Bendigo Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bendigo Bank Bundle

Bendigo Bank faces intense competition from rivals and the constant threat of new entrants disrupting the market. Understanding the power of its suppliers and the availability of substitutes is crucial for its strategic planning.

This preview is just the beginning. The full analysis provides a complete strategic snapshot with force-by-force ratings, visuals, and business implications tailored to Bendigo Bank.

Suppliers Bargaining Power

Bendigo Bank's core capital providers are its depositors, a very broad and varied group of customers. This wide spread of depositors means that no individual or small group can significantly influence the interest rates the bank offers. In 2024, Bendigo Bank reported total customer deposits of approximately $100 billion, highlighting the sheer scale and diversity of its deposit base.

The bank's focus on community banking further strengthens its position. Customers often choose Bendigo Bank due to local connections and support for their communities, not just the best available interest rates. This loyalty makes deposits less sensitive to small rate changes, effectively lowering the bargaining power of these 'suppliers' of capital.

Bendigo Bank, while heavily reliant on stable retail deposits, also taps into wholesale funding markets. These markets are populated by sophisticated investors and lenders who wield significant influence. For instance, during periods of market stress, such as the liquidity concerns seen in early 2023, wholesale funding costs can escalate rapidly as these suppliers demand higher rates.

The bargaining power of these wholesale funding suppliers is a key consideration for Bendigo Bank. When liquidity tightens, these institutional players can dictate more stringent terms and higher interest rates, directly impacting the bank's cost of funds. This dynamic was evident in 2023, with increased volatility in wholesale markets affecting borrowing costs for many financial institutions.

Technology and software providers hold significant bargaining power over banks like Bendigo. As financial institutions increasingly rely on specialized core banking systems, advanced cybersecurity, and sophisticated digital platforms, these vendors become indispensable. Bendigo Bank's ongoing digital transformation, including its core system consolidation and cloud migration, amplifies this power. The proprietary nature of these critical technologies and the substantial costs associated with switching vendors mean that banks often have limited alternatives, giving suppliers considerable leverage.

Labor Market Dynamics

The availability and cost of skilled labor, particularly in technology, finance, and customer service, form a critical supplier group for Bendigo Bank. Wage inflation and intense competition for talent directly impact operating expenses and profitability.

In 2024, the Australian finance sector continued to experience a tight labor market, with reports indicating significant demand for IT and digital specialists. For instance, a mid-2024 survey highlighted that average salaries for cybersecurity professionals in Australian banking saw an increase of approximately 8-10% year-on-year, directly influencing labor costs.

- Talent Acquisition Costs: Increased competition for skilled professionals in areas like data analytics and digital banking can drive up recruitment and onboarding expenses.

- Wage Pressures: General wage inflation across the economy, coupled with sector-specific demand, puts upward pressure on employee compensation packages.

- Retention Strategies: Bendigo Bank's commitment to personalized service necessitates attracting and retaining staff with strong interpersonal skills, making employee retention a key strategic imperative.

Regulatory Compliance Services

Suppliers of regulatory compliance services, such as legal, auditing, and specialized consulting firms, wield considerable influence over Bendigo Bank. The intricate and ever-changing financial regulations in Australia necessitate these expert services, making them crucial for the bank’s operations.

Bendigo Bank’s need to comply with stringent prudential standards, operational resilience frameworks, and financial accountability laws means these specialized suppliers are indispensable. This reliance can translate into significant costs for the bank, reflecting the suppliers' bargaining power.

- High Demand for Specialized Expertise: The complexity of Australian financial regulations, including those related to anti-money laundering (AML) and Know Your Customer (KYC) requirements, drives demand for niche compliance skills.

- Regulatory Burden: In 2024, Australian banks faced ongoing scrutiny and potential fines for non-compliance, underscoring the critical nature of regulatory advice and audits. For instance, the Australian Prudential Regulation Authority (APRA) continues to enforce rigorous capital and risk management standards.

- Limited Number of Qualified Suppliers: The pool of firms with proven expertise in navigating specific Australian financial regulatory frameworks is not vast, giving established providers greater leverage in pricing and contract terms.

- Switching Costs: The effort and expense involved in onboarding new compliance providers, including training and data integration, create a barrier to switching, further solidifying the power of incumbent suppliers.

