Bekaert Handling Group A/S SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bekaert Handling Group A/S Bundle

Bekaert Handling Group A/S possesses strong brand recognition and a robust product portfolio, but faces challenges in adapting to rapidly evolving market trends and increasing competition. Our comprehensive SWOT analysis delves into these dynamics, revealing critical opportunities for innovation and potential threats to market share.

Want the full story behind Bekaert Handling Group A/S's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bekaert Handling Group A/S demonstrates a significant strength through its highly specialized product portfolio, concentrating on advanced handling systems like Flexible Intermediate Bulk Containers (FIBCs) and liquid containers. This focused approach enables the company to cultivate deep expertise and develop highly tailored solutions, effectively addressing the precise requirements of various industries for secure and dependable goods transport. In 2023, Bekaert's FIBC segment reported robust demand, contributing significantly to its overall revenue growth.

Bekaert Handling Group A/S's commitment to innovation and efficiency is a significant strength, setting it apart in the transport packaging sector. This focus translates into products designed for enhanced functionality and optimized logistics, directly benefiting customers. For instance, their development of advanced load securing solutions, such as the Dyneema® composite materials, demonstrates a clear drive for superior performance and safety, crucial for maintaining a competitive edge.

Bekaert Handling Group A/S, as part of the larger Bekaert Group, showcased impressive financial resilience throughout 2024. Despite facing a tougher market and reduced sales volumes, the group managed to keep its profit margins steady. This stability in profitability is a key indicator of strong operational control and efficient cost management.

The group's financial health is further underscored by its robust cash flow generation. A healthy EBITu (Earnings Before Interest, Taxes, and Unallocated Items) margin, which stood at a respectable 6.5% in 2024, coupled with strong free cash flow, demonstrates the company's ability to generate cash from its core operations. This financial muscle allows Bekaert to weather economic downturns and invest in future growth.

Strategic Portfolio Management

Bekaert Handling Group A/S benefits from the broader Bekaert group's strategic portfolio management. This involves actively rationalizing its offerings and shifting towards higher-margin products. For instance, in 2023, Bekaert completed the divestment of its Dramix® steel fiber business, a move aimed at sharpening its focus on core, more profitable areas. This strategic pruning allows for better resource allocation to segments with stronger growth potential and improved overall business resilience.

This focus on portfolio optimization enhances Bekaert Handling Group's ability to concentrate on its most promising and profitable segments. By divesting more commoditized businesses, the group can channel investment and expertise into areas that offer greater returns and competitive advantages. This strategic discipline is crucial for navigating market fluctuations and building a more robust financial foundation.

The ongoing portfolio rationalization directly supports Bekaert Handling Group's objective of improving its product mix. This strategic direction is designed to increase the proportion of higher-margin products within its portfolio, thereby boosting profitability. Such a strategy is vital for long-term value creation and maintaining a competitive edge in the market.

- Portfolio Rationalization: Bekaert group actively divested non-core assets, such as the Dramix® steel fiber business in 2023.

- Focus on Higher Margins: The strategy prioritizes segments offering better profitability and growth prospects.

- Enhanced Business Resilience: By shedding commoditized offerings, the group strengthens its overall financial stability and adaptability.

- Resource Allocation: Streamlined portfolio allows for more effective investment in key, high-potential areas.

Sustainability and ESG Alignment

Bekaert Handling Group A/S demonstrates a strong commitment to sustainability, aligning its operations with the EU's Corporate Sustainability Reporting Directive (CSRD). This proactive approach ensures transparency and accountability in its environmental, social, and governance (ESG) performance. For instance, Bekaert is actively pursuing decarbonization efforts within its road logistics, a critical area for emissions reduction in the packaging sector. Furthermore, the company is investing in solar installations, showcasing a tangible move towards renewable energy sources.

This focus on sustainability is not just about compliance; it's a strategic imperative for market competitiveness. As customer and regulatory expectations around ESG continue to rise, Bekaert's proactive stance positions it favorably. In 2024, for example, a significant portion of institutional investors are prioritizing companies with robust ESG frameworks, and Bekaert's initiatives directly address this growing demand. The packaging industry, in particular, faces increasing scrutiny regarding its environmental footprint, making Bekaert's sustainability efforts a key strength.

