Believe Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Believe Bundle

Believe's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the ever-present threat of new entrants. Understanding these dynamics is crucial for any business operating in this space.

The complete report reveals the real forces shaping Believe’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of Believe's suppliers, mainly artists and record labels, is typically spread out because there are so many independent artists worldwide. For instance, in 2023, the global recorded music market generated approximately $28.6 billion, with a significant portion coming from a diverse range of artists, not just a few superstars.

However, artists who are highly successful or offer very specific types of music possess greater individual leverage. Their established fan bases mean they can drive substantial streaming numbers and revenue, giving them more sway in negotiations. This is particularly true for artists who have a unique sound or appeal that is not easily replicated.

Believe's approach to managing this supplier power involves acquiring stakes in various labels and building strategic alliances. These moves help ensure access to valuable content and can lessen the impact of individual suppliers demanding more favorable terms.

Switching digital distributors presents artists and labels with several hurdles. These include navigating complex administrative processes, the risk of disrupting crucial release timelines, and the effort required to build rapport with a new distribution partner. While these switching costs aren't insurmountable, they do contribute to client retention for companies like Believe, thereby moderating the bargaining power of artists and labels seeking to switch providers.

The threat of forward integration by suppliers can significantly impact Believe's bargaining power. For instance, major independent labels or highly successful artists could decide to handle their own distribution and marketing, cutting out intermediaries like Believe. This move would directly increase their leverage.

The increasing availability of do-it-yourself tools and direct-to-fan platforms is a key driver behind this trend. These resources allow suppliers to take on more functions themselves, strengthening their position and potentially lessening their need for services offered by companies like Believe. For example, by 2024, the global music streaming market was projected to reach over $30 billion, indicating a growing ecosystem where artists have more direct access to consumers.

Importance of Believe to Supplier's Business

Believe's multifaceted service offering significantly enhances its value proposition to artists, thereby diminishing supplier bargaining power. Beyond simple distribution, Believe provides crucial marketing, promotion, and artist development services. These are essential for artists to effectively monetize their content and cultivate long-term careers.

For many artists, particularly those just starting out, Believe's extensive global network and sophisticated technological platform are indispensable. This reliance on Believe's infrastructure limits the bargaining power of individual artists, as they often lack the resources and reach to achieve similar market penetration independently.

- Global Reach: Believe's platform connects artists to over 200 territories, expanding their audience significantly.

- Artist Services: In 2023, Believe reported significant growth in its value-added services, aiding artists in revenue generation.

- Technological Edge: The company's advanced data analytics and distribution tools provide artists with insights and efficiency unmatched by smaller operations.

Availability of Substitute Suppliers

The digital music distribution landscape is highly competitive, with numerous providers like TuneCore, DistroKid, and CD Baby vying for artists' business. This abundance of choices significantly empowers artists.

For instance, TuneCore, a subsidiary of Believe, faces competition from platforms that offer comparable services, often at competitive price points. In 2023, the global digital music distribution market was valued at approximately USD 22.5 billion, indicating substantial room for new entrants and existing players to expand, further intensifying competition.

This high availability of alternative distribution services directly impacts Believe's bargaining power with artists. If Believe's terms or service offerings become less attractive, artists can readily switch to competitors, forcing Believe to remain competitive in its pricing and feature sets.

- High Market Saturation: The digital music distribution market features many established and emerging players, providing artists with ample alternatives.

- Competitive Pricing: The presence of numerous distributors often leads to competitive pricing strategies, putting pressure on established companies like Believe to offer attractive terms.

- Artist Empowerment: Artists can leverage the availability of substitute suppliers to negotiate better deals or seek services that better align with their specific needs.

The bargaining power of Believe's suppliers, primarily artists and record labels, is influenced by the global music market's size and diversity. In 2023, this market reached approximately $28.6 billion, with a broad base of artists contributing to its revenue, thus diffusing individual supplier power.

However, highly successful artists with dedicated fan bases wield greater influence due to their ability to drive significant streaming numbers and revenue, enhancing their negotiation leverage. This is particularly true for artists with unique, hard-to-replicate musical styles.

