Bentley Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bentley Bundle

Bentley's position in the luxury automotive market is shaped by intense rivalry, the significant power of its discerning buyers, and the constant threat of innovative substitutes. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Bentley’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Proprietary technology providers can wield considerable bargaining power over Bentley Systems. For instance, reliance on specialized hardware manufacturers or operating system vendors whose products are critical for Bentley's software functionality means these suppliers can dictate terms. In 2023, the global market for specialized enterprise software components, a segment Bentley likely engages with, saw significant price increases due to supply chain constraints and high demand for advanced processing capabilities.

Bentley's increasing reliance on major cloud infrastructure providers like AWS, Azure, and Google Cloud significantly amplifies supplier bargaining power. The concentrated nature of this market, with these few giants dominating, allows them to set pricing and terms, directly affecting Bentley's operational expenses and the reliability of its cloud-based offerings.

For instance, in 2024, the global cloud computing market was valued at over $600 billion, with AWS, Azure, and Google Cloud holding substantial market shares. This concentration means Bentley has limited alternatives for critical infrastructure, giving these providers considerable leverage in negotiations for services and service level agreements.

The availability of highly skilled software engineers, industry-specific experts, and R&D professionals significantly bolsters supplier power. For instance, in 2024, the demand for AI/ML engineers outstripped supply, with job postings for these roles increasing by an estimated 70% year-over-year, driving up compensation packages.

A limited pool of talent, particularly those with deep expertise in complex infrastructure domains or emerging technologies, can lead to increased labor costs. This scarcity can also impede a company's ability to innovate and execute projects efficiently if not proactively addressed through strategic talent acquisition and development.

Data and Content Providers

The bargaining power of data and content providers is a significant factor for companies like Bentley Systems, which rely heavily on specialized information. These suppliers often hold unique or exclusive datasets, such as geospatial data, building codes, and environmental regulations. Their ability to control access and set licensing terms can directly impact the cost and quality of Bentley's integrated solutions.

For instance, the market for specialized geospatial data is often concentrated, with a few key players dominating. In 2023, the global geospatial analytics market was valued at approximately $78.4 billion and is projected to grow significantly. This growth, coupled with the specialized nature of the data, allows these suppliers to command higher prices and dictate terms, influencing the overall cost structure for software providers like Bentley.

- Concentrated Market: Key data providers often operate in markets with limited competition, increasing their leverage.

- Data Exclusivity: Unique or proprietary datasets are highly valuable and command premium pricing.

- Licensing Fees: The cost of accessing and using essential data directly impacts Bentley's operational expenses.

- Data Quality and Accuracy: Suppliers' ability to maintain high-quality data is critical, giving them influence over service delivery.

Component and Tool Vendors

Component and tool vendors, particularly those supplying specialized software development tools, libraries, or pre-built components, exert some bargaining power. These suppliers can accelerate Bentley's development cycles or provide unique functionalities, potentially creating switching costs. For instance, if Bentley heavily relies on a proprietary development framework from a specific vendor, migrating to an alternative could be time-consuming and expensive, impacting development efficiency and time-to-market.

The reliance on these specialized tools can be significant. In 2024, the global market for developer tools and platforms was estimated to be worth tens of billions of dollars, indicating substantial investment and integration within software development workflows. Vendors offering highly integrated solutions or those with a strong intellectual property position can leverage this to influence pricing or terms.

- High Switching Costs: Vendors providing unique, deeply integrated software components can impose significant costs and delays if Bentley needs to switch to a different supplier.

- Specialized Functionality: Tools offering critical, hard-to-replicate functionalities give vendors leverage, especially if they are essential for Bentley's product differentiation or development speed.

- Market Concentration: If only a few vendors offer a particular type of specialized tool, their collective bargaining power increases.

Suppliers can exert significant bargaining power over Bentley Systems, particularly when they provide critical inputs, operate in concentrated markets, or possess unique expertise. This leverage can manifest in higher prices, less favorable terms, or restricted access to essential resources. For Bentley, managing these supplier relationships is key to controlling costs and ensuring operational continuity.

