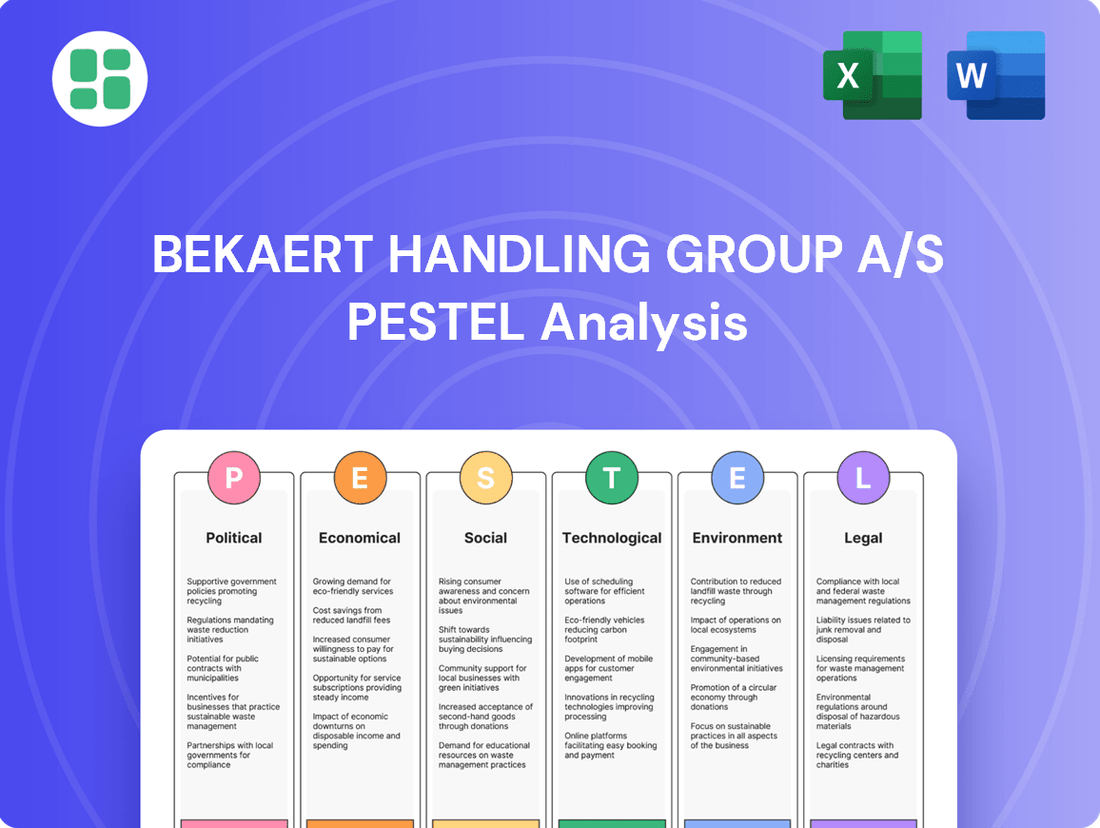

Bekaert Handling Group A/S PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bekaert Handling Group A/S Bundle

Gain a critical understanding of the external forces shaping Bekaert Handling Group A/S's trajectory with our meticulously crafted PESTLE analysis. From evolving political landscapes to technological advancements, this analysis provides the crucial context needed to navigate the complexities of the modern market. Unlock actionable intelligence and refine your strategic planning—download the full PESTLE analysis now.

Political factors

Global trade policies and the imposition of tariffs directly influence Bekaert Handling Group's operational costs, particularly for key materials like polypropylene used in Flexible Intermediate Bulk Containers (FIBCs). For instance, the US imposed tariffs on steel and aluminum in 2018, which, while not directly impacting polypropylene, signals the potential for broader trade protectionism that could affect other inputs or finished goods markets. These policies can also alter the price competitiveness of Bekaert's products in export markets, requiring agile pricing and sourcing strategies.

Geopolitical tensions and ongoing trade disputes, such as those between the US and China, can create significant supply chain volatility. These disruptions may lead to increased logistics costs and potential shortages of essential raw materials, forcing companies like Bekaert to re-evaluate their supplier base and explore alternative sourcing regions. For example, in early 2024, continued trade friction could necessitate a diversification of Bekaert's supply chain beyond traditional hubs to mitigate risks and ensure consistent production.

Geopolitical instability, particularly regional conflicts, directly impacts Bekaert Handling Group's operational efficiency. For instance, the ongoing conflicts in Eastern Europe have led to significant disruptions in global shipping routes and increased energy prices, affecting transportation costs for components and finished goods. These disruptions can delay the delivery of essential materials, forcing the company to explore alternative sourcing and logistics, potentially at higher expenses, as seen with the general rise in freight costs globally, which saw a significant spike in late 2024.