Believe mitigates supplier power by acquiring stakes in labels and forming strategic alliances, ensuring content access and reducing reliance on individual suppliers' demands.

Switching costs for artists and labels, such as administrative complexities and the risk to release schedules, help retain clients for distributors like Believe, thereby moderating supplier bargaining power.

The threat of forward integration, where major artists or labels might handle their own distribution and marketing, could increase supplier leverage by bypassing intermediaries.

The rise of DIY tools and direct-to-fan platforms allows suppliers to manage more functions independently, strengthening their position and potentially reducing their need for services from companies like Believe. The global music streaming market was projected to exceed $30 billion by 2024, highlighting increased artist access to consumers.

Believe's comprehensive services, including marketing, promotion, and artist development, enhance its value proposition, diminishing supplier bargaining power by providing essential career-building support.

Many artists, especially emerging ones, rely on Believe's extensive global network and advanced technology for market penetration, limiting their independent bargaining power.

The digital music distribution sector is highly competitive, with numerous providers like TuneCore, DistroKid, and CD Baby offering similar services, which empowers artists by providing ample alternatives and often leading to competitive pricing strategies.

The global digital music distribution market's valuation of approximately USD 22.5 billion in 2023 indicates significant competition, forcing companies like Believe to maintain attractive terms and features to retain artists.

| Factor | Impact on Believe's Supplier Bargaining Power | Supporting Data (2023/2024 Projections) |

|---|---|---|

| Supplier Concentration | Low to Moderate | Global recorded music market: ~$28.6 billion. Diverse artist base limits individual supplier power, but superstar artists have high leverage. |

| Switching Costs | Moderate | Artists face administrative hurdles, release timeline risks, and the need to build new relationships when switching distributors. |

| Threat of Forward Integration | Moderate | Successful artists/labels can bypass distributors, increasing their leverage. |

| Availability of Substitutes | High | Numerous digital distributors (TuneCore, DistroKid) offer competitive services and pricing, empowering artists. Global digital distribution market: ~$22.5 billion. |

| Importance of Supplier's Input | High | Artists' content is the core product; Believe's services are crucial for monetization and career growth. |

