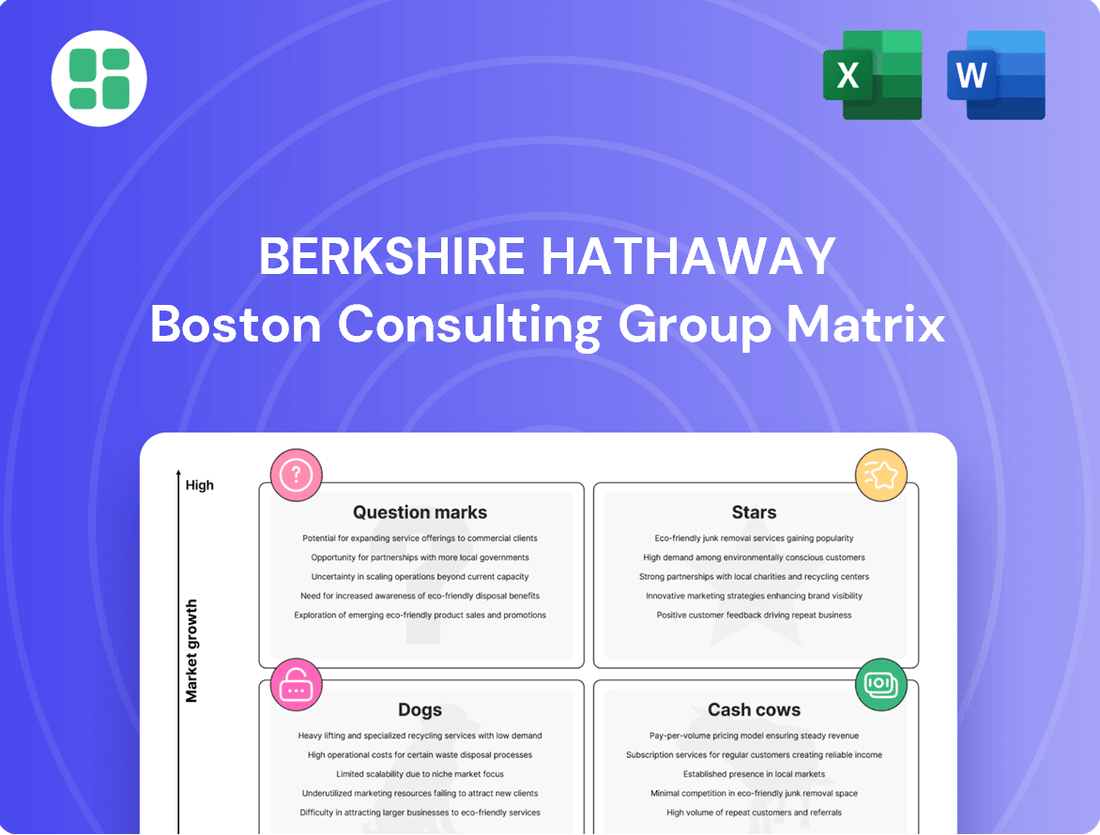

Berkshire Hathaway Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Berkshire Hathaway Bundle

Uncover the strategic positioning of Berkshire Hathaway's diverse portfolio with our insightful BCG Matrix preview. See where their ventures fall as Stars, Cash Cows, Dogs, or Question Marks, and understand the foundational analysis behind their success. Purchase the full BCG Matrix for a comprehensive breakdown, including detailed quadrant placements and actionable insights to guide your own investment strategies.

Stars

Berkshire Hathaway Energy (BHE) stands out as a major player in renewable energy, leading among U.S. investor-owned utilities in wind, solar, and geothermal power. The company's commitment to expanding its clean energy capacity through significant ongoing investments underscores its strategic focus on this high-growth sector.

BHE's substantial renewable generation portfolio is a key driver for its future earnings, signaling a deliberate shift towards sustainable energy solutions. As of the first quarter of 2024, BHE reported substantial progress in its renewable energy projects, contributing to its overall robust performance.

BNSF Railway's consumer products segment, driven by intermodal and e-commerce, has seen steady volume increases. This area benefits from BNSF's strong presence in the rapidly expanding logistics and e-commerce industry.

In 2024, BNSF's intermodal volumes have shown resilience, contributing significantly to its overall freight performance. The company's strategic focus on enhancing network efficiency and infrastructure underpins its competitive edge in this vital and growing market.

