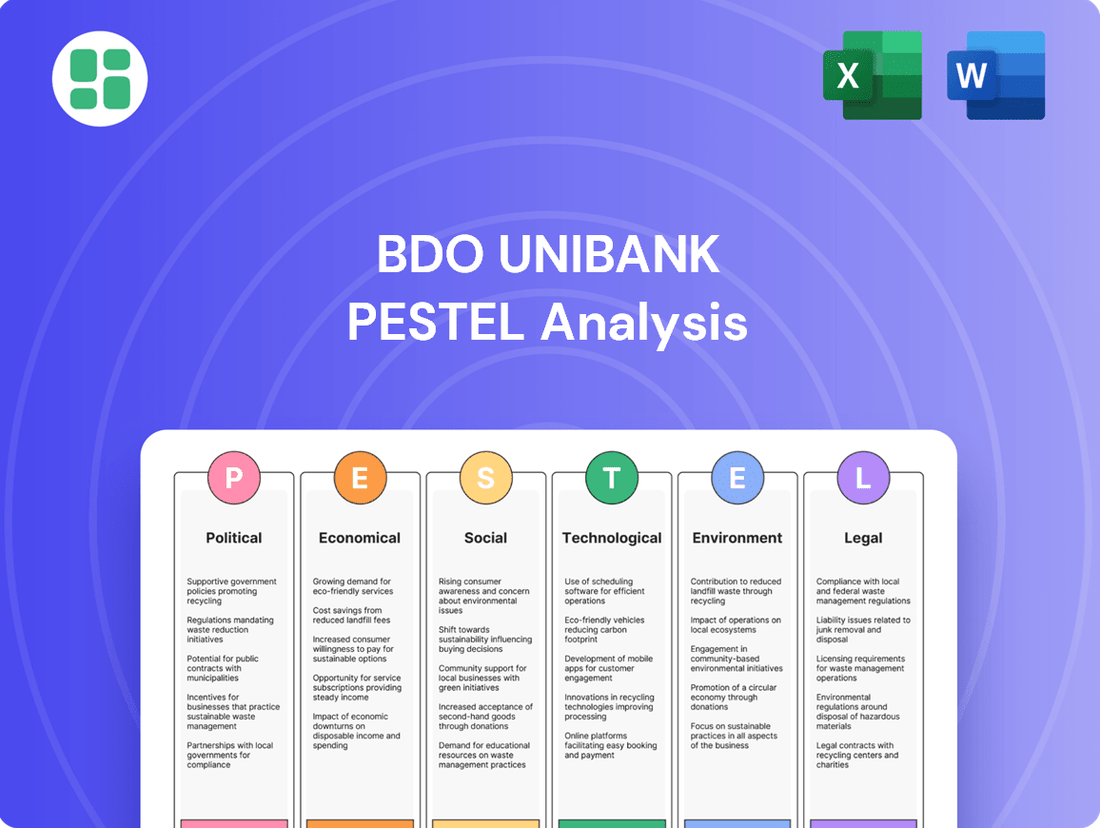

BDO Unibank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BDO Unibank Bundle

Discover the critical political, economic, social, technological, legal, and environmental factors shaping BDO Unibank's strategic landscape. Our comprehensive PESTLE analysis provides actionable intelligence to navigate these external forces and identify opportunities. Unlock a deeper understanding of BDO Unibank's future by purchasing the full report today.

Political factors

The Bangko Sentral ng Pilipinas (BSP) remains a key influencer for BDO Unibank, with its policies directly impacting operations. In 2024, the BSP continued its focus on bolstering financial inclusivity and sector stability, introducing frameworks for digital banks and enhancing consumer protection measures. These initiatives create a more robust and secure operating environment for established institutions like BDO.

The Philippine government, spearheaded by the Bangko Sentral ng Pilipinas (BSP), is strongly committed to boosting financial inclusion. Their goal is to bring more Filipinos into the formal financial system, a key objective for national development. As of Q4 2023, the BSP reported that 56% of adult Filipinos had transaction accounts, a figure they aim to significantly increase.

BDO Unibank is a proactive participant in these national efforts. The bank is expanding its physical footprint, particularly in rural areas, and enhancing its digital platforms to serve previously unbanked populations. This includes offering simplified account opening procedures and promoting basic financial literacy programs to empower more citizens.

These initiatives directly support national development plans by democratizing access to banking services. By fostering greater economic participation, BDO's alignment with government financial inclusion drives contributes to a more robust and inclusive economy for a wider segment of the Philippine population.

