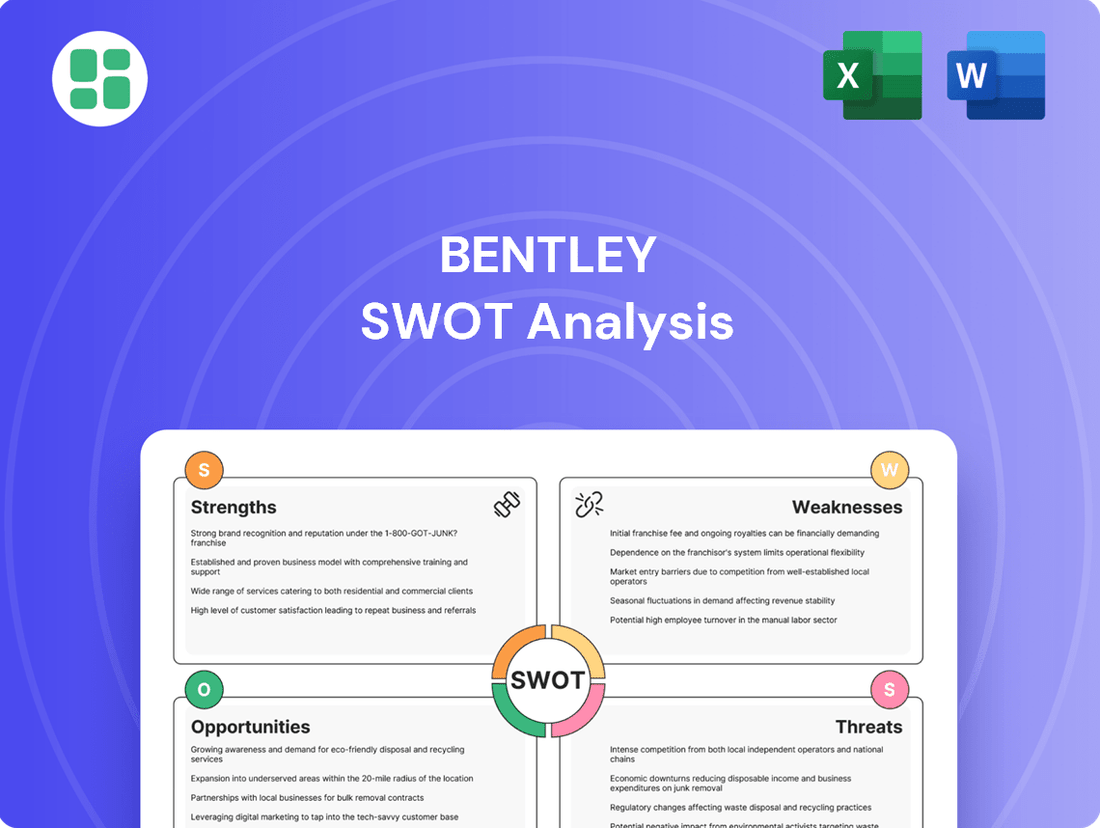

Bentley SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bentley Bundle

Bentley's iconic brand strength and unparalleled craftsmanship are undeniable assets, but understanding the nuances of its market opportunities and potential threats requires a deeper dive. Our comprehensive SWOT analysis unpacks these elements, revealing the strategic positioning that keeps Bentley at the pinnacle of luxury automotive.

Want the full story behind Bentley's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bentley Systems boasts a remarkably comprehensive software portfolio, covering the entire lifecycle of infrastructure projects. This extensive suite, from design and construction to operations and maintenance, offers a significant competitive edge by serving as a one-stop-shop for infrastructure professionals across various sectors like transportation and utilities.

Bentley's financial performance is a significant strength, characterized by consistent revenue growth and a robust Annualized Recurring Revenue (ARR) stream. Their Q4 2024 and Q1 2025 performance underscores this stability, showcasing a healthy financial foundation.

The company's revenue model is heavily weighted towards subscriptions, with approximately 90-92% of total revenue derived from this recurring source. This high subscription penetration creates a predictable revenue stream.