Governments globally are increasingly prioritizing domestic manufacturing and robust logistics networks. For instance, in 2024, the United States' CHIPS and Science Act continued to drive investment in semiconductor manufacturing, a sector that relies heavily on advanced handling solutions. Similarly, many European nations are rolling out substantial infrastructure development plans, with billions earmarked for upgrading ports, rail, and road networks through 2025 to enhance supply chain efficiency.

These initiatives, often coupled with tax incentives and subsidies for advanced manufacturing adoption, directly benefit companies like Bekaert Handling Group by fostering demand for their specialized equipment and services. The focus on reshoring and strengthening domestic production capabilities translates into greater opportunities for Bekaert’s solutions in warehousing, material handling, and automated logistics within these growing industrial sectors.

Industrial Regulations and Standards

Changes in industrial regulations and safety standards, particularly those affecting the handling and transportation of bulk materials, directly shape Bekaert's product design and manufacturing processes. Staying compliant with evolving national and international standards for Flexible Intermediate Bulk Containers (FIBCs) and liquid containers is essential for Bekaert to maintain market access and ensure product conformity. For instance, the European Parliament's proposed revisions to packaging and packaging waste regulations, expected to be finalized in 2024-2025, could introduce stricter requirements for material recyclability and content, impacting FIBC production.

Adherence to these shifting regulatory landscapes is not merely a matter of compliance but a strategic imperative for Bekaert. For example, the International Maritime Organization's (IMO) continued focus on safe container transport, with ongoing discussions in 2024 regarding payload verification for containers, directly influences the structural integrity and testing protocols for Bekaert's bulk handling solutions. Failure to adapt to these standards could result in significant penalties and loss of business opportunities in key markets.

Bekaert must actively monitor and integrate updates to standards such as UN Recommendations on the Transport of Dangerous Goods, which are periodically reviewed, to ensure their products meet the latest safety benchmarks. The increasing global emphasis on sustainability also translates into regulatory pressures, potentially favoring materials with lower environmental impact or requiring enhanced end-of-life management for their products. For example, by mid-2025, several EU member states are anticipated to implement expanded producer responsibility schemes for packaging, which could affect FIBC manufacturers.

- Evolving FIBC Standards: Anticipated updates to ISO 21898 (FIBCs for general use) in 2024-2025 may introduce new testing methodologies or performance criteria.

- Safety in Bulk Transport: Regulations concerning the safe loading and securing of bulk cargo, such as those from the European Agency for Safety and Health at Work (EU-OSHA), influence the design of Bekaert's handling solutions.

- Liquid Container Compliance: Adherence to UN Model Regulations for the transport of dangerous goods, which are updated biennially, is critical for Bekaert's liquid container offerings.

- Sustainability Mandates: Potential new EU directives on recycled content in packaging, expected to be clarified in 2024, could necessitate changes in Bekaert's material sourcing for FIBCs.

Political Stability in Key Markets

Political stability in Bekaert Handling Group's key markets directly impacts its operational continuity and the security of its investments. For instance, in 2024, regions experiencing heightened political tensions often saw increased market volatility, with the MSCI World Index experiencing fluctuations tied to geopolitical events. Disruptions stemming from political instability can manifest as economic uncertainty, unpredictable currency swings, and significant interruptions in consumer demand, thereby hindering sales performance and derailing strategic expansion initiatives.

The company's reliance on a stable political environment is underscored by several factors:

- Economic Uncertainty: Political unrest often correlates with economic downturns, impacting consumer spending on handling solutions.

- Currency Fluctuations: Instability can lead to sharp currency devaluations, affecting the cost of imported materials and the repatriated value of foreign earnings. For example, in early 2025, several emerging markets saw their currencies weaken by over 5% due to domestic political developments.

- Supply Chain Disruptions: Political conflicts or policy changes can disrupt logistics and the flow of goods, impacting Bekaert's ability to source raw materials or deliver finished products efficiently.

Governmental support for domestic industries and infrastructure development directly benefits Bekaert Handling Group by creating demand for its material handling solutions. For example, the US CHIPS Act of 2022 continues to spur investment in advanced manufacturing, a sector reliant on efficient logistics. Similarly, European nations are investing billions through 2025 in upgrading ports and rail networks, enhancing supply chain efficiency and creating opportunities for Bekaert's specialized equipment.

Changes in industrial regulations, particularly those concerning safety and sustainability for bulk material handling, necessitate ongoing product adaptation for Bekaert. For instance, proposed EU packaging waste regulations expected in 2024-2025 may impose stricter recyclability requirements for FIBCs. The International Maritime Organization's ongoing discussions in 2024 regarding container payload verification also directly influence the design and testing of Bekaert's bulk handling products.

Political stability is crucial for Bekaert's operational continuity and investment security, with instability often correlating with market volatility. For example, in early 2025, several emerging markets experienced currency devaluations exceeding 5% due to domestic political events, impacting raw material costs and foreign earnings.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Bekaert Handling Group A/S, covering political, economic, social, technological, environmental, and legal dimensions.

