Berkshire Hathaway PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Berkshire Hathaway Bundle

Uncover the intricate web of political, economic, social, technological, legal, and environmental factors influencing Berkshire Hathaway's vast empire. Our meticulously researched PESTLE analysis provides the critical context needed to understand the forces shaping its future. Equip yourself with actionable intelligence to navigate this complex landscape. Download the full report now and gain a decisive advantage.

Political factors

Berkshire Hathaway's diverse operations, particularly in insurance and energy, are subject to a complex web of governmental regulations. For instance, the insurance industry faces state-level oversight in the U.S., impacting pricing, solvency, and product offerings. Changes in these regulations, such as new capital requirements or consumer protection mandates, can directly affect Berkshire's profitability and strategic flexibility across its insurance subsidiaries.

The energy sector, including Berkshire Hathaway Energy, is heavily regulated by agencies like the Federal Energy Regulatory Commission (FERC) and state public utility commissions. These bodies dictate everything from rate structures to environmental standards. In 2024, ongoing discussions around energy transition policies and infrastructure investments present both challenges and opportunities, potentially influencing capital expenditures and operational strategies for Berkshire's energy businesses.

Furthermore, shifts in broader economic policies, trade agreements, or antitrust regulations can have ripple effects across Berkshire's vast portfolio. For example, changes in corporate tax laws, like those enacted in recent years, directly impact net earnings. The company must continually adapt to evolving political landscapes and regulatory environments to maintain its competitive edge and ensure compliance across all its operating segments.

Berkshire Hathaway, as a global entity, is significantly influenced by trade policies and tariffs. Fluctuations in import and export duties directly affect its diverse manufacturing and retail arms, impacting raw material costs and the final price of goods in international markets. For instance, ongoing trade discussions between major economies in 2024 and projections for 2025 could introduce new tariff structures impacting Berkshire's supply chain efficiency and product competitiveness.

Changes in corporate tax rates significantly impact Berkshire Hathaway's bottom line. For instance, the U.S. Tax Cuts and Jobs Act of 2017, which lowered the federal corporate tax rate from 35% to 21%, provided a substantial boost to many companies, including Berkshire. Looking ahead, any shifts in these rates, whether up or down, will directly influence Berkshire's reported earnings and its capacity for reinvestment. The company's global footprint means it also contends with varying international tax laws, which can affect the repatriation of foreign earnings and the overall efficiency of its capital allocation.

Capital gains taxes also play a crucial role in Berkshire's investment strategy. Fluctuations in these rates can alter the attractiveness of holding certain assets for extended periods, potentially influencing Berkshire's portfolio management decisions. Furthermore, the complex web of international tax treaties impacts how Berkshire manages its cross-border investments and operations, affecting its overall tax liability and financial flexibility. For example, changes to tax treaties could alter the withholding tax rates on dividends received from foreign subsidiaries, directly impacting cash flows.

Antitrust and Competition Laws

Berkshire Hathaway's extensive reach across numerous sectors means it's consistently under the microscope of antitrust and competition regulators. Its history of significant acquisitions, such as the $11.6 billion acquisition of Alleghany Corporation in 2022, often triggers reviews to ensure market fairness and prevent monopolistic practices.

Regulatory bodies like the U.S. Federal Trade Commission (FTC) and the Department of Justice (DOJ) actively monitor market concentration. For instance, in 2023, the FTC continued its focus on large-scale mergers, though specific actions against Berkshire Hathaway's core operations were not prominent, the general environment of increased antitrust enforcement, particularly concerning large conglomerates, remains a key consideration.

This scrutiny can directly affect Berkshire's strategic flexibility. Potential future large-scale acquisitions or even organic growth that leads to dominant market positions in specific industries could face challenges, potentially leading to delays, imposed conditions, or even outright blocking of deals, thereby limiting its expansion avenues.

- Regulatory Scrutiny: Berkshire Hathaway's diverse holdings, including insurance, energy, and manufacturing, place it under constant observation by antitrust authorities globally.

- Merger & Acquisition Impact: Significant deals, like the 2022 Alleghany acquisition, are subject to antitrust reviews, potentially influencing deal terms or feasibility.

- Market Dominance Concerns: Dominant market shares in any of its operating segments could attract regulatory attention, risking investigations or divestiture orders.

- Strategic Limitations: Heightened antitrust enforcement can restrict Berkshire's ability to pursue strategic growth through further acquisitions or consolidation, impacting its conglomerate model.

Infrastructure Spending and Policy

Government infrastructure spending significantly impacts Berkshire Hathaway's BNSF Railway. For instance, the Infrastructure Investment and Jobs Act of 2021, a major bipartisan bill, allocated substantial funds towards transportation, including rail. This federal investment is crucial for BNSF's ongoing modernization efforts, aiming to improve speed, reliability, and capacity across its extensive network.

Policy decisions regarding freight transportation, environmental regulations, and trade agreements also play a vital role. Favorable policies can boost freight volumes and reduce operational costs for BNSF. In 2024, continued focus on supply chain resilience and efficiency through policy could further benefit BNSF's operations and capital investment plans.

- Infrastructure Investment and Jobs Act (2021): Allocated over $100 billion for transportation, including significant funding for rail infrastructure improvements.

- BNSF Capital Expenditures: BNSF consistently invests billions annually in its network. In 2023, capital expenditures were approximately $3.9 billion, with plans for similar levels in 2024, often driven by infrastructure needs and government incentives.

