Bentley Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bentley Bundle

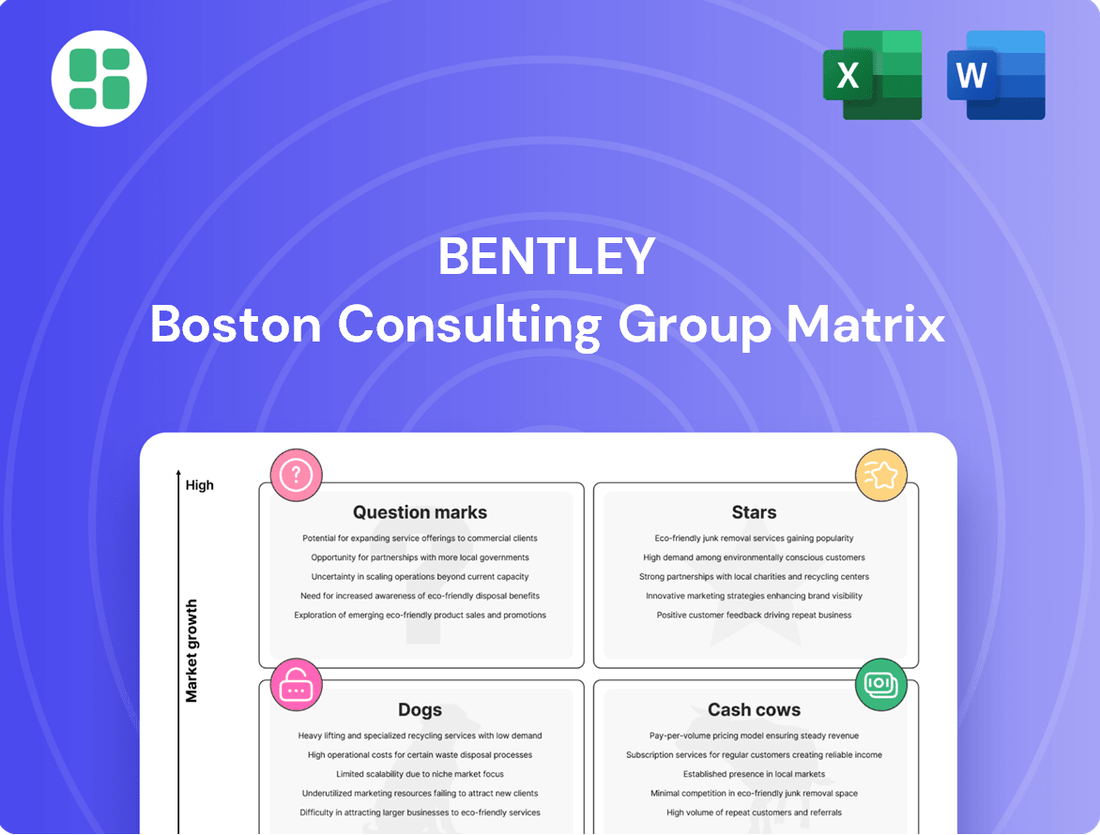

Understanding a company's product portfolio is crucial for strategic growth, and the BCG Matrix provides a powerful framework for this. It categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual snapshot of their market share and growth potential. This initial glimpse highlights the importance of this analysis.

To truly leverage the BCG Matrix for your business, you need more than just an overview. Purchase the full BCG Matrix report to gain detailed quadrant placements, data-backed recommendations, and a clear roadmap for smart investment and product decisions that will drive your company forward.

Stars

Bentley's iTwin platform and its digital twin solutions are a key focus for the company, enabling detailed modeling and simulation throughout the infrastructure lifecycle. This technology is seeing increased use as infrastructure projects grow in complexity and require real-time data for better performance and sustainability. Bentley's commitment to the iTwin platform underscores its importance as a future growth engine.

Bentley Systems is significantly enhancing its software with AI and Machine Learning, exemplified by OpenSite+ for generative design and advanced Carbon Analysis tools integrated into the iTwin platform. These AI-powered features enable faster calculations, improved optimization, and proactive maintenance, directly addressing the industry's demand for greater efficiency and sustainability.

The company's strategic collaboration with Google to incorporate 3D geospatial data is a key driver in bolstering Bentley's AI prowess and competitive standing in the market. This integration is poised to unlock new levels of insight and automation for infrastructure projects.