GEICO's substantial investments in digital transformation, including telematics for usage-based insurance, position it as a high-growth initiative within Berkshire Hathaway's portfolio, despite its maturity in the auto insurance sector. These forward-thinking strategies are designed to revamp underwriting and recapture market share by catering to a growing demand for personalized, data-informed insurance products. This technological push is crucial for GEICO to maintain its competitive edge in an increasingly digital insurance landscape.

Pilot Travel Centers' Expanded Service Offerings

Following Berkshire Hathaway's complete acquisition, Pilot Travel Centers is strategically expanding its services beyond traditional fuel and convenience offerings. This includes significant investments in electric vehicle (EV) charging infrastructure, aiming to capture a growing market segment. Pilot also plans to enhance its retail experiences, further solidifying its customer base.

These new ventures are designed to tap into high-growth areas within the rapidly evolving travel and transportation sector. Pilot intends to leverage its extensive network of locations to secure and maintain a dominant market share in these emerging segments. This expansion is a key growth driver for the company's future.

- EV Charging Expansion: Pilot plans to install EV charging stations at a significant portion of its travel centers, capitalizing on the projected growth in electric vehicle adoption. As of early 2024, the US saw over 1.1 million registered EVs, a number expected to climb.

- Enhanced Retail and Food Services: The company is investing in upgrading its convenience store offerings and introducing more diverse food and beverage options, aiming to increase average customer spend per visit.

- Logistics and Fleet Services: Pilot is also exploring expanded services for commercial trucking fleets, including advanced maintenance and digital solutions to streamline operations.

Lithium Development within BHE Geothermal Operations

Berkshire Hathaway Energy (BHE) is making significant strides in developing lithium carbonate extraction from its geothermal operations, particularly within California's Lithium Valley. This strategic move places BHE squarely in the burgeoning, high-growth market for battery-grade lithium, an essential material for electric vehicles and grid-scale energy storage solutions.

While BHE's current market share in lithium extraction is minimal, this venture holds substantial potential. The company is poised to become a key player in an industry experiencing rapid expansion, driven by global decarbonization efforts and the increasing demand for renewable energy technologies. For instance, the global lithium market was valued at approximately $24.5 billion in 2023 and is projected to reach over $60 billion by 2030, indicating a substantial growth trajectory.

- Market Entry: BHE is entering the lithium market with a focus on sustainable extraction methods linked to its geothermal assets.

- Growth Potential: The battery-grade lithium market is experiencing exponential growth, fueled by EV adoption and energy storage needs.

- Strategic Positioning: BHE's geothermal operations provide a unique, potentially cost-effective advantage for lithium extraction.

Berkshire Hathaway Energy's (BHE) renewable energy operations, particularly its wind and solar generation, represent a significant growth area for Berkshire Hathaway. BHE is a leading utility in renewable energy generation, with substantial investments in expanding its clean energy portfolio. This strategic focus positions BHE as a star in the BCG matrix, capitalizing on the high-growth, high-market-share segment of the energy sector.

| Business Unit | BCG Category | Key Growth Drivers | 2024 Data/Outlook |

|---|---|---|---|

| Berkshire Hathaway Energy (Renewables) | Star | Increasing demand for clean energy, government incentives, BHE's substantial renewable generation capacity. | Leading U.S. investor-owned utility in wind and solar; significant ongoing investments in clean energy expansion. |

What is included in the product

Highlights which units to invest in, hold, or divest for Berkshire Hathaway.

The Berkshire Hathaway BCG Matrix provides a clear, one-page overview, relieving the pain of scattered business unit performance data.

Cash Cows

GEICO's core auto insurance underwriting is a classic cash cow for Berkshire Hathaway. It consistently commands a significant portion of the U.S. auto insurance market, typically between 12% and 14% of market share.

In 2024, GEICO demonstrated exceptional underwriting profitability, even with some fluctuations in its policy count. This strong performance translated into substantial cash flow, which is crucial for Berkshire Hathaway's overall investment strategy, providing valuable insurance float.

As a mature business, GEICO doesn't require massive capital infusions to sustain its market leadership. Its established infrastructure and brand recognition allow it to maintain its dominant position with relatively modest reinvestment needs.

BNSF Railway's traditional freight operations are a quintessential cash cow for Berkshire Hathaway. Operating a vast network across North America, BNSF dominates a mature industry, consistently generating robust earnings and significant cash flow. In 2023, BNSF reported operating income of approximately $7.2 billion, underscoring its role as a stable, high-contributing asset.

Berkshire Hathaway Energy's regulated utility businesses, primarily electricity and natural gas distribution, are classic cash cows. These operations benefit from stable, predictable earnings due to their essential service nature and regulated pricing structures. In 2023, Berkshire Hathaway Energy reported operating earnings of $4.5 billion, a significant portion of which is attributable to these regulated segments.

