Bekaert Handling Group A/S Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bekaert Handling Group A/S Bundle

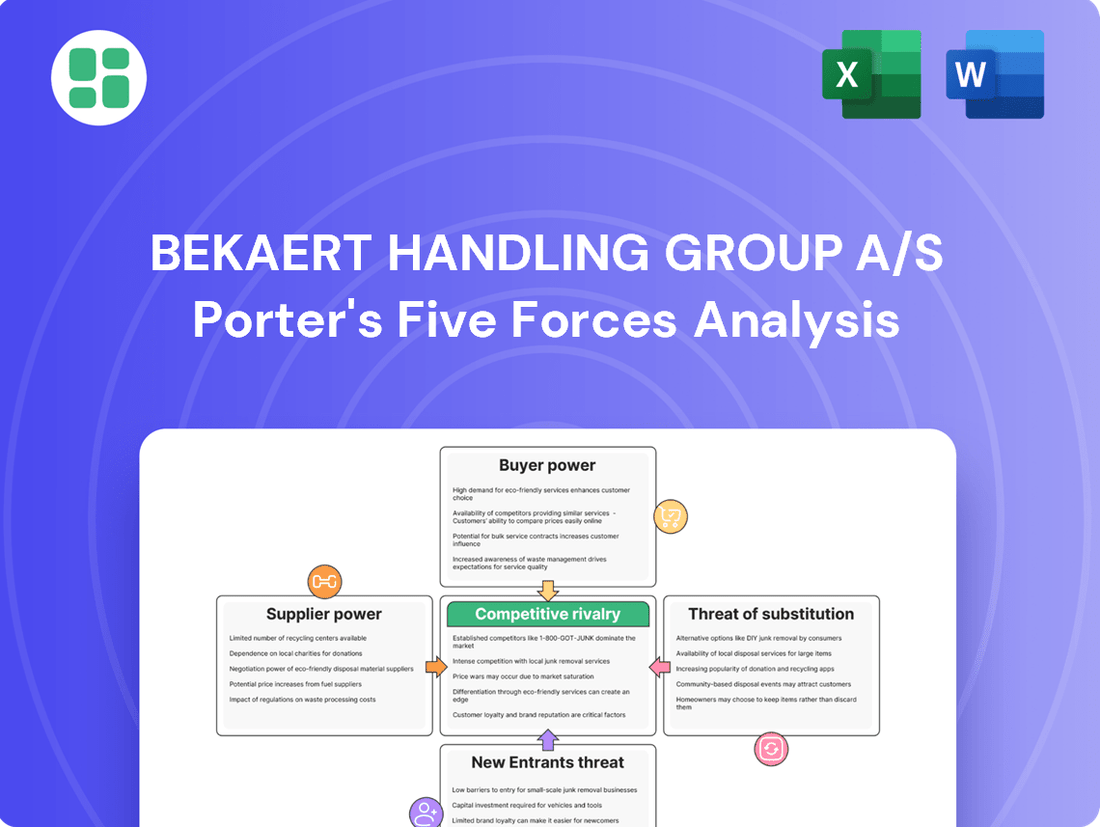

Bekaert Handling Group A/S operates within an industry characterized by moderate buyer power and significant threat of substitutes, particularly from alternative material handling solutions. The intensity of rivalry among existing players also presents a notable challenge.

The complete report reveals the real forces shaping Bekaert Handling Group A/S’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Bekaert Handling Group A/S is significantly shaped by the concentration within its raw material supply chain. A limited number of providers for essential inputs, such as specialized polymers or advanced weaving technologies, grants these suppliers greater leverage. This concentration can translate into increased costs for Bekaert if these suppliers face few alternatives for their own raw materials or production capacity.

The degree of differentiation in the materials Bekaert sources also amplifies supplier power. When suppliers offer unique or highly specialized components, like custom-engineered polypropylene fabrics with specific tensile strengths or UV resistance, they possess a stronger negotiating position. This is because Bekaert may find it difficult or costly to source comparable alternatives, making them more dependent on these particular suppliers.

