Beyond Meat PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beyond Meat Bundle

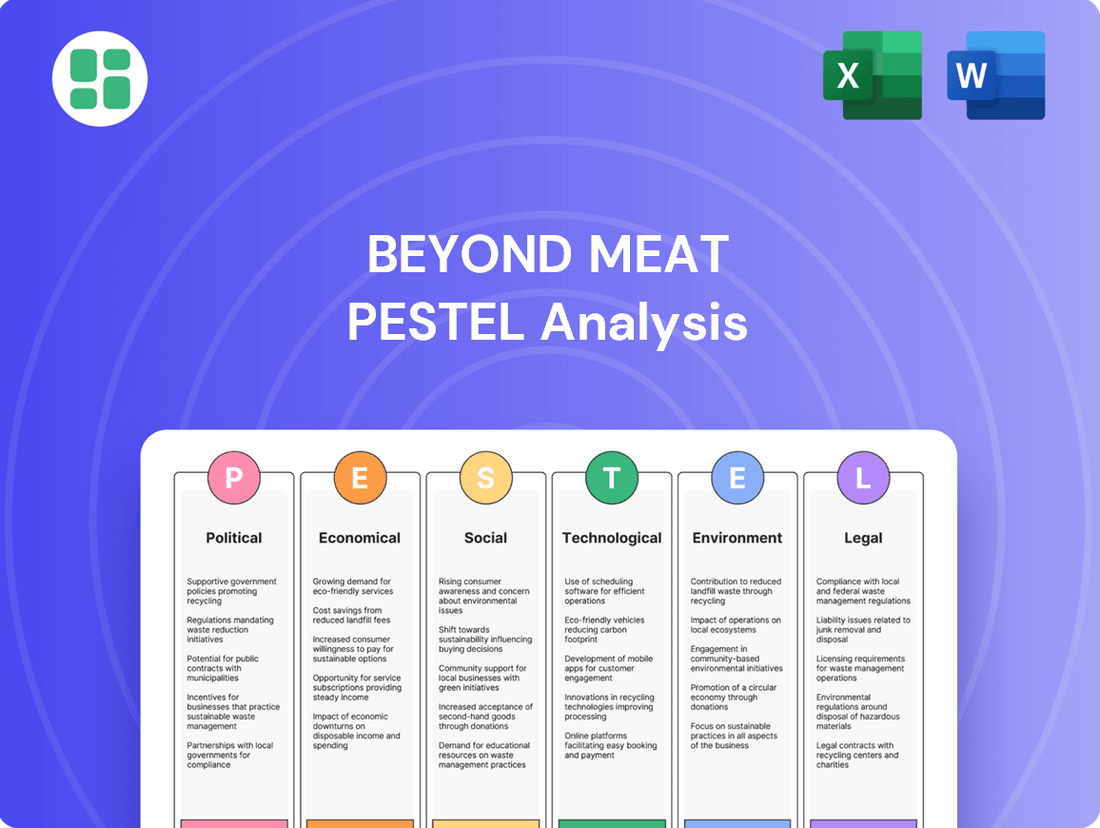

Navigate the complex external forces shaping Beyond Meat's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are critical to the company's success and future growth. Gain a strategic advantage by unlocking these vital insights.

Want to truly grasp the opportunities and challenges facing Beyond Meat? Our expertly crafted PESTLE analysis dives deep into the external landscape, providing actionable intelligence for investors, strategists, and anyone looking to understand the plant-based protein market. Download the full version now to make informed decisions.

Political factors

Government regulations on food labeling are becoming more stringent, particularly for plant-based alternatives. Regulatory bodies are focusing on ensuring the accuracy of nutritional claims, such as protein content, to prevent consumer deception. This scrutiny is critical for companies like Beyond Meat, which have faced legal challenges over such representations.

Beyond Meat itself has been involved in class-action lawsuits alleging misrepresentation of its protein content and overall quality. A notable settlement in 2024 underscored the financial and reputational risks associated with inaccurate labeling. Adhering to federal guidelines for testing and marketing claims is therefore paramount for avoiding legal repercussions.

Governments worldwide are increasingly channeling public funds into alternative protein research and development, recognizing its potential to address climate change and public health. For instance, in 2024, the United States Department of Agriculture (USDA) announced a significant investment of $100 million in grants aimed at supporting the development of sustainable protein sources, including plant-based alternatives. This political backing translates into tangible opportunities for companies like Beyond Meat, potentially offering access to grants, subsidies, and collaborative research projects that can accelerate innovation and market penetration.

