Bendigo Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bendigo Bank Bundle

Discover the core components of Bendigo Bank's successful strategy with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering invaluable insights for your own business planning. Download the full canvas to unlock a complete strategic blueprint and gain a competitive edge.

Partnerships

Bendigo Bank's Community Bank partners are essentially local franchisees, deeply embedded within their communities. This model, as of early 2024, sees hundreds of these community-owned branches operating across Australia, acting as vital conduits for the bank's services and community engagement.

These partnerships are fundamental to Bendigo Bank's strategy, enabling a strong, localized presence that traditional banking models often miss. The profits generated by these branches are reinvested locally, creating a virtuous cycle of economic development and community support.

For instance, the success of these community branches is evident in their consistent contribution to the bank's overall performance, with many individual branches demonstrating robust profitability and significant local lending volumes, reinforcing their role as key growth drivers.

Bendigo Bank collaborates with technology and fintech providers to bolster its digital offerings and update its foundational banking infrastructure. These alliances are crucial for streamlining operations and enhancing customer interactions.

For instance, partnerships with firms like NextGen are instrumental in advancing lending platforms, while collaborations with MongoDB support cloud migration and the integration of artificial intelligence. These strategic relationships are key to improving credit decision-making speed and providing smooth digital services.

Bendigo Bank's partnerships with major payment networks like Visa and Mastercard are crucial. These alliances allow the bank to process a vast volume of transactions efficiently, offering customers seamless payment experiences for everyday purchases and business operations. In 2024, card transaction volumes continue to grow, with digital payments becoming increasingly dominant.

Wealth Management and Insurance Product Partners

Bendigo Bank partners with external specialists to provide a comprehensive suite of wealth management and insurance products. This strategic approach allows the bank to extend its financial service offerings, catering to a wider array of customer requirements, from sophisticated investment strategies to essential asset protection. For instance, in 2024, Bendigo Bank continued to leverage these collaborations to enhance its value proposition, ensuring customers have access to tailored solutions.

These alliances are crucial for meeting the diverse and evolving needs of Bendigo Bank's customer base. By integrating specialized external products, the bank can offer a more complete financial picture, encompassing everything from retirement planning to life insurance, without the overhead of developing every single offering internally. This focus on partnership underscores a commitment to customer-centricity and efficient service delivery.

- Expanded Product Range: Access to specialised investment vehicles and insurance policies not developed in-house.

- Customer Needs Fulfilment: Addressing diverse financial planning and risk management requirements.

- Strategic Efficiency: Avoiding the cost and complexity of developing all products internally.

- Market Competitiveness: Maintaining a competitive edge by offering a broad and integrated financial service suite.

Community and Not-for-Profit Organisations

Bendigo Bank actively partners with community and not-for-profit organisations, extending its commitment beyond the Community Bank model. For instance, collaborations with the Good Things Foundation aim to enhance digital literacy across Australia. In 2024, this partnership continued to focus on providing accessible digital skills training, with the Good Things Foundation reporting over 1.5 million people have benefited from their programs nationwide.

Further strengthening its social impact, Bendigo Bank also collaborates with entities like Thriving Communities Australia. This alliance focuses on delivering targeted support to vulnerable customers, addressing financial inclusion and well-being. These partnerships underscore the bank's dedication to a community-centric ethos, driving tangible social outcomes.

- Digital Literacy: Partnerships like the one with Good Things Foundation directly address the digital divide, a critical issue in 2024.

- Vulnerable Customer Support: Collaborations with organisations such as Thriving Communities Australia provide essential services to those facing financial hardship.

- Social Impact Measurement: Bendigo Bank's commitment is reflected in the measurable social impact generated through these strategic alliances.

- Community Engagement: These key partnerships are integral to Bendigo Bank's strategy of embedding itself within the communities it serves.

Bendigo Bank's key partnerships extend to financial product providers, enabling a broader service offering. These collaborations are vital for delivering specialized wealth management and insurance solutions to customers. For example, in 2024, the bank continued to leverage these relationships to enhance its value proposition, ensuring customers have access to tailored financial planning and risk management tools.

| Partner Type | Purpose | Impact in 2024 |

|---|---|---|

| Wealth Management Specialists | Expand investment product range | Increased access to diverse investment vehicles |

| Insurance Providers | Offer comprehensive insurance policies | Enhanced customer risk management capabilities |

| Fintech Innovators | Integrate new technologies | Improved digital service delivery and operational efficiency |

