Bendigo Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bendigo Bank Bundle

Discover the intricate external forces shaping Bendigo Bank's strategic landscape with our comprehensive PESTLE analysis. We delve into political stability, economic shifts, social trends, technological advancements, environmental considerations, and legal frameworks that directly impact its operations. Gain a crucial competitive edge by understanding these vital factors. Download the full PESTLE analysis now to unlock actionable insights and fortify your strategic planning.

Political factors

Government policies, including fiscal and monetary measures, significantly influence the banking sector. For instance, the Reserve Bank of Australia's (RBA) cash rate decisions directly impact lending margins. In early 2024, the RBA maintained the cash rate at 4.35%, a level that continues to shape borrowing costs and Bendigo Bank's net interest income.

Changes in taxation, such as corporate tax rates, also affect profitability. The Australian federal budget announcements are closely watched for any shifts that could influence Bendigo Bank's bottom line. Government spending patterns can also indirectly affect the economy, influencing loan demand and credit risk for the bank.

Bendigo Bank must remain agile, adapting its strategies to align with the evolving political landscape and economic objectives set by the Australian government. This includes navigating potential changes in banking regulations and ensuring compliance with new directives aimed at financial stability and consumer protection.

The Australian government, through bodies like the Australian Prudential Regulation Authority (APRA), actively works to ensure financial sector stability. Initiatives such as rigorous stress testing and enhanced capital adequacy requirements, which Bendigo Bank must adhere to, are designed to build resilience against economic shocks. For instance, APRA's ongoing prudential framework reviews, particularly post-pandemic, aim to bolster banks' ability to withstand adverse conditions, directly impacting Bendigo Bank's strategic planning and risk management.

Australia's generally stable political environment offers a predictable operating framework for Bendigo Bank. However, global geopolitical shifts and evolving trade relationships can subtly influence economic confidence and capital movements, potentially affecting the bank's loan expansion and the quality of its assets. For instance, ongoing supply chain disruptions stemming from international conflicts, as observed throughout 2024, can lead to increased business costs and a more cautious investment climate.

Consumer Protection and Privacy Legislation

Government scrutiny over consumer protection and data privacy is a significant political factor for Bendigo Bank, with a clear trend towards more stringent regulations. This intensifying focus is exemplified by initiatives like the Consumer Data Right (CDR), which mandates greater transparency and customer control over data. For instance, the CDR rollout aims to empower consumers by allowing them to securely share their banking data with accredited third parties, a move that necessitates robust data security and consent management systems from financial institutions. This regulatory landscape directly impacts how banks like Bendigo Bank design their digital services and manage customer information, making compliance a critical operational imperative.

These evolving legislative frameworks demand substantial investment in compliance and technology upgrades. Bendigo Bank, like its peers, must continually adapt its data handling practices to meet new requirements, ensuring enhanced data security, transparent communication, and explicit customer consent mechanisms. Failure to comply can result in significant financial penalties and, more importantly, damage to public trust, which is a cornerstone of the banking sector. In 2023 alone, financial regulators globally imposed billions of dollars in fines for data privacy and consumer protection breaches, underscoring the financial and reputational risks involved.

- Increased regulatory oversight on data privacy and consumer rights.

- Mandatory compliance with frameworks like the Consumer Data Right (CDR).

- Need for enhanced data security and transparent customer consent processes.

- Potential for significant penalties and reputational damage due to non-compliance.

Regional Development and Community Support Policies

Bendigo Bank's community-focused approach resonates strongly with government initiatives aimed at fostering regional development and local economic vitality. Policies supporting regional growth, such as infrastructure investments and grants for small businesses, directly benefit the bank's operational model. For instance, the Australian government's continued investment in regional infrastructure, estimated at over $10 billion in the 2023-24 budget for various projects, creates a more robust economic environment for Bendigo Bank's customers and branches.

The bank's alignment with these political factors can translate into tangible advantages. Government support for SMEs, a core demographic for Bendigo Bank, often includes funding programs that the bank can facilitate or partner with. In 2024, the Boosting Female Founder Initiative, for example, provided significant grants to women-led businesses, many of which operate in regional Australia and could be potential clients for Bendigo Bank.

This symbiotic relationship fosters a supportive political landscape for Bendigo Bank's unique community banking model. The bank's ability to tap into government funding streams and its role in local economic development often lead to favorable regulatory considerations and enhanced community trust, which is crucial for its continued success.

- Government grants and funding programs for regional development create direct opportunities for Bendigo Bank.

- Infrastructure projects in regional areas stimulate economic activity, benefiting the bank's customer base.

- Policies supporting small and medium-sized enterprises (SMEs) align with Bendigo Bank's core business.