- CSRD Alignment: Bekaert is integrating the EU's Corporate Sustainability Reporting Directive requirements into its reporting, enhancing transparency.

- Decarbonization Efforts: The group is actively working to reduce carbon emissions in its road logistics operations.

- Renewable Energy Adoption: Bekaert is implementing solar installations to increase its use of renewable energy sources.

- Market Competitiveness: These sustainability initiatives are vital for meeting evolving customer demands and regulatory expectations in the packaging market.

Bekaert Handling Group A/S leverages its specialized product focus on FIBCs and liquid containers, enabling deep expertise and tailored solutions for secure goods transport. This specialization drove robust demand in its FIBC segment in 2023, contributing significantly to revenue. The company's commitment to innovation, exemplified by advanced load securing materials like Dyneema®, enhances product performance and safety, solidifying its competitive edge.

The group demonstrated financial resilience in 2024, maintaining steady profit margins despite market challenges and reduced sales volumes. This stability reflects strong operational control and effective cost management. Furthermore, robust cash flow generation, supported by a 6.5% EBITu margin in 2024, provides financial flexibility for investment and weathering economic downturns.

Bekaert Handling Group benefits from strategic portfolio management, including the 2023 divestment of its Dramix® steel fiber business to focus on higher-margin products. This rationalization enhances resource allocation to promising segments, improving overall business resilience and financial foundation. This strategic pruning supports the objective of increasing higher-margin products within the portfolio, boosting long-term profitability and market competitiveness.

The group's commitment to sustainability, aligned with CSRD, is a key strength. Efforts in decarbonizing road logistics and investing in solar installations position Bekaert favorably amidst rising ESG expectations from investors and regulators. In the packaging sector, these initiatives are crucial for addressing environmental scrutiny and meeting market demands.

| Strength | Description | Supporting Data/Examples |

| Specialized Product Portfolio | Focus on FIBCs and liquid containers allows for deep expertise and tailored solutions. | Robust demand in FIBC segment in 2023 contributed significantly to revenue growth. |

| Innovation and Efficiency | Development of advanced handling systems and load securing solutions. | Use of Dyneema® composite materials for superior performance and safety. |

| Financial Resilience | Steady profit margins and robust cash flow generation. | Maintained stable profit margins in 2024 despite market challenges; 6.5% EBITu margin in 2024. |

| Strategic Portfolio Management | Divestment of non-core assets to focus on higher-margin products. | Divestment of Dramix® steel fiber business in 2023 to sharpen focus on core, profitable areas. |

| Commitment to Sustainability | Alignment with CSRD and proactive ESG initiatives. | Decarbonization efforts in road logistics and investment in solar installations. |