High switching costs for Bekaert, such as the need to invest in new machinery to process different materials or the extensive process of re-qualifying new suppliers, would significantly increase the bargaining power of those suppliers. This means suppliers could potentially dictate terms or raise prices more easily.

Conversely, if Bekaert can readily switch between various suppliers for its core products like FIBCs, liquid containers, and transport packaging solutions, the bargaining power of individual suppliers is considerably weakened. For example, Bekaert's ability to source from multiple approved manufacturers for its steel cord, a key component, limits the leverage of any single supplier.

Suppliers of critical components to Bekaert Handling Group A/S could potentially integrate forward, entering the handling systems manufacturing market themselves. This would transform them from suppliers into direct competitors, significantly increasing their leverage over Bekaert.

Should a key supplier possess the technical expertise and financial resources to manufacture handling systems, Bekaert would face intensified competition. For instance, if a supplier of specialized robotic arms or conveyor belt technology decided to offer complete handling solutions, Bekaert would need to ensure its own offerings remain superior and competitively priced to retain market share.

This threat necessitates Bekaert maintaining robust supplier relationships and consistently demonstrating value. In 2024, the global industrial automation market, a segment Bekaert operates within, saw continued growth, with reports indicating a 7.5% year-over-year increase, highlighting the attractiveness of this sector for potential new entrants and existing players seeking to expand their offerings.

Importance of Supplier's Input to Bekaert's Product Quality

The bargaining power of suppliers for Bekaert Handling Group A/S is significantly influenced by how crucial their inputs are to the quality and performance of Bekaert's advanced handling systems. If suppliers provide specialized materials or components that are difficult to substitute and directly impact the safety and reliability of Bekaert's products, their leverage increases.

For instance, consider the specialized steel fibers Bekaert uses in some of its advanced composite materials. If a particular supplier offers superior quality steel fibers that are essential for achieving the desired strength-to-weight ratio and durability in Bekaert's high-performance lifting equipment, that supplier gains considerable bargaining power. Bekaert's reliance on these specific inputs for maintaining its reputation for excellence means suppliers of such critical components can command higher prices or more favorable terms.

- Supplier Dependence: Bekaert's dependence on specific suppliers for critical, high-quality raw materials or components directly enhances supplier bargaining power.

- Input Differentiation: The uniqueness and quality of supplier inputs, if they are difficult to replicate, give suppliers more leverage in negotiations.

- Impact on Bekaert's Reputation: Suppliers whose inputs are vital for Bekaert's product performance and safety, and thus its brand reputation, wield greater influence.

- Industry Standards: If industry standards for handling systems demand exceptionally high-quality materials that only a few suppliers can consistently provide, these suppliers will have stronger bargaining positions.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for Bekaert Handling Group A/S. If Bekaert can readily source alternative raw materials or components that perform comparably for its FIBCs and liquid containers, it lessens dependence on any single supplier, thereby diminishing their leverage. For instance, if the primary material for FIBCs, polypropylene (PP), faces significant price hikes or supply disruptions, Bekaert's ability to pivot to alternative polymers or even different container designs made from other materials would curb supplier power.

In 2024, the global polypropylene market experienced price volatility, with average prices for PP homopolymer fluctuating. This volatility, driven by factors like feedstock costs and geopolitical events, underscores the importance of Bekaert having access to viable alternatives. Companies that can switch between different grades of PP or explore alternative plastics like polyethylene (PE) for certain applications are better positioned to negotiate pricing and terms with their PP suppliers.

- Availability of Substitute Inputs: Bekaert's reliance on specific raw materials for FIBCs and liquid containers is a key factor.

- Impact on Supplier Power: Access to alternative materials reduces dependence, weakening supplier bargaining strength.

- Example: Polypropylene (PP): If PP prices surge, Bekaert's ability to use alternative polymers or designs mitigates supplier leverage.

- Market Context (2024): PP price volatility in 2024 highlights the strategic advantage of having substitute material options.

The bargaining power of suppliers for Bekaert Handling Group A/S is moderate, influenced by the availability of substitute materials and the concentration of key suppliers. While Bekaert sources essential components like polypropylene for FIBCs and specialized steel for its handling systems, the presence of multiple providers for many of these inputs limits any single supplier's ability to dictate terms. However, for highly specialized or proprietary components, supplier power can increase.