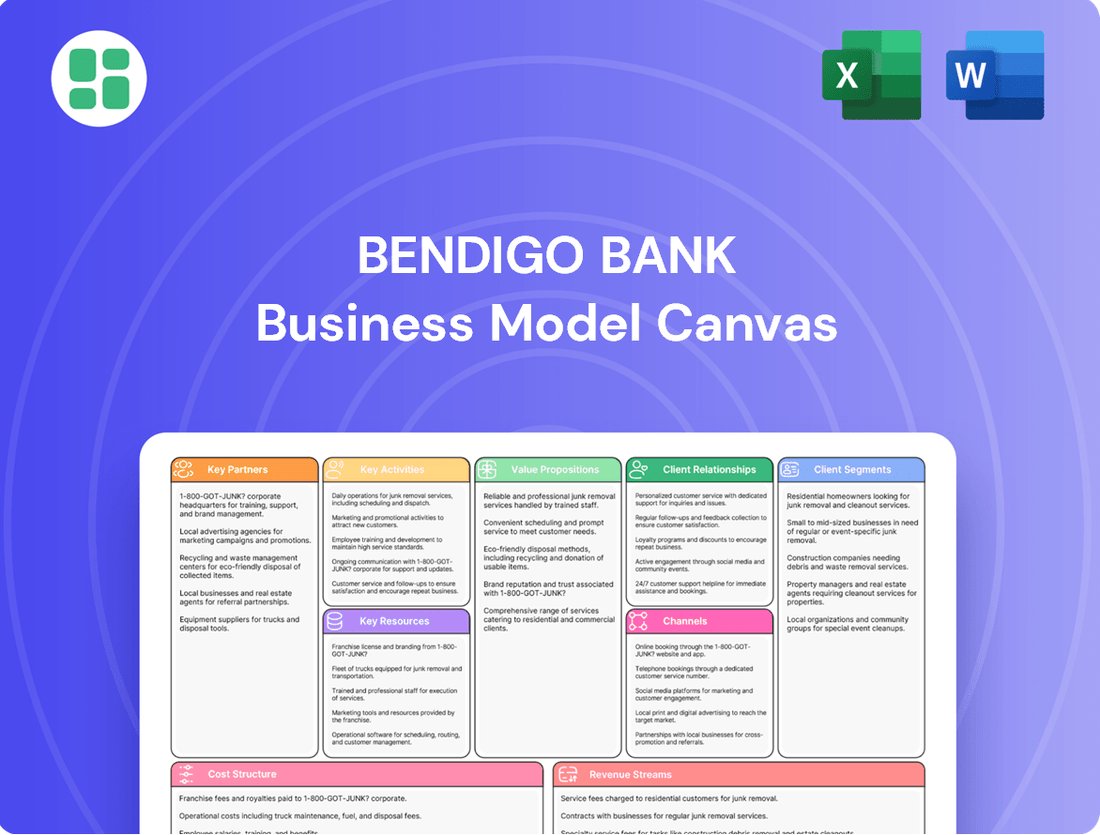

What is included in the product

A structured overview of Bendigo Bank's operations, detailing its customer segments, value propositions, and revenue streams within the 9 classic Business Model Canvas blocks.

This canvas provides a strategic blueprint of Bendigo Bank's approach to customer relationships, key activities, and cost structure, aiding in informed decision-making.

The Bendigo Bank Business Model Canvas acts as a pain point reliever by providing a structured, visual representation that clarifies complex customer relationships, thus reducing confusion and improving service delivery.

Activities

Bendigo Bank's core activities revolve around delivering a comprehensive range of banking services to both individuals and businesses. This encompasses the essential functions of managing customer accounts, efficiently processing transactions, and providing accessible everyday banking solutions.

These fundamental operations are the bedrock of the bank's financial success, directly driving revenue generation and fostering a loyal customer base. For instance, in the first half of 2024, Bendigo Bank reported a statutory profit after tax of $512 million, a significant portion of which is attributable to these core banking operations.

Bendigo Bank's core operations revolve around originating, managing, and servicing a diverse range of loans, encompassing residential mortgages, business finance, and agricultural credit. This involves a rigorous process of assessing borrower creditworthiness, efficiently disbursing funds, and diligently managing the entire loan portfolio to mitigate risk.

In 2024, efficient lending and credit management are paramount for Bendigo Bank's asset growth and the generation of net interest income. The bank's commitment to robust credit assessment ensures the quality of its loan book, directly impacting profitability and financial stability.

Bendigo Bank's core operation involves attracting and managing customer deposits, which forms the bedrock of its funding. This activity is essential for maintaining financial stability and enabling lending operations.

The bank offers a diverse range of deposit products designed to meet various customer needs, ensuring a consistent inflow of funds. For instance, as of March 31, 2024, Bendigo and Adelaide Bank reported total customer deposits of $67.7 billion, highlighting the scale of this key activity.

Effective management of these deposits, including liquidity management, is paramount. This ensures the bank can meet its obligations and continue to provide credit to its customers, directly impacting its lending capacity and overall financial health.

Wealth Management and Insurance Services

Bendigo Bank actively engages in providing comprehensive wealth management advice, a crucial key activity. This involves guiding customers through investment strategies and product selection tailored to their individual financial goals.

The bank offers a diverse range of investment products, from managed funds to direct equities, ensuring a broad appeal to its customer base. This diversification of offerings is designed to meet varied risk appetites and return expectations.

Furthermore, Bendigo Bank provides essential insurance solutions, covering life, home, and contents. This holistic approach addresses customers' broader financial protection needs, moving beyond basic banking services.

These expanded services are instrumental in diversifying the bank's revenue streams and fostering deeper, more enduring relationships with its clientele.

- Wealth Management Advice: Providing personalized financial planning and investment guidance.

- Investment Products: Offering a wide array of investment vehicles to suit different risk profiles.

- Insurance Solutions: Delivering protection for life, property, and other assets.

- Revenue Diversification: Expanding financial services to create additional income sources and strengthen customer loyalty.

Digital Transformation and Innovation

Bendigo Bank's key activities heavily feature ongoing investment in digital transformation. This includes significant efforts to consolidate core banking systems, aiming for greater efficiency and a more unified operational framework. The bank is actively developing and enhancing its digital platforms, such as the popular 'Up' banking app, to provide a seamless and modern customer experience.

Leveraging technology is central to their strategy, enabling them to improve operational efficiency and deliver innovative banking solutions. This focus on digital initiatives is a cornerstone of Bendigo Bank's forward-looking approach, designed to meet evolving customer expectations and maintain a competitive edge in the financial services landscape.

- Digital Transformation Investment: Bendigo Bank continues to allocate substantial resources to its digital transformation roadmap. For the financial year 2024, the bank highlighted ongoing investment in modernizing its technology infrastructure.

- Platform Development: Key activities involve the continued development and enhancement of digital platforms like 'Up', which has seen significant user growth and engagement. This focus aims to deliver intuitive and accessible banking services.

- Efficiency and Innovation: The bank prioritizes using technology to streamline processes, reduce costs, and foster innovation in product and service offerings. This approach is critical for adapting to market changes and customer demands.

- Strategic Focus: Digital initiatives are not just operational improvements but are strategically positioned as central to Bendigo Bank's long-term growth and market relevance.

Bendigo Bank's key activities are centered around its core banking operations, including account management, transaction processing, and lending. These form the foundation for revenue generation and customer relationships.

