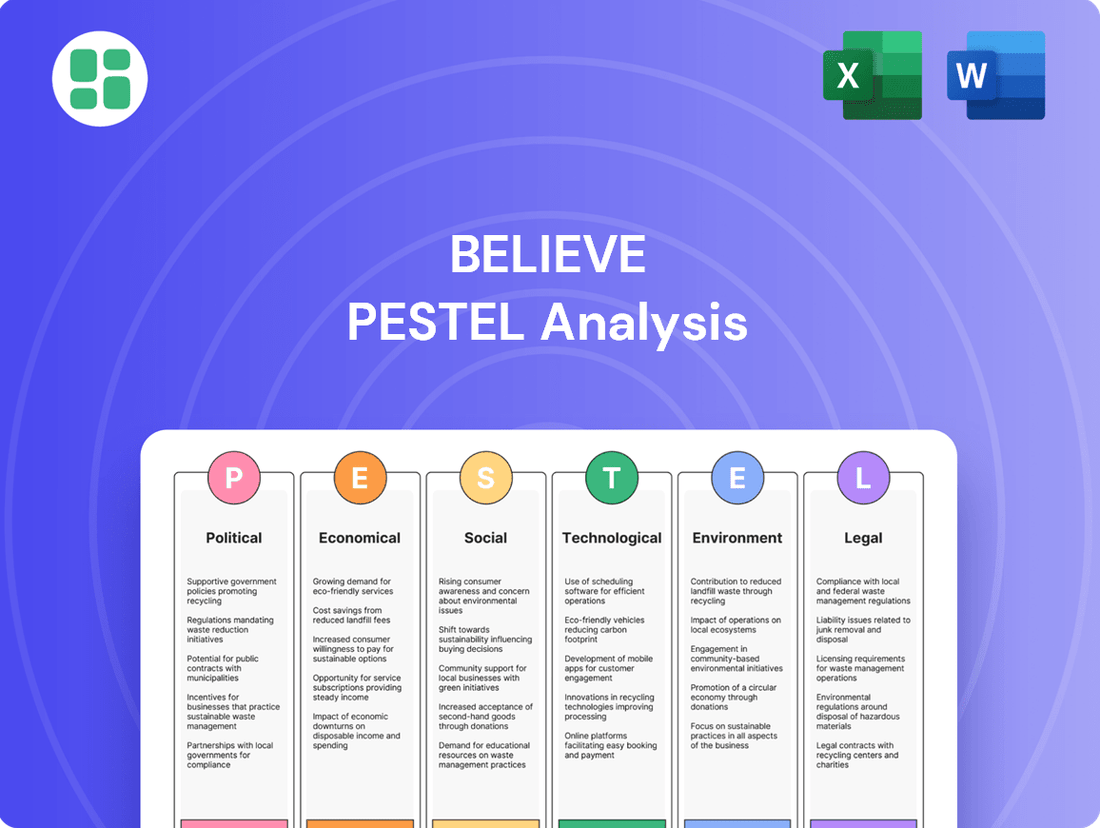

Believe PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Believe Bundle

Navigate the complex external forces shaping Believe's trajectory with our meticulously researched PESTLE Analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the company. Equip yourself with the strategic foresight needed to make informed decisions and secure your competitive advantage. Download the full analysis now for actionable intelligence.

Political factors

Governments worldwide are intensifying their focus on regulating major digital platforms, a trend that directly affects music distribution services like Believe. New legislation is emerging concerning antitrust issues, content oversight, and ensuring equitable payments to artists and rights holders. For instance, the European Union's Digital Markets Act (DMA), fully applicable from March 2024, imposes significant obligations on large online platforms, potentially altering how Believe interacts with dominant tech players and manages its content distribution.

International trade agreements significantly shape the landscape for digital services like those offered by Believe. For instance, the EU-US Data Privacy Framework, implemented in July 2023, aims to facilitate cross-border data flows, potentially easing operations for digital distributors. However, ongoing discussions and potential shifts in trade policies, such as those emerging from the World Trade Organization's Committee on Trade in Services, could introduce new regulations or tariffs on digital content, impacting Believe's revenue streams and operational costs in various markets.

The strength and consistency of copyright and intellectual property (IP) enforcement are critical for Believe, a company deeply invested in music rights. For instance, in 2023, the global music industry generated an estimated $26.2 billion in recorded music revenue, according to the IFPI. This growth is underpinned by the ability to protect and monetize creative works.

