Beyond Meat Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beyond Meat Bundle

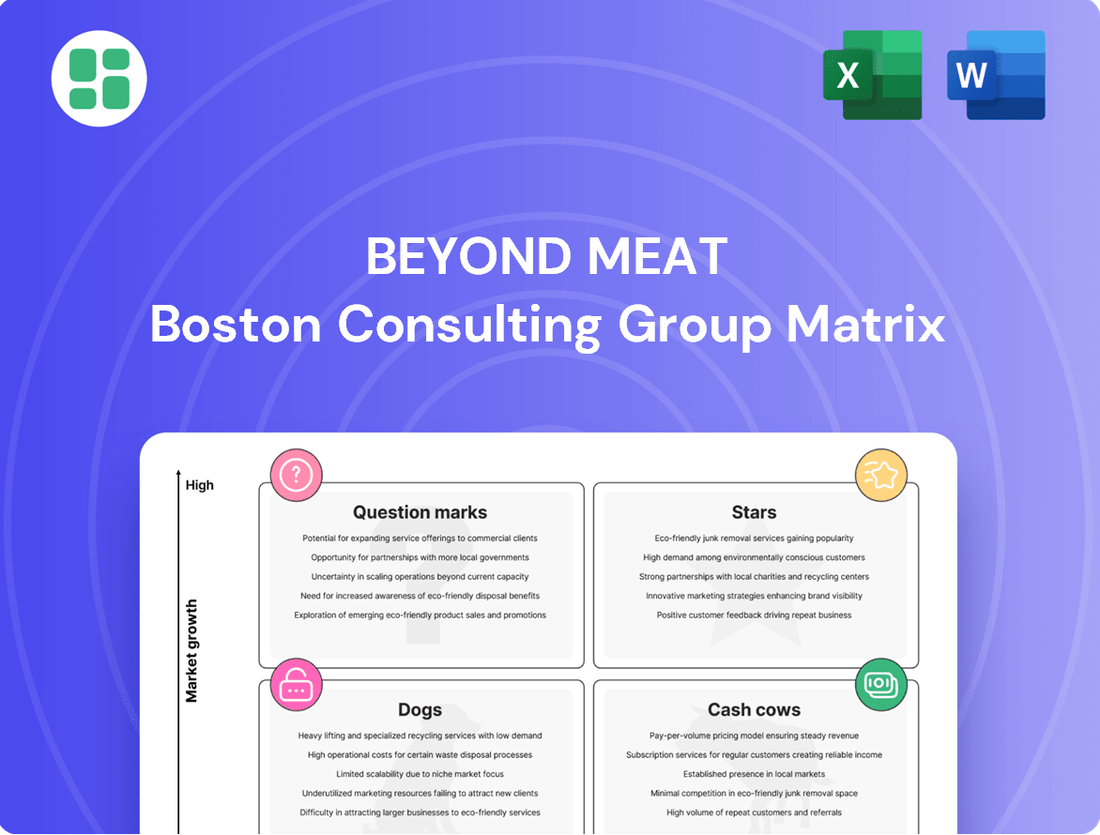

Curious about Beyond Meat's strategic positioning? Our BCG Matrix analysis offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand how Beyond Meat is navigating the competitive landscape and where its future growth lies, you need the full picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Beyond Meat's expansion of its Beyond Steak line, now featuring Chimichurri and Korean BBQ-Style options, places it firmly in the Stars category of the BCG Matrix. These new offerings are not just expanding the product range but are actively driving growth and capturing market share in the burgeoning plant-based steak sector.

These steak varieties are noted for their rapid growth and strong sales performance within the plant-based meat market. Their appeal is amplified by their health-focused attributes, such as low saturated fat and zero cholesterol, directly addressing the preferences of health-conscious consumers.

The strategic introduction of these flavors is designed to solidify Beyond Meat's position as a leader in the plant-based steak segment, a market that continues to see significant expansion and consumer interest. This innovation is a key driver for the company's revenue growth and market dominance.