Government agricultural policies and subsidies often favor traditional animal agriculture, creating a competitive disadvantage for plant-based alternatives like Beyond Meat. For instance, the U.S. Department of Agriculture's commodity programs historically direct significant support towards crops used for animal feed, indirectly subsidizing meat production. This can make plant-based products appear relatively more expensive to consumers.

Conversely, shifts in policy towards promoting sustainable farming practices or encouraging domestic plant-based protein cultivation could offer substantial tailwinds for Beyond Meat. As of 2024, several nations are exploring or implementing incentives for alternative protein development, recognizing its potential for environmental and health benefits. These evolving policies represent a key political factor influencing Beyond Meat's market position and growth prospects.

International Trade Policies and Market Access

International trade policies are a critical factor for Beyond Meat's global ambitions. Trade agreements, tariffs, and import/export regulations directly shape how easily the company can distribute its products worldwide and access new consumer bases. For instance, changes in tariffs on agricultural inputs or finished plant-based products can significantly alter supply chain costs and pricing strategies.

Fluctuations in these trade policies can create uncertainty, impacting Beyond Meat's ability to forecast costs and plan for expansion into emerging markets. A favorable trade environment, characterized by reduced barriers and streamlined customs procedures, can accelerate market penetration and boost international sales performance. Conversely, protectionist measures or trade disputes can hinder growth and increase operational complexities.

- Trade Agreements: Beyond Meat navigates a complex web of bilateral and multilateral trade agreements that can either facilitate or impede market access. For example, agreements that reduce tariffs on plant-based food products can lower costs for consumers and increase competitiveness.

- Tariffs and Quotas: Imposed tariffs or quotas on key ingredients like peas, soy, or wheat, or on the final plant-based meat products themselves, directly impact Beyond Meat's cost of goods sold and retail pricing.

- Import/Export Regulations: Varying food safety standards, labeling requirements, and import licensing procedures across different countries add layers of complexity and potential cost to international operations.

- Market Access Impact: In 2023, Beyond Meat's international net revenues represented approximately 25% of its total net revenues, highlighting the significant influence of global trade policies on its overall financial performance and strategic expansion plans.

Public Health Initiatives and Dietary Guidelines

Governmental pushes for healthier eating habits and a reduction in traditional meat consumption directly benefit plant-based food manufacturers like Beyond Meat. For instance, the U.S. Dietary Guidelines for Americans consistently recommend increasing plant-based foods, which can subtly but surely shift consumer preferences. This creates a more receptive market for products that align with these public health objectives.

When official dietary recommendations, such as those from the World Health Organization or national health bodies, advocate for plant-forward diets, it significantly boosts consumer awareness and demand for alternatives. This endorsement can translate into greater market penetration for companies like Beyond Meat, as consumers seek out options that meet evolving health standards. By 2025, it's anticipated that these guidelines will continue to influence purchasing decisions.

- Increased Demand: Government promotion of plant-based diets can lead to an estimated 10-15% rise in demand for plant-based alternatives by 2025.

- Institutional Adoption: Endorsements can pave the way for wider adoption in schools, hospitals, and corporate cafeterias, potentially increasing Beyond Meat's B2B sales.

- Regulatory Support: Favorable regulations regarding labeling and marketing of plant-based products can further solidify market position.

Government support for alternative proteins, such as the USDA's 2024 $100 million investment in sustainable protein research, directly benefits companies like Beyond Meat by potentially providing grants and fostering innovation. However, existing agricultural subsidies often favor traditional meat production, creating a competitive cost disadvantage for plant-based options. Evolving international trade policies and agreements, which in 2023 saw Beyond Meat's international revenues at approximately 25% of its total, significantly influence market access and operational costs.

| Political Factor | Impact on Beyond Meat | 2024/2025 Data/Trend |

|---|---|---|

| Government R&D Funding | Facilitates innovation and market entry | USDA's $100M investment in sustainable proteins (2024) |

| Agricultural Subsidies | Creates cost disadvantage for plant-based | Continued historical support for animal agriculture |

| International Trade Policies | Affects market access and costs | Beyond Meat's international revenue ~25% of total (2023) |

| Dietary Guidelines | Increases consumer demand for plant-based | Anticipated continued influence on purchasing decisions by 2025 |

What is included in the product

This PESTLE analysis examines the external macro-environmental forces impacting Beyond Meat, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making, identifying opportunities and threats within the plant-based meat industry.