- The bank's community model benefits from a political environment that prioritizes local economic growth.

Government policies significantly shape the banking sector, influencing everything from interest rates to regulatory compliance. The Reserve Bank of Australia's (RBA) cash rate, which stood at 4.35% in early 2024, directly impacts Bendigo Bank's lending margins and net interest income. Changes in fiscal policy and government spending also affect economic conditions, influencing loan demand and credit risk for the bank.

Increased regulatory oversight, particularly concerning data privacy and consumer rights, is a growing political factor. Frameworks like the Consumer Data Right (CDR) necessitate robust data security and transparent customer consent processes for institutions like Bendigo Bank. Non-compliance can lead to substantial penalties, as seen with billions in fines globally in 2023 for data breaches, highlighting the critical need for adherence.

Bendigo Bank's community-focused model aligns well with government initiatives promoting regional development and supporting small businesses. Continued investment in regional infrastructure, with the Australian government allocating over $10 billion in the 2023-24 budget, creates a more favorable economic environment for the bank and its customers.

What is included in the product

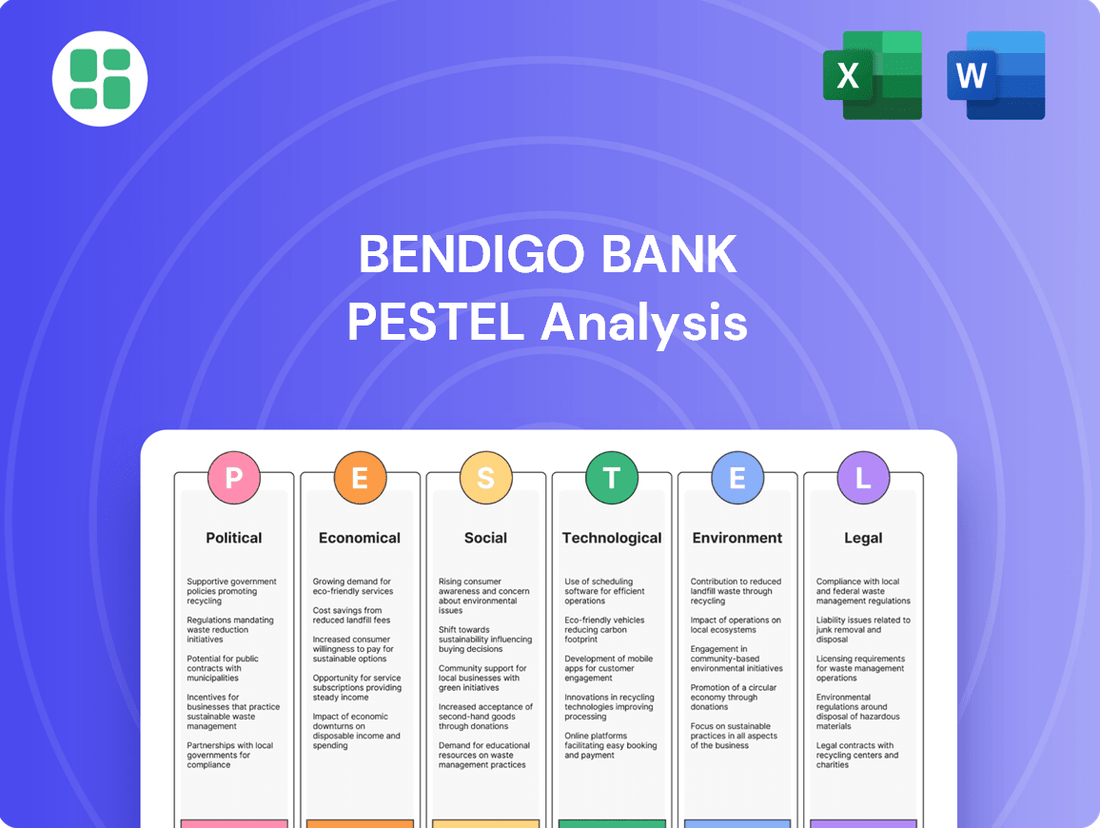

This PESTLE analysis explores how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, uniquely affect Bendigo Bank's operations and strategic positioning.

It offers a comprehensive evaluation of the opportunities and threats presented by these dynamic forces, providing actionable insights for strategic decision-making.

A concise Bendigo Bank PESTLE analysis that highlights key external factors impacting the financial sector, serving as a proactive tool to mitigate potential risks and inform strategic decision-making.

Economic factors

The Reserve Bank of Australia's cash rate, which stood at 4.35% as of early 2024, directly influences Bendigo Bank's net interest margin (NIM). This rate impacts the cost of funds for the bank and the rates it can charge on loans, directly affecting its profitability.