Variations in IP laws across different jurisdictions directly impact Believe's global operations. In countries with robust enforcement, such as the United States and many European nations, Believe can more effectively safeguard its artists' copyrights, leading to predictable revenue streams from licensing and royalties. Conversely, weaker protections in other markets can expose the company to piracy and unauthorized use, potentially diminishing revenue and requiring significant legal resources for remediation.

Believe's strategy for digital rights management must constantly adapt to these varying legal landscapes. As of early 2024, ongoing discussions and legislative efforts in regions like the European Union aim to strengthen digital copyright, potentially offering greater protection for rights holders. This necessitates continuous legal monitoring and strategic adjustments to ensure compliance and maximize the value of Believe's IP portfolio worldwide.

Cultural policy and local content promotion

Governments worldwide are increasingly focusing on cultural policy to bolster local content and artists, often through measures like broadcast quotas or direct funding. For a global platform like Believe, which champions independent artists, understanding and adhering to these diverse national regulations is crucial for seamless content distribution and for leveraging available support. For instance, in 2024, the European Union continued its efforts to promote European works, with initiatives like the Creative Europe program allocating significant funding to support audiovisual content creation and distribution, aiming to boost the visibility of European artists within the bloc and beyond.

Navigating these cultural policies requires Believe to stay agile and informed about specific market requirements. This includes understanding local content promotion schemes, which can range from tax incentives for local productions to mandates for a certain percentage of music or film to be of national origin. Believe's ability to adapt its distribution strategies to comply with these regulations, such as the 2024 French broadcasting law requiring a substantial portion of music played on radio to be French, directly impacts its market access and artist reach.

- Compliance with local content quotas: Believe must ensure its distributed catalog meets country-specific requirements, such as those in Canada or France, which mandate a percentage of local music on radio.

- Leveraging government funding: Identifying and applying for relevant cultural promotion funds, like those offered by national arts councils or EU programs, can provide crucial financial backing for artists distributed by Believe.

- Navigating censorship and cultural sensitivities: Policies related to acceptable content vary significantly by region, requiring Believe to implement robust content moderation and review processes to avoid regulatory penalties.

- Adapting to evolving digital media regulations: As governments update laws to address the digital landscape, Believe needs to monitor changes in areas like data privacy and platform accountability that could impact its operations and artist agreements.

Data governance and cybersecurity policies

Governments worldwide are intensifying their focus on data governance and cybersecurity, with new regulations shaping how companies like Believe manage sensitive information. For instance, the European Union's General Data Protection Regulation (GDPR) continues to set a high standard, and similar frameworks are emerging globally. Believe's compliance efforts are critical, as data breaches can lead to significant financial penalties and reputational damage.

The evolving landscape means Believe must continuously adapt its data handling practices. This includes investing in robust cybersecurity infrastructure and ensuring transparent data usage policies.

- Data Privacy Laws: Believe must comply with regulations like GDPR, CCPA, and emerging national data protection laws, which dictate how user and artist data is collected, processed, and stored.

- Cybersecurity Mandates: Governments are increasingly mandating specific cybersecurity measures, requiring companies to implement advanced threat detection, data encryption, and incident response plans.

- Cross-Border Data Flows: Policies governing the transfer of data across international borders impact Believe's operations, necessitating careful adherence to differing national requirements.

- Enforcement and Penalties: Non-compliance can result in substantial fines; for example, GDPR penalties can reach up to 4% of annual global revenue or €20 million, whichever is higher.

Governmental policies directly influence the operational environment for digital music distributors like Believe. New regulations concerning antitrust, content moderation, and fair artist compensation are becoming more prevalent. For example, the European Union's Digital Markets Act, fully effective from March 2024, imposes strict rules on large online platforms, potentially altering Believe's distribution partnerships.

International trade and data flow agreements significantly impact Believe's global reach. The EU-US Data Privacy Framework, established in July 2023, aims to simplify cross-border data transfers, which is beneficial for digital service providers. However, ongoing trade policy discussions could introduce new regulations affecting digital content services.

The enforcement of intellectual property rights is paramount for Believe, given its reliance on music licensing. The global recorded music market reached an estimated $26.2 billion in 2023, according to the IFPI, highlighting the importance of robust IP protection. Variations in copyright laws across different countries necessitate continuous adaptation of Believe's legal and operational strategies.

Cultural policies aimed at promoting local content can create both opportunities and challenges for Believe. Many governments implement measures like broadcast quotas or direct funding to support domestic artists. Believe's ability to navigate these diverse national regulations, such as France's 2024 broadcasting law requiring a significant portion of radio music to be French, is crucial for market access and artist visibility.

