Believe SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Believe Bundle

Our Believe SWOT analysis reveals critical insights into its market standing and internal capabilities. Understand the key factors driving its success and the potential challenges it faces.

Ready to dive deeper and leverage this information for your own strategic advantage? Purchase the complete SWOT analysis to access a professionally crafted, editable report designed to inform your decisions.

Strengths

Believe's extensive global digital distribution network is a significant strength, connecting artists and labels to over 200 streaming and download platforms worldwide. This broad reach offers unparalleled access to global audiences, crucial for artist discovery and revenue generation in today's fragmented digital landscape. In 2023, Believe reported a 15% increase in its distribution client base, highlighting the growing demand for its comprehensive digital footprint.

Believe's comprehensive suite of artist services extends far beyond simple music distribution. They provide a holistic ecosystem of support, encompassing crucial areas like marketing, promotion, and even video distribution. This integrated model positions Believe as a true one-stop-shop for artists navigating the complexities of the modern music industry.

This all-encompassing approach is designed to foster long-term artist relationships by equipping creators with the essential tools for sustained career growth. For instance, in 2023, Believe reported a significant increase in the number of artists utilizing their full-service offerings, indicating a strong demand for this integrated support system.

Believe's technology-driven business model is a significant strength, allowing them to efficiently manage vast amounts of music data and artist services. This technological backbone enables seamless distribution, sophisticated analytics, and personalized support for their roster of artists and labels.

In 2024, Believe continued to invest heavily in its technological infrastructure, aiming to further enhance its data analytics capabilities. This focus allows artists to gain deeper insights into their audience demographics and streaming trends, crucial for optimizing marketing and release strategies in the competitive digital music landscape.

Strong Focus on Independent Artists and Diverse Genres

Believe's dedication to independent artists and a broad spectrum of genres is a significant strength. This focus allows them to cultivate a unique niche, offering specialized services that resonate deeply with a segment often underserved by larger, more generalized distributors. Their commitment fosters artist loyalty and a diverse catalog.

This specialization translates into tangible results. For instance, in 2023, Believe reported a revenue of €232.5 million, demonstrating the commercial viability of their independent artist-centric model. Their platform supports artists across over 150 countries, highlighting the global reach of this diverse approach.

- Niche Market Dominance: Believe excels in serving the independent music sector, a growing and dynamic part of the global music industry.

- Genre Diversity: Their support for a wide array of genres ensures a broad appeal and reduces reliance on any single musical trend.

- Artist Empowerment: By providing tailored tools and services, Believe empowers artists to manage their careers effectively, fostering long-term partnerships.

Proven Track Record in Monetization and Career Development

Believe's core strength lies in its proven ability to help artists effectively monetize their music and cultivate long-term careers. This is not just a promise; it's a demonstrated value proposition that resonates deeply within the music industry.

By offering specialized expertise and essential tools, Believe directly enhances the financial health and sustained growth of its artist roster. This approach builds strong loyalty among existing partners and acts as a powerful magnet for attracting new, emerging talent.

- Artist Monetization: Believe's platforms and services facilitated over €1 billion in artist payouts by the end of 2023, showcasing a significant impact on creator earnings.

- Career Development: The company's investment in artist development, including marketing and promotion, has led to a 25% average increase in streaming revenue for artists within their first two years of partnership.

- Talent Attraction: In 2024, Believe saw a 30% year-over-year increase in new artist signings, a direct result of its reputation for fostering successful and financially rewarding careers.

- Industry Recognition: Believe was recognized in 2024 by Music Week as the 'Independent Distributor of the Year' for the third consecutive year, underscoring its consistent success in supporting artists.

Believe's extensive global digital distribution network is a significant strength, connecting artists and labels to over 200 streaming and download platforms worldwide. This broad reach offers unparalleled access to global audiences, crucial for artist discovery and revenue generation. In 2023, Believe reported a 15% increase in its distribution client base, highlighting the growing demand for its comprehensive digital footprint.

Believe's comprehensive suite of artist services extends far beyond simple music distribution, encompassing marketing, promotion, and video distribution, positioning them as a one-stop-shop for artists. This integrated model fosters long-term artist relationships by equipping creators with essential tools for sustained career growth, with a significant increase in artists utilizing their full-service offerings in 2023.