Changes in interest rates, such as the anticipated gradual decline in the cash rate throughout 2024 and into 2025, can alter borrowing demand from customers and the attractiveness of deposits. This requires Bendigo Bank to actively manage its balance sheet to adapt to these shifting market conditions.

Inflationary pressures in Australia have been a significant concern, with the Consumer Price Index (CPI) reaching 6.0% in the year to December 2023, a notable increase from previous years. This can reduce consumer spending power, potentially impacting demand for Bendigo Bank's lending products and services, and could also affect the ability of borrowers to service their loans.

Conversely, Australia's economic growth trajectory is crucial for Bendigo Bank. The Australian economy grew by 1.5% in the year to December 2023. A healthy economic environment generally leads to increased business investment and consumer confidence, which in turn drives higher demand for banking services such as mortgages and business loans, thereby boosting the bank's revenue and asset quality.

Consumer spending is a major driver for Bendigo Bank's lending products like mortgages and personal loans. In the March quarter of 2024, Australian retail trade turnover saw a modest increase of 0.1%, indicating a cautious consumer environment. High household debt, which stood at approximately 183% of disposable income in late 2023, presents a challenge, potentially impacting loan repayment capacity during economic slowdowns and influencing the bank's credit risk assessment.

Property Market Trends

The Australian property market's performance is a critical economic factor for Bendigo Bank, directly impacting its significant mortgage portfolio. Fluctuations in house prices and housing affordability influence both the demand for new home loans and the potential risk associated with existing ones. For instance, in the 12 months to May 2024, Australian capital city dwelling prices rose by 7.5%, according to CoreLogic, indicating a generally supportive environment for lending.

Investor sentiment and housing affordability are key drivers of loan volumes. As of Q1 2024, the national home loan approval rate hovered around 35-40%, reflecting a cautious but active market. A robust property market bolsters the bank's lending capacity and the value of its collateral, contributing to financial stability.

- House Price Growth: Australian capital city dwelling prices saw a 7.5% increase in the year to May 2024, supporting collateral values for Bendigo Bank.

- Housing Affordability: While prices are rising, affordability remains a concern, potentially moderating loan growth.

- Investor Sentiment: Positive investor sentiment can drive demand for mortgages, benefiting the bank's lending activities.

- Loan Approval Rates: National home loan approval rates in Q1 2024 were approximately 35-40%, indicating market activity.

Competition in the Financial Sector

The Australian financial sector is intensely competitive, featuring established major banks, agile smaller banks, and a growing number of non-bank lenders all aggressively pursuing market share. This dynamic environment places considerable pressure on Bendigo Bank's pricing strategies for its products and services, necessitating continuous innovation and clear differentiation to attract and retain its customer base. For instance, as of the first half of 2024, the average variable mortgage rate offered by the major banks hovered around 6.5%, while challenger banks and non-bank lenders often presented rates slightly lower, around 6.2-6.3%, demonstrating the pricing pressures Bendigo Bank faces.

Bendigo Bank actively utilizes its distinct community-focused banking model as a significant competitive advantage. This approach aims to foster deeper customer relationships and local economic engagement, setting it apart from more transaction-oriented competitors. The bank's commitment to community investment, evidenced by its 2023 financial year reporting over $10 million in community contributions, reinforces this differentiation strategy.

- Intense Competition: Major banks, smaller banks, and non-bank lenders actively compete for customers.

- Pricing Pressure: Competition necessitates competitive pricing on financial products and services.

- Innovation Imperative: Differentiation and innovation are key to attracting and retaining customers.

- Community Model Advantage: Bendigo Bank leverages its community focus as a unique selling proposition.

Economic factors significantly shape Bendigo Bank's operating environment, influencing lending volumes and profitability. The Reserve Bank of Australia's cash rate, at 4.35% in early 2024, directly impacts the bank's net interest margin by affecting funding costs and lending rates. Anticipated gradual rate decreases through 2024-2025 will necessitate balance sheet adjustments to manage shifting customer borrowing and deposit behaviour.