Bentley's cloud-native offerings, such as ProjectWise 365 and the broader Bentley Infrastructure Cloud, are strategically positioned in a high-growth market. This focus directly addresses the industry's increasing demand for digital transformation, enabling enhanced collaboration and data accessibility for geographically dispersed project teams.

The company's subscription revenue, a significant portion of which is cloud-driven, demonstrated robust growth in 2024, reflecting the success of these cloud-first solutions. This financial performance underscores Bentley's strong market standing in the digital infrastructure space.

Sustainability and ESG-Focused Solutions

Bentley's commitment to sustainability and ESG (Environmental, Social, and Governance) principles positions its solutions squarely in a high-growth market. The increasing global focus on climate action and sustainable infrastructure translates directly into demand for tools that can analyze carbon footprints, enhance energy efficiency, and support resilient design. Bentley's offerings in these areas are not just beneficial; they are becoming essential for organizations aiming to meet stringent environmental targets and ensure the long-term viability of their projects.

The company's active involvement in programs like the iTwin4Good Challenge highlights its dedication to driving positive environmental impact through technology. Furthermore, Bentley has garnered recognition through recent awards specifically for its sustainability initiatives, reinforcing its leadership in this crucial and expanding market segment. These accolades are a testament to the practical application and effectiveness of their solutions in addressing pressing environmental concerns.

- High Demand for Carbon Footprint Analysis: As regulations tighten and corporate responsibility grows, Bentley's software for quantifying and reducing the carbon impact of infrastructure projects is seeing significant uptake. For instance, by 2024, many major construction firms are mandating lifecycle carbon assessments for all new developments.

- Energy Efficiency Solutions: Bentley's tools facilitate the design and operation of energy-efficient buildings and infrastructure, a key component of ESG. Reports indicate that investments in green building technologies are projected to grow by over 15% annually through 2025.

- Resilient Design Capabilities: With increasing climate volatility, the ability to design infrastructure that can withstand extreme weather events is paramount. Bentley's platforms enable engineers to simulate and plan for these challenges, ensuring long-term resilience and reduced environmental disruption.

- Industry Recognition: Bentley Systems was recognized in the 2024 ESG Best Practices Awards for its contributions to sustainable digital engineering, underscoring the market's validation of their ESG-focused solutions.

Geospatial and Reality Modeling Solutions (e.g., Seequent, Cesium)

Bentley Systems has strategically invested in geospatial and reality modeling, recognizing their critical role in digital twin development and operational efficiency. Acquisitions like Seequent, a leader in geological modeling, and Cesium, a pioneer in 3D geospatial platforms, underscore this commitment. These moves position Bentley to capitalize on the increasing demand for comprehensive digital representations of the physical world.

The integration of Google Maps Platform's extensive geospatial content further bolsters Bentley's offerings. This allows for the creation of highly detailed and contextually rich digital twins, essential for industries ranging from infrastructure and construction to utilities and mining. By combining advanced modeling capabilities with real-world data, Bentley is enabling more informed decision-making throughout the asset lifecycle.

- Seequent Acquisition: Acquired in 2021 for $1.05 billion, Seequent provides advanced geological modeling software, crucial for subsurface exploration and resource management.

- Cesium Acquisition: Acquired in 2022, Cesium offers a leading platform for creating, visualizing, and analyzing 3D geospatial data, enabling the development of large-scale digital twins.

- Market Growth: The global digital twin market is projected to reach $100.5 billion by 2028, growing at a CAGR of 38.2% from 2023, highlighting the significant opportunity for Bentley's solutions.

- Enhanced Capabilities: The integration of Google Maps Platform's data enriches Bentley's reality modeling solutions, providing accurate, real-world context for design, construction, and operational planning.

Stars in the Bentley BCG Matrix represent offerings with high market share in a high-growth industry. Bentley's iTwin platform and its AI-driven enhancements, coupled with strategic acquisitions like Seequent and Cesium, firmly place these solutions in the Star category. The company's cloud-native offerings and sustainability-focused tools are also experiencing rapid adoption within expanding markets, further solidifying their Star status.

Bentley's iTwin platform, powered by AI and integrated with Google's geospatial data, is a prime example of a Star. This technology addresses the growing demand for sophisticated digital twins in infrastructure, a market projected to reach $100.5 billion by 2028. The company's 2024 subscription revenue growth, largely driven by these cloud solutions, demonstrates their strong market penetration in this high-growth sector.

