Bharat Petroleum Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bharat Petroleum Bundle

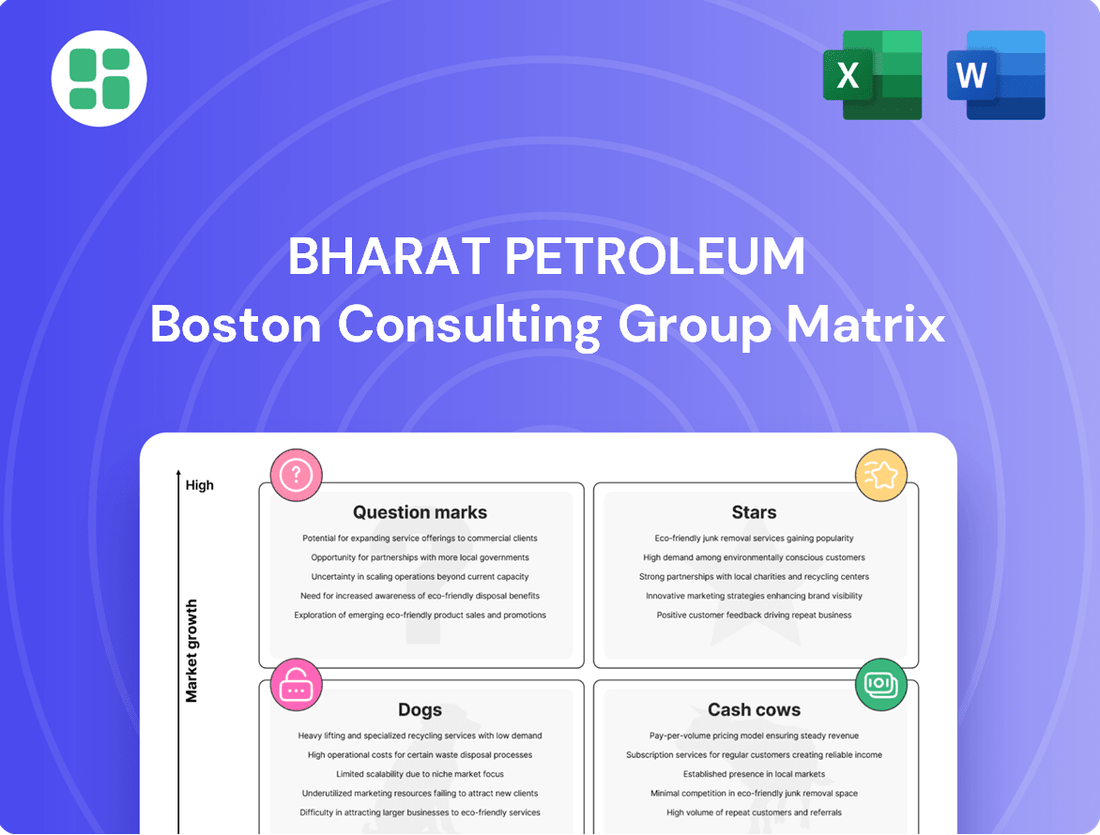

Curious about Bharat Petroleum's market standing? Our preview offers a glimpse into how their products might be classified within the BCG Matrix – are they Stars, Cash Cows, Dogs, or Question Marks? To truly unlock strategic advantage and make informed decisions about resource allocation and future investments, you need the complete picture.

Dive deeper into Bharat Petroleum's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Bharat Petroleum Corporation Limited (BPCL) is undertaking significant petrochemical expansion, earmarking an investment of roughly ₹54,000 to ₹75,000 crore for new facilities at its Bina and Kochi refineries. These ambitious projects include the development of an ethylene cracker and polypropylene units, aiming to tap into a market projected for robust annual growth.

The demand for key petrochemical products is anticipated to rise by 7-8% each year, presenting a substantial opportunity for BPCL to capture a larger market share. This strategic expansion is designed to solidify BPCL's position in a high-growth sector, with the new facilities expected to begin operations between 2027 and 2029.