What is included in the product

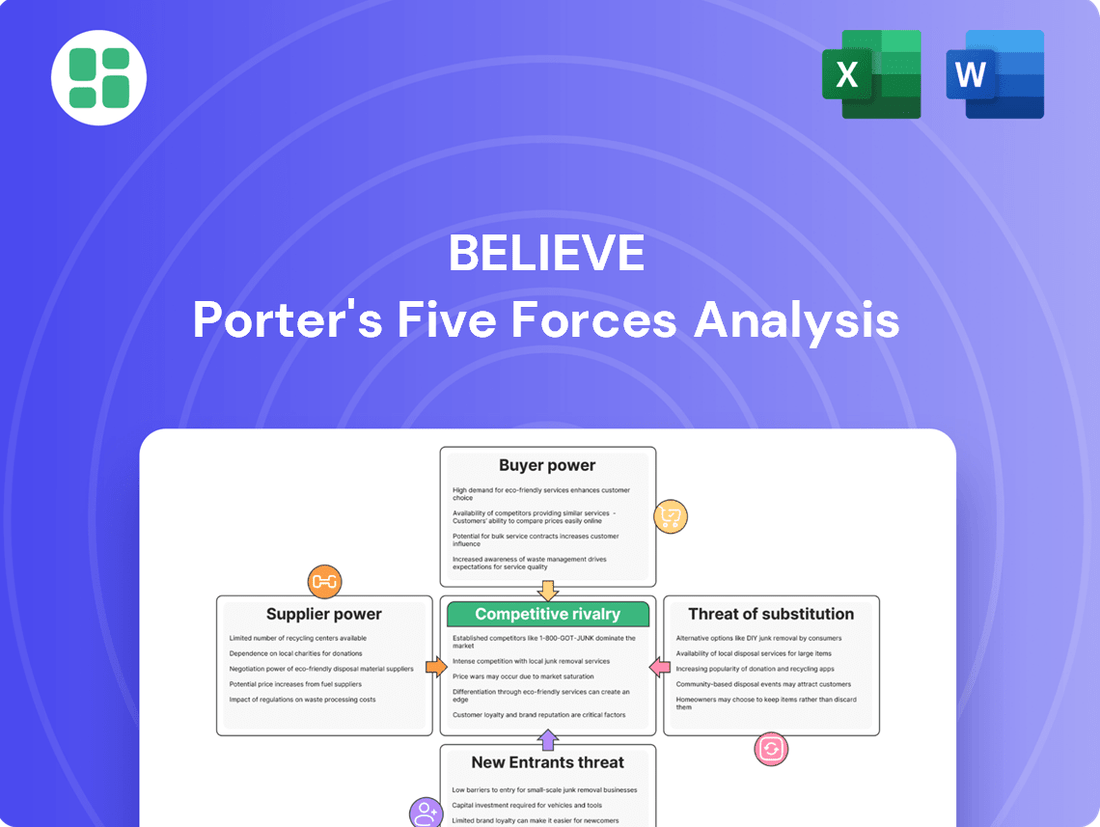

This analysis dissects the competitive forces impacting Believe, revealing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential for substitute products.

Visualize competitive intensity across all five forces at a glance, simplifying complex market dynamics for confident strategic planning.

Customers Bargaining Power

Believe's customer base is incredibly diverse, made up of countless independent artists and record labels across the globe. This fragmentation means that no single customer, or even a small group of customers, has the power to dictate terms or significantly influence Believe's pricing or service offerings. For instance, in 2023, Believe reported a diverse revenue stream with no single artist or label accounting for more than a minor percentage of their overall income, underscoring this low customer concentration.

The availability of substitute services significantly bolsters the bargaining power of customers in the music industry. Artists and labels aren't tied to a single digital distribution or artist service provider; they have a diverse array of alternatives. For instance, services like DistroKid, TuneCore, and CD Baby offer comparable functionalities, allowing artists to distribute their music globally.

This abundance of choice means customers can easily switch if they find better terms, lower fees, or superior features elsewhere. In 2024, the digital music distribution market is projected to continue its growth, with numerous players vying for market share, further empowering artists and labels to negotiate favorable terms. The ease of switching between these platforms directly translates into increased leverage for the customer.

Customer switching costs are a crucial factor in assessing the bargaining power of customers. For Believe, while they strive for artist loyalty through comprehensive services, the actual cost and effort for artists to switch distributors are not prohibitively high, particularly for those utilizing only basic distribution services.

This ease of migration means artists can readily move to alternative platforms if they discover more favorable terms or superior service offerings. In 2023, the digital music distribution market saw significant growth, with revenues projected to reach over $30 billion globally, indicating a competitive landscape where customer retention is paramount.

Price Sensitivity of Customers

Independent artists, especially those just starting out, are very mindful of costs and how they split revenue. Believe's pricing and the value customers feel they get from its services directly impact whether these artists choose and stay with the platform. For instance, in 2024, many emerging artists were seeking distribution partners offering lower upfront fees and more favorable royalty splits, with some platforms advertising rates as low as 10-15% commission on streams.

This price sensitivity means Believe must offer competitive terms to win over and keep its artist base. A key factor for artists is the return on investment from their music, making Believe's service fees and revenue share models crucial decision points. Believe's ability to provide transparent and attractive financial arrangements is therefore paramount in managing this customer bargaining power.

Believe's competitive pricing strategy is a direct response to the price sensitivity of its customer base, particularly independent artists.

- Price Sensitivity: Emerging artists often have tight budgets, making them highly attuned to distribution fees and revenue share percentages.

- Value Perception: Artists evaluate Believe based on the perceived value of its services relative to its cost, influencing their decision to partner.

- Competitive Landscape: Believe's pricing must remain competitive against other distribution services that may offer lower entry costs or higher royalty payouts.

- Customer Retention: Attractive pricing and favorable revenue models are key drivers for retaining artists on the Believe platform.

Customer's Ability to Self-Distribute

Customers' ability to self-distribute, amplified by technological advancements, significantly boosts their bargaining power. The rise of social media and direct-to-fan platforms in 2024 allows creators to engage audiences and promote their work without relying solely on traditional intermediaries. This creates a viable alternative, even if it doesn't fully replicate global distribution networks.