The bargaining power of suppliers is amplified when there are few alternatives available, or when switching to a different supplier would be costly and time-consuming. For instance, Bentley's reliance on cloud infrastructure providers like AWS, Azure, and Google Cloud highlights this dynamic. In 2024, the global cloud computing market, valued at over $600 billion, is dominated by these few major players, giving them considerable influence over pricing and service agreements.

| Supplier Type | Key Leverage Factors | Impact on Bentley |

|---|---|---|

| Cloud Infrastructure Providers | Market concentration, high switching costs | Increased operational expenses, potential service disruptions |

| Specialized Data Providers | Data exclusivity, proprietary datasets | Higher licensing fees, impact on solution quality |

| Talent Providers (e.g., AI/ML Engineers) | Scarcity of specialized skills, high demand | Increased labor costs, potential project delays |

What is included in the product

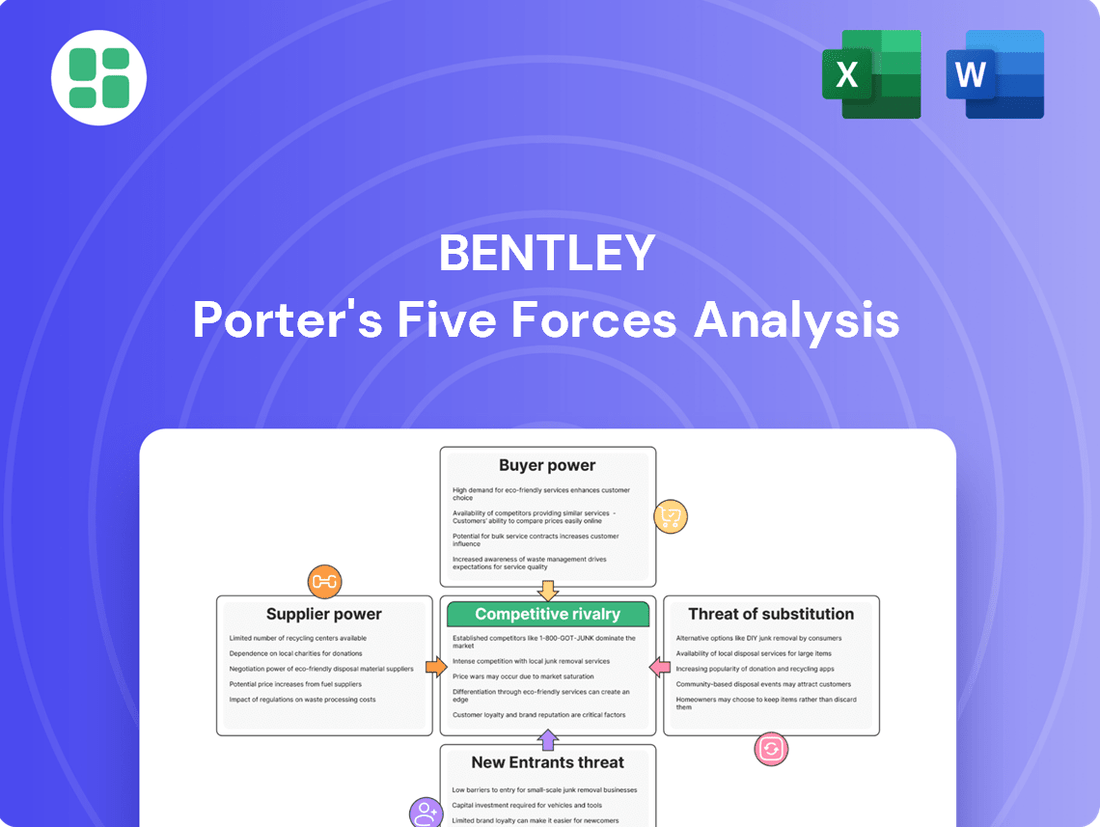

Bentley's Porter's Five Forces analysis deeply examines the competitive intensity, buyer and supplier power, threat of new entrants, and the risk of substitutes impacting its luxury automotive market position.

Quickly identify and mitigate competitive threats with a visual, easy-to-understand breakdown of each Porter's Five Force.

