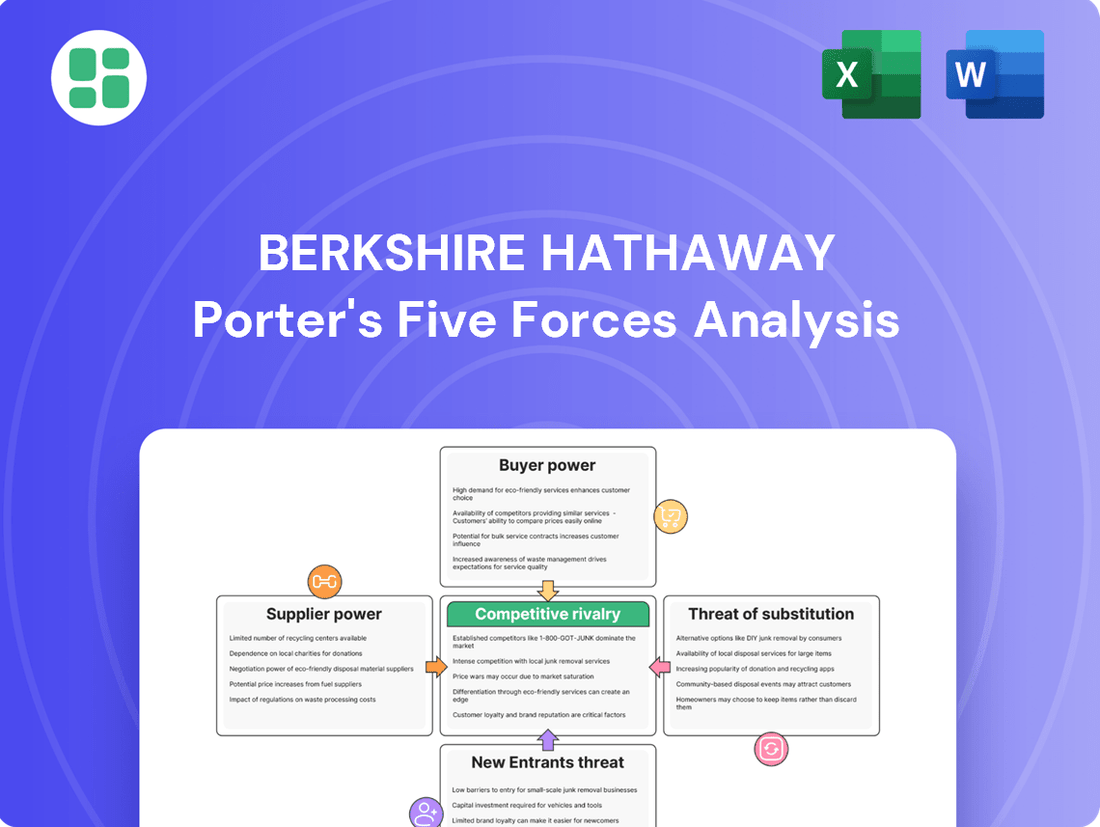

Berkshire Hathaway Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Berkshire Hathaway Bundle

Berkshire Hathaway navigates a complex landscape shaped by intense rivalry and the ever-present threat of substitutes. Understanding these forces is crucial for any investor or strategist looking to grasp its enduring success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Berkshire Hathaway’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Berkshire Hathaway's diverse holdings mean supplier power varies greatly. For example, GEICO's technology vendors face a different competitive landscape than BNSF Railway's fuel suppliers. This broad operational base helps dilute the impact of any single supplier's leverage.

Berkshire Hathaway's vast scale, encompassing numerous subsidiaries, grants it substantial bargaining power over suppliers. This collective purchasing might allows them to secure advantageous pricing and terms, especially for widely available goods and services. For instance, in 2023, Berkshire's consolidated revenues exceeded $300 billion, a testament to the sheer volume of goods and services its diverse operations procure.

In sectors where Berkshire Hathaway relies on highly specialized or regulated components, like advanced rail technology or specific energy generation equipment, a scarcity of qualified suppliers can significantly amplify their bargaining power. For instance, in the rail industry, the demand for specialized components for high-speed rail projects can be met by only a handful of manufacturers, giving them considerable leverage over pricing and terms.