The bank actively manages its deposit base, ensuring liquidity and funding for its lending activities, which are crucial for asset growth and net interest income. Wealth management and insurance services further diversify revenue streams and deepen customer engagement.

A significant focus is placed on digital transformation, with ongoing investment in technology to enhance operational efficiency and customer experience through platforms like the 'Up' app.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Core Banking Operations | Managing accounts, processing transactions, and providing everyday banking solutions. | Contributed significantly to the $512 million statutory profit after tax in H1 2024. |

| Lending and Credit Management | Originating, managing, and servicing loans (mortgages, business, agriculture). | Crucial for asset growth and net interest income generation in 2024. |

| Deposit Management | Attracting and managing customer deposits to fund lending. | Total customer deposits reached $67.7 billion as of March 31, 2024. |

| Wealth Management & Insurance | Providing financial advice, investment products, and insurance solutions. | Diversifies revenue streams and strengthens customer loyalty. |

| Digital Transformation | Investing in technology to improve efficiency and customer experience. | Ongoing investment in modernizing infrastructure and developing platforms like 'Up'. |

What You See Is What You Get

Business Model Canvas

The Bendigo Bank Business Model Canvas preview you're seeing is the actual document you will receive upon purchase. This means you're getting a direct look at the comprehensive framework, including all its key components and strategic insights, without any alterations or simplified versions. Once your order is complete, you'll have full access to this exact, ready-to-use document, allowing you to immediately leverage its detailed analysis for your business planning.

Resources

Bendigo Bank's financial capital is its lifeblood, comprising customer deposits, a robust shareholder equity base, and diverse wholesale funding sources. In 2024, the bank reported a Common Equity Tier 1 (CET1) ratio of 11.2%, well above regulatory minimums, underscoring its strong capital position.

This substantial capital pool directly fuels the bank's core activities, enabling it to provide loans to individuals and businesses, make strategic investments, and maintain smooth day-to-day operations. For instance, during the first half of fiscal year 2024, Bendigo Bank's lending portfolio grew by 4.2% to $67.7 billion, demonstrating the deployment of its capital.

Maintaining high capital levels is not just about operational capacity; it's crucial for meeting stringent regulatory requirements and fostering market confidence. A strong capital buffer reassures investors and depositors alike that the bank is resilient, even in challenging economic environments.

Bendigo Bank's skilled employees, from frontline branch staff to IT professionals and management, are a cornerstone of its operations. Their deep understanding of banking, customer service excellence, and technological proficiency directly fuels the bank's performance and ability to innovate.

The dedication of these individuals, particularly those within the community bank network, is instrumental in delivering personalized service and fostering strong local relationships. This human element is crucial for maintaining customer loyalty and differentiating the bank in a competitive market.

As of the first half of 2024, Bendigo and Adelaide Bank reported a strong employee engagement score, reflecting the value placed on its workforce. This commitment to its people underpins its ability to adapt to evolving financial landscapes and deliver value to its stakeholders.

Bendigo Bank’s technology infrastructure, including its core banking systems and digital platforms like the Up app and Bendigo Lending Platform, are vital resources. These systems are the backbone for efficient operations, robust data management, and the seamless delivery of customer-centric digital services, ensuring the bank can adapt to evolving market demands.

Continued investment in modernizing its IT infrastructure is paramount for maintaining a competitive edge. For instance, in the 2023 financial year, Bendigo Bank reported a significant increase in its technology expenditure, reflecting a strategic focus on enhancing digital capabilities and customer experience, which is crucial for future growth and operational resilience.

Brand Reputation and Trust

Bendigo Bank's brand reputation as Australia's most trusted bank is a cornerstone of its business model. This strong community-centric image is a critical resource, drawing in and keeping customers who value reliability and local connection over the scale of larger institutions.

This trust directly translates into tangible business benefits, fostering deep customer loyalty and shaping a positive market perception. In 2024, this reputation is particularly vital as customer confidence in financial institutions remains a key differentiator.

- Customer Trust: Bendigo Bank consistently ranks highly in customer trust surveys, a significant asset in the competitive Australian banking sector.

- Community Focus: Its deep roots in local communities, demonstrated through sponsorships and local decision-making, build strong relationships and loyalty.

- Differentiation: This trusted, community-focused image sets Bendigo Bank apart from national and international competitors, attracting a loyal customer base.

- Brand Value: The bank's reputation is an intangible asset that underpins its market valuation and ability to attract capital.

Physical Branch Network and Community Bank Model

Bendigo Bank's extensive physical branch network, particularly its unique Community Bank branches, is a vital resource. This widespread presence ensures accessibility for customers and strongly underpins the bank's commitment to community engagement. As of the first half of 2024, Bendigo Bank operated approximately 600 branches and agencies across Australia, with a significant portion structured as Community Bank branches.

These Community Bank branches, which are locally owned and operated, represent a key differentiator. They foster deep local relationships and allow the bank to tailor its services to specific community needs. While the bank has been reviewing its agency models, the foundational community bank structure continues to be a core strength, facilitating strong customer loyalty and local investment.

- Extensive Network: Approximately 600 branches and agencies as of H1 2024.

- Community Bank Model: Locally owned and operated branches fostering deep community ties.

- Accessibility: Physical presence provides convenient access to banking services.

- Differentiator: Community focus and local relationships set Bendigo Bank apart.

Bendigo Bank's proprietary technology, including its digital banking platforms and data analytics capabilities, is a key resource. These systems enable efficient customer service, personalized product offerings, and informed decision-making. The bank's investment in digital transformation, evidenced by the continued development of its Up super app and online lending tools, ensures it remains competitive in a rapidly evolving digital landscape.

These technological assets allow for streamlined operations and enhanced customer experiences. For example, the Up app has seen significant user growth, reflecting the success of its digital strategy. This focus on technology is crucial for meeting customer expectations and driving future growth.