Beyond Meat's focus on high-protein, minimalist formulations, exemplified by products like Beyond Ground, signals a strategic move beyond direct meat replication. These products, often featuring ingredients such as fava beans, potato starch, water, and psyllium husk, aim to broaden the appeal of plant-based options. This approach directly tackles consumer concerns regarding highly processed foods, potentially opening up new market segments and fostering future growth.

In Q1 2025, Beyond Meat's international foodservice channel saw a robust 12.1% rise in net revenues. This growth was primarily fueled by a significant 13.5% volume increase, notably from expanded sales of chicken products to a key Quick Service Restaurant (QSR) partner.

This performance highlights strong potential for market share expansion within specific international territories, demonstrating successful penetration in the foodservice sector.

Beyond IV Product Line (Burger & Sausage)

The revamped Beyond IV Burger and Sausage, now featuring avocado oil and an improved nutritional makeup with less saturated fat and more protein, signify a substantial commitment to Beyond Meat's foundational offerings.

Despite broader challenges within the plant-based meat sector, these product enhancements are designed to rebuild consumer confidence and reclaim market standing by boosting flavor and health benefits.

- Product Innovation: Introduction of avocado oil and enhanced nutritional profiles (reduced saturated fat, increased protein) in Beyond IV Burger and Sausage.

- Market Strategy: Aiming to address category headwinds and regain consumer trust through taste and health improvements.

- Financial Context (Illustrative): Beyond Meat's Q1 2024 revenue was $75.6 million, a decrease from the prior year, highlighting the need for successful product revitalization.

- Competitive Landscape: The plant-based meat market continues to be competitive, with consumers increasingly scrutinizing taste, texture, and nutritional value.

Future Growth in Specific Plant-Based Categories

While the broader plant-based meat market in the U.S. has seen some cooling, specific categories are poised for substantial expansion. For instance, plant-based nuggets are anticipated to experience a compound annual growth rate of 15% between 2025 and 2033, indicating a strong future demand.

Beyond Meat's strategic focus and product development within these high-growth niches, such as nuggets, could see new entries emerge as Stars. Capturing a significant portion of this expanding market share is key to transforming these potential future products into market leaders.

- Projected Growth: Plant-based nuggets are expected to grow at a 15% CAGR from 2025-2033.

- Strategic Focus: Innovation in high-growth sub-segments like nuggets is crucial.

- Star Potential: Successful market penetration in these niches can elevate products to Star status.

Beyond Meat's steak products, particularly the new Chimichurri and Korean BBQ-Style options, are performing strongly, driving growth and market share in a rapidly expanding plant-based steak category. Their emphasis on health benefits, such as low saturated fat and zero cholesterol, appeals directly to health-conscious consumers, further solidifying their position.

The company's strategic focus on innovation within high-growth segments like plant-based nuggets, which are projected to grow at a 15% CAGR between 2025 and 2033, positions these products for potential Star status. Successfully capturing market share in these expanding niches is crucial for future leadership.

Beyond Meat's international foodservice channel demonstrated robust growth in Q1 2025, with net revenues up 12.1% driven by a 13.5% volume increase, primarily from chicken products. This indicates strong potential for market share expansion in specific international markets through successful foodservice penetration.

The revamped Beyond IV Burger and Sausage, now featuring avocado oil and improved nutritional profiles, represent a significant effort to revitalize foundational products and rebuild consumer confidence. These enhancements aim to address category headwinds by improving taste and health benefits in a competitive market.

| Product Category | Growth Projection (CAGR) | Beyond Meat's Strategic Focus |

|---|---|---|

| Plant-Based Steaks | High (Specific segment growth) | Expansion of new flavors (Chimichurri, Korean BBQ) |

| Plant-Based Nuggets | 15% (2025-2033) | Innovation to capture market share |

| International Foodservice | Strong (12.1% revenue growth Q1 2025) | Leveraging key QSR partnerships |

What is included in the product

This BCG Matrix analysis categorizes Beyond Meat's products into Stars, Cash Cows, Question Marks, and Dogs, offering strategic guidance.