Bharat Petroleum Corporation Limited (BPCL) is strategically positioning itself in the burgeoning green hydrogen market, a key component of its future growth. The company is making significant investments in green hydrogen projects, including a 5 MW electrolyser plant at its Bina Refinery. This initiative is powered by indigenous technology developed in collaboration with the Bhabha Atomic Research Centre (BARC).

Further demonstrating its commitment, BPCL has established a green hydrogen refuelling station at its Kochi Refinery. These efforts align directly with India's ambitious National Green Hydrogen Mission, aiming to establish the country as a global hub for green hydrogen production and utilization.

BPCL's foray into green hydrogen is driven by the sector's high growth prospects, particularly in decarbonizing crucial industries like aviation and mobility. This strategic move is expected to solidify BPCL's role as a leader in the clean energy transition, capitalizing on the increasing demand for sustainable energy solutions.

Bharat Petroleum Corporation Limited (BPCL) is aggressively expanding its biofuel production and blending capabilities, aiming to support India's ambitious goal of achieving 20% ethanol blending in petrol by 2025. This strategic move is evident in their rollout of biofuel offerings at more than 4,000 retail outlets across the country.

The company is also making significant strides in compressed biogas (CBG) by planning to establish numerous CBG plants. This focus on biofuels positions BPCL to capitalize on a high-growth sector, directly contributing to national energy security and environmental sustainability objectives. For instance, by December 2023, India's ethanol blending in petrol had reached approximately 11.5%, highlighting the substantial room for growth and BPCL's role in accelerating this transition.

Renewable Energy Generation Capacity

Bharat Petroleum Corporation Limited (BPCL) is making significant strides in renewable energy, aiming for an ambitious 2 GW of capacity by 2025 and a substantial 10 GW by 2035. These investments are primarily focused on wind and solar power projects, positioning BPCL to capitalize on the burgeoning clean energy market.

- Target Capacity: 2 GW by 2025, 10 GW by 2035.

- Investment Focus: Wind and solar power projects.

- Market Position: Nascent but rapidly expanding, indicating a strong future outlook in clean energy.

City Gas Distribution (CGD) Expansion

Bharat Petroleum Corporation Limited (BPCL) is strategically expanding its City Gas Distribution (CGD) network, aiming to capture 20% of India's CGD market. This ambitious growth plan involves significant capital infusion, reflecting the high potential within this sector. The CGD market is experiencing a boom, driven by India's rapid urbanization and a strong government push towards cleaner fuels for both domestic use and transportation.

This expansion positions BPCL's CGD business as a potential star in its portfolio. The sector's inherent growth trajectory, fueled by increasing demand for natural gas, offers a fertile ground for BPCL to enhance its market share and revenue streams. By 2024, India's natural gas consumption was projected to reach 70 billion cubic meters, with CGD accounting for a substantial portion of this growth.

- Market Share Target: BPCL aims for 20% of the Indian CGD market.

- Growth Drivers: Urbanization and the shift to cleaner fuels are key catalysts.

- Investment Focus: Significant capital is being allocated to CGD expansion.

- Sector Potential: CGD represents a high-growth opportunity for BPCL.

Bharat Petroleum Corporation Limited (BPCL) is making substantial investments in its petrochemical expansion, targeting a significant increase in its market share within this high-growth sector. The company's strategic focus on ethylene crackers and polypropylene units, with projected operational start dates between 2027 and 2029, positions these ventures as potential stars in its portfolio.

The City Gas Distribution (CGD) business is also a strong contender for star status, with BPCL aiming to capture 20% of the Indian market. Driven by rapid urbanization and a government push for cleaner fuels, the CGD sector is experiencing robust growth, with India's natural gas consumption projected to reach 70 billion cubic meters by 2024.

| Business Segment | Growth Potential | BPCL's Strategic Focus | Market Outlook | BCG Classification |

|---|---|---|---|---|

| Petrochemicals Expansion | High (7-8% annual growth projected) | New ethylene cracker & polypropylene units | Robust demand for key products | Star |

| City Gas Distribution (CGD) | High (driven by urbanization & clean fuel push) | Aiming for 20% market share | Rapidly expanding sector | Star |

| Green Hydrogen | Very High (decarbonization of industries) | 5 MW electrolyser plant, refuelling station | Key component of future growth | Question Mark (potential star) |

| Biofuels | High (ethanol blending targets) | Expanding production & blending capabilities | Supports national energy security | Question Mark (potential star) |

| Renewable Energy | High (clean energy market growth) | Targeting 2 GW by 2025, 10 GW by 2035 | Nascent but rapidly expanding | Question Mark (potential star) |

What is included in the product

The Bharat Petroleum BCG Matrix analyzes its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide investment strategies.

