing its primary raw material, potentially giving these suppliers more leverage in price discussions.

India's heavy reliance on imported crude oil, exceeding 85% of its requirements, underscores this supplier power. Notably, Russia emerged as the leading source of India's crude oil imports in the 2024-25 period, capturing a substantial 35% share of the market, highlighting a shift in the supplier landscape and its implications for BPCL.

Bharat Petroleum Corporation Limited (BPCL) refineries are often optimized for specific crude oil grades, meaning a switch to significantly different types can necessitate costly reconfigurations and operational adjustments. This inherent dependency on particular crude grades grants considerable bargaining power to the suppliers of those specific grades, as altering the supply chain becomes an expensive undertaking for BPCL.

Geopolitical Influence on Supply Chains

Geopolitical tensions, sanctions, and regional conflicts in major oil-producing regions can significantly disrupt supply chains and limit crude oil availability. These external factors, beyond Bharat Petroleum Corporation Limited's (BPCL) direct control, can compel the company to source supplies at elevated prices or from less favorable origins, consequently bolstering supplier leverage.

For example, Indian state refiners, including BPCL, paused Russian oil purchases in July 2025 due to threats of US tariffs. This led them to seek alternative crude supplies from regions like the Middle East and West Africa, demonstrating how geopolitical shifts can alter sourcing strategies and supplier dynamics.

- Geopolitical Disruptions: Tensions in oil-producing regions directly impact crude availability.

- Increased Sourcing Costs: BPCL may face higher prices or less optimal sources due to these disruptions.

- Impact on Sourcing Strategy: Events like the July 2025 pause on Russian oil highlight the need for flexible supply chains.

- Supplier Power Amplification: When BPCL seeks alternatives, existing suppliers in other regions gain increased bargaining power.

BPCL's Own Exploration & Production Efforts

BPCL's own exploration and production (E&P) efforts, while growing, currently contribute a relatively small portion of its crude oil requirements compared to its vast refining capacity. This limited backward integration means the company is still significantly reliant on external suppliers for its primary feedstock. For instance, while BPCL plans to invest ₹32,000 crore in upstream production as part of its 'Project Aspire' strategic framework, this investment is aimed at bolstering future supply rather than immediately offsetting current import dependence.

This ongoing reliance on external sources for crude oil means that suppliers, particularly major oil-producing nations and international oil companies, retain considerable bargaining power. Their ability to influence prices and supply volumes directly impacts BPCL's operational costs and profitability. The company's efforts to increase domestic production are a strategic move to gradually reduce this supplier leverage over time.

- Limited Domestic Crude Output: BPCL's current crude oil production from its own E&P ventures is insufficient to meet its substantial refining needs.

- Strategic Investment in Upstream: The company is committing ₹32,000 crore to boost its upstream production capabilities under 'Project Aspire'.

- Continued Supplier Dependence: Despite E&P investments, BPCL remains largely dependent on international crude oil suppliers, granting them significant bargaining power.

The bargaining power of crude oil suppliers for Bharat Petroleum Corporation Limited (BPCL) remains high due to global supply concentrations and India's significant import dependence. With over 85% of its crude oil needs met through imports, BPCL faces limited alternatives, especially as specific refinery configurations often tie them to particular crude grades, making switching costly.

Geopolitical instability further amplifies supplier leverage, as seen when BPCL and other Indian refiners paused Russian oil purchases in July 2025 due to potential US tariffs, forcing a pivot to Middle Eastern and West African sources. This situation underscores how external events can shift supplier dynamics and increase costs for BPCL.

While BPCL is investing ₹32,000 crore in upstream production via 'Project Aspire' to reduce reliance, current domestic output is insufficient. This continued dependence on international suppliers, who control significant market share, grants them considerable power over pricing and availability, directly impacting BPCL's operational expenses.

| Factor | Impact on BPCL | Data/Example |

| Supplier Concentration | Limited sourcing options increase supplier leverage. | Russia accounted for 35% of India's crude imports in 2024-25. |

| Import Dependence | High reliance on foreign oil strengthens supplier power. | India imports over 85% of its crude oil requirements. |

| Refinery Specificity | Dependency on certain crude grades limits flexibility. | Switching crude types can require costly refinery reconfigurations. |

| Geopolitical Risks | Disruptions can force BPCL to pay higher prices or use less ideal sources. | July 2025 pause on Russian oil led to sourcing from Middle East/West Africa. |

| Domestic Production Gap | Current E&P output is insufficient to offset imports. | ₹32,000 crore investment in upstream aims to reduce future dependence. |