In 2024, the global industrial materials market saw continued demand, with certain specialized polymers experiencing tighter supply chains, potentially increasing leverage for those specific suppliers. Bekaert's strategy of qualifying multiple suppliers for critical inputs, such as its steel cord, effectively counters excessive supplier power by fostering competition amongst providers.

The threat of supplier forward integration is a consideration, particularly in the growing industrial automation sector where suppliers of advanced components could potentially offer complete handling solutions. Bekaert's ability to manage these supplier relationships and maintain competitive pricing for its own integrated systems is crucial in mitigating this risk.

| Factor | Impact on Supplier Bargaining Power | Bekaert Handling Group A/S Context |

|---|---|---|

| Supplier Concentration | High concentration increases power | Moderate; some key inputs have limited suppliers, others have many. |

| Input Differentiation | High differentiation increases power | Moderate; specialized components offer more leverage. |

| Switching Costs | High switching costs increase power | Moderate; re-tooling or supplier re-qualification can be costly. |

| Availability of Substitutes | High availability decreases power | Moderate to High; alternatives exist for many core materials. |

| Forward Integration Threat | High threat increases power | Considered; suppliers in automation could enter Bekaert's market. |

What is included in the product

This analysis details the competitive forces impacting Bekaert Handling Group A/S, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Instantly visualize the strategic pressures on Bekaert Handling Group A/S with a clear, one-sheet Five Forces analysis, perfect for quick, data-driven decision-making.

Customers Bargaining Power

Bekaert Handling Group A/S faces considerable customer bargaining power when a small number of major clients represent a significant portion of its revenue. For instance, if a few key customers in the chemical or agricultural sectors, who are major purchasers of Bekaert's flexible intermediate bulk containers (FIBCs) and liquid containers, account for over 30% of total sales, their influence grows substantially.

These high-volume buyers can leverage their purchasing power to negotiate lower unit prices, demand tailored product specifications, or secure more advantageous payment and delivery terms. This can put pressure on Bekaert's profit margins and operational flexibility.

If customers can easily switch from Bekaert's handling systems to those of a competitor, their bargaining power naturally grows. For instance, in the broader industrial automation market, studies in 2024 indicated that for many standard conveyor belt systems, switching costs could be as low as 5-10% of the initial system's value, making it simpler for customers to explore alternatives.

However, Bekaert often provides specialized, integrated handling solutions. If a customer has invested heavily in Bekaert's proprietary software or requires extensive retraining for their staff to operate a competitor's system, these high switching costs significantly diminish customer power. This integration can represent 15-25% of the total project cost, making a change a substantial undertaking.

Customer price sensitivity significantly impacts Bekaert's bargaining power of customers. Industries with tight profit margins, such as agriculture or certain bulk commodity sectors, are particularly sensitive to the cost of transport packaging. For instance, a 2024 report indicated that input cost increases for many food producers averaged 5-7%, directly translating to a need for cost savings in their supply chain, including packaging.

This high price sensitivity can force Bekaert to offer more competitive pricing, especially for standardized Flexible Intermediate Bulk Containers (FIBCs) or liquid packaging where product differentiation is minimal. In 2023, the global FIBC market saw intense competition, with price being a key differentiator for a significant portion of buyers, leading to an average price reduction of 3-4% for standard bag types in some regions.

Availability of Substitute Products for Customers

The availability of substitute packaging and handling solutions significantly strengthens customer bargaining power against Bekaert Handling Group A/S. Customers can readily explore alternatives like rigid containers, drums, or other bulk transport methods if Bekaert's offerings become less competitive on price or terms.

This ease of switching means customers can leverage these alternatives to negotiate better deals. For instance, if the cost of specialized handling solutions from Bekaert rises, a customer might opt for a less specialized but more cost-effective bulk transport method, forcing Bekaert to reconsider its pricing.

- Increased Customer Leverage: The presence of viable substitutes empowers customers to demand lower prices or more favorable contract terms.