The Bharat Petroleum BCG Matrix offers a clear, actionable overview, simplifying complex portfolio decisions for executives.

Cash Cows

Bharat Petroleum Corporation Limited's (BPCL) refining operations are a significant Cash Cow, contributing substantially to its financial strength. With a refining capacity of approximately 14% of India's total, BPCL leverages its extensive infrastructure to process crude oil into various refined products. This segment consistently generates robust Gross Refining Margins (GRM), underscoring its profitability.

Despite the mature nature of the oil refining industry, the sustained and high demand for refined petroleum products in India provides a stable revenue stream for BPCL. The company's well-established operational network ensures efficient production and distribution, translating into predictable and substantial cash flows. This operational efficiency is further evidenced by BPCL's record profit in FY 2023-24, a testament to the enduring strength of its refining business.

Bharat Petroleum Corporation Limited (BPCL) commands a significant presence in India's conventional fuel retail market, boasting approximately a quarter of the nation's fuel stations. This established network is projected to expand by 4,000 new outlets by 2029, reinforcing its position in a market characterized by steady demand for petrol and diesel.

The substantial retail footprint translates into consistent sales volumes and robust cash flow generation, providing crucial financial support for BPCL's broader strategic objectives. India's continued growth in liquid fuel consumption underpins the stability and cash-generating capacity of this segment, even as the market matures.

Bharat Petroleum Corporation Limited's (BPCL) Liquefied Petroleum Gas (LPG) marketing and distribution segment is a clear Cash Cow. With over 6,200 distributorships and 53 bottling plants, BPCL commands a substantial share of the Indian LPG market, a sector characterized by stable demand and consistent revenue generation.

This segment benefits from the essential nature of LPG for household and commercial use, ensuring a reliable cash flow for BPCL. While growth prospects in this mature market are relatively modest, its high market penetration and established infrastructure solidify its position as a significant contributor to the company's financial strength.

Lubricants Business

Bharat Petroleum Corporation Limited's (BPCL) lubricants business operates as a Cash Cow within its portfolio, characterized by a stable demand in a mature market. This segment benefits from an extensive network of 525 distributorships and four strategically located blending plants, ensuring consistent product availability and market reach.

While the lubricants sector may not exhibit rapid growth, BPCL's established brand equity and robust distribution infrastructure translate into a dependable stream of revenue and profit. This reliability makes it a cornerstone for consistent financial performance.

- Market Position: BPCL's lubricants hold a strong position in a mature, albeit steady, market.

- Revenue Generation: The business provides a consistent and reliable source of income due to established brand loyalty and demand.

- Operational Strength: Supported by 525 distributorships and 4 blending plants, the operational backbone ensures efficient market penetration and supply chain management.

Upstream Petroleum Products

Bharat Petroleum Corporation Limited's (BPCL) upstream petroleum products, encompassing its domestic and international exploration and production ventures, function as significant cash cows within its portfolio. These established assets, including operations in Mozambique and Brazil, ensure a consistent supply of crude oil, bolstering refining operations and contributing reliably to the company's profitability. For instance, BPCL's stake in the Rovuma LNG project in Mozambique is a key contributor to its upstream revenue stream.

These upstream assets provide a stable, though not necessarily high-growth, income. They are crucial for supporting BPCL's downstream refining and marketing businesses, acting as a dependable source of cash generation. In the fiscal year 2023-24, BPCL's exploration and production segment reported significant operational contributions, underpinning the company's overall financial resilience.