Potential for Vertical Integration or In-house Capabilities

Berkshire Hathaway's vast financial strength, demonstrated by its $167.6 billion in cash and equivalents as of March 31, 2024, offers a unique advantage. This liquidity means Berkshire could, in theory, acquire key suppliers or develop internal capabilities for critical inputs across its diverse holdings. The mere possibility of such vertical integration serves as a powerful check on suppliers seeking to dictate unfavorable terms or prices.

This strategic option is particularly relevant for Berkshire's manufacturing and industrial segments. For instance, if a supplier of specialized components for its Precision Castparts division began to exert undue pricing pressure, Berkshire could explore acquiring that supplier or investing in its own component manufacturing. This potential for backward integration, backed by substantial capital, significantly moderates the bargaining power of suppliers.

- Financial Capacity for Acquisition: Berkshire's $167.6 billion in cash as of Q1 2024 provides the means to acquire critical suppliers.

- Deterrent Effect: The threat of vertical integration limits suppliers' ability to demand higher prices or unfavorable terms.

- Strategic Flexibility: This option enhances Berkshire's control over its supply chain and reduces reliance on external parties.

Supplier Switching Costs

Supplier switching costs significantly influence the bargaining power of suppliers for Berkshire Hathaway's diverse operating companies. When these costs are high, suppliers gain more leverage.

For instance, in Berkshire's insurance sector, reliance on proprietary software systems for policy administration and claims processing can create substantial switching costs. This dependence makes it difficult and expensive to move to a different software provider, thereby strengthening the position of the current software vendors.

Similarly, specialized maintenance for Berkshire's railcar leasing businesses, such as BNSF Railway, might involve unique equipment or highly trained personnel. The cost and time required to find and onboard new, equally capable maintenance providers can be considerable, giving existing specialized suppliers greater bargaining power.

- High switching costs for specialized software in insurance operations increase supplier leverage.

- Specialized maintenance requirements for railcars present significant barriers to switching suppliers.

- The expense and effort involved in changing providers for critical operational components bolster supplier power.

Berkshire Hathaway's immense scale and financial clout significantly diminish supplier bargaining power across many of its diverse businesses. Their ability to negotiate favorable terms is bolstered by substantial purchasing volumes, as evidenced by their over $300 billion in consolidated revenues in 2023. Furthermore, their $167.6 billion in cash reserves as of March 31, 2024, provides a potent deterrent, as Berkshire could potentially acquire suppliers or develop in-house capabilities, thereby limiting external leverage.

| Factor | Impact on Berkshire Hathaway | Supporting Data (as of latest available) |

|---|---|---|

| Purchasing Volume | Reduces supplier power | 2023 Consolidated Revenues: >$300 billion |

| Financial Strength | Mitigates supplier power through potential acquisition/integration | Cash & Equivalents (Q1 2024): $167.6 billion |

| Diversification | Dilutes impact of any single supplier | Multiple subsidiaries across various industries |

What is included in the product

Berkshire Hathaway's Porter's Five Forces analysis delves into the competitive intensity, buyer and supplier power, threat of new entrants, and the availability of substitutes affecting its diverse business empire.

Effortlessly identify and mitigate competitive threats by visualizing Berkshire Hathaway's market position across all five forces.

Customers Bargaining Power

Berkshire Hathaway's customer base is remarkably spread out, encompassing millions of individual policyholders with GEICO, substantial industrial clients relying on BNSF Railway, and numerous consumers served by Berkshire Hathaway Energy. This wide dispersion prevents any single customer or a small group from wielding substantial influence over the entire conglomerate.

Customer price sensitivity within Berkshire Hathaway's diverse portfolio significantly impacts their bargaining power. For instance, individual policyholders in its insurance operations, like GEICO, may exhibit higher price sensitivity, readily switching providers for minor cost savings. In 2024, the competitive landscape in auto insurance saw continued pressure on premiums, making price a key differentiator for many consumers.

Conversely, large industrial clients or businesses relying on Berkshire's BNSF railroad services often place a premium on operational reliability and logistical efficiency. These customers are less likely to switch based solely on price if it means compromising on service continuity or speed. BNSF's significant investments in infrastructure and technology throughout 2024 underscore its commitment to providing dependable service, which can mitigate customer price sensitivity.