What is included in the product

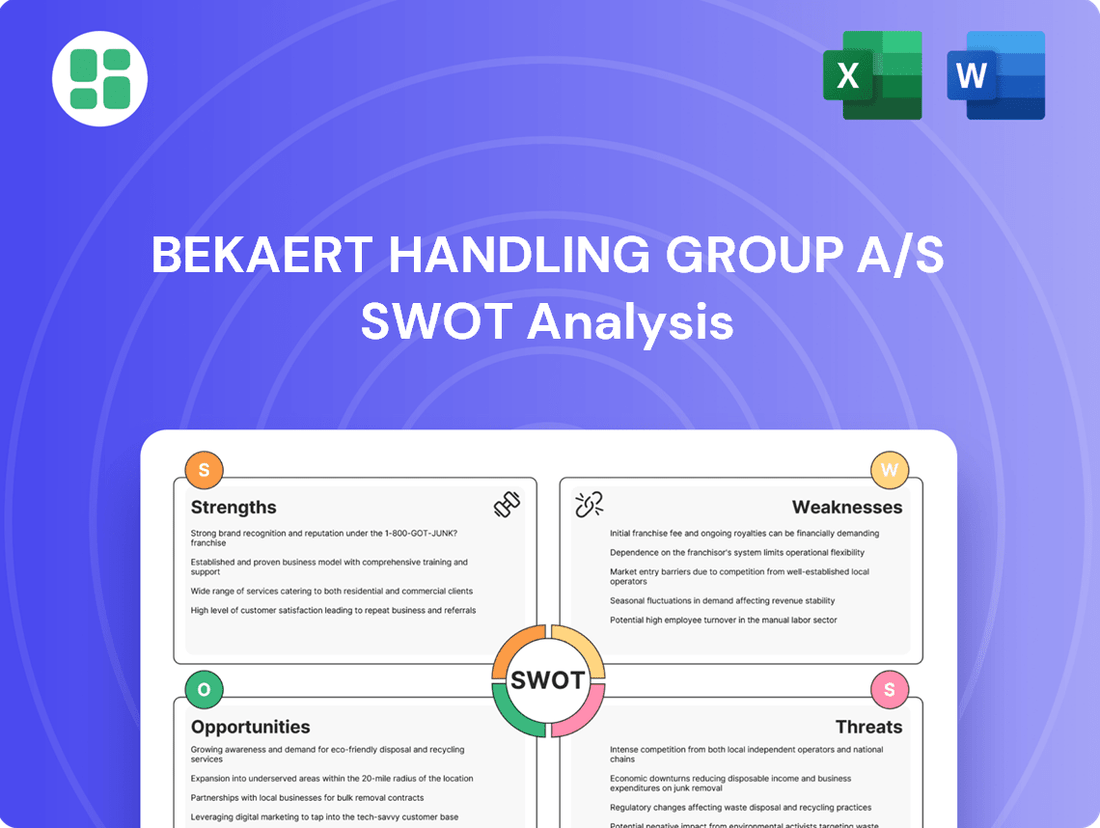

Delivers a strategic overview of Bekaert Handling Group A/S’s internal and external business factors, highlighting its strengths in established markets and opportunities for technological innovation, while also acknowledging weaknesses in production scalability and threats from increased competition.

Offers a clear, actionable SWOT analysis for Bekaert Handling Group A/S, pinpointing key areas for improvement to relieve operational pain points.

Weaknesses

Bekaert Handling Group A/S's production of FIBCs and liquid containers is heavily dependent on plastic-based materials, particularly polypropylene. This reliance makes the company susceptible to price swings in these key commodities.

The packaging sector, including bulk packaging, has experienced significant raw material price volatility. Factors like global economic conditions, geopolitical events, and ongoing supply chain issues have contributed to these fluctuations.

For instance, polypropylene prices saw considerable ups and downs throughout 2023 and early 2024, influenced by energy costs and demand shifts. This volatility directly affects Bekaert Handling Group's production expenses, potentially squeezing profit margins if these costs cannot be passed on to customers effectively.

Bekaert Handling Group A/S faces significant vulnerabilities due to ongoing global supply chain instability. Challenges like raw material scarcity and shipping delays, which impacted global manufacturing throughout 2024, directly hinder the company's capacity to procure essential components for its transport packaging solutions.

These disruptions can lead to production slowdowns and increased costs, potentially affecting Bekaert Handling Group's ability to meet customer demand efficiently. For instance, the automotive sector, a key client for packaging, experienced production cuts in early 2024 due to semiconductor shortages, illustrating the ripple effect of supply chain issues.

Bekaert Handling Group A/S's reliance on industrial sectors like food, chemical, and agriculture presents a significant weakness. These industries are cyclical, meaning demand for Bekaert's bulk handling systems can fluctuate considerably with broader economic conditions. For instance, a downturn in agricultural commodity prices or reduced investment in food processing infrastructure could directly translate to lower sales for the company.

Potential for Increased Regulatory Compliance Costs

The company faces potential increases in regulatory compliance costs due to the evolving environmental landscape. For instance, the EU's Packaging and Packaging Waste Regulation (PPWR), set to be fully implemented in phases, will likely impose stricter requirements on packaging materials and their end-of-life management. This could necessitate significant investments in new, more sustainable materials or revised operational processes, thereby impacting overall costs.

Bekaert Handling Group A/S, like many in its sector, must navigate the growing emphasis on Extended Producer Responsibility (EPR) schemes. These programs often require manufacturers to finance or manage the collection, recycling, or disposal of their products post-consumption. Failure to adapt to these evolving EPR mandates, which are becoming more stringent across various jurisdictions, could lead to penalties or increased operational expenses.

Specifically, the push towards circular economy principles, driven by regulations and consumer demand, means that Bekaert Handling Group A/S may need to re-evaluate its current packaging solutions.