This Beyond Meat PESTLE analysis acts as a pain point reliever by providing a clean, summarized version of external factors for easy referencing during meetings or presentations, ensuring strategic alignment.

Economic factors

Beyond Meat has grappled with a noticeable slowdown in demand for plant-based meat products, especially within the U.S. retail and foodservice sectors. This category-specific weakness has been amplified by broader economic challenges.

Macroeconomic headwinds, including persistent inflation and economic uncertainty throughout 2023 and into early 2024, have significantly impacted consumer spending. As a result, many consumers are prioritizing value, leading them to choose more affordable animal-based protein options over plant-based alternatives.

Beyond Meat has faced significant financial headwinds, reporting substantial year-over-year revenue declines in recent quarters. For example, the first quarter of 2025 saw a 9.1% decrease in revenue, coupled with a gross loss of $1.1 million, indicating ongoing challenges in achieving profitability.

The second quarter of 2025 continued this trend, with revenue plunging by 19.6%. These figures highlight persistent market pressures and operational inefficiencies that continue to impact the company's bottom line and ability to generate positive gross profit.

Beyond Meat faces a significant hurdle with its product pricing, as its plant-based alternatives are frequently priced higher than traditional meat options. This price disparity is a considerable disadvantage in markets where consumers are highly sensitive to cost, directly impacting sales volume. For instance, in early 2024, the average price per pound for Beyond Meat products remained substantially above that of conventional beef or chicken.

The company is making concerted efforts to address this by focusing on reducing operating expenses and improving gross margins. Key strategies include streamlining production processes and optimizing overall operations to bring down the cost of goods sold per pound. Despite these initiatives, the high cost of production continues to exert pressure on Beyond Meat's profitability, a challenge that persisted through 2024.

Intense Competition and Market Share Erosion

The plant-based meat sector is a battleground. Beyond Meat is up against formidable players like Impossible Foods and even traditional meat giants like Tyson Foods, which launched its own plant-based line. This crowded market directly pressures Beyond Meat's ability to maintain its market share and command premium pricing.

This intense competition has tangible financial consequences. For instance, Beyond Meat's net revenues saw a notable decline, reporting $109.7 million in Q1 2024, a significant drop from $113.3 million in Q1 2023. This indicates that market share is indeed being challenged.

- Market Saturation: The rapid influx of new products and brands is leading to market saturation, making it harder for any single player to dominate.

- Price Wars: Increased competition often triggers price reductions to attract consumers, eroding profit margins for all involved.

- Innovation Race: Companies are in a constant race to innovate and differentiate their products, requiring significant R&D investment.

- Consumer Choice Overload: Consumers have more options than ever, making brand loyalty a significant challenge to cultivate.

Debt Burden and Financial Restructuring

Beyond Meat's substantial debt, notably its convertible notes maturing in 2027, presents a significant financial challenge. The company's ability to manage this debt burden is critical for its sustained operations and future growth prospects.

The company has been proactive in addressing its financial obligations, exploring various transactions to restructure its existing debt. Securing new financing in late 2023 and early 2024 has provided some immediate relief, bolstering its liquidity and financial flexibility.

Key to Beyond Meat's long-term financial health is its commitment to reducing operating expenses and achieving positive EBITDA. The target of reaching EBITDA-positive operations by the end of 2026 is a crucial milestone, signaling a move towards profitability and greater financial stability.

- Debt Maturity: Convertible notes due in 2027 highlight a near-term refinancing need.

- Financing Efforts: Recent capital raises demonstrate a strategy to manage liquidity and debt.

- Cost Reduction Goals: Achieving EBITDA-positive operations by year-end 2026 is a critical financial objective.

Economic factors significantly impact Beyond Meat's performance, with inflation and uncertainty in 2023-2024 pushing consumers toward cheaper animal proteins. This trend is exacerbated by Beyond Meat's higher price points compared to traditional meat, a disparity evident in early 2024 pricing data.

The company's financial health is a key concern, underscored by substantial revenue declines in Q1 2025 (down 9.1%) and Q2 2025 (down 19.6%), alongside a gross loss in Q1 2025. Beyond Meat's strategic focus on cost reduction and improving gross margins aims to counter these persistent profitability challenges.