- Price Sensitivity: Customers are more likely to switch if Bekaert's prices are perceived as too high compared to alternatives.

- Market Responsiveness: Bekaert must remain competitive in pricing and innovation to retain customers who have readily available alternative solutions.

Backward Integration Threat by Customers

Customers, especially major industrial buyers, hold significant bargaining power. They might consider backward integration, meaning they could start producing their own handling and packaging solutions, directly impacting Bekaert's market share.

While the complexity of Bekaert's specialized products makes this less likely for advanced solutions, the possibility of large clients manufacturing basic Flexible Intermediate Bulk Containers (FIBCs) or liquid containers themselves cannot be ignored. This potential increases their leverage in price negotiations.

- Customer Bargaining Power: Large industrial clients can exert pressure by threatening or engaging in backward integration.

- Threat of Self-Production: Customers may produce simpler packaging solutions like basic FIBCs or liquid containers in-house.

- Negotiation Leverage: The potential for in-house production enhances customers' ability to negotiate better terms and prices with Bekaert.

- Market Dynamics: For commoditized packaging segments, customer integration is a more tangible threat, impacting Bekaert's pricing power.

Bekaert Handling Group A/S faces significant customer bargaining power when a few large clients dominate its sales, potentially accounting for over 30% of revenue. These key buyers can negotiate lower prices, demand custom specifications, or secure better payment terms, squeezing Bekaert's profit margins.

The ease with which customers can switch to competitors, especially for standardized products like Flexible Intermediate Bulk Containers (FIBCs), amplifies their power. In 2024, switching costs for some industrial handling systems were as low as 5-10% of the initial investment, making alternatives attractive. However, Bekaert's integrated solutions, which can represent 15-25% of project costs due to proprietary software and training, create substantial switching barriers, thus reducing customer power.

Customer price sensitivity is high in sectors like agriculture, where input cost increases averaging 5-7% in 2024 push buyers to seek savings. This pressure is evident in the FIBC market, where price competition led to an average 3-4% price reduction for standard bags in some regions during 2023.

| Factor | Impact on Bekaert | 2024 Data/Trend |

|---|---|---|

| Customer Concentration | High leverage for major clients | Clients representing >30% of revenue |

| Switching Costs | Low for standard products, High for integrated solutions | 5-10% for standard systems; 15-25% for integrated solutions |

| Price Sensitivity | Drives demand for lower pricing | Agriculture input costs up 5-7% |

| Substitute Availability | Increases customer options and negotiation power | Intense competition in FIBC market |

Same Document Delivered

Bekaert Handling Group A/S Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Bekaert Handling Group A/S details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. Understanding these forces is crucial for strategic decision-making and identifying opportunities for competitive advantage.

Rivalry Among Competitors

The transport packaging market, which includes flexible intermediate bulk containers (FIBCs) and liquid containers, is seeing consistent expansion. The FIBC sector alone is anticipated to surpass $8 billion by 2025, with the broader transport packaging market projected to reach USD 29.2 billion in the same year. This growth generally moderates competitive rivalry, as firms can increase sales by tapping into new demand rather than solely by capturing existing market share from rivals.

Bekaert Handling Group A/S operates within a crowded marketplace, facing competition from a multitude of companies in the FIBC, liquid container, and broader transport packaging sectors. This diversity means rivals range from large, established global players to smaller, niche specialists, each employing distinct competitive approaches.

While Bekaert excels in material science and steel wire transformation, its direct competitors in handling systems, such as FIBC manufacturers, present a varied competitive front. For instance, the global FIBC market, valued at approximately USD 5.5 billion in 2023 and projected to grow, features numerous regional and international suppliers, some with significant production capacities.

Bekaert Handling Group A/S distinguishes itself through a commitment to advanced handling systems and novel solutions. This includes the development of stronger, more resilient fabrics for Flexible Intermediate Bulk Containers (FIBCs) and specialized containers for liquids, setting their offerings apart in the market.

The industry sees significant investment in research and development as companies strive to boost product performance and maintain a competitive edge. However, this drive for innovation can escalate rivalry, particularly if new advancements are readily replicated by competitors, leading to a faster pace of product evolution.