Inflation, recorded at 6.0% year-on-year to December 2023, can dampen consumer spending, potentially reducing demand for banking products and increasing credit risk for borrowers. Conversely, Australia's economic growth, which was 1.5% in the year to December 2023, supports increased business investment and consumer confidence, driving demand for banking services.

| Economic Factor | Data Point (2023-2024) | Impact on Bendigo Bank |

|---|---|---|

| RBA Cash Rate | 4.35% (Early 2024) | Influences Net Interest Margin (NIM) |

| Inflation (CPI) | 6.0% (Year to Dec 2023) | May reduce consumer spending, impact loan demand |

| Economic Growth | 1.5% (Year to Dec 2023) | Supports increased loan demand and asset quality |

| Capital City Dwelling Price Growth | 7.5% (Year to May 2024) | Strengthens collateral values for mortgage portfolio |

| Home Loan Approval Rate | 35-40% (Q1 2024) | Indicates market activity and lending opportunities |

Same Document Delivered

Bendigo Bank PESTLE Analysis

The Bendigo Bank PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a comprehensive breakdown of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Bendigo Bank.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

Australia's demographic landscape is notably changing, with a significant trend towards an ageing population. By 2024, the proportion of Australians aged 65 and over is projected to continue its upward trajectory, impacting demand for financial services. This shift directly influences the need for specialized banking products such as retirement planning, comprehensive wealth management solutions, and services facilitating intergenerational wealth transfer.

Bendigo Bank needs to strategically adapt its product development and marketing efforts to align with these evolving customer needs. Catering to the diverse requirements of different age cohorts and varied household structures, from single-person households to multi-generational families, is crucial for maintaining relevance and capturing market share in the coming years. For instance, the demand for aged care financing and advisory services is expected to grow substantially.

Bendigo Bank's success is deeply intertwined with its community-centric approach, fostering strong relationships built on trust. Societal values that champion local support and ethical conduct directly bolster the bank's reputation and customer loyalty. For instance, in 2023, Bendigo Bank reported a customer satisfaction score of 85%, a testament to its community engagement.

The general level of financial literacy in Australia directly impacts how individuals interact with banking services. A higher level of understanding can lead to more informed choices about loans, investments, and savings products. For instance, a 2023 survey indicated that only 56% of Australians felt confident managing their finances, highlighting a significant area for improvement.

Bendigo Bank has a clear opportunity to enhance financial literacy through targeted education programs. By empowering customers with better financial decision-making skills, the bank can foster deeper engagement and build stronger, more trusting long-term relationships. This proactive approach can also lead to increased product adoption and customer loyalty.

Changing Work Patterns and Lifestyles

The shift towards remote work and the gig economy significantly alters how people manage their money and engage with financial institutions. For instance, by the end of 2024, it's projected that over 30% of the global workforce will be participating in some form of freelance or contract work, a trend that necessitates flexible banking solutions. Bendigo Bank must evolve its digital platforms and product offerings to cater to these dynamic employment structures, ensuring seamless access and tailored support for a diverse clientele.

Adapting to these evolving work patterns means prioritizing digital accessibility and offering specialized financial products. This could include features that simplify income tracking for gig workers or provide flexible loan options that accommodate fluctuating incomes. By embracing these changes, Bendigo Bank can better serve its customers' evolving needs in the modern economic landscape.

Key adaptations for Bendigo Bank include:

- Enhanced digital banking platforms for 24/7 access and self-service options.

- Development of flexible financial products such as adaptable loan repayments and savings tools for irregular income streams.

- Targeted support and resources for individuals in non-traditional employment, like freelancers and contract workers.

Social Expectations for ESG and Sustainability

Societal pressure for businesses to adopt robust Environmental, Social, and Governance (ESG) practices is intensifying. Consumers are actively selecting brands that reflect their personal values on sustainability and social responsibility. For instance, a 2024 survey indicated that 68% of consumers consider a company's ESG performance when making purchasing decisions.

Bendigo Bank's established community-centric approach positions it well to meet these rising expectations. This focus not only resonates with ethically-minded customers but also appeals to investors prioritizing sustainable and responsible financial institutions. In 2024, ESG-focused funds saw significant inflows, with global sustainable investment assets reaching an estimated $37.4 trillion by the end of 2024, demonstrating a clear market trend.

- Growing consumer demand for sustainable products and services.

- Increased investor scrutiny of corporate ESG performance.

- Bendigo Bank's existing community engagement as a competitive advantage.

- The financial sector's role in driving societal sustainability goals.

Australia's aging population, with the 65+ demographic projected to rise significantly by 2024, necessitates specialized financial services like retirement planning and wealth management. Bendigo Bank's community focus, evidenced by an 85% customer satisfaction score in 2023, aligns with societal values of trust and local support, enhancing its reputation. The ongoing challenge of financial literacy, with only 56% of Australians confident in managing finances in 2023, presents an opportunity for Bendigo Bank to offer educational programs, fostering deeper customer relationships.

Technological factors

Bendigo Bank's digital transformation is a critical technological factor, with customer preferences heavily leaning towards mobile and online banking. In 2024, digital channels are no longer optional but essential for customer engagement and service delivery.

To maintain competitiveness, Bendigo Bank must consistently invest in and upgrade its digital offerings. This includes ensuring its mobile banking app and online portals provide a smooth, user-friendly, and secure experience. For instance, as of early 2024, a significant majority of banking transactions for many Australian banks are conducted digitally, highlighting the urgency of robust digital platforms.