- EU PPWR implementation: Phased rollout impacting packaging design and end-of-life solutions.

- Extended Producer Responsibility (EPR): Increasing financial and operational burdens for product lifecycle management.

- Circular Economy mandates: Potential need for investment in recyclable or reusable packaging materials.

- Material innovation costs: Expenses associated with adopting new, compliant materials or processing technologies.

Competition in a Growing Market

The global FIBC (Flexible Intermediate Bulk Container) market is indeed growing, with projections suggesting it could reach approximately USD 8.5 billion by 2028, up from around USD 6.5 billion in 2023. This expansion, however, also acts as a magnet for numerous competitors, both established and emerging, from across the world. Bekaert Handling Group A/S, while known for its specialized offerings, faces the inherent challenge of this crowded landscape. Intense competition can directly impact pricing power and potentially erode market share if the group doesn't maintain a consistent edge through ongoing innovation and superior customer service.

The increasing demand for bulk packaging solutions, driven by sectors like agriculture, chemicals, and construction, fuels market growth but simultaneously intensifies competition. For Bekaert Handling Group A/S, this means that maintaining a competitive advantage requires more than just quality products; it necessitates a proactive approach to differentiation. Without continuous investment in research and development to introduce novel features or enhanced sustainability aspects, and without a strong focus on customer support and delivery reliability, the pressure on margins and market position will likely mount.

- Market Growth Attracts Competition: The FIBC market is projected for robust growth, creating opportunities but also drawing in a larger pool of global competitors.

- Pricing Pressure: Increased competition can lead to price wars, potentially impacting Bekaert Handling Group A/S's profitability if cost efficiencies and value propositions aren't strongly maintained.

- Differentiation is Key: To counter competitive threats, Bekaert Handling Group A/S must continually innovate its product offerings and elevate its service levels to stand out in a crowded marketplace.

- Market Share Risk: Failure to innovate and differentiate could result in a loss of market share to competitors who are more agile or offer more compelling value propositions.

Bekaert Handling Group A/S's profitability is vulnerable to fluctuations in raw material costs, particularly polypropylene, which saw significant price volatility throughout 2023 and into early 2024. This dependence on commodity pricing, influenced by energy costs and global demand, directly impacts production expenses and potential profit margins if costs cannot be effectively passed on to customers. The company also faces challenges from ongoing global supply chain disruptions, including raw material scarcity and shipping delays, which hampered manufacturing throughout 2024, potentially leading to production slowdowns and increased costs.

Preview the Actual Deliverable

Bekaert Handling Group A/S SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You’re viewing a live preview of the actual SWOT analysis file, showcasing the key insights into Bekaert Handling Group A/S. The complete version becomes available after checkout, offering a comprehensive understanding of their strategic position.

Opportunities

The global market for sustainable packaging is experiencing robust growth, driven by heightened environmental awareness and stricter regulations. By 2025, the sustainable packaging market is projected to reach over $430 billion, a significant increase from previous years. This presents a prime opportunity for Bekaert Handling Group A/S to innovate.

Bekaert Handling Group A/S can leverage this trend by focusing on developing and marketing FIBCs and liquid containers made from recycled plastics or biodegradable materials. For instance, the company could highlight the reduced carbon footprint of products manufactured using post-consumer recycled (PCR) content, a key factor for environmentally conscious buyers.

The global e-commerce market is booming, with projections indicating it will reach $8.1 trillion by 2026, up from $5.7 trillion in 2023. This surge directly fuels the demand for robust logistics and material handling solutions. Bekaert Handling Group A/S is well-positioned to capitalize on this trend by providing advanced transport packaging designed for automated warehouses and efficient supply chains, a critical need in this rapidly expanding sector.

The food, chemicals, and pharmaceuticals sectors are experiencing significant growth, driving demand for Flexible Intermediate Bulk Containers (FIBCs) and liquid bulk containers. For instance, the global food packaging market is projected to reach over $400 billion by 2027, with a substantial portion relying on flexible packaging solutions. Similarly, the chemical industry's expansion, particularly in specialty chemicals, necessitates reliable containment and transport options.