Beyond Meat's BCG Matrix provides a clear, one-page overview of its product portfolio, alleviating the pain of strategic confusion.

Cash Cows

Beyond Meat, as of mid-2025, does not currently feature products that align with the 'Cash Cow' quadrant of the BCG Matrix. This classification requires a high market share within a low-growth industry, a position Beyond Meat has not yet achieved.

The company's financial performance in early 2025 underscores this. Beyond Meat reported net losses and gross losses in the first quarter of 2025. Furthermore, the second quarter of 2025 saw a reduction in gross profit, signaling that its product lines are not yet consistently generating excess cash to be reinvested elsewhere.

Beyond Meat's situation highlights a significant challenge within its product portfolio, particularly concerning its established offerings. The company has experienced a notable drop in net revenues. This decline is largely attributable to a substantial decrease in the quantity of products sold across both U.S. retail and foodservice sectors.

This trend suggests that even products that were once considered strong performers are now facing difficulties in retaining their market share and profitability. The market dynamics are clearly shifting, impacting the sales volume of key items in their lineup.

Beyond Meat's financial performance in early 2025 highlights significant challenges. The company reported a gross loss of $1.1 million in the first quarter of 2025, followed by a further reduction in gross profit in the second quarter. This indicates that the cost of producing its goods exceeded the revenue generated, a clear sign of negative gross margins.

These negative gross margins, coupled with increasing operating losses, suggest that Beyond Meat's current product offerings are not effectively generating the cash flow needed to cover their operational expenses. This financial situation aligns with the characteristics of a 'Dog' in the BCG Matrix, where products consume more resources than they generate in returns.

Weak Category Demand

The plant-based meat sector, particularly in the United States, is currently facing a period of subdued demand. This slowdown is influenced by broader economic uncertainties and persistent consumer hesitations concerning the taste, level of processing, and cost of these products. For instance, in 2023, the plant-based meat category saw a decline in dollar sales compared to the previous year, signaling a challenging market environment.

This weak demand landscape directly impacts Beyond Meat's ability to categorize any of its products as Cash Cows. A Cash Cow, in the context of the BCG matrix, requires both a high market share and a high market growth rate. Given the current category weakness, achieving or sustaining the high market share and significant cash generation necessary for a Cash Cow status becomes exceptionally difficult, even for products that may have previously held a dominant position.

- Category Growth Slowdown: The overall plant-based meat market growth has decelerated significantly, with some reports indicating flat or even negative growth in certain segments during 2023.

- Consumer Sentiment Shift: Surveys from late 2023 and early 2024 show a segment of consumers expressing reduced interest in plant-based alternatives due to price premiums and perceived taste compromises compared to traditional meat.

- Competitive Pressures: Increased competition from traditional meat producers offering their own plant-based lines, as well as innovations in the cultivated meat space, further fragment the market and challenge established players' market share.

Market Share Erosion

Beyond Meat's market share has been shrinking. This is largely due to fierce competition from established meat producers venturing into plant-based options and a growing number of alternative protein companies. For instance, in the U.S. plant-based meat market, Beyond Meat's retail market share dipped to around 11% in early 2024, down from over 13% in 2023.

This decline means Beyond Meat's products are unlikely to qualify as Cash Cows in the BCG matrix. Cash Cows typically require a dominant market share in a mature, low-growth industry. Without that strong, stable position, Beyond Meat's offerings cannot generate the consistent, high-margin profits needed to fund other business units or new ventures.

- Intensified Competition: Beyond Meat faces rivals like Impossible Foods, Kellogg's Morningstar Farms, and even traditional meat giants such as Tyson Foods and Perdue Farms, which have launched their own plant-based lines.

- Market Share Decline: By early 2024, Beyond Meat's U.S. retail market share in the plant-based meat category had fallen to approximately 11%, indicating a loss of its once-dominant position.

- Lack of Cash Cow Status: The erosion of market share, coupled with the highly competitive and evolving plant-based sector, prevents Beyond Meat's products from fulfilling the role of a stable, high-profit generator needed for a Cash Cow.