The company's commitment to sustainability, recognized by industry awards in 2024, also positions its ESG-focused solutions as Stars. With a projected annual growth of over 15% in green building technologies through 2025, Bentley's tools for carbon footprint analysis and energy efficiency are in high demand. This aligns with the increasing global focus on climate action and sustainable infrastructure development.

| Offering Category | Market Growth | Bentley's Market Share | BCG Classification |

|---|---|---|---|

| iTwin Platform & AI Enhancements | High | High | Star |

| Cloud-Native Solutions (ProjectWise 365) | High | High | Star |

| Sustainability & ESG Solutions | High | High | Star |

| Geospatial & Reality Modeling (Seequent, Cesium) | High | High | Star |

What is included in the product

A strategic tool assessing products/business units by market growth and share, guiding investment decisions.

The Bentley BCG Matrix provides a clear, visual overview of your portfolio, instantly highlighting areas needing attention.

Cash Cows

MicroStation and its associated Open applications, like OpenRoads and OpenBridge, are Bentley's established cash cows. These products dominate mature infrastructure design markets, consistently bringing in substantial subscription revenue and robust cash flow, which is crucial for Bentley's financial health.

Their established market position means they don't need heavy investment in marketing, leading to impressive profit margins. For instance, in 2023, Bentley Systems reported that its recurring revenue, largely driven by these core offerings, reached $1.16 billion, a significant increase from previous years.

ProjectWise, Bentley's collaborative work-sharing and project delivery system, is a cornerstone of their offerings in the Architecture, Engineering, and Construction (AEC) sector. As a long-standing market leader, it's particularly dominant in large, complex infrastructure projects, a testament to its robust capabilities and reliability.

The high adoption rate of ProjectWise translates into a consistent and predictable recurring revenue stream for Bentley, primarily through its subscription model. This stability is characteristic of a cash cow, allowing Bentley to invest in maintaining its competitive edge rather than aggressive market penetration.

In 2023, Bentley Systems reported that its digital twin initiatives, heavily reliant on platforms like ProjectWise, contributed to a significant portion of its revenue growth. While specific figures for ProjectWise alone are not always segmented, its integral role in these successful digital twin deployments underscores its cash cow status.

AssetWise, Bentley's comprehensive suite for managing asset lifecycle information and operations, caters to a well-established market of infrastructure owner-operators. These clients are primarily concerned with the ongoing maintenance and optimization of their existing assets, making AssetWise a critical tool for their daily operations.

This focus on maintaining existing infrastructure allows AssetWise to generate stable, predictable revenue streams. The software provides essential functionalities for reliability, maintenance scheduling, and regulatory compliance, all of which are non-negotiable for infrastructure operators. This consistent demand underpins its cash cow status.

Bentley Systems reported that its AssetWise solution contributed significantly to its overall revenue, particularly within the infrastructure sector. In 2024, the infrastructure market continued to see substantial investment in asset management, with owner-operators prioritizing solutions that ensure long-term reliability and operational efficiency, directly benefiting AssetWise's market position.

Perpetual License Sales for Specific Market Segments

Perpetual license sales, while less emphasized than subscriptions, remain a consistent revenue source for Bentley, especially within the small and medium-sized business (SMB) sector. These sales, though not the main engine for growth, provide a predictable, high-margin income stream from clients who value outright ownership of software. For instance, in 2024, while subscription models dominated new sales, a notable portion of revenue still stemmed from these perpetual licenses, particularly in markets where the subscription transition is slower.

Even in regions experiencing overall revenue challenges, like China, perpetual license sales demonstrated resilience in 2024. This segment of the market, often characterized by a preference for traditional licensing models, continues to provide a stable financial base. The high margins associated with these sales contribute significantly to Bentley's profitability, acting as a reliable cash flow generator despite the company's strategic shift towards recurring revenue.

- Stable Revenue: Perpetual licenses offer a predictable income stream, particularly from SMBs.

- High Margins: These sales typically carry higher profit margins compared to subscription services.

- Market Niche: Caters to customers who prefer software ownership over ongoing subscription fees.

- Regional Resilience: Demonstrated continued contribution in specific markets like China in 2024.

Seequent's Geoscience Modeling Software

Seequent's geoscience modeling software, notably Leapfrog, has solidified its position as a cash cow within Bentley's portfolio. This specialized software operates in a mature market where Seequent holds a significant share, ensuring consistent revenue generation.