As banking increasingly shifts online, the risk of cyberattacks and data breaches escalates significantly. Bendigo Bank must deploy advanced cybersecurity defenses and stringent data protection measures to secure customer data and preserve its reputation. Failure to do so can lead to substantial financial penalties and a loss of customer confidence.

In 2024, the financial services sector experienced a notable rise in sophisticated cyber threats, with phishing and ransomware attacks being particularly prevalent. According to industry reports, the average cost of a data breach for financial institutions in 2024 exceeded $5 million, highlighting the critical need for robust security investments.

Bendigo Bank's commitment to data protection is paramount, especially with evolving regulations like Australia's Security Legislation Amendment (Critical Infrastructure Protection) Act 2022, which imposes stricter cybersecurity obligations on critical entities, including financial services. Staying compliant with these evolving standards is essential for mitigating both financial and reputational damage.

Bendigo Bank's adoption of Artificial Intelligence (AI) and Machine Learning (ML) presents a powerful avenue for boosting efficiency, tailoring customer interactions, and strengthening risk oversight. These advanced technologies are instrumental in areas like fraud detection, credit assessment, and predictive modeling, with AI-powered chatbots already handling a significant portion of customer inquiries, freeing up human agents for more complex issues.

The bank is actively leveraging AI for enhanced fraud detection, which saw a notable reduction in fraudulent transactions in early 2024 compared to the previous year. Furthermore, ML algorithms are being refined for more accurate credit scoring, potentially expanding access to finance for a wider customer base while mitigating default risks. This strategic focus on AI and ML is crucial for maintaining a competitive edge in the evolving financial landscape.

Cloud Computing and Infrastructure Modernization

Leveraging cloud computing is a significant technological factor for Bendigo Bank, offering enhanced scalability, flexibility, and cost efficiency across its IT operations. This modernization is crucial for adapting to evolving digital demands.

Migrating core banking systems and sensitive data to cloud platforms can significantly accelerate innovation cycles and bolster data analytics capabilities. For instance, by mid-2024, many financial institutions reported substantial improvements in processing speeds and data insights post-cloud migration, with some seeing up to a 30% reduction in operational IT costs.

Modernizing its technological backbone is not just about efficiency; it's essential for future agility and resilience. This includes improving disaster recovery mechanisms, ensuring business continuity, and enabling faster deployment of new digital services to meet customer expectations in a competitive landscape.

- Scalability: Cloud infrastructure allows Bendigo Bank to easily scale its IT resources up or down based on demand, optimizing performance and cost.

- Innovation Acceleration: Cloud-native development and managed services facilitate quicker introduction of new products and features.

- Cost Efficiency: Transitioning from capital expenditure on physical hardware to operational expenditure on cloud services can lead to significant savings.

- Enhanced Analytics: Cloud platforms provide robust tools for advanced data analytics, enabling deeper customer insights and better risk management.

Fintech Collaboration and Open Banking

The financial technology (Fintech) landscape is rapidly evolving, with new players and innovative solutions constantly emerging. For Bendigo Bank, this presents a dual challenge and opportunity. The implementation of Open Banking, such as Australia's Consumer Data Right (CDR), is a significant technological factor. This allows customers to securely share their financial data with third-party providers, fostering greater competition and personalized services.

Bendigo Bank can strategically partner with Fintech companies to co-create and offer cutting-edge financial products. This collaboration allows them to tap into specialized expertise and accelerate the development of new services. For instance, a partnership could lead to more intuitive budgeting tools or streamlined loan application processes, directly addressing customer demand for enhanced digital experiences. By embracing this collaborative ecosystem, Bendigo Bank can remain competitive and adapt to the growing customer expectation for data-driven, personalized financial management.

The impact of these trends is already visible. By the end of 2024, it's projected that over 30% of Australian consumers will have utilized at least one CDR-enabled service. This highlights the growing adoption and the imperative for established institutions like Bendigo Bank to actively participate in this data-sharing environment.

- Fintech Partnerships: Collaborating with Fintechs can accelerate innovation and broaden service offerings.

- Open Banking Adoption: Initiatives like Australia's CDR are driving customer demand for data sharing and personalized services.

- Customer Expectations: Consumers increasingly expect seamless digital experiences and tailored financial management tools.

- Competitive Landscape: Embracing technological advancements is crucial for maintaining market share and relevance.

Bendigo Bank's technological advancement is heavily reliant on its digital transformation, with a strong emphasis on mobile and online banking platforms. By 2024, digital channels are no longer optional but a fundamental requirement for customer engagement and service delivery, reflecting a significant shift in customer preferences towards convenient, accessible banking solutions.