Bekaert Handling Group A/S can capitalize on this by forging strategic alliances within these booming industries. Developing specialized FIBCs and liquid bulk containers that meet the stringent safety, hygiene, and regulatory requirements of food, chemical, and pharmaceutical applications will be key. This targeted product innovation ensures Bekaert remains a preferred supplier and can expand its market share in these critical, high-demand segments.

Adoption of Smart Packaging Technologies

The increasing adoption of smart packaging, incorporating technologies like RFID and IoT, presents a significant opportunity for Bekaert Handling Group A/S. These advancements boost supply chain visibility and product safety. For instance, the global smart packaging market was valued at approximately $30.5 billion in 2023 and is projected to reach $52.6 billion by 2028, growing at a CAGR of 11.5%.

Bekaert Handling Group A/S can leverage this trend by integrating smart features into its handling solutions. This would allow customers to gain enhanced traceability and operational efficiency.

- Enhanced Supply Chain Transparency: Implementing RFID and IoT in packaging allows for real-time tracking of goods throughout the supply chain.

- Improved Product Safety and Integrity: Smart sensors can monitor environmental conditions like temperature and humidity, alerting to potential spoilage or damage.

- Value-Added Services: Offering integrated smart packaging solutions provides Bekaert Handling Group A/S with a competitive edge and new revenue streams by catering to customer demands for advanced logistics.

Geographical Market Expansion

The Asia Pacific region presents a significant opportunity for Bekaert Handling Group A/S, driven by robust industrialization and burgeoning e-commerce. For instance, the Asia-Pacific logistics market was valued at approximately USD 2.4 trillion in 2023 and is projected to grow substantially. This expansion could involve establishing new operations or forming strategic alliances to capture this increasing demand for bulk packaging.

Expanding into emerging markets in Latin America and Africa also offers substantial growth potential. These regions are witnessing increased manufacturing activity and a growing middle class, which fuels demand for efficient supply chain solutions and, consequently, advanced handling and packaging products. For example, the African logistics market is anticipated to reach over USD 200 billion by 2027.

- Asia Pacific Industrialization: Rapid growth in manufacturing and trade creates a strong demand for bulk packaging.

- E-commerce Boom: The surge in online retail necessitates efficient and reliable packaging solutions for shipping.

- Emerging Market Potential: Latin America and Africa offer untapped markets with increasing industrial and consumer needs.

- Diversification of Revenue: Entering new geographical areas reduces reliance on existing markets and mitigates risk.

The growing demand for sustainable packaging, projected to exceed $430 billion by 2025, offers Bekaert Handling Group A/S a chance to innovate with eco-friendly materials. Furthermore, the booming e-commerce sector, expected to reach $8.1 trillion by 2026, directly increases the need for their robust transport packaging solutions.

Bekaert can also capitalize on the expansion within the food, chemicals, and pharmaceuticals industries, which rely heavily on FIBCs and liquid bulk containers, with the food packaging market alone nearing $400 billion by 2027. The integration of smart packaging technologies, a market valued at $30.5 billion in 2023, presents an opportunity to enhance supply chain visibility and offer value-added services.

Geographically, the Asia Pacific region, with its logistics market valued at approximately $2.4 trillion in 2023, and emerging markets in Latin America and Africa, where the African logistics market is set to surpass $200 billion by 2027, represent significant untapped growth potential.

Threats

The ongoing escalation of global trade disputes, marked by rising tariffs and protectionist policies, presents a significant challenge for Bekaert Handling Group A/S. These tensions inject considerable uncertainty into international markets, directly impacting supply chains and the cost of raw materials. For instance, in 2024, the World Trade Organization (WTO) reported that the value of trade covered by import restrictions increased by 15% compared to the previous year, highlighting a growing trend that could affect Bekaert's operational expenses and pricing strategies.

Such trade friction can disrupt established trade flows, potentially limiting Bekaert's access to key markets or increasing the cost of exporting its products. This could lead to a direct impact on sales volumes and overall profitability if the company cannot effectively absorb or pass on these increased costs. For example, a hypothetical 5% increase in import duties on steel, a critical component for Bekaert's handling equipment, could significantly raise production costs, affecting competitive pricing.

