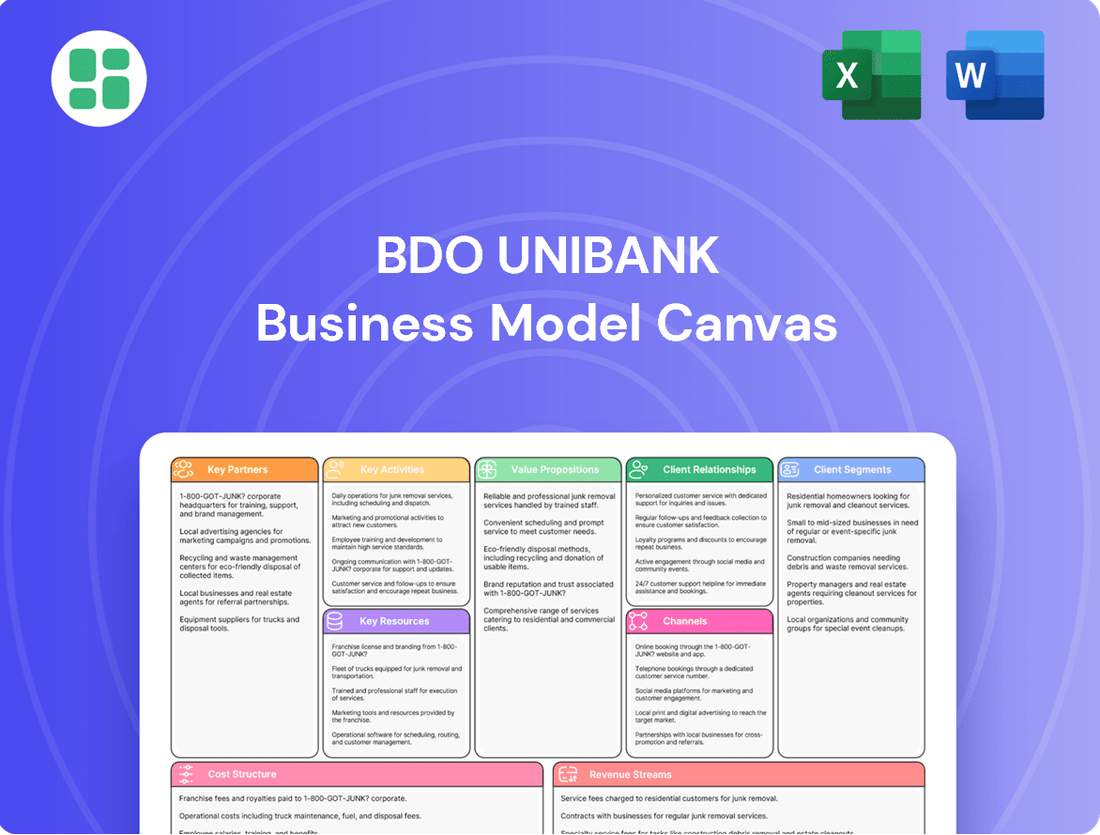

BDO Unibank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BDO Unibank Bundle

Unlock the strategic blueprint behind BDO Unibank's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap for understanding their market dominance. Discover the key partnerships and cost structures that drive their operations and gain actionable insights for your own business strategy.

Partnerships

BDO Unibank actively forms strategic alliances with fintech firms to bolster its digital offerings and payment capabilities. This approach is central to their digital transformation strategy, aiming to provide customers with more responsive and secure digital platforms.

These collaborations are crucial for expanding BDO's digital ecosystem, allowing them to integrate cutting-edge technologies and offer a wider array of financial services. For instance, by partnering with companies specializing in areas like digital payments or wealth management technology, BDO can quickly introduce new features that cater to modern consumer expectations.

The bank's commitment to these technology partnerships is evident in its continuous efforts to enhance customer experience and streamline operations. In 2024, the Philippine digital banking sector saw significant growth, with mobile banking transactions increasing by a substantial margin, underscoring the importance of such strategic fintech collaborations for staying competitive.