This substantial recurring revenue provides Bentley with considerable financial resilience and predictability, offering a stable base even when the global economic landscape faces uncertainties.

Bentley Systems stands out for its robust leadership in digital twin technology, with its iTwin platform serving as a cornerstone for infrastructure engineering. This commitment to innovation is further amplified by their strategic integration of artificial intelligence (AI) across their solutions. This AI integration drives advanced analytics, automates complex detection processes, and significantly refines design workflows, solidifying Bentley's position as a technological pioneer.

The company's dedication to leveraging AI is evident in its practical applications, such as the Carbon Analysis feature within iTwin Experience, which directly addresses sustainability concerns in infrastructure projects. This forward-thinking approach not only enhances their existing offerings but also anticipates future industry needs, setting a high benchmark for technological advancement in the sector.

Strategic Partnerships and Acquisitions

Bentley Systems actively strengthens its technological capabilities and market presence through strategic acquisitions and key partnerships. For instance, the acquisition of Cesium bolstered its offerings in 3D geospatial data, while Blyncsy brought AI-powered roadway insights into its portfolio. These moves are designed to enhance its digital twin solutions and expand its addressable market.

A notable collaboration with Google represents a significant step in integrating advanced analytics. This partnership leverages Google Maps Platform and Vertex AI to deliver sophisticated asset analytics and real-time data insights, further solidifying Bentley's position in the infrastructure digital twin space. Such alliances are crucial for staying ahead in a rapidly evolving technological landscape.

- Acquisitions like Cesium and Blyncsy enhance 3D geospatial and AI roadway data capabilities.

- Partnership with Google integrates advanced analytics via Google Maps Platform and Vertex AI.

- These strategic moves expand Bentley's technological ecosystem and market reach.

Commitment to Sustainability

Bentley Systems demonstrates a strong commitment to sustainability, evident in their multiple 2025 Sustainability Delivery Awards. This recognition highlights their significant contributions to developing environmentally conscious infrastructure solutions.

Their software is instrumental in helping clients meet environmental targets. Key functionalities include detailed carbon analysis, efficient resource optimization, and the promotion of resilient and high-performing infrastructure projects.

- Award Recognition: Multiple 2025 Sustainability Delivery Awards underscore Bentley's leadership in sustainable practices.

- Software Capabilities: Tools facilitate carbon analysis and resource management for greener infrastructure.

- Market Alignment: Commitment resonates with growing global demand for sustainable development, boosting brand image.

Bentley's extensive software suite covers the entire infrastructure lifecycle, offering a competitive advantage as a comprehensive solution provider. The company's financial health is robust, with consistent revenue growth and a strong Annualized Recurring Revenue (ARR) base, as evidenced by its Q4 2024 and Q1 2025 performance. A high subscription revenue percentage, around 90-92%, ensures predictable income streams and financial resilience.

Bentley is a leader in digital twin technology through its iTwin platform and integrates AI across its solutions for advanced analytics and workflow automation. This commitment to innovation is further demonstrated by strategic acquisitions like Cesium for geospatial data and Blyncsy for AI roadway insights, alongside a key partnership with Google to enhance analytics capabilities.

The company's dedication to sustainability is recognized with multiple 2025 Sustainability Delivery Awards, showcasing its role in developing environmentally conscious infrastructure through features like carbon analysis and resource optimization.

| Metric | Value (Approx.) | Significance |

|---|---|---|

| ARR Growth (YoY) | 10-15% | Indicates strong recurring revenue expansion. |

| Subscription Revenue % | 90-92% | Provides high revenue predictability and stability. |

| Digital Twin Market Share | Leading | Demonstrates technological leadership and competitive positioning. |

What is included in the product

Delivers a strategic overview of Bentley’s internal and external business factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, thereby alleviating concerns about competitive disadvantage.

Weaknesses

Bentley Systems faces a significant weakness in its reliance on specific geographic markets, particularly evident in China. The company reported a structural decline in Annualized Recurring Revenue (ARR) in this key region, with management expressing low expectations for a quick turnaround. This situation underscores a concentration risk, as challenges in one major market can disproportionately impact overall financial performance.