In sectors like freight rail, customers often encounter significant hurdles when considering a switch. For instance, the extensive infrastructure investment required to change rail providers, coupled with long-term contracts that lock in pricing and service, means a customer might face millions in relocation and setup costs. This effectively anchors them to their current provider, substantially weakening their leverage.

Brand Loyalty and Trust

Berkshire Hathaway's consumer-facing businesses, such as GEICO, have built significant brand loyalty and trust over many years. This deep-seated customer allegiance makes it less likely for individuals to switch to a competitor based solely on price. For instance, GEICO consistently reports high customer retention rates, a testament to this trust.

This established reputation and customer stickiness directly diminishes the collective bargaining power of customers. When consumers are loyal, they are less inclined to shop around aggressively for lower prices, which in turn limits their ability to demand concessions from Berkshire Hathaway's subsidiaries.

- Brand Loyalty: GEICO, a key Berkshire Hathaway subsidiary, benefits from decades of building trust, leading to strong customer retention.

- Reduced Price Sensitivity: Loyal customers are less likely to switch providers for minor price differences, weakening their bargaining leverage.

- Customer Stickiness: Established trust creates a barrier to entry for competitors, further solidifying Berkshire's customer base.

Regulatory Influence on Pricing

In sectors like energy utilities and freight rail, regulatory bodies heavily influence pricing. This oversight often caps how much customer bargaining power can reduce prices, as rates are typically established to ensure fair returns for the company and service reliability. For instance, in 2024, the U.S. Energy Information Administration reported that average retail electricity prices for residential customers hovered around 16.8 cents per kilowatt-hour, a figure influenced by state-level regulatory decisions on utility costs and investments.

This regulatory framework can significantly dampen the bargaining power of customers. Instead of direct negotiation, customers' ability to influence prices is channeled through public comment periods and advocacy with regulatory agencies. This process, while providing a voice, is less immediate and direct than typical consumer bargaining. For example, the Surface Transportation Board oversees freight rail rates, impacting the cost of transporting goods for numerous industries, and their decisions in 2024 will continue to shape these essential costs.

- Regulatory Oversight Limits Price Flexibility: Government agencies often set or approve prices in essential services, creating a ceiling on how much customers can negotiate down costs.

- Focus on Fair Returns and Stability: Pricing is designed to ensure utilities can operate profitably and reliably, not solely to satisfy customer demands for lower prices.

- Indirect Customer Influence: Customers exert influence through regulatory processes rather than direct price negotiations, a slower and less direct form of bargaining.

- Example: Energy Sector Pricing: In 2024, U.S. residential electricity prices averaged approximately 16.8 cents per kWh, reflecting regulatory approvals of utility operating costs and capital expenditures.

Berkshire Hathaway's vast customer base, spanning insurance, energy, and rail, generally exhibits low to moderate bargaining power. While individual insurance customers might be price-sensitive, the cost and complexity of switching providers in sectors like freight rail significantly limit their leverage. Furthermore, regulatory oversight in utilities and transportation often dictates pricing, reducing direct customer negotiation power.

| Berkshire Hathaway Subsidiary | Customer Type | Bargaining Power Factor | 2024 Data Point/Trend |

|---|---|---|---|

| GEICO (Insurance) | Individual Policyholders | Price Sensitivity, Brand Loyalty | Continued competitive pricing pressure in auto insurance, but strong brand retention limits switching. |

| BNSF Railway | Industrial/Commercial Clients | Switching Costs, Service Reliability | High infrastructure investment required to switch rail providers, reinforcing customer stickiness. |

| Berkshire Hathaway Energy | Residential & Commercial Users | Regulatory Oversight, Service Necessity | Average U.S. residential electricity prices around 16.8 cents per kWh in 2024, influenced by regulatory decisions. |

Same Document Delivered

Berkshire Hathaway Porter's Five Forces Analysis

This preview showcases the complete Berkshire Hathaway Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its diverse business landscape. The document you see here is precisely the same professionally crafted analysis you will receive immediately upon purchase, ensuring no surprises or placeholder content. You are viewing the final, ready-to-use document, guaranteeing instant access to this in-depth strategic evaluation.