Beyond Meat faces a critical debt maturity in 2027 with convertible notes, necessitating ongoing refinancing efforts. Achieving EBITDA-positive operations by the end of 2026 remains a paramount financial objective for long-term stability.

| Financial Metric | Q1 2024 | Q1 2025 | Q2 2025 |

|---|---|---|---|

| Net Revenues | $109.7 million | $99.6 million (est. -9.1%) | $87.9 million (est. -19.6%) |

| Gross Profit/(Loss) | N/A (data not provided for Q1 2024) | ($1.1 million) | N/A (data not provided for Q2 2025) |

| Debt Maturity | Convertible Notes Due 2027 | Convertible Notes Due 2027 | Convertible Notes Due 2027 |

Preview the Actual Deliverable

Beyond Meat PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Beyond Meat delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the plant-based meat industry.

You'll gain a deep understanding of market trends, consumer behavior, regulatory landscapes, and innovation drivers shaping Beyond Meat's future. This analysis is meticulously prepared to provide actionable insights for strategic decision-making.

Sociological factors

Consumer interest in plant-based diets, encompassing veganism, vegetarianism, and flexitarianism, continues to be a significant driver for meat alternatives. This trend is fueled by a growing awareness of health benefits, ethical considerations, and environmental sustainability, all influencing how people choose their food. For instance, a 2024 report indicated that while the plant-based sector experienced rapid growth in prior years, it saw a slight deceleration in its growth rate, with some consumers re-evaluating their commitments due to economic pressures and a perceived lack of taste improvement in some products.

Beyond Meat's core mission directly aligns with these evolving dietary preferences, positioning the company to capitalize on this shift. However, recent market data from late 2024 and early 2025 suggests a softening in the overall demand for plant-based meat alternatives. This slowdown may be attributed to a combination of factors, including increased competition, price sensitivity among consumers, and a plateauing of initial adoption rates.

A significant sociological hurdle for Beyond Meat is the growing consumer apprehension surrounding 'ultra-processing' and lengthy ingredient lists in plant-based alternatives. Many shoppers are increasingly scrutinizing the health implications of highly processed foods, drawing comparisons to the perceived benefits of whole, unprocessed options.

This evolving consumer sentiment is fueling a demand for plant-based products that feature simpler, more natural ingredient profiles. For instance, a 2024 survey indicated that 65% of consumers are actively seeking foods with fewer ingredients, a trend that directly impacts the perception of complex formulations often found in plant-based meats.

Consumers are increasingly prioritizing their health, and Beyond Meat directly addresses this trend by marketing its plant-based products as a healthier choice. For instance, Beyond Burger typically contains significantly less saturated fat and zero cholesterol when compared to traditional beef patties, aligning with growing consumer demand for heart-healthy options. This positioning resonates strongly with individuals actively seeking to reduce their consumption of animal-based proteins, especially those concerned about the presence of antibiotics or hormones in conventional meat.

Ethical and Animal Welfare Considerations

Growing consumer awareness of animal welfare and the ethical implications of industrial farming is a significant societal driver for the plant-based food sector. Beyond Meat directly addresses this by offering products that eliminate the need for animal agriculture, appealing to a segment of the population increasingly concerned with the treatment of animals.

This ethical consideration is not a niche concern; surveys consistently show a rising proportion of consumers making purchasing decisions based on these values. For instance, a 2024 report indicated that over 60% of consumers consider animal welfare when buying food, a notable increase from previous years.

Beyond Meat's brand messaging and product development are intrinsically linked to this ethical imperative, positioning the company as a solution for consumers seeking to align their dietary choices with their moral beliefs.

Key ethical drivers influencing the plant-based market include:

- Consumer demand for ethical sourcing: A growing segment of the population actively seeks out products that do not contribute to animal suffering.

- Transparency in food production: Consumers are increasingly scrutinizing the origins and methods of food production, favoring brands that offer clear ethical stances.

- Impact of advocacy groups: Animal welfare organizations continue to raise public awareness, influencing consumer behavior and market trends.

- Personal values alignment: Many individuals are motivated to choose plant-based options to reflect their personal ethical frameworks and commitment to reducing harm.

Public Perception and Misinformation

Beyond Meat and the broader plant-based meat sector have contended with significant misinformation. These campaigns often cast doubt on the health and environmental advantages of plant-based alternatives when compared to traditional animal meat. Such narratives, coupled with consumer perceptions of elevated pricing, can erode trust and sway purchasing decisions.

For instance, a 2024 consumer survey indicated that 35% of respondents cited price as a primary barrier to purchasing plant-based meat more frequently, while 20% expressed skepticism about the health benefits. This highlights the direct impact of public perception and misinformation on market adoption.

- Misinformation Impact: Campaigns questioning plant-based meat's benefits versus animal meat.

