Beyond Meat Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beyond Meat Bundle

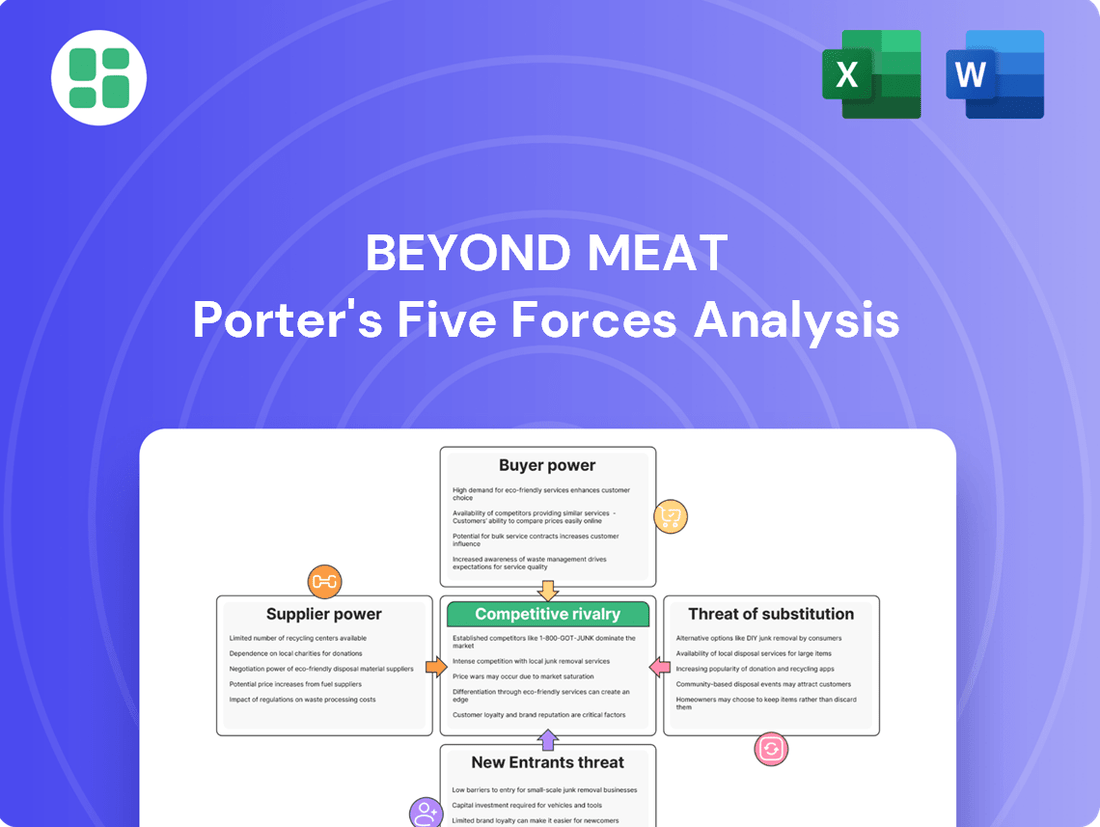

Beyond Meat navigates a dynamic landscape, facing intense rivalry from established meat producers and burgeoning plant-based competitors. The threat of new entrants looms, while buyer power can significantly impact pricing and product innovation. Understanding these forces is crucial for any stakeholder.

Ready to move beyond the basics? Get a full strategic breakdown of Beyond Meat’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Beyond Meat's reliance on a small number of specialized protein suppliers, particularly for pea and soy protein, significantly strengthens the bargaining power of these suppliers. This concentration means these suppliers hold considerable sway over pricing and contract terms, directly affecting Beyond Meat's operational costs and profitability.

While plant-based raw materials might seem readily available, the journey to becoming the high-quality protein isolates Beyond Meat relies on is far from simple. This intricate processing demands specialized equipment and expertise, creating a bottleneck.

This necessity for advanced processing significantly bolsters the bargaining power of the limited number of suppliers who possess the capability to deliver these refined ingredients. For instance, in 2023, the cost of specialized protein extraction and refinement processes contributed a notable percentage to the overall cost of goods sold for companies in the plant-based protein sector, impacting margins and supplier negotiations.

Beyond Meat's profitability is closely tied to the agricultural markets, meaning that swings in the prices of its core plant-based ingredients, like peas and soy, can create significant unpredictability. For instance, in 2023, global commodity prices for key agricultural inputs experienced notable volatility due to factors such as weather patterns and geopolitical events. This volatility directly squeezes Beyond Meat's gross margins, making it harder to maintain consistent financial performance.