The Philippines generally enjoys political stability, creating a favorable landscape for the banking sector’s expansion, even with the occasional hurdles. BDO Unibank, a leading financial entity, upholds rigorous corporate governance, consistently earning accolades, such as those from ASEAN corporate governance scorecards.

These robust governance frameworks are crucial for bolstering investor trust and ensuring the bank's ability to withstand economic fluctuations. For instance, BDO Unibank's commitment to transparency and ethical practices was underscored by its consistent inclusion in various corporate governance rankings throughout 2024.

Anti-Money Laundering and Counter-Terrorism Financing Efforts

The Philippine government's commitment to robust anti-money laundering (AML) and counter-terrorism financing (CTF) regulations is a significant political factor. These measures are designed to protect the financial system's integrity, and BDO Unibank, like all financial institutions, must remain vigilant in its compliance. This involves ongoing investment in sophisticated compliance technology and comprehensive staff training to navigate the dynamic legal landscape. Staying current with these international standards is paramount for preserving customer trust and averting potential financial penalties.

BDO Unibank's adherence to these AML/CTF regulations is not just a legal obligation but a strategic imperative. For instance, the Anti-Money Laundering Council (AMLC) actively monitors financial transactions, and non-compliance can lead to substantial fines. In 2023, the Philippines continued to strengthen its AML/CTF framework, aligning with global best practices recommended by the Financial Action Task Force (FATF). This ongoing effort underscores the importance of proactive compliance for BDO Unibank.

- Strengthened Regulatory Oversight: The Bangko Sentral ng Pilipinas (BSP) consistently updates its circulars and advisories to ensure banks meet evolving AML/CTF standards.

- Increased Compliance Costs: BDO Unibank must allocate significant resources to technology, personnel, and training to maintain compliance.

- Reputational Risk Mitigation: Demonstrating strong AML/CTF practices safeguards BDO Unibank's reputation among international partners and investors.

- International Cooperation: The Philippines actively participates in international efforts to combat financial crimes, necessitating alignment with global standards.

Geopolitical Tensions and Trade Policies

Global geopolitical tensions and rising trade protectionism present potential headwinds for the Philippine economy, which in turn could impact the banking sector. While the Philippines benefits from a lower dependence on merchandise exports compared to some regional peers, BDO Unibank must remain vigilant regarding these external shifts. Such global uncertainties can significantly sway investment decisions and shape overall economic sentiment, making proactive risk assessment crucial for financial institutions.

For instance, the ongoing trade disputes between major economic blocs, which intensified through 2024, could lead to supply chain disruptions and increased import costs. Although the Philippines' export basket is diversified, a slowdown in global demand, a direct consequence of these tensions, could still dampen export growth. This economic slowdown might translate into reduced corporate borrowing and a more cautious consumer spending environment, affecting BDO Unibank's loan portfolio and fee-based income streams.

- Trade Protectionism: Increased tariffs and non-tariff barriers enacted by key trading partners can raise the cost of Philippine exports and potentially reduce demand.

- Geopolitical Instability: Conflicts and political unrest in major global regions can disrupt international trade routes, impact commodity prices (like oil, which affects inflation), and deter foreign direct investment into emerging markets like the Philippines.

- Investment Flows: Heightened global uncertainty often leads investors to seek safer havens, potentially reducing capital inflows into the Philippines and affecting liquidity in the financial markets.

- Economic Sentiment: Negative global news and outlooks can erode consumer and business confidence domestically, leading to decreased spending and investment, thereby impacting the banking sector's performance.

The Philippine government's focus on financial inclusion, spearheaded by the Bangko Sentual ng Pilipinas (BSP), is a significant political driver. The BSP aims to increase the percentage of adult Filipinos with transaction accounts, targeting a substantial rise from the 56% recorded in Q4 2023. BDO Unibank actively supports this by expanding its reach into rural areas and enhancing digital platforms, aligning with national development goals.

What is included in the product

This PESTLE analysis thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting BDO Unibank, providing a comprehensive understanding of its operating landscape.

It offers actionable insights and strategic recommendations for navigating external challenges and capitalizing on emerging opportunities within the Philippine banking sector.

A concise, actionable summary of BDO Unibank's PESTLE analysis, equipping leadership with the insights needed to proactively address external challenges and capitalize on opportunities.

Economic factors

The Philippine economy is anticipated to continue its robust growth trajectory, with GDP growth projections hovering around 6% for both 2024 and 2025. This expansion is largely fueled by strong domestic consumption and increased government spending on infrastructure projects.