Customers Bargaining Power

Bentley Systems' customers, often major engineering firms and government bodies, experience significant hurdles when considering a switch to a competitor. These barriers include the expense of retraining staff on new software, the complex process of transferring extensive project data, and the potential disruption to vital ongoing work, all of which diminish their ability to easily change providers.

Bentley's software often forms the backbone of critical infrastructure projects, impacting everything from initial design to ongoing maintenance. This deep integration means customers face significant operational hurdles if they switch, limiting their power to push for lower prices or demand extensive modifications.

For instance, in 2024, the global construction software market was valued at approximately $3.5 billion, with a significant portion attributed to specialized design and management solutions like those offered by Bentley. This reliance underscores the high switching costs for customers deeply embedded in Bentley's ecosystem.

Bentley's customer concentration can significantly influence its bargaining power. If a few large enterprise clients or government entities account for a substantial portion of Bentley's revenue, these key accounts gain considerable leverage.

These major customers, by virtue of their purchasing volume and strategic importance, can negotiate for better pricing, customized solutions, or enhanced service agreements. For instance, if a single client represents over 10% of Bentley's annual revenue, their ability to demand concessions increases dramatically, potentially impacting Bentley's profit margins.

Demand for Integrated Solutions

Customers are increasingly seeking integrated software solutions that manage the entire asset lifecycle, from initial design to ongoing operations. This trend towards end-to-end functionality significantly shifts bargaining power towards buyers.

For instance, in the construction technology sector, a 2024 survey indicated that 65% of large construction firms prioritize integrated platforms over standalone solutions when making purchasing decisions. This preference allows these firms to negotiate more favorable terms and influence the development of new features that align with their need for comprehensive asset management.

The demand for integrated solutions means that companies offering fragmented products may face pressure to consolidate or partner to meet market expectations. Buyers can leverage their need for a unified system to secure better pricing and more tailored product roadmaps from vendors.

- Demand for Integrated Solutions: Clients are actively seeking comprehensive software that covers the entire asset lifecycle, from design to operations.

- Customer Leverage: This demand for end-to-end functionality empowers customers, allowing them to influence product development and pricing.

- Market Trends: A 2024 industry survey revealed that 65% of large construction firms prioritize integrated platforms, highlighting this significant market shift.

- Vendor Response: Companies with fragmented offerings face pressure to integrate or partner to remain competitive and meet buyer expectations.

Access to Open Standards and Interoperability

The increasing adoption of open standards in the Architecture, Engineering, and Construction (AEC) sector directly impacts customer bargaining power. If Bentley's software suite doesn't seamlessly integrate with other industry-standard platforms, clients can leverage this to negotiate better terms or explore competitors offering broader compatibility. This push for interoperability means customers can more easily switch or combine solutions, reducing reliance on a single vendor.

For instance, the Common Data Environment (CDE) concept, a cornerstone of BIM (Building Information Modeling) and increasingly mandated in public projects, relies heavily on data interoperability. Projects requiring adherence to ISO 19650 standards, which promote open data exchange, give clients leverage. If Bentley's offerings present significant hurdles in adhering to these open standards, customers can demand concessions or look elsewhere. In 2024, a significant portion of major infrastructure projects globally are specifying open BIM requirements, directly enhancing customer power in selecting compliant software solutions.

- Interoperability Mandates: Growing numbers of government and private sector projects are requiring adherence to open standards like IFC (Industry Foundation Classes), giving clients the power to demand solutions that support these formats.

- Reduced Vendor Lock-in: Customers can more easily avoid being tied to a single software provider if open standards allow for data portability and integration with alternative tools.

- Cost Savings Potential: The ability to integrate best-of-breed solutions through open standards can lead to cost efficiencies for customers, increasing their bargaining power when negotiating with software vendors.

- Market Trends in AEC: By 2024, the AEC industry's digital transformation is heavily influenced by the demand for connected workflows, making interoperability a key purchasing criterion for clients.