- Supply Chain Focus: Policy initiatives in 2024 continue to emphasize strengthening supply chains, which directly benefits freight rail operators like BNSF by potentially increasing demand for their services.

Government stability and policy continuity are paramount for Berkshire Hathaway's long-term investments, particularly in sectors like energy and insurance. Political shifts can introduce regulatory uncertainty, impacting capital deployment and strategic planning. For instance, the 2024 U.S. election cycle will shape future regulatory approaches across various industries.

Berkshire Hathaway's global operations are sensitive to international relations and trade policies. For example, ongoing geopolitical tensions in 2024 and projected trade dynamics for 2025 can influence supply chains and market access for its diverse businesses.

Government spending on infrastructure, such as the Infrastructure Investment and Jobs Act, directly benefits Berkshire's BNSF Railway. This legislation, enacted in 2021, continues to drive rail modernization, with BNSF investing billions annually, around $3.9 billion in 2023, to enhance its network.

Changes in tax legislation, both domestically and internationally, significantly affect Berkshire's profitability. The company must navigate varying corporate tax rates and capital gains tax policies, which can alter its net earnings and investment strategies.

What is included in the product

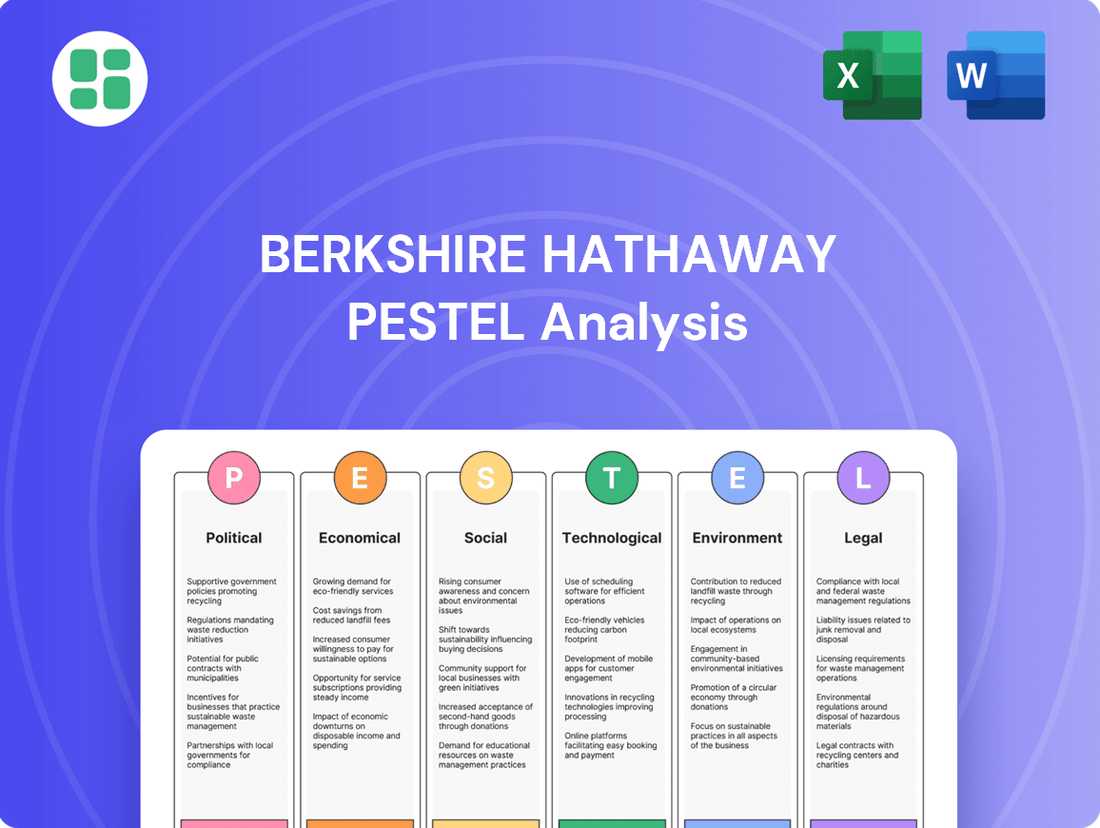

This PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Berkshire Hathaway's diverse portfolio.

It provides a comprehensive overview of how these external factors create both strategic challenges and opportunities for the conglomerate's various businesses.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, highlighting key external factors impacting Berkshire Hathaway's strategy.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the Political, Economic, Social, Technological, Environmental, and Legal forces affecting Berkshire Hathaway.

Economic factors

Interest rate fluctuations significantly impact Berkshire Hathaway's vast insurance operations. The company's substantial 'float,' or policyholder funds, are invested, and the returns on these investments are directly tied to prevailing interest rates. For instance, during periods of rising rates, Berkshire's fixed-income portfolio can generate higher earnings, boosting overall profitability. Conversely, lower interest rate environments can compress these margins, prompting strategic adjustments in how these funds are deployed.

Inflationary pressures directly impact Berkshire Hathaway's diverse operations. For instance, rising costs for raw materials can squeeze margins in manufacturing segments, while higher fuel prices affect BNSF Railway's operating expenses. Insurance businesses face increased claims costs due to the inflated value of repairs and replacements.