Rivalry Among Competitors

Berkshire Hathaway's competitive rivalry is a complex tapestry woven across numerous industries, from insurance and railroads to energy and manufacturing. This diversification means its competitive landscape isn't defined by a single dominant rival but by intense competition within each distinct sector. For instance, in the insurance sector, Berkshire Hathaway competes with giants like UnitedHealth Group and Progressive, while its BNSF railroad faces competition from Union Pacific. In 2023, Berkshire's insurance operations generated over $33 billion in revenue, highlighting the scale of its engagement in this highly competitive field.

The insurance industry, a key area for Berkshire Hathaway with GEICO as a prominent participant, experiences intense rivalry. Competitors frequently engage in aggressive marketing campaigns and focus heavily on price to attract customers. This dynamic environment demands constant innovation in pricing strategies, technological advancements, and customer service to maintain and grow market share.

Berkshire Hathaway's core operations, like BNSF Railway and Berkshire Hathaway Energy, are deeply entrenched in capital-intensive sectors. These industries demand massive, ongoing investments in infrastructure, creating high barriers to entry and fostering competition among a select group of well-resourced incumbents rather than a broad base of smaller players.

For instance, BNSF Railway's extensive network requires continuous capital expenditure for track maintenance, upgrades, and new rolling stock. In 2023, BNSF reported capital expenditures of approximately $4.1 billion, underscoring the substantial ongoing investment needed to maintain and grow its competitive position in the freight transportation market.

Acquisition and Investment Competition

Berkshire Hathaway competes fiercely in the acquisition arena, not just with operational rivals but also with other financial titans. Large conglomerates, private equity funds, and major institutional investors are all vying for the same high-quality businesses that fit Berkshire's long-term value proposition. This intense competition means Berkshire must be strategic and swift in identifying and securing attractive investment targets.

The sheer volume of capital deployed by these competing entities significantly influences deal valuations. For instance, in 2023, global private equity deal value reached approximately $1.1 trillion, demonstrating the substantial financial firepower arrayed against Berkshire. This environment necessitates a disciplined approach, ensuring that acquisitions meet Berkshire's stringent return criteria.

- Acquisition Market Rivalry: Berkshire Hathaway faces competition from other large conglomerates, private equity firms, and institutional investors for attractive businesses.

- Competition for Opportunities: The company competes to secure investment opportunities that align with its long-term value strategy.

- Impact of Private Equity: In 2023, global private equity deal value was around $1.1 trillion, highlighting the significant capital competing for similar assets.

- Strategic Necessity: Intense competition requires Berkshire to be strategic and swift in identifying and securing deals that meet its investment criteria.

Technological Disruption Across Sectors

Technological disruption is a major force shaping competitive rivalry across Berkshire Hathaway's diverse business segments. In 2024, the insurance sector, a core area for Berkshire, continues to see advancements in artificial intelligence and data analytics. These technologies are streamlining underwriting processes and claims management, leading to greater operational efficiency. For instance, GEICO, a Berkshire subsidiary, leverages sophisticated data models to price risk more accurately.

The energy sector, another significant part of Berkshire's portfolio through Berkshire Hathaway Energy, faces disruption from emerging generation and storage technologies. The increasing adoption of renewable energy sources and advancements in battery storage systems are fundamentally altering the energy landscape, presenting both challenges and opportunities. Berkshire Hathaway Energy invested billions in renewable energy projects in 2023, demonstrating its commitment to adapting to these shifts.

Berkshire's varied holdings necessitate continuous adaptation to stay ahead. The company's ability to integrate and capitalize on new technologies across its insurance, energy, manufacturing, and service businesses is crucial for maintaining its competitive advantage. Failure to adapt could lead to erosion of market share and profitability in the face of more agile, tech-forward competitors.

- Insurance Efficiency: AI and data analytics are enhancing underwriting accuracy and claims processing, as seen in GEICO's operations.

- Energy Transformation: New renewable energy and storage technologies are reshaping the energy market, requiring significant investment and adaptation from Berkshire Hathaway Energy.

- Cross-Sector Adaptation: Berkshire's diverse segments must embrace technological change to preserve their competitive edge and market position.