This shift empowers customers by offering them choices and reducing their dependence on established channels. For instance, artists can now leverage platforms like Bandcamp or Patreon to sell merchandise and music directly, bypassing record labels and their associated fees. In 2023, the global creator economy was estimated to be worth over $250 billion, showcasing the scale of this direct engagement.

- Direct-to-Consumer Sales: Platforms like Etsy and Shopify empower individual sellers, reducing reliance on brick-and-mortar retailers.

- Social Media Marketing: In 2024, businesses are increasingly using platforms like TikTok and Instagram for direct customer engagement and sales, bypassing traditional advertising.

- Digital Content Distribution: Artists and content creators can now distribute music, videos, and art globally via their own websites or specialized platforms, reducing the need for traditional media companies.

- Customer Feedback Loops: Direct channels allow for immediate customer feedback, enabling businesses to adapt offerings more quickly and reducing the bargaining power of intermediaries who previously controlled information flow.

The bargaining power of customers for Believe is generally low due to the fragmented nature of its customer base, comprising numerous independent artists and labels globally. This lack of concentration means no single customer can significantly influence Believe's pricing or services.

The abundance of alternative music distribution services, such as DistroKid and TuneCore, provides artists with numerous options. In 2024, the competitive digital music distribution market offers artists the flexibility to switch platforms easily if they find better terms, directly enhancing their leverage.

Customer switching costs are relatively low for artists using basic distribution services, allowing for seamless migration to competitors. The digital music distribution market's growth, projected to exceed $30 billion in 2023, highlights a competitive environment where customer retention through attractive terms is crucial for companies like Believe.

Artists, especially emerging ones, are highly price-sensitive, scrutinizing distribution fees and revenue splits. Believe must offer competitive pricing and transparent financial models to attract and retain its artist clientele, as demonstrated by some platforms in 2024 offering commissions as low as 10-15%.

Same Document Delivered

Believe Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis you will receive immediately after purchase, ensuring no surprises or placeholder content. You are looking at the actual, professionally formatted document, which will be instantly accessible for your strategic planning needs. What you see here is precisely the document you'll download, ready for immediate application.

Rivalry Among Competitors

Believe operates in a crowded digital music market, facing intense rivalry from both major players and smaller independent distributors. Companies like The Orchard, a subsidiary of Sony Music, and the various distribution arms of Universal Music Group represent significant competition due to their established infrastructure and extensive artist rosters.

The market also includes numerous agile independent distributors such as DistroKid, TuneCore (which Believe itself owns), CD Baby, and Symphonic. This proliferation of competitors, each vying for artist attention and market share, significantly escalates the competitive rivalry within the sector.

The independent music market is seeing robust growth, with forecasts indicating sustained expansion. This expansion, while potentially easing competitive pressures by creating more opportunities, is simultaneously intensifying rivalry. The swift shift to digital music consumption and the rising prominence of independent artists mean that companies are fiercely competing for audience attention and market share.

Believe differentiates itself through a comprehensive suite of services, encompassing distribution, marketing, promotion, and artist development, all powered by technology and a global network. This integrated approach aims to provide artists with a holistic platform for growth.

However, the music industry is highly competitive, with many rivals offering similar services. This means Believe must constantly innovate and prove its superior value proposition to artists and labels to maintain its edge in a crowded market.

Switching Costs for Customers

Believe faces significant competitive rivalry due to the low switching costs for artists and labels when moving between digital music distribution platforms. This ease of transition means competitors can readily entice Believe's clients with more favorable deals or unique services, making customer loyalty a constant battle.

The digital music distribution landscape in 2024 is characterized by intense competition, with numerous players vying for market share. For instance, while specific figures for Believe's customer churn due to switching costs aren't publicly detailed, the broader industry trend shows that artists and labels are increasingly agile in their platform choices. This agility is driven by the availability of competitive pricing models and specialized features offered by rivals, directly impacting Believe's ability to retain its client base without continuous strategic adjustments.

- Low Switching Costs: Artists and labels can easily move their music catalogs between distributors with minimal effort or financial penalty.