Potential for forward integration by suppliers

Suppliers of specialized plant proteins, like pea or soy protein isolates, often hold significant technical know-how and established production facilities. This makes forward integration a tangible threat, allowing them to potentially move into producing finished plant-based meat products themselves.

This capability for suppliers to directly compete with Beyond Meat could significantly alter the competitive landscape. It introduces the possibility of new entrants or existing suppliers becoming direct rivals, thereby increasing pressure on Beyond Meat's market share and its established supply chain relationships.

- Supplier Capabilities: Key suppliers of plant proteins possess the R&D and manufacturing infrastructure to produce finished goods.

- Market Pressure: The threat of forward integration by suppliers can intensify competition and potentially drive down prices for Beyond Meat.

- 2024 Impact: As the plant-based market matures, suppliers may see greater incentive to capture more value by moving downstream.

Contractual obligations and high switching costs

Beyond Meat's reliance on long-term supply contracts, often with minimum purchase commitments, significantly strengthens its suppliers' bargaining power. For instance, its agreements, like those with Roquette Frères for pea protein, lock in volumes, making it difficult for Beyond Meat to quickly adjust sourcing even if market conditions change. This contractual structure inherently favors the supplier.

The substantial costs and operational disruptions involved in switching suppliers or developing new ingredient sources further entrench supplier power. Beyond Meat would face considerable expenses in vetting, qualifying, and integrating new suppliers, alongside potential impacts on product quality and consistency. These high switching costs create a sticky relationship, limiting Beyond Meat's flexibility.

- Contractual Lock-ins: Multi-year agreements with minimum purchase obligations reduce Beyond Meat's agility in sourcing.

- High Switching Costs: The financial and operational burden of changing suppliers reinforces supplier leverage.

- Ingredient Dependency: Reliance on specialized ingredients like pea protein from specific suppliers magnifies their influence.

Beyond Meat's dependence on a limited number of specialized protein suppliers, particularly for pea and soy protein isolates, grants these suppliers significant leverage. The complex processing required for these ingredients means only a few entities possess the necessary technical expertise and infrastructure, as evidenced by the fact that in 2023, the cost of these specialized ingredients represented a substantial portion of the company's cost of goods sold.

These suppliers' capabilities extend to potential forward integration, where they could develop their own finished plant-based meat products, thereby becoming direct competitors. This threat is amplified as the plant-based market matures, with suppliers in 2024 increasingly looking for avenues to capture greater value by moving further down the supply chain.

Beyond Meat's reliance on long-term supply contracts with minimum purchase commitments, such as its agreements for pea protein, further solidifies supplier power by reducing sourcing flexibility. The high costs and operational disruptions associated with switching suppliers create significant switching costs, reinforcing the entrenched influence of existing partners.

| Supplier Factor | Impact on Beyond Meat | 2023/2024 Relevance |

|---|---|---|

| Specialized Ingredient Processing | Limited supplier pool, higher costs | Key protein isolates formed a significant portion of COGS in 2023, impacting margins. |

| Forward Integration Threat | Potential for new competitors, price pressure | Suppliers are increasingly incentivized in 2024 to move downstream as the market grows. |

| Contractual Lock-ins & Switching Costs | Reduced sourcing flexibility, entrenched relationships | Multi-year agreements and the expense of changing suppliers limit Beyond Meat's agility. |

What is included in the product

This analysis unpacks the competitive forces shaping Beyond Meat's market, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly gauge competitive intensity and identify strategic opportunities by visualizing Beyond Meat's Porter's Five Forces with a dynamic, interactive dashboard.

Customers Bargaining Power

Consumers are increasingly mindful of their budgets, and this trend is particularly evident in the plant-based meat sector. Many shoppers find that alternatives to traditional meat can be more expensive. For instance, in early 2024, reports indicated that plant-based burgers often carried a price tag 20-30% higher than their beef counterparts, a significant factor for budget-conscious buyers.

This price sensitivity directly impacts companies like Beyond Meat. As consumers seek value, they are more likely to explore lower-cost options, including store brands or even reducing their consumption of these premium alternatives. This puts considerable pressure on Beyond Meat to justify its pricing or find ways to become more cost-competitive to maintain market share.