What is included in the product

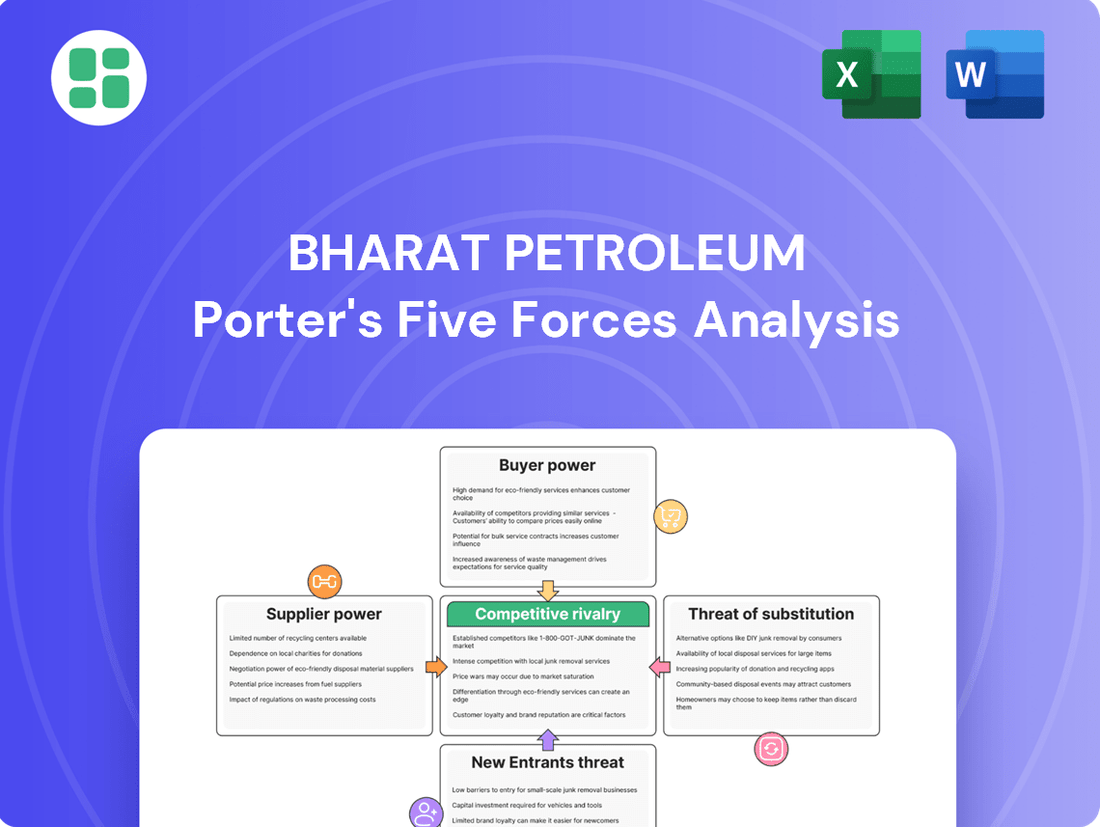

Tailored exclusively for Bharat Petroleum, analyzing its position within its competitive landscape by examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes.

Visualize competitive intensity with a dynamic Porter's Five Forces dashboard, instantly highlighting areas of strategic vulnerability for Bharat Petroleum.

Customers Bargaining Power

Individual consumers of fuels and LPG are highly price-sensitive, frequently opting for the most affordable choice or being swayed by government-regulated pricing. This sensitivity means that even small price discrepancies can significantly influence purchasing decisions, particularly as basic petroleum products are largely indistinguishable.

Bharat Petroleum Corporation Limited (BPCL) benefits from an extensive retail network, but brand loyalty among fuel consumers can be fragile. In the Indian market, where price is a dominant factor, customers are quick to switch providers for even minor cost savings, underscoring the potent bargaining power of the end-user.

The Indian retail fuel sector is evolving, with a rising demand for premium, high-octane fuels and a growing interest in alternative energy sources. This shift presents both an opportunity and a challenge for BPCL, as it caters to changing consumer preferences while still navigating the intense price competition in the traditional fuel segments.