This positive economic outlook creates a fertile ground for BDO Unibank. A growing economy typically means more opportunities for banks to extend loans and attract deposits, as businesses and individuals become more active financially.

Higher economic activity directly correlates with a greater demand for banking and financial services. As the economy expands, BDO Unibank can expect increased transaction volumes, loan origination, and a larger customer base seeking its diverse financial products.

The Bangko Sentro ng Pilipinas (BSP) is anticipated to maintain its monetary easing stance, with projections of interest rate cuts in 2024 and 2025 aimed at boosting domestic consumption and investment. For instance, the BSP's policy rate was 6.50% as of early 2024, a level that could be adjusted downwards.

These potential rate reductions directly impact BDO Unibank's net interest margins, as lower borrowing costs for the bank could translate to narrower spreads on loans. Furthermore, a more accommodative monetary policy environment generally encourages higher credit demand across retail, corporate, and SME segments, presenting both opportunities and challenges for BDO's lending business.

The BSP's commitment to keeping inflation low and stable, targeting a range of 2-4%, is crucial for fostering a predictable economic climate. This stability is vital for BDO Unibank, as it allows for more accurate financial planning and risk management, ultimately supporting sustainable economic growth and a healthy financial sector.

Inflation, while moderating, remains a crucial economic factor. The Bangko Sentral ng Pilipinas (BSP) has a target of an average inflation rate of 2% by the end of 2025. This stability is vital for maintaining consumer purchasing power, directly influencing BDO Unibank's consumer lending and deposit growth.

Stable inflation allows consumers to maintain their spending capacity, which is beneficial for BDO Unibank's loan portfolio and deposit base. For instance, if inflation remains within the BSP's target range, consumers are more likely to engage in borrowing for purchases and maintain healthy deposit balances.

Conversely, elevated inflation rates could negatively impact consumer spending and the repayment capacity of borrowers. If inflation surges beyond expectations, it erodes the real value of income, potentially leading to defaults on loans and reduced demand for new credit products offered by BDO Unibank.

Credit Demand and Loan Growth

The Philippine banking sector, including BDO Unibank, is experiencing robust loan growth, projected to continue in double digits throughout 2024 and into 2025. This surge is fueled by a recovering economy and strong credit appetite across corporate, commercial, and consumer markets. BDO itself demonstrated impressive performance, with its loan portfolio expanding significantly in 2024, exceeding the industry average and directly contributing to its profitability.

Key drivers for this credit demand include:

- Corporate Expansion: Businesses are actively seeking financing for capital expenditures and working capital needs as economic confidence rises.

- Consumer Spending: Increased disposable income and greater access to credit are boosting demand for personal loans, auto loans, and mortgages.

- Commercial Activity: Small and medium-sized enterprises (SMEs) are also playing a crucial role, accessing loans for growth and operational requirements.

- BDO's Market Position: BDO Unibank's strategic focus on these segments has allowed it to capture a substantial share of this growing loan market.

Remittances and Household Consumption

Remittances from Overseas Filipinos remain a significant pillar of the Philippine economy, consistently bolstering household consumption. This steady flow of funds directly translates into increased spending power for recipient families. For BDO Unibank, this translates into higher deposit bases and a greater volume of payment transactions.

The sustained consumer spending, fueled by remittances, is a critical driver for economic growth. In 2024, remittances were projected to grow by 3% according to Bangko Sentral ng Pilipinas (BSP) forecasts, underscoring their continued importance. This robust consumption pattern also fuels demand for BDO's consumer loan products, from personal loans to housing loans, contributing to the bank's lending portfolio.

A strong labor market further underpins household incomes and, consequently, consumption. The Philippines' unemployment rate remained relatively stable, hovering around 4.0% to 4.5% in early 2024, providing a solid foundation for domestic spending alongside external remittance inflows. This economic stability benefits BDO by creating a favorable environment for both deposit growth and loan uptake.

- Remittance Growth: BSP projected a 3% growth in remittances for 2024.

- Unemployment Rate: Philippine unemployment rate remained around 4.0%-4.5% in early 2024.

- Economic Impact: Remittances and domestic consumption are key drivers of Philippine GDP.

- BDO Benefit: Increased deposits, payment transactions, and loan demand for BDO Unibank.

The Philippine economy is set for continued robust growth, with GDP projected around 6% for both 2024 and 2025, driven by strong domestic consumption and infrastructure spending. This positive environment is highly beneficial for BDO Unibank, creating ample opportunities for loan expansion and deposit growth as economic activity increases.