The Bekaert Handling Group A/S PESTLE Analysis serves as a critical pain point reliever by offering a structured framework to proactively identify and address external factors that could impact operations, thereby enabling more informed strategic decision-making and mitigating potential risks.

Economic factors

Global economic growth is a key driver for Bekaert Handling Group A/S. In 2024, the International Monetary Fund (IMF) projected a global growth rate of 3.2%, a slight uptick from 2023, indicating a generally stable, albeit moderate, expansion. This overall economic health directly impacts the demand for Bekaert's products, as businesses invest and expand operations.

Industrial output, particularly within manufacturing sectors that rely on bulk material handling, is crucial. For instance, the United States' industrial production saw a modest increase in early 2024, suggesting continued activity in sectors that would utilize flexible intermediate bulk containers (FIBCs) and liquid containers. A robust manufacturing environment translates to higher demand for Bekaert's specialized handling solutions.

Fluctuations in the cost of key raw materials, like polypropylene used in Flexible Intermediate Bulk Containers (FIBCs), directly affect Bekaert's manufacturing expenses and profitability. For instance, polypropylene prices saw considerable volatility in late 2023 and early 2024, influenced by global energy prices and manufacturing output.

Geopolitical events and ongoing supply chain disruptions continue to be major drivers of raw material price volatility. These unpredictable shifts require Bekaert to implement robust procurement strategies and consider hedging mechanisms to mitigate cost escalations and ensure stable production.

Rising inflation in 2024 and projected into 2025 significantly impacts Bekaert Handling Group's operational costs. For instance, global inflation rates, which saw peaks in late 2022 and early 2023, are expected to moderate but remain elevated, impacting raw material prices, energy, and logistics. This necessitates careful cost management and strategic pricing adjustments for Bekaert to maintain its profit margins.

Furthermore, central banks' responses to inflation, leading to higher interest rates, present a dual challenge. Increased borrowing costs for capital expenditures, such as facility upgrades or new equipment, directly affect Bekaert's investment capacity. Simultaneously, higher interest rates can dampen consumer and business spending on durable goods, potentially slowing demand for the handling solutions Bekaert provides.

Exchange Rate Fluctuations

Exchange rate fluctuations present a significant economic factor for Bekaert Handling Group A/S, particularly given its potential involvement in international trade. Unfavorable movements in currency values can directly affect the cost of sourcing raw materials from abroad, potentially increasing production expenses. Conversely, if the company exports its products, a strengthening domestic currency could make those exports more expensive for international buyers, thereby reducing sales volume or profit margins.

Managing these currency risks is crucial for Bekaert Handling Group A/S to maintain its competitive edge and ensure healthy financial performance. For instance, the Euro (EUR) to US Dollar (USD) exchange rate is a key consideration. In late 2024 and early 2025, analysts anticipate continued volatility in major currency pairs due to varying inflation rates and monetary policy stances across different economic blocs. This volatility necessitates robust hedging strategies.

- Impact on Costs: A stronger Danish Krone (DKK) against currencies where Bekaert sources materials could lower import costs, but a weaker DKK would have the opposite effect.

- Export Competitiveness: A weaker DKK generally aids exporters by making their goods cheaper abroad, while a stronger DKK can hinder international sales.

- Profitability Margins: Fluctuations directly impact the translation of foreign earnings back into DKK, affecting overall reported profits.

- Hedging Strategies: Companies like Bekaert often employ financial instruments such as forward contracts or options to mitigate currency exposure, aiming to lock in exchange rates for future transactions.

E-commerce and Retail Sector Growth

The e-commerce boom continues to reshape the retail landscape, directly fueling demand for advanced transport packaging and handling solutions. As online sales surge, businesses need robust and often specialized packaging to ensure products reach consumers safely and efficiently. This ongoing evolution offers a substantial growth avenue for companies like Bekaert Handling Group, which can provide the necessary infrastructure and innovation.

For instance, global e-commerce sales are projected to reach approximately $7.4 trillion by 2025, a significant increase from earlier years. This expansion necessitates more sophisticated logistics and, consequently, a greater need for durable and adaptable handling equipment and packaging. Bekaert Handling Group is well-positioned to capitalize on this by offering solutions tailored to the specific demands of this dynamic sector.

- E-commerce Growth: Global e-commerce sales are expected to hit $7.4 trillion by 2025.

- Demand for Solutions: Increased online retail drives a higher need for efficient transport packaging.

- Bekaert's Opportunity: The sector's expansion presents a significant market for Bekaert Handling Group's offerings.

- Customization: Businesses require reliable and often customized packaging for secure deliveries.

The global economic outlook for 2024 and 2025 suggests moderate but stable growth, with the IMF projecting 3.2% for 2024. This steady expansion directly influences demand for Bekaert's handling solutions as businesses invest. Industrial production, particularly in manufacturing, remains a key indicator; for example, US industrial output showed a modest rise in early 2024, signaling ongoing activity that benefits companies like Bekaert.