Governments are also increasing scrutiny on data governance and cybersecurity. Regulations like the GDPR continue to set a high bar for data protection, with similar laws emerging worldwide. Believe's adherence to these mandates, including robust cybersecurity measures and transparent data policies, is essential to avoid substantial penalties, which under GDPR can reach up to 4% of annual global revenue.

| Policy Area | Impact on Believe | Example/Data Point (2023-2024) |

|---|---|---|

| Digital Platform Regulation | Alters distribution partnerships and revenue models. | EU's Digital Markets Act (effective March 2024) |

| International Data Flows | Facilitates or hinders cross-border operations. | EU-US Data Privacy Framework (July 2023) |

| Intellectual Property Enforcement | Secures revenue streams from licensing. | Global recorded music revenue: $26.2 billion (2023, IFPI) |

| Cultural Policies (Local Content) | Requires adaptation for market access. | French broadcasting law mandates local music percentage (2024) |

| Data Governance & Cybersecurity | Demands investment in compliance and security. | GDPR fines can reach 4% of global annual revenue. |

What is included in the product

The Believe PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the business, offering a comprehensive view of the external landscape.

The Believe PESTLE Analysis provides a clear, actionable framework, transforming complex external factors into manageable insights that directly address the pain of strategic uncertainty.

Economic factors

The global digital music market is experiencing robust expansion, with projections indicating continued growth. This upward trend is fueled by increasing internet access and widespread smartphone ownership worldwide, directly benefiting companies like Believe that operate within this digital ecosystem.

This market expansion translates into a larger addressable audience for Believe's distribution and artist services. For instance, the digital music market size was valued at approximately USD 24.9 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 12.0% from 2024 to 2030, according to some industry reports.

Believe can leverage this growth by strategically investing in emerging markets and adopting new technologies. This proactive approach allows the company to capitalize on evolving consumer behaviors and technological advancements, solidifying its position in the dynamic digital music landscape.

Inflationary pressures and shifts in consumer disposable income directly influence spending on entertainment, including subscription services. As the cost of living rises, consumers may re-evaluate discretionary spending, potentially impacting Believe's partners' revenue streams.

For instance, in early 2024, inflation rates remained a concern for many economies, leading to tighter household budgets. This could translate to reduced spending on non-essential services like streaming, affecting Believe's service fee collection and overall growth forecasts.

A slowdown in consumer entertainment spending can create a ripple effect, impacting the revenue of Believe's partners. Consequently, this downturn could lead to revised service fees for Believe and potentially lower its growth projections for the 2024-2025 period.

Advertising on free-tier music streaming services is a significant revenue stream, with global digital advertising spending projected to reach $740 billion in 2024, according to Statista. This growth indicates a robust market, but also highlights the sensitivity of Believe's revenue to broader economic conditions affecting ad budgets.

Shifts in digital advertising, such as the increasing dominance of short-form video content and privacy-focused tracking changes, can alter how effectively music content is monetized. For instance, the ongoing evolution of ad targeting capabilities directly influences the CPM (cost per mille) rates advertisers are willing to pay, impacting the overall revenue pool available for distribution.

Monetization models and artist payouts

The music industry's monetization models are constantly shifting, with new subscription tiers and direct-to-fan sales becoming increasingly important. For Believe, a company focused on artist revenue, these changes directly influence their operational strategy and artist partnerships. For instance, the growth of premium subscription services across major streaming platforms in 2024 and 2025 presents both opportunities and challenges in how royalties are calculated and distributed.

Believe's core business revolves around maximizing artist earnings, making understanding evolving payout structures critical. As platforms introduce more nuanced revenue-sharing agreements, Believe must adapt its services to ensure artists benefit fairly. This includes navigating the complexities of emerging revenue streams like NFTs and virtual concerts, which gained significant traction in late 2023 and are projected to expand further.

The financial health of artists and, by extension, Believe, is directly tied to the effectiveness of these monetization strategies. Consider the impact of a 5% increase in direct-to-fan sales revenue on an artist's overall income, which can significantly alter their ability to invest in future projects. Believe's ability to leverage these new models will be a key differentiator in the competitive landscape.

- Evolving Subscription Models: Streaming platforms saw a global subscriber base exceeding 1 billion by the end of 2023, with projections indicating continued growth into 2025, impacting royalty payouts.

- Direct-to-Fan Growth: Platforms facilitating direct artist-to-fan sales reported a 20% year-over-year increase in transaction volume in 2023, a trend expected to accelerate.

- Emerging Platforms: The rise of platforms offering new monetization avenues, such as fan clubs and exclusive content, provides artists with diversified income streams beyond traditional royalties.

- Payout Structure Adaptability: Believe's success hinges on its agility in adapting to platform payout changes, which can vary significantly based on listener engagement and subscription tier performance.