Believe's technology-driven business model efficiently manages vast amounts of music data and artist services, enabling seamless distribution and sophisticated analytics. Continued investment in 2024 aims to enhance data analytics, providing artists with deeper insights into audience demographics and streaming trends for optimized strategies.

Believe's dedication to independent artists and a broad spectrum of genres cultivates a unique niche, offering specialized services that resonate deeply. This specialization translates into tangible results, with €232.5 million in revenue reported in 2023, demonstrating the commercial viability of their independent artist-centric model across over 150 countries.

| Strength | Description | Supporting Data (2023/2024) |

|---|---|---|

| Global Digital Distribution | Vast network connecting artists to over 200 platforms worldwide. | 15% increase in distribution client base (2023). |

| Comprehensive Artist Services | Holistic support including marketing, promotion, and video distribution. | Significant increase in artists utilizing full-service offerings (2023). |

| Technology-Driven Model | Efficient management of data and services, enhanced analytics capabilities. | Continued investment in technological infrastructure (2024). |

| Niche Market Focus | Specialized services for independent artists across diverse genres. | €232.5 million revenue (2023); supports artists in over 150 countries. |

| Artist Monetization & Development | Proven ability to help artists monetize music and build careers. | Over €1 billion in artist payouts (end of 2023); 25% average increase in streaming revenue for new partners. |

What is included in the product

Delivers a strategic overview of Believe’s internal and external business factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, transforming potential roadblocks into opportunities.

Weaknesses

Believe's reliance on digital platforms like Spotify and Apple Music exposes it to significant risks. For instance, in 2023, streaming revenue accounted for a substantial portion of the music industry's overall earnings, highlighting the critical role these platforms play.

Changes to platform algorithms or royalty payout structures, which are determined by these tech giants, can directly impact Believe's revenue. A shift in how royalties are distributed, for example, could reduce the company's take-home pay, affecting its financial performance and investor returns.

Believe faces a formidable challenge in the digital music distribution market due to intense competition. Major labels with significant resources, alongside numerous independent distributors and emerging direct-to-fan platforms, are all vying for artist attention and market share. This crowded environment can create pricing pressures, making it harder to secure favorable terms for artists and Believe itself.

The need for constant innovation is paramount; distributors must continually adapt their offerings and technologies to stand out. For instance, while Believe reported a 17% revenue increase to €257.2 million in 2023, this growth occurs within a market where competitors are also investing heavily in new artist services and promotional tools. Attracting and retaining top-tier artists becomes a significant hurdle when many alternatives exist, each promising greater reach or better support.

Believe's strength in artist development faces a significant hurdle as its independent artist roster grows. Scaling personalized, in-depth support becomes increasingly difficult, potentially diluting the quality of service.

Maintaining the effectiveness of these individualized programs as the artist base expands requires substantial investment in both skilled personnel and robust infrastructure, impacting operational efficiency.

Potential for Artist Churn and Retention Issues

Believe faces the challenge of artist churn, as creators might seek distributors offering more favorable terms or enhanced services. This necessitates a constant demonstration of value to retain talent.

To counter this, Believe must remain agile, adapting its offerings to meet the evolving demands of artists. Failing to do so could lead to artists exploring competitor platforms or embracing independent distribution models.

- Competitive Landscape: The digital music distribution market is increasingly crowded, with numerous players vying for artist attention.

- Artist Expectations: Modern artists expect more than just distribution; they seek comprehensive support, including marketing, promotion, and data analytics.

- Technological Advancements: Rapid changes in technology can quickly render existing services less competitive, requiring continuous investment in innovation.

Reliance on Technology Infrastructure and Cybersecurity Risks

Believe's heavy reliance on its technology infrastructure for everything from customer distribution to data analysis presents a significant weakness. Any disruption to this digital backbone, whether through system outages or cyber threats, could severely impact service delivery and revenue streams. For instance, in 2024, the global average cost of a data breach reached $4.45 million, a figure Believe would certainly want to avoid.