Bendigo Bank's bargaining power with its core capital providers, its depositors, is relatively low due to the sheer scale and diversity of its customer base. With approximately $100 billion in customer deposits in 2024, no single depositor or small group can significantly influence interest rates.

The bank's community focus further reduces supplier power, as customer loyalty often outweighs minor rate differentials. However, wholesale funding markets present a different dynamic, where sophisticated investors can exert considerable influence, especially during times of market stress, as seen with liquidity concerns in early 2023.

Technology and software providers hold significant leverage over Bendigo Bank due to the increasing reliance on specialized, proprietary systems. The high costs and complexity of switching vendors for critical functions like core banking and cybersecurity amplify these suppliers' bargaining power.

Skilled labor, particularly in IT and digital roles, represents another area where supplier bargaining power is notable. Wage inflation and intense competition for talent in 2024, with cybersecurity professionals seeing an 8-10% salary increase, directly impact Bendigo Bank's operational costs.

What is included in the product

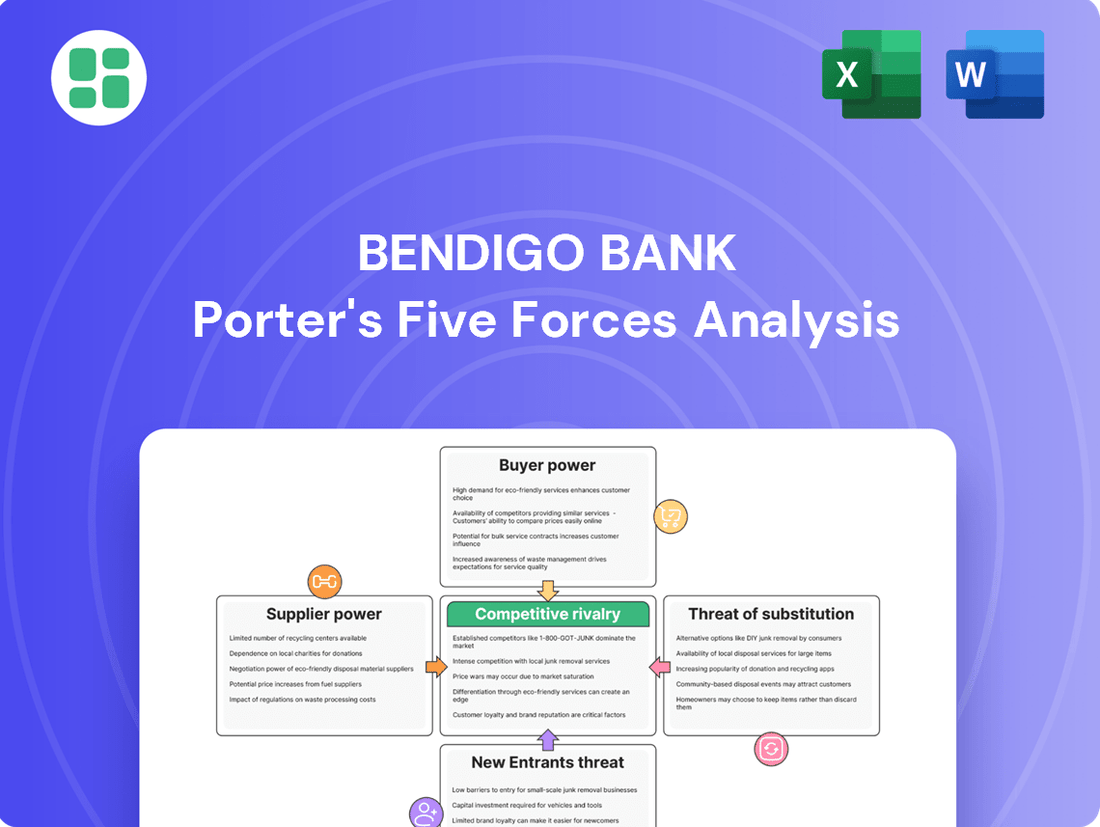

Tailored exclusively for Bendigo Bank, this analysis dissects the competitive forces shaping its market, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the banking sector.