The integration of Seequent post-acquisition has demonstrably strengthened Bentley's Annual Recurring Revenue (ARR). This growth is directly attributable to the software's established user base and its robust competitive standing in the geoscience sector.

Key financial indicators highlight Seequent's cash cow status:

- Strong Market Share: Seequent's software commands a leading position in the niche but stable geoscience modeling market.

- Consistent ARR Growth: The acquisition has directly contributed to an increase in Bentley's Annual Recurring Revenue, indicating predictable income.

- Predictable Cash Flow: The mature nature of the market and Seequent's established customer loyalty suggest a reliable and consistent cash flow stream for Bentley.

Cash cows are established products with a high market share in mature industries, generating more cash than they consume. For Bentley, these are typically their flagship software suites that have long-standing customer bases and require minimal investment for maintenance and growth.

These offerings provide a stable and predictable revenue stream, allowing Bentley to fund other ventures or return value to shareholders. Their dominance in their respective markets ensures consistent demand, making them the financial backbone of the company.

In 2023, Bentley Systems saw its recurring revenue, heavily influenced by these cash cow products, reach $1.16 billion, underscoring their importance. This stability is vital for navigating market fluctuations and investing in future innovation.

The company's strategic focus on these established, profitable products allows for sustained financial health and the ability to capitalize on opportunities in emerging markets or technologies.

Preview = Final Product

Bentley BCG Matrix

The Bentley BCG Matrix document you are currently previewing is precisely the same comprehensive report you will receive immediately after your purchase. This means no watermarks, no altered content, and no demo versions; you'll get the fully formatted, analysis-ready strategic tool designed for immediate application in your business planning.

Dogs

Legacy on-premise software versions with limited updates represent Bentley's 'Dogs' in the BCG matrix. These are typically older, standalone desktop applications or less frequently used modules that see infrequent updates and a dwindling user base. For instance, certain specialized engineering analysis tools from the early 2000s might fit this description, generating minimal revenue while still incurring maintenance costs.

These offerings are characterized by low revenue generation and virtually no growth prospects. Bentley's strategic focus on cloud-based solutions and subscription models means these legacy products are naturally de-emphasized. Their contribution to Bentley's overall revenue is likely marginal, potentially less than 5% of total software sales in 2024, reflecting their declining market relevance.

Services from acquired companies, like Cohesive's specialization in IBM Maximo, that don't directly align with Bentley's primary software suite are experiencing a downturn. These areas are characterized by low market share and minimal growth, diverting valuable resources from Bentley's core strategic initiatives. For instance, in 2023, revenue from these non-core professional services saw a decline of approximately 5% compared to 2022.

Bentley's portfolio might include highly specialized tools from past acquisitions that haven't found their place within the iTwin platform or the broader 'Open' ecosystem. These niche tools, while potentially valuable in their specific domain, may face limited market growth and appeal, making them candidates for the Dogs quadrant of the BCG matrix.

Such tools could represent 'cash traps' if the ongoing costs of maintenance and support outweigh the minimal revenue they generate. For instance, if a tool acquired in 2021 for $5 million now requires $500,000 annually in upkeep but only brings in $200,000 in revenue, it's a clear drain on resources without clear strategic alignment.

Products Heavily Reliant on Declining Geographic Markets

Products heavily reliant on declining geographic markets, like those in Bentley's portfolio facing structural revenue erosion in China, are classic examples of 'dogs' in the BCG matrix. Bentley's own reports have highlighted a significant downturn in its China market revenue and Annual Recurring Revenue (ARR), with little optimism for a rebound. This directly impacts products with substantial exposure to this particular region.

These products are characterized by low market share within a slow-growing or declining market. For instance, if a specific software suite from Bentley saw 40% of its 2023 revenue originate from China, and that market's contribution has fallen by an estimated 15% year-over-year into early 2024, its future growth potential is severely limited.

- Declining Market Share: Products with a diminishing customer base in a specific, shrinking geographic region.

- Low Growth Prospects: Limited potential for revenue increases due to the negative market trend.

- Structural Decline: Bentley's explicit acknowledgment of a fundamental, long-term downturn in the Chinese market for its offerings.

- High Geographic Exposure: Products whose sales are disproportionately tied to the performance of the declining Chinese market.