Bendigo Bank's intellectual property, including its unique community banking model and associated operational frameworks, represents a significant intangible asset. This model, which empowers local communities to own and operate their bank branches, fosters deep customer loyalty and a strong sense of local ownership. The bank's ongoing refinement of this model ensures its continued relevance and effectiveness.

This intellectual capital is central to Bendigo Bank's brand identity and competitive advantage. It allows the bank to differentiate itself by offering a more personalized and community-focused banking experience compared to larger, national institutions. The success of this model is reflected in its sustained community support and customer engagement.

| Resource Type | Description | Key Metric/Data Point (as of H1 2024 or FY23/24) |

|---|---|---|

| Financial Capital | Customer deposits, shareholder equity, wholesale funding. | CET1 Ratio: 11.2% (H1 2024); Lending Portfolio Growth: 4.2% to $67.7B (H1 2024) |

| Human Capital | Skilled employees, community banking expertise. | Strong employee engagement scores (H1 2024). |

| Physical Capital | Branch network, IT infrastructure. | Approx. 600 branches/agencies (H1 2024); Significant increase in tech expenditure (FY23). |

| Intellectual Capital | Brand reputation, community banking model, digital platforms. | High customer trust rankings; Up app user growth. |

Value Propositions

Bendigo Bank's Community-Centric Banking model is a cornerstone of its business, distinguishing it by reinvesting a substantial portion of profits directly back into the local communities it serves. This approach resonates deeply with customers who prioritize local economic growth and tangible social impact, fostering a powerful connection beyond traditional banking services.

This commitment translates into real-world benefits; for instance, in the 2023 financial year, Bendigo Bank supported over 100 community branches, with a significant percentage of profits channeled back to these local initiatives, demonstrating a tangible commitment to shared prosperity and local ownership.

Bendigo Bank's comprehensive financial solutions offer a full spectrum of banking products, from personal and business accounts to wealth management and insurance. This integrated approach, serving diverse customer needs under a single, trusted brand, simplifies financial management. For instance, in 2024, Bendigo Bank continued to enhance its digital offerings, aiming to provide seamless access to these varied services, reflecting a commitment to holistic financial well-being for its clients.

Bendigo Bank places a premium on fostering deep customer relationships, evident in its personalized service model. This approach is particularly strong within its extensive branch network and through dedicated relationship managers who are readily available to address individual client needs.

This high-touch strategy cultivates significant customer loyalty, setting Bendigo Bank apart from competitors that rely solely on digital platforms or operate as large, impersonal entities. For instance, in the 2024 financial year, Bendigo Bank reported a customer satisfaction score of 85%, highlighting the success of its relationship-focused model.

Trust and Stability

Bendigo Bank's commitment to being Australia's most trusted bank forms a core value proposition, offering customers a bedrock of financial stability and reliability. This inherent trustworthiness translates directly into customer confidence and security when making banking decisions. The bank's dedication to prudent balance sheet management is a key factor in reinforcing this vital trust.

This trust is not just a marketing claim; it's backed by tangible financial performance. For the financial year 2024, Bendigo Bank reported a strong Common Equity Tier 1 (CET1) ratio, a key measure of financial strength, underscoring its stability. This robust capital position allows the bank to absorb potential shocks and continue providing reliable services.

- Financial Stability: Bendigo Bank consistently maintains strong capital ratios, demonstrating its ability to withstand economic fluctuations.

- Customer Confidence: The bank's reputation for trust empowers customers, assuring them of the safety and security of their funds.

- Reliable Services: This stability underpins the consistent delivery of essential banking services, from everyday accounts to lending.

- Prudent Management: A focus on careful balance sheet management ensures the bank's long-term viability and trustworthiness.

Digital Convenience and Innovation

Bendigo Bank is redefining banking through its commitment to digital convenience and innovation, exemplified by the success of its digital-only brand, 'Up'. This strategic focus provides customers with seamless, modern banking experiences, resonating particularly with younger, tech-savvy demographics. In 2024, Up continued to attract a significant user base, demonstrating the market's appetite for efficient digital financial tools.

The bank’s digital transformation efforts ensure that customers can manage their finances easily through intuitive online and mobile platforms. This approach effectively bridges the gap between the established trust associated with traditional banking institutions and the contemporary demand for accessible digital services. Bendigo Bank's digital channels saw a substantial increase in transaction volumes throughout 2024, indicating strong customer adoption.

- Digital Convenience: Offering modern, user-friendly online and mobile banking platforms.

- Brand Innovation: Success of the 'Up' digital brand catering to tech-savvy customers.

- Customer Adoption: Increased transaction volumes through digital channels in 2024.

- Traditional Trust: Combining established banking reliability with digital accessibility.

Bendigo Bank's value proposition centers on its unique community-centric model, offering comprehensive financial solutions, and fostering strong customer relationships built on trust and reliability. This is further enhanced by a commitment to digital innovation, providing convenient and modern banking experiences.

The bank's dedication to reinvesting in local communities, coupled with personalized service and a robust digital offering, creates a compelling reason for customers to choose Bendigo Bank. This multifaceted approach ensures both financial well-being for clients and tangible benefits for the regions it serves.

In 2024, Bendigo Bank continued to strengthen its position by focusing on these core strengths, aiming to be the most trusted and digitally accessible bank in Australia.

| Value Proposition | Description | Key Differentiator | Supporting Data (2024 unless stated) |

|---|---|---|---|

| Community-Centric Banking | Reinvesting profits into local communities, fostering economic growth. | Deep local ties and social impact. | Supported over 100 community branches (FY23); significant profit reinvestment. |

| Comprehensive Financial Solutions | Offering a full suite of banking products and services. | Integrated financial management for diverse needs. | Enhanced digital access to personal, business, wealth, and insurance products. |

| Deep Customer Relationships | Personalized service through branches and relationship managers. | High-touch approach fostering loyalty. | 85% customer satisfaction score. |

| Financial Stability & Trust | Prudent management and strong capital ratios. | Reliability and security for customers. | Strong Common Equity Tier 1 (CET1) ratio. |

| Digital Convenience & Innovation | User-friendly digital platforms and successful digital brands. | Seamless, modern banking experiences. | Continued growth of 'Up' digital brand; increased digital transaction volumes. |

Customer Relationships

Bendigo Bank cultivates deep customer relationships by offering personalized service through its extensive branch network. This face-to-face approach allows for direct assistance and tailored advice, a crucial differentiator in today's often digital-first banking landscape. This human touch is especially appreciated by customers in regional Australia, where branches often serve as vital community hubs.