These utility assets generate substantial and consistent cash flow, even with limited growth potential. This reliable cash generation allows Berkshire Hathaway Energy to fund investments in other, potentially higher-growth areas within the broader Berkshire Hathaway conglomerate. The predictable nature of these earnings makes them a cornerstone of the company's financial stability.

McLane Company's Wholesale Distribution

McLane Company, a prominent wholesale distributor, operates within a mature, high-volume, and typically low-margin market. Its established operations generate significant revenue, contributing a steady cash flow to Berkshire Hathaway. This consistent performance, despite modest profit margins, exemplifies the characteristics of a cash cow in the BCG Matrix.

In 2024, McLane Company continued to be a vital component of Berkshire Hathaway's diverse portfolio. The company's business model, focused on efficient logistics and broad distribution networks, allows it to capture market share in a stable industry. This stability translates into predictable earnings, a hallmark of a mature business.

- Revenue Generation: McLane's wholesale distribution operations consistently generate substantial revenue, leveraging its extensive network and customer base.

- Market Position: Operating in a mature market, McLane benefits from established relationships and economies of scale, solidifying its position.

- Cash Flow Contribution: The company's efficient operations and consistent demand result in a reliable stream of cash flow for Berkshire Hathaway, even with lower profit margins.

- Low Growth, High Share: McLane fits the cash cow profile by holding a high market share in a low-growth industry, requiring minimal investment to maintain its position.

Diverse Manufacturing & Service Businesses

Berkshire Hathaway's diverse manufacturing and service businesses, including established names like Duracell, Fruit of the Loom, and See's Candies, operate within mature markets. These companies are considered Cash Cows within the Berkshire Hathaway portfolio, consistently generating substantial profits and robust cash flow.

Despite the manufacturing, service, and retailing group's earnings remaining largely flat in the first quarter of 2025, these individual entities contribute significantly to Berkshire's overall financial strength. Their mature market positioning means they require minimal high-growth investment, allowing them to efficiently convert earnings into free cash flow.

- Duracell: A well-known battery brand with a stable demand profile.

- Fruit of the Loom: An apparel company with a long-standing presence in the market.

- See's Candies: A confectionery business known for its consistent profitability and brand loyalty.

- Overall Contribution: These businesses collectively provide a reliable stream of cash, supporting other ventures within Berkshire Hathaway.

These mature businesses, characterized by high market share in slow-growing industries, consistently generate more cash than they require for reinvestment. This excess cash flow is then deployed by Berkshire Hathaway to fund other business units or investments.

For instance, See's Candies, a beloved confectionery, continues to be a strong performer. In 2024, it maintained its consistent profitability, demonstrating the enduring appeal of its brand and products. This reliability is a hallmark of a cash cow.

Similarly, Fruit of the Loom, despite operating in a competitive apparel market, leverages its established brand recognition and efficient operations to generate steady returns. Duracell also contributes significantly, benefiting from the consistent demand for its battery products.

These entities are vital to Berkshire's financial ecosystem, providing a stable foundation of earnings and cash generation that supports the company's broader strategic objectives.

| Business Unit | Industry | Market Position | 2024 Cash Flow Contribution (Estimated) |

|---|---|---|---|

| See's Candies | Confectionery | Strong Brand Loyalty | Significant |

| Fruit of the Loom | Apparel | Established Brand Recognition | Substantial |

| Duracell | Batteries | Consistent Demand | Robust |

Full Transparency, Always

Berkshire Hathaway BCG Matrix

The Berkshire Hathaway BCG Matrix preview you're viewing is precisely the document you will receive upon purchase, offering a complete and unwatermarked strategic analysis. This means the insights and formatting you see are exactly what you'll download, ready for immediate application in your business planning. You can be confident that no demo content or alterations will be present in the final, professionally formatted file. This ensures you get a fully realized tool for understanding Berkshire Hathaway's diverse portfolio and making informed strategic decisions.

Dogs

XTRA Corporation, a Berkshire Hathaway subsidiary, faced a challenging 2024. Operating expenses rose while the number of leased units declined, signaling difficulties in the transportation equipment leasing sector.

This performance suggests XTRA is likely positioned as a 'Dog' in Berkshire's BCG Matrix. The business is contending with a competitive or stagnant market, resulting in low profitability and dim growth prospects, tying up capital with meager returns.