The plant-based meat market is experiencing significant growth, with numerous competitors like Impossible Foods and Gardein, alongside many private label options. This saturation means consumers have a vast selection, diminishing their reliance on any single provider. For instance, in 2024, the global plant-based meat market was valued at approximately $8.5 billion, a figure expected to climb substantially.

For both retail shoppers and foodservice businesses, the cost and effort to switch from Beyond Meat to another plant-based option or even back to conventional meat are very low. This ease of substitution directly increases the bargaining power customers hold.

Stagnation and decline in plant-based meat sales

The plant-based meat sector has experienced a noticeable slowdown, with sales and unit volumes showing stagnation and even decline in 2023 and early 2024. This waning consumer enthusiasm directly translates to increased bargaining power for customers.

This shift in market dynamics empowers consumers to demand better pricing and product quality from companies like Beyond Meat. They now have more leverage to choose among a wider array of options, including traditional meat products and other plant-based alternatives.

- Sales Decline: Beyond Meat reported a net revenue decrease of 30.5% in the first quarter of 2024 compared to the same period in 2023.

- Unit Volume Drop: Unit volumes also saw a significant contraction, reflecting reduced consumer purchases.

- Consumer Choice: Consumers are increasingly price-sensitive and are exploring various protein sources, including traditional meat and other emerging alternatives.

- Market Saturation: The market is becoming more competitive, with numerous brands vying for consumer attention, further amplifying customer choice.

Growing preference for less processed foods

The growing consumer preference for less processed, 'clean label' foods and whole-food plant-based alternatives directly impacts Beyond Meat. This trend can pull consumers away from highly processed meat mimicry products, potentially reducing demand for Beyond Meat's offerings and increasing customer bargaining power. For instance, in 2023, the global plant-based food market was valued at approximately $40.2 billion, with a significant portion driven by consumer demand for healthier and less processed options.

This shift empowers customers as they seek out products with simpler ingredient lists and fewer artificial additives. Companies that fail to adapt to this demand risk losing market share to those offering more natural, whole-food-based plant-based options.

- Consumer Shift: Increasing demand for 'clean label' and minimally processed foods.

- Impact on Beyond Meat: Potential for reduced sales if products are perceived as too processed.

- Market Data: The global plant-based food market shows strong growth, with health and natural ingredients being key drivers.

Customers possess significant bargaining power due to the increasing price sensitivity observed in the plant-based meat market. In early 2024, plant-based burgers were often 20-30% more expensive than beef, pushing budget-conscious consumers to seek alternatives or reduce consumption. This pressure forces companies like Beyond Meat to justify their pricing or become more cost-competitive.

The market's saturation with numerous competitors, including Impossible Foods, Gardein, and private label brands, further amplifies customer choice. With the global plant-based meat market valued at approximately $8.5 billion in 2024, consumers have ample options, diminishing their reliance on any single provider. The ease of switching to another plant-based option or back to conventional meat significantly enhances customer leverage.

| Metric | Value | Period | Source |

| Beyond Meat Net Revenue Change | -30.5% | Q1 2024 vs Q1 2023 | Beyond Meat Financial Reports |

| Plant-Based Burger Price Premium | 20-30% | Early 2024 | Market Analysis Reports |

| Global Plant-Based Meat Market Value | ~$8.5 Billion | 2024 | Market Research Firms |

Full Version Awaits

Beyond Meat Porter's Five Forces Analysis

You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file detailing Beyond Meat's competitive landscape through Porter's Five Forces. This comprehensive analysis covers the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the plant-based meat industry. The preview you see is the same professionally written and formatted document the customer will receive after purchasing, ready for immediate use.

Rivalry Among Competitors

Beyond Meat faces fierce competition from established plant-based brands, including Impossible Foods, Gardein, and Tofurky. These rivals are actively innovating their product lines and investing heavily in marketing to capture a larger share of the growing plant-based market. For instance, in 2024, the plant-based meat market continued its expansion, with key players consistently introducing new products and flavors to appeal to a broader consumer base.

Major conventional meat producers, including giants like Tyson Foods and Kellogg's through its Morningstar Farms brand, have made significant inroads into the plant-based market. These established players are strategically leveraging their vast distribution networks and well-recognized brand equity to compete directly with newer entrants like Beyond Meat.

This influx of traditional meat companies intensifies competitive rivalry, particularly within retail grocery channels where shelf space is a critical battleground. For instance, by 2024, many of these legacy companies had expanded their plant-based portfolios significantly, aiming to capture a larger share of the growing consumer demand for meat alternatives.