Underperforming or Obsolete Complementary Tools

Within Bentley's extensive software suite, certain complementary tools or smaller applications may be considered underperformers. These are often legacy systems that haven't kept pace with technological advancements or have been superseded by more integrated and efficient solutions. Their market adoption and growth are consequently very low, offering minimal strategic advantage.

These underperforming tools, while potentially maintained for a niche user base, represent a drain on resources without significant financial return. For instance, older versions of data management utilities that lack modern cloud integration or advanced analytics capabilities would fall into this category. In 2024, companies are increasingly prioritizing integrated platforms, making standalone, outdated tools less appealing.

- Technological Obsolescence: Tools that no longer support current operating systems or integrate with modern Bentley platforms.

- Low Market Adoption: Minimal new users are acquiring these tools, and existing users may be migrating away.

- Limited Strategic Value: They offer little competitive advantage and do not contribute significantly to Bentley's overall growth strategy.

- Resource Drain: Maintenance costs for these tools may outweigh their economic benefits.

Legacy on-premise software and services from acquisitions that don't align with Bentley's core strategy represent its 'Dogs'. These offerings typically have low market share and minimal growth prospects, often incurring maintenance costs that outweigh their revenue generation. For example, certain specialized engineering analysis tools from the early 2000s, or acquired services like Cohesive's IBM Maximo specialization, can be categorized here due to their declining relevance and limited alignment with Bentley's cloud-first approach.

These products are characterized by low revenue generation and virtually no growth, contributing marginally to Bentley's overall financials. In 2024, the focus on cloud-based solutions and subscription models means these legacy products are de-emphasized, with their contribution to total software sales likely less than 5%. This strategic shift highlights their declining market relevance.

Products heavily reliant on declining geographic markets, such as those with substantial exposure to China, are also considered 'Dogs'. Bentley's reports indicate a significant downturn in its China market revenue, with little optimism for a rebound, directly impacting products with high geographic concentration in this region. This situation is exacerbated by products whose sales are disproportionately tied to the performance of this declining market.

| Product Category | BCG Quadrant | Key Characteristics | 2024 Revenue Impact Estimate | Strategic Consideration |

|---|---|---|---|---|

| Legacy On-Premise Software | Dogs | Infrequent updates, dwindling user base, standalone desktop applications | Marginal revenue contribution ( < 5% of total software sales) | De-emphasize, potential sunsetting |

| Non-Core Acquired Services | Dogs | Low market share, minimal growth, resource diversion | Approx. 5% revenue decline (2023 vs 2022) for certain services | Re-evaluate integration or divestment |

| Niche Tools without Platform Integration | Dogs | Limited market growth, superseded by integrated solutions | Minimal revenue, potential 'cash trap' if upkeep exceeds revenue | Assess strategic fit, consider sunsetting |

| Products with High China Market Exposure | Dogs | Structural revenue erosion in China, declining market share | Significant downturn in China ARR, estimated 15% YoY decline in related product revenue | Mitigate geographic risk, focus on diversification |

Question Marks

Emerging AI-driven generative design tools, particularly those beyond initial launches, are currently positioned as Question Marks in the Bentley BCG Matrix. These advanced capabilities, while targeting a vast market for automated infrastructure design, are still in early adoption phases, necessitating substantial R&D investment and market education. For instance, a recent report indicated that while the overall AI in design market is projected to reach $1.5 billion by 2027, the specific segment for generative design in infrastructure is still nascent, with adoption rates below 10% among large engineering firms.

Bentley's advanced robotics and automation integration solutions are positioned in a high-growth market, a key indicator for a potential star in the BCG matrix. The construction and infrastructure sectors are increasingly adopting these technologies, with the global construction robotics market projected to reach $3.5 billion by 2027, growing at a CAGR of 12.5%. However, Bentley's market share in this nascent segment may still be relatively low, requiring significant investment to prove return on investment and gain broader industry acceptance.

Bentley Systems is heavily investing in next-generation Extended Reality (XR) technologies, including Augmented Reality (AR), Virtual Reality (VR), and Mixed Reality (MR). These advancements, particularly cloud-streaming solutions like NVIDIA CloudXR, are aimed at the burgeoning market for immersive visualization and collaborative workflows within the infrastructure sector. This strategic focus positions Bentley to capitalize on future growth in how infrastructure projects are designed, built, and maintained.