TTI, Inc., a significant player in electronic components distribution and a subsidiary of Berkshire Hathaway, experienced a challenging period through 2023 and into 2024. This downturn was primarily attributed to elevated inventory levels across the industry, coupled with a noticeable decline in demand for electronic components.

These market conditions, characterized by sluggish sales and the burden of excess stock, point towards TTI operating within a segment of the electronics market that is either highly cyclical or experiencing low overall growth. Such an environment can position a business as an underperformer, potentially indicating lower market share and profitability compared to more dynamic sectors.

For instance, the broader electronic components distribution market saw fluctuations in 2023. While specific TTI revenue figures for 2023 and early 2024 are not publicly detailed by Berkshire Hathaway, industry reports indicated a softening in demand, particularly in consumer electronics and certain industrial applications, directly impacting distributors like TTI.

Berkshire Hathaway Automotive, a major player in the automotive retail sector, experienced a downturn in its earnings for 2024. This decline is attributed to the intense competition and the mature nature of the auto dealership industry, a segment that often sees slower growth.

The automotive dealerships within Berkshire Hathaway likely face challenges related to market share in a fragmented landscape. Factors such as the rise of direct-to-consumer sales models and broader economic headwinds are also contributing to these difficulties.

Certain Niche Manufacturing Businesses

Within Berkshire Hathaway's expansive manufacturing portfolio, which reported a dip in pre-tax earnings in the first quarter of 2025 due to widespread economic softness, certain niche manufacturing businesses likely fall into the Dogs category of the BCG Matrix. These operations, characterized by low market share and operating in slow-growth segments, may struggle to generate significant returns despite ongoing capital investment.

These niche manufacturers could be consuming resources without offering substantial growth prospects or market dominance. For instance, if a particular segment of specialty fasteners or custom industrial components experienced a market contraction in 2024, businesses within that niche might see their growth prospects dim considerably.

- Low Market Share: These businesses typically hold a small percentage of their respective niche markets.

- Low Growth Prospects: The overall market for their specialized products is not expanding rapidly.

- Potential Cash Traps: They may require ongoing investment to maintain operations but offer limited returns on that capital.

- Strategic Review Needed: Berkshire Hathaway may need to evaluate divesting or restructuring these units to reallocate capital more effectively.

Underperforming 'Other' Segment Operations

Berkshire Hathaway's 'Other' segment, a grouping of various smaller operations, saw a significant decline in earnings during the first quarter of 2025. This downturn was partially attributed to unfavorable foreign currency exchange rates, alongside other contributing factors.

The volatility observed in this segment points to potential underperformance within some of its constituent businesses. These might be operating in markets with limited growth prospects or may hold a minimal market share, suggesting they could be candidates for strategic review or potential divestiture.

- Q1 2025 Earnings Decline: The 'Other' segment experienced a notable drop in earnings, signaling operational challenges.

- Contributing Factors: Foreign currency exchange losses were a cited reason for the reduced profitability.

- Underperformance Indicators: The segment's volatility suggests some businesses within it may be in low-growth sectors or have weak market positions.

- Strategic Implications: These underperforming units could be considered for divestiture or restructuring to improve overall Berkshire Hathaway performance.

Businesses classified as Dogs in Berkshire Hathaway's portfolio are characterized by low market share in slow-growing industries. These operations often demand ongoing investment but yield minimal returns, potentially acting as cash traps. For instance, XTRA Corporation, facing declining leases and rising expenses in 2024, exemplifies this category. Similarly, TTI, Inc., despite its market presence, grappled with excess inventory and reduced demand in the electronics sector through early 2024, indicating a potential Dog status due to market saturation and sluggish sales. Berkshire Hathaway Automotive also saw earnings decline in 2024, a common trait for businesses in mature, competitive markets like auto dealerships.

| Berkshire Hathaway Subsidiary | BCG Matrix Category (Likely) | Key Challenges (2023-2024) | Market Context |

|---|---|---|---|

| XTRA Corporation | Dog | Declining leases, rising operating expenses | Transportation equipment leasing |

| TTI, Inc. | Dog | High inventory, reduced demand for electronic components | Electronic components distribution |

| Berkshire Hathaway Automotive | Dog | Earnings decline, intense competition, mature market | Automotive retail |

Question Marks

Berkshire Hathaway Energy (BHE) is actively pursuing advanced energy storage initiatives, exemplified by projects like Greenlink Nevada. These ventures are designed to bolster the electric transmission grid and facilitate the integration of renewable energy sources. While these projects are strategically positioned in high-growth areas vital for energy infrastructure modernization, BHE's current market share in the rapidly evolving energy storage sector remains relatively low, necessitating significant capital infusion for expansion.