The Bangko Sentral ng Pilipinas (BSP) is expected to ease monetary policy, with potential interest rate cuts in 2024-2025 to stimulate investment, though this could impact BDO's net interest margins. Meanwhile, the BSP's target for inflation to remain between 2-4% by the end of 2025 is crucial for BDO’s financial planning and risk management.

Loan growth in the Philippine banking sector, including BDO Unibank, is anticipated to remain in double digits through 2025, fueled by corporate expansion, increased consumer spending, and SME activity. Remittances from Overseas Filipinos, projected to grow by 3% in 2024, continue to be a vital economic pillar, bolstering household consumption and benefiting BDO through higher deposits and transaction volumes.

| Economic Factor | 2024 Projection/Status | 2025 Projection | Impact on BDO Unibank |

|---|---|---|---|

| GDP Growth | ~6% | ~6% | Increased loan demand, deposit growth |

| Inflation Target (BSP) | 2-4% | ~2% by year-end | Stable environment for planning, consumer spending |

| Interest Rate Policy | Potential easing | Potential easing | Impact on net interest margins, credit demand |

| Loan Growth (Industry) | Double-digit | Double-digit | Market share capture, revenue growth |

| Remittance Growth | ~3% | Continued steady inflow | Higher deposits, transaction volumes |

Preview the Actual Deliverable

BDO Unibank PESTLE Analysis

The BDO Unibank PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting BDO Unibank. You can confidently purchase knowing the content and structure shown in the preview is the same document you'll download after payment.

Sociological factors

The Philippines boasts a young demographic, with a median age of approximately 25.7 years as of 2024. This youthful population, coupled with a growing middle class and increasing urbanization, creates a significant demand for accessible banking solutions. The expanding formal financial sector, driven by these demographic trends, presents a substantial opportunity for BDO Unibank to grow its customer base.

Despite advancements, a considerable segment of the Philippine population, estimated at 36% in 2023 according to the Bangko Sentral ng Pilipinas (BSP), remains unbanked, underscoring the persistent demand for enhanced financial literacy and inclusion. BDO Unibank is actively engaged in numerous outreach programs aimed at educating citizens about financial products and services, thereby driving deeper market penetration.

BDO's strategic expansion of its physical footprint through new branches and ATMs, coupled with a robust digital banking platform, is crucial for effectively reaching underserved communities and bridging the financial inclusion gap. This multi-channel approach ensures accessibility for a wider demographic, promoting greater participation in the formal financial system.

Philippine consumers are increasingly embracing digital avenues for their banking needs. In 2024, a significant portion of the population, particularly the younger demographic, is opting for online and mobile banking due to its unparalleled convenience and the proliferation of user-friendly financial technology. This trend means BDO Unibank must consistently enhance its digital offerings to stay competitive.

This digital transformation is not just about convenience; it's also about accessibility. As of early 2025, internet penetration in the Philippines continues to climb, providing more Filipinos with the means to engage with digital financial services. BDO Unibank's ability to provide seamless, secure, and feature-rich digital platforms is paramount to capturing this growing market segment and ensuring customer loyalty in an evolving financial landscape.

Urbanization and Rural Outreach

The ongoing shift towards urban centers fuels a strong demand for sophisticated banking services, a trend BDO Unibank actively caters to in major cities. Simultaneously, the bank is committed to enhancing financial inclusion in rural areas, recognizing the unique needs of these communities.

BDO Unibank's strategy involves leveraging its vast branch network and innovative digital platforms, such as Cash Agad, to ensure financial services are accessible throughout the Philippines. This commitment is crucial for bridging the financial access gap, particularly in remote regions.

- Urban Demand: Metropolitan areas, experiencing high population growth, require advanced digital banking and investment products.

- Rural Outreach: BDO's Cash Agad program, a key initiative, has significantly expanded access to cash-out services in over 1,000 municipalities as of early 2024, reaching many previously underserved areas.

- Bridging the Gap: This dual focus addresses the differing financial needs and accessibility challenges faced by both urban and rural populations across the archipelago.

Income Inequality and Access to Credit

Income inequality significantly shapes how people access financial services. In the Philippines, a substantial portion of the population, particularly those in lower-income brackets, may face hurdles in obtaining traditional banking products. This can limit their ability to save, invest, or access capital for business ventures.

BDO Unibank actively works to bridge this gap. For instance, their microfinance programs and specialized services for Small and Medium Enterprises (SMEs) are designed to reach segments of the population that might otherwise be excluded from mainstream financial systems. This inclusive approach is crucial for fostering economic development and broadening the bank's market reach.