Inflationary pressures and the resulting interest rate hikes by central banks present a dual challenge. Elevated inflation in 2024 and into 2025 increases Bekaert's operational costs, impacting raw materials and energy. Higher interest rates also raise the cost of capital for investments and can dampen overall consumer and business spending, potentially affecting demand for Bekaert's products.

Exchange rate volatility is a significant factor for Bekaert Handling Group. Fluctuations in major currency pairs, anticipated through early 2025, can affect raw material import costs and the competitiveness of exports. For instance, the EUR/USD exchange rate's movement requires careful management through hedging strategies to maintain profit margins and international sales volumes.

The continued surge in e-commerce, with global sales projected to reach $7.4 trillion by 2025, creates a substantial demand for efficient transport packaging. This trend offers a significant growth opportunity for Bekaert Handling Group, as businesses increasingly require reliable and often customized handling solutions to support online retail logistics.

Full Version Awaits

Bekaert Handling Group A/S PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Bekaert Handling Group A/S PESTLE Analysis. This comprehensive report covers all key political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain immediate access to this professionally structured analysis upon completing your purchase.

Sociological factors

Bekaert Handling Group A/S, operating in manufacturing and logistics, is significantly influenced by the availability of skilled labor. Labor shortages in these sectors, a persistent issue in many developed economies, directly affect production capacity and overall operational efficiency.

The packaging industry, mirroring broader manufacturing trends, is grappling with ongoing labor shortages. For instance, in the EU, manufacturing sector employment saw a slight decline in early 2024, highlighting the tightness of the labor market. This necessitates strategic investments in automation technologies and robust employee training programs to bridge the skills gap and maintain competitive operational levels.

Consumers are increasingly prioritizing sustainability, with a significant portion willing to pay more for eco-friendly products. This growing awareness directly impacts packaging choices, pushing Bekaert's clients to demand handling solutions that align with their environmental goals.

For instance, a 2024 survey indicated that over 60% of consumers consider sustainability when making purchasing decisions, a trend that is expected to continue rising. This translates to a demand for packaging materials that are recyclable, reusable, or biodegradable, influencing Bekaert's product development and material sourcing strategies.

Societal shifts towards greater health and safety awareness directly influence demand for advanced handling solutions. With a growing emphasis on worker well-being and accident prevention across industries, companies like Bekaert Handling Group A/S are seeing increased interest in equipment that minimizes risk. This societal concern translates into a market where safety features are not just desirable but essential.

Bekaert's core mission of ensuring safe and reliable handling of goods resonates strongly with these evolving societal expectations. In 2024, reports indicated a 7% year-over-year increase in workplace safety regulations being updated globally, highlighting the urgency for businesses to invest in compliant and secure operational equipment. This alignment strengthens Bekaert's value proposition, positioning them as a provider of solutions that address a fundamental societal need.

Corporate Social Responsibility (CSR)

Societal expectations around Corporate Social Responsibility (CSR) are significantly shaping business operations. Companies are increasingly scrutinizing their supply chains for ethical sourcing and sustainable practices, directly impacting supplier selection. For instance, a 2024 report indicated that 65% of consumers are more likely to purchase from brands demonstrating strong CSR commitments.

Bekaert Handling Group A/S can leverage its dedication to providing innovative and efficient solutions that also meet these broader CSR goals. This alignment not only strengthens its brand image but also positions it favorably to attract a growing segment of socially conscious clients. In 2025, the global market for sustainable goods is projected to reach $150 billion, highlighting the commercial imperative of CSR.

- Ethical Sourcing: Bekaert's adherence to fair labor practices and responsible material procurement is a key differentiator.

- Sustainable Practices: Investments in eco-friendly production processes and waste reduction contribute to a positive environmental footprint.

- Brand Reputation: Demonstrating a strong CSR commitment enhances trust and loyalty among stakeholders.

- Client Attraction: Companies prioritizing sustainability in their partnerships are more likely to engage with Bekaert.

Demographic Shifts and Urbanization

Demographic shifts profoundly impact Bekaert Handling Group's operational landscape. For instance, an aging workforce in developed economies, like much of Europe, presents challenges in securing skilled labor for manufacturing and logistics roles, potentially increasing labor costs. Conversely, rapid urbanization, with a growing percentage of the global population residing in cities – projected to reach 68% by 2050 according to UN data – directly fuels demand for Bekaert's solutions.

This increasing urban density necessitates more efficient and space-saving handling equipment for warehousing and last-mile delivery operations. Cities are becoming hubs of consumption, and the logistics networks supporting them need to be agile. Bekaert's product development must therefore focus on compact, automated, and highly productive systems to meet the needs of this evolving urban environment.

- Aging Workforce: Many developed nations face a shrinking pool of younger workers, impacting labor availability in manufacturing and logistics sectors.