Bendigo Bank's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive forces, perfect for quick strategic decision-making.

Customers Bargaining Power

Customers in the Australian banking sector face a landscape brimming with choices, from the dominant 'Big Four' to regional banks, credit unions, and an expanding field of neobanks and fintech innovators. This abundance of alternatives empowers customers, allowing them to readily switch providers if they encounter superior interest rates, enhanced services, or more user-friendly digital platforms. As of early 2024, the Australian Prudential Regulation Authority (APRA) reported that while the major banks still hold a significant market share, the growth of smaller institutions and digital-only banks is steadily increasing competitive pressure.

For everyday banking needs like checking accounts and basic home loans, customers don't face many hurdles when switching providers. This is especially true now, with digital banking making it simpler than ever to move your money. For instance, in 2023, the Australian fintech sector saw significant growth, with new players offering competitive rates and lower fees, directly impacting traditional banks like Bendigo.

Online comparison sites and financial aggregators have made it incredibly easy for customers to see what different banks offer. This means they can quickly compare things like interest rates and fees, which gives them more power. For instance, in 2024, many consumers actively used these tools to find the best deals on home loans and savings accounts, putting pressure on banks like Bendigo to remain competitive.

Community Bank Model Loyalty

Bendigo Bank's Community Bank model cultivates deep customer loyalty, particularly in the local areas where these branches operate. This model directly reinvests profits back into the community, creating a strong sense of shared benefit and connection. This localized approach often translates into a reduced sensitivity to price competition, as customers prioritize the tangible community support and personalized banking experience. For instance, in 2024, Bendigo Bank continued to highlight its community investment, with many Community Bank branches reporting strong customer retention rates, often exceeding national averages for traditional banking models.

The bargaining power of customers is somewhat tempered by the unique value proposition of Bendigo's Community Bank model. Customers are drawn to the tangible benefits their banking provides to their local area, such as funding for community projects. This shared purpose creates a bond that makes customers less inclined to switch for minor cost advantages. In 2024, customer satisfaction surveys for Bendigo's Community Bank network consistently showed high scores related to community impact and personal service, indicating a strong defense against customer attrition driven by price alone.

- Community Focus: Bendigo Bank's Community Bank model fosters strong local ties, reducing customer price sensitivity.

- Loyalty Drivers: Customers value personalized service and direct community reinvestment, creating a loyal customer base.

- Mitigated Bargaining Power: The unique model somewhat offsets the typical bargaining power of customers in banking.

Interest Rate Environment Sensitivity

Customer bargaining power is significantly influenced by the interest rate environment. When rates rise, customers can more easily switch to institutions offering better deposit yields. Conversely, falling rates give borrowers more leverage to negotiate lower loan rates or refinance.

The anticipation of interest rate cuts in 2025 is a key factor. This outlook empowers borrowers to shop around for more favorable loan terms. For instance, if the Reserve Bank of Australia (RBA) were to lower the cash rate, as some economists predict for mid-2025, this would likely translate into reduced borrowing costs across the market.

- Interest Rate Sensitivity: Bendigo Bank's customers, particularly those seeking loans or holding deposits, have increased bargaining power when interest rates fluctuate.

- Borrower Leverage: In a declining rate scenario, borrowers are more inclined to refinance and seek out the most competitive loan products, potentially increasing pressure on Bendigo Bank's net interest margins.

- Deposit Competition: Conversely, rising rates incentivize depositors to chase higher yields, forcing banks to compete more aggressively on deposit pricing.

- 2025 Outlook: Forecasts for potential RBA rate cuts in 2025 suggest a period where borrower bargaining power could strengthen, prompting a strategic review of lending rates and product offerings.

The bargaining power of customers for Bendigo Bank is moderately high, driven by the competitive Australian banking landscape and the ease of switching providers. While Bendigo's Community Bank model fosters loyalty, customers still have access to numerous alternatives offering competitive rates and services, particularly in the digital banking space.

The availability of online comparison tools in 2024 allows customers to easily assess and switch between banks based on interest rates and fees. This transparency directly influences Bendigo's pricing strategies and service offerings, as customers are empowered to seek better value elsewhere.