Governments globally are tightening environmental rules, with many considering bans on single-use plastics and requiring higher percentages of recycled materials in packaging. For Bekaert Handling Group A/S, this presents a challenge if they are slow to adapt or don't invest enough in sustainable alternatives. Failure to comply could result in significant fines and restricted access to key markets. For instance, the EU's Packaging and Packaging Waste Regulation aims for 100% recyclable or reusable packaging by 2030, impacting material choices significantly.

A weakening global macroeconomic outlook, with forecasts suggesting a potential slowdown in major economies throughout 2024 and into 2025, poses a significant threat. This could translate into reduced industrial activity, directly impacting Bekaert Handling Group A/S by lowering demand for its transport packaging solutions.

For instance, if key manufacturing sectors experience contraction, as some analysts predict for parts of Europe in late 2024, the volume of goods requiring robust packaging will likely decrease. This scenario could directly affect Bekaert's revenue streams and overall profitability, as fewer products move through supply chains.

Technological Disruption from New Packaging Alternatives

The packaging sector is dynamic, with advancements like molded fiber and other sustainable materials constantly emerging. These innovations could present a cost or performance advantage over Bekaert's current offerings, especially if they achieve greater market adoption. For instance, the global sustainable packaging market was valued at approximately $272.1 billion in 2023 and is projected to reach $472.2 billion by 2030, indicating a significant shift towards eco-friendly solutions.

Bekaert Handling Group A/S faces a threat if these new packaging alternatives offer superior cost-effectiveness or environmental credentials. A failure to adapt and innovate could lead to a loss of market share. For example, companies investing heavily in biodegradable plastics or advanced paper-based solutions might capture segments currently served by Bekaert.

- Emerging Materials: Innovations such as compostable bioplastics and advanced molded pulp are gaining traction, potentially offering a more sustainable and sometimes cheaper alternative to traditional bulk containers.

- Cost-Benefit Analysis: Competitors leveraging these new materials might achieve lower production costs or offer enhanced product protection, directly impacting Bekaert's price competitiveness.

- Consumer Demand: A growing consumer preference for sustainable packaging, driven by environmental concerns, could accelerate the adoption of these disruptive alternatives, pressuring Bekaert to respond.

Increased Competition from Low-Cost Producers

The bulk packaging market, especially for standard Flexible Intermediate Bulk Containers (FIBCs), is susceptible to intense competition from manufacturers in regions with significantly lower production costs. This dynamic can exert downward pressure on pricing, potentially impacting Bekaert Handling Group A/S's profit margins if differentiation strategies for premium or specialized products are not robust.

For instance, in 2024, the global FIBC market saw continued price sensitivity, with reports indicating that producers in Southeast Asia often offered products at 10-15% lower price points for comparable standard bags. This makes it crucial for Bekaert Handling Group A/S to emphasize value-added services, material innovation, and specialized product designs to maintain its competitive edge and avoid margin erosion.

- Price Pressure: Low-cost producers can undercut market prices for commoditized FIBCs.

- Margin Compression: Increased competition may lead to reduced profitability for Bekaert Handling Group A/S.

- Differentiation Imperative: The need to highlight premium features and specialized solutions becomes critical.

Intensifying global trade disputes, exemplified by a 15% increase in trade covered by import restrictions reported by the WTO in 2024, directly threaten Bekaert Handling Group A/S by increasing operational costs and market access challenges. Furthermore, evolving environmental regulations, such as the EU's 2030 goal for 100% recyclable packaging, necessitate significant adaptation to avoid fines and market exclusion.

A projected global economic slowdown in 2024-2025 could decrease demand for Bekaert's transport packaging solutions, particularly if key manufacturing sectors contract as anticipated in parts of Europe. The rapid innovation in sustainable packaging materials, with the market valued at $272.1 billion in 2023, also poses a threat if Bekaert fails to match competitors' cost-effectiveness and environmental credentials.

Intense competition from low-cost producers, particularly in Southeast Asia offering standard FIBCs at 10-15% lower prices in 2024, puts significant pressure on Bekaert's profit margins. This necessitates a strong focus on value-added services and product differentiation to maintain competitiveness and prevent margin erosion.

SWOT Analysis Data Sources

This SWOT analysis for Bekaert Handling Group A/S is built upon a foundation of credible data, including their official financial statements, comprehensive market research reports, and insights from industry experts. This ensures a well-rounded and accurate assessment of the company's current standing and future potential.