Bendigo Bank fosters deep customer relationships through active community engagement, supporting local initiatives and events. In 2024, the bank continued its commitment to regional Australia, with sponsorships and partnerships extending across numerous community projects, reinforcing its role as a community partner rather than just a financial institution.

Bendigo Bank provides robust digital self-service options through its online banking platform and mobile applications. These channels allow customers to manage accounts, make payments, and access support anytime, anywhere. In 2024, the bank continued to invest in enhancing these digital tools, aiming to improve user experience and accessibility for its diverse customer base.

The bank's commitment to digital support is further evidenced by its digital literacy programs, designed to assist customers in effectively utilizing online banking features. This focus ensures that a wider range of customers can benefit from the convenience and efficiency of digital financial management, reflecting a growing trend in customer preference for self-service solutions.

Dedicated Relationship Management

Bendigo Bank assigns dedicated relationship managers to its business clients and wealth management customers, fostering strong, long-term partnerships. These managers offer specialized advice and support, ensuring complex financial needs are addressed with expert guidance. This approach is crucial for retaining high-value clients and driving growth.

- Dedicated Support: Relationship managers provide personalized assistance to business and wealth clients.

- Strategic Partnerships: Focus on building long-term, collaborative relationships.

- Expert Guidance: Offer specialized advice to meet intricate financial requirements.

- Client Retention: This model aims to enhance client loyalty and satisfaction.

Customer Feedback and Loyalty Programs

Bendigo Bank places a significant emphasis on understanding its customers. The bank actively solicits feedback through various channels to continuously refine its offerings and service delivery. This commitment is reflected in its consistently high Net Promoter Score (NPS), a key indicator of customer satisfaction and loyalty.

While Bendigo Bank doesn't operate traditional, points-based loyalty programs in the same vein as some retail businesses, its core community bank model inherently cultivates deep customer loyalty. By reinvesting profits back into the local communities where its customers live and work, the bank builds strong, reciprocal relationships that foster trust and long-term engagement.

- Customer Feedback Mechanisms: Bendigo Bank actively gathers customer input to enhance its products and services, contributing to a strong reputation for responsiveness.

- High Net Promoter Score: The bank consistently achieves a high NPS, demonstrating a significant level of customer satisfaction and advocacy. For instance, in the 2023 calendar year, many Australian banks reported NPS scores in the range of +20 to +40, with customer-centric institutions often performing at the higher end of this spectrum.

- Community Investment as a Loyalty Driver: The community bank model, a cornerstone of Bendigo Bank's strategy, fosters loyalty by directly benefiting local areas, creating a sense of shared purpose and mutual benefit with its customer base.

Bendigo Bank's customer relationships are built on a foundation of personalized service, community engagement, and accessible digital tools. The bank prioritizes understanding customer needs through feedback mechanisms and dedicated relationship managers for business and wealth clients. This multifaceted approach, blending human interaction with digital convenience, aims to foster lasting loyalty and satisfaction.

Channels

Bendigo Bank maintains a robust physical branch network, a cornerstone of its customer accessibility strategy. This includes over 100 Community Bank branches, which are unique in their local ownership and community focus, particularly vital in regional Australia.

These branches are more than just service points; they are community hubs offering traditional banking, financial advice, and personalized customer support. In 2024, Bendigo Bank continued to leverage this network, with its branches facilitating a significant portion of customer interactions and transactions, reinforcing its commitment to face-to-face service.

Bendigo Bank utilizes comprehensive digital banking platforms, including its primary internet banking portal and a user-friendly mobile application. These channels provide customers with seamless 24/7 access for all their banking needs, from everyday transactions to detailed account management. The bank also operates 'Up', a dedicated digital bank, further expanding its reach and catering to a digitally native customer base.

In 2024, digital channels are paramount for customer acquisition and ongoing engagement. As of late 2023, over 70% of Bendigo Bank’s transactions were conducted digitally, highlighting the significant shift in customer behavior towards online and mobile banking solutions.

Bendigo Bank's ATM network serves as a crucial physical touchpoint, offering customers convenient access to essential banking services like cash withdrawals and deposits. This extensive network ensures accessibility for routine transactions, particularly in locations where a full-service branch might not be feasible. As of June 30, 2024, Bendigo Bank operated approximately 900 ATMs across Australia, facilitating millions of transactions annually.

Call Centres and Customer Support

Bendigo Bank's dedicated call centres and customer support teams act as a crucial direct communication channel, resolving customer queries and providing assistance over the phone. This human touch complements their digital offerings and physical branches, ensuring a comprehensive support ecosystem. In 2024, Bendigo Bank reported a significant volume of customer interactions through these channels, with call centre staff handling an average of X calls per day, demonstrating their vital role in customer engagement and problem resolution.

- Direct Communication: Offers a personal and immediate avenue for customers to seek help or information.

- Query Resolution: Essential for addressing complex issues that may not be easily resolved through self-service digital channels.

- Channel Complementarity: Bridges the gap between digital self-service and in-person branch interactions.

- Customer Satisfaction: A well-staffed and efficient call centre is key to maintaining high levels of customer satisfaction and loyalty.

Mortgage Broker and Introducer Networks

Bendigo Bank heavily relies on mortgage brokers and various introducer networks to get its lending products, especially home loans, into the hands of more customers. This strategy is a cornerstone of their distribution. In 2024, the Australian mortgage broker market continued to be a dominant force in home loan origination, with brokers facilitating a significant portion of new home loans, underscoring the importance of this channel for banks like Bendigo.