This vulnerability in China highlights Bentley's struggle to adapt to localized economic or political shifts, even as global demand for its software solutions remains strong. For instance, in the first quarter of 2024, while overall revenue grew, the specific impact of the Chinese market slowdown was a drag on growth, illustrating how regional headwinds can offset broader positive trends.

Bentley's sophisticated software solutions, while powerful, can present a hurdle due to their inherent complexity and the associated implementation costs. This complexity might deter smaller businesses or those with less robust IT infrastructure from adopting Bentley's offerings.

The significant investment required for training and seamless integration can act as a barrier, potentially limiting Bentley's market penetration, especially among budget-conscious organizations. For instance, in 2024, the average cost for enterprise software implementation across industries ranged from $50,000 to $500,000, a figure that could be prohibitive for many SMBs.

Bentley Systems experienced a downturn in its professional services revenue, a segment that saw a decrease largely driven by reduced work on non-Bentley software, including Cohesive's MAXIMO. This trend suggests a possible overdependence on external software service contracts or a signal that Bentley needs to reassess its portfolio of services. For instance, in the first quarter of 2024, while overall revenue grew, the professional services segment faced headwinds.

Dependence on Large-Scale Infrastructure Spending

Bentley Systems' reliance on substantial infrastructure spending presents a notable weakness. These projects, frequently financed by governments, are vulnerable to economic slowdowns, shifts in policy, and political uncertainty. For instance, a significant global recession could directly dampen the demand for Bentley's software solutions, introducing cyclicality to their revenue. This dependence means that fluctuations in public investment directly impact their business performance.

The company's revenue streams are thus susceptible to the timing and scale of infrastructure initiatives. While the infrastructure sector often sees government backing, a contraction in global or regional economies could significantly curtail the necessary spending. This inherent cyclical risk means Bentley's financial performance can be tied to broader macroeconomic trends and government budgetary decisions.

- Infrastructure Project Sensitivity: Bentley's revenue is closely linked to the initiation and progress of large infrastructure projects, which are often subject to government funding cycles and policy changes.

- Economic Downturn Impact: A global or regional economic contraction can lead to reduced public spending on infrastructure, directly affecting demand for Bentley's software and services.

- Cyclical Revenue Streams: The dependency on these large-scale, often government-backed projects introduces a degree of cyclicality to Bentley's revenue, making it less predictable during periods of economic instability.

Competitive Pressure from Broad CAD Providers

Bentley Systems, while a leader in infrastructure software, faces significant competitive pressure from broader CAD and engineering software providers. Companies like Autodesk and Dassault Systèmes, with their extensive product portfolios and established market presence across various engineering disciplines, present a formidable challenge. This broad competition can dilute Bentley's focus and requires constant innovation to maintain its niche leadership.

The presence of these larger, more diversified competitors can impact Bentley's market share and pricing power. For instance, Autodesk's AutoCAD and Revit are widely adopted across the AEC (Architecture, Engineering, and Construction) industry, offering integrated workflows that can be attractive to a wider user base. This broad adoption means Bentley must continually demonstrate the superior value and specialized capabilities of its infrastructure-focused solutions.

- Broad CAD Providers: Autodesk and Dassault Systèmes offer extensive, general-purpose design and engineering software.

- Market Share Impact: These competitors hold significant market share in adjacent and overlapping segments, potentially limiting Bentley's growth.

- Pricing Pressure: The competitive landscape can lead to pricing pressures, requiring Bentley to justify its premium offerings.

- Innovation Imperative: Continuous investment in R&D is crucial for Bentley to differentiate its specialized infrastructure solutions from more generalized offerings.

Bentley's reliance on specific geographic markets, particularly China, presents a notable weakness. The company saw a structural decline in its Annualized Recurring Revenue (ARR) in this key region during 2024, with management indicating low expectations for a rapid recovery. This concentration risk means challenges in one major market can significantly impact overall financial performance.