The bank must continuously invest in upgrading its digital infrastructure, ensuring its mobile app and online portals offer a seamless, secure, and user-friendly experience. This commitment is vital as a substantial majority of banking transactions for Australian banks are conducted digitally, underscoring the critical need for robust digital platforms to meet evolving customer demands and maintain competitiveness.

The increasing reliance on digital platforms also elevates the risk of cyberattacks and data breaches, necessitating advanced cybersecurity measures and stringent data protection protocols. For instance, in early 2024, financial institutions faced a notable increase in sophisticated cyber threats, with the average cost of a data breach exceeding $5 million, emphasizing the critical importance of investing in robust security to protect customer data and reputation.

Bendigo Bank's strategic adoption of Artificial Intelligence (AI) and Machine Learning (ML) is a key technological driver, enhancing operational efficiency, personalizing customer interactions, and strengthening risk management. These technologies are instrumental in areas like fraud detection and credit assessment, with AI-powered tools already managing a significant volume of customer inquiries by mid-2024, thereby improving service delivery and agent productivity.

Legal factors

Bendigo Bank operates within a stringent regulatory environment overseen by the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC). These bodies enforce prudential standards, capital adequacy ratios, and licensing requirements crucial for the bank's stability and customer protection. For instance, APRA's capital requirements, particularly for banks, are designed to ensure they can absorb unexpected losses. As of late 2024, the Common Equity Tier 1 (CET1) capital ratio for major Australian banks, including those of Bendigo Bank's scale, remained robust, generally exceeding regulatory minimums and international benchmarks like Basel III, demonstrating a strong compliance posture.

Bendigo Bank operates under stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws, necessitating significant investment in sophisticated systems for customer identification, transaction monitoring, and suspicious activity reporting to AUSTRAC. These regulations, updated regularly to combat evolving financial crime, demand continuous vigilance and comprehensive staff training to ensure compliance. Non-adherence can result in substantial penalties; for instance, in 2023, the Australian Transaction Reports and Analysis Centre (AUSTRAC) continued to enforce these laws, with significant enforcement actions against financial institutions for AML/CTF breaches, underscoring the critical need for robust compliance frameworks.

Bendigo Bank operates under stringent consumer credit and lending legislation, notably the National Consumer Credit Protection Act (NCCP). This act mandates responsible lending, clear disclosure, and robust consumer protections, ensuring fair practices and preventing predatory lending. Compliance is paramount for safeguarding customer trust and avoiding significant penalties. In 2023, the Australian Securities and Investments Commission (ASIC) reported that financial institutions paid over $200 million in refunds and compensation related to responsible lending breaches, highlighting the financial implications of non-compliance.

Privacy and Data Protection Laws (e.g., Privacy Act, CDR)

Bendigo Bank operates under strict privacy and data protection laws, notably the Privacy Act 1988 and the Consumer Data Right (CDR). These regulations mandate careful handling of customer data, impacting how the bank collects, uses, stores, and shares sensitive information. For instance, the CDR, which aims to give consumers more control over their data, requires banks to provide secure and standardized access to data for accredited third parties, a process that demands significant investment in technology and compliance frameworks.

Ensuring compliance involves implementing strong data governance, obtaining explicit customer consent, and maintaining advanced cybersecurity measures. Failure to protect customer data can result in severe penalties; in 2023, the Australian Information Commissioner issued a $1.5 million penalty to Optus for a significant data breach, highlighting the financial and reputational risks involved. Bendigo Bank must therefore prioritize these areas to maintain customer trust and avoid substantial fines.

Key legal factors impacting Bendigo Bank include:

- Privacy Act 1988: Governs the handling of personal information, requiring adherence to the Australian Privacy Principles (APPs).

- Consumer Data Right (CDR): Mandates data sharing for consumers, necessitating secure APIs and data management systems.

- Cybersecurity Regulations: Increasing focus on mandatory breach reporting and enhanced security standards for critical infrastructure, including financial institutions.

- Potential Penalties: Significant fines and reputational damage for non-compliance, as demonstrated by breaches in the broader financial sector.

Competition Law and Market Conduct

Bendigo Bank operates under Australia's robust competition laws, designed to prevent anti-competitive actions like price-fixing, abuse of market dominance, and unfair dealings. These regulations are critical for fostering a healthy and equitable financial services environment.

Compliance with these laws means Bendigo Bank must scrupulously review its business strategies, pricing structures, and overall market engagement. Adherence ensures the bank avoids costly legal penalties and upholds fair competition principles.

- Australian Competition and Consumer Commission (ACCC) oversight: The ACCC actively monitors the financial sector for breaches of competition law.