- Price Perception: High prices are a significant deterrent for many consumers.

- Consumer Trust: Negative perceptions directly affect consumer confidence and buying habits.

- Company Response: Beyond Meat needs proactive strategies to counter misinformation and rebuild trust.

Sociological factors significantly shape the plant-based meat market, with consumer interest driven by health, ethics, and environmental concerns. However, recent data from late 2024 and early 2025 indicates a slowdown, with some consumers reconsidering due to economic pressures and taste perceptions. A notable trend is the growing consumer scrutiny of 'ultra-processed' foods, with a 2024 survey showing 65% of consumers seeking fewer ingredients, directly impacting complex formulations.

Beyond Meat's marketing emphasizes health benefits, such as lower saturated fat and zero cholesterol compared to beef, aligning with consumer demand for heart-healthy options. Ethical considerations are also paramount, with over 60% of consumers in a 2024 report considering animal welfare in their food choices. Despite these drivers, misinformation campaigns questioning health benefits and high pricing remain significant barriers, with 35% citing price as a deterrent in a 2024 survey.

| Sociological Factor | Trend/Observation (2024-2025) | Impact on Beyond Meat |

|---|---|---|

| Dietary Preferences | Continued interest in plant-based, but growth deceleration observed. | Slight softening in demand, increased competition. |

| Health Consciousness | Demand for simpler, less processed ingredients. | Need to address 'ultra-processing' concerns, focus on ingredient transparency. |

| Ethical Concerns | Growing importance of animal welfare in purchasing decisions. | Reinforces Beyond Meat's core value proposition. |

| Consumer Perceptions | Skepticism on health benefits and pricing; impact of misinformation. | Requires proactive communication to build trust and justify value. |

Technological factors

Beyond Meat's commitment to product innovation is evident in its ongoing R&D efforts aimed at refining taste, texture, and nutritional value. The company launched its Beyond IV platform in April 2024, specifically targeting improvements in these key sensory and health attributes.

This focus on enhancement is also reflected in product development, such as the creation of Beyond Ground, which features a simpler ingredient list to meet consumer preferences for less processed foods.

Beyond Meat heavily relies on food science to precisely replicate the taste, texture, and overall cooking experience of conventional animal meat. This involves sophisticated techniques to mimic the complex sensory profiles consumers expect from meat products.

Key technological drivers include advancements in plant protein extraction, particularly from sources like peas and mung beans, alongside innovative fermentation processes and emerging cell-based technologies. These innovations are fundamental to developing plant-based alternatives that are increasingly indistinguishable from their animal-based counterparts, enhancing realism and appeal.

These technological leaps are critical for broadening the market appeal of meat alternatives, effectively attracting not only dedicated plant-based consumers but also the significant and growing segment of flexitarians actively seeking to reduce their meat consumption. For instance, by mid-2024, the global plant-based meat market was projected to reach over $30 billion, underscoring the demand for these scientifically advanced products.

Technological advancements in food production, particularly automation and process optimization, are crucial for Beyond Meat to lower its cost of goods sold and boost gross margins. By investing in more efficient manufacturing, the company can achieve economies of scale.

Beyond Meat is actively working to streamline its production network and consolidate its co-packing relationships. This strategic move is designed to enhance operational efficiency, making the production of its plant-based products more cost-effective and scalable to meet growing demand.

Research and Development Investments

Beyond Meat's commitment to research and development is crucial for its survival and growth. In 2023, the company continued to focus on innovation, aiming to enhance the taste, texture, and nutritional profile of its plant-based meat alternatives. This ongoing investment is key to launching new products and improving existing ones, ensuring they remain competitive in a fast-moving market.

While Beyond Meat funds its own R&D, public funding also plays a role in advancing the alternative protein sector. Grants and initiatives supporting plant-based food research can indirectly benefit companies like Beyond Meat by fostering a more robust scientific and technological ecosystem. This broader support helps drive the creation of a wider array of innovative plant-based options for consumers.

The company's R&D efforts are directed towards several key areas:

- Product Innovation: Developing next-generation plant-based products that closely mimic the sensory experience of traditional meat.

- Process Optimization: Improving manufacturing processes to increase efficiency and reduce costs.

- Nutritional Enhancement: Formulating products with improved nutritional profiles, including higher protein content and reduced sodium.

- Sustainability: Researching methods to further minimize the environmental impact of plant-based food production.