Sustained inflation poses a risk to Berkshire's profitability if it cannot fully pass increased costs onto customers or if its investment returns lag behind price increases. For example, if inflation averages 3.5% in 2024, and Berkshire's cost of goods sold rises proportionally without commensurate price hikes, its net income could be negatively affected.

Furthermore, inflation influences consumer spending habits. Higher prices can reduce disposable income, potentially dampening demand for products and services offered by Berkshire's retail and consumer goods subsidiaries, affecting sales volumes and revenue generation.

Global economic growth directly influences Berkshire Hathaway's vast portfolio. For instance, robust global expansion in 2024 and projected continued growth into 2025 typically fuels demand for services like BNSF Railway, a key Berkshire subsidiary. Higher consumer confidence and disposable income during these periods also boost sales for its retail and manufacturing segments.

Conversely, a slowdown in global economic activity, such as the moderate growth experienced in early 2024, can dampen performance across Berkshire's diverse holdings. Reduced industrial output and trade volumes can impact freight demand, while tighter consumer budgets can affect sales of products from companies like Clayton Homes or See's Candies.

The International Monetary Fund (IMF) projected global growth at 3.2% for 2024, with a similar rate anticipated for 2025, indicating a generally stable but not exceptionally rapid economic environment. This moderate growth presents both opportunities and challenges for Berkshire Hathaway's subsidiaries, requiring strategic adaptation to varying market conditions.

Currency Exchange Rates

While Berkshire Hathaway is largely U.S.-centric, its significant international investments and global operations mean it's not immune to currency exchange rate fluctuations. Changes in the value of foreign currencies against the U.S. dollar can impact the reported value of its overseas assets, liabilities, and ultimately, its earnings when these are translated back into dollars. This inherent volatility can introduce an element of unpredictability into Berkshire's reported financial performance.

For instance, a strengthening U.S. dollar can reduce the dollar value of foreign earnings, while a weakening dollar can have the opposite effect. This dynamic was evident in early 2024, where currency movements played a role in the reported earnings of many multinational corporations. Berkshire's diverse portfolio means it's exposed to a range of currency pairs, each with its own economic drivers.

- Impact on Reported Earnings: Fluctuations in exchange rates directly affect the translation of foreign subsidiary earnings into U.S. dollars, potentially creating gains or losses on paper.

- Asset Valuation: The value of Berkshire's international holdings, from equities to real estate, is subject to changes in currency exchange rates, impacting its overall balance sheet.

- Competitive Landscape: For its operating companies with international sales, currency shifts can alter the price competitiveness of their products and services in foreign markets.

- Hedging Strategies: Berkshire may employ currency hedging strategies to mitigate some of this risk, though the effectiveness and cost of such strategies can vary.

Consumer Spending Trends

Berkshire Hathaway's diverse holdings, from retail giants like Nebraska Furniture Mart to consumer staples like See's Candies, are significantly impacted by consumer spending patterns. In 2024, a key factor is the resilience of consumer confidence amidst inflationary pressures and evolving economic conditions. For instance, the U.S. personal consumption expenditures (PCE) saw a notable increase in early 2024, indicating continued spending power, though the pace of growth is closely monitored.

Shifts in disposable income and purchasing behaviors directly translate to revenue for Berkshire's consumer-facing businesses. Higher disposable incomes generally fuel increased sales volumes for durable goods and discretionary items. Conversely, economic uncertainty can lead consumers to tighten their belts, affecting sales of higher-ticket items.

- Consumer Confidence: Fluctuations in consumer sentiment directly correlate with spending on non-essential goods and services.

- Disposable Income: The amount of money left after taxes significantly influences purchasing power for Berkshire's retail and consumer product segments.

- Inflationary Impact: Persistent inflation can erode purchasing power, potentially shifting consumer preferences towards value-oriented brands or delaying major purchases.

- Spending Patterns: Changes in how consumers allocate their budgets, whether towards experiences or goods, directly affect revenue streams for companies like See's Candies and apparel brands.

Berkshire Hathaway's performance is closely tied to interest rate environments. For example, in the first quarter of 2024, rising rates contributed to higher investment income on its substantial insurance float. The company's significant holdings in fixed-income securities benefit directly from increased yields, enhancing overall profitability.

Inflationary pressures continue to impact Berkshire's diverse operations. Rising costs for materials and labor can affect manufacturing and railroad segments, while increased claims costs are a factor for its insurance businesses. For instance, sustained inflation above 3% in 2024 could necessitate price adjustments across various subsidiaries to maintain margins.

Global economic growth, projected at around 3.2% for 2024 by the IMF, generally supports demand for Berkshire's services, such as BNSF Railway. However, a slowdown in key international markets can temper growth in its overseas investments and operations, impacting overall earnings translation.

Consumer spending patterns remain a critical economic factor. In early 2024, U.S. personal consumption expenditures showed resilience, benefiting Berkshire's retail and consumer goods segments like See's Candies. However, shifts in disposable income due to inflation can still influence purchasing decisions for higher-priced items.

Preview Before You Purchase

Berkshire Hathaway PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Berkshire Hathaway PESTLE analysis provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the conglomerate. Dive into the detailed insights that will empower your strategic decision-making.

Sociological factors

Demographic shifts are a significant consideration for Berkshire Hathaway. For instance, the aging population in many developed countries, including the United States, is projected to continue. In the US, the Census Bureau's 2023 estimates show that individuals aged 65 and over constituted approximately 17.3% of the population, a figure expected to grow. This trend can bolster demand for life insurance, annuities, and healthcare-related services, areas where Berkshire Hathaway has substantial investments.