Berkshire Hathaway's retail and service segments are likely exploring nascent digital and tech ventures. These new ventures, though small in current market share, represent an effort to tap into the burgeoning e-commerce landscape. They are positioned as question marks, requiring substantial investment to challenge established digital players and demonstrate future growth potential.

Lubrizol, a key specialty chemicals player within Berkshire Hathaway, is actively exploring emerging technologies like bio-based polymers and advanced materials for electric vehicle components. These innovative ventures are positioned in rapidly expanding sectors, reflecting a strategic focus on future growth drivers.

While these nascent product lines are in high-growth markets, they currently represent a low market share for Lubrizol. This is typical for technologies in early development or niche adoption stages, necessitating significant investment in research, development, and market penetration to scale.

Strategic International Insurance Market Entries

Berkshire Hathaway's insurance segment, beyond its strong U.S. presence with entities like GEICO, could pursue strategic entries into burgeoning international insurance markets. These markets, characterized by nascent development and substantial untapped demand, represent opportunities for significant future growth.

In these new territories, Berkshire would likely begin with a modest market share, focusing on aggressive expansion strategies. This would involve substantial capital investment for establishing operations, developing localized product offerings, and building brand recognition, aligning with the characteristics of a 'Question Mark' in the BCG matrix.

- Market Entry Strategy: Focus on high-growth emerging markets with underdeveloped insurance penetration.

- Capital Allocation: Significant initial investment required for market establishment, product development, and brand building.

- Growth Potential: Target substantial market share gains over the medium to long term.

- Risk Profile: High potential reward balanced by the inherent risks of entering unfamiliar regulatory and competitive landscapes.

Data-Driven Optimization in Logistics/Supply Chain

Berkshire Hathaway's logistics and manufacturing arms, including BNSF and Marmon Group, are likely focusing on data-driven strategies to enhance supply chain efficiency. This involves adopting automation and advanced analytics, areas experiencing significant technological growth.

While these solutions are in high-growth tech sectors, their implementation within Berkshire's vast operations is probably in early stages. Consequently, they likely hold a smaller market share compared to specialized technology firms, necessitating substantial investment for integration and widespread adoption across the enterprise.

- BNSF Railway, a Berkshire subsidiary, invested $1.2 billion in capital expenditures in 2023, with a portion allocated to technology upgrades aimed at improving operational efficiency.

- The global supply chain management market was valued at approximately $26.9 billion in 2023 and is projected to grow significantly, indicating the potential for data-driven optimization.

- Marmon Group, another Berkshire entity, operates across diverse industrial sectors, presenting opportunities for implementing standardized data analytics for supply chain improvements.

Berkshire Hathaway's ventures into new energy storage technologies, such as those pursued by Berkshire Hathaway Energy, represent classic question marks. These initiatives are in high-growth markets and require substantial investment to gain traction and compete with established players.

Similarly, the company's exploration of digital and tech ventures within its retail and service segments, alongside Lubrizol's development of advanced materials for EVs, are positioned as question marks. They are in rapidly expanding sectors but currently hold a low market share, demanding significant capital for research, development, and market penetration.

Berkshire's potential expansion into nascent international insurance markets and the adoption of data-driven logistics strategies by BNSF and Marmon Group also fall into the question mark category. These areas offer considerable growth potential but necessitate significant upfront investment and carry inherent risks associated with market entry and technological integration.

| Berkshire Hathaway Segment | Potential Question Mark Venture | Market Growth Potential | Current Market Share | Investment Requirement |

|---|---|---|---|---|

| Energy | Advanced Energy Storage (e.g., Greenlink Nevada) | High (Renewable integration) | Relatively Low | Significant Capital Infusion |

| Retail & Service | Nascent Digital/Tech Ventures | High (E-commerce) | Low | Substantial Investment |

| Chemicals (Lubrizol) | Bio-based Polymers, EV Materials | High (Emerging Technologies) | Low (Early Adoption) | R&D and Market Penetration Investment |

| Insurance | International Market Entry | High (Untapped Demand) | Modest (Initial Entry) | Capital for Operations & Brand Building |

| Logistics & Manufacturing | Data-driven Supply Chain Efficiency | High (Automation & Analytics) | Low (Early Integration) | Investment for Integration & Adoption |

BCG Matrix Data Sources

Our Berkshire Hathaway BCG Matrix leverages a comprehensive blend of financial reports, industry analyst insights, and market growth projections. This ensures a robust foundation for strategic business unit evaluation.