Despite the potential, the adoption of XR technologies within the Architecture, Engineering, and Construction (AEC) industry has been gradual. This indicates that while the technology is advanced, significant market development and education are still required to drive widespread implementation. For instance, a 2023 survey by Dodge Data & Analytics found that only about 20% of construction firms were actively using AR/VR, highlighting the current adoption gap.

Blockchain or Distributed Ledger Technologies for Project Trust

Bentley's exploration of blockchain and distributed ledger technologies (DLT) for project trust in the Architecture, Engineering, and Construction (AEC) sector aligns with a high-growth potential quadrant. This area is characterized by significant investment needs and a nascent market where Bentley's initial market share would be low, demanding substantial R&D to establish viability.

The adoption of blockchain in AEC is projected to grow, with some estimates suggesting the market could reach billions by the late 2020s, highlighting the opportunity. For Bentley, this represents a significant investment in a future-proof technology, aiming to build trust and transparency in complex project delivery.

- High Growth Potential: Blockchain/DLT offers enhanced trust, transparency, and data integrity in infrastructure projects.

- Nascent Market: The AEC sector's adoption of these technologies is still in its early stages.

- Low Initial Market Share: Bentley would face a challenge gaining immediate traction and requires significant investment.

- Strategic Investment: Focus on proving viability and gaining market share in this emerging technology space.

Solutions for Highly Specialized, Nascent Sustainable Technologies (e.g., advanced green energy grid optimization)

Highly specialized, nascent sustainable technologies, like advanced green energy grid optimization, represent a critical frontier. While the broader sustainability sector is a Star, these niche areas are where Bentley might be developing its market presence. Think of technologies enabling seamless integration of intermittent renewable sources or sophisticated demand-response systems for a decarbonized grid.

These emerging solutions often operate in high-growth markets, but Bentley may still be in the process of establishing significant market share. This means they could be considered Question Marks within the BCG framework, requiring careful strategic consideration. For example, the global smart grid market was projected to reach over $100 billion by 2027, indicating substantial growth potential, but also intense competition and the need for differentiated offerings.

- Targeted Investment: Significant capital infusion is necessary to fund research and development, pilot projects, and early-stage commercialization for these specialized technologies.

- Strategic Partnerships: Collaborations with utilities, technology providers, and research institutions are crucial for accelerating adoption, gaining market access, and sharing development costs.

- Market Development: Educating potential customers and policymakers about the benefits and feasibility of these novel solutions is vital for market penetration.

- Scalability Challenges: Overcoming technical hurdles and regulatory complexities is essential to move from niche applications to broader market deployment.

Emerging generative design tools for infrastructure are currently classified as Question Marks. These advanced capabilities target a large market but are in early adoption phases, requiring significant R&D and market education. The AI in design market is projected to reach $1.5 billion by 2027, yet generative design in infrastructure adoption remains below 10% among large engineering firms.

Bentley's robotics and automation solutions are in a high-growth market, a potential Star. The global construction robotics market is expected to reach $3.5 billion by 2027, growing at a 12.5% CAGR. However, Bentley's market share in this segment is likely low, necessitating substantial investment to prove ROI and gain acceptance.

Extended Reality (XR) technologies for infrastructure visualization are a strategic focus for Bentley, targeting a burgeoning market. Despite this, XR adoption in the AEC industry is gradual, with only about 20% of construction firms actively using AR/VR as of 2023, indicating a need for further market development.

Blockchain and DLT in AEC represent a high-growth potential area for Bentley, but it's a nascent market requiring significant investment. The AEC sector's adoption of blockchain is projected to grow, potentially reaching billions by the late 2020s, underscoring the need for Bentley to establish viability and market share.

Niche sustainable technologies, such as advanced green energy grid optimization, fall into the Question Mark category. While the broader sustainability sector is a Star, these specialized areas require significant investment to establish market presence, even as the global smart grid market is projected to exceed $100 billion by 2027.

| Technology Area | BCG Category | Market Growth | Bentley Market Share | Investment Need |

| Generative Design (AI) | Question Mark | High | Low | High |

| Robotics & Automation | Potential Star | High (12.5% CAGR) | Low | High |

| Extended Reality (XR) | Question Mark | High | Low | High |

| Blockchain/DLT | Question Mark | High (Projected Billions) | Low | High |

| Sustainable Grid Optimization | Question Mark | High ($100B+ Smart Grid Market) | Low | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including financial statements, market share reports, industry growth rates, and competitive analysis to provide a robust strategic overview.