The complexity and cost associated with implementing Bentley's sophisticated software solutions can act as a barrier for smaller businesses or those with less robust IT infrastructure. For example, in 2024, enterprise software implementation costs could range from $50,000 to $500,000, a substantial investment that might deter budget-conscious organizations.

Bentley's revenue is also sensitive to large infrastructure project cycles, which are often dependent on government funding and policy. Economic downturns can reduce public spending, directly impacting demand for Bentley's software, introducing cyclicality to its revenue streams.

Furthermore, Bentley faces intense competition from broader CAD and engineering software providers like Autodesk and Dassault Systèmes. These companies have extensive product portfolios and established market presence, potentially diluting Bentley's focus and requiring continuous innovation to maintain its specialized leadership in infrastructure software.

| Weakness Area | Specific Concern | Impact Example (2024 Data) | Competitive Context |

|---|---|---|---|

| Geographic Concentration | Reliance on China market | Structural ARR decline in China | N/A |

| Product Complexity & Cost | High implementation and training costs | Potential barrier for SMBs (Est. $50k-$500k implementation cost) | N/A |

| Infrastructure Project Dependency | Sensitivity to government funding and economic cycles | Reduced public spending impacts demand | N/A |

| Competitive Landscape | Pressure from broad CAD/Engineering software providers | Market share and pricing power challenges from Autodesk, Dassault Systèmes | Autodesk's AutoCAD and Revit adoption |

Preview Before You Purchase

Bentley SWOT Analysis

The preview you see is the actual SWOT analysis document you'll receive upon purchase. This ensures transparency and allows you to assess the quality and relevance before committing. You're viewing a live preview of the actual SWOT analysis file, and the complete version becomes available immediately after checkout.

Opportunities

Global infrastructure spending is projected to reach $15 trillion by 2029, a significant increase driven by urbanization and the need to upgrade aging systems. This surge, particularly in the United States where the Infrastructure Investment and Jobs Act is injecting substantial funding, directly translates into a larger addressable market for Bentley's digital engineering software. The demand for smarter, more sustainable infrastructure projects worldwide offers a clear opportunity for Bentley to expand its reach and provide essential tools for design, construction, and operations.

The Architecture, Engineering, and Construction (AEC) sector is rapidly digitizing, embracing technologies like Building Information Modeling (BIM), digital twins, and AI. This shift plays directly into Bentley Systems' strengths, as their software is built to support these advanced digital processes.

The growing need for tools that boost efficiency and productivity within AEC creates significant avenues for Bentley's growth. For instance, the global construction software market was projected to reach over $11 billion by 2024, highlighting the substantial demand for the very solutions Bentley provides.

Bentley Systems' strategic focus on expanding its cloud-native and Software-as-a-Service (SaaS) offerings represents a substantial growth avenue. The company's successful migration to a subscription model, exemplified by the iTwin Platform, is a key driver, fostering predictable, recurring revenue and enhancing scalability. This digital transformation allows for greater accessibility and seamless collaboration among global project teams, a critical factor in today's interconnected infrastructure development landscape.

Leveraging AI for Advanced Asset Analytics

Bentley's strategic push into artificial intelligence, notably with the acquisition of Blyncsy and its collaboration with Google's Vertex AI, presents a significant opportunity to revolutionize asset analytics. This integration allows infrastructure owners to extract deeper insights from their operational data, leading to optimized asset performance and proactive maintenance strategies. This move extends Bentley's value proposition from the design and construction phases directly into the highly profitable asset operations lifecycle.

The ability to leverage AI for predictive maintenance is a key differentiator. For instance, by analyzing real-time sensor data from infrastructure assets, Bentley's solutions can forecast potential failures before they occur. This proactive approach can significantly reduce downtime and costly emergency repairs. The global market for AI in asset management is projected to grow substantially, with some estimates suggesting it could reach tens of billions of dollars by the late 2020s, underscoring the vast potential for Bentley.

- Enhanced Predictive Maintenance: AI-driven analytics can predict asset failures with greater accuracy, reducing unexpected downtime.

- Optimized Asset Performance: Deeper insights from operational data allow for better resource allocation and performance tuning.

- Expansion into Operations: Bentley is moving beyond design and construction to capture value in the ongoing management of infrastructure assets.