The plant-based meat industry has seen a slowdown, with overall market sales and unit volumes experiencing a downturn. This stagnation means companies are now vying for a piece of a market that isn't growing, or is even shrinking, which naturally ramps up the competition among established players.

High marketing and R&D investment requirements

Beyond Meat, like other players in the plant-based meat sector, faces intense rivalry driven by substantial marketing and R&D investment demands. To remain competitive and capture consumer interest, companies must consistently pour resources into innovation, focusing on enhancing taste, texture, and nutritional value. This necessitates ongoing development of new products and refinement of existing ones, a costly endeavor.

Aggressive marketing campaigns are also crucial to build brand awareness and differentiate offerings in a crowded marketplace. For instance, in 2023, the plant-based food market saw significant marketing efforts from major players, with companies like Impossible Foods and Beyond Meat continuing to invest in advertising and promotional activities to gain market share. This high-stakes environment means that companies that cannot sustain these high investment levels risk falling behind.

- High R&D Spending: Companies must invest in improving product attributes like taste and texture to compete effectively.

- Aggressive Marketing: Significant marketing budgets are required to build brand recognition and consumer loyalty.

- Market Saturation: The growing number of competitors intensifies the need for differentiation through innovation and branding.

- Capital Intensity: The continuous need for investment in both R&D and marketing makes this a capital-intensive industry, favoring well-funded players.

Price wars and margin pressure

The plant-based meat industry, including Beyond Meat, experiences intense competition. This rivalry often escalates into price wars and aggressive promotional campaigns as companies vie for market share. Consumers, particularly in the current economic climate of 2024, are highly sensitive to price, making them responsive to discounts and deals.

This dynamic directly translates to significant downward pressure on gross margins for all players. For Beyond Meat, this necessitates a relentless focus on operational efficiency and cost reduction strategies to maintain profitability amidst these market pressures. For instance, in its Q1 2024 earnings report, Beyond Meat reported a gross margin of 13.7%, a figure that reflects the ongoing challenges of balancing pricing and cost of goods sold.

- Intense Rivalry: Numerous established food companies and startups are entering the plant-based sector, increasing competitive intensity.

- Consumer Price Sensitivity: Shoppers are increasingly looking for value, making price a key decision factor in plant-based purchases.

- Margin Erosion: The need to compete on price directly impacts profitability, forcing companies to find cost savings.

- Beyond Meat's Margin: Beyond Meat's gross margin was 13.7% in Q1 2024, highlighting the pressure it faces.

Beyond Meat operates in a highly competitive landscape, facing pressure from both established plant-based brands and traditional meat companies entering the alternative protein space. This rivalry is fueled by significant investments in product innovation and aggressive marketing strategies, as companies strive to capture a larger share of a market that, while growing, has seen a recent slowdown in sales and unit volumes as of 2024.

The need to differentiate through enhanced taste, texture, and nutritional value, coupled with substantial marketing expenditures, makes this a capital-intensive industry. Companies like Beyond Meat must continually invest in R&D and promotional activities to remain relevant, a challenge exacerbated by consumer price sensitivity, particularly in the current economic climate of 2024.

This intense competition, including aggressive pricing and promotional tactics, directly impacts profitability, leading to margin erosion. For instance, Beyond Meat reported a gross margin of 13.7% in Q1 2024, reflecting the ongoing struggle to balance competitive pricing with production costs.

| Competitor Type | Key Players | Competitive Tactics | Impact on Beyond Meat |

|---|---|---|---|

| Established Plant-Based Brands | Impossible Foods, Gardein, Tofurky | Product innovation, aggressive marketing, new product launches | Direct competition for market share and consumer mindshare |

| Conventional Meat Producers | Tyson Foods, Morningstar Farms (Kellogg's) | Leveraging distribution networks, brand equity, expanding plant-based portfolios | Increased competition for shelf space, brand loyalty challenges |

| Industry Trend | Market slowdown, price sensitivity | Price wars, promotional campaigns, focus on cost reduction | Margin pressure, need for operational efficiency |

SSubstitutes Threaten

The enduring popularity of traditional animal meat presents a substantial threat to Beyond Meat. Globally, consumers continue to overwhelmingly favor conventional meat, making it the primary substitute for plant-based alternatives. This deep-seated preference, reinforced by decades of established eating habits and widespread availability, poses a significant challenge to market penetration for companies like Beyond Meat.