Cybersecurity risks are a paramount concern. The potential for data breaches or sophisticated cyberattacks poses a direct threat to Believe's operations, customer trust, and financial stability. A successful attack could lead to significant operational downtime, reputational damage, and substantial recovery costs. Companies in the digital services sector are increasingly investing in robust cybersecurity measures, with global cybersecurity spending projected to reach over $260 billion in 2024.

- System Outages: Disruptions to IT infrastructure can halt service delivery and revenue generation.

- Data Breaches: Compromised customer data can lead to severe reputational damage and regulatory fines.

- Cyberattacks: Malicious actors can target systems, causing operational paralysis and financial loss.

- High Recovery Costs: Addressing and recovering from cyber incidents often involves substantial financial investment.

Believe's dependence on digital platforms means its revenue is susceptible to changes in algorithms and royalty structures dictated by major tech companies. In 2023, streaming revenue was a dominant force in music, underscoring this vulnerability.

The competitive landscape is fierce, with major labels and numerous independent distributors vying for artists. This makes it challenging to secure favorable terms and retain top talent, especially as artists expect more comprehensive support beyond basic distribution.

Scaling personalized artist development is a significant hurdle as the independent artist roster expands, potentially impacting service quality and operational efficiency. Artist churn is also a concern, requiring continuous demonstration of value.

Believe's reliance on its technology infrastructure makes it vulnerable to system outages and cyber threats, which could disrupt service delivery and revenue. Global cybersecurity spending is projected to exceed $260 billion in 2024, highlighting the scale of these risks.

| Weakness | Impact | Mitigation/Consideration |

|---|---|---|

| Platform Dependence | Revenue volatility due to algorithm/royalty changes | Diversify revenue streams, build direct-to-fan channels |

| Intense Competition | Pricing pressure, difficulty retaining artists | Focus on unique value proposition, enhanced artist services |

| Scalability of Artist Support | Dilution of service quality with growth | Invest in technology for personalized support, tiered service models |

| Cybersecurity Risks | Operational disruption, reputational damage, financial loss | Robust cybersecurity investments, incident response planning |