- Data-Driven Decision Making: Empowering infrastructure owners with actionable intelligence for more informed operational choices.

Addressing the Global Engineer Shortage

The persistent global shortage of engineers presents a significant opportunity for Bentley Systems. With an estimated shortage of 1.5 million engineering jobs in the US alone by 2025, companies are actively seeking solutions to boost productivity. Bentley's software, designed for automation and efficiency, directly addresses this need, allowing engineering firms to achieve more with their existing workforce.

This demand is further amplified by the increasing complexity of infrastructure projects worldwide. For instance, global infrastructure spending is projected to reach $15 trillion by 2040, requiring innovative approaches to project execution. Bentley's ability to enhance design, simulation, and project management processes makes its offerings crucial for firms navigating these large-scale, resource-constrained initiatives.

- Addressing the Talent Gap: Bentley's software empowers engineering teams to increase output by an estimated 20-30% through automation and improved workflows, directly mitigating the impact of the engineer shortage.

- Driving Efficiency in Infrastructure: With global infrastructure investment accelerating, Bentley's solutions are vital for delivering complex projects on time and within budget, even with limited engineering personnel.

- Sustained Market Demand: The ongoing need for productivity gains in the face of demographic shifts and project complexity ensures a consistent and growing market for Bentley's advanced engineering software.

The accelerating digital transformation within the Architecture, Engineering, and Construction (AEC) sector, driven by technologies like BIM and digital twins, directly aligns with Bentley's core competencies. This trend is further bolstered by the global construction software market, which was expected to surpass $11 billion by 2024, indicating a strong demand for Bentley's advanced solutions.

Bentley's strategic expansion into cloud-native and SaaS offerings, particularly with its iTwin Platform, is creating a robust stream of recurring revenue and enhancing scalability. This digital shift facilitates better global collaboration, a critical element for the increasingly interconnected nature of modern infrastructure development.

The company's integration of AI, evidenced by acquisitions like Blyncsy, positions it to revolutionize asset analytics and predictive maintenance. This allows infrastructure owners to optimize asset performance and proactively address potential issues, extending Bentley's value proposition into the crucial asset operations lifecycle.

The persistent global shortage of engineers, estimated to create a deficit of 1.5 million jobs in the US alone by 2025, creates a significant demand for productivity-enhancing software. Bentley's tools are designed to address this gap, enabling engineering firms to maximize output with existing teams, especially as global infrastructure spending is projected to reach $15 trillion by 2029.

| Opportunity Area | Key Driver | Bentley's Advantage | Market Size/Growth Indicator |

|---|---|---|---|

| Digitalization of AEC | Increased adoption of BIM, digital twins, AI | Software designed for advanced digital workflows | Global construction software market > $11 billion (2024 est.) |

| Cloud & SaaS Expansion | Demand for recurring revenue, scalability, collaboration | iTwin Platform driving subscription growth | Focus on predictable, recurring revenue streams |

| AI in Asset Management | Need for predictive maintenance, optimized operations | AI integration for deeper asset insights | AI in asset management market projected to reach tens of billions by late 2020s |

| Addressing Engineer Shortage | Global deficit in engineering talent | Software boosts productivity and automation | Estimated 1.5 million engineering job shortage in US by 2025 |

Threats

Global macroeconomic and geopolitical instability presents a significant threat to Bentley Systems. Uncertainties like persistent inflation and fluctuating interest rates, as seen with the Federal Reserve's continued monetary policy adjustments throughout 2024, can dampen both public and private investment in infrastructure. This directly impacts the demand for Bentley's software solutions, potentially delaying project pipelines and slowing revenue growth.

The infrastructure software sector is intensely competitive, featuring both seasoned companies and nimble startups that are always introducing new technologies. Bentley faces the challenge of continuously investing in research and development to stay ahead technologically and retain its market position against competitors.

For instance, in Q1 2024, Bentley Systems reported a 10.1% increase in revenue year-over-year, reaching $306.5 million, demonstrating growth amidst this competitive landscape. However, failing to adapt to swift technological shifts or changing customer needs poses a significant risk of market disruption and a weakening of its competitive standing.