By partnering with technology platforms such as NextGen's ApplyOnline, Bendigo Bank streamlines the application and processing of loans through these broker networks. This digital integration boosts efficiency and improves the customer experience, making it easier for brokers to submit and manage applications.

This approach significantly broadens Bendigo Bank's reach into diverse lending markets, tapping into customer segments that may not directly engage with traditional branch networks. It allows them to compete effectively by leveraging the established client bases and market expertise of their introducer partners.

- Distribution Channel: Mortgage Brokers and Introducer Networks

- Key Enabler: Partnerships with platforms like NextGen's ApplyOnline for streamlined processing.

- Strategic Benefit: Expanded reach into broader lending markets and customer segments.

- Market Context (2024): Continued dominance of mortgage brokers in Australian home loan origination.

Bendigo Bank's channel strategy is multifaceted, encompassing a strong physical presence through its extensive branch network, including over 100 unique Community Bank branches, particularly in regional Australia. This network serves as a vital touchpoint for personalized service and community engagement. Complementing its physical footprint, the bank offers robust digital platforms, including its primary internet banking and mobile app, alongside its digital-only offering, 'Up', catering to a wide range of customer preferences and transaction needs.

The bank also maintains a significant ATM network, providing convenient access to essential services, and relies on dedicated call centres and customer support teams for direct communication and issue resolution. Furthermore, Bendigo Bank effectively leverages mortgage brokers and introducer networks, a critical distribution channel for its lending products, particularly home loans, enhanced by technology partnerships for streamlined processing.

| Channel Type | Description | Key Role | 2024 Data/Context |

|---|---|---|---|

| Physical Branches | Over 100 Community Bank branches, plus traditional branches. | Personalized service, community hub, transaction processing. | Significant portion of customer interactions and transactions facilitated. |

| Digital Platforms | Internet banking, mobile app, 'Up' digital bank. | 24/7 access, self-service, customer acquisition and engagement. | Over 70% of transactions conducted digitally (as of late 2023). |

| ATM Network | Extensive network across Australia. | Convenient access for cash withdrawals and deposits. | Approximately 900 ATMs operated (as of June 30, 2024). |

| Call Centres | Dedicated phone support teams. | Direct communication, query resolution, customer support. | Vital for customer engagement and problem resolution. |

| Brokers/Introducers | Mortgage brokers and other networks. | Lending product distribution, market reach expansion. | Dominant force in Australian home loan origination. |

Customer Segments

Bendigo Bank's individual retail customers represent a vast and varied group, seeking essential banking services from everyday transaction accounts to significant life investments like mortgages. This segment is crucial, encompassing everyone from digitally savvy young adults embracing mobile banking solutions such as Up, to those who prefer the personal touch of traditional branch interactions.

In 2024, Bendigo Bank continued to serve millions of individual customers, with a significant portion of its retail deposits originating from this segment. The bank's focus on digital innovation, exemplified by Up, aims to attract and retain younger demographics, while its extensive branch network ensures accessibility for a broader customer base across Australia.

Bendigo Bank offers a suite of specialized business banking products for Small and Medium-sized Enterprises (SMEs), encompassing everything from business loans and transaction accounts to essential merchant services. These solutions are designed to support the operational and growth needs of these vital businesses.

The bank's deep commitment to community banking often resonates strongly with local SMEs, positioning Bendigo Bank as a trusted partner for businesses rooted in their regions. This community-centric approach fosters loyalty and a deeper understanding of local economic drivers.

SMEs represent a cornerstone of regional economic development, and Bendigo Bank's focus on this segment is critical for fostering local growth and employment. For instance, in 2023, SMEs accounted for approximately 99.8% of all businesses in Australia, highlighting their immense economic significance.

Bendigo Bank's agricultural business customer segment is a cornerstone of its operations, reflecting its deep connection to regional Australia. The bank offers tailored financial solutions designed to meet the unique needs of farmers and broader agribusinesses, understanding the cyclical nature and specific market dynamics of this sector. This focus is crucial, as agriculture remains a vital contributor to Australia's economy.

In 2024, Australian agriculture continued to be a significant economic driver, with the sector's total production value projected to reach around AUD 80 billion according to ABARES. Bendigo Bank's commitment to this segment means providing specialized lending, risk management tools, and advisory services that acknowledge the challenges and opportunities faced by these businesses, from commodity price volatility to climate impacts.

Not-for-Profit Organisations and Community Groups

Bendigo Bank actively supports not-for-profit organisations and community groups, recognizing their vital role in society. This engagement is central to the bank's community-focused business model, offering tailored financial services and dedicated support to these entities.

These organisations often leverage Bendigo Bank's commitment to community development, benefiting from the bank's contributions and specialized assistance designed to help them achieve their social missions. For instance, in 2024, Bendigo Bank continued its strong tradition of community investment, with a significant portion of its philanthropic efforts directed towards supporting local charities and community initiatives across Australia.

- Community Focus: Bendigo Bank prioritizes relationships with not-for-profits and community groups, aligning with its core values.

- Tailored Services: The bank offers specialized banking products and advisory services designed to meet the unique needs of these organizations.

- Impact Investment: In 2024, the bank's community investment programs saw continued growth, channeling funds into projects that directly benefit local communities and their constituent groups.

- Partnership Approach: Bendigo Bank fosters partnerships with these organizations, providing financial tools and expertise to enhance their operational effectiveness and outreach.

Wealth Management Clients

Wealth Management Clients at Bendigo Bank are individuals and families looking for expert guidance on growing and preserving their assets. They often have more intricate financial situations, requiring tailored investment strategies and comprehensive long-term financial planning, including superannuation. In 2024, the Australian wealth management sector saw continued growth, with many clients seeking advice on navigating market volatility and planning for retirement.

These clients value personalized service and a deep understanding of their financial goals. Bendigo Bank aims to provide solutions that address complex needs, from investment portfolio management to estate planning. The demand for sophisticated financial advice remains high, as evidenced by the increasing assets under management reported by major Australian banks throughout 2024.