- Income Disparity: In 2023, the Philippines' Gini coefficient, a measure of income inequality, stood at approximately 0.42, indicating a notable gap between high and low earners.

- SME Contribution: SMEs account for over 99% of businesses in the Philippines and contribute significantly to employment, highlighting the importance of accessible credit for this sector.

- Financial Inclusion Efforts: BDO Unibank's initiatives aim to increase financial inclusion, which is vital for empowering underserved communities and driving broader economic participation.

The Philippines' youthful demographic, with a median age of 25.7 years in 2024, fuels demand for accessible banking. Despite this, 36% of the population remained unbanked in 2023, presenting an opportunity for BDO Unibank's financial literacy programs. The increasing adoption of digital banking, supported by growing internet penetration by early 2025, necessitates continuous enhancement of BDO's online and mobile platforms.

Income inequality, reflected in a 2023 Gini coefficient of 0.42, means BDO Unibank's microfinance and SME support are vital for financial inclusion. SMEs, comprising over 99% of Philippine businesses, benefit from accessible credit, reinforcing BDO's role in economic development.

| Sociological Factor | 2024/2025 Data Point | Implication for BDO Unibank |

|---|---|---|

| Youthful Population | Median age: 25.7 years (2024) | High demand for digital and accessible banking services. |

| Financial Inclusion Gap | 36% unbanked population (2023) | Opportunity for outreach and education programs to increase customer base. |

| Digital Adoption | Increasing internet penetration (early 2025) | Need to continuously improve user-friendly digital banking platforms. |

| Income Inequality | Gini coefficient: 0.42 (2023) | Importance of microfinance and SME support for broader market reach. |

Technological factors

The Philippine banking sector is rapidly digitizing, with a noticeable surge in the adoption of digital banking and payment platforms. This trend is reshaping how consumers interact with financial services, emphasizing convenience and accessibility. By mid-2024, reports indicated that over 70% of transactions in the Philippine banking system were already happening digitally, a significant jump from previous years.

BDO Unibank is at the forefront of this shift, channeling substantial investments into its 'Go Digital' strategy. This involves a continuous enhancement of its mobile and online banking platforms, aiming to deliver a seamless, secure, and user-friendly experience for its customers. The bank's digital spending in 2024 alone was projected to exceed PHP 10 billion, focusing on upgrading infrastructure and developing new digital features.

This digital transformation is not merely about offering new services; it's a crucial element for boosting operational efficiency and deepening customer engagement. As more Filipinos embrace digital channels, BDO Unibank's commitment to these initiatives positions it to better serve its growing customer base and maintain a competitive edge in an evolving financial landscape.

The escalating digital landscape presents substantial cybersecurity threats and data protection challenges for financial institutions like BDO Unibank. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the immense financial risk.

BDO Unibank must proactively fortify its cybersecurity infrastructure, integrating cutting-edge fraud detection systems and robust data protection protocols to mitigate these risks. This includes investing in continuous monitoring and threat intelligence to stay ahead of evolving attack vectors.

Adherence to stringent data privacy regulations, such as the Data Privacy Act of 2012 in the Philippines, is crucial for protecting sensitive customer data and preserving client confidence. Failure to comply can result in significant penalties and reputational damage.

The Philippine FinTech landscape is rapidly evolving, with new digital-only banks and payment platforms emerging, intensifying competition for traditional players like BDO Unibank. For instance, by the end of 2024, over 30 FinTech companies were registered with the Bangko Sentral ng Pilipinas, offering innovative solutions in payments, lending, and investments.

BDO Unibank can strategically partner with these FinTech innovators to broaden its digital reach and integrate cutting-edge services into its existing ecosystem. Collaborations could focus on areas like embedded finance or specialized digital lending platforms, leveraging FinTech agility to complement BDO's established customer base and trust.

This dynamic interplay between competition and collaboration demands constant innovation from BDO Unibank. Staying ahead requires not only adapting to new technologies but also proactively seeking opportunities to integrate and enhance digital offerings, ensuring continued relevance and competitiveness in the evolving financial services market.

AI, Machine Learning, and Automation

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally reshaping banking operations. These technologies are enabling hyper-personalized financial products, more efficient automated decision-making processes, and significantly enhanced fraud detection capabilities. For BDO Unibank, this presents a substantial opportunity to elevate customer service, streamline internal workflows, and refine risk assessment strategies. AI-driven solutions are anticipated to be a primary driver of innovation within the financial sector throughout 2025.