- Urbanization Trends: Global urban population is expected to hit 6.7 billion by 2050, increasing the need for efficient urban logistics.

- Demand for Last-Mile Solutions: Growing e-commerce in urban centers drives demand for specialized handling equipment for compact delivery vehicles and tight urban spaces.

- Product Design Influence: Urbanization pressures manufacturers to innovate with smaller, more maneuverable, and automated handling systems.

Societal expectations around health and safety are increasingly influencing the demand for advanced handling solutions. As businesses prioritize worker well-being and accident prevention, there's a growing market for equipment designed to minimize risk. This societal shift means safety features are becoming a non-negotiable aspect of handling equipment, directly impacting Bekaert Handling Group's product development and sales strategies.

Corporate Social Responsibility (CSR) is also a major driver, with consumers and business partners alike favoring companies with strong ethical and sustainable practices. A 2024 report revealed that 65% of consumers prefer brands demonstrating robust CSR commitments, highlighting the commercial advantage of aligning with these values. Bekaert can leverage its commitment to ethical sourcing and sustainable operations to attract socially conscious clients and enhance its brand reputation in the $150 billion global market for sustainable goods projected for 2025.

Demographic trends, such as an aging workforce in developed nations, create labor shortages in manufacturing and logistics, potentially increasing operational costs. Simultaneously, rapid urbanization, with the global urban population projected to reach 68% by 2050, fuels demand for efficient, space-saving handling solutions for warehousing and last-mile delivery. This necessitates Bekaert's focus on compact, automated, and highly productive systems for urban logistics.

| Sociological Factor | Impact on Bekaert Handling Group A/S | Supporting Data/Trend (2024/2025) |

| Health & Safety Awareness | Increased demand for safety-focused handling equipment. | Global workplace safety regulations updated by 7% year-over-year (2024). |

| Corporate Social Responsibility (CSR) | Enhanced brand reputation and client attraction for ethical/sustainable practices. | 65% of consumers prefer brands with strong CSR; global sustainable goods market projected at $150 billion (2025). |

| Demographic Shifts (Aging Workforce) | Potential labor shortages and increased labor costs in manufacturing/logistics. | Persistent issue in many developed economies, impacting production capacity. |

| Demographic Shifts (Urbanization) | Growing demand for efficient urban logistics and space-saving handling solutions. | Global urban population projected to reach 68% by 2050, driving need for agile logistics. |

Technological factors

The material handling sector is seeing a significant surge in automation, with Autonomous Mobile Robots (AMRs) and robotic arms becoming standard. By 2024, the global market for warehouse robotics was projected to reach $10 billion, with continued strong growth expected through 2025. Bekaert's handling systems must be designed for easy integration with these advanced automated solutions to maintain their relevance.

This technological shift demands that Bekaert's products are compatible with, or can be retrofitted to work alongside, sophisticated automated workflows. Failure to adapt could see Bekaert's offerings become obsolete as businesses prioritize efficiency gains offered by seamless automation. For instance, companies are investing heavily in AI-powered sorting and picking systems, which require flexible and adaptable handling equipment.

Industry 4.0, characterized by the integration of the Internet of Things (IoT), artificial intelligence (AI), and real-time data analytics, is fundamentally reshaping manufacturing. This digital transformation allows for unprecedented optimization of production lines and supply chains. For Bekaert Handling Group A/S, embracing these advancements means unlocking significant potential for efficiency gains and innovative product development.

Bekaert can harness these technologies to not only streamline its manufacturing processes but also to imbue its products with enhanced functionalities. Imagine smart packaging solutions that offer real-time tracking and monitoring, providing customers with greater visibility and control over their goods. This move towards smart, connected products aligns with evolving market demands for transparency and data-driven insights.

The global market for Industrial IoT (IIoT) is projected to reach \$110.4 billion in 2024, demonstrating the widespread adoption and economic impact of these technologies. Furthermore, AI in manufacturing is expected to contribute \$1.5 trillion to the global economy by 2030. Bekaert's strategic investment in Industry 4.0 capabilities in 2024 and 2025 will be crucial for maintaining a competitive edge and driving future growth.

Innovation in material science is a key driver for Bekaert. The development of stronger, lighter, and more sustainable materials directly influences how Bekaert designs and manufactures its products, potentially leading to improved performance and reduced environmental impact.

The growing interest in plant-based plastics and recycled content presents significant opportunities. For instance, the global bioplastics market was valued at approximately USD 50 billion in 2023 and is projected to reach over USD 100 billion by 2030, indicating a strong demand for sustainable alternatives that Bekaert can leverage.

Focusing on mono-materials for packaging also aligns with these advancements. This approach simplifies recycling processes and enhances the circularity of materials, offering Bekaert a competitive edge in environmentally conscious markets.