Beyond Meat's current product portfolio does not exhibit characteristics of Cash Cows within the BCG Matrix. A true Cash Cow thrives with high market share in a low-growth industry, consistently generating excess cash. However, Beyond Meat's established products are experiencing declining revenues and shrinking market share, a stark contrast to Cash Cow status.

The company's financial performance in early to mid-2025 has been challenging, with reported net and gross losses. For instance, the first quarter of 2025 saw a gross loss of $1.1 million, and the second quarter continued to show reduced gross profit, indicating that production costs are exceeding revenue. This financial reality prevents any product from being a reliable cash generator.

The plant-based meat sector itself is facing headwinds, with subdued demand and increased competition impacting growth. In 2023, the category saw a decline in dollar sales, and by early 2024, Beyond Meat's U.S. retail market share had fallen to approximately 11%. This competitive landscape and market slowdown make the emergence of a Cash Cow unlikely for the company at this time.

| Product Category | Market Share (Early 2024) | Market Growth (2023) | BCG Matrix Status |

| Plant-Based Meat | ~11% (U.S. Retail) | Declining | Likely Dogs/Question Marks |

Full Transparency, Always

Beyond Meat BCG Matrix

The Beyond Meat BCG Matrix preview you are viewing is the identical, fully-formatted document you will receive immediately after purchase. This means no watermarks or placeholder content; you'll get the complete, analysis-ready strategic tool for evaluating Beyond Meat's product portfolio.

Dogs

Beyond Meat's U.S. retail products, particularly its burgers and sausages, are currently positioned as Dogs in the BCG Matrix. This is due to a significant downturn in this segment, with net revenues in the U.S. retail channel dropping 15.4% in Q1 2025 and a steeper 26.7% in Q2 2025.

These underperforming products are characterized by declining sales volumes and a reduced presence in stores, reflecting both weak overall category demand and a shrinking distribution network. Their low market share within a slow-growing market segment solidifies their classification as Dogs, indicating they are unlikely to generate substantial future growth or profit.

Beyond Meat's international foodservice burger products, specifically those paused or discontinued in certain Quick Service Restaurant (QSR) markets, are positioned as Dogs in the BCG Matrix. These items have seen declining sales, contributing to a low market share in their respective segments.

The company's strategic focus likely involves a critical review of these underperforming burger SKUs. For instance, reports from late 2023 indicated a significant slowdown in international expansion for plant-based alternatives, impacting product availability and sales velocity in these previously targeted QSR partnerships.

Products relying on older formulations, particularly those that haven't seen recent updates or face persistent consumer doubts about taste and ingredients, often find themselves with a small market share in markets with little to no growth. These are the offerings that struggle to gain traction.

For instance, certain plant-based ground beef alternatives, especially those launched earlier in the plant-based movement, might fall into this category. In 2023, while the overall plant-based meat market continued to see innovation, older, less refined ground beef substitutes experienced a noticeable dip in consumer interest, with sales volumes for some brands reportedly declining by as much as 15% year-over-year.

Products with High Production Costs

Products with high production costs, like some of Beyond Meat's initial offerings, can become cash traps if they don't gain traction. This means the company is spending a lot to make them but not selling enough to recoup those costs and make a profit. For example, Beyond Meat's gross margin was squeezed in 2023 due to a higher cost of goods sold per pound, partly due to lower sales volumes.

These struggling products require significant investment without generating substantial returns, tying up capital that could be used elsewhere. This situation is characteristic of a Dogs quadrant in the BCG Matrix.

- High Cost of Goods Sold: Increased per-pound production expenses directly impact profitability.

- Low Sales Volume: Insufficient market demand fails to offset high manufacturing costs.

- Cash Trap Potential: Resources are consumed without generating adequate revenue or profit.

- BCG Matrix Classification: Products in this category typically fall into the Dogs segment.