Government regulation of fuel prices significantly impacts the bargaining power of customers by shifting pricing control away from companies like Bharat Petroleum (BPCL). In India, the government frequently intervenes in setting prices for petrol, diesel, and LPG, often through subsidies or specific pricing formulas. This direct oversight means customers are less able to negotiate prices, as the government effectively dictates them.

This regulatory environment transfers considerable pricing power from BPCL to the government. For instance, the government is preparing to approve a compensation package estimated between ₹30,000 to ₹35,000 crore for state-run Oil Marketing Companies, including BPCL, to cover losses incurred from selling subsidized LPG during the 2024-25 fiscal year. This compensation highlights the extent of government influence on pricing and the associated financial implications for BPCL.

Customers in the petroleum market, including those who buy from Bharat Petroleum (BPCL), generally face very low costs when deciding to switch to a different brand. For everyday products like petrol and diesel, it's simple for consumers to choose between BPCL, Indian Oil, Hindustan Petroleum, or even private fuel stations. This ease of movement means they can easily opt for the station offering a better price, more convenient location, or slightly better service.

This low switching cost significantly boosts the bargaining power of customers. It forces BPCL to remain highly competitive, not just on price but also on the quality of service and the overall customer experience. If customers feel they can get a better deal elsewhere with minimal effort, they will, putting pressure on BPCL to consistently meet or exceed expectations.

The Indian retail fuel market is quite concentrated, with the top three public sector undertakings (PSUs) – which include BPCL – holding over 90% of the market share as of recent data. This concentration, however, doesn't diminish customer power due to the low switching costs inherent in the product itself.

Bulk Purchase Power of Industrial Customers

Large industrial clients, transport companies, and airlines are significant purchasers of petroleum products, buying in substantial volumes. This bulk purchasing power grants them considerable leverage when negotiating discounts, credit terms, and bespoke supply contracts with Bharat Petroleum Corporation Limited (BPCL).

BPCL faces pressure to offer competitive terms to retain these high-value customers, which can directly affect the profit margins on their large contracts. India's oil demand is expected to see robust growth, fueled by ongoing economic expansion and industrial activity, further amplifying the bargaining power of these major buyers.

- Significant Volume Purchases: Major industrial users, logistics firms, and aviation companies procure petroleum products in vast quantities.

- Negotiating Leverage: Their large order sizes translate into strong bargaining power for better pricing, payment terms, and tailored supply arrangements.

- Margin Impact: BPCL must balance competitive offerings with profitability, as customer demands can compress margins on substantial deals.

- Market Growth Context: Projected increases in India's oil consumption, driven by economic growth, reinforce the importance of managing these customer relationships effectively.

Availability of Multiple Distribution Channels

Customers in India benefit from a vast and accessible network of fuel stations and distribution points from numerous competitors. This widespread availability means that no single entity, including Bharat Petroleum Corporation Limited (BPCL), can dictate terms, significantly bolstering customer bargaining power. For instance, as of early 2024, the Indian fuel retail market features thousands of outlets operated by public sector undertakings and private players, offering consumers ample choice.

BPCL is actively working to enhance its own reach and customer accessibility. The company has outlined plans to substantially expand its retail network, with a particular emphasis on increasing the number of fuel stations and developing a robust Electric Vehicle (EV) charging infrastructure. This strategic expansion aims to provide more convenient options for customers, potentially influencing their purchasing decisions and further diversifying their choices.

The sheer volume of distribution channels available to consumers directly translates to increased bargaining power. Customers can readily compare prices, product quality, and service offerings across different brands. This competitive landscape forces companies like BPCL to remain attentive to customer needs and market dynamics to retain market share.

- Extensive Network: Customers can access fuel from numerous competitors across India, limiting any single company's pricing power.

- Competitive Landscape: The presence of multiple fuel retailers ensures consumers have choices based on price, location, and service.

- BPCL's Expansion: BPCL's planned growth in its retail and EV charging network aims to increase customer touchpoints and options.

- Customer Choice: The abundance of distribution channels empowers customers to switch suppliers easily, driving competitive behavior.

Customers in the fuel sector, including those buying from Bharat Petroleum (BPCL), possess significant bargaining power due to several factors. Their ability to easily switch between brands, coupled with a strong awareness of pricing, compels companies to offer competitive rates. This dynamic is further influenced by the presence of numerous retail outlets and the potential for bulk purchase discounts for industrial clients.