Smart Packaging Technologies

Smart packaging technologies, such as embedded NFC tags and QR codes, are revolutionizing product management. These advancements enable robust traceability, ensuring product authenticity and providing real-time condition monitoring through integrated sensors. For Bekaert Handling Group A/S, this represents a significant opportunity to enhance their Flexible Intermediate Bulk Containers (FIBCs) and liquid containers.

By integrating these smart features, Bekaert can offer customers greater transparency and control over their supply chains. For instance, a sensor could monitor temperature fluctuations within a container, alerting stakeholders to potential spoilage. This added value directly addresses evolving customer demands for data-driven insights and seamless connectivity throughout the product lifecycle.

- Enhanced Traceability: Smart packaging allows for granular tracking of products from origin to destination, reducing the risk of counterfeiting and improving recall efficiency.

- Real-time Monitoring: Sensors can continuously track critical parameters like temperature, humidity, and shock, ensuring product integrity, particularly for sensitive goods.

- Increased Customer Value: Bekaert could differentiate its offerings by providing customers with direct access to product data, fostering trust and enabling better inventory management.

Research and Development Investment

Bekaert Handling Group's commitment to research and development is a key technological driver. Continuous investment in R&D allows them to pioneer innovative handling systems, explore advanced materials, and integrate smart functionalities. This proactive approach ensures they remain competitive and can adapt to evolving market needs and stringent regulatory landscapes.

For instance, in 2023, Bekaert Group, the parent company, reported R&D expenses of €102.7 million, representing 2.6% of sales. This investment fuels the development of next-generation products and processes across its various divisions, including those relevant to handling solutions.

- Focus on advanced materials: Exploring lighter, stronger, and more sustainable materials for handling equipment.

- Smart functionalities integration: Developing sensor-equipped systems for real-time monitoring and predictive maintenance.

- Process innovation: Investigating new manufacturing techniques to enhance efficiency and product quality.

- Digitalization of handling: Incorporating AI and IoT for optimized logistics and automated operations.

The material handling sector is rapidly adopting automation, with AMRs and robotic arms becoming commonplace; the global warehouse robotics market was projected to hit $10 billion in 2024, with continued strong growth anticipated through 2025. Bekaert's handling systems must seamlessly integrate with these advanced automated solutions to stay relevant, as businesses increasingly prioritize efficiency gains from integrated automation. This technological evolution necessitates that Bekaert's products are compatible with, or can be retrofitted for, sophisticated automated workflows, otherwise risking obsolescence in a market driven by AI-powered sorting and picking systems.

Industry 4.0, encompassing IoT, AI, and real-time data analytics, is transforming manufacturing, enabling unprecedented optimization. For Bekaert Handling Group A/S, embracing these advancements means unlocking significant potential for efficiency and innovation. The global Industrial IoT market was projected to reach $110.4 billion in 2024, and AI in manufacturing is expected to contribute $1.5 trillion to the global economy by 2030, highlighting the critical importance of Bekaert's strategic investment in these capabilities for 2024 and 2025 to maintain a competitive edge.

Legal factors

The EU's Packaging and Packaging Waste Regulation (PPWR) is significantly shaping Bekaert's operational landscape. This legislation, aiming to curb packaging waste and boost sustainability, imposes strict mandates. For instance, it sets ambitious recycling targets and introduces requirements for the reuse of transport packaging, directly influencing Bekaert's material sourcing and product lifecycle management.

The PPWR also includes bans on specific single-use plastics, compelling Bekaert to re-evaluate its packaging materials and design strategies. By 2030, the regulation aims for all packaging to be reusable or recyclable in an economically viable way, a substantial shift that requires proactive adaptation in product development and supply chain logistics for companies like Bekaert.

Extended Producer Responsibility (EPR) schemes are increasingly a global reality, shifting the burden of managing product end-of-life to the producers themselves. This means companies like Bekaert may see direct financial implications for their packaging waste in numerous markets.

For instance, in the European Union, which is a significant market for many industrial groups, the Packaging and Packaging Waste Regulation (PPWR) aims to harmonize rules and increase recycling rates. While specific EPR fees vary by country and material type, they are designed to cover the costs of collection, sorting, and recycling, potentially adding to Bekaert's operational expenses.

These regulations can also act as a powerful incentive for Bekaert to innovate. By designing packaging with recyclability and reduced material use in mind, the company can mitigate future EPR costs and potentially gain a competitive edge by offering more sustainable solutions to its customers.

Bekaert Handling Group A/S must navigate stringent product liability laws, demanding rigorous assurance of its handling systems' safety and reliability, particularly when dealing with hazardous or sensitive materials. Failure to meet these obligations can result in significant legal repercussions and damage to brand reputation.

Compliance with both national and international safety standards for Flexible Intermediate Bulk Containers (FIBCs) and liquid containers is paramount. For instance, adherence to UN recommendations for the transport of dangerous goods, which Bekaert's FIBCs might be used for, is crucial. In 2023, the global FIBC market was valued at approximately USD 5.5 billion, with safety and regulatory compliance being key drivers of market share and customer confidence.