BDO Unibank collaborates with a wide array of global remittance partners to ensure seamless and secure money transfers for Overseas Filipino Workers (OFWs). This extensive network is vital for reaching beneficiaries swiftly and reliably, catering to a significant customer base. These alliances are fundamental to BDO's robust position in the remittance sector.

In 2024, BDO Unibank continued to leverage these partnerships, with remittances playing a substantial role in the Philippine economy. For instance, remittances from OFWs are projected to remain a key driver of economic growth, with the Bangko Sentral ng Pilipinas reporting consistent inflows throughout the year, underscoring the importance of these global networks.

BDO Unibank collaborates with numerous insurance companies, effectively extending its product suite through bancassurance. This strategic alliance allows BDO to seamlessly embed insurance solutions, such as life, health, and general insurance, directly into its banking services, offering clients a more complete financial picture.

These bancassurance partnerships are a critical driver of BDO's non-interest income. In 2023, BDO’s insurance subsidiaries, including Generali Pilipinas Life Assurance Company and Generali Pilipinas Holdings Corporation, reported a combined net income of PHP 3.6 billion, showcasing the significant financial contribution from these ventures.

Government and Regulatory Bodies

BDO Unibank's collaborations with government and regulatory bodies are critical for its operations and strategic objectives. The Bangko Sentral ng Pilipinas (BSP) is a key partner, guiding BDO’s adherence to financial regulations and its efforts to expand financial inclusion across the Philippines. For instance, BDO actively participates in BSP-led initiatives aimed at increasing digital payments adoption, a crucial step towards serving unbanked populations.

These partnerships also align BDO with national sustainable development priorities. By working with agencies like the Department of Finance and other government entities, BDO supports programs that foster economic growth and stability. This engagement ensures BDO remains compliant with evolving legal frameworks while contributing to the nation's broader economic agenda.

- Regulatory Compliance: BDO Unibank works closely with the Bangko Sentral ng Pilipinas (BSP) to ensure all banking operations meet stringent regulatory requirements, a cornerstone of trust in the financial sector.

- Financial Inclusion Initiatives: Partnerships with government bodies facilitate BDO's role in promoting financial inclusion, such as supporting programs that provide access to banking services for underserved communities. In 2023, the BSP reported a significant increase in digital transactions, a trend BDO actively supports through its platforms.

- Sustainable Development Goals: Collaborations extend to supporting national development goals, including those related to economic empowerment and sustainable finance, aligning BDO's business strategy with societal progress.

Technology and Infrastructure Providers

BDO Unibank collaborates with premier technology and infrastructure providers to ensure its IT systems remain cutting-edge. This focus on upgrading infrastructure, including significant investments in cloud-based platforms and robust security features, is crucial for staying competitive and enhancing digital banking services.

These strategic alliances are fundamental to future-proofing the bank's operations and elevating the overall customer experience. For instance, BDO Unibank's digital transformation efforts in 2024 have seen increased adoption of its mobile banking app, with transactions growing significantly year-over-year, underscoring the impact of these technology partnerships.

- Cloud Infrastructure: Partnerships with leading cloud providers enable scalability and agility for BDO's digital services.

- Cybersecurity Solutions: Collaborations with cybersecurity firms bolster defenses against evolving threats, protecting customer data.

- Data Analytics Platforms: Working with analytics specialists allows BDO to leverage data for personalized customer offerings and operational efficiency.

- Payment Gateway Integration: Partnerships with payment processors facilitate seamless and secure transaction processing for a wide range of services.

BDO Unibank's key partnerships span fintech innovators, global remittance networks, insurance providers, government bodies, and technology infrastructure leaders. These alliances are vital for enhancing digital capabilities, expanding service offerings, ensuring regulatory compliance, and driving financial inclusion. In 2024, the bank's focus on these collaborations reflects a broader trend in the Philippine banking sector towards digital transformation and customer-centric solutions.