Berkshire Hathaway navigates intense competitive rivalry across its diverse holdings, from insurance to railroads. In insurance, companies like UnitedHealth Group and Progressive are formidable rivals, with Berkshire's insurance operations generating over $33 billion in revenue in 2023. The capital-intensive nature of sectors like railroads, where BNSF competes with Union Pacific, creates high barriers to entry, limiting competition to well-resourced incumbents.

| Industry Segment | Key Competitors | 2023 Revenue/Investment Data |

|---|---|---|

| Insurance | UnitedHealth Group, Progressive | Berkshire Insurance Revenue: >$33 billion |

| Railroads | Union Pacific | BNSF Capital Expenditures: ~$4.1 billion (2023) |

| Acquisition Market | Private Equity, Institutional Investors | Global Private Equity Deal Value: ~$1.1 trillion (2023) |

SSubstitutes Threaten

While direct replacements for core insurance policies are scarce, large enterprises can explore self-insurance or establish captive insurance companies to manage specific risks, potentially bypassing traditional insurers for certain exposures.

For instance, in 2024, many Fortune 500 companies continued to leverage their substantial financial reserves and sophisticated risk management departments to absorb smaller losses internally, reducing their reliance on certain insurance products.

Furthermore, proactive risk mitigation efforts and enhanced safety protocols can diminish the demand for particular types of insurance coverage, serving as effective indirect substitutes.

For Berkshire Hathaway's BNSF Railway, the threat of substitutes is a significant consideration. Trucking, air cargo, and maritime shipping all represent alternative ways to move goods, and their attractiveness varies based on specific needs. For instance, trucking offers flexibility, especially for shorter distances, and in 2024, the trucking industry continued to be a major competitor in freight movement.

The choice between rail and its substitutes hinges on a delicate balance of speed, cost, and the nature of the cargo. While rail excels at moving bulk commodities over long distances efficiently, time-sensitive or high-value goods might find air cargo or expedited trucking more suitable. In 2023, the US freight transportation sector saw trucking account for a substantial portion of total ton-miles, highlighting its continued relevance as a substitute.

Berkshire Hathaway Energy contends with the growing threat of substitutes from decentralized energy generation. Rooftop solar installations, for example, empower consumers to produce their own electricity, directly reducing reliance on traditional utility providers. By 2024, the U.S. solar market saw significant growth, with residential solar capacity expanding, offering a tangible alternative.

Furthermore, advancements in energy efficiency and smart grid technologies act as potent substitutes by lowering overall electricity demand. Consumers adopting energy-efficient appliances and smart thermostats can significantly cut their consumption. This trend, coupled with the rise of localized battery storage solutions, presents a substantial challenge to the established utility model, as it allows for greater energy independence and resilience.

Evolving Retail and Manufacturing Landscape

Berkshire Hathaway faces a significant threat of substitutes across its vast retail and manufacturing operations. For instance, in apparel and home furnishings, fast fashion and direct-to-consumer online brands can offer similar products at lower price points, directly competing with Berkshire's established retail chains. This dynamic is amplified by shifting consumer tastes, with a growing preference for sustainable or ethically sourced goods, which may not be readily available or prominently featured in all of Berkshire's current offerings.

The rise of e-commerce platforms presents a potent substitute for traditional brick-and-mortar retail, a sector where Berkshire Hathaway has substantial investments. In 2024, online retail sales continued their upward trajectory, capturing an increasing share of consumer spending. This trend forces Berkshire's retail subsidiaries to invest heavily in digital transformation and omnichannel strategies to remain competitive against online-only rivals who often benefit from lower overhead costs.

Within its manufacturing segments, the threat of substitutes is also pronounced. For example, in the building products sector, innovative materials or prefabricated construction methods could reduce demand for traditional components like lumber or certain types of insulation. Similarly, advancements in battery technology could substitute for lead-acid batteries produced by some of Berkshire's subsidiaries. The company must continuously monitor these technological shifts and adapt its product lines to mitigate the impact of these evolving substitutes.

- Evolving Consumer Preferences: Shifts towards sustainable and ethically sourced products can displace traditional offerings.

- Digital Disruption: E-commerce models are increasingly substituting for brick-and-mortar retail experiences.

- Technological Advancements: New materials and manufacturing techniques can render existing products obsolete.

- Price Sensitivity: Competitors offering similar products at lower price points pose a constant threat.

Financial Product Innovation

The threat of substitutes for Berkshire Hathaway's financial products is amplified by rapid financial product innovation. New fintech solutions and peer-to-peer lending platforms offer alternative ways for consumers and businesses to manage finances, invest, and secure loans, often with lower overhead and greater convenience. For instance, the global fintech market was valued at approximately $111.8 billion in 2021 and is projected to grow significantly, indicating a robust and expanding substitute landscape.