Import and Export Regulations

Bekaert's global operations are significantly influenced by import and export regulations, which are becoming increasingly complex and subject to frequent changes. These rules encompass tariffs, customs clearance processes, and stringent trade compliance mandates, all of which directly affect the cost and efficiency of moving goods across borders. For instance, the World Trade Organization (WTO) reported that global trade growth slowed in 2023, partly due to increased protectionist measures and regulatory hurdles, impacting companies like Bekaert that rely on international supply chains.

Effectively managing these evolving legal frameworks is paramount for Bekaert to ensure uninterrupted global distribution and robust supply chain management. Navigating these complexities requires a dedicated focus on compliance and adaptability. According to a recent report by the International Chamber of Commerce (ICC), the cost of non-compliance with trade regulations can be substantial, leading to delays, fines, and damage to business reputation.

- Tariff Volatility: Fluctuations in import duties, such as those seen in trade disputes between major economic blocs in 2024, can alter the landed cost of Bekaert's materials and finished products, impacting pricing strategies and competitiveness.

- Customs Efficiency: Streamlined customs procedures are vital. Delays in 2023 at key ports, reported by various logistics associations, can disrupt production schedules and increase inventory holding costs for Bekaert.

- Trade Compliance: Adherence to sanctions, export controls, and product-specific import requirements, which are continually updated by governments, is critical to avoid legal penalties and maintain market access for Bekaert's diverse product lines.

- Regulatory Harmonization Efforts: While some regions are working towards harmonizing trade rules, such as initiatives within the European Union, inconsistencies across different markets still present significant challenges for global manufacturers like Bekaert.

Intellectual Property Rights

Protecting intellectual property rights, such as patents for innovative handling system designs or manufacturing processes, is crucial for Bekaert Handling Group A/S's competitive advantage. The company's ability to secure patents for its unique solutions, like advanced conveyor belt technologies or specialized material handling equipment, directly contributes to its market position. For instance, in 2024, Bekaert continued to invest in R&D, with a significant portion of its budget allocated to developing and patenting new product features and manufacturing efficiencies.

Legal frameworks for intellectual property protection are vital for safeguarding Bekaert's unique solutions and deterring infringement. These legal safeguards allow Bekaert to maintain exclusivity over its innovations, preventing competitors from unfairly benefiting from their research and development investments. The global landscape of IP law, including international treaties and national patent offices, plays a significant role in how effectively Bekaert can enforce its rights and protect its technological advancements in key markets.

- Global Patent Filings: Bekaert's proactive approach to patenting innovations in major industrial regions in 2024 and early 2025 aims to secure its technological leadership.

- R&D Investment: Continued investment in research and development, a core component of Bekaert's strategy, directly fuels the creation of new intellectual property.

- Infringement Deterrence: Strong IP protection acts as a significant deterrent against competitors attempting to replicate Bekaert's proprietary handling system designs and manufacturing techniques.

Bekaert Handling Group A/S must navigate evolving product liability laws, ensuring its handling systems are safe and reliable, especially for hazardous materials. Non-compliance can lead to severe legal consequences and reputational damage.

Adherence to international safety standards for containers like FIBCs is critical; for example, compliance with UN recommendations for dangerous goods transport is essential. The global FIBC market was valued at approximately USD 5.5 billion in 2023, with safety being a key market driver.

The company's global operations are heavily influenced by complex and changing import/export regulations, including tariffs and customs. In 2023, global trade growth slowed due to protectionist measures, impacting companies like Bekaert reliant on international supply chains.

Bekaert's intellectual property, such as patents for handling system designs, is vital for its competitive edge. In 2024, Bekaert continued significant R&D investment to develop and patent new product features and manufacturing efficiencies.

Environmental factors

The global drive for sustainability and circular economy principles is reshaping the packaging and industrial handling sectors. Bekaert Handling Group A/S must prioritize designing products that are readily recyclable, reusable, or incorporate recycled materials to meet these evolving environmental expectations.

This commitment is crucial as consumer and regulatory pressure mounts; for instance, the EU's Circular Economy Action Plan aims to double resource productivity by 2030, directly impacting material choices in manufacturing.

The effectiveness of waste management and recycling infrastructure significantly influences the success of Bekaert Handling Group's sustainable packaging. Regions with robust recycling programs, like many in Western Europe, can better support the circularity of Bekaert's recyclable materials. For instance, in 2023, the EU reported a recycling rate of 48.2% for municipal waste, a figure that directly affects the availability of recycled content for packaging manufacturers.

Conversely, areas with underdeveloped waste management systems present challenges. A lack of adequate recycling facilities can impede the closed-loop potential of Bekaert's packaging, even if the materials themselves are designed for recyclability. This can lead to higher landfill dependency, undermining the environmental benefits of their sustainable offerings and potentially increasing operational costs for clients relying on local recycling capabilities.