- Upstream Asset Base: BPCL holds interests in various oil and gas blocks, both domestically and internationally, providing a foundational crude oil supply.

- Revenue Stability: These existing production assets generate consistent revenue, acting as a reliable cash generator for the company.

- Support for Refining: The crude oil produced from upstream operations directly supports BPCL's refining segment, enhancing operational efficiency and profitability.

- International Presence: Ventures in regions like Brazil and Mozambique diversify BPCL's upstream footprint and contribute to its global production capacity.

Bharat Petroleum Corporation Limited's (BPCL) refining operations are a significant Cash Cow, contributing substantially to its financial strength. With a refining capacity of approximately 14% of India's total, BPCL leverages its extensive infrastructure to process crude oil into various refined products. This segment consistently generates robust Gross Refining Margins (GRM), underscoring its profitability.

Despite the mature nature of the oil refining industry, the sustained and high demand for refined petroleum products in India provides a stable revenue stream for BPCL. The company's well-established operational network ensures efficient production and distribution, translating into predictable and substantial cash flows. This operational efficiency is further evidenced by BPCL's record profit in FY 2023-24, a testament to the enduring strength of its refining business.

Bharat Petroleum Corporation Limited (BPCL) commands a significant presence in India's conventional fuel retail market, boasting approximately a quarter of the nation's fuel stations. This established network is projected to expand by 4,000 new outlets by 2029, reinforcing its position in a market characterized by steady demand for petrol and diesel.

The substantial retail footprint translates into consistent sales volumes and robust cash flow generation, providing crucial financial support for BPCL's broader strategic objectives. India's continued growth in liquid fuel consumption underpins the stability and cash-generating capacity of this segment, even as the market matures.

Bharat Petroleum Corporation Limited's (BPCL) Liquefied Petroleum Gas (LPG) marketing and distribution segment is a clear Cash Cow. With over 6,200 distributorships and 53 bottling plants, BPCL commands a substantial share of the Indian LPG market, a sector characterized by stable demand and consistent revenue generation.

This segment benefits from the essential nature of LPG for household and commercial use, ensuring a reliable cash flow for BPCL. While growth prospects in this mature market are relatively modest, its high market penetration and established infrastructure solidify its position as a significant contributor to the company's financial strength.

Bharat Petroleum Corporation Limited's (BPCL) lubricants business operates as a Cash Cow within its portfolio, characterized by a stable demand in a mature market. This segment benefits from an extensive network of 525 distributorships and four strategically located blending plants, ensuring consistent product availability and market reach.

While the lubricants sector may not exhibit rapid growth, BPCL's established brand equity and robust distribution infrastructure translate into a dependable stream of revenue and profit. This reliability makes it a cornerstone for consistent financial performance.

- Market Position: BPCL's lubricants hold a strong position in a mature, albeit steady, market.

- Revenue Generation: The business provides a consistent and reliable source of income due to established brand loyalty and demand.

- Operational Strength: Supported by 525 distributorships and 4 blending plants, the operational backbone ensures efficient market penetration and supply chain management.

Bharat Petroleum Corporation Limited's (BPCL) upstream petroleum products, encompassing its domestic and international exploration and production ventures, function as significant cash cows within its portfolio. These established assets, including operations in Mozambique and Brazil, ensure a consistent supply of crude oil, bolstering refining operations and contributing reliably to the company's profitability. For instance, BPCL's stake in the Rovuma LNG project in Mozambique is a key contributor to its upstream revenue stream.

These upstream assets provide a stable, though not necessarily high-growth, income. They are crucial for supporting BPCL's downstream refining and marketing businesses, acting as a dependable source of cash generation. In the fiscal year 2023-24, BPCL's exploration and production segment reported significant operational contributions, underpinning the company's overall financial resilience.

- Upstream Asset Base: BPCL holds interests in various oil and gas blocks, both domestically and internationally, providing a foundational crude oil supply.

- Revenue Stability: These existing production assets generate consistent revenue, acting as a reliable cash generator for the company.

- Support for Refining: The crude oil produced from upstream operations directly supports BPCL's refining segment, enhancing operational efficiency and profitability.