Changes in household formation also play a role. As of 2024, there's a noted trend towards smaller household sizes in some regions, alongside evolving family structures. These changes can impact demand for housing, home furnishings, and related financial products, areas touched by Berkshire's diverse holdings like Clayton Homes and its mortgage businesses.

Consumer preferences are shifting significantly, with a growing emphasis on digital engagement and sustainability. Berkshire Hathaway's diverse portfolio, including retail giants like See's Candies and Brooks Brothers, feels this directly. For instance, the global e-commerce market, which saw substantial growth in 2024, continues to expand, pushing companies to bolster their online presence and delivery capabilities to meet evolving shopping habits.

The demand for environmentally friendly products is also on the rise. Consumers are increasingly scrutinizing the sustainability practices of brands, influencing purchasing decisions. This trend necessitates that Berkshire Hathaway's manufacturing and consumer goods segments, such as those within its energy operations or its diverse manufacturing holdings, adapt to incorporate greener materials and production methods to align with these changing values and maintain market share.

Personalization is another key driver, with consumers expecting tailored experiences and products. This impacts how Berkshire Hathaway's businesses interact with customers, from online interfaces to product customization. Meeting these expectations is crucial for building brand loyalty and remaining competitive in a market where unique customer journeys are highly valued, a trend that analysts predict will continue to accelerate through 2025.

The availability of skilled labor remains a critical factor for Berkshire Hathaway's diverse operations. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a persistent shortage of skilled trades, impacting sectors like manufacturing and construction where Berkshire has significant investments. This scarcity can drive up labor costs and necessitate increased investment in training and development programs across its subsidiaries.

Unionization trends and evolving employee expectations also play a crucial role. As of early 2025, there's a notable increase in union activity across various industries, potentially affecting wage negotiations and operational flexibility for companies like BNSF Railway. Furthermore, a growing emphasis on work-life balance and remote work options, as evidenced by surveys from organizations like Gallup in late 2024, requires Berkshire's portfolio companies to adapt their human resource strategies to attract and retain top talent.

Health and Safety Concerns

Public health crises, such as the lingering effects of the COVID-19 pandemic, directly impact Berkshire Hathaway's diverse operations. For instance, supply chain disruptions and labor availability in its manufacturing and retail segments can be exacerbated by health concerns. The company's insurance businesses, like GEICO and Berkshire Hathaway Reinsurance, face increased claims and potential adjustments to premiums due to evolving health risks and the frequency of events impacting well-being.

Workplace safety standards are paramount for Berkshire Hathaway, particularly within its industrial and transportation subsidiaries. Adherence to stringent safety protocols not only ensures employee well-being but also minimizes operational disruptions and potential liabilities. For example, in 2023, the Occupational Safety and Health Administration (OSHA) reported a 3.6% injury and illness rate for private industry, highlighting the ongoing importance of robust safety management systems across all sectors.

Societal concerns about general well-being and health can influence consumer behavior and regulatory landscapes. This can affect demand for products and services offered by Berkshire Hathaway's various companies. Furthermore, a strong commitment to health and safety contributes to a positive corporate reputation, which is crucial for attracting and retaining talent and maintaining customer loyalty.

- Public Health Impact: Lingering pandemic effects continue to influence supply chains and labor availability across Berkshire's industrial and retail holdings.

- Insurance Sector Sensitivity: Health crises directly affect insurance claims and premium setting for companies like GEICO and Berkshire Hathaway Reinsurance.

- Workplace Safety Focus: Maintaining high workplace safety standards is critical for operational continuity and mitigating risks in industrial and transportation divisions.

- Reputational Value: Demonstrating a commitment to employee and public health enhances Berkshire Hathaway's corporate image and stakeholder trust.

Corporate Social Responsibility (CSR) and ESG Expectations

Societal pressure for robust Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) performance significantly shapes Berkshire Hathaway's investment strategy and how its subsidiaries operate. This growing demand means companies are increasingly judged on their ethical frameworks, environmental stewardship, and community engagement. For instance, in 2024, a significant portion of global institutional investors, estimated to be over 70%, explicitly integrated ESG factors into their investment decision-making processes, a trend that directly impacts capital allocation for a conglomerate like Berkshire Hathaway.

Berkshire Hathaway’s subsidiaries, from insurance to energy, face heightened scrutiny from investors, consumers, and their workforce regarding their ethical conduct and broader societal impact. This focus on ESG principles is not merely about compliance; it's a strategic imperative. Companies demonstrating strong ESG credentials often enjoy enhanced brand perception, greater access to capital pools that prioritize sustainability, and a reduced exposure to potential regulatory or reputational risks. For example, a 2025 report indicated that companies with top-tier ESG ratings saw an average of 15% higher valuation multiples compared to their lower-rated peers.

- Investor Demand: Over 70% of institutional investors in 2024 considered ESG factors in their investment decisions.

- Brand Reputation: Strong ESG adherence can boost brand image and attract environmentally and socially conscious consumers.

- Capital Access: Companies with high ESG scores may find it easier and cheaper to secure funding.

- Risk Mitigation: Proactive ESG management helps avoid fines, lawsuits, and negative publicity.