Venture capital and investment in music tech

The music technology sector saw significant venture capital activity leading up to and into 2024. For instance, in 2023, global investment in music tech startups reached approximately $1.8 billion, a notable figure despite broader economic headwinds. This level of funding directly impacts the competitive landscape, fueling innovation and potentially creating new avenues for companies like Believe.

A strong investment climate fosters a dynamic environment where new technologies and business models emerge rapidly. This can lead to strategic partnerships and acquisition opportunities for established players. Conversely, a downturn in venture capital, as seen in some periods of 2024, might constrain the pace of innovation and intensify competition for existing market share.

- Global music tech funding in 2023 was around $1.8 billion.

- Increased investment fuels innovation and new market entrants.

- A slowdown in VC can heighten competitive pressures for established companies.

- Partnerships and M&A activity are often driven by investment trends.

Economic factors significantly shape the music industry's landscape, influencing everything from consumer spending on streaming services to advertising revenue. Inflationary pressures, as observed in early 2024 with persistent cost-of-living concerns, can lead consumers to re-evaluate discretionary spending, potentially impacting Believe's partners' revenue streams and, consequently, Believe's own growth projections for 2024-2025.

The digital advertising market, a crucial revenue source for free-tier music services, is projected to reach $740 billion globally in 2024, underscoring its importance. However, shifts in advertising strategies, such as the rise of short-form video and changes in privacy tracking, directly influence monetization effectiveness and advertiser willingness to pay, impacting revenue pools.

Believe's success is intrinsically linked to evolving monetization models, including direct-to-fan sales and new subscription tiers. The global streaming subscriber base surpassed 1 billion by the end of 2023, a figure expected to climb, directly affecting royalty payouts and requiring Believe to adapt its services to ensure fair artist compensation.

| Economic Factor | Impact on Believe | 2024/2025 Data Point |

| Inflationary Pressures | Reduced consumer discretionary spending on entertainment, potentially lowering partner revenue and Believe's growth forecasts. | Inflation rates remained a concern in early 2024, impacting household budgets. |

| Digital Advertising Market | Sensitivity of ad-supported revenue to economic conditions affecting ad budgets and changes in ad targeting effectiveness. | Global digital advertising spending projected to reach $740 billion in 2024. |

| Monetization Model Evolution | Direct impact on artist earnings and Believe's operational strategy through changing royalty structures and new revenue streams. | Global streaming subscriber base exceeded 1 billion by end of 2023, with continued growth expected. |

Preview Before You Purchase

Believe PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Believe PESTLE Analysis breaks down the external factors impacting the business, offering actionable insights for strategic planning.

What you’re previewing here is the actual file—fully formatted and professionally structured. It provides a detailed examination of Political, Economic, Social, Technological, Legal, and Environmental influences, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. This Believe PESTLE Analysis is designed to be a valuable tool for understanding the broader landscape and identifying potential opportunities and threats.

Sociological factors

The music industry has seen a dramatic shift from physical formats like CDs to digital consumption, with streaming services now dominating. In 2023, global recorded music revenue reached $28.6 billion, with streaming accounting for an impressive 67% of that total, demonstrating the profound impact of this change on how people access and enjoy music.

Believe's strategic advantage lies in its adaptability to these evolving consumer behaviors. By offering robust digital distribution and marketing services, the company effectively caters to audiences who discover and engage with music primarily through platforms like Spotify and Apple Music, ensuring its relevance in the modern music landscape.

The music industry is witnessing a significant surge in independent artists, with an estimated 35% of recorded music revenue in 2024 attributed to non-major label artists. This DIY culture empowers creators to bypass traditional gatekeepers, directly engaging with fans and managing their careers using digital platforms. Believe's model is perfectly positioned to capitalize on this trend, offering essential services like distribution, promotion, and data analytics that support this burgeoning independent artist ecosystem.

Social media platforms are now the dominant force in how people find new music, with TikTok, Instagram, and YouTube Reels frequently serving as launchpads for viral hits. Believe needs to actively cultivate strategies on these platforms to boost artist exposure and connect with fans, recognizing that user-generated content and trending sounds directly impact music consumption. For instance, in 2024, a significant percentage of Gen Z reported discovering new artists primarily through short-form video content.

Diversity and inclusion in the music industry

Societal expectations are increasingly pushing for greater diversity and inclusion within the music industry. This shift influences which artists and music styles gain popularity, and also shapes how companies operate internally. Believe's expansive global reach and dedication to supporting a wide array of artists across different genres are key strengths, allowing it to benefit from and contribute to a more inclusive music landscape.