Customer bargaining power is amplified by interest rate movements. For instance, the anticipation of potential RBA rate cuts in 2025 could empower borrowers to refinance, increasing pressure on Bendigo Bank to offer competitive loan terms.

| Factor | Impact on Bendigo Bank | Customer Action Example (2024/2025) |

| Abundance of Choice | Moderate pressure on pricing and service differentiation. | Switching to a neobank for lower transaction fees. |

| Ease of Switching | Requires continuous innovation and competitive offerings. | Using comparison sites to find a better mortgage rate. |

| Interest Rate Sensitivity | Increased leverage for borrowers in a falling rate environment. | Refinancing a home loan due to predicted rate cuts in 2025. |

| Community Bank Loyalty | Mitigates some price sensitivity, but not total immunity. | Prioritizing local impact over a marginal rate difference. |

What You See Is What You Get

Bendigo Bank Porter's Five Forces Analysis

This preview showcases the complete Bendigo Bank Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the Australian banking sector. You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, providing actionable insights into industry rivalry, buyer and supplier power, the threat of new entrants, and the impact of substitutes.

Rivalry Among Competitors

The Australian banking sector is highly concentrated, with the 'Big Four' – Commonwealth Bank, Westpac, ANZ, and NAB – controlling a substantial portion of the market. As of early 2024, these major banks collectively held over 70% of total assets in the Australian financial system, illustrating their immense market power.

Bendigo Bank, as a regional bank, contends with intense rivalry from these dominant players. The Big Four leverage significant advantages, including greater economies of scale in operations, vast branch networks across the country, and considerably larger marketing budgets, which allow them to attract and retain customers more effectively.

Competition is incredibly tough in banking, especially for home loans and attracting customer savings. Banks are constantly trying to outdo each other on price, often by changing interest rates or offering special deals. This makes it harder for everyone, including Bendigo Bank, to maintain healthy profit margins on the money they lend and borrow.

In 2024, this price war was a major factor, and it’s anticipated to remain a significant challenge throughout 2025. For instance, the average variable home loan rate offered by major Australian banks hovered around 6.5% in early 2024, with smaller lenders and neobanks often competing at or below this level, squeezing margins for all players.

Bendigo Bank, like all major financial institutions, faces intense competition driven by digital transformation. Banks are pouring billions into technology to improve customer service and streamline operations. For instance, in the 2023 financial year, the Australian banking sector saw significant investment in digital capabilities, with major banks allocating substantial portions of their IT budgets towards cloud migration, AI, and cybersecurity to stay competitive.

This relentless innovation race fuels rivalry as institutions vie for market share through advanced digital products and services. Bendigo's own neobank, Up, exemplifies this trend, offering a streamlined digital banking experience that challenges traditional models. The success of such digital-first offerings forces incumbents to continually enhance their own platforms, creating a dynamic and highly competitive landscape where technological prowess is a key differentiator.

Regulatory Scrutiny and Compliance Costs

The Australian banking sector faces intense regulatory scrutiny, leading to significant and ever-changing compliance costs for all participants. These ongoing expenses, driven by prudential requirements and consumer protection laws, directly impact profitability and operational efficiency.

While stringent regulations can deter new entrants, they also create a substantial operational burden. For instance, the Australian Prudential Regulation Authority (APRA) continuously updates capital adequacy requirements and risk management frameworks, necessitating ongoing investment in systems and expertise.

- Increased Operational Costs: Banks must invest heavily in technology, personnel, and processes to meet evolving compliance standards, such as those related to anti-money laundering (AML) and Know Your Customer (KYC) regulations.

- Impact on Smaller Institutions: Smaller banks may find it disproportionately challenging to absorb these rising compliance costs compared to larger, more established institutions, potentially widening the competitive gap.

- Focus on Risk Management: The regulatory environment forces all banks, including Bendigo Bank, to prioritize robust risk management frameworks, which can divert resources from other strategic initiatives.

- Potential for Fines and Penalties: Non-compliance can result in substantial financial penalties and reputational damage, underscoring the critical importance of adherence.

Community-Centric Niche vs. Scale Play

Bendigo Bank's deliberate focus on community and regional banking creates a strong differentiator against larger, more national competitors. This approach fosters deep customer loyalty and a unique market position, as evidenced by its strong presence in its core markets. For instance, as of June 30, 2024, Bendigo and Adelaide Bank reported a customer base of approximately 2.4 million, with a significant portion concentrated in regional Australia.