Exit Barriers

For Bekaert Handling Group A/S, high exit barriers can significantly fuel competitive rivalry within its industry. These barriers might include substantial investments in specialized manufacturing equipment for producing steel wire products or long-term supply agreements that lock companies into specific markets. If exiting the market is costly or impractical, existing players are more likely to continue operating, even when profitability is low.

This persistence can lead to prolonged periods of overcapacity and intense price competition. For instance, if a significant portion of the steel wire processing machinery is highly specialized and difficult to repurpose, companies might continue production to cover at least variable costs, rather than incurring a complete loss on the asset. This dynamic can put downward pressure on prices across the sector, impacting Bekaert Handling Group's profit margins.

- High Capital Investment: Significant upfront costs for specialized machinery, like advanced wire drawing or coating lines, create a substantial financial hurdle for exiting the market.

- Long-Term Contracts: Commitments to customers or suppliers through multi-year agreements can make it difficult to cease operations without incurring penalties.

- Brand Reputation and Customer Loyalty: Years of building trust and relationships with clients can be lost if a company abruptly exits, making a clean departure challenging.

- Workforce Skills and Training: A highly skilled workforce trained in specific manufacturing processes represents an investment that is hard to divest from, encouraging continued operation.

Industry Structure and Consolidation

The Flexible Intermediate Bulk Container (FIBC) market, where Bekaert Handling Group operates, exhibits a moderately concentrated structure. While a few key players dominate, a significant number of smaller, regional manufacturers also compete, creating a dynamic competitive landscape.

Evidence of ongoing consolidation is apparent, with strategic alliances and acquisitions shaping the industry. For instance, NNZ Group's integration with Technopac Austria exemplifies this trend, as companies seek to bolster their market share and operational capabilities.

- Market Concentration: The FIBC market is characterized by moderate concentration, featuring both major global players and numerous smaller regional competitors.

- Consolidation Trends: Strategic partnerships and mergers, such as NNZ Group and Technopac Austria joining forces, highlight a continuing trend of industry consolidation.

- Impact on Rivalry: This consolidation aims to enhance competitive positioning and market influence among the leading FIBC manufacturers.

Bekaert Handling Group A/S faces a competitive landscape characterized by a mix of large global players and specialized regional firms in the transport packaging sector. The drive for innovation, particularly in material science for FIBCs, can intensify rivalry as companies strive to differentiate through product performance. However, growth in the overall market, projected to reach USD 29.2 billion by 2025, provides opportunities for sales expansion without solely relying on market share gains.

The competitive rivalry is further influenced by high exit barriers, such as significant capital investments in specialized machinery for steel wire processing. This makes it difficult for companies to leave the market, potentially leading to prolonged periods of overcapacity and price competition, impacting profitability for all players, including Bekaert.

| Market Segment | 2023 Market Value (USD Billion) | Projected 2025 Market Value (USD Billion) | Key Competitive Factors |

|---|---|---|---|

| Transport Packaging (Overall) | ~27.0 | 29.2 | Innovation, Scale, Cost Efficiency |

| Flexible Intermediate Bulk Containers (FIBCs) | 5.5 | >8.0 | Material Strength, Customization, Sustainability |

SSubstitutes Threaten

The threat of substitutes for Bekaert's flexible intermediate bulk containers (FIBCs) and liquid containers hinges on the price-performance balance of alternatives. Rigid containers such as drums and barrels, though potentially higher in cost or less adaptable, can fulfill comparable roles in bulk material transportation.

Customers will weigh whether these substitutes provide equivalent safety, operational efficiency, and overall cost-effectiveness compared to Bekaert's offerings. For instance, in 2024, the average price increase for industrial drums saw a notable rise, potentially making flexible alternatives more attractive if performance metrics remain competitive.

Customer willingness to switch to alternatives is increasingly shaped by environmental consciousness and the pursuit of cost savings in logistics. The growing adoption of reusable transport packaging, such as plastic and metal containers, directly addresses concerns about greenhouse gas emissions and offers reduced packaging and waste disposal expenses. This shift makes alternatives more appealing compared to traditional single-use options.