The demand for diverse representation is evident in market trends. For instance, in 2023, streaming data showed continued growth in genres often associated with underrepresented artists, highlighting a broader listener base seeking varied musical experiences. Believe's strategy aligns with this by actively promoting and distributing music from a broad spectrum of global talent, ensuring a more equitable platform.

- Artist Representation: In 2024, major music labels reported a 15% increase in signing artists from minority ethnic backgrounds compared to 2022, reflecting industry-wide efforts.

- Genre Popularity: Genres like Afrobeats and K-Pop, driven by diverse artist communities, saw significant global streaming growth, with Afrobeats streams increasing by over 20% in major markets in 2023.

- Corporate Culture: Believe's internal diversity metrics, aiming for 40% female leadership by 2025, demonstrate a commitment to fostering an inclusive workplace that mirrors the industry's evolving demands.

- Global Reach: Believe's presence in over 50 countries allows it to tap into and promote diverse musical traditions, connecting artists with new audiences worldwide.

Global reach and cultural exchange through music

Digital music distribution has truly revolutionized how music travels across borders, making it easier than ever for artists from anywhere to connect with listeners globally. This unprecedented access fosters a vibrant cultural exchange, where diverse musical styles can flourish and find new audiences.

Believe, with its extensive network reaching over 200 digital platforms worldwide, is perfectly positioned to leverage this trend. By facilitating the global reach of its artists, Believe not only capitalizes on this cultural exchange but also actively diversifies its artist roster, bringing a wider array of sounds to the international stage.

- Global Music Market Growth: The global recorded music market reached an estimated $28.6 billion in 2023, showing continued expansion driven by digital consumption.

- Digital Platform Reach: Believe's distribution network spans over 200 digital service providers, including major global players and regional platforms, offering unparalleled market access for artists.

- Emerging Market Opportunities: As of early 2024, emerging markets are showing significant growth in music streaming adoption, presenting new avenues for cultural exchange and artist discovery.

- Artist Diversity: Believe's commitment to independent artists contributes to a more diverse musical landscape, with a significant portion of its roster representing artists from non-traditional music hubs.

Sociological factors significantly shape the music industry, influencing everything from artist discovery to consumer expectations. The rise of independent artists, now accounting for an estimated 35% of recorded music revenue in 2024, highlights a cultural shift towards creator empowerment and direct fan engagement.

Social media platforms are crucial for music discovery, with short-form video content frequently launching viral hits; a significant percentage of Gen Z in 2024 reported finding new artists this way. Believe's ability to navigate these platforms is key to its success.

Societal demands for diversity and inclusion are also impacting the industry, with genres like Afrobeats and K-Pop experiencing substantial global streaming growth, demonstrating a broader listener base seeking varied musical experiences. Believe's global reach and commitment to diverse talent align with these evolving societal values.

| Factor | 2023/2024 Data Point | Impact on Believe |

|---|---|---|

| Independent Artist Revenue Share | 35% of recorded music revenue (2024 estimate) | Leverages Believe's distribution and support services for emerging talent. |

| Primary Music Discovery Channel for Gen Z | Short-form video content (2024 data) | Necessitates strong social media marketing strategies for artist promotion. |

| Growth in Diverse Genres (e.g., Afrobeats) | Over 20% streaming growth in major markets (2023) | Benefits from Believe's global network and diverse artist roster. |

| Industry Diversity Initiatives | 15% increase in signing minority ethnic artists (2024 vs 2022) | Aligns with Believe's commitment to inclusivity and broad artist representation. |

Technological factors

Artificial intelligence is revolutionizing the music industry, impacting everything from production to how listeners discover new tracks. Companies like Believe can harness AI for advanced audio mastering, personalized playlist curation, and predictive analytics to understand listener trends. For instance, AI-powered tools can analyze vast datasets to identify emerging genres or predict the success of a song, offering artists and labels invaluable strategic guidance.

Believe can leverage these AI advancements to significantly enhance its service offerings. By integrating AI, the company can provide artists with deeper, data-driven insights into their fan base, enabling more targeted marketing campaigns and efficient content distribution. This also extends to streamlining internal operations, such as content moderation and royalty tracking, freeing up resources for more artist-centric development.

Streaming platforms are rapidly advancing, with new features and monetization models emerging constantly. Believe needs to ensure its distribution infrastructure can support these innovations, allowing artists to leverage new tools like interactive content or enhanced fan engagement features. For instance, the rise of short-form video integrations on platforms like TikTok and Instagram Reels, which saw significant user growth throughout 2024, presents both opportunities and challenges for music discovery and artist promotion.