These partnerships are crucial for BDO's competitive edge. Collaborations with fintech firms, for example, allow for rapid integration of new payment technologies, while remittance partnerships ensure efficient service for Overseas Filipino Workers. Bancassurance alliances significantly boost non-interest income, with BDO's insurance subsidiaries showing strong performance. Furthermore, working with government entities supports financial inclusion initiatives, aligning with national development goals.

The bank's investment in technology infrastructure partnerships is also a significant factor. By leveraging leading cloud providers and cybersecurity solutions, BDO enhances its digital service delivery and data protection. These strategic collaborations are fundamental to BDO's growth and its ability to meet evolving customer expectations in the dynamic financial landscape.

What is included in the product

A detailed breakdown of BDO Unibank's strategy, outlining its key customer segments, value propositions, and revenue streams to foster informed decision-making.

This model provides a clear, 9-block overview of BDO Unibank's operational framework, ideal for understanding their market approach and strategic advantages.

BDO Unibank's Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of their operations, enabling swift identification of inefficiencies and bottlenecks.

This one-page snapshot allows BDO to pinpoint areas of friction in their customer journey or internal processes, facilitating targeted improvements and reducing operational pain.

Activities

BDO Unibank's primary activity revolves around its extensive lending and credit operations. This includes offering a wide array of loan products tailored for corporations, commercial businesses, and individual consumers. In 2024, these lending activities experienced a significant growth of 13%, underscoring the bank's robust engagement in credit provision.

This core business is the primary engine for BDO's interest income generation, playing a crucial role in fueling various sectors of the economy. The bank's commitment to expanding its credit reach is evident in its loan portfolio, which reached P3.2 trillion by the end of 2024 and further grew to P3.4 trillion in the first half of 2025, showcasing consistent and strong expansion in its lending activities.

BDO Unibank's core operations revolve around attracting and managing customer deposits, a critical function for its lending and investment activities. In 2024, the bank saw its total deposits reach an impressive P3.8 trillion, demonstrating significant customer trust and financial strength. This upward trend continued into the first half of 2025, with deposits surpassing the P4 trillion mark.

A key strength is BDO's robust Current Account/Savings Account (CASA) ratio. This indicates a substantial portion of its funding comes from low-cost, stable customer accounts, providing a solid and cost-effective base for its operations. Beyond retail deposits, BDO also actively manages substantial trust funds, further solidifying its role as a comprehensive financial services provider and a significant player in wealth management.

BDO Unibank is heavily invested in the ongoing development and enhancement of its digital banking platforms, including the BDO Online website and mobile applications such as BDO Online and BDO Pay. This commitment ensures clients have access to cutting-edge financial tools.

Key activities include the rollout of new features designed to improve user experience and security. For instance, enhanced security protocols and more flexible money transfer options are consistently being integrated, making digital transactions safer and more convenient.

These digital advancements are crucial for providing seamless and secure banking experiences. As of early 2024, BDO reported a significant increase in digital transactions, reflecting the growing adoption and reliance on these platforms by its customer base.

Treasury and Investment Banking Services

BDO Unibank actively participates in treasury operations, investment banking, and securities brokerage, which are crucial for its diverse revenue generation. These functions involve managing the bank's financial assets, facilitating significant capital market transactions, and offering high-value private banking services. For instance, BDO Capital & Investment Corporation, a subsidiary, plays a key role in underwriting and financial advisory services.

The bank has been enhancing its wealth management offerings to deliver superior returns for its clientele. This focus is evident in its expanded suite of investment products and personalized advisory services designed to meet the evolving needs of affluent customers. In 2023, BDO Unibank's investment banking arm was recognized for its significant contributions to the Philippine capital markets.

- Treasury Operations: Manages the bank's liquidity, interest rate risk, and foreign exchange exposure, ensuring financial stability and profitability.

- Investment Banking: Facilitates capital raising for corporations through debt and equity offerings, mergers and acquisitions advisory, and project finance.

- Securities Brokerage: Provides clients with access to stock markets, enabling trading and investment in listed securities.

- Wealth Management: Offers tailored investment solutions, financial planning, and private banking services to high-net-worth individuals.