Bentley's customers, particularly large enterprise clients and government bodies, possess significant bargaining power due to high switching costs and the critical nature of Bentley's software in their operations. This power is amplified when customers demand integrated solutions and open standards, allowing them to negotiate better terms and influence product roadmaps.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2024) |

|---|---|---|

| Switching Costs | High (training, data migration, operational disruption) | Significant investment required for retraining and data transfer. |

| Customer Concentration | High leverage for large, key accounts | Major clients can negotiate substantial concessions if they represent a significant revenue share. |

| Demand for Integrated Solutions | Increased power for buyers seeking end-to-end platforms | 65% of large construction firms prioritize integrated platforms. |

| Open Standards Adoption | Enhanced ability to negotiate and avoid vendor lock-in | Major infrastructure projects increasingly mandate open BIM and ISO 19650 compliance. |

Preview Before You Purchase

Bentley Porter's Five Forces Analysis

This preview showcases the complete Bentley Porter's Five Forces Analysis, providing an in-depth examination of competitive forces within the luxury automotive market. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately upon purchase, ensuring no surprises or placeholder content. You can confidently use this detailed report to understand Bentley's competitive landscape and strategic positioning.

Rivalry Among Competitors

Bentley Systems operates in a highly competitive landscape, facing significant rivalry from established players like Autodesk, Dassault Systèmes, and Trimble. These companies boast comprehensive product suites and deep market penetration, making it challenging for any single entity to dominate. For instance, Autodesk, a major competitor, reported revenues of approximately $5.1 billion in fiscal year 2024, underscoring its substantial market presence and resources dedicated to innovation and customer acquisition.

Competitors frequently present a wide array of products, some of which directly compete with Bentley's specialized services. For instance, in 2024, major consulting firms like Accenture and Deloitte continued to expand their digital transformation and cloud advisory services, areas where Bentley also operates. This broad offering enables rivals to bundle services, potentially presenting more holistic solutions to clients.

This extensive product range allows competitors to engage clients across multiple disciplines, fostering deeper relationships and increasing switching costs. A client utilizing a competitor's broad suite of services, from IT infrastructure to HR consulting, might find it more convenient and cost-effective to consolidate their strategic advisory needs with the same provider, rather than engaging Bentley for a specific segment.

The infrastructure software market is a hotbed of innovation, fueled by relentless technological progress in digital twins, AI, cloud computing, and reality modeling. This constant evolution means companies must pour significant resources into research and development to introduce cutting-edge features and enhance existing offerings. For instance, in 2023, major players in the infrastructure software space saw substantial R&D expenditures, with some investing upwards of 15% of their revenue to maintain a competitive edge.

This continuous pursuit of technological superiority creates an intense rivalry, as firms vie to be the first to market with groundbreaking solutions. Companies that fail to keep pace risk obsolescence, making the innovation race a critical determinant of success. The pressure to innovate is so high that it often leads to strategic partnerships and acquisitions aimed at acquiring new technologies and talent.

Pricing Strategies and Licensing Models

Competitive rivalry is a significant factor for Bentley Systems, particularly concerning its pricing strategies and licensing models. Competitors in the AEC (Architecture, Engineering, and Construction) software market frequently employ diverse approaches, offering various subscription plans, perpetual licenses, and even usage-based pricing. This creates a dynamic environment where Bentley must remain competitive.

These varied pricing structures from rivals directly impact Bentley's own commercial offerings. Aggressive pricing, such as lower subscription fees or more flexible licensing terms, can exert considerable pressure on Bentley's profitability. Consequently, Bentley may find itself compelled to adjust its pricing and licensing models to maintain market share and attract new customers in this highly competitive landscape.

- Subscription Models: Many competitors offer tiered subscription plans, often with monthly or annual payment options, catering to different user needs and budgets.

- Perpetual Licenses: While less common now, some competitors still offer perpetual licenses, which represent a one-time purchase for ongoing software use, though typically with ongoing maintenance fees.

- Usage-Based Pricing: Certain software providers are experimenting with usage-based models, where customers pay based on the actual consumption of software resources or services.

- Competitive Impact: Flexible or lower pricing by competitors can force Bentley to re-evaluate its own pricing to remain attractive, potentially impacting revenue per user.

Geographic Market Penetration

Competitive rivalry intensifies as companies pursue global market penetration, seeking to establish or expand their footprint in both emerging economies and mature markets. This push for wider reach means companies are constantly looking for new customer bases and ways to increase their market share worldwide.