Believe leverages advanced data analytics to refine audience targeting and foster artist development. By scrutinizing listener behavior, including streaming patterns and engagement metrics, the company provides artists and labels with crucial insights. For instance, in 2024, Believe reported a significant increase in data-driven campaign effectiveness, leading to a 15% uplift in fan acquisition for artists utilizing their analytics platform.

This technological capability is paramount for Believe's strategy, enabling personalized marketing efforts and informed career decisions for artists. The platform's ability to process and present complex listener data in an accessible format empowers users to understand their fanbase better and identify growth opportunities. By Q1 2025, Believe's analytics tools were instrumental in helping over 500 independent artists achieve new milestones in their streaming and fan engagement.

Blockchain for rights management and transparency

Blockchain technology presents a significant opportunity for enhancing transparency and efficiency within the music industry, particularly in managing rights and distributing royalties. Believe can leverage this technology to build greater trust among artists and stakeholders.

By adopting blockchain, Believe could streamline complex royalty calculations and payments, potentially reducing administrative costs and ensuring more accurate and timely compensation for creators. This move aligns with the industry's ongoing efforts to create fairer and more transparent systems.

While the widespread adoption of blockchain in music rights management is still developing, its potential impact is substantial. For instance, by 2024, the global blockchain in music market is projected to reach significant figures, indicating growing interest and investment in these solutions. Believe's exploration in this area could position them as an innovator.

- Enhanced Transparency: Blockchain can create an immutable ledger for music rights ownership and royalty streams, making it easier to track and verify.

- Improved Efficiency: Automating royalty payments through smart contracts on a blockchain can reduce manual processing and potential errors.

- Fairer Compensation: Artists and rights holders could receive more direct and timely payments, fostering greater trust in the distribution process.

- Reduced Administrative Costs: Streamlining processes via blockchain can lower overheads associated with complex rights management.

Development of new immersive audio experiences

The evolution of immersive audio, including spatial audio and virtual reality (VR) music experiences, presents significant opportunities. Believe must stay abreast of these advancements to ensure its artists can effectively distribute and monetize their content across emerging platforms like the metaverse. For instance, the global metaverse market was projected to reach USD 75.8 billion in 2024, indicating substantial growth in virtual environments where new audio experiences are paramount.

These technological shifts necessitate strategic adaptation. Believe could explore partnerships or develop proprietary solutions for VR/AR content creation and distribution. The increasing adoption of spatial audio in music streaming services, with platforms like Apple Music and Amazon Music heavily investing in the technology, underscores the growing consumer demand for more engaging audio formats. By 2025, it's anticipated that a significant portion of new music releases will feature spatial audio mixes, making it a crucial consideration for artists and labels alike.

- Spatial Audio Adoption: Major streaming services are increasingly integrating spatial audio, enhancing listener immersion.

- Metaverse Growth: The expanding metaverse market offers new channels for music discovery and consumption.

- Artist Monetization: Believe needs to ensure artists can capitalize on revenue streams within these new immersive environments.

- Technological Integration: Proactive integration with VR/AR and metaverse platforms is key to future-proofing content delivery.

Technological advancements are reshaping the music landscape, with AI and data analytics offering Believe unprecedented tools for artist development and audience engagement. The company's strategic integration of these technologies, exemplified by a 15% uplift in fan acquisition through its analytics platform in 2024, positions it to capitalize on evolving market dynamics.

Blockchain technology holds promise for enhancing transparency in royalty distribution, a critical area for artist trust and satisfaction. While still in early adoption phases, the growing global blockchain in music market signals a significant future opportunity for Believe to innovate and streamline its operations.

The rise of immersive audio formats like spatial audio and the expansion of the metaverse present new avenues for music consumption and artist monetization. Believe's proactive approach to integrating with these emerging platforms, such as anticipating a significant portion of new music releases featuring spatial audio by 2025, is crucial for its long-term relevance.

| Technology | Impact on Believe | 2024/2025 Data/Projections |

|---|---|---|

| Artificial Intelligence | Enhanced production, personalized discovery, predictive analytics | AI tools analyzed vast datasets to identify emerging genres; 500+ independent artists used analytics tools by Q1 2025 |

| Data Analytics | Refined audience targeting, data-driven artist development | 15% uplift in fan acquisition via analytics platform in 2024 |

| Blockchain | Improved transparency, efficiency in royalty distribution | Global blockchain in music market projected for significant growth |

| Immersive Audio & Metaverse | New distribution and monetization channels | Metaverse market projected at USD 75.8 billion in 2024; significant portion of new releases expected to feature spatial audio by 2025 |

Legal factors

Believe navigates a complex web of evolving copyright laws for digital content, a crucial element in its PESTLE analysis. These laws dictate how music is distributed, licensed, and protected globally, directly impacting Believe's revenue streams and artist agreements.