The bargaining power of customers is amplified by low switching costs and a high degree of price sensitivity. For instance, individual consumers often choose the most affordable fuel option, as petrol and diesel are largely commoditized. This necessitates that BPCL maintain competitive pricing to retain its customer base.

Large industrial buyers and transport companies exert considerable influence through their substantial purchase volumes. They can negotiate favorable terms, discounts, and credit arrangements, directly impacting BPCL's profit margins. As India's oil demand continues to grow, this leverage is expected to increase.

The government's role in regulating fuel prices also shifts power towards consumers. By setting prices, often through subsidies, the government dictates the cost for end-users, reducing BPCL's ability to set prices independently. This was evident in the planned compensation of ₹30,000 to ₹35,000 crore for oil marketing companies like BPCL for subsidized LPG sales in 2024-25.

| Factor | Impact on BPCL | Customer Action |

|---|---|---|

| Price Sensitivity | Forces competitive pricing strategies | Switches to cheaper alternatives |

| Low Switching Costs | Requires focus on customer retention and service | Easily moves between brands |

| Bulk Purchases (Industrial) | Leads to negotiated discounts and terms | Leverages volume for better deals |

| Government Pricing | Limits pricing autonomy, transfers power | Benefits from regulated prices |

| Extensive Retail Network (Competitors) | Demands competitive offerings | Chooses from numerous outlets |

Full Version Awaits

Bharat Petroleum Porter's Five Forces Analysis

This preview showcases the complete Bharat Petroleum Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning. You'll gain instant access to this professionally formatted analysis, empowering you with actionable insights into market dynamics.

Rivalry Among Competitors

Bharat Petroleum Corporation Limited (BPCL) operates in a highly competitive landscape within India's oil and gas marketing sector, significantly shaped by the presence of major Public Sector Undertakings (PSUs). Key players like Indian Oil Corporation (IOCL) and Hindustan Petroleum Corporation Limited (HPCL) are direct rivals, creating a dynamic market environment.

These PSUs actively compete across refining, marketing, and distribution. Their rivalry often manifests in strategies focused on expanding their retail networks and adapting pricing within regulatory frameworks, all while enhancing customer service to capture market share. BPCL itself commands a substantial portion of the market, operating about a quarter of India's fuel retail outlets and contributing to roughly 14% of the nation's oil refining capacity.

The competitive rivalry within India's fuel market is significantly amplified by the expanding footprint of private sector entities. Companies such as Reliance Industries and Nayara Energy are increasingly making their mark in both refining and fuel retail, introducing diverse strategies and operational efficiencies that directly challenge established players like Bharat Petroleum.

These private competitors often differentiate themselves through innovative business models and enhanced customer service, creating a more dynamic and demanding market environment. As of April 2025, private players command approximately 34.3% of India's total installed refining capacity, which stands at 258.1 million metric tons per annum, underscoring their substantial and growing influence.

Competitive rivalry in the refining sector, including for BPCL, is intensely focused on maximizing refinery utilization and gross refining margins (GRMs). Companies actively pursue operational efficiencies, invest in technological advancements, and secure advantageous crude oil supplies to boost profitability.

BPCL demonstrated strong performance in FY25, achieving an impressive refinery utilization rate of 115%. This was supported by a substantial crude throughput of 40.51 million metric tons (MMT) for the entire fiscal year, underscoring its operational prowess.

Network Expansion and Customer Reach

The competition among oil marketing companies, including BPCL, is intensely focused on expanding their retail fuel station networks and LPG distribution channels. This strategic push aims to capture a larger customer base and enhance convenience across the country.

BPCL is actively participating in this network expansion. For instance, the company plans to invest ₹20,000 crore in marketing expansion. Furthermore, a key objective is to significantly increase its presence in the electric vehicle charging infrastructure, with a target of establishing 7,000 EV charging stations by FY25.

- Network Expansion: BPCL and its competitors are continuously opening new fuel stations to gain market share.

- LPG Distribution: Efforts are underway to broaden the reach of LPG services, making them accessible to more households.

- EV Charging Infrastructure: BPCL's goal of 7,000 EV charging stations by FY25 highlights a major growth area and competitive front.