- Competitive Pressure: Rivals can offer aggressive pricing, better royalty splits, or advanced promotional tools to attract clients away from Believe.

- Retention Challenge: Believe must continually innovate and offer compelling value propositions to prevent customer attrition in a fluid market.

Strategic Stakes

The digital music distribution sector is a battleground for major music companies aiming to capture the growing independent artist segment. This strategic importance fuels aggressive tactics, including mergers, acquisitions, and substantial investments in technology and artist support, all of which ratchet up the rivalry.

These intense competitive dynamics are evident in the market. For instance, in 2024, major labels continued to consolidate their digital presence, with Universal Music Group, Sony Music Entertainment, and Warner Music Group actively pursuing partnerships and acquisitions to bolster their streaming capabilities and artist rosters. This drive for market share means companies are constantly innovating and offering more attractive terms to artists, leading to a highly dynamic and competitive environment.

- Strategic Importance: Major music companies view digital distribution as crucial for accessing and nurturing independent artists, a key growth area.

- Aggressive Strategies: This importance translates into frequent acquisitions, increased tech spending, and enhanced artist services to gain an edge.

- Intensified Rivalry: These actions directly escalate competition within the digital music distribution landscape.

- Market Activity: In 2024, significant investments in streaming technology and artist development by major players underscored this competitive fervor.

Competitive rivalry is a significant force for Believe, intensified by low switching costs for artists and labels who can easily move between distributors. This ease of transition empowers rivals to lure clients with better deals or unique services, making client retention a constant challenge. In 2024, the digital music distribution market remained highly competitive, with artists and labels demonstrating increased agility in platform selection due to competitive pricing and feature sets from various distributors.

| Competitor Type | Examples | Impact on Rivalry |

|---|---|---|

| Major Music Companies | Universal Music Group, Sony Music Entertainment, Warner Music Group | Aggressive strategies, acquisitions, and tech investments to capture independent artists intensify competition. |

| Independent Distributors | The Orchard, DistroKid, TuneCore, CD Baby, Symphonic | Proliferation of agile players vying for artist attention and market share escalates rivalry. |

| Lower Switching Costs | Artists/Labels can move catalogs with minimal effort/penalty. | Facilitates client poaching by competitors offering more attractive terms or services. |

SSubstitutes Threaten

Direct-to-fan platforms such as Bandcamp and Patreon offer artists a powerful alternative to traditional music distribution and monetization channels. These platforms allow artists to bypass intermediaries, directly engaging with their audience, selling merchandise, and offering exclusive content. For instance, Patreon reported over 200,000 creators in 2023, highlighting the growing trend of artists seeking direct fan support.

These direct-to-fan models can serve as substitutes for some of Believe's core services, particularly for emerging artists or those focused on niche markets. By enabling direct sales and fan subscriptions, these platforms reduce the reliance on major distributors and labels, potentially impacting Believe's market share for certain artist segments.

For artists seeking broader support, traditional record label deals present a significant substitute to Believe's offerings. These major label agreements often provide substantial financial advances, extensive marketing campaigns, and global distribution networks, which can be more appealing than Believe's platform-centric approach for artists prioritizing upfront capital and established industry backing.

In 2024, the music industry continued to see major labels invest heavily in artist development, with some deals reportedly including advances exceeding $1 million for emerging talent. This contrasts with Believe's model, which typically offers a smaller percentage of revenue to artists but with greater creative control and no upfront recoupment of advances, making the "all-inclusive" nature of major label deals a compelling alternative for certain artists.

Live performances and merchandise sales offer artists alternative revenue streams, lessening their dependence on digital distribution. For instance, in 2024, the global live music industry was projected to reach over $100 billion, highlighting its significant economic impact. This diversification can reduce the perceived necessity of digital platforms for artist income.

User-Generated Content Platforms

User-generated content (UGC) platforms present a significant threat of substitutes for traditional music distribution models. Platforms like TikTok and Instagram Reels, where music is frequently incorporated into short-form videos, can serve as an alternative avenue for music discovery and consumption, often bypassing traditional distributors.