- International Presence: Ventures in regions like Brazil and Mozambique diversify BPCL's upstream footprint and contribute to its global production capacity.

BPCL's refining and retail fuel segments are its primary cash cows, consistently generating substantial profits. The company's extensive refining capacity and its dominant position in the retail fuel market, with a quarter of India's fuel stations, ensure stable and predictable cash flows. These established businesses provide the financial muscle to support other ventures.

| Business Segment | BCG Category | Key Strengths | FY 2023-24 Contribution (Illustrative) |

|---|---|---|---|

| Refining | Cash Cow | 14% of India's refining capacity, strong GRM, record profits in FY24 | Significant profit contributor |

| Retail Fuel Stations | Cash Cow | 25% market share, 4,000 new outlets planned by 2029, stable demand | Consistent revenue and cash flow |

| LPG Marketing | Cash Cow | 6,200+ distributorships, 53 bottling plants, essential product | Reliable cash flow generation |

| Lubricants | Cash Cow | 525 distributorships, 4 blending plants, established brand | Dependable revenue stream |

| Upstream E&P | Cash Cow | Domestic and international assets (Mozambique, Brazil), stable crude supply | Supports refining, overall financial resilience |

What You See Is What You Get

Bharat Petroleum BCG Matrix

The Bharat Petroleum BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive report, meticulously crafted to provide strategic insights, will be delivered to you without any watermarks or demo content. You can confidently expect to download a ready-to-use analysis that accurately reflects the strategic positioning of Bharat Petroleum's business units.

Dogs

Some of BPCL's 24 oil and gas exploration blocks, particularly those in the initial exploration phases that haven't led to substantial discoveries or are situated in difficult geological or geopolitical areas, could be categorized as Dogs. These blocks tie up capital for exploration without a guaranteed return or significant current output, indicating a low market share in terms of actual production and restricted growth potential.

Outdated Niche Petroleum Products represent a segment within Bharat Petroleum's portfolio that likely exhibits declining demand. These could include specialized fuels or lubricants whose utility is diminishing due to shifts in technology or consumer preferences, such as certain types of industrial oils or historical fuel grades.

These products typically possess low sales volumes and a minimal market share, demanding significant resources for maintenance and compliance without generating substantial returns. For instance, while specific figures aren't public, consider the broader trend of declining demand for leaded gasoline, which would fall into such a category for any refiner.

The strategic consideration for these products is often divestiture or a managed phase-out. In 2023, the global demand for certain specialty lubricants saw a slight contraction, highlighting the pressures faced by niche petroleum segments.

Bharat Petroleum's (BPCL) legacy retail outlets, though a small fraction of its expansive network of over 21,800 stations, can be found in areas with waning demand or facing fierce local competition. These locations often exhibit low throughput and struggle with profitability, representing a low market share in their immediate vicinity and minimal growth prospects.

These underperforming outlets, categorized as Dogs in the BCG matrix, risk becoming cash traps if strategic decisions aren't made. For instance, if a station in a declining rural area sees its daily sales drop below 3,000 liters, it might fall into this category, requiring careful consideration for optimization or divestment to free up capital for more promising ventures.

Early-Stage Digital Initiatives with Low Adoption

Early-stage digital initiatives within Bharat Petroleum, despite significant investment in digital transformation such as 'Project Anubhav', may exhibit low customer adoption. These ventures, while aiming to enhance customer engagement, could be categorized as Dogs if they fail to gain traction. For instance, a newly launched mobile application for loyalty point redemption that experiences minimal downloads or active users would fit this profile.

Such initiatives represent areas where BPCL has invested resources but has not yet seen substantial market share or customer engagement in the digital realm. These could include experimental digital loyalty programs or new online service platforms that haven't resonated with the customer base. For example, if a new digital payment integration for fuel purchases sees less than 5% of eligible transactions processed through it within its first year, it would indicate low adoption.

- Low Customer Engagement: Digital loyalty programs or service platforms that have failed to attract a significant user base, indicating a need for strategic re-evaluation.

- Underperforming Digital Investments: Initiatives like a revamped customer portal with limited user traffic or a digital feedback mechanism that receives negligible input.