Growing global awareness of climate change is pushing industries, including those Bekaert operates within, to significantly reduce their carbon footprints. This translates to increased scrutiny on manufacturing efficiency, supply chain logistics, and the environmental impact of raw material sourcing. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), which started its transitional phase in October 2023, could impact Bekaert's imported materials if they originate from regions with less stringent carbon pricing.

Raw Material Sourcing and Resource Depletion

The environmental impact of sourcing raw materials, especially non-renewable ones, is a significant and increasing concern for businesses like Bekaert. This pressure is driving a shift towards more sustainable practices.

Bekaert may find strong incentives to investigate and adopt bio-based or renewable materials for its packaging solutions. This strategic move would not only lessen its dependence on finite fossil fuels but also directly address the pressing issue of resource depletion, aligning with global environmental goals.

- Global plastic production from fossil fuels reached approximately 370 million metric tons in 2023, highlighting the scale of reliance on non-renewable resources.

- The demand for bio-based plastics is projected to grow significantly, with market forecasts suggesting a compound annual growth rate (CAGR) of over 15% between 2024 and 2030.

- Bekaert's exploration of recycled content in packaging saw a 5% increase in utilization in 2024, demonstrating a tangible step towards resource efficiency.

Plastic Pollution and Microplastic Concerns

The growing global problem of plastic pollution, including the pervasive issue of microplastics, is placing considerable pressure on companies that manufacture plastic-based packaging. Bekaert, as a producer of these containers, is experiencing increased scrutiny and regulatory pressure to reduce its plastic waste footprint and investigate the use of alternative materials or innovative designs.

The United Nations Environment Programme (UNEP) reported in 2024 that plastic pollution continues to be a major environmental challenge, with estimates suggesting that over 11 million metric tons of plastic enter the ocean annually. This trend necessitates a shift in manufacturing practices.

- Regulatory Pressure: Governments worldwide are implementing stricter regulations on single-use plastics and packaging waste, impacting Bekaert's operational costs and product development strategies.

- Consumer Demand: Consumers are increasingly favoring sustainable products, pushing Bekaert to innovate with eco-friendly packaging solutions to maintain market share.

- Material Innovation: The search for biodegradable and recyclable alternatives to traditional plastics is intensifying, requiring significant investment in research and development for Bekaert.

- Supply Chain Impact: Suppliers of raw plastic materials may face new environmental compliance costs, which could be passed on to manufacturers like Bekaert.

The increasing focus on environmental sustainability and the circular economy is a significant driver for Bekaert Handling Group A/S. Companies are expected to prioritize recyclable, reusable, or recycled materials in their packaging solutions, aligning with global initiatives like the EU's Circular Economy Action Plan. This shift is also influenced by the growing problem of plastic pollution, with millions of tons entering oceans annually, prompting stricter regulations and a demand for eco-friendly alternatives.

Bekaert must navigate varying levels of waste management infrastructure globally, as regions with robust recycling programs, such as Western Europe where municipal waste recycling rates reached 48.2% in 2023, offer better support for circularity. Conversely, underdeveloped systems pose challenges to achieving closed-loop potential. Furthermore, the imperative to reduce carbon footprints is impacting supply chains, with mechanisms like the EU's Carbon Border Adjustment Mechanism (CBAM) potentially affecting imported materials based on their origin's carbon pricing.

The company is also seeing increased pressure to reduce its reliance on non-renewable resources, with global plastic production from fossil fuels reaching approximately 370 million metric tons in 2023. This trend fuels the demand for bio-based plastics, which are projected to grow at a CAGR exceeding 15% from 2024 to 2030. Bekaert's own efforts in 2024 saw a 5% increase in the utilization of recycled content in its packaging, reflecting a tangible commitment to resource efficiency.

| Environmental Factor | Impact on Bekaert Handling Group A/S | Supporting Data/Trend |

|---|---|---|

| Circular Economy & Sustainability | Need for recyclable, reusable, and recycled materials. | EU Circular Economy Action Plan aims to double resource productivity by 2030. |

| Waste Management Infrastructure | Varied effectiveness impacts material circularity. | EU municipal waste recycling rate was 48.2% in 2023. |

| Climate Change & Carbon Footprint | Scrutiny on manufacturing, logistics, and sourcing. | EU CBAM impacts imported materials based on carbon pricing. |

| Resource Depletion & Material Sourcing | Shift towards bio-based and renewable materials. | Global plastic production from fossil fuels ~370 million metric tons (2023); Bio-based plastics CAGR projected >15% (2024-2030). |

| Plastic Pollution | Pressure to reduce plastic waste and explore alternatives. | UNEP: Over 11 million metric tons of plastic enter oceans annually. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bekaert Handling Group A/S is informed by a comprehensive review of official government publications, reputable financial news outlets, and leading industry analysis firms. This approach ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in verifiable and current information.