However, this community-centric niche inherently limits its operational scale compared to the Big Four banks. While this strategy builds resilience and customer connection, it can constrain Bendigo Bank's ability to leverage economies of scale for aggressive pricing or offer the sheer breadth of products and services available from its larger rivals. In 2024, the Australian banking landscape continued to see intense competition, with major banks often using their scale to offer more competitive rates on certain products.

- Community Focus: Bendigo Bank’s strategy cultivates strong customer loyalty and a distinct brand identity, setting it apart from generalized national banks.

- Scale Limitations: The niche approach means Bendigo Bank operates at a smaller scale, potentially impacting its ability to compete on price or product diversity against larger institutions.

- Competitive Landscape: In 2024, the banking sector remained highly competitive, with large banks leveraging their scale to offer competitive pricing and extensive product suites.

Competitive rivalry in the Australian banking sector is fierce, primarily driven by the dominance of the 'Big Four' banks. These larger institutions possess significant advantages in scale, marketing, and operational efficiency, allowing them to exert considerable influence on pricing and product offerings.

Bendigo Bank, as a regional player, faces constant pressure to compete on price, particularly in key areas like home loans and savings accounts, as seen with average variable home loan rates around 6.5% in early 2024. This intense competition necessitates continuous investment in digital capabilities to remain relevant.

| Competitor | Market Share (Approx. Early 2024) | Key Competitive Strengths |

|---|---|---|

| Commonwealth Bank | ~20-25% | Scale, Digital Innovation, Brand Loyalty |

| Westpac | ~18-23% | Extensive Branch Network, Diverse Product Range |

| ANZ | ~17-22% | International Presence, Corporate Banking Strength |

| NAB | ~16-21% | Business Banking Focus, Customer Service Reputation |

| Bendigo Bank | ~1-2% | Community Focus, Regional Strength, Digital Offering (Up) |

SSubstitutes Threaten

Neobanks and digital-only banks pose a considerable threat of substitution for traditional banks like Bendigo Bank. These agile competitors often provide a more streamlined, mobile-centric banking experience with attractive features and lower fees, directly targeting digitally inclined consumers. For instance, by the end of 2023, neobanks globally continued to gain traction, with many reporting substantial user growth, indicating a clear shift in customer preference towards digital-first solutions.

Fintech companies and specialized lenders present a significant threat of substitutes for traditional banks like Bendigo. These disruptors offer streamlined, often digital-first alternatives for services like lending and payments. For instance, peer-to-peer lending platforms and Buy Now Pay Later services are directly competing for consumer and business credit needs.

The growth of these fintech alternatives is substantial. In 2024, the global fintech market was projected to reach over $1.1 trillion, indicating a strong customer preference for these new financial models. This trend means customers might bypass traditional banking channels for more specialized and convenient digital solutions.

Customers increasingly turn to direct investment and wealth management platforms, bypassing traditional savings accounts. For instance, the Australian Securities Exchange (ASX) reported a significant increase in retail investor participation, with online brokers facilitating a growing volume of transactions. These platforms offer diverse investment options, from shares to managed funds, providing alternatives to bank-held deposits and reducing reliance on traditional banking products for wealth growth.

Cryptocurrencies and Decentralized Finance (DeFi)

Cryptocurrencies and decentralized finance (DeFi) present a nascent but growing threat of substitutes for traditional banking services. These technologies enable value storage, fund transfers, and lending outside of conventional financial institutions. As of early 2024, the total market capitalization of cryptocurrencies has seen significant fluctuations, with some estimates placing it in the trillions of dollars at its peak, indicating substantial user engagement and investment.

The appeal of DeFi lies in its potential for higher yields on deposits and more efficient transaction processing, directly challenging incumbent banks. For instance, DeFi lending protocols have offered annual percentage yields (APYs) significantly exceeding those of traditional savings accounts, attracting users seeking better returns. This trend is particularly relevant for younger, tech-savvy demographics who are more inclined to explore alternative financial systems.