- Penalties for non-compliance: Fines for breaches can be substantial, impacting profitability and reputation. For instance, in 2023, the ACCC secured significant penalties against financial institutions for misconduct.

- Market conduct scrutiny: Bendigo Bank's digital offerings and customer agreements are regularly assessed for potential anti-competitive elements.

Bendigo Bank's operations are heavily shaped by Australian financial services legislation, including the Banking Act 1959 and the Corporations Act 2001. These acts establish the framework for prudential regulation, corporate governance, and consumer protection, with APRA and ASIC as key regulators. For example, APRA's ongoing focus on strengthening bank resilience means that capital requirements, particularly Common Equity Tier 1 (CET1) ratios, remain a critical compliance area; major Australian banks generally maintained CET1 ratios well above the 10.5% minimum in late 2024.

The bank must also navigate evolving consumer protection laws, such as those related to responsible lending and product suitability, which are actively enforced by ASIC. In 2023, ASIC reported that financial institutions provided over $200 million in refunds and compensation for responsible lending breaches, underscoring the significant financial implications of non-compliance.

Furthermore, stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) legislation, overseen by AUSTRAC, requires continuous investment in compliance systems and training to prevent financial crime. Recent enforcement actions in the broader financial sector highlight the substantial penalties, including multi-million dollar fines, that can be imposed for AML/CTF failures.

Bendigo Bank's commitment to data privacy under the Privacy Act 1988 and the Consumer Data Right (CDR) framework is also a significant legal consideration. The CDR, in particular, necessitates secure data sharing capabilities, with non-compliance risks amplified by the $1.5 million penalty issued to Optus in 2023 for a data breach, demonstrating the severe consequences of inadequate data protection.

| Legislation/Regulation | Key Requirement | Enforcing Body | Impact/Example |

|---|---|---|---|

| Banking Act 1959 | Prudential standards, capital adequacy | APRA | Ensures financial stability; CET1 ratios generally above 10.5% in late 2024 |

| Corporations Act 2001 | Corporate governance, disclosure | ASIC | Ensures fair market practices and investor protection |

| National Consumer Credit Protection Act | Responsible lending, consumer disclosure | ASIC | Led to over $200 million in refunds/compensation in 2023 for breaches |

| AML/CTF Act | Transaction monitoring, reporting | AUSTRAC | Requires robust systems to combat financial crime; significant fines for non-compliance |

| Privacy Act 1988 / CDR | Data protection, data sharing | OAIC | Mandates secure data handling; Optus received a $1.5 million penalty in 2023 for breach |

Environmental factors

Climate change presents significant physical risks for Bendigo Bank, with extreme weather events like floods and droughts becoming more common and severe. These events directly impact the bank's loan portfolios, potentially leading to increased defaults from property damage or agricultural losses, especially in vulnerable regional areas.

For instance, the Australian Bureau of Meteorology reported that 2023 was Australia's warmest year on record, with widespread impacts from extreme weather. Bendigo Bank must therefore integrate robust climate risk assessments into its lending and investment strategies to ensure long-term portfolio resilience and protect its financial stability.

The global drive towards decarbonization presents significant transition risks for Bendigo Bank. As economies shift to lower-carbon models, industries heavily reliant on fossil fuels face increased regulatory scrutiny, technological disruption, and evolving market demands. This could impact the creditworthiness of borrowers in sectors like mining, agriculture, and heavy manufacturing, potentially leading to increased loan defaults.

Bendigo Bank must proactively assess its exposure to these carbon-intensive sectors within its loan portfolio. For instance, by mid-2024, financial institutions are increasingly pressured to disclose their financed emissions. Failure to adapt lending strategies could result in stranded assets and a decline in the value of collateral held against loans to these industries.

The bank's strategy needs to incorporate robust climate-related financial risk assessments. This involves understanding how policy changes, such as carbon pricing mechanisms or stricter emissions standards, might affect borrowers. By identifying and potentially reducing exposure to high-transition-risk sectors, Bendigo Bank can mitigate potential financial losses and align its operations with a sustainable future.

The demand for sustainable finance and Environmental, Social, and Governance (ESG) investments is rapidly increasing. In 2024, global sustainable debt issuance reached a new high, with projections suggesting continued growth through 2025, driven by both retail and institutional investors seeking to align their capital with ethical and environmental values.

Bendigo Bank is well-positioned to capitalize on this trend by expanding its offering of green loans, sustainable investment portfolios, and socially responsible banking products. This strategic move can attract environmentally conscious customers and investors, enhancing the bank's market differentiation and reinforcing its community-focused ethos.