Ensuring compliance with copyright regulations, including rights clearance and licensing, is paramount for Believe's business model. The company must actively protect its artists' content from piracy, a persistent challenge in the digital music landscape.

The global digital music market, valued at over $25 billion in 2023, underscores the significance of robust copyright adherence. Believe's ability to manage these legal intricacies directly influences its market position and profitability.

Data privacy regulations like GDPR in Europe and CCPA in California are becoming increasingly stringent, impacting how companies like Believe handle personal data. These laws mandate careful collection, processing, and storage of user information, requiring robust compliance measures to prevent hefty fines and maintain trust.

Failure to comply can lead to significant penalties; for instance, GDPR violations can result in fines of up to 4% of a company's annual global revenue or €20 million, whichever is higher. Believe's commitment to data protection is therefore crucial for its operational integrity and reputation in the 2024-2025 period.

Believe's global music distribution hinges on intricate licensing deals with Performance Rights Organizations (PROs) and collection societies. In 2024, these agreements are crucial for ensuring artists and rights holders are properly compensated, with royalty collection and distribution being a core operational function. Failure to navigate these complex legal frameworks can lead to compliance issues and impact revenue streams.

Antitrust concerns in the digital music market

Antitrust concerns are growing in the digital music sector as consolidation continues. Believe, as a key player, needs to navigate these regulations carefully. Authorities are increasingly watchful of dominant platforms and any practices that might stifle fair competition, potentially impacting Believe's strategic moves and collaborations.

For instance, in 2023, the European Commission continued its investigations into potential anti-competitive practices in digital markets, including music streaming services. Believe must ensure its operations, including distribution agreements and pricing strategies, align with antitrust laws to prevent penalties or limitations on its business model.

- Regulatory Scrutiny: Antitrust bodies may examine market share and exclusive deals within digital music, potentially affecting Believe's partnerships.

- Compliance Burden: Believe must invest in legal expertise to ensure adherence to evolving antitrust regulations globally, especially in key markets like the EU and US.

- Market Dynamics: Increased consolidation among major labels and streaming services can intensify antitrust focus on all significant participants.

Contractual agreements between artists, labels, and platforms

The legal landscape for Believe involves intricate contractual agreements with artists, independent labels, and digital distribution platforms. These contracts are crucial for defining revenue splits, royalty payments, and intellectual property rights. For instance, Believe's role as a distributor means navigating agreements that ensure fair compensation for artists and compliance with platform terms of service, which are constantly evolving.

Robust contractual frameworks are essential for Believe's operational integrity and growth. These agreements must clearly outline distribution rights, licensing terms, and dispute resolution mechanisms. In 2024, the music industry saw continued scrutiny on artist contracts, with many seeking more transparent and equitable revenue sharing models, a trend Believe must actively address in its own agreements.

Key contractual considerations for Believe include:

- Artist Agreements: Ensuring fair royalty rates and clear ownership of master recordings.

- Label Partnerships: Establishing mutually beneficial terms for distribution and marketing services.

- Platform Licensing: Negotiating favorable terms with streaming services like Spotify and Apple Music, which are critical revenue channels.

- Copyright and Rights Management: Implementing strong legal protections for intellectual property in a digital environment.

Believe's operations are heavily influenced by evolving copyright laws, particularly concerning digital music distribution and licensing. Navigating these global regulations is essential for securing revenue and managing artist relationships effectively.

Data privacy laws, such as GDPR and CCPA, impose strict requirements on how Believe handles user information, with non-compliance potentially leading to significant financial penalties. For example, GDPR fines can reach up to 4% of global annual revenue.

Antitrust regulations are also a growing concern in the digital music sector, as authorities scrutinize market dominance and competitive practices. Believe must ensure its agreements and strategies align with these laws to avoid regulatory intervention, especially given the ongoing investigations in markets like the EU.

Believe's business relies on robust contractual agreements with artists, labels, and platforms, defining crucial aspects like royalty payments and intellectual property rights. The industry trend towards more transparent artist compensation models necessitates careful contract review and negotiation for Believe in 2024-2025.

Environmental factors

Data centers powering digital streaming services, including those used by Believe, are substantial energy consumers. In 2023, global data center energy consumption was estimated to be around 1.5% of total electricity demand, a figure projected to rise with increased digital activity.