While mainstream adoption is still developing, the underlying technology and the increasing accessibility of crypto wallets and exchanges mean this threat is likely to grow. By mid-2024, the number of global cryptocurrency users is projected to surpass 500 million, highlighting a substantial and expanding user base that could shift away from traditional banking. This evolving landscape necessitates that Bendigo Bank monitor and potentially adapt to these alternative financial channels.

- Growing User Base: Global cryptocurrency users are expected to exceed 500 million by mid-2024.

- Attractive Yields: DeFi lending protocols have offered significantly higher APYs than traditional banks.

- Technological Maturation: Advances in blockchain and DeFi are making these alternatives more robust and user-friendly.

- Demographic Shift: Younger generations are more open to adopting and utilizing decentralized financial services.

Internal Corporate Finance and Treasury Solutions

Large corporations are increasingly building robust internal treasury and finance departments. These internal teams can directly access capital markets for funding, bypassing traditional bank services. For example, in 2024, many large Australian companies continued to tap into bond markets for significant portions of their capital requirements, reducing their reliance on bank loans.

This trend presents a significant threat of substitution for banks like Bendigo. Sophisticated clients can manage their own cash, investments, and even complex hedging strategies internally, diminishing the need for external treasury solutions. This shift is particularly pronounced among companies with substantial financial expertise and direct access to diverse funding sources.

- Internal Treasury Management: Many large firms now possess the in-house capability to manage liquidity, execute foreign exchange transactions, and optimize working capital, directly substituting bank-offered treasury services.

- Direct Capital Market Access: Companies can issue commercial paper, corporate bonds, or even equity directly, circumventing the need for bank intermediation in raising capital. In 2023, global corporate bond issuance reached trillions of dollars, highlighting this alternative.

- Fintech Solutions: Specialized financial technology firms offer integrated platforms for treasury management, payments, and financial planning, providing powerful alternatives to traditional banking solutions.

The threat of substitutes for Bendigo Bank is multifaceted, encompassing digital-first competitors, specialized fintech solutions, and even direct capital market access by corporations. These alternatives often offer greater convenience, lower costs, or more tailored services, directly challenging traditional banking models. For instance, the continued growth of neobanks and the increasing adoption of decentralized finance platforms highlight a clear customer appetite for innovation and efficiency that bypasses established institutions.

Fintech companies are particularly adept at unbundling banking services, offering specialized solutions for payments, lending, and investments that can be more attractive than a bank's all-encompassing offering. The global fintech market's projected growth to over $1.1 trillion in 2024 underscores the significant customer shift towards these agile, digitally-native providers.

Furthermore, the rise of direct investment platforms and the increasing sophistication of corporate treasury functions mean that customers have more options than ever for managing their wealth and capital needs. This diversifies the competitive landscape, forcing traditional banks to adapt to evolving customer preferences and technological advancements.

Entrants Threaten

The Australian banking industry presents formidable barriers to entry, primarily due to stringent regulatory requirements overseen by the Australian Prudential Regulation Authority (APRA). These regulations mandate substantial capital reserves, robust risk management systems, and adherence to complex licensing procedures, making it exceedingly difficult and expensive for newcomers to establish a foothold.

In 2024, the capital adequacy ratios for Australian banks, as stipulated by APRA, remain high, ensuring financial stability but also demanding significant upfront investment. For instance, Common Equity Tier 1 (CET1) ratios are a critical measure, and exceeding these benchmarks requires substantial capital infusion, deterring potential entrants who lack the financial capacity to meet these rigorous standards.

Furthermore, the established reputation and trust that incumbent banks like Bendigo Bank have cultivated over years of operation represent a significant intangible barrier. New entrants would need to invest heavily in marketing and customer acquisition to build comparable brand recognition and confidence, a task made even more challenging by the existing loyalty to well-known financial institutions.

Bendigo Bank, like other established financial institutions, leverages decades of brand recognition and deeply ingrained customer trust, which are paramount in the sensitive area of financial services. This existing loyalty acts as a significant barrier for newcomers. For instance, in 2024, customer acquisition costs for digital-first banks can still be substantial, often exceeding AUD 100 per customer, highlighting the expense of overcoming established trust.