These innovations can directly challenge traditional insurance and banking offerings by providing different risk-reward profiles or bypassing established distribution channels. Alternative investment vehicles, such as cryptocurrencies or decentralized finance (DeFi) protocols, present a distinct threat by offering potentially higher returns or novel investment strategies that traditional products may not match. The increasing adoption of these alternatives suggests a growing willingness among consumers to explore options outside of conventional financial services.

- Fintech Adoption: By the end of 2023, it's estimated that over 80% of consumers in developed markets use at least one fintech service.

- P2P Lending Growth: The peer-to-peer lending market globally is expected to reach over $300 billion by 2027, demonstrating a substantial shift in credit access.

- Alternative Investments: Assets under management in alternative investments, including private equity and hedge funds, surpassed $13 trillion in 2023, showcasing a significant diversion of capital from traditional markets.

The threat of substitutes for Berkshire Hathaway's diverse operations is multifaceted, ranging from alternative transportation methods for BNSF Railway to decentralized energy solutions impacting Berkshire Hathaway Energy. For its insurance and financial services, fintech innovations and alternative investments present significant competitive pressures.

In 2024, the continued growth of e-commerce directly challenges Berkshire's retail footprint, while advancements in materials science and construction techniques pose a threat to its building products segment. Consumers' increasing preference for sustainable and ethically sourced goods also reshapes demand across various sectors.

These substitutes can erode market share and profitability by offering lower costs, greater convenience, or alignment with evolving consumer values, necessitating ongoing adaptation and innovation from Berkshire Hathaway's subsidiaries.

| Berkshire Hathaway Segment | Key Substitutes Identified | Impact/Trend (2023-2024) | Data Point/Example |

|---|---|---|---|

| Insurance | Self-insurance, captive insurance, fintech solutions | Growing adoption by large enterprises; increasing fintech service usage | Over 80% of consumers in developed markets used at least one fintech service by end of 2023. |

| Railroads (BNSF) | Trucking, air cargo, maritime shipping | Trucking remains a dominant competitor for freight movement | US trucking accounted for a substantial portion of total freight ton-miles in 2023. |

| Energy | Rooftop solar, energy efficiency, battery storage | Significant growth in residential solar installations | U.S. residential solar capacity expanded notably in 2024. |

| Retail | E-commerce, direct-to-consumer brands | Continued upward trajectory of online retail sales | Online retail sales captured an increasing share of consumer spending in 2024. |

| Manufacturing | Innovative materials, prefabricated construction, advanced battery tech | Potential to reduce demand for traditional components | Advancements in battery technology could substitute for lead-acid batteries. |

Entrants Threaten

The threat of new entrants for Berkshire Hathaway is significantly mitigated by high capital requirements across its core industries. For instance, establishing a freight rail operation, akin to Berkshire's BNSF Railway, necessitates billions of dollars for track infrastructure, rolling stock, and regulatory compliance. Similarly, entering the energy utility sector, where Berkshire has substantial investments, requires massive upfront capital for power generation, transmission, and distribution networks, often exceeding $10 billion for a single large-scale project.

The insurance sector, a cornerstone of Berkshire Hathaway's operations, faces significant barriers to entry due to extensive regulatory hurdles. In 2024, companies seeking to operate in this space must navigate a complex web of state-specific licensing, capital requirements, and consumer protection laws. For instance, the National Association of Insurance Commissioners (NAIC) continuously updates solvency standards and reporting mandates, making compliance a substantial ongoing cost.

Berkshire Hathaway's established subsidiaries, like BNSF Railway and GEICO, leverage massive economies of scale. This translates to lower per-unit costs for operations, making it incredibly difficult for newcomers to match their pricing and efficiency. For instance, BNSF's vast network allows for optimized logistics, a feat unachievable for a startup.

Furthermore, decades of accumulated operational experience grant Berkshire Hathaway an edge in understanding market dynamics, managing risks effectively, and refining processes. This deep-seated expertise means new entrants face a steep learning curve, potentially leading to higher initial costs and slower market penetration compared to Berkshire's seasoned subsidiaries.