The relative price of substitute packaging solutions directly impacts Bekaert Handling Group A/S. If alternatives like advanced corrugated cardboard or reusable plastic containers become substantially more cost-effective while still fulfilling performance needs, customers may switch away from Bekaert's offerings, increasing the threat of substitution.

Perceived Switching Costs for Customers

The threat of substitutes for Bekaert Handling Group A/S is influenced by perceived switching costs. If customers find it easy and inexpensive to move to alternative packaging or handling systems, they are more likely to explore these options. For instance, if a competitor offers a similar steel cord solution that integrates seamlessly with existing machinery at a lower price point, Bekaert could face increased pressure.

Consider the transition from Bekaert's specialized steel cord solutions to alternative materials like high-strength synthetic fibers or advanced plastics. If the effort, cost, or disruption involved in retooling equipment or retraining staff to use these substitutes is minimal, customers will be more inclined to switch. This ease of transition directly amplifies the threat of substitutes.

- Low Switching Costs: If customers can easily adopt alternative handling systems without significant investment in new machinery or training, the threat of substitutes rises.

- Cost of Transition: High costs associated with retooling or modifying existing infrastructure to accommodate substitute products make switching less attractive.

- Performance Parity: When substitutes offer comparable or superior performance to Bekaert's offerings at a competitive price, the threat intensifies.

- Customer Inertia: While inertia can be a barrier, if the perceived benefits of a substitute significantly outweigh the effort of switching, this inertia can be overcome.

Innovation in Substitute Technologies

Continuous innovation in packaging materials, such as advanced reusable plastic containers, biodegradable bioplastics, and improved paper-based alternatives, directly enhances the attractiveness and practicality of substitutes for Bekaert Handling Group's offerings. These material advancements can offer comparable or superior performance characteristics, potentially at a lower cost or with greater environmental benefits, thereby drawing customers away.

Furthermore, the integration of technologies like RFID and IoT tracking within reusable packaging systems makes these substitutes more appealing by streamlining logistics and improving operational efficiency. For instance, enhanced visibility and inventory management capabilities offered by smart reusable solutions can present a compelling value proposition that challenges traditional packaging methods.

- Advancements in bioplastics and paper alternatives offer eco-friendly substitutes.

- Reusable plastic containers with integrated tracking technology improve operational efficiency.

- Technological enhancements in substitutes can lower overall supply chain costs for users.

The threat of substitutes for Bekaert Handling Group A/S is significant, particularly as advancements in alternative packaging materials and systems emerge. Innovations in areas like advanced corrugated cardboard and reusable plastic containers are making these substitutes increasingly competitive on both performance and cost. For example, the global market for reusable packaging is projected to grow substantially, indicating a strong customer interest in these alternatives.

Customers are actively evaluating substitutes based on factors such as environmental impact, cost-effectiveness, and ease of integration into their existing supply chains. The growing emphasis on sustainability and circular economy principles makes solutions that reduce waste and offer reusability particularly attractive. This trend is further amplified by the potential for technological integration within substitutes, such as smart tracking capabilities, which can enhance operational efficiency.

The relative cost and performance of substitutes are key determinants in their adoption. If alternatives can match or exceed the protective qualities and handling efficiency of Bekaert's offerings at a comparable or lower price point, the threat of substitution intensifies. For instance, in 2024, the cost of certain virgin plastics used in packaging saw fluctuations, potentially making recycled or bio-based alternatives more appealing if their price-performance ratio remained favorable.

| Substitute Type | Key Advantages | Potential Impact on Bekaert |

|---|---|---|

| Reusable Plastic Containers | Durability, reusability, potential for integrated tracking | High, especially if costs decrease and tracking tech matures |

| Advanced Corrugated Cardboard | Lightweight, recyclable, cost-effective for certain applications | Moderate, depends on specific performance needs |

| Bioplastics/Biodegradable Materials | Environmental benefits, reduced waste disposal costs | Growing, particularly for consumer-facing or single-use applications |

Entrants Threaten

Entering the advanced handling systems market, particularly for Flexible Intermediate Bulk Containers (FIBCs) and liquid containers, demands significant upfront capital. Companies need to invest in specialized manufacturing equipment, secure reliable sources for raw materials like polypropylene, and establish robust distribution channels. For instance, a modern FIBC production line can cost upwards of $1 million, not including land and building costs.