- Requires Turnaround Strategy: These ventures, despite initial investment, are not currently contributing significantly to digital market share and necessitate a focused effort to improve adoption and value proposition.

Underutilized Non-Core Assets

Underutilized non-core assets for Bharat Petroleum, within the context of the BCG Matrix, would represent ventures or holdings that have not achieved significant market traction. These could be smaller, ancillary businesses or initiatives that were perhaps started with less rigorous strategic alignment or a less robust market potential assessment. As of 2024, BPCL has been actively reviewing its portfolio, and such assets are characterized by their minimal revenue generation and ongoing resource consumption without a clear path to future growth. They typically hold a low market share in their specific segments and face limited growth prospects.

These assets would be categorized as Dogs in the BCG Matrix. They are not contributing substantially to the company's overall performance and are unlikely to do so in the future without significant strategic intervention or divestment. For instance, a small, niche retail outlet or a minor logistics operation that isn't integrated into the core refining or marketing business might fit this description if it’s not meeting performance benchmarks.

- Low Market Share: These assets typically command a very small percentage of their respective markets.

- Low Growth Prospects: The industries or segments these assets operate in are not expected to expand significantly.

- Resource Drain: They consume capital and management attention without generating commensurate returns.

- Potential for Divestment: Companies often consider divesting such assets to reallocate resources to more promising areas.

Bharat Petroleum's (BPCL) Dog category within the BCG matrix encompasses ventures with low market share and low growth prospects, often requiring careful management to avoid becoming cash drains. These include underperforming legacy retail outlets, particularly those in declining areas with low sales volumes, and early-stage digital initiatives that have failed to gain significant customer traction. For instance, a retail outlet with daily sales below 3,000 liters or a digital loyalty platform with minimal user engagement would be classified as Dogs. Such assets demand strategic review for potential divestment or turnaround strategies to optimize resource allocation.

| BPCL BCG Matrix: Dogs | Characteristics | Examples within BPCL | Strategic Implications | 2024 Context/Data |

| Low Market Share & Low Growth | Consume resources without significant returns; potential cash traps. | Underperforming legacy retail outlets; early-stage digital initiatives with low adoption. | Divestment, managed phase-out, or turnaround strategy. | Focus on optimizing underperforming assets and reallocating capital to Stars and Cash Cows. |

| Oil & Gas Exploration Blocks | Initial exploration phases, difficult geology, or unproven reserves. | Certain blocks in initial exploration phases without substantial discoveries. | Re-evaluation of exploration strategy, potential divestment if prospects are poor. | Continued investment in exploration remains crucial, but risk assessment for marginal blocks is key. |

| Outdated Niche Petroleum Products | Diminishing demand due to technological shifts or changing consumer preferences. | Specialized industrial oils or historical fuel grades with declining utility. | Managed phase-out or niche market focus if viable. | Global trends show a contraction in demand for some specialty lubricants, pressuring such segments. |

Question Marks

Bharat Petroleum Corporation Limited (BPCL) is actively building its electric vehicle (EV) charging infrastructure, having already installed over 3,100 stations. The company has ambitious plans to scale this to 7,000 stations, with a specific focus on deploying 6,000 fast chargers at its retail outlets by 2025.

Despite India's EV market experiencing high growth, the current utilization rates at BPCL's charging stations are lower than anticipated. This suggests that while the long-term market potential is significant, BPCL's current market share in terms of energy dispensed remains relatively small, indicating a nascent stage for this segment.

Bharat Petroleum's (BPCL) collaboration with BluJ Aerospace and CIAL to develop a hydrogen-powered VTOL aviation ecosystem positions it in a potential Star category. This venture taps into a nascent, high-growth market, but currently holds a very small market share. Significant R&D and infrastructure investment are crucial for its future success.

Bharat Petroleum Corporation Limited (BPCL) is strategically positioning itself within the energy sector's evolving landscape, particularly concerning its net-zero emissions target by 2040. A significant component of this strategy involves substantial investments in Carbon Capture, Utilization, and Storage (CCUS) technologies. These technologies are recognized as vital for achieving decarbonization goals and hold considerable long-term growth potential for the energy industry.