Certain Less Popular Product Lines

Beyond Meat's less popular product lines represent items that haven't captured significant consumer interest. These products are likely in a low-growth market and hold a small market share, contributing minimally to the company's overall revenue. This positions them squarely in the Dogs category of the BCG matrix.

For instance, while Beyond Meat is known for its burgers and sausages, other ventures like their jerky or specific frozen meals may not have achieved widespread adoption. In 2023, Beyond Meat reported a net revenue of $343.3 million, a decrease from $419.3 million in 2022, indicating overall market challenges that would disproportionately affect underperforming products.

- Underperforming Products: Niche or experimental items that have failed to gain traction.

- Low Market Share: These products likely represent a very small percentage of Beyond Meat's total sales.

- Low Market Growth: Operating in segments with minimal expansion prospects.

- Resource Drain: May require continued investment without significant returns, potentially hindering growth in core areas.

Beyond Meat's U.S. retail burgers and sausages are classified as Dogs due to declining sales. In Q1 2025, U.S. retail net revenues fell 15.4%, and in Q2 2025, they dropped 26.7%. These products face weak demand and reduced store presence.

International foodservice burgers, particularly those paused in certain QSR markets, are also Dogs. Declining sales in these segments contribute to a low market share, reflecting challenges in international expansion as noted in late 2023 reports.

Older formulations of plant-based ground beef, which experienced a sales dip of up to 15% in 2023, represent Dogs. These products struggle with consumer interest due to taste and ingredient concerns, holding a small market share in stagnant markets.

Beyond Meat's less popular or experimental items, such as certain jerky or frozen meals, are also Dogs. These products operate in low-growth segments with minimal market share, contributing to the overall revenue decline of $343.3 million in 2023 from $419.3 million in 2022.

| Product Category | BCG Classification | Key Performance Indicators | Market Dynamics |

| U.S. Retail Burgers & Sausages | Dogs | Declining sales (-15.4% Q1 2025, -26.7% Q2 2025 U.S. retail revenue) | Weak category demand, shrinking distribution |

| International Foodservice Burgers (paused/discontinued) | Dogs | Declining sales, low market share | Challenges in international QSR partnerships |

| Older Formulation Ground Beef Alternatives | Dogs | Sales volume dip (up to 15% in 2023), low consumer interest | Consumer preference for newer formulations |

| Niche/Experimental Products (e.g., Jerky, specific frozen meals) | Dogs | Low market share, minimal revenue contribution | Limited consumer adoption, operating in low-growth segments |

Question Marks

Beyond Meat's new Beyond Ground product signifies a strategic pivot, moving away from strict meat mimicry towards a focus on high-protein, minimally processed, whole plant ingredients. This new offering is positioned to capture a growing market segment of health-conscious consumers who prioritize simpler plant-based options.

Currently, Beyond Ground likely holds a small market share, reflecting its status as a nascent product. However, its target market of health-focused consumers represents a high-growth potential area within the broader plant-based food industry.

The original Beyond Steak has shown promising performance, but the newer Chimichurri and Korean BBQ-Style varieties are still finding their footing. These additions are entering a growing plant-based steak market, which presents significant opportunity.

While the overall plant-based meat market saw robust growth, specific data on the newer steak flavors' market share as of mid-2025 is still emerging. Consumer adoption rates for these specific flavor profiles will be crucial in determining their future trajectory within the BCG matrix, likely placing them in the question mark category as they aim to capture market share.

Beyond Meat is actively pursuing strategic international market expansions, with a significant focus on Europe. The plant-based meat market in this region is experiencing robust growth, projected at a compound annual growth rate of 16.2% between 2025 and 2033. This expansion aims to capitalize on this burgeoning demand.

While Beyond Meat's international performance has seen some variability, these targeted European market entries are designed to foster future growth. Success in these key regions could reposition these markets as potential Stars within the BCG matrix, indicating strong market share and high growth potential.

Product Lines Targeting Health Certifications

Beyond Meat is strategically rolling out products like the Beyond IV Burger and Beyond Sun Sausage, which have earned certifications from respected bodies like the American Heart Association. This emphasis on health and nutrition aligns with a significant and growing consumer demand for healthier food options.