BDO Unibank can leverage AI and ML for several key advancements. Imagine personalized investment recommendations tailored to individual risk appetites and financial goals, or automated loan application processing that significantly reduces turnaround times. Furthermore, AI can analyze vast datasets to identify and prevent fraudulent transactions in real-time, bolstering security for both the bank and its customers. By 2025, the adoption of AI is expected to be a critical differentiator for banks seeking to maintain a competitive edge.

- Hyper-personalization: AI enables BDO Unibank to offer customized financial products and services based on individual customer data and behavior.

- Operational Efficiency: Automation through AI/ML can streamline processes like loan approvals, customer support, and back-office operations, reducing costs and improving speed.

- Enhanced Security: Machine learning algorithms are crucial for advanced fraud detection and cybersecurity, protecting against evolving threats.

- Data-Driven Insights: AI tools can analyze market trends and customer data to inform strategic decisions and product development.

Mobile Banking Infrastructure and Connectivity

The Philippines boasts a rapidly growing mobile penetration rate, reaching approximately 87.8% of the population by early 2024, according to Statista. This widespread adoption of mobile devices is a significant advantage for BDO Unibank, enabling the bank to effectively deliver its digital banking services. Improved internet connectivity, though still a work in progress in some areas, is crucial for seamless mobile banking experiences.

BDO Unibank leverages this expanding mobile and internet infrastructure to enhance its digital offerings, such as its mobile banking app and online platforms. This allows for more efficient customer service and broader reach. The bank's ability to provide accessible digital financial solutions is directly tied to the ongoing development of telecommunications networks across the archipelago.

- Mobile Penetration: Approaching 88% of the Philippine population by early 2024, creating a vast user base for digital banking.

- Internet Connectivity: Ongoing improvements are vital for enhancing the performance and accessibility of mobile banking services, especially in underserved regions.

- Digital Channel Effectiveness: BDO Unibank's investment in its mobile app and digital platforms directly benefits from increased mobile device usage and better connectivity.

The technological landscape is rapidly evolving, with AI and machine learning becoming central to banking innovation. BDO Unibank is actively integrating these technologies to offer hyper-personalized services, streamline operations, and bolster cybersecurity. By 2025, AI adoption is expected to be a key differentiator for competitive banks.

The bank's digital strategy is further supported by the Philippines' high mobile penetration rate, nearing 88% by early 2024. This widespread mobile access allows BDO Unibank to effectively deliver its digital banking services, enhancing customer reach and engagement. Ongoing improvements in internet connectivity are crucial for optimizing these mobile experiences.

BDO Unibank's digital transformation is also shaped by the competitive FinTech sector, with over 30 FinTech companies registered by the BSP in 2024. Strategic partnerships with these innovators can expand BDO's digital offerings and integrate cutting-edge services, ensuring continued relevance.

Legal factors

Bangko Sentral ng Pilipinas (BSP) regulations are foundational to BDO Unibank's operations, dictating everything from capital requirements to consumer protection measures. For instance, BSP's ongoing focus on digital banking, as seen in its 2023 circulars, pushes BDO to invest in fintech and cybersecurity to maintain compliance and competitiveness.

Capital adequacy ratios are a key BSP mandate; by the end of 2023, BDO Unibank maintained a robust Capital Adequacy Ratio (CAR) of 14.22% and a Common Equity Tier 1 (CET1) ratio of 12.49%, both well above the BSP's minimum requirements, demonstrating its financial resilience.

Furthermore, the BSP’s push for sustainable finance, with guidelines issued in 2023 and continuing into 2024, influences BDO's lending practices and investment strategies, encouraging greener financial products and services.

The Data Privacy Act of 2012 (RA 10173) is a cornerstone for financial institutions like BDO Unibank, mandating stringent protocols for handling personal and sensitive data. This includes securing customer information during all processing stages, from account opening to transaction monitoring.

Recent directives from the National Privacy Commission (NPC) further refine these requirements, particularly concerning the secure transmission and storage of sensitive personal information, impacting how BDO Unibank manages its digital customer interactions and data infrastructure.

Non-compliance with the DPA can lead to significant penalties, as evidenced by the NPC’s ongoing enforcement actions against various entities for data breaches and privacy violations, underscoring the critical need for BDO Unibank to maintain robust data protection measures to preserve customer trust and avoid financial repercussions.

BDO Unibank, like all financial institutions, operates under the strict purview of the Anti-Money Laundering Act (AMLA) and its subsequent amendments. This legislation is critical in preventing the financial system from being exploited for illegal purposes, such as money laundering and terrorist financing.