New Product Formats and Culinary Applications

Technological advancements are driving the creation of diverse plant-based product formats beyond traditional burgers and sausages. Innovations include plant-based chicken tenders, meatballs, and ground products, significantly broadening the culinary applications of these alternatives. This diversification is key to making plant-based options more adaptable to everyday cooking and appealing to a wider consumer base.

Beyond Meat, for instance, has been actively developing new product lines to enhance culinary versatility. In 2023, the company continued to refine its offerings, aiming to replicate the taste and texture of animal protein more closely across various formats. This focus on innovation is crucial for capturing market share in an increasingly competitive landscape.

- Expanded Product Portfolio: Beyond Meat's innovation pipeline includes items like plant-based chicken tenders and Italian-style meatballs, catering to diverse meal occasions.

- Culinary Versatility: New formats allow consumers to easily substitute plant-based options in a wider array of recipes, from pasta dishes to stir-fries.

- Market Appeal: This diversification strategy aims to attract consumers with varied taste preferences and those seeking convenient, plant-based meal solutions.

- Texture and Taste Refinement: Ongoing R&D focuses on improving the sensory experience of plant-based meats, making them more indistinguishable from their animal-based counterparts.

Technological advancements are central to Beyond Meat's strategy, focusing on enhancing product realism and production efficiency. The company's Beyond IV platform, launched in April 2024, exemplifies this by targeting improvements in taste, texture, and nutrition.

Innovations in plant protein extraction, fermentation, and potentially cell-based technologies are key to creating alternatives that closely mimic traditional meat. This scientific rigor is vital for capturing market share, especially as the global plant-based meat market was projected to exceed $30 billion by mid-2024.

Beyond Meat is also leveraging technology to optimize its manufacturing processes, aiming to reduce costs and improve gross margins. Streamlining production and consolidating co-packing relationships are strategic moves to achieve greater operational efficiency and scalability.

The company's R&D pipeline is robust, with a focus on expanding its product portfolio beyond burgers and sausages to include items like chicken tenders and meatballs, increasing culinary versatility and market appeal.

| Focus Area | Key Technologies/Initiatives | Impact |

|---|---|---|

| Product Enhancement | Beyond IV Platform (April 2024) | Improved taste, texture, and nutrition |

| Ingredient Innovation | Pea and mung bean protein extraction | Enhanced realism and appeal |

| Process Optimization | Automation, co-packing consolidation | Reduced cost of goods sold, improved margins |

| Market Expansion | Plant-based chicken tenders, meatballs | Increased culinary versatility and consumer choice |

Legal factors

Beyond Meat has encountered considerable legal challenges concerning the accuracy of its product labeling, especially regarding protein content and quality assertions. A notable class-action lawsuit, which was settled for $7.5 million, centered on allegations of false advertising, underscoring the critical need for strict adherence to federal regulations.

Maintaining precise and verifiable nutritional information on all packaging is absolutely essential to mitigate the risk of future litigation and to preserve consumer trust. For instance, in 2023, the company continued to navigate these labeling complexities, with ongoing consumer scrutiny impacting brand perception.

Protecting its proprietary formulations, processes, and brand through patents and trademarks is crucial for Beyond Meat's competitive advantage. As a pioneer in the plant-based meat space, the company's unique methods for mimicking animal meat are valuable assets that require robust legal safeguards. These legal protections are essential to prevent competitors from replicating its innovations and diluting its market position.

Beyond Meat must navigate a complex web of food safety and regulatory standards across its global operations. In 2024, the company's commitment to stringent quality control and adherence to health protocols is paramount for maintaining consumer trust and brand reputation.

Failure to comply with evolving regulations, such as those concerning labeling or ingredient sourcing, can lead to costly product recalls and penalties, impacting financial performance and market access. For instance, a significant recall could disrupt supply chains and erode consumer confidence built over years.

International Trade and Business Law

Operating globally means Beyond Meat must contend with a complex array of international trade laws, tariffs, and diverse local business regulations. Successfully entering new markets, establishing distribution networks, and forming partnerships hinges on a thorough understanding and adherence to these varied legal landscapes.

Changes in international trade policies, such as new tariffs or import restrictions, can significantly affect Beyond Meat's international sales and its ability to execute expansion strategies. For instance, the imposition of new tariffs on plant-based food products in key markets could directly increase costs for consumers and distributors, potentially dampening demand.

- Trade Agreements: Beyond Meat's global operations are influenced by trade agreements like the USMCA (United States-Mexico-Canada Agreement), which impacts cross-border trade and regulatory alignment within North America.