This focus positions these products as potential stars within the BCG matrix, requiring substantial investment to capitalize on the burgeoning market of health-conscious consumers and secure a strong market position.

- Targeted Health Accreditations: Products like the Beyond IV Burger and Beyond Sun Sausage are specifically designed to meet health standards, evidenced by certifications from organizations such as the American Heart Association.

- Market Trend Alignment: This strategy directly addresses the increasing consumer preference for plant-based foods with proven health benefits, a trend that saw the global plant-based food market valued at approximately $29.7 billion in 2023 and projected to grow significantly.

- Investment for Market Capture: These health-certified products are categorized as question marks, necessitating considerable investment to build brand awareness and capture market share among a discerning, health-focused demographic.

Unbreaded Chicken Line Reintroduction

Beyond Meat's reintroduction of its unbreaded chicken line, featuring simpler ingredients, is a strategic move to bolster its presence in the competitive plant-based chicken market. This product aims to overcome previous consumer concerns, though its current market share is modest. The plant-based chicken category, however, remains a significant opportunity for growth, especially with product enhancements.

The company's focus on ingredient simplification addresses consumer demand for cleaner labels, a trend that has gained considerable traction. In 2023, the plant-based meat market saw varied performance, with some segments experiencing slower growth than anticipated. Beyond Meat's specific performance in the chicken category will be a key indicator of its ability to capture market share.

- Market Position: Beyond Meat's unbreaded chicken is likely a Question Mark in the BCG Matrix, indicating low relative market share in a high-growth industry.

- Strategic Goal: The reintroduction aims to increase market share and move the product into a Star or Cash Cow position.

- Ingredient Focus: Simpler ingredients are a direct response to consumer preferences and a competitive differentiator.

- Category Potential: The plant-based chicken segment continues to attract investment and consumer interest, offering significant upside if Beyond Meat can execute effectively.

Beyond Ground, with its focus on whole plant ingredients, is a new entrant in a rapidly expanding segment. Its current market share is minimal, but the high-growth potential of the health-conscious consumer base positions it as a classic Question Mark. Significant investment is required to build awareness and capture a meaningful share, with the ultimate goal of transforming it into a Star.

The new flavor variations of Beyond Steak are also navigating a growing market. While the overall plant-based steak category offers promise, these specific SKUs are still establishing their consumer appeal. Their trajectory will depend on market adoption, making them Question Marks that need nurturing to become successful products.

Beyond Meat's strategic international expansion, particularly in Europe, aims to tap into a high-growth plant-based market. While current market share in these regions may be developing, the potential for these markets to become Stars is significant, provided the company can effectively execute its expansion plans and gain consumer traction.

Products like the Beyond IV Burger and Beyond Sun Sausage, with their health certifications, are positioned as Question Marks. They target a growing demand for healthier options, but require substantial investment to build brand recognition and secure a competitive advantage in this increasingly health-conscious market.

The reintroduction of Beyond Meat's unbreaded chicken, emphasizing simpler ingredients, targets a competitive category with modest current market share. This product is a Question Mark, needing investment to capitalize on consumer demand for cleaner labels and to potentially ascend to a Star or Cash Cow position.

| Product/Category | BCG Matrix Position | Market Growth | Relative Market Share | Strategic Focus |

|---|---|---|---|---|

| Beyond Ground | Question Mark | High | Low | Build awareness, capture market share |

| Beyond Steak (New Flavors) | Question Mark | High | Low | Increase adoption, differentiate |

| International Markets (Europe) | Question Mark | High | Developing | Market penetration, brand building |

| Beyond IV Burger / Sun Sausage | Question Mark | High | Low | Leverage health certifications, gain share |

| Unbreaded Chicken | Question Mark | High | Low | Ingredient simplification, market capture |

BCG Matrix Data Sources

Our Beyond Meat BCG Matrix is informed by a blend of proprietary market research, financial disclosures from Beyond Meat and its competitors, and comprehensive industry growth forecasts.