While Believe actively distributes content to these platforms, the direct upload and monetization capabilities for creators on UGC sites can reduce reliance on intermediaries for certain types of music usage. This dynamic is particularly relevant as the creator economy continues to expand, with an estimated 50 million people worldwide identifying as creators in 2023, according to Influencer Marketing Hub.

The ease with which users can sample and share music within these UGC environments offers a low-friction alternative to purchasing or streaming through established channels. For instance, TikTok reported over 1 billion monthly active users globally as of late 2023, highlighting the immense reach and influence of these platforms in shaping music trends.

The threat is amplified when creators directly license or utilize music within their content, potentially diminishing the perceived value of traditional distribution services for that specific usage. This can lead to a shift in how music is discovered and consumed, impacting revenue streams for artists and distributors alike.

- Platform Dominance: UGC platforms like TikTok boast over 1 billion monthly active users, making them powerful hubs for music discovery.

- Creator Economy Growth: With an estimated 50 million creators globally in 2023, the direct monetization of music within UGC content is becoming more prevalent.

- Low-Friction Consumption: The ease of sampling and sharing music on these platforms offers a convenient alternative to traditional music consumption methods.

- Bypassing Distributors: Direct upload and monetization by creators can reduce the necessity of traditional distribution channels for certain music uses.

Physical Distribution Alternatives

While digital music distribution is the primary channel, physical formats like vinyl and CDs are experiencing a niche resurgence. This trend, coupled with artists' ability to sell directly or through specialized retailers, presents a limited but developing substitute for purely digital models. Believe has strategically managed its transition away from agreements heavily dependent on physical sales, mitigating this threat.

The market for vinyl, for instance, has seen consistent growth. In 2023, vinyl sales in the US accounted for over $1.2 billion, a significant increase from previous years, demonstrating a tangible demand for physical media. This indicates that while digital remains dominant, the threat of substitutes, particularly for certain genres and artist fan bases, cannot be entirely dismissed.

Believe's proactive approach to optimizing its physical distribution strategy, including managing contract exits and focusing on digital-first releases, directly addresses this evolving landscape. This ensures the company remains agile in a market where consumer preferences can shift, and alternative consumption methods emerge.

Direct-to-fan platforms like Patreon, which boasted over 200,000 creators in 2023, offer artists alternatives to traditional distribution. Major record labels, with significant investments in artist development and advances potentially exceeding $1 million in 2024, also present a compelling substitute for artists prioritizing upfront capital and broad industry reach.

User-generated content platforms, such as TikTok with over 1 billion monthly active users as of late 2023, allow for direct music discovery and consumption, bypassing traditional channels. The growing creator economy, estimated at 50 million individuals globally in 2023, further fuels this trend by enabling creators to monetize music directly within their content.

The resurgence of physical music formats, with vinyl sales alone exceeding $1.2 billion in the US in 2023, also represents a niche substitute. While Believe has adapted its strategy to focus on digital, these alternative revenue streams and consumption methods highlight the dynamic nature of the music industry and the need for continuous adaptation.

| Substitute Type | Key Features | Artist Appeal | Impact on Believe |

|---|---|---|---|

| Direct-to-Fan Platforms (e.g., Patreon) | Direct fan engagement, merchandise sales, exclusive content | Creative control, direct revenue, niche market focus | Reduces reliance on distributors for certain artist segments |

| Major Record Labels | Large financial advances, extensive marketing, global distribution | Upfront capital, established industry backing, broad reach | Attracts artists prioritizing immediate resources over platform control |

| User-Generated Content (UGC) Platforms (e.g., TikTok) | Music discovery via short-form video, direct creator monetization | Organic reach, trend participation, low-friction sharing | Bypasses traditional distribution for music usage in viral content |

| Physical Music Formats (e.g., Vinyl) | Niche market resurgence, tangible product sales | Collector appeal, alternative revenue stream | Limited impact due to Believe's digital focus, but represents evolving consumption |

Entrants Threaten

While starting a basic digital distribution service might not demand huge upfront cash, establishing a global digital music powerhouse like Believe, complete with advanced technology, a broad international network, and a full suite of artist support, requires significant capital. Believe's substantial revenue, reaching €228.3 million in 2023, and its reported net profit of €13.8 million for the same year, underscore the immense financial resources needed to compete at this level.