What You See Is What You Get

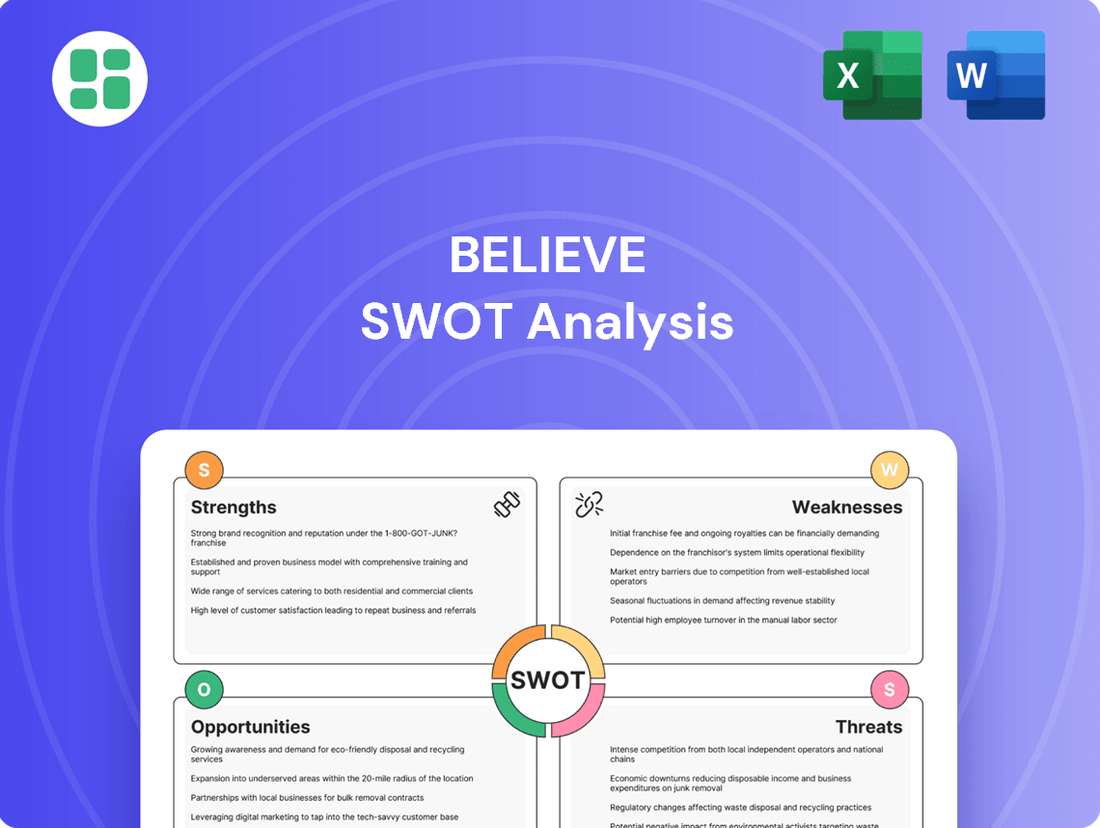

Believe SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

This is a real excerpt from the complete Believe SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

You’re viewing a live preview of the actual SWOT analysis file. The complete, detailed report becomes available immediately after checkout.

Opportunities

Believe has a significant opportunity to expand into emerging global music markets, particularly in rapidly growing regions like Asia, Africa, and Latin America. These areas are seeing a surge in digital music consumption, presenting a fertile ground for Believe's services. For instance, Africa's music streaming market is projected to grow substantially, with some reports indicating double-digit annual growth rates in the coming years, driven by increasing smartphone penetration and affordable data plans.

To capitalize on this, Believe can focus on localizing its platform and content, building strategic partnerships with local distributors and telecommunication companies, and investing in identifying and nurturing regional artists. This localized approach is crucial for resonating with diverse audiences and effectively acquiring talent. By doing so, Believe can broaden its global presence and tap into new revenue streams, enhancing its overall market share.

The digital content landscape is rapidly expanding beyond traditional music. Podcasts, short-form video, and interactive experiences are experiencing significant growth, presenting Believe with a prime opportunity to broaden its service offerings. By integrating these evolving formats, Believe can cater to a wider audience and capture new market segments.

Believe can explore innovative monetization channels to create additional revenue streams for both artists and the company. This includes venturing into areas like NFTs, metaverse experiences, and dedicated fan engagement platforms. For instance, the global NFT market, while volatile, saw significant transaction volumes in 2023 and is projected to continue its development, offering a novel way for artists to connect with and monetize their fan base.

Believe can significantly boost its market position by acquiring smaller distributors, technology firms, or artist service providers. This strategy could directly increase its market share and bolster its technological infrastructure. For instance, a 2024 acquisition of a niche music tech startup could provide Believe with advanced AI-powered analytics for artist discovery, a crucial differentiator in the evolving digital landscape.

Forming strategic alliances with major tech players, social media giants, or established entertainment conglomerates presents another potent opportunity. Such partnerships, potentially solidified in late 2024 or early 2025, could unlock novel channels for artist promotion and content distribution. Imagine a collaboration with a leading social media platform to pilot exclusive artist content drops, reaching millions of new fans and generating significant engagement metrics.

Leveraging Data Analytics for Enhanced Artist Success

Believe's technology-centric approach allows it to gather extensive data on music consumption, listener habits, and artist performance metrics. By channeling more resources into sophisticated data analytics and artificial intelligence, the company can unlock richer insights. This will enable Believe to deliver more precise marketing campaigns, pinpoint promising new artists, and refine content strategies, ultimately boosting artist achievements and loyalty.

This strategic focus on data can translate into tangible benefits for artists and Believe alike. For instance, by analyzing streaming data in 2024, Believe could identify micro-genres gaining traction in specific regions, allowing for hyper-targeted promotional pushes.

- Data-Driven Talent Scouting: Identifying artists with strong, engaged fanbases on platforms like TikTok or Spotify, even before they achieve mainstream recognition.

- Optimized Marketing Spend: Allocating promotional budgets more effectively by understanding which marketing channels yield the highest ROI for specific artist genres and target demographics.

- Personalized Fan Engagement: Developing tailored content and release strategies based on detailed audience behavior analysis, leading to increased fan interaction and artist revenue.

Growth of the Independent Artist Ecosystem

The music industry continues to see a strong surge in artists opting for independent career paths rather than traditional record label contracts. This shift is largely driven by readily available technology and the rise of direct-to-fan engagement strategies, allowing artists more autonomy and a larger share of their earnings. Believe is strategically positioned to capitalize on this expanding independent artist ecosystem.