Societal attitudes towards health and safety are evolving, influencing consumer choices and regulatory frameworks that impact Berkshire Hathaway's diverse operations. The growing emphasis on well-being means companies must prioritize employee health and safety, as evidenced by the 3.6% injury and illness rate in private industry reported by OSHA for 2023. This focus not only ensures operational continuity but also strengthens corporate reputation, fostering trust among customers and employees alike.

Technological factors

The insurance sector, including Berkshire Hathaway's GEICO, is rapidly digitizing. This transformation involves integrating artificial intelligence for faster claims handling and leveraging big data for more precise risk evaluation. For instance, AI-powered tools can analyze claim documents and images, potentially speeding up processing times significantly.

Online platforms are becoming central to policy acquisition and customer engagement. This shift allows for greater accessibility and convenience for policyholders. By 2024, it's projected that a substantial portion of new insurance policies will be initiated or managed digitally, reflecting a growing reliance on these channels.

Adopting these advanced technologies is not just about modernization; it's a strategic imperative. Companies like GEICO are investing in these areas to boost operational efficiency, enhance customer satisfaction through personalized experiences, and maintain a competitive edge in an evolving market landscape. This digital push is expected to drive down operational costs and improve underwriting accuracy.

BNSF Railway is heavily investing in automation and AI to boost efficiency. For instance, they are exploring autonomous train technology, which could revolutionize operations. This push aligns with a broader industry trend; the global AI in logistics market was valued at approximately $3.5 billion in 2023 and is projected to grow significantly, with some estimates reaching over $15 billion by 2028.

Predictive maintenance powered by AI is another key area. By analyzing vast amounts of sensor data, BNSF can anticipate equipment failures, reducing downtime and repair costs. This proactive approach is crucial for maintaining operational reliability. In 2024, the company continued to deploy advanced diagnostic tools across its fleet, aiming to minimize unexpected service disruptions.

Furthermore, AI is optimizing route planning, allowing BNSF to create more efficient train schedules. This not only saves fuel but also increases the overall capacity of the network. By leveraging these technological advancements, BNSF aims to achieve substantial cost savings, enhance safety protocols, and solidify its competitive edge in the freight transportation sector through 2025.

Berkshire Hathaway, with its extensive digital footprint across insurance, energy, and manufacturing, faces substantial cybersecurity risks. In 2024, global cybercrime costs were projected to reach $10.5 trillion annually, a figure that underscores the immense financial and operational threats. Protecting sensitive customer information, proprietary technologies, and critical infrastructure is a constant challenge for the conglomerate.

The potential for data breaches, ransomware attacks, and service disruptions necessitates continuous investment in advanced cybersecurity protocols. For instance, the average cost of a data breach in 2024 was estimated at $4.73 million, highlighting the direct financial impact. Maintaining customer trust and operational continuity across Berkshire's diverse portfolio hinges on effective threat mitigation and rapid incident response capabilities.

Renewable Energy Technologies

Berkshire Hathaway Energy's significant investments in renewable energy are directly influenced by technological advancements. The company is actively expanding its portfolio of solar and wind power generation, which are becoming increasingly cost-competitive. For example, by the end of 2023, Berkshire Hathaway Energy reported operating over 5,000 megawatts of wind and solar projects.

The rapid evolution of battery storage technology is also a critical factor, enabling more reliable integration of intermittent renewable sources into the grid. This allows Berkshire Hathaway Energy to enhance grid stability and manage energy supply more effectively, supporting their grid modernization initiatives. By 2024, the company was exploring and investing in large-scale battery storage projects to complement its renewable generation capacity.

These technological shifts are reshaping Berkshire Hathaway Energy's investment strategies, pushing for greater adoption of cleaner energy solutions. The drive towards sustainability and the economic advantages of new technologies are key motivators for their ongoing capital allocation in the renewable sector.

- Solar Power Growth: Berkshire Hathaway Energy aims to increase its solar capacity significantly, with projects like the solar farms in Nevada contributing to a cleaner energy mix.

- Wind Energy Dominance: The company continues to be a major player in wind energy, operating large wind farms across the United States, leveraging advancements in turbine efficiency.

- Battery Storage Integration: Investments in battery storage are crucial for managing grid load and ensuring the reliability of renewable energy sources, with several pilot and large-scale projects underway.

- Cost Reduction Trends: The declining costs of solar panels and wind turbines, a trend projected to continue through 2025, make these technologies increasingly attractive for long-term investment.

E-commerce and Supply Chain Technologies

Berkshire Hathaway's retail and manufacturing arms are deeply impacted by the ongoing advancements in e-commerce and supply chain technologies. For instance, in 2023, global e-commerce sales reached an estimated $6.3 trillion, highlighting the immense digital marketplace Berkshire's businesses operate within. Staying ahead means embracing sophisticated inventory management, optimizing last-mile delivery, and creating seamless online customer journeys.

These technological integrations are not just about convenience; they are fundamental to operational efficiency and market expansion. Companies like Berkshire Hathaway are investing in technologies that streamline warehousing, automate order fulfillment, and provide real-time visibility across complex supply networks. This focus is crucial for maintaining competitiveness and meeting evolving consumer expectations for speed and personalization.

The strategic adoption of these technologies directly influences customer satisfaction and market reach. For example, innovations in delivery logistics can significantly reduce shipping times, a key factor in online purchasing decisions. Berkshire Hathaway's diverse portfolio, from See's Candies to its automotive dealerships, all benefit from enhanced digital storefronts and more agile, responsive supply chains.