Existing major banks, particularly the Big Four, benefit from substantial economies of scale across their operations, technology investments, and funding costs. This allows them to offer highly competitive pricing and a broad spectrum of financial products, making it difficult for new players to match their cost efficiencies.

Furthermore, these established institutions boast extensive physical branch networks and sophisticated digital platforms, representing a significant barrier to entry. For instance, as of June 2024, the Big Four banks in Australia collectively operated thousands of branches and millions of digital users, a footprint that would require immense capital and time for a new entrant to replicate.

Emergence of Neobanks and Fintechs as 'Challengers'

While traditional banking faces high barriers to entry, the financial services landscape is being reshaped by neobanks and fintech companies. These agile, technology-first firms are increasingly challenging incumbent players by focusing on specific market niches and customer segments. Their lower operating costs and innovative digital offerings allow them to attract customers, particularly younger demographics, and chip away at market share.

The threat of new entrants is amplified by the digital nature of these challengers. For instance, in 2024, the global fintech market was valued at over $11 trillion, demonstrating significant growth and investment. These new players often bypass the extensive physical infrastructure and legacy systems that burden traditional banks like Bendigo Bank, enabling them to offer more competitive pricing and user-friendly experiences.

Key aspects of this threat include:

- Niche Specialization: Fintechs often target underserved or specific customer needs, such as international money transfers or small business lending, creating initial footholds.

- Lower Cost Structures: Digital-only operations reduce overhead, allowing for more aggressive pricing strategies.

- Technological Agility: Rapid adoption of new technologies enables faster product development and adaptation to market changes.

- Customer Acquisition: Innovative marketing and user experience can attract customers away from traditional banks.

Technological Advancements and Digital Disruption

Technological advancements, especially in cloud computing, APIs, and artificial intelligence, are lowering the barriers to entry in banking. These innovations reduce the need for massive, traditional IT infrastructure, allowing agile, tech-savvy companies to enter the market more easily. For instance, the rise of neobanks, digital-only banks, demonstrates this trend, with many establishing operations with significantly lower overheads than incumbent institutions. While regulatory compliance still presents a considerable challenge, the digital disruption is undeniably making market entry more feasible for new players.

The threat of new entrants is influenced by several factors:

- Reduced Infrastructure Costs: Cloud computing and open banking APIs decrease the capital expenditure required for new financial service providers.

- Digital Agility: New entrants can leverage modern technology stacks to offer more streamlined and customer-centric digital experiences, often at a lower cost.

- Regulatory Hurdles: Despite technological enablers, stringent regulations in the banking sector remain a significant deterrent for many potential new entrants.

- Customer Loyalty and Trust: Established banks like Bendigo Bank benefit from long-standing customer relationships and a high degree of trust, which new entrants must work to build.

While traditional banking faces high barriers, fintechs and neobanks are disrupting the market. These digital-first players leverage lower operating costs and innovative technology to attract customers, particularly younger demographics. For instance, in 2024, the global fintech market was valued at over $11 trillion, showcasing significant investment and growth potential for new entrants.

These new entrants often bypass physical infrastructure, offering competitive pricing and user-friendly digital experiences. For example, neobanks can operate with significantly lower overheads than traditional banks, making market entry more feasible despite regulatory hurdles. However, building customer trust and loyalty, as exemplified by Bendigo Bank's established reputation, remains a key challenge for these newcomers.

| Factor | Impact on New Entrants | Example (2024 Data/Trends) |

|---|---|---|

| Regulatory Hurdles | High barrier due to capital requirements and licensing. | APRA's stringent capital adequacy ratios (e.g., CET1) demand significant upfront investment. |

| Brand Reputation & Trust | Significant barrier; requires substantial investment in marketing. | Customer acquisition costs for digital banks can exceed AUD 100 per customer. |

| Economies of Scale | Challenging for new entrants to match pricing and product breadth. | Big Four banks' operational efficiencies and funding costs create a competitive advantage. |

| Technological Agility & Lower Costs | Enables new entrants to offer competitive digital experiences. | Fintechs' digital-only models reduce overhead, allowing for aggressive pricing. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bendigo Bank utilizes data from the bank's annual reports, ASX filings, and industry-specific publications like those from ABA. We also incorporate insights from market research firms and economic data providers to assess competitive intensity and market dynamics.