New entrants in the music distribution landscape face a significant hurdle in gaining access to essential distribution channels and platforms. Securing agreements with major digital service providers (DSPs) like Spotify, Apple Music, and Amazon Music is crucial for reaching a wide audience, but these established relationships are often difficult for newcomers to penetrate.

Believe, for instance, leverages its extensive, long-standing partnerships with over 200 platforms. These existing connections and automated systems provide an immediate advantage, offering a broad and efficient reach that new entrants struggle to replicate. This established network acts as a substantial barrier, making it challenging for emerging distributors to compete on equal footing.

Believe’s strength lies in its sophisticated technological infrastructure and a deep bench of digital music specialists. This advanced platform is crucial for everything from music distribution and insightful data analysis to nurturing artist careers, creating a significant hurdle for newcomers.

The cost and complexity of replicating Believe's proprietary technology and cultivating a similarly skilled workforce are substantial. For instance, in 2023, the digital music market saw continued investment in AI-driven analytics and personalized fan engagement tools, highlighting the ongoing need for technological innovation.

Brand Loyalty and Reputation

Believe has cultivated a robust brand and reputation, particularly among independent artists and labels, by consistently empowering their career development. This strong standing presents a significant barrier to new entrants.

New competitors would need to commit substantial resources to marketing and artist relationship building to establish a similar level of trust and loyalty in a highly saturated market. For instance, in 2023, the global music market revenue reached an estimated $28.6 billion, highlighting the competitive landscape. This makes it challenging for newcomers to quickly capture meaningful market share.

- Brand Strength: Believe's established reputation as an artist empowerment platform is a key deterrent.

- Market Saturation: The crowded music industry requires significant investment to stand out.

- Artist Loyalty: Building comparable trust and loyalty with artists takes time and consistent effort.

- Market Share Acquisition: New entrants face a steep uphill battle to gain significant traction quickly.

Regulatory and Legal Landscape

The music industry is heavily regulated, with complex rules surrounding music rights and licensing agreements. Navigating these, along with international regulations, presents a significant hurdle for newcomers. For instance, in 2023, the global music publishing market was valued at approximately $11.3 billion, a sector rife with intricate royalty collection and distribution systems.

Established players like Believe possess the necessary legal and operational frameworks to manage these complexities. This includes robust systems for tracking royalties and actively combating copyright infringement, a challenge that can easily overwhelm startups lacking such infrastructure. The sheer volume of digital music rights management, involving countless licenses and territories, requires substantial investment in technology and expertise.

Believe's established presence allows it to leverage existing relationships and operational efficiencies in managing these legal intricacies. This includes:

- Navigating complex music rights: Understanding and managing mechanical, performance, and synchronization licenses across various territories.

- Securing licensing agreements: Establishing deals with streaming platforms, broadcasters, and other music users.

- Combating copyright infringement: Implementing digital fingerprinting and legal recourse against unauthorized use of music.

- Managing royalty payments: Ensuring accurate and timely distribution of royalties to artists and rights holders.

The threat of new entrants in the digital music distribution space is significantly mitigated by the substantial capital requirements and established infrastructure of companies like Believe. Newcomers face immense challenges in replicating Believe's global network of over 200 platform partnerships and its advanced technological capabilities, which are crucial for efficient distribution and artist support. The market's regulatory complexity, particularly concerning music rights and royalties, further erects a formidable barrier, demanding considerable legal and operational expertise that startups often lack.

| Factor | Impact on New Entrants | Believe's Advantage |

|---|---|---|

| Capital Requirements | High, for technology and global reach | €228.3 million revenue (2023) supports investment |

| Distribution Network Access | Difficult to secure DSP agreements | Partnerships with 200+ platforms |

| Technological Infrastructure | Costly to replicate advanced analytics and artist tools | Proprietary technology and digital music specialists |

| Regulatory Navigation | Complex music rights and licensing | Established legal and operational frameworks for royalty management |

Porter's Five Forces Analysis Data Sources

Our Believe Porter's Five Forces Analysis is built upon a robust foundation of data, including company annual reports, industry-specific market research from firms like Gartner and Forrester, and publicly available financial filings.