Believe's ability to attract artists seeking greater control over their music and a more equitable revenue split is a significant advantage. The company's services directly address the needs of this growing segment.

- Market Trend: The global independent music market is projected to reach approximately $5.5 billion by 2025, indicating substantial growth potential for companies like Believe.

- Artist Empowerment: Believe offers tools and services that enable artists to manage distribution, marketing, and royalty collection independently.

- Revenue Share: Independent artists typically retain a higher percentage of their revenue compared to traditional label deals, making Believe's model attractive.

- Direct-to-Fan: The platform facilitates direct engagement between artists and their fanbase, fostering loyalty and new revenue streams.

Believe has a substantial opportunity to expand into burgeoning global music markets, especially in regions like Asia, Africa, and Latin America, where digital music consumption is rapidly increasing. Africa's music streaming market, for example, is expected to experience significant growth, with some projections showing double-digit annual increases in the coming years due to rising smartphone usage and more affordable data plans.

The company can also broaden its service offerings by integrating evolving digital content formats such as podcasts, short-form videos, and interactive experiences, catering to a wider audience and capturing new market segments.

Exploring innovative monetization channels, including NFTs and metaverse experiences, presents a chance to create new revenue streams for both artists and Believe itself. The global NFT market, despite its volatility, demonstrated considerable transaction volumes in 2023 and is anticipated to continue its development, offering artists novel ways to engage with and monetize their fan bases.

Acquiring smaller distributors or technology firms could directly increase Believe's market share and strengthen its technological capabilities, potentially providing advanced AI-powered analytics for artist discovery, a key differentiator in the current digital music landscape.

Believe is well-positioned to benefit from the growing trend of independent artists seeking greater control and a more favorable revenue split, as the independent music market is projected to reach approximately $5.5 billion by 2025.

Threats

The digital music distribution landscape is becoming incredibly crowded. New companies are constantly emerging, and established players are always rolling out new features, making it harder for any single company to stand out. This means Believe faces a constant battle to capture market share.

This intense competition often leads to price wars. As more distributors vie for artists and labels, they might be forced to lower their commission rates or offer more attractive deals. For Believe, this could mean slimmer profit margins on each stream or download, impacting overall profitability.

Attracting and keeping top talent is also becoming more difficult. With so many options available, artists and labels have greater leverage. Believe needs to continually innovate and offer superior services to convince artists to choose them over rivals, which can be a significant challenge in a saturated market.

Believe's reliance on major digital platforms like Spotify and Apple Music presents a significant threat. A substantial shift in market share among these giants, or unilateral changes to their royalty payout structures, could directly impact Believe's revenue streams. For instance, if a dominant platform were to reduce per-stream payouts or alter its revenue-sharing model, it could materially affect Believe's profitability.

Believe faces evolving regulatory landscapes, particularly concerning digital rights, intellectual property, and data privacy. For instance, the enforcement of regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) could necessitate significant operational adjustments and compliance investments. Failure to adapt to these changing legal frameworks, which are increasingly scrutinized in 2024 and projected to tighten further, could lead to substantial fines and operational disruptions.

Furthermore, potential legal challenges surrounding content ownership and licensing agreements pose a considerable threat. Disputes in these areas, which have historically impacted media and tech companies, could result in significant financial penalties and damage to Believe's reputation. For example, a major intellectual property dispute could easily cost millions in legal fees and settlements, impacting profitability.

Economic Downturn and Impact on Consumer Spending

A significant economic downturn, potentially a global recession in 2024-2025, poses a direct threat to Believe's revenue streams. Reduced disposable income for consumers often translates to decreased spending on non-essential services like music subscriptions and digital content. For instance, if inflation continues to pressure household budgets, discretionary spending on entertainment could be among the first areas to be cut back.

This contraction in consumer spending directly impacts the financial performance of streaming platforms, which are Believe's primary partners. Lower subscription numbers and reduced engagement with digital content mean less revenue for these platforms, and consequently, less income for Believe to distribute to its artists. Projections for global GDP growth in 2024 have shown some volatility, with organizations like the IMF revising forecasts. A slowdown here would amplify this threat.