Compliance mandates rigorous customer due diligence processes, including thorough Know Your Customer (KYC) procedures, and the diligent reporting of any suspicious transactions to the relevant authorities. BDO Unibank's adherence to these regulations, alongside international Anti-Money Laundering/Combating the Financing of Terrorism (AML/CTF) standards, is paramount.

Failure to comply with AMLA can result in significant penalties, including substantial fines and severe damage to the bank's reputation. For instance, in 2023, regulators globally imposed billions of dollars in fines for AML violations, underscoring the gravity of these legal requirements.

Consumer Protection Laws and Financial Consumer Protection Act

Consumer protection laws are a significant focus for regulators, compelling financial institutions like BDO Unibank to prioritize fair treatment, transparency, and robust complaint resolution processes. This heightened emphasis is designed to foster greater trust and confidence within the financial sector.

BDO Unibank has proactively implemented a comprehensive Consumer Protection Risk Management System. This system is specifically designed to identify, assess, and mitigate potential risks that could impact their clients, ensuring a safer banking experience.

The Philippine government, through measures like the proposed Financial Consumer Protection Act, continues to strengthen safeguards for financial consumers. For instance, the Bangko Sentral ng Pilipinas (BSP) has been actively promoting financial literacy and consumer protection initiatives, with various circulars issued throughout 2023 and early 2024 reinforcing these mandates for all banks.

- Regulatory Scrutiny: Increased regulatory oversight demands adherence to stringent consumer protection standards.

- Risk Management: BDO's Consumer Protection Risk Management System is key to mitigating client-facing risks.

- Transparency and Fairness: Laws mandate clear communication and equitable practices in all banking interactions.

- Complaint Mechanisms: Accessible and effective channels for addressing customer grievances are essential.

Taxation Policies and Fiscal Reforms

Changes in government taxation policies and ongoing fiscal reforms directly influence BDO Unibank's profitability and operational costs. For instance, the Philippine government's fiscal consolidation efforts, aiming to manage debt levels post-pandemic, could lead to adjustments in corporate tax rates or the introduction of new levies. The bank must proactively adapt its financial planning and business strategies to align with these evolving tax landscapes.

Monitoring legislative developments is crucial for effective financial management. Recent proposals or enacted laws, such as potential changes to the Bank Secrecy Law or adjustments in capital gains taxes on financial instruments, could significantly alter the financial sector's operating environment. BDO Unibank's ability to navigate these changes will be key to maintaining its competitive edge and financial stability.

- Corporate Income Tax: The Philippines' corporate income tax rate stands at 30%, a key factor in BDO Unibank's net earnings. Any proposed reduction, like those seen in other ASEAN nations, would directly impact profitability.

- Financial Transaction Taxes: The potential introduction or modification of taxes on financial transactions, such as a gross receipts tax or a stamp tax on certain banking products, could increase operational expenses.

- Fiscal Reforms: Government initiatives aimed at broadening the tax base or improving tax collection efficiency could indirectly affect the economic environment in which BDO Unibank operates.

- Tax Incentives: Conversely, government incentives for specific sectors or investments might present opportunities for the bank to structure its operations or offer new products.

The regulatory environment, shaped by the Bangko Sentral ng Pilipinas (BSP), is paramount for BDO Unibank. BSP's directives on capital adequacy, such as the 14.22% Capital Adequacy Ratio (CAR) and 12.49% Common Equity Tier 1 (CET1) ratio maintained by BDO at the end of 2023, are critical. Furthermore, evolving regulations concerning digital banking and sustainable finance, as highlighted in 2023 and 2024 circulars, necessitate continuous investment and strategic adaptation by the bank.

Environmental factors

BDO Unibank is navigating a landscape of evolving ESG reporting mandates, with regulators like the Securities and Exchange Commission (SEC) and the Bangko Sentral ng Pilipinas (BSP) increasingly requiring robust disclosures. The bank's proactive compliance demonstrates a commitment to transparency and accountability in its sustainability efforts.

The bank's 2024 Sustainability Report details its performance across economic, environmental, social, and governance pillars, underscoring alignment with globally recognized frameworks. This includes adherence to the Global Reporting Initiative (GRI) standards, the International Sustainability Standards Board's (ISSB) IFRS S1 and S2, and the United Nations Sustainable Development Goals (UN SDGs).

This strategic alignment signifies BDO Unibank's dedication to integrating sustainable practices into its core operations, reflecting a broader industry trend towards environmentally and socially responsible business conduct. Such adherence is crucial for maintaining investor confidence and meeting stakeholder expectations in the current financial climate.