- E-commerce Growth: Global e-commerce sales are projected to exceed $7.4 trillion by 2025, underscoring the necessity for robust online strategies.

- Supply Chain Efficiency: Investments in supply chain technology can yield significant cost savings, with some companies reporting reductions of up to 15% in logistics expenses.

- Customer Experience: Integrated online and offline retail experiences are becoming standard, with 73% of consumers expecting a seamless omnichannel journey.

- Last-Mile Delivery: Innovations in last-mile delivery, such as autonomous vehicles and drone delivery, are set to transform logistics, with the market expected to grow substantially in the coming years.

Berkshire Hathaway's diverse operations are increasingly shaped by technological advancements, from AI in insurance claims to automation in railways and renewable energy integration. These innovations are critical for enhancing efficiency, reducing costs, and maintaining a competitive edge across its vast portfolio. Cybersecurity remains a paramount concern, demanding continuous investment to protect against escalating global threats, with the cost of cybercrime projected to reach $10.5 trillion annually by 2025.

The energy sector, particularly Berkshire Hathaway Energy, is heavily investing in solar and wind power, driven by falling technology costs and advancements in battery storage. By the end of 2023, the company already operated over 5,000 megawatts of renewable projects, with further expansion planned. Similarly, retail and manufacturing segments are leveraging e-commerce and supply chain technologies, with global e-commerce sales expected to surpass $7.4 trillion by 2025, necessitating seamless digital customer experiences and efficient logistics.

These technological shifts are not merely upgrades but strategic imperatives for operational resilience and market leadership. For instance, AI in logistics is a rapidly growing market, valued at approximately $3.5 billion in 2023 and anticipated to reach over $15 billion by 2028, a trend BNSF Railway is actively capitalizing on through route optimization and predictive maintenance.

| Area of Impact | Key Technologies | 2024/2025 Data/Projections | Berkshire Hathaway Relevance |

| Insurance | AI, Big Data | AI in claims processing, enhanced risk assessment | GEICO's operational efficiency and customer experience |

| Railways | Automation, AI, Predictive Maintenance | AI in logistics market to reach $15B+ by 2028 | BNSF Railway's efficiency, cost reduction, and safety |

| Energy | Renewable Energy Tech, Battery Storage | Global renewable energy investments growing | Berkshire Hathaway Energy's solar/wind expansion |

| Retail/Manufacturing | E-commerce, Supply Chain Tech | E-commerce sales to exceed $7.4T by 2025 | Streamlining operations, enhancing customer reach |

| Cross-Sector | Cybersecurity | Global cybercrime costs to reach $10.5T annually by 2025 | Protecting sensitive data and operational continuity |

Legal factors

Berkshire Hathaway's vast insurance empire, encompassing entities like GEICO and Berkshire Hathaway Reinsurance, navigates a labyrinth of state-specific regulations in the United States, alongside federal oversight and international rules for its global operations. These frameworks dictate everything from minimum capital reserves to how claims are processed, directly influencing Berkshire's operational flexibility and profitability.

For instance, state insurance departments mandate solvency requirements, ensuring Berkshire's subsidiaries can meet their obligations. In 2024, the National Association of Insurance Commissioners (NAIC) continued to refine risk-based capital (RBC) standards, a key area of focus for insurers. Failure to adhere to these stringent solvency and consumer protection laws can lead to significant fines and operational restrictions.

Anticipated shifts in regulatory landscapes for 2025, particularly concerning data privacy and cybersecurity within financial services, could necessitate substantial investments in compliance infrastructure for Berkshire's insurance arms. These evolving legal requirements directly impact Berkshire's ability to innovate and price its diverse insurance products efficiently across its extensive portfolio.

Berkshire Hathaway's energy and freight rail businesses face significant scrutiny under environmental regulations. For instance, the U.S. Environmental Protection Agency (EPA) continues to enforce stringent standards for emissions and waste management, impacting operations at Berkshire Hathaway Energy and BNSF Railway.

Compliance with laws such as the Clean Air Act and Clean Water Act is paramount. Failure to adhere to these can result in substantial fines; for example, in 2023, companies across various sectors paid billions in environmental penalties. BNSF Railway, in particular, must manage its impact on land use and water resources across its extensive network.

The evolving landscape of climate policy, especially concerning carbon emissions, presents a material risk and opportunity. As of early 2025, discussions around enhanced greenhouse gas reduction targets are ongoing, potentially requiring further investments in cleaner technologies for Berkshire's transportation and energy assets.

Berkshire Hathaway, as a vast employer, must adhere to a complex web of labor laws. These include federal and state regulations on minimum wage, workplace safety, and overtime. For instance, the Fair Labor Standards Act (FLSA) sets the national minimum wage, which impacts many of Berkshire's subsidiaries.

The company's significant presence in sectors like BNSF Railway necessitates careful management of union relations. Collective bargaining agreements with unions such as the Brotherhood of Locomotive Engineers and Trainmen are crucial for operational stability. In 2024, ongoing negotiations and potential labor disputes in the transportation sector remain a key legal and financial consideration for Berkshire.

Ensuring compliance with labor standards across its diverse portfolio, from insurance to manufacturing, is a constant challenge. This involves monitoring changes in employment law and proactively addressing any potential violations to avoid costly litigation and reputational damage.