Success in diverse geographic regions hinges on a company's ability to offer localized support, navigate varying regulatory environments, and adapt products or services to meet specific regional demands. For instance, in 2024, automotive manufacturers are heavily investing in China, a key growth market, with many reporting significant sales increases driven by localized product offerings and manufacturing capabilities.

- Global Expansion Efforts: Companies are actively expanding into regions like Southeast Asia and Africa, aiming to capture early market share in these developing economies.

- Localization Strategies: Tailoring product features, marketing campaigns, and customer service to local cultural nuances and consumer preferences is crucial for gaining traction.

- Regulatory Compliance: Adhering to diverse legal frameworks, import/export regulations, and product safety standards in each new market presents a significant challenge and cost.

- Market Share Battles: In established markets like North America and Europe, rivalry remains fierce, with companies often competing on price, innovation, and brand loyalty to maintain or grow their share.

The competitive rivalry within Bentley's market is intense, driven by well-established players like Autodesk and Dassault Systèmes, who possess broad product portfolios and significant market presence. These competitors often bundle services, offering comprehensive solutions that can make it harder for Bentley to capture specific market segments. For example, Autodesk's fiscal year 2024 revenue of approximately $5.1 billion highlights its substantial resources dedicated to innovation and customer acquisition, directly impacting Bentley's competitive positioning.

The constant need for innovation, especially in areas like digital twins and AI, forces companies to invest heavily in R&D, with some investing over 15% of revenue in 2023 to stay ahead. This technological arms race pressures Bentley to continuously enhance its offerings and maintain a competitive edge, as falling behind risks obsolescence. Pricing and licensing models also form a key battleground, with rivals employing diverse strategies like tiered subscriptions and usage-based pricing, compelling Bentley to remain flexible and competitive to retain market share.

| Competitor | Approximate FY2024 Revenue | Key Competitive Factor |

|---|---|---|

| Autodesk | $5.1 billion | Broad product suite, deep market penetration |

| Dassault Systèmes | Reported €5.72 billion in FY2024 | Comprehensive product offerings |

| Trimble | Reported $3.8 billion in FY2023 | Integrated technology solutions |

SSubstitutes Threaten

For less demanding tasks or smaller projects, users may turn to more generic design software or even robust productivity suites. These alternatives, while not offering the sophisticated features of specialized engineering applications, can fulfill basic design and calculation needs at a significantly lower cost. For instance, advanced spreadsheet programs can handle simpler data analysis and project tracking, posing a threat for very basic project management needs.

Large engineering firms and government entities with substantial IT budgets may opt to develop proprietary software in-house. This strategy provides complete customization and control, directly competing with commercial solutions like those offered by Bentley. For instance, a major infrastructure project might justify the significant upfront investment in custom software to meet highly specialized workflow requirements, bypassing the need for Bentley's standard product suite.

Despite the rise of sophisticated digital design and analysis software, traditional manual methods persist as a threat of substitutes in infrastructure development. These can include drafting by hand or using older, less automated calculation techniques, especially in regions with limited access to advanced technology or for highly specialized, legacy projects. For instance, in 2024, a significant portion of infrastructure planning in developing economies still relies on more manual processes due to cost and infrastructure limitations.

Outsourced Engineering Services

The threat of substitutes for Bentley Systems' software is significant, particularly from outsourced engineering services. Companies can bypass the need for extensive in-house software licensing and management by engaging third-party firms. These firms leverage their own specialized software and expertise, effectively fulfilling engineering, design, and analysis requirements without the client directly investing in or operating Bentley's solutions.

This trend is fueled by the increasing complexity and cost of specialized engineering software. For instance, the global engineering services outsourcing market was valued at approximately $215 billion in 2023 and is projected to grow substantially. This growth indicates a strong preference among many organizations to outsource, reducing their capital expenditure on software and focusing on core competencies.

- Market Growth: The global engineering services outsourcing market is expected to reach over $300 billion by 2028, highlighting a significant shift towards external service providers.

- Cost Efficiency: Outsourcing can offer substantial cost savings by eliminating the need for software licenses, hardware upgrades, and specialized IT support staff.

- Access to Expertise: Service providers often possess deep domain expertise and access to the latest software and technologies, which can be more cost-effective than building that capability internally.