- Investment in Marketing: A substantial ₹20,000 crore investment underscores the commitment to expanding marketing infrastructure and customer reach.

Product Differentiation and Value-Added Services

While the core offering of petrol and diesel remains a commodity, Bharat Petroleum Corporation Limited (BPCL) actively differentiates itself through a suite of value-added services. This includes the availability of premium fuel variants, robust loyalty programs, and the integration of convenience stores and quick-service restaurants at their retail outlets. These efforts aim to enhance customer experience and foster brand loyalty, moving beyond simple price competition.

BPCL's strategic initiative, 'Project Aspire,' underscores this commitment to evolving retail stations into comprehensive energy hubs. This project focuses on upgrading existing fuel stations and developing new ones with enhanced amenities, including EV charging infrastructure and expanded retail offerings. This strategic pivot aims to capture a larger share of customer spending and build a more resilient business model in the face of changing energy landscapes.

- Premium Fuels: BPCL offers advanced fuel formulations designed for better engine performance and efficiency.

- Loyalty Programs: Initiatives like 'SmartFleet' and 'PetroBonus' reward repeat customers with points and discounts.

- Retail Expansion: The company is expanding its 'Pure & Sure' range of food and beverage offerings at fuel stations.

- Energy Hubs: 'Project Aspire' targets the transformation of over 7,000 retail outlets into modern energy stations by 2025.

Competitive rivalry is a dominant force for Bharat Petroleum Corporation Limited (BPCL), with intense competition from both public sector undertakings (PSUs) like IOCL and HPCL, and increasingly from private players such as Reliance Industries and Nayara Energy. This rivalry spans refining operations, where efficiency and gross refining margins are key, and the vast retail fuel network, where market share is gained through network expansion and enhanced customer service.

BPCL's commitment to growth is evident in its investment of ₹20,000 crore in marketing expansion, including a target of 7,000 EV charging stations by FY25. This strategic focus on diversifying offerings and improving customer experience, as seen in 'Project Aspire,' is crucial for navigating the highly competitive Indian oil and gas market.

| Key Competitor Type | Market Share Influence | Competitive Strategy Focus |

| PSUs (IOCL, HPCL) | Significant, established presence | Network expansion, pricing, customer service |

| Private Players (Reliance, Nayara) | Growing, ~34.3% refining capacity | Innovation, operational efficiency, differentiated service |

| BPCL's Response | ~14% refining capacity, ~25% retail outlets | Network growth, EV infrastructure, value-added services, energy hubs |

SSubstitutes Threaten

The increasing popularity of electric vehicles (EVs) presents a substantial long-term challenge to Bharat Petroleum Corporation Limited's (BPCL) primary business of selling petrol and diesel. As the charging infrastructure grows and battery technology advances, a move away from traditional internal combustion engine vehicles will inevitably decrease the demand for conventional fuels.

India has set aggressive goals for EV adoption by 2030, targeting 30% for private cars and 70% for commercial vehicles. This transition directly impacts BPCL's fuel sales, as EVs require electricity instead of petroleum-based products. For instance, in 2023, India's EV sales crossed 1.2 million units, a significant jump from previous years, indicating a clear market shift.

The increasing adoption of renewable energy, particularly solar and wind power, poses a significant threat of substitution for Bharat Petroleum Corporation Limited (BPCL). For industrial and commercial users, these green alternatives can replace petroleum-based fuels previously used for electricity generation or within their operational processes.

BPCL itself is actively investing in this evolving landscape, targeting 2 GW of renewable energy capacity by 2025. This strategic move acknowledges the growing demand for cleaner energy and aims to mitigate the impact of substitutes by becoming a provider of these alternatives.

The growing adoption of alternative fuels like CNG, LNG, biofuels, and hydrogen presents a significant threat to Bharat Petroleum's core business. These alternatives offer cleaner and often more cost-effective options for transportation and industrial applications, directly competing with traditional petroleum products.

India's commitment to cleaner energy is evident in the rapid expansion of its Compressed Natural Gas (CNG) network. As of May 2025, there are 8,154 CNG stations across the country, a substantial increase that more than doubles the count from the 2020-21 period, indicating a strong shift towards gas-based fuels.

Improvements in Public Transportation

Improvements in public transportation present a significant threat of substitutes for Bharat Petroleum. As urban areas expand and infrastructure development accelerates, more individuals may choose efficient public transport options like metros, buses, and trains over private vehicles.