Furthermore, the price point of traditional animal meat often remains more competitive than plant-based options. In 2024, the average price per pound for conventional ground beef, for instance, was considerably lower than that of Beyond Meat's plant-based ground. This cost advantage makes traditional meat a more accessible option for a broader consumer base, especially during periods of economic uncertainty, further solidifying its position as a formidable substitute.

Consumer skepticism regarding taste and texture remains a significant threat. Despite ongoing innovation, a notable portion of consumers still find plant-based alternatives to be less satisfying than traditional meat. This perception directly influences purchasing decisions, reinforcing the preference for conventional meat products and limiting the appeal of alternatives.

Concerns about the highly processed nature of some plant-based meats are a significant threat of substitutes for companies like Beyond Meat. A growing consumer focus on health and 'clean eating' has fueled skepticism, pushing some consumers towards less processed whole-food plant-based options such as beans, lentils, or tofu, or even back to traditional meat products. This trend is particularly relevant as consumers become more ingredient-conscious, seeking simpler formulations.

Emergence of other protein alternatives

Beyond Meat contends with a growing array of protein substitutes. These include advancements in fermentation-based proteins and cultivated meat, alongside traditional plant-based staples like lentils and tofu, all vying for consumer attention. The market for plant-based foods is expanding, with projections indicating significant growth, though the competitive landscape is also intensifying.

These alternatives present varied benefits to consumers. Fermented proteins can offer unique flavor profiles and textures, while cultivated meat promises a more direct replication of traditional meat. Traditional plant-based options, meanwhile, often boast established consumer trust and affordability.

- Market Growth: The global plant-based meat market was valued at approximately $7.0 billion in 2023 and is projected to reach over $32 billion by 2030, indicating substantial growth but also increased competition.

- Emerging Technologies: Companies are investing heavily in precision fermentation and cell-cultivated meat, aiming to improve taste, texture, and cost-effectiveness, posing a direct challenge to Beyond Meat's current offerings.

- Traditional Alternatives: The enduring popularity and lower price points of legumes, grains, and tofu provide a constant, accessible substitute for consumers seeking plant-based protein.

Price advantage of traditional meat

The significant price advantage of traditional meat remains a potent threat for plant-based alternatives like Beyond Meat. In many regions, especially during times of economic strain and rising inflation, conventional meat products are simply more affordable for consumers. For instance, in early 2024, reports indicated that the average price per pound for ground beef remained substantially lower than that of plant-based ground substitutes in major U.S. grocery chains, making it a more accessible option for budget-conscious households.

This price disparity directly impacts consumer choice, particularly for those prioritizing cost-effectiveness. When faced with tighter budgets, consumers are more likely to opt for the cheaper, traditional meat option, even if they have an interest in plant-based diets. This trend was observed in consumer spending data throughout 2023, which showed a slight but noticeable shift towards value-oriented food purchases, benefiting conventional meat producers.

- Price Disparity: Traditional meat often carries a lower price tag per pound compared to plant-based alternatives.

- Economic Sensitivity: Inflationary pressures and economic uncertainty amplify the appeal of cheaper, conventional meat.

- Consumer Behavior: Budget-conscious consumers are more likely to choose traditional meat due to its lower cost, impacting demand for substitutes.

- Market Penetration: The price advantage limits the market penetration of plant-based meats, especially in price-sensitive segments.

The threat of substitutes for Beyond Meat is multifaceted, primarily stemming from the enduring appeal and accessibility of traditional animal meat. Despite advancements in plant-based technology, consumers often perceive traditional meat as superior in taste and texture, a preference solidified by decades of ingrained eating habits. Furthermore, the economic advantage of conventional meat, particularly evident in 2024 with its generally lower price per pound compared to plant-based alternatives, makes it a more attractive option for a significant portion of the market, especially during periods of economic sensitivity.

| Substitute Category | Key Advantage | 2024 Price Comparison (Illustrative) | Consumer Perception Factor |

|---|---|---|---|

| Traditional Animal Meat | Established taste/texture, lower cost | Ground Beef: ~$4.50/lb vs. Plant-Based Ground: ~$6.00/lb | Familiarity, perceived authenticity |

| Whole Plant Foods (Legumes, Tofu) | Lower cost, less processed, perceived healthiness | Dried Lentils: ~$1.50/lb, Tofu: ~$3.00/lb | Simplicity, naturalness, affordability |

| Emerging Proteins (Cultivated, Fermented) | Potential for direct meat replication, innovation | (Limited widespread retail availability in 2024, high R&D costs) | Novelty, future potential, ethical appeal |

Entrants Threaten

The plant-based protein market, while growing, still presents relatively low barriers to entry in certain segments compared to the established traditional meat industry. This means new companies can emerge more readily, especially those targeting niche markets or utilizing innovative production methods. For instance, the initial capital required to develop a new plant-based burger formulation might be significantly less than building a large-scale meat processing facility.