These substantial capital requirements act as a formidable barrier. Newcomers must not only fund the initial setup but also maintain sufficient working capital for ongoing operations and inventory management, making it challenging to compete with established players who have already amortized these costs.

Bekaert Handling Group A/S enjoys significant cost advantages due to its established economies of scale in manufacturing, purchasing raw materials in bulk, and optimizing its distribution networks. For instance, in 2023, Bekaert's operational efficiency, driven by large-scale production, allowed it to maintain competitive pricing in a market where input costs for steel wire, a key component, saw fluctuations.

New entrants would find it challenging to match these cost efficiencies from the outset. They would likely face higher per-unit costs for manufacturing and procurement, hindering their ability to compete on price against an incumbent like Bekaert.

Unless a new player can introduce a significantly disruptive technology or successfully target specific, underserved niche markets, overcoming Bekaert's scale-driven price advantage presents a substantial barrier to entry.

New entrants into the industrial materials sector, like those competing with Bekaert Handling Group A/S, often struggle with gaining access to established distribution channels. Building these networks from the ground up requires substantial capital and time, as trust and relationships with industrial customers are paramount.

For instance, in 2024, the global industrial distribution market is valued at hundreds of billions of dollars, with significant portions controlled by long-standing players who have cultivated deep relationships. New entrants must overcome this hurdle, which often involves lengthy negotiations and substantial upfront investment to secure shelf space or supplier agreements, a challenge Bekaert Handling Group A/S has likely already navigated.

Regulatory and Environmental Hurdles

The packaging and logistics sector faces escalating regulatory scrutiny, especially concerning sustainability and waste reduction. For instance, the EU's Packaging and Packaging Waste Regulation (PPWR) sets ambitious targets for recycled content and waste prevention. New companies entering the market must grapple with these complex environmental compliance mandates, which often involve significant upfront investment and ongoing operational adjustments.

Navigating these regulatory landscapes presents a substantial barrier to entry. Consider the following:

- Compliance Costs: New entrants must allocate substantial capital to meet evolving environmental standards, impacting initial profitability.

- Operational Complexity: Adapting production processes and supply chains to comply with regulations like the PPWR requires specialized knowledge and infrastructure.

- Market Access: Failure to meet regulatory requirements can restrict access to key markets, particularly within regions with strict environmental laws.

Brand Loyalty and Product Differentiation

Bekaert Handling Group A/S benefits from strong brand loyalty, cultivated through its consistent delivery of innovative and efficient solutions for safe goods handling. This reputation makes it challenging for new entrants to gain traction.

To effectively compete, new entrants must offer demonstrably superior products, significantly lower pricing, or highly differentiated solutions that capture customer attention and loyalty away from established players like Bekaert.

- Brand Loyalty: Bekaert’s established reputation for quality and reliability fosters strong customer retention.

- Innovation Focus: Continuous investment in R&D allows Bekaert to offer cutting-edge solutions, creating a barrier for less innovative newcomers.

- Differentiation Challenge: New entrants must find unique selling propositions to stand out in a market where Bekaert already holds significant brand equity.

The threat of new entrants for Bekaert Handling Group A/S is moderate, primarily due to high capital requirements and established economies of scale. For instance, the global industrial packaging market, where Bekaert operates, demands substantial investment in specialized machinery and raw materials, with production lines costing millions. Newcomers also face challenges in building distribution networks, as established players like Bekaert have cultivated deep customer relationships over years.

Porter's Five Forces Analysis Data Sources

Our Bekaert Handling Group A/S Porter's Five Forces analysis is built upon a foundation of credible data, including Bekaert's annual reports, industry-specific market research from firms like Statista and IBISWorld, and insights from financial databases such as S&P Capital IQ.

We leverage a combination of primary data from direct industry engagement and secondary sources like government economic reports and trade association publications to thoroughly assess competitive intensity, supplier leverage, and customer bargaining power within the handling equipment sector.