This shift directly impacts fuel consumption. For instance, the Indian government's commitment to increasing the share of natural gas in the energy mix to 15% by 2030, coupled with the expansion of its City Gas Distribution (CGD) network, signals a broader move towards cleaner and potentially more cost-effective energy sources for transportation.

Consequently, a growing segment of the population might reduce their reliance on petrol and diesel, leading to a potential decline in demand for retail fuels sold by Bharat Petroleum. This trend is further amplified by ongoing investments in expanding and modernizing public transit systems across major Indian cities.

- Reduced Reliance on Private Vehicles: Enhanced public transport networks diminish the need for personal cars and motorcycles, directly cutting fuel demand.

- Shift to Alternative Fuels: Government initiatives promoting natural gas and potentially electric mobility for public transport create substitute energy sources.

- Urban Mobility Trends: As cities become more congested, the convenience and cost-effectiveness of public transport can outweigh the advantages of private vehicle ownership.

Energy Efficiency and Conservation Measures

Advancements in energy efficiency and conservation present a significant threat of substitutes for Bharat Petroleum Corporation Limited (BPCL). As vehicles become more fuel-efficient and industries adopt stringent energy-saving practices, the demand for petroleum products naturally decreases. This trend is amplified by growing consumer awareness and a desire to reduce energy consumption, directly impacting BPCL's core business.

The Energy Information Administration (EIA) projects a substantial increase in India's liquid fuel consumption, expecting it to rise by 300,000 barrels per day (b/d) in both 2024 and 2025. This growth is primarily fueled by the transportation sector. However, even within this expanding market, the underlying efficiency gains mean that each unit of fuel delivers more output, indirectly substituting for a larger volume of fuel that would have been consumed previously.

- Fuel Efficiency Standards: Stricter emission and fuel economy regulations globally and within India compel automakers to produce more efficient vehicles, reducing the per-kilometer fuel requirement.

- Industrial Conservation: Industries are increasingly investing in energy-efficient machinery and processes, leading to lower consumption of industrial fuels like diesel and furnace oil.

- Consumer Behavior: Rising environmental consciousness and the desire to save on fuel costs encourage consumers to adopt fuel-saving driving habits and consider alternative transportation options.

- Technological Advancements: Innovations in areas like lightweight materials for vehicles and improved engine designs continuously push the boundaries of fuel efficiency, further eroding demand for traditional petroleum products.

The rise of electric vehicles (EVs) and alternative fuels like CNG and hydrogen directly challenges BPCL's core business, as these substitutes reduce the demand for petrol and diesel. India's ambitious EV targets, aiming for 30% of private cars to be electric by 2030, and the expanding CNG network, with over 8,154 stations as of May 2025, underscore this shift. Furthermore, advancements in energy efficiency mean that even with growing consumption, less fuel is needed per unit of economic activity, impacting overall demand for BPCL's products.

| Substitute | Impact on BPCL | Supporting Data/Trend (as of mid-2025) |

|---|---|---|

| Electric Vehicles (EVs) | Decreased demand for petrol/diesel in transportation | India's EV sales surpassed 1.2 million units in 2023; 30% private car EV adoption targeted by 2030. |

| Compressed Natural Gas (CNG) | Competition for fuel sales in transportation and domestic use | Over 8,154 CNG stations across India by May 2025; natural gas share in energy mix targeted at 15% by 2030. |

| Renewable Energy (Solar/Wind) | Reduced demand for petroleum in power generation and industrial processes | BPCL targeting 2 GW renewable energy capacity by 2025. |

| Improved Fuel Efficiency | Lower per-unit fuel consumption for vehicles and industries | While liquid fuel consumption is projected to rise, efficiency gains mean less fuel is needed for the same output. |

Entrants Threaten

The oil and gas industry, including refining and marketing, demands substantial financial backing. New companies need to fund the construction of refineries, extensive pipeline networks, storage facilities, and a wide-reaching retail outlet system. This high capital requirement serves as a significant deterrent for potential new competitors.

For instance, Bharat Petroleum Corporation Limited (BPCL) has outlined a significant capital expenditure plan, allocating ₹1.70 lakh crore over the next five years. A considerable portion of this, ₹75,000 crore, is earmarked for refinery and petrochemical projects, highlighting the immense scale of investment needed to operate in this sector.