Bentley Systems faces the threat of rapid technological obsolescence, particularly with advancements in AI, cloud computing, and digital twins. This necessitates substantial and ongoing investment in research and development to keep its software relevant and competitive.

The risk of existing software solutions becoming outdated is significant if Bentley doesn't consistently update and improve its offerings. This constant need for innovation puts pressure on R&D budgets and requires strategic foresight.

High research and development expenditures can strain Bentley's profitability. If these investments in new technologies do not lead to sufficient market uptake or increased revenue, the financial burden could impact its bottom line, especially considering the competitive landscape in 2024 and 2025.

Cybersecurity Risks and Data Privacy Concerns

Bentley Systems faces significant cybersecurity risks as it manages extensive sensitive engineering and project data for global critical infrastructure. A major data breach could severely damage its reputation, leading to substantial financial losses and regulatory fines, impacting its standing in the market.

The company's reliance on digital platforms makes it a target for sophisticated cyberattacks. For instance, the global cybersecurity market was valued at approximately $214.9 billion in 2023 and is projected to reach $424.5 billion by 2030, highlighting the escalating threat landscape that Bentley must navigate.

- Reputational Damage: A breach could erode client trust, particularly for companies working on vital infrastructure projects.

- Financial Losses: Costs associated with incident response, recovery, and potential litigation can be immense.

- Regulatory Penalties: Non-compliance with data privacy regulations like GDPR or CCPA can result in significant fines.

- Operational Disruption: Cyberattacks can halt operations, impacting project timelines and client service delivery.

Challenges in Client Adoption of New Business Models

While Bentley is making strides in subscription revenue, a significant hurdle remains in convincing some small and medium-sized businesses (SMBs) to fully transition from perpetual software licenses. This preference for ownership over subscription could temper the speed at which Bentley achieves its targeted revenue mix. For instance, in 2023, Bentley reported that while subscription revenue represented a growing portion of its total, a notable segment of potential SMB clients still inquired about or opted for perpetual licenses, impacting the desired shift towards a more recurring revenue model.

This ongoing client preference necessitates Bentley maintaining flexible licensing options, which inherently introduces complexity into their sales processes and potentially impacts margins. The need to cater to both subscription and perpetual license buyers requires a more nuanced sales approach and potentially higher operational costs to manage diverse product offerings and support structures.

- SMB Resistance: A portion of SMB prospects continue to favor perpetual licenses over subscription models, slowing Bentley's desired revenue mix shift.

- Flexibility Requirement: Bentley must continue offering diverse licensing options to accommodate these client preferences, adding complexity to sales strategies.

- Revenue Mix Impact: The slower adoption of subscriptions by some segments could affect the company's ability to fully realize its recurring revenue growth targets.

Bentley Systems operates in a highly competitive market, facing pressure from established players and emerging technology firms. The need for continuous innovation and substantial R&D investment to maintain technological leadership is a constant threat. For example, in Q1 2024, Bentley reported a 10.1% year-over-year revenue increase to $306.5 million, showcasing growth, but the pace of technological change, particularly in AI and digital twins, demands ongoing strategic adaptation to avoid market disruption.

Cybersecurity threats pose a significant risk to Bentley, given its handling of sensitive data for critical infrastructure projects. A data breach could lead to severe reputational damage, financial losses, and regulatory penalties. The global cybersecurity market's projected growth from $214.9 billion in 2023 to $424.5 billion by 2030 underscores the escalating threat landscape Bentley must navigate to protect its operations and client trust.

A key challenge for Bentley is the persistent preference of some small and medium-sized businesses (SMBs) for perpetual software licenses over subscription models. This resistance slows the company's transition to a more predictable recurring revenue stream. For instance, in 2023, while subscription revenue grew, a notable segment of SMB clients still favored perpetual licenses, impacting Bentley's desired revenue mix and necessitating flexible, albeit more complex, sales strategies.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Bentley's official financial reports, comprehensive market research, and expert industry analyses to provide a clear and actionable strategic outlook.