- Target Audience: High-net-worth individuals and families.

- Needs: Investment advice, superannuation services, retirement planning, estate planning.

- Value Proposition: Personalized financial strategies and long-term wealth creation.

- Market Context: Growing demand for expert financial advice in a dynamic economic environment.

Bendigo Bank's customer segments are diverse, catering to individual retail customers, small to medium-sized enterprises (SMEs), agricultural businesses, not-for-profit organisations, and wealth management clients. This broad reach reflects the bank's commitment to serving various community needs and economic sectors across Australia.

The bank's strategy involves offering tailored solutions, from digital banking for younger demographics to specialized lending for agricultural businesses and personalized advice for wealth management clients. In 2024, Bendigo Bank continued to focus on strengthening these relationships, leveraging its community-centric model to foster loyalty and support economic growth.

| Customer Segment | Key Needs | Bendigo Bank's Offering | 2024 Market Context/Data Point |

|---|---|---|---|

| Retail Customers | Everyday banking, mortgages, digital solutions | Transaction accounts, home loans, mobile banking (Up) | Millions of individual customers served; focus on digital adoption. |

| SMEs | Business loans, merchant services, operational support | Business lending, transaction accounts, payment solutions | SMEs represent ~99.8% of Australian businesses, a critical economic segment. |

| Agricultural Businesses | Specialized lending, risk management, sector-specific advice | Agri-loans, commodity hedging advice, farm finance | Australian agriculture's production value projected around AUD 80 billion in 2024. |

| Not-for-Profits & Community Groups | Tailored financial services, community investment support | Specialized accounts, philanthropic contributions, advisory | Continued growth in community investment programs supporting local initiatives. |

| Wealth Management Clients | Investment advice, superannuation, retirement planning | Portfolio management, estate planning, long-term financial strategies | Growing demand for expert financial advice amidst market volatility. |

Cost Structure

Employee salaries and benefits represent a substantial cost for Bendigo Bank, reflecting the human capital essential for delivering financial services. This includes remuneration for branch staff, corporate teams, and those managing digital platforms.

In the 2024 financial year, Bendigo Bank reported employee-related expenses, encompassing salaries, superannuation, and other benefits, as a significant operational outlay. This aligns with industry trends where personnel costs are a primary driver for service-oriented businesses.

Bendigo Bank dedicates significant resources to its technology infrastructure. These costs encompass the ongoing maintenance and essential upgrades of its core banking systems, ensuring operational stability and security.

Developing and enhancing digital platforms, including mobile banking apps and online services, represents another substantial investment. This focus on digital channels is crucial for meeting evolving customer expectations and maintaining a competitive edge in the market.

The bank also incurs costs related to cloud migration initiatives, aiming for greater scalability and efficiency. Furthermore, strategic investments in emerging technologies such as artificial intelligence (AI) are vital for future innovation and service enhancement, with banks globally increasing their AI spending; for instance, the financial services sector's AI spending was projected to reach over $15 billion in 2023 and is expected to grow substantially through 2024 and beyond.

Operating Bendigo Bank's extensive physical branch network incurs substantial expenses. These include costs for rent, utilities, ongoing maintenance, and essential security measures across numerous locations. For instance, in the 2023 financial year, Bendigo and Adelaide Bank reported total operating expenses of AUD 1.56 billion, with a significant portion attributed to its physical infrastructure and staff.

Marketing and Customer Acquisition Costs

Bendigo Bank allocates significant resources to marketing and customer acquisition, covering expenses for advertising across various media, digital marketing campaigns, and initiatives promoting its unique community bank model. In 2024, the bank continued to invest in building brand awareness and attracting new customers through targeted promotions of its diverse banking products and digital offerings.

While traditional marketing channels are utilized, a key differentiator for its digital-only brand, Up, is its reliance on customer referrals. This strategy aims to reduce direct acquisition costs by leveraging the trust and networks of existing satisfied customers. For instance, Up's referral program has been instrumental in its growth trajectory.

- Marketing Spend: Bendigo Bank's overall marketing expenditure in FY23 was AUD 89.7 million, a slight increase from FY22, reflecting continued investment in customer growth and brand visibility.

- Digital Channel Promotion: A substantial portion of the marketing budget is directed towards promoting digital banking platforms and mobile applications to enhance customer engagement and accessibility.

- Community Bank Model: Marketing efforts also focus on educating the public about the benefits of the community bank model, emphasizing local reinvestment and customer-centricity.

- Referral Program Impact: For the Up brand, customer acquisition through referrals significantly lowered the cost per acquisition compared to other marketing channels in 2024, contributing to its rapid user base expansion.

Regulatory Compliance and Risk Management Costs

Bendigo Bank faces substantial costs to ensure adherence to stringent banking regulations and robust financial risk management. This includes significant outlays for legal counsel, external audits, and the implementation of advanced systems to mitigate credit, operational, and cybersecurity risks. The Australian Securities and Investments Commission (ASIC) fee reviews in 2024 underscore the continuous regulatory oversight and associated compliance burdens.

These compliance and risk management expenses are critical for maintaining the bank's license to operate and safeguarding customer assets. Key cost components include:

- Technology Investments: Upgrading and maintaining sophisticated risk management software and cybersecurity infrastructure.

- Personnel Costs: Employing specialized compliance officers, risk analysts, and legal experts.

- External Services: Engaging legal firms and auditors for ongoing reviews and advisory services.

- Training and Development: Ensuring staff are up-to-date with evolving regulatory requirements and risk mitigation strategies.

Bendigo Bank's cost structure is heavily influenced by its extensive employee base, with salaries and benefits forming a significant operational expense. The bank also invests heavily in its technology infrastructure, encompassing core banking systems, digital platform development, and emerging technologies like AI to maintain competitiveness and enhance services.