This significant energy footprint presents an environmental challenge for the entire digital music ecosystem. As awareness grows, companies like Believe, though not direct operators, may face increasing pressure from stakeholders and regulators to advocate for or support the use of renewable energy sources within their supply chain.

The digital infrastructure powering music streaming and distribution, including servers, data centers, and network equipment, generates a significant carbon footprint. Estimates suggest that data centers alone accounted for around 1% of global electricity consumption in 2023, a figure projected to rise with increasing data traffic.

Believe, as a key player in digital music distribution, is indirectly connected to this environmental impact. While not directly manufacturing physical goods, its operations rely on this energy-intensive digital ecosystem, making its indirect carbon footprint a consideration in its sustainability strategy.

The energy used to power these digital services often comes from fossil fuels, contributing to greenhouse gas emissions. The increasing demand for high-definition streaming and the growth of cloud-based services are expected to further escalate the energy requirements of global digital infrastructure.

Believe, while focused on digital, operates within an industry increasingly scrutinized for its environmental footprint. The physical production of vinyl and CDs, along with the carbon emissions from touring, are significant concerns. For instance, a 2024 report highlighted that global music consumption still accounts for an estimated 200,000 tons of CO2 annually, with touring being a major contributor.

As consumer and regulatory pressure mounts, Believe may need to encourage or facilitate more sustainable choices among its partners. This could involve promoting eco-friendly merchandise production or supporting artists who prioritize lower-impact touring methods, potentially influencing their distribution choices.

Corporate social responsibility initiatives

Believe faces growing expectations to showcase robust corporate social responsibility (CSR) and environmental commitment. This pressure is evident across industries, pushing companies to integrate sustainable practices into their core operations.

Believe can bolster its brand image by actively participating in CSR efforts. These might include fostering eco-friendly partnerships or implementing strategies to mitigate its digital environmental impact, aligning with broader sustainability goals.

For instance, in 2024, the global average ESG (Environmental, Social, and Governance) investment in media and entertainment companies saw a notable uptick, indicating investor appetite for socially responsible businesses. Companies like Believe are increasingly evaluated on their tangible contributions to environmental protection and social well-being.

- Sustainability Focus: Believe could champion eco-friendly practices within its digital content creation and distribution channels.

- Digital Footprint: Initiatives to offset carbon emissions from data centers and online operations are becoming crucial.

- Partner Engagement: Encouraging and supporting CSR among its business partners can amplify positive impact.

- Reputation Enhancement: Strong CSR performance is directly linked to improved brand perception and customer loyalty in the current market.

Waste management from physical media

While Believe's primary focus is digital music distribution, the broader music industry still generates physical media like vinyl records and CDs. This sector, though declining, still represents a significant portion of music sales for some artists and labels. For instance, in 2023, vinyl sales in the US reached over $1.2 billion, demonstrating continued consumer interest in physical formats.

A growing societal emphasis on environmental sustainability and waste reduction could indirectly impact Believe. A strong public sentiment against waste from physical products might encourage artists and labels to prioritize digital-only releases, further accelerating the industry's digital transformation. This trend is already visible, with physical media sales as a percentage of total music revenue continuing to shrink year over year.

- Vinyl sales in the US exceeded $1.2 billion in 2023.

- Physical media's share of the overall music market continues to decrease.

- Societal pressure for waste reduction can influence release strategies towards digital.

The digital infrastructure powering music distribution, including data centers, consumes significant energy. Global data center energy consumption was estimated at 1.5% of total electricity demand in 2023, a figure expected to grow with increased digital activity.

This reliance on energy, often from fossil fuels, contributes to greenhouse gas emissions. Believe, as a digital distributor, is indirectly linked to this carbon footprint, facing pressure to support renewable energy within its supply chain.

While digital is primary, physical media like vinyl still holds market share, with US vinyl sales exceeding $1.2 billion in 2023. Growing environmental consciousness could further shift focus towards digital-only releases, reducing physical waste.

| Environmental Factor | Impact on Believe | Data/Trend |

|---|---|---|

| Data Center Energy Consumption | Indirect carbon footprint, potential pressure for renewable energy sourcing. | Estimated 1.5% of global electricity demand in 2023, projected to rise. |

| Physical Media Waste | Potential shift towards digital-only releases as environmental awareness grows. | US vinyl sales over $1.2 billion in 2023; overall physical media share declining. |

| Investor ESG Focus | Increased scrutiny on sustainability practices, influencing brand perception and investment. | Notable uptick in ESG investment in media and entertainment in 2024. |

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data from official government publications, reputable financial institutions like the World Bank and IMF, and leading market research firms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in credible, up-to-date information.