Currently, CCUS technologies are in the nascent stages of commercial deployment and market adoption within India. This early-stage positioning means that BPCL's current market share in this specific segment is low, classifying its CCUS initiatives as a 'Question Mark' in the BCG matrix. Despite the low current market share, the high growth potential due to increasing environmental regulations and the global push for cleaner energy sources makes this a crucial area for future development and investment.

Next-Generation Non-Fuel Retail Ventures

Bharat Petroleum Corporation Limited (BPCL) is actively expanding into non-fuel retail (NFR) as a key component of its Future Big Bets strategy. This initiative aims to reposition its fuel stations as multifaceted energy hubs, thereby enhancing customer engagement and creating new avenues for revenue generation beyond traditional fuel sales.

The NFR segment presents significant growth opportunities by improving the overall customer experience and diversifying BPCL's income streams. While BPCL is making strides in this area, its market penetration in specialized NFR categories, beyond standard convenience store offerings, is still in its nascent stages of development.

- High Growth Potential: The NFR segment is projected to grow significantly, driven by evolving consumer preferences for convenience and a broader range of services at fuel stations.

- Revenue Diversification: BPCL's expansion into NFR aims to reduce its reliance on volatile fuel prices by tapping into higher-margin retail sales.

- Customer Experience Enhancement: By offering a wider array of products and services, BPCL seeks to transform its outlets into preferred destinations for customers.

- Market Development: While BPCL has a strong presence in fuel retailing, its market share in specialized NFR offerings is still being established, indicating a strategic focus on building this segment.

New Refinery Project Development

Bharat Petroleum Corporation Limited (BPCL) is considering a substantial new refinery project with a projected capacity of 9 to 12 million tonnes per annum. This initiative signifies a significant future investment for the company, positioning it for potential growth in a sector with evolving market dynamics.

This new refinery project aligns with the Stars or Question Marks quadrants of the BCG Matrix. While India's overall fuel demand is on an upward trajectory, the success of a new refinery hinges on several factors, including strategic location, competitive landscape, and future market share capture. Therefore, it represents a high-growth potential venture but currently possesses a low market share, necessitating a considerable capital expenditure.

- Capacity: 9-12 million tonnes/year for the proposed new refinery.

- Market Growth: India's overall fuel demand is projected to grow, indicating a favorable macro environment.

- Investment: Represents a significant capital outlay for BPCL.

- BCG Classification: Likely a Question Mark due to high growth potential but uncertain market share capture and a substantial investment requirement.

Bharat Petroleum's (BPCL) Carbon Capture, Utilization, and Storage (CCUS) initiatives are classified as Question Marks. While the long-term growth potential is substantial due to the global push for decarbonization and tightening environmental regulations, the current market adoption and BPCL's market share in this nascent technology segment are low. Significant investment in research, development, and infrastructure is required for these ventures to mature and capture a meaningful market share.

BPCL's new refinery project, with a proposed capacity of 9 to 12 million tonnes per annum, also falls into the Question Mark category. India's fuel demand growth offers a high-potential market, but the success of a new refinery is contingent on securing market share against established players and navigating evolving energy transition dynamics. This represents a significant capital investment with an uncertain return profile in the near to medium term.

BPCL's expansion into specialized non-fuel retail (NFR) offerings is another area that can be viewed as a Question Mark. While the overall NFR segment presents robust growth opportunities, BPCL's penetration into niche or advanced NFR categories beyond convenience stores is still in its early stages. This requires strategic development to build market share and capitalize on the evolving customer expectations at its retail outlets.

The company's investment in hydrogen-powered VTOL aviation ecosystems, through collaborations, is also a Question Mark. This venture targets a high-growth, albeit nascent, market. BPCL's current market share in this specific aviation technology is minimal, underscoring the need for substantial R&D and infrastructure build-out to establish a significant presence.

BCG Matrix Data Sources

Our Bharat Petroleum BCG Matrix leverages data from annual reports, market research, and competitor analysis to provide a comprehensive view of their product portfolio.