Antitrust and Consumer Protection Litigation

Berkshire Hathaway's vast market influence makes it a potential target for antitrust scrutiny concerning its competitive practices and market dominance. For instance, in 2023, the Federal Trade Commission (FTC) continued its focus on large corporate mergers, a trend that could impact Berkshire's subsidiary acquisitions.

Consumer protection litigation also presents a significant legal risk, encompassing issues like product safety, misleading advertising, and customer service standards across its diverse portfolio of companies. In 2024, regulatory bodies like the Consumer Financial Protection Bureau (CFPB) have maintained a vigilant stance on fair lending and data privacy, potentially affecting Berkshire's financial services arms.

- Antitrust Risk: Berkshire's scale across various sectors, from insurance to manufacturing, invites potential challenges related to monopolistic tendencies or anti-competitive behavior.

- Consumer Protection Focus: Allegations concerning product defects, deceptive marketing, or unfair customer treatment can lead to costly lawsuits and reputational damage.

- Regulatory Landscape: Ongoing enforcement actions by agencies like the FTC and CFPB in 2024 highlight the increasing regulatory pressure on large conglomerates.

- Mitigation Strategies: Robust internal compliance frameworks and proactive legal counsel are crucial for navigating these complex litigation risks.

Data Privacy and Security Laws

Berkshire Hathaway's diverse operations, from insurance to retail, mean it must navigate an increasingly complex landscape of data privacy and security laws. Regulations like the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose strict requirements on how customer data is collected, processed, and stored. Emerging state-specific privacy laws in the US further complicate compliance efforts.

Failure to adhere to these legal mandates can lead to severe financial penalties. For instance, GDPR fines can reach up to 4% of a company's annual global turnover or €20 million, whichever is higher. Beyond fines, non-compliance poses significant risks to Berkshire Hathaway's reputation and can erode customer trust, impacting long-term business relationships.

To mitigate these risks, robust data governance and stringent security protocols are not just advisable, but legally essential. This includes investing in advanced cybersecurity measures, conducting regular data audits, and ensuring transparent data handling practices across all subsidiaries to maintain legal standing and customer confidence.

- GDPR Fines: Up to 4% of global annual turnover or €20 million.

- CCPA Impact: Provides consumers with rights regarding their personal information.

- State-Specific Laws: Growing number of US states enacting their own privacy regulations.

- Risk Mitigation: Essential investment in data governance and cybersecurity.

Berkshire Hathaway faces significant legal challenges related to antitrust and consumer protection. Its vast scale across numerous industries, from insurance to manufacturing, attracts scrutiny regarding potential monopolistic practices, as highlighted by the FTC's focus on mergers in 2023. Consumer protection litigation, covering issues like product safety and advertising, remains a key risk, with agencies like the CFPB actively monitoring fair lending and data privacy in 2024.

Navigating evolving data privacy laws, including GDPR and CCPA, necessitates substantial investment in compliance and cybersecurity. Failure to comply can result in severe penalties, such as GDPR fines up to 4% of global annual turnover. Proactive legal counsel and robust internal frameworks are crucial for mitigating these complex litigation and regulatory risks across Berkshire's diverse operations.

Environmental factors

Global and national climate change policies, such as carbon pricing mechanisms and renewable energy mandates, significantly influence Berkshire Hathaway's energy and transportation businesses. For instance, the Inflation Reduction Act of 2022 in the U.S. provides substantial tax credits for clean energy, potentially boosting investments in renewable generation within Berkshire Hathaway Energy's portfolio.

These regulations directly affect operational costs and necessitate strategic adjustments. Companies like Berkshire Hathaway must navigate evolving emissions reduction targets, which could lead to increased capital expenditure in cleaner technologies or a re-evaluation of existing assets.

The ongoing push for sustainability across industries means Berkshire Hathaway faces continuous compliance efforts and the opportunity to capitalize on the transition to a low-carbon economy. For example, the European Union's Carbon Border Adjustment Mechanism (CBAM), phased in from October 2023, could impact supply chains and manufacturing operations within Berkshire's diverse holdings.

The escalating frequency and severity of extreme weather events, a direct consequence of climate change, present substantial risks for Berkshire Hathaway. These events can lead to increased claims for its insurance operations, as seen with the record insured losses from natural catastrophes in recent years, such as the $100 billion+ in global insured losses estimated for 2022 by Swiss Re.

Furthermore, Berkshire's diverse portfolio, including energy infrastructure and BNSF Railway, is susceptible to operational disruptions. For instance, widespread flooding or severe storms can halt rail traffic, impacting supply chains and revenue, while power outages from extreme weather can affect its energy utilities.

To mitigate these environmental challenges, Berkshire Hathaway must continually adapt its infrastructure and refine its risk assessment models. This proactive approach is essential for maintaining operational continuity and financial stability in the face of a changing climate, with investments in resilient infrastructure becoming increasingly critical.

Berkshire Hathaway's diverse operations, particularly in manufacturing and energy, face increasing pressure from resource scarcity. Concerns over water availability and the supply of critical raw materials directly impact production costs and operational continuity for segments like BNSF Railway and its numerous manufacturing subsidiaries. For instance, the ongoing global focus on water conservation, highlighted by reports indicating significant water stress in various regions where Berkshire operates, necessitates proactive management of water usage across its facilities.