- Focus on Core Business: By outsourcing, companies can redirect their resources and management attention to their primary business operations rather than managing complex software ecosystems.

Emerging Open-Source Alternatives

The threat of substitutes for specialized enterprise software like Bentley's is generally low, but emerging open-source alternatives in specific engineering and geospatial niches could pose a future challenge. These community-driven projects offer cost savings, appealing to users less concerned with premium features or extensive support.

While direct, feature-for-feature replacements are rare, the growing maturity of open-source geospatial platforms, for instance, could siphon off smaller projects or departments seeking budget-friendly solutions. For example, by mid-2024, the adoption of open-source GIS software like QGIS continued to climb, with its user base expanding significantly, indicating a growing awareness and acceptance of these alternatives.

- Growing Open-Source Adoption: Open-source solutions are increasingly viable for specific engineering tasks, offering a cost-effective alternative.

- Niche Domain Challenges: In areas like geospatial data processing, open-source platforms are gaining traction, potentially impacting specialized software providers.

- Cost-Benefit Analysis: Users prioritizing lower costs over advanced features or dedicated enterprise support may gravitate towards these free or low-cost options.

- Long-Term Threat: While not an immediate widespread replacement, the continuous development of open-source capabilities presents a potential long-term substitute threat.

The threat of substitutes for Bentley's software comes from various sources, including less demanding generic software, in-house proprietary solutions, and even traditional manual methods. For less critical tasks, basic design software or advanced spreadsheets can suffice at a lower cost. Major organizations might develop custom solutions for unique needs, bypassing commercial offerings entirely. Furthermore, in some regions or for specific legacy projects, manual drafting and older calculation techniques persist, especially in 2024 where cost and infrastructure limitations still favor these methods in developing economies.

Outsourced engineering services represent a significant substitute threat. By engaging third-party firms, companies can avoid the direct investment and management of specialized software like Bentley's. These firms utilize their own expertise and software, fulfilling design and analysis needs externally. This trend is amplified by the increasing complexity and cost of enterprise software, making outsourcing an attractive option for many organizations looking to manage expenditures and focus on core business functions.

| Substitute Type | Description | Key Advantage | 2024 Relevance |

|---|---|---|---|

| Generic Software/Productivity Suites | Basic design, calculation, and project tracking tools. | Lower cost for less demanding tasks. | Continues to serve niche, low-complexity needs. |

| In-house Proprietary Software | Custom-built solutions by large organizations. | Complete customization and control. | Justified for highly specialized, large-scale projects. |

| Traditional Manual Methods | Hand drafting, older calculation techniques. | Accessibility in regions with limited tech infrastructure. | Persists in developing economies due to cost and infrastructure. |

| Outsourced Engineering Services | Third-party firms providing design and analysis. | Cost savings, access to expertise, focus on core business. | Market valued at ~$215 billion in 2023, projected to grow. |

| Open-Source Alternatives | Community-driven geospatial and engineering platforms. | Cost savings, flexibility for specific niches. | Growing adoption, e.g., QGIS user base expanding. |

Entrants Threaten

Entering the infrastructure software market demands significant upfront capital for research and development. Companies need to invest heavily to create advanced, dependable, and compliant software solutions. For instance, developing a new platform for smart city infrastructure management could easily cost tens of millions of dollars in R&D alone.

The sheer complexity involved in modeling, simulating, and managing data for vast infrastructure projects presents a formidable financial hurdle. Potential new entrants face the challenge of building robust systems capable of handling intricate engineering requirements and massive datasets, a task that requires substantial and sustained investment.

New entrants often struggle with the significant need for deep industry expertise, particularly in capital-intensive sectors like infrastructure. Mastering intricate engineering, regulatory frameworks, and project management across transportation, utilities, and construction demands years of hands-on experience and specialized knowledge. For instance, a new firm attempting to enter the highly regulated US utility sector would need to navigate decades of established practices and complex environmental standards, a steep learning curve that deters many.

Bentley Systems' decades of experience have cultivated a formidable brand reputation and deep trust among infrastructure professionals worldwide. This established goodwill acts as a significant barrier, making it difficult for newcomers to quickly gain credibility and the confidence of clients who prioritize software reliability for critical, high-value projects.