Strong Brand Loyalty and Distribution Networks

Berkshire Hathaway benefits significantly from strong brand loyalty and deeply entrenched distribution networks, acting as a substantial deterrent to new entrants. Companies like GEICO have cultivated decades of customer trust, making it difficult for newcomers to attract policyholders. In 2024, GEICO continued to leverage its direct-to-consumer model, which bypasses traditional agent commissions, contributing to its competitive pricing and market share.

BNSF Railway, another Berkshire subsidiary, boasts an extensive and integrated logistics network that is incredibly challenging and costly for any new competitor to replicate. Building a comparable rail infrastructure and establishing the necessary interconnections would require billions in capital investment and years of development. This existing infrastructure provides Berkshire with a significant operational advantage and a barrier to entry for potential rivals in the freight transportation sector.

The sheer scale of marketing and infrastructure required for new entrants to compete with Berkshire's established brands is immense. For instance, a new insurance provider would need to invest heavily in advertising to match GEICO's brand recognition, a feat that proved difficult for many in 2024 as the insurance market remained highly competitive. Similarly, establishing a new national rail network is practically unfeasible, reinforcing the existing competitive landscape.

- Brand Recognition: GEICO's brand awareness, consistently high in consumer surveys throughout 2024, represents a significant hurdle for new insurance companies.

- Distribution Channels: BNSF's vast rail network, covering approximately 32,500 route miles across 28 states in 2024, is a critical distribution asset that new entrants cannot easily match.

- Customer Trust: Decades of reliable service and customer satisfaction have fostered deep loyalty, making it hard for new companies to gain traction.

- Capital Investment: The enormous capital outlay needed to build comparable brand equity and distribution infrastructure deters most potential new market participants.

Proprietary Technology and Infrastructure

Berkshire Hathaway's substantial ownership of vast physical infrastructure, exemplified by BNSF's extensive rail network, creates a formidable barrier to entry. Replicating such an immense and complex logistical system requires billions in capital investment and years of development, effectively deterring potential new competitors.

Furthermore, the company leverages proprietary operational technologies and deep expertise honed over decades. This technological advantage, often embedded in its diverse subsidiaries, makes it exceptionally challenging and costly for newcomers to match Berkshire's efficiency and scale.

- BNSF Railway's asset base: Over 32,500 miles of track across 28 states in 2024.

- Capital Investment: BNSF invested approximately $1.8 billion in capital expenditures in 2023 to maintain and improve its network.

- Proprietary Systems: Investments in advanced tracking, scheduling, and maintenance software enhance operational efficiency, a key differentiator.

The threat of new entrants for Berkshire Hathaway is exceptionally low due to immense capital requirements and established competitive advantages. Industries like freight rail and energy utilities, where Berkshire has significant holdings, demand billions in infrastructure investment, making it nearly impossible for new players to compete. For example, BNSF Railway, a Berkshire subsidiary, operates over 32,500 miles of track across 28 states, a scale that is prohibitively expensive to replicate.

Regulatory complexities, particularly in the insurance sector, also serve as a substantial barrier. Navigating state-specific licensing, capital mandates, and consumer protection laws, as overseen by bodies like the NAIC, requires significant legal and financial resources. This, combined with strong brand loyalty, as seen with GEICO, and proprietary operational technologies, creates a formidable defense against new market entrants.

| Barrier Type | Berkshire Hathaway Example | Estimated Cost/Impact |

|---|---|---|

| Capital Requirements | BNSF Railway Infrastructure | Billions of dollars for track, rolling stock, and rights-of-way. BNSF invested ~$1.8 billion in capital expenditures in 2023. |

| Regulatory Hurdles | Insurance Operations (e.g., GEICO) | Substantial legal and compliance costs for state-specific licensing and solvency standards. |

| Economies of Scale | BNSF Logistics Network | Lower per-unit operating costs due to vast network reach, difficult for newcomers to match. |

| Brand Loyalty & Trust | GEICO Direct-to-Consumer Model | Decades of customer satisfaction and high brand recognition in 2024, making customer acquisition costly for new entrants. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Berkshire Hathaway leverages a comprehensive suite of data, including Berkshire Hathaway's own annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and Statista.

We augment this with data from financial databases such as S&P Capital IQ and Bloomberg, alongside macroeconomic indicators and regulatory filings relevant to Berkshire Hathaway's diverse business segments.