The imperative for sustainable sourcing and efficient resource utilization is growing for Berkshire Hathaway. Companies within the conglomerate are increasingly evaluated on their adoption of circular economy principles and their commitment to reducing waste. This trend is not just about environmental responsibility; it's a strategic move to mitigate supply chain disruptions and enhance long-term resilience. For example, investments in renewable energy sources by Berkshire Hathaway Energy aim to diversify away from finite fossil fuels, aligning with sustainability goals and potentially reducing exposure to volatile commodity prices.

Effectively managing these environmental factors is crucial for Berkshire Hathaway's operational risk reduction and long-term viability. By prioritizing sustainable practices, such as optimizing energy consumption and exploring recycled materials in manufacturing, the company can build a more robust business model. This proactive approach can lead to cost savings, improved brand reputation, and a stronger competitive position in an evolving market landscape, especially as regulatory frameworks around environmental impact continue to tighten.

Transition to Renewable Energy

Berkshire Hathaway Energy, a significant component of Berkshire Hathaway's operations, faces a dynamic landscape driven by the global transition to renewable energy. This shift away from fossil fuels toward sources like solar and wind power directly influences the company's existing asset management and future investment strategies. For instance, in 2023, Berkshire Hathaway Energy reported substantial investments in renewable energy projects, aiming to expand its clean energy generation capacity.

The increasing demand for sustainable energy solutions presents considerable growth opportunities for Berkshire Hathaway Energy. However, it also poses challenges related to the potential devaluation or repurposing of traditional fossil fuel-dependent assets. The company's strategic foresight in navigating this transition is crucial for maintaining its long-term competitive edge and ensuring future relevance in the energy sector.

- Renewable Energy Growth: Berkshire Hathaway Energy's investments in solar and wind projects continue to expand, contributing to a cleaner energy mix.

- Asset Management Challenges: Managing the lifecycle of existing fossil fuel assets requires careful strategic planning amidst evolving environmental regulations.

- Market Opportunities: The global push for decarbonization opens new avenues for investment in renewable energy infrastructure and related technologies.

- Regulatory Impact: Environmental policies and incentives supporting renewable energy adoption directly shape investment decisions and operational strategies.

Pollution Control and Waste Management

Berkshire Hathaway's diverse industrial and energy holdings, such as those in manufacturing and utilities, inherently contribute to pollution and waste streams. For instance, its subsidiary BNSF Railway manages vast operations that require careful consideration of emissions and waste disposal. The company must navigate stringent environmental regulations impacting air and water quality, the handling of hazardous materials, and land reclamation efforts across its numerous sites.

The financial implications of environmental compliance are significant. In 2023, for example, environmental remediation and compliance costs can run into millions for large industrial conglomerates. Berkshire Hathaway's commitment to proactive waste reduction and investment in advanced pollution control technologies, such as those employed by its energy companies to minimize emissions from power generation, are vital not only for regulatory adherence but also for upholding its corporate social responsibility and long-term sustainability. This focus helps mitigate potential fines and reputational damage, ensuring operational continuity.

- Regulatory Compliance Costs: Companies like Berkshire Hathaway face substantial expenditures annually for environmental monitoring, reporting, and adherence to regulations like the Clean Air Act and Clean Water Act.

- Investment in Green Technologies: Significant capital is allocated towards upgrading facilities with pollution abatement equipment and exploring cleaner energy sources to reduce environmental impact.

- Waste Management Efficiency: Implementing circular economy principles and robust waste segregation programs across its subsidiaries aims to minimize landfill waste and promote recycling, as seen in initiatives at companies like Precision Castparts.

- ESG Reporting Metrics: Berkshire Hathaway's environmental performance is increasingly scrutinized through Environmental, Social, and Governance (ESG) frameworks, with key performance indicators including greenhouse gas emissions intensity and water usage.

Berkshire Hathaway is significantly impacted by global shifts towards sustainability and stricter environmental regulations. Policies like carbon pricing and renewable energy mandates directly influence its energy and transportation sectors, with initiatives such as the Inflation Reduction Act of 2022 in the U.S. offering substantial tax credits for clean energy, potentially boosting investments in renewable generation within Berkshire Hathaway Energy.

The increasing frequency and severity of extreme weather events, a consequence of climate change, pose substantial risks, leading to higher insurance claims for its insurance operations, as evidenced by the over $100 billion in global insured losses from natural catastrophes in 2022. Furthermore, operational disruptions from events like floods or storms can impact Berkshire's infrastructure, including BNSF Railway.

Resource scarcity, particularly concerning water availability and critical raw materials, directly affects production costs and operational continuity for subsidiaries like BNSF Railway and its manufacturing arms. Proactive management of water usage and the adoption of circular economy principles are becoming essential for mitigating supply chain risks and enhancing long-term resilience.

Berkshire Hathaway Energy is navigating the transition to renewable energy, with substantial investments in solar and wind projects in 2023. While this presents growth opportunities, it also challenges the management of existing fossil fuel assets amidst evolving environmental regulations and the growing demand for sustainable energy solutions.

PESTLE Analysis Data Sources

Our PESTLE analysis for Berkshire Hathaway is built on data from reputable financial news outlets, government regulatory filings, and economic forecasting agencies. We gather insights on political stability, economic indicators, technological advancements, environmental regulations, and social trends to provide a comprehensive view.