Customer Lock-in and Ecosystem

Customer lock-in presents a significant barrier for new entrants in the software and technology sectors, particularly for established players like Bentley Systems. Existing customers are often deeply integrated into proprietary systems, making the cost and complexity of switching prohibitive. This is exacerbated by the vast amounts of data accumulated in specific formats, which would require substantial effort to migrate.

For new competitors to gain traction, they must not only demonstrate a superior product offering but also address the inertia of existing customer bases. This often involves developing robust data migration tools and ensuring seamless interoperability with current workflows. Without these solutions, the entrenched ecosystem advantage of incumbent firms remains a formidable obstacle.

- High Switching Costs: Industries with significant upfront investment in software, training, and data integration create substantial switching costs, deterring customers from adopting new solutions.

- Proprietary Data Formats: Companies that utilize unique data storage and management systems can make it difficult and expensive for clients to transition their accumulated information to a competitor's platform.

- Established Workflows: Deeply embedded operational processes and employee familiarity with existing software solutions create resistance to change, even when superior alternatives are available.

- Ecosystem Advantage: The network effects and integrated services offered by established providers, often encompassing hardware, software, and support, further solidify customer loyalty and raise barriers for new entrants.

Intellectual Property and Patents

The infrastructure software sector is heavily protected by intellectual property, including patents covering algorithms, sophisticated modeling techniques, and robust data management systems. New companies entering this market must contend with this intricate IP environment.

Navigating this complex IP landscape presents a substantial hurdle for new entrants. They must either innovate entirely new solutions to avoid infringement or risk significant legal and financial penalties if they cross existing patent boundaries.

For instance, in 2024, the software industry continued to see substantial patent filings, with companies like Microsoft, IBM, and Oracle consistently ranking among the top patent assignees. This indicates the ongoing importance of IP as a defensive and offensive strategy within the sector.

- Patent Filings: In 2023, the USPTO reported over 300,000 utility patents granted, a significant portion of which relate to software and computer technology.

- Litigation Costs: Patent infringement lawsuits can cost millions of dollars in legal fees and damages, creating a substantial barrier to entry.

- R&D Investment: Companies with strong patent portfolios often invest heavily in research and development, further solidifying their competitive advantage.

- Licensing Fees: New entrants may need to pay substantial licensing fees to utilize patented technologies, impacting their cost structure.

The threat of new entrants in the infrastructure software market is significantly mitigated by high capital requirements, deep industry expertise, and established customer loyalty. These factors combine to create substantial barriers, making it challenging for new companies to gain a foothold. For example, the need for extensive R&D and navigating complex regulatory environments requires millions in upfront investment.

Customer lock-in, driven by high switching costs and proprietary data formats, also plays a crucial role in deterring new players. Existing users are deeply integrated into current systems, making migration costly and complex. In 2023, industries with significant software integration, like manufacturing and construction, saw an average of 20-30% of IT budgets allocated to maintaining existing systems, highlighting this inertia.

Intellectual property protection, through patents on algorithms and data management, further strengthens incumbent positions. New entrants must either innovate to avoid infringement or face costly legal battles, a risk amplified by the millions spent annually on software-related patents by major tech firms.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024/2025 Estimates) |

|---|---|---|---|

| Capital Requirements | High R&D, infrastructure, and marketing costs. | Significant financial hurdle. | Estimated $20M-$50M+ for a comprehensive infrastructure software suite. |

| Industry Expertise | Need for specialized knowledge in engineering, regulations, and project management. | Steep learning curve and talent acquisition challenges. | Years of experience required; specialized roles can command salaries 15-25% above general IT roles. |

| Customer Lock-in | High switching costs due to integration, data migration, and training. | Difficult to displace established vendors. | Average switching cost for enterprise software can range from 10% to 50% of annual software spend. |

| Intellectual Property | Patents on core technologies and algorithms. | Risk of infringement lawsuits and licensing fees. | Major software companies filed over 35,000 software patents in 2023. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, financial statements of key players, and publicly available company filings. We also incorporate insights from trade associations and economic databases to provide a comprehensive view of the competitive landscape.