Climate change presents significant physical risks, like extreme weather events impacting borrowers' assets, and transition risks, as industries shift towards lower-carbon models, both of which BDO Unibank must actively manage within its loan portfolios. The bank's commitment is demonstrated through its pioneering role in sustainable financing, including the issuance of ASEAN Sustainability Bonds.

These bonds, which have seen strong investor interest, are specifically earmarked to finance projects in renewable energy, green infrastructure, and other environmentally sound initiatives, totaling billions in commitments. This strategic direction not only helps BDO Unibank mitigate its exposure to climate-related risks but also actively supports the Philippines' transition towards a more sustainable, low-carbon economy, aligning with national climate goals.

The Bangko Sentral ng Pilipinas (BSP) has introduced Sustainable Finance Taxonomy Guidelines (SFTG), setting a framework for banks to classify and manage their financing activities. These guidelines are crucial for banks like BDO Unibank as they dictate how credit and sustainable financial products are extended, aligning them with broader sustainability objectives.

BDO Unibank is expected to fully comply with these SFTG requirements by the close of 2024. This regulatory directive from the BSP actively encourages and promotes green investments throughout the Philippine banking sector, influencing lending practices and product development.

Disaster Preparedness and Climate Resilience

The Philippines, highly susceptible to typhoons and other natural calamities, necessitates that BDO Unibank maintains rigorous disaster preparedness and business continuity strategies. These plans are vital for ensuring the bank's operations can continue smoothly even when faced with extreme weather events.

Climate change poses a significant threat to the nation's socio-economic stability, directly affecting BDO Unibank's capacity to deliver uninterrupted services and safeguard its financial assets. For instance, the country experienced an estimated PHP 20 billion in agricultural damage from typhoons in 2023 alone, highlighting the broad economic impact.

- Operational Continuity: BDO Unibank must have well-defined protocols to maintain critical banking functions during and after disasters, minimizing service disruptions for its customers.

- Asset Protection: Safeguarding physical branches, data centers, and other essential infrastructure from damage is paramount to preventing significant financial losses.

- Customer Support: Ensuring customers can access essential banking services, including emergency funds and communication channels, is a key aspect of resilience.

- Economic Impact Mitigation: By maintaining operations, the bank plays a crucial role in supporting economic recovery in affected areas.

Resource Efficiency and Pollution Control

BDO Unibank is actively pursuing resource efficiency and pollution control across its operations. This commitment is evident in their focus on reducing energy consumption and improving waste management within the bank itself. For instance, BDO aims to reduce its carbon footprint by implementing energy-saving technologies in its branches and offices.

Beyond internal operations, BDO Unibank extends its sustainability efforts to its financed projects. The bank supports clients involved in clean transportation initiatives and those focused on sustainable natural resource management. This strategic alignment helps foster environmentally responsible business practices throughout the economy.

- Energy Consumption Reduction: BDO Unibank is implementing measures to decrease its energy usage, contributing to lower operational costs and a reduced environmental impact.

- Waste Management Improvement: The bank is enhancing its waste management systems to minimize landfill contributions and promote recycling and responsible disposal.

- Support for Clean Transportation: BDO finances projects and businesses that promote cleaner modes of transport, aligning with global efforts to decarbonize the transportation sector.

- Sustainable Natural Resource Management: The bank provides financial support to clients engaged in practices that ensure the responsible and sustainable use of natural resources.

Environmental factors significantly shape BDO Unibank's operations and strategy, particularly concerning climate change and sustainability mandates. The bank is actively aligning with evolving ESG reporting requirements from bodies like the BSP and SEC, as demonstrated by its 2024 Sustainability Report which adheres to GRI and ISSB standards.

BDO Unibank is proactively managing climate-related physical and transition risks, underscored by its issuance of ASEAN Sustainability Bonds totaling billions to fund green projects. This commitment is further reinforced by the BSP's Sustainable Finance Taxonomy Guidelines, which BDO is expected to fully implement by the end of 2024 to guide green investments.

Given the Philippines' vulnerability to natural calamities, BDO Unibank prioritizes robust disaster preparedness and business continuity. The economic impact of such events, like the PHP 20 billion agricultural damage from typhoons in 2023, highlights the critical need for operational resilience and asset protection.

The bank is also focused on internal resource efficiency, aiming to reduce energy consumption and improve waste management, while extending support to clients in clean transportation and sustainable natural resource management.

PESTLE Analysis Data Sources

Our PESTLE Analysis for BDO Unibank draws from a comprehensive mix of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the bank.