Resource Scarcity and Operational Footprint

Concerns over resource scarcity, such as water and energy, are becoming more prominent, directly impacting operational costs and risk for financial institutions like Bendigo Bank. The bank's own environmental footprint, encompassing energy use and waste generation across its branches and data centers, is under increasing scrutiny from stakeholders and regulators.

Bendigo Bank is actively addressing these challenges through various initiatives. For instance, in FY23, the bank reported a 10% reduction in Scope 1 and 2 greenhouse gas emissions compared to its FY20 baseline, demonstrating a commitment to energy efficiency. They are also focusing on sustainable procurement practices and waste reduction programs to minimize their operational impact.

These efforts are crucial for enhancing Bendigo Bank's reputation and ensuring long-term operational sustainability. Demonstrating environmental responsibility not only aligns with growing societal expectations but also mitigates potential regulatory risks and can attract environmentally conscious investors and customers.

- Energy Efficiency: Continued investment in energy-efficient technologies for its physical and digital infrastructure.

- Waste Reduction: Implementing programs to decrease waste generation, with a target of 75% of waste diverted from landfill by 2025.

- Sustainable Procurement: Prioritizing suppliers with strong environmental credentials and ethical practices.

- Water Management: Monitoring and managing water consumption at its facilities, particularly in water-stressed regions.

Regulatory and Reporting Requirements for Climate Risk

Regulators such as the Australian Prudential Regulation Authority (APRA) are intensifying their focus on climate-related financial risks. APRA's guidance, including its prudential standard CPS 230 Operational Risk Management, now explicitly requires institutions like Bendigo Bank to assess and manage these emerging risks. This means Bendigo Bank must actively disclose its climate impact and demonstrate resilience, often by adhering to international frameworks like the Task Force on Climate-related Financial Disclosures (TCFD). For instance, in 2024, APRA continued to emphasize the importance of integrating climate risk into governance and risk management frameworks, with a particular focus on scenario analysis and data capabilities.

Bendigo Bank faces a landscape of evolving reporting mandates. These requirements are designed to provide stakeholders with a clearer understanding of how climate change could affect the bank's financial performance and stability. The expectation is for proactive compliance and transparent disclosure, which are critical not only for meeting regulatory obligations but also for maintaining the trust and confidence of investors, customers, and the broader community. The push for greater transparency is evident in the increasing adoption of sustainability reporting standards globally, with many financial institutions aiming to align their disclosures by 2025.

- APRA's CPS 230: Mandates assessment and management of climate-related financial risks.

- TCFD Alignment: Increasing expectation for disclosure following the Task Force on Climate-related Financial Disclosures framework.

- Stakeholder Confidence: Proactive compliance and transparent reporting are vital for maintaining trust in 2024 and beyond.

Bendigo Bank must navigate increasing regulatory scrutiny on climate-related financial risks, as exemplified by APRA's CPS 230, requiring robust assessment and management. This evolving landscape necessitates alignment with frameworks like TCFD for transparent disclosure, crucial for stakeholder confidence through 2025.

The growing demand for sustainable finance presents a significant opportunity for Bendigo Bank. By expanding its green loan and ESG investment offerings, the bank can attract environmentally conscious customers and investors, enhancing its market position and reinforcing its community focus.

Addressing its own environmental footprint is paramount, with initiatives like reducing greenhouse gas emissions by 10% (FY23 vs FY20 baseline) and diverting 75% of waste from landfill by 2025 demonstrating commitment. These actions bolster reputation and operational sustainability.

| Environmental Factor | Impact on Bendigo Bank | Key Data/Initiatives (2024/2025 Focus) |

|---|---|---|

| Climate Change Physical Risks | Increased loan defaults from extreme weather events (floods, droughts). | 2023 was Australia's warmest year on record. Integration of climate risk assessments into lending. |

| Transition Risks (Decarbonization) | Creditworthiness of borrowers in fossil fuel-reliant sectors may decline. | Pressure for financed emissions disclosure by mid-2024. Risk of stranded assets in high-carbon sectors. |

| Sustainable Finance Demand | Opportunity to attract ESG-conscious customers and investors. | Global sustainable debt issuance reached new highs in 2024, with continued growth projected. Expansion of green loans and ESG portfolios. |

| Resource Scarcity & Operational Footprint | Increased operational costs and stakeholder scrutiny on environmental impact. | 10% reduction in Scope 1 & 2 GHG emissions (FY23 vs FY20). Target of 75% waste diversion from landfill by 2025. |

| Regulatory Focus (Climate Risk) | Mandatory assessment and management of climate-related financial risks. | APRA's CPS 230 guidance. Increasing expectation for TCFD alignment in disclosures. |

PESTLE Analysis Data Sources

Our Bendigo Bank PESTLE analysis is constructed using a robust blend of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the Australian banking sector.