Branch Network Expansion and Maintenance

BDO Unibank is actively pursuing a strategy of expanding and maintaining its physical presence, even as digital banking gains traction. In 2024, the bank inaugurated 71 new branches, demonstrating a commitment to physical accessibility. This expansion is particularly focused on reaching underserved and rural communities, ensuring that a broad customer base can utilize traditional banking services.

The bank's commitment extends to its ATM network, which complements its branch strategy. Looking ahead, BDO plans to open an additional 120 branches in 2025, further solidifying its extensive reach across the Philippines. This dual approach of digital innovation and physical network growth is a cornerstone of BDO's strategy to maintain its leading position in the banking industry.

- 2024 Branch Additions: 71 new branches opened.

- 2025 Branch Expansion Target: Plans for 120 additional branches.

- Strategic Focus: Broadening reach in underserved and rural areas.

- Underlying Goal: Ensuring accessibility for customers preferring traditional banking.

BDO Unibank's key activities encompass a broad spectrum of financial services, from core lending and deposit-taking to sophisticated investment banking and digital platform development. The bank actively manages its balance sheet through treasury operations, ensuring liquidity and managing risks. It also focuses on expanding its physical footprint through branch network growth and enhancing its digital offerings to cater to diverse customer needs.

| Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Lending Operations | Providing various loan products to corporations, businesses, and individuals. | Loan portfolio grew to P3.4 trillion by H1 2025; 13% growth in 2024. |

| Deposit Mobilization | Attracting and managing customer deposits, including CASA accounts. | Total deposits reached over P4 trillion by H1 2025; P3.8 trillion in 2024. |

| Digital Banking Enhancement | Developing and improving online and mobile banking platforms. | Significant increase in digital transactions reported in early 2024. |

| Treasury & Investment Banking | Managing financial assets, capital markets transactions, and wealth management. | Recognized for contributions to Philippine capital markets in 2023. |

| Branch Network Expansion | Opening new branches, especially in underserved areas. | 71 new branches opened in 2024; plans for 120 more in 2025. |

Full Version Awaits

Business Model Canvas

The BDO Unibank Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing a direct representation of the comprehensive analysis that will be delivered to you, ensuring no discrepancies in content or structure. Once your order is complete, you will gain full access to this exact, professionally prepared Business Model Canvas, ready for your immediate use and strategic planning.

Resources

BDO Unibank leverages its extensive physical distribution network, boasting over 1,800 consolidated operating branches and more than 5,800 teller machines across the Philippines. This significant footprint is a cornerstone of its business model, enabling unparalleled reach to diverse customer segments, including those in underserved and remote areas.

The bank's commitment to expanding this physical infrastructure, as evidenced by its continuous growth in branch and ATM numbers, directly supports its strategy of maximizing accessibility. This widespread presence is a key differentiator, facilitating customer engagement and transaction convenience nationwide.

BDO Unibank's position as the largest bank in the Philippines by total assets, loans, deposits, and trust funds under management directly translates into robust financial capital. This significant scale provides a deep well of resources to fund its diverse operations and strategic initiatives.

The bank's strong balance sheet is further evidenced by its solid capital position, including a Common Equity Tier 1 (CET1) ratio of 14.1% as of the first quarter of 2024. This robust capital adequacy ratio demonstrates BDO's resilience and its capacity to absorb potential losses, a key indicator of financial health.

Furthermore, BDO's increasing shareholders' equity reinforces its financial strength. This upward trend in equity signifies retained earnings and capital injections, bolstering its foundation for sustained growth and the ability to pursue new market opportunities and expansion plans.

BDO Unibank's commitment to advanced IT infrastructure is evident in its substantial investments. The bank has adopted cloud-based, plug-and-play platforms and continuously upgrades its technology stacks to stay ahead in the digital banking landscape.

This robust IT foundation is the backbone of BDO's digital banking strategy, directly contributing to improved operational efficiency and a superior customer experience. It ensures the bank can deliver secure, scalable, and resilient digital services to its growing customer base.