The plant-based food market, despite recent headwinds in the meat-mimicry sector, is still anticipated to experience substantial growth over the long term. Projections indicate a compound annual growth rate (CAGR) of around 10-15% for the global plant-based food market through 2030, reaching potentially over $160 billion. This promising outlook continues to draw in new entrants, from well-funded startups to established food conglomerates diversifying their portfolios, thereby increasing competitive pressures.

New companies entering the plant-based meat market, especially those using cutting-edge food technologies, frequently attract significant venture capital. For instance, in 2023, the alternative protein sector saw substantial investment, with companies focusing on cellular agriculture and precision fermentation raising hundreds of millions. This influx of capital allows these startups to aggressively fund research and development and quickly expand their production capabilities, directly challenging established players like Beyond Meat.

Ease of establishing distribution in retail and foodservice

While establishing distribution for plant-based meat alternatives remains a hurdle, new entrants can leverage evolving strategies. For instance, private label collaborations with major retailers offer a pathway to shelf space, bypassing some of the traditional gatekeepers. In 2024, the plant-based food sector continued to see innovation in distribution models, with direct-to-consumer channels and specialized online retailers gaining traction, providing alternative avenues for market entry.

Service partnerships with foodservice providers are also becoming more accessible. Emerging brands can target niche markets or specific consumer preferences, making them attractive to restaurants looking to expand their plant-based offerings. This can lead to quicker adoption and visibility than solely relying on traditional retail channels. The growing consumer demand for diverse plant-based options in 2024 encouraged more foodservice operators to experiment with new suppliers.

- New brands can gain retail shelf access through private label agreements.

- Foodservice partnerships are becoming more attainable for emerging players.

- Targeting niche consumer segments facilitates market entry.

- Direct-to-consumer and specialized online retail are growing distribution avenues.

Lower brand loyalty due to product similarities

If new entrants can offer plant-based products with similar taste, texture, and nutritional content at attractive price points, the existing market's perceived lack of strong brand differentiation becomes a significant vulnerability. This situation makes it considerably easier for new companies to gain a foothold and attract customers away from established brands.

For instance, in 2024, the plant-based meat sector continued to see a proliferation of brands, many offering products that consumers found difficult to distinguish from one another in blind taste tests. This product similarity directly impacts brand loyalty.

- Product Similarity: Many plant-based meat alternatives exhibit comparable taste and texture profiles, reducing perceived uniqueness.

- Price Sensitivity: Consumers, especially in 2024, demonstrated increased price sensitivity in the plant-based market, making lower-cost alternatives more appealing.

- Market Entry: The ease with which new entrants can replicate existing product formulations lowers the barrier to entry and encourages competition.

- Brand Loyalty Erosion: Without significant innovation or unique selling propositions, consumer loyalty to existing brands is easily challenged by new, competitively priced options.

The threat of new entrants in the plant-based protein market remains moderate, though evolving factors are making entry more feasible. While established brands have built recognition, the ongoing innovation in food technology and accessible venture capital in 2023, with hundreds of millions invested in alternative proteins, allows startups to quickly develop and scale production. Furthermore, new players can leverage private label partnerships and direct-to-consumer channels, as seen with growing online retail in 2024, to bypass traditional distribution hurdles.

| Factor | Impact on Threat of New Entrants | Supporting Data/Trend |

|---|---|---|

| Capital Requirements | Moderate to Low | Developing a new plant-based formulation requires less capital than traditional meat processing facilities. |

| Product Differentiation | Moderate | Product similarity in taste and texture makes it easier for new entrants to compete, especially with price sensitivity observed in 2024. |

| Access to Distribution | Moderate | Private label deals and growth in direct-to-consumer channels in 2024 offer alternative market entry points. |

| Venture Capital Investment | High | Alternative protein sector attracted significant VC funding in 2023, enabling startups to challenge incumbents. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Beyond Meat is built upon a foundation of reliable data, including Beyond Meat's own SEC filings and investor relations materials. We supplement this with reports from leading market research firms specializing in the food and beverage industry, as well as industry trade publications.