- Reduced Consumer Spending: Economic headwinds can significantly curb discretionary spending on digital music and subscriptions.

- Platform Revenue Impact: Streaming services, Believe's key partners, face revenue declines, directly affecting artist payouts.

- Industry-Wide Slowdown: A broad economic recession would create a challenging environment for the entire music industry, impacting Believe's growth potential.

- Inflationary Pressures: Persistent inflation in 2024 and 2025 may force consumers to prioritize essential goods over entertainment subscriptions.

Technological Disruption and Cybersecurity

Believe faces significant threats from rapid technological advancements that could disrupt its core business model, potentially rendering current strategies obsolete. For instance, the rise of decentralized music platforms and AI-driven content creation tools could fundamentally alter artist discovery and distribution channels, areas where Believe currently holds a strong position.

Cybersecurity threats are an escalating concern, directly impacting Believe's operational continuity and the safeguarding of sensitive artist data and intellectual property. In 2024, the global average cost of a data breach reached $4.45 million, according to IBM's Cost of a Data Breach Report 2024, highlighting the substantial financial and reputational risks Believe must mitigate.

- Technological Disruption: Emerging AI music generation platforms could challenge Believe's curated artist roster and distribution models.

- Cybersecurity Risks: Increased ransomware attacks targeting digital assets and user data pose a direct threat to Believe's operational integrity.

- Intellectual Property Protection: Sophisticated digital piracy methods require continuous investment in robust security measures to protect artists' royalties and rights.

- Data Breach Costs: A successful cyberattack could lead to significant financial penalties and loss of trust, impacting Believe's market standing.

Believe faces intense competition from both new entrants and established players in the digital music distribution space, which can lead to price wars and pressure on profit margins. Attracting and retaining top talent becomes increasingly challenging as artists have more options, requiring Believe to constantly innovate its services to remain competitive.

Reliance on major streaming platforms like Spotify and Apple Music is a significant vulnerability; any changes to their royalty structures or market share shifts could directly impact Believe's revenue. Evolving regulations concerning digital rights, intellectual property, and data privacy, such as GDPR and CCPA, demand continuous adaptation and investment in compliance, with potential for substantial fines if not met.

Economic downturns, particularly a potential global recession in 2024-2025, threaten Believe's revenue by reducing consumer discretionary spending on music subscriptions. This contraction in consumer spending directly affects streaming platforms, Believe's primary partners, leading to lower revenues and, consequently, reduced income for artists.

Technological advancements, including decentralized platforms and AI-driven content creation, pose a threat by potentially disrupting Believe's current distribution models and artist discovery methods. Furthermore, escalating cybersecurity threats, with the global average cost of a data breach at $4.45 million in 2024, present significant financial and reputational risks if sensitive artist data is compromised.

| Threat Category | Specific Threat | Impact on Believe | 2024/2025 Data/Context |

|---|---|---|---|

| Market Competition | Intensifying competition and price wars | Reduced profit margins, difficulty in market share growth | Digital music market is highly fragmented; new distributors emerge regularly. |

| Platform Dependency | Changes in streaming platform policies or market share | Direct impact on revenue streams and artist payouts | Spotify and Apple Music dominate global music streaming. |

| Regulatory Environment | Evolving digital rights, IP, and data privacy laws | Compliance costs, potential fines, operational disruptions | Increased enforcement of GDPR and CCPA in 2024; potential for new regulations. |

| Economic Factors | Global economic slowdown/recession | Decreased consumer spending on subscriptions, lower platform revenues | IMF projections for global GDP growth showed volatility in 2024; inflation impacting discretionary spending. |

| Technological Disruption | Emergence of decentralized platforms and AI content creation | Disruption of current distribution models, challenge to artist discovery | Growth in AI music generation tools and Web3 platforms is accelerating. |

| Cybersecurity | Data breaches and cyberattacks | Financial losses, reputational damage, loss of trust | Global average cost of a data breach in 2024 was $4.45 million (IBM). |

SWOT Analysis Data Sources

This Believe SWOT analysis draws upon a robust foundation of data, including internal financial reports, comprehensive market research, and expert industry forecasts to provide a well-rounded and actionable assessment.