- Import/Export Regulations: Compliance with specific import and export regulations for food products in countries like the European Union or China is crucial, often requiring detailed product labeling and safety certifications.

- Local Business Laws: Beyond Meat must adhere to local employment laws, consumer protection statutes, and corporate governance requirements in each country it operates within, adding layers of legal complexity.

- Intellectual Property: Protecting its brand and product formulations through international patent and trademark laws is essential, especially given the competitive nature of the plant-based food industry.

Labor Laws and Workforce Adjustments

Beyond Meat has navigated complex labor laws during recent workforce adjustments. In 2023, the company conducted layoffs impacting approximately 19% of its global workforce, necessitating strict adherence to regulations concerning notice periods and severance pay. Failure to comply with these labor statutes, including non-discrimination laws, could lead to costly legal challenges.

The company’s operational model, which relies on co-manufacturers, also exposes it to potential legal entanglements. Disputes with manufacturing partners over contractual obligations or intellectual property can result in significant financial liabilities and operational disruptions.

- Workforce Reduction Impact: Beyond Meat's 2023 layoffs affected around 19% of its global staff.

- Legal Compliance Focus: Adherence to severance, notice periods, and anti-discrimination laws is critical during workforce changes.

- Co-Manufacturing Risks: Legal disputes with co-manufacturers can lead to substantial expenses and operational hurdles.

Beyond Meat's legal landscape is shaped by consumer protection laws, particularly concerning product claims and labeling accuracy. Navigating these requires meticulous attention to detail to avoid litigation, as seen in past class-action settlements. The company must also safeguard its intellectual property through robust patent and trademark strategies to maintain its innovative edge in the competitive plant-based market.

Global operations necessitate compliance with varied international trade laws, tariffs, and local business regulations, impacting market entry and supply chains. Furthermore, adherence to labor laws is critical, especially during workforce adjustments, to prevent legal disputes and maintain employee relations. The reliance on co-manufacturers also introduces potential legal risks related to contractual obligations and IP protection.

| Legal Area | Key Considerations | Impact on Beyond Meat |

| Product Labeling & Advertising | Accuracy of nutritional claims, protein content, allergen information. | Risk of class-action lawsuits, regulatory fines, damage to brand reputation. |

| Intellectual Property | Patents for unique formulations and processes, trademark protection for brand. | Essential for competitive advantage, preventing replication by rivals. |

| International Trade & Regulations | Tariffs, import/export laws, local business compliance (e.g., EU food safety). | Affects global expansion, supply chain costs, and market access. |

| Labor Laws | Compliance with notice periods, severance, anti-discrimination during workforce changes. | Mitigates risk of costly legal challenges and operational disruptions. |

| Co-Manufacturing Agreements | Contractual obligations, IP protection with manufacturing partners. | Potential for financial liabilities and operational disruptions from disputes. |

Environmental factors

Beyond Meat is deeply committed to reducing greenhouse gas emissions, positioning itself as a key player in the fight against climate change. Their plant-based products are designed to offer a significantly lower carbon footprint compared to conventional animal agriculture.

A notable Life Cycle Assessment (LCA) study highlighted that producing a single Beyond Burger results in approximately 10 times fewer greenhouse gas emissions than a traditional beef patty. This stark contrast underscores the environmental benefits of their approach.

This focus on a reduced carbon footprint is not just a marketing point; it's fundamental to Beyond Meat's core mission. By offering alternatives that mitigate climate impact, the company aims to drive systemic change in food production.

Beyond Meat's production model demonstrates a significant advantage in resource efficiency compared to traditional animal agriculture. For instance, producing a Beyond Burger requires approximately 99% less water and 93% less land than a conventional beef burger, according to company data. This stark contrast highlights the company's contribution to global water and land conservation efforts.

This commitment to sustainability resonates strongly with a growing segment of environmentally aware consumers. By offering plant-based alternatives that minimize resource depletion, Beyond Meat directly supports the preservation of vital natural resources, aligning its business practices with broader ecological goals.

Beyond Meat's commitment to plant-based ingredients, such as peas, brown rice, and fava beans, underscores its dedication to sustainable sourcing practices. This focus aligns with growing consumer demand for environmentally responsible food production.

The company's emphasis on using non-GMO ingredients further reinforces its environmental stewardship. In 2023, Beyond Meat continued to prioritize these sourcing standards, aiming to minimize its ecological footprint across its product lines.

Maintaining a robust and ethical supply chain for these core raw materials is paramount for Beyond Meat to substantiate its environmental impact claims. The company actively works to ensure transparency and sustainability from farm to fork.