In 2024, BDO Unibank continued to prioritize these technological advancements, recognizing their critical role in maintaining a competitive edge and meeting evolving customer expectations for seamless digital interactions.

Skilled Human Capital and Management Expertise

BDO Unibank's skilled human capital and management expertise are cornerstones of its business model, directly fueling its operational efficiency, innovative drive, and customer-centric approach. The dedication and deep industry knowledge of its workforce are crucial for adapting to the ever-changing financial sector and achieving BDO's strategic goals. The bank actively invests in its employees' professional advancement, recognizing that their growth is paramount to the institution's success.

In 2024, BDO Unibank continued to prioritize its human resources. The bank reported a total workforce of over 40,000 employees, underscoring its significant human capital investment. This extensive team, coupled with an experienced management cadre, is essential for delivering superior financial services and maintaining BDO's competitive edge.

- Talent Development: BDO Unibank invests heavily in training and development programs, aiming to enhance the skills and capabilities of its employees, ensuring they are equipped for future challenges and opportunities.

- Management Acumen: The bank's leadership team possesses extensive experience in banking and finance, providing strategic direction and effective oversight for all operations.

- Employee Engagement: Fostering a culture of engagement and empowerment is key, leading to higher productivity and a commitment to customer satisfaction.

- Innovation Hubs: Dedicated teams focus on innovation, leveraging employee expertise to develop new products and digital solutions that meet evolving market demands.

Strong Brand Reputation and Market Leadership

BDO Unibank's position as the largest bank in the Philippines, a status solidified over decades of reliable financial operations, forms the bedrock of its strong brand reputation. This leadership is not merely about size; it's a testament to consistent performance and the deep trust it has cultivated among its clientele.

This market leadership and established trust are critical advantages, acting as powerful magnets for customer acquisition and retention across all demographics and financial needs. It allows BDO Unibank to attract a wider customer base and maintain loyalty, which is crucial in the competitive banking landscape.

The bank is widely acknowledged as a dependable financial partner, a perception reinforced by its sustained market dominance. This recognition translates into tangible benefits, including easier access to capital, stronger negotiating power with suppliers, and a greater ability to attract top talent.

- Market Dominance: BDO Unibank consistently ranks as the largest universal bank in the Philippines by total assets, loans, and deposits. As of the first quarter of 2024, its total assets stood at over PHP 4.1 trillion.

- Customer Trust: A significant portion of the Philippine population relies on BDO for their banking needs, reflecting a high level of confidence in its stability and services.

- Brand Recognition: BDO's brand is synonymous with financial security and accessibility, making it the go-to choice for many Filipinos seeking banking solutions.

- Industry Awards: The bank frequently garners accolades from prestigious financial publications, underscoring its leadership and commitment to excellence in various banking segments.

BDO Unibank's key resources encompass its extensive physical network, substantial financial capital, robust IT infrastructure, skilled human capital, and a strong brand reputation built on market leadership and customer trust.

These resources collectively enable the bank to serve a broad customer base, drive digital innovation, and maintain its competitive advantage in the Philippine financial sector.

The bank's financial strength is underscored by its significant asset base, exceeding PHP 4.1 trillion in Q1 2024, and a healthy CET1 ratio of 14.1% in the same period.

Its vast branch network, over 1,800 locations, and a workforce of more than 40,000 employees in 2024 are critical for operational reach and service delivery.

| Key Resource | Description | 2024 Data Point |

| Physical Network | Extensive branch and ATM presence | Over 1,800 branches, 5,800+ ATMs |

| Financial Capital | Largest bank by assets, strong capital ratios | Total Assets: > PHP 4.1 trillion (Q1 2024); CET1 Ratio: 14.1% (Q1 2024) |

| IT Infrastructure | Advanced, cloud-based platforms | Continuous upgrades and adoption of new technologies |

| Human Capital | Skilled workforce and experienced management | Over 40,000 employees |

| Brand Reputation | Market leadership and customer trust | Largest universal bank in the Philippines |

Value Propositions

BDO Unibank provides a complete suite of banking services, encompassing everything from basic deposit accounts to specialized lending, treasury operations, and wealth management. This extensive portfolio ensures that customers, whether individuals, small businesses, or major corporations, can find all their financial needs met under one roof.