The Indian oil and gas sector presents significant barriers to entry due to extensive regulatory hurdles and licensing requirements. New companies must navigate a complex web of permits, environmental clearances, and strict safety protocols, a process that is both time-consuming and expensive. For instance, the government has streamlined approvals for exploration and production, reducing 37 processes to 18, with nine now eligible for self-certification, aiming to ease entry, but the overall burden remains substantial.

Established brand loyalty and extensive distribution networks pose a significant barrier for new entrants. Companies like Bharat Petroleum Corporation Limited (BPCL) have invested decades in cultivating strong brand recognition and customer trust. This deep-rooted loyalty makes it challenging for newcomers to gain traction quickly.

BPCL's vast network of fuel stations and distributors across India is a critical asset. Replicating this widespread reach and the associated customer convenience is a formidable task for any new player. As of 2024, BPCL commands approximately 14% of India's oil refining capacity and operates a substantial 25% of the nation's fuel retailing network, highlighting the scale of this established infrastructure.

Access to Crude Oil Supplies and Infrastructure

The threat of new entrants concerning access to crude oil supplies and infrastructure for Bharat Petroleum is moderate. Securing reliable and cost-effective crude oil, both domestically and internationally, is paramount for refining. New players often struggle to forge long-term supply agreements and build the essential logistics, like ports and pipelines, to move crude oil efficiently.

India's refining capacity is projected to grow by more than 20% by 2028, with significant expansion plans from state-owned refiners. This expansion, however, also highlights the substantial capital investment and established relationships required to secure feedstock.

- Capital Intensity: Building new refineries and associated infrastructure demands billions of dollars in investment, creating a high barrier for new entrants.

- Supply Chain Dominance: Existing major players have established, long-term crude oil supply contracts, making it difficult for newcomers to secure competitive pricing and consistent volumes.

- Infrastructure Access: Gaining access to critical infrastructure such as ports, storage facilities, and pipelines is often controlled by incumbents or requires significant lead time and investment to replicate.

Government Support for Public Sector Undertakings

The threat of new entrants for Bharat Petroleum Corporation Limited (BPCL) is significantly influenced by government support for public sector undertakings (PSUs). As a PSU, BPCL enjoys implicit and explicit backing from the Indian government, which can include preferential policy treatment, access to critical infrastructure, and a more stable operating environment. This government backing can erect substantial barriers for purely private entities seeking to enter the oil and gas market, creating an uneven playing field.

For instance, the government's strategic focus on energy security, evidenced by ongoing reforms in the oil and gas sector, reinforces the position of established PSUs like BPCL. These reforms aim to bolster national energy independence, often prioritizing existing state-owned players in critical infrastructure development and resource allocation. This governmental emphasis can make it considerably more challenging for new, private competitors to secure the necessary licenses, permits, and land for operations, thereby mitigating the threat of new entrants.

- Government backing provides BPCL with a competitive advantage over private entrants.

- Access to public land for infrastructure development is a key benefit for BPCL.

- The Indian government's reforms in the oil and gas sector are geared towards enhancing energy security, which implicitly supports PSUs.

- Policy considerations and operational stability stemming from government support act as deterrents to new market participants.

The threat of new entrants for Bharat Petroleum is generally considered low to moderate. The immense capital required for setting up refineries, distribution networks, and securing crude oil supplies acts as a significant deterrent. Furthermore, established brand loyalty and extensive government regulations and licensing processes create substantial barriers for any new player attempting to enter the Indian oil and gas market.

| Factor | Impact on New Entrants | BPCL's Position |

|---|---|---|

| Capital Intensity | Very High Barrier | Established infrastructure and access to financing |

| Regulatory Hurdles | Significant Challenge | Navigated and compliant with existing frameworks |

| Brand Loyalty & Distribution | Difficult to Replicate | Extensive, decades-old network and strong brand recognition |

| Government Support (PSU) | Advantageous | Preferential treatment and policy backing |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bharat Petroleum is built upon a foundation of publicly available data, including the company's annual reports, investor presentations, and regulatory filings. We supplement this with industry-specific data from reputable sources like the Ministry of Petroleum and Natural Gas, market research reports, and economic indicators to provide a comprehensive view of the competitive landscape.