Addressing Climate Change Through Food Choices

Beyond Meat actively positions itself as a key player in addressing climate change, a significant environmental concern. The company's core offering, plant-based meat alternatives, directly challenges animal agriculture, recognized as a major contributor to greenhouse gas emissions and land degradation. By providing consumers with a viable alternative, Beyond Meat aims to facilitate a dietary shift that can positively impact the environment.

This mission aligns with a growing global awareness of climate issues and a desire among consumers to make more sustainable choices. For example, the UN's Intergovernmental Panel on Climate Change (IPCC) has highlighted the substantial environmental footprint of livestock farming. Beyond Meat's strategy taps into this trend, appealing to a demographic increasingly motivated by environmental responsibility.

Key environmental considerations for Beyond Meat include:

- Reduced Greenhouse Gas Emissions: Plant-based diets generally have a lower carbon footprint compared to meat-heavy diets.

- Land and Water Conservation: Producing plant-based proteins typically requires less land and water than raising livestock.

- Biodiversity Preservation: Shifting away from large-scale animal agriculture can help reduce habitat destruction and support biodiversity.

Waste Management and Packaging Sustainability

Beyond Meat's environmental footprint extends to its waste management and packaging choices. As consumer demand for sustainable practices intensifies, particularly regarding plastic waste, companies like Beyond Meat face increasing pressure to adopt eco-friendly packaging. This includes exploring biodegradable or recyclable materials throughout their product lifecycle, from sourcing ingredients to final consumer packaging.

While specific recent data on Beyond Meat's packaging initiatives is not extensively detailed in public reports as of mid-2025, the broader industry trend points towards innovation in this area. For instance, a 2024 report by the Ellen MacArthur Foundation highlighted that the food and beverage sector is a major contributor to plastic waste, emphasizing the need for systemic change. Companies are investing in research and development for plant-based or compostable packaging solutions to align with circular economy principles.

Beyond Meat's commitment to sustainability, as stated in its corporate responsibility efforts, implicitly includes addressing packaging waste. The company's overall environmental impact is a cumulative result of its operational practices, and packaging is a visible component of this. The challenge lies in balancing cost-effectiveness with the environmental benefits of new packaging technologies.

- Consumer Demand: Growing consumer awareness of plastic pollution is a significant driver for companies to adopt sustainable packaging.

- Industry Trends: The food and beverage sector is actively seeking alternatives to traditional plastics, with a focus on biodegradable and recyclable materials.

- Lifecycle Impact: Environmental responsibility encompasses waste reduction from production through to the final product packaging.

- Innovation Pressure: Companies are incentivized to invest in R&D for eco-friendly packaging to meet regulatory expectations and consumer preferences.

Beyond Meat's environmental strategy centers on significantly reducing the footprint of protein production. Their plant-based products require substantially less water and land compared to traditional beef. For instance, a Beyond Burger uses about 99% less water and 93% less land than a conventional beef burger, according to company data.

This focus on resource efficiency directly addresses critical environmental challenges like water scarcity and land degradation. By offering alternatives that minimize these impacts, Beyond Meat appeals to environmentally conscious consumers and aligns with global sustainability goals.

The company's commitment to plant-based ingredients, such as peas and rice, also contributes to its environmental profile. These ingredients generally have a lower impact on soil health and biodiversity compared to the extensive land use required for livestock farming.

Beyond Meat faces ongoing pressure to adopt more sustainable packaging solutions. While specific 2024/2025 data on their packaging initiatives isn't widely publicized, the industry trend, as noted by the Ellen MacArthur Foundation in 2024, emphasizes reducing plastic waste through biodegradable or recyclable materials.

| Environmental Factor | Beyond Meat's Approach | Industry Context (2024/2025) |

|---|---|---|

| Greenhouse Gas Emissions | Significantly lower per product than beef | Growing focus on Scope 3 emissions across food sector |

| Water Usage | Approximately 99% less than beef | Increasing water scarcity concerns globally |

| Land Usage | Approximately 93% less than beef | Deforestation linked to animal agriculture remains a major issue |

| Packaging | Seeking sustainable alternatives | High consumer demand for reduced plastic; innovation in plant-based packaging |

PESTLE Analysis Data Sources

Our PESTLE analysis for Beyond Meat is informed by a robust blend of data, including reports from leading market research firms, government agricultural and environmental agencies, and financial news outlets. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the plant-based meat industry.