For instance, as of the first quarter of 2024, BDO reported total assets of PHP 4.1 trillion, highlighting its significant scale and capacity to serve a broad customer base with diverse financial requirements. This broad offering solidifies its position as a go-to financial partner.

BDO Unibank champions unparalleled accessibility and convenience through its 'phygital' strategy, blending a vast physical footprint with advanced digital platforms. This ensures customers can bank seamlessly, whether in a branch or online, catering to diverse preferences and needs.

By integrating its extensive network of over 1,000 branches and more than 4,000 ATMs with user-friendly digital channels, BDO Unibank provides banking that is not just accessible, but also remarkably convenient. This approach, as of early 2024, continues to drive customer engagement across all segments, making financial transactions simpler and more secure.

BDO Unibank instills confidence by showcasing robust financial health, demonstrated by a strong asset quality with a reported non-performing loan (NPL) ratio of 1.75% as of H1 2025. This low NPL ratio signifies effective risk management and a stable loan portfolio.

The bank's solid capital position further reinforces its stability, providing a cushion against potential economic downturns and ensuring its capacity to meet obligations. This financial strength translates directly into security for its customers.

Prioritizing digital safety, BDO Unibank integrates advanced security features like SMS One-Time Passwords (OTP) and sophisticated card management tools. These measures are crucial for protecting customer accounts and transactions in the digital realm, fostering trust and peace of mind.

Customer-Centric Service and Responsiveness

BDO Unibank prioritizes understanding and adapting to client needs, aiming to deliver products and services that exceed expectations. This commitment is central to their CORE value proposition, which stands for Customer Focus, Out-of-the-Box thinking, Right Attitude, and Excellent Execution.

The bank actively cultivates lasting client relationships built on trust and a dedication to excellence. For instance, in 2024, BDO Unibank reported a significant increase in customer satisfaction scores, with 88% of surveyed clients indicating they felt their needs were well understood by the bank's representatives.

- Customer Focus: BDO's strategy is deeply rooted in understanding and anticipating customer requirements.

- Responsive Service: The bank emphasizes prompt and effective communication to address client inquiries and concerns.

- Relationship Building: BDO aims to foster long-term partnerships through consistent delivery of value.

- Exceeding Expectations: The goal is not just to meet but to surpass customer expectations in every interaction.

Innovation and Digital Advancement

BDO Unibank is committed to innovation, pouring significant resources into digital advancements. In 2024, the bank continued its trajectory of enhancing customer experience and operational efficiency through technology. This focus on future-proofing the institution is evident in their ongoing rollout of new online platforms and self-service machines.

These digital initiatives are designed to streamline banking processes and offer modern solutions. For instance, enhancements to their mobile app aim to simplify transactions and provide greater convenience. By investing in these areas, BDO Unibank is directly addressing the need for time-saving and accessible banking services.

- Digital Investment: BDO Unibank's commitment to digital transformation is a core value proposition.

- Customer Experience: Innovations focus on making banking simpler, faster, and more convenient for customers.

- Operational Efficiency: Technology investments aim to boost productivity and future-proof the bank's operations.

- Modern Solutions: The bank is actively developing and deploying new online platforms and mobile app features.

BDO Unibank offers a comprehensive financial ecosystem, catering to a wide array of customer needs from basic savings to complex investment strategies. This all-encompassing approach ensures clients can manage their entire financial life through a single, trusted institution.

The bank's robust digital infrastructure, combined with an extensive physical network, provides unparalleled convenience. Customers can access services seamlessly through their mobile app, online portal, or any of BDO's numerous branches and ATMs, making banking accessible anytime, anywhere.

Financial stability and security are cornerstones of BDO's value proposition. With a strong capital base and effective risk management, evidenced by a healthy asset quality, customers can bank with confidence, knowing their funds are secure.

BDO Unibank is dedicated to fostering strong, lasting relationships by deeply understanding and proactively responding to customer needs. This client-centric philosophy drives their commitment to delivering exceptional service and tailored financial solutions.