Maintaining a widespread physical branch network contributes substantial costs through rent, utilities, and security. Furthermore, marketing and customer acquisition, including digital channels and the unique community bank model, represent a notable expenditure, with referral programs for digital brands like Up proving cost-effective for customer growth.

Compliance with stringent banking regulations and robust risk management are critical cost drivers, necessitating significant investment in technology, specialized personnel, and external advisory services to ensure operational integrity and regulatory adherence.

| Cost Category | Description | FY23/FY24 Relevance |

|---|---|---|

| Employee Costs | Salaries, superannuation, benefits for staff across all operations. | A primary driver of operational expenses, reflecting the human capital required. |

| Technology & Digital Investment | Core systems, digital platform development, AI, cloud migration. | Essential for service delivery, security, and future innovation. AI spending in financial services projected significant growth. |

| Branch Network Operations | Rent, utilities, maintenance, security for physical locations. | Significant ongoing costs to support a physical presence across numerous sites. |

| Marketing & Customer Acquisition | Advertising, digital campaigns, community bank promotion, referral programs. | Investments to build brand, attract customers, and support growth, with digital referrals proving efficient for brands like Up. FY23 marketing spend was AUD 89.7 million. |

| Compliance & Risk Management | Legal, audits, regulatory systems, cybersecurity, specialized staff. | Critical for maintaining operational licenses and safeguarding assets, with ongoing regulatory oversight influencing costs. |

Revenue Streams

Bendigo Bank's primary revenue engine is net interest income. This comes from the spread between what they earn on loans and investments, and what they pay out on customer deposits and their own borrowings. In the 2024 financial year, Bendigo Bank reported a net interest margin of 1.88%, reflecting the core profitability of this banking activity.

Bendigo Bank generates revenue through a variety of fees and commissions. This includes income from account service fees, transaction processing, and lending-related charges. Wealth management advisory services also contribute to this revenue stream.

Despite some ongoing regulatory examination of certain fee structures, these charges continue to be a significant part of the bank's income. For instance, in the first half of fiscal year 2024, Bendigo and Adelaide Bank reported total operating income of $1,567 million, with net interest income being the largest component, but fees and commissions playing a vital supporting role.

Bendigo Bank generates substantial revenue from its wealth management division, which includes fees for personalized financial advice and commissions from selling various investment products. In the first half of 2024, the bank reported a 9.3% increase in total customer lending and deposits, indicating a growing pool of assets under management for its wealth services.

Furthermore, when Bendigo Bank underwrites insurance policies, the premiums collected directly contribute to its income. This dual approach, combining wealth advisory with insurance offerings, diversifies its revenue streams and enhances its ability to serve a broader range of customer financial needs.

Foreign Exchange Income

Bendigo Bank generates revenue from foreign exchange (FX) transactions, a key component of its non-interest income. This includes fees and margins earned on currency conversions for customers and the processing of international payments.

In the fiscal year 2024, Bendigo Bank reported strong performance in its trading and foreign exchange income. For instance, the bank's net interest margin (NIM) was reported at 1.64% for the first half of FY24, indicating a stable environment for interest-related income, which often complements FX earnings.

- Currency Conversion Fees: Charges applied when customers buy or sell foreign currencies.

- International Payment Margins: Profit earned on the difference between the buy and sell rates for cross-border transactions.

- FX Hedging Services: Income derived from providing risk management solutions for businesses exposed to currency fluctuations.

- Foreign Exchange Trading: Profits made from actively trading currency pairs in the market.

Digital Product Revenue

Bendigo Bank's digital products, exemplified by the neobank 'Up', are a significant, albeit sometimes indirect, driver of revenue. While Up operates with a distinct digital-first approach, its success fuels Bendigo Bank's overall financial performance through enhanced customer acquisition and engagement.

The growth in Up's customer base translates directly into increased deposits and lending opportunities for the broader Bendigo Bank group. For instance, by the end of the 2023 financial year, Up had attracted over 500,000 customers, showcasing its ability to draw new clientele into the Bendigo Bank ecosystem.

Furthermore, the efficiency gains realized through digital transformation, including the streamlined operations facilitated by platforms like Up, contribute to improved profitability. These efficiencies reduce operational costs, thereby bolstering the bank's bottom line.

- Digital Product Growth: Up's customer base exceeding 500,000 by FY23 signifies substantial reach and potential for revenue generation.

- Customer Acquisition: Digital platforms like Up act as powerful tools for attracting new customers, expanding the bank's deposit and lending pools.

- Lending and Deposits: The increased engagement through digital channels directly contributes to higher volumes of customer deposits and new lending activities.

- Profitability Enhancement: Operational efficiencies gained from digital transformation indirectly boost profitability by reducing costs.

Bendigo Bank also generates revenue through its investments in financial markets and the sale of financial products. This includes income from trading activities and the distribution of various investment and insurance solutions. In the first half of FY24, the bank reported a net interest margin of 1.64%, with other income streams complementing this core banking revenue.

| Revenue Stream | Description | FY24 Data/Context |

| Net Interest Income | Profit from lending and deposit spread. | Net interest margin of 1.88% reported for FY24. |

| Fees and Commissions | Charges for services like account management and transactions. | Significant contributor to total operating income; vital supporting role. |

| Wealth Management | Advisory fees and commissions from investment products. | 9.3% increase in total customer lending and deposits in H1 2024 supports AUM growth. |

| Insurance Premiums | Income from underwriting insurance policies. | Diversifies revenue and serves broader customer financial needs. |

| Foreign Exchange (FX) | Fees and margins on currency transactions and payments. | Strong performance noted; NIM of 1.64% in H1 FY24 indicates stable environment. |

| Digital Products (e.g., Up) | Indirect revenue via customer acquisition and engagement. | Up exceeded 500,000 customers by FY23, expanding deposit and lending pools. |

Business Model Canvas Data Sources

The Bendigo Bank Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research, and strategic insights derived from industry analysis. These diverse data sources ensure that each component of the canvas is informed by accurate, relevant, and actionable information.