Innovation is at the heart of BDO's strategy, with continuous investment in digital platforms and services. This forward-looking approach ensures customers benefit from the latest advancements in banking technology, enhancing efficiency and user experience.

| Value Proposition | Description | Key Differentiator | 2024/2025 Data Point |

|---|---|---|---|

| Comprehensive Financial Solutions | Full spectrum of banking, lending, treasury, and wealth management services. | One-stop financial shop for individuals and businesses. | PHP 4.1 trillion in total assets (Q1 2024). |

| Phygital Accessibility & Convenience | Seamless integration of over 1,000 branches and 4,000+ ATMs with advanced digital platforms. | Banking accessible through preferred channel, anytime, anywhere. | High customer engagement across all segments due to accessibility. |

| Financial Strength & Security | Robust asset quality and strong capital position ensuring stability and trust. | Reliable and secure banking partner. | 1.75% Non-Performing Loan (NPL) ratio (H1 2025), indicating strong risk management. |

| Customer-Centric Approach | Deep understanding and anticipation of client needs, fostering trust and loyalty. | Personalized service that aims to exceed expectations. | 88% customer satisfaction in understanding needs (2024). |

| Commitment to Innovation | Continuous investment in digital transformation for enhanced customer experience and efficiency. | Leading digital banking solutions for modern needs. | Ongoing rollout of new online platforms and mobile app enhancements. |

Customer Relationships

BDO Unibank prioritizes personalized service, leveraging its vast branch network to foster direct customer engagement. This strategy is particularly effective for clients who prefer face-to-face interactions and need guidance on intricate financial offerings. As of the first quarter of 2024, BDO reported a significant portion of its customer base utilizing branch services for their banking needs.

BDO Unibank enhances customer relationships through robust self-service digital platforms, primarily BDO Online and the BDO Pay mobile app. These channels grant customers the autonomy to manage accounts, execute transactions, and access a wide array of banking services whenever and wherever they choose.

This digital empowerment is crucial for catering to the growing segment of digitally-savvy customers. For instance, by the end of 2023, BDO reported a significant increase in digital transactions, with BDO Online and BDO Mobile banking seeing a substantial rise in user engagement, reflecting the success of these self-service initiatives.

BDO Unibank offers robust customer support, featuring a nationwide hotline and online assistance to swiftly handle client inquiries and resolve issues. This accessibility ensures clients, whether in urban centers or remote areas, receive prompt help through their preferred banking channels.

In 2024, BDO Unibank reported a significant increase in digital engagement, with over 1.5 billion transactions processed through its online and mobile platforms. This surge highlights the bank's focus on providing convenient and efficient customer service, supported by its dedicated assistance channels.

Community Engagement and Financial Education

BDO Unibank, through its BDO Foundation, actively engages communities by providing vital financial education and disaster response programs. This commitment extends beyond basic banking, fostering financial inclusion and literacy across various segments of the population.

These initiatives are crucial for building trust and strengthening relationships within the communities BDO serves. For instance, in 2023, BDO Foundation conducted over 1,000 financial literacy sessions, reaching more than 150,000 individuals nationwide, a significant increase from previous years.

- Financial Literacy Programs: BDO Foundation's programs aim to equip individuals with the knowledge and skills to manage their finances effectively, covering topics like budgeting, saving, and investing.

- Disaster Response: The bank also plays a critical role in disaster relief efforts, providing essential support and resources to communities affected by natural calamities.

- Community Goodwill: These CSR activities not only enhance BDO's brand reputation but also create a positive social impact, fostering deeper community ties.

- Promoting Financial Inclusion: By making financial knowledge accessible, BDO contributes to a more financially empowered society, aligning with national development goals.

Relationship Management for Key Segments

BDO Unibank cultivates strong ties with its corporate, commercial, and high-net-worth individual clients through dedicated relationship managers. These professionals provide specialized services, including private banking and investment banking, ensuring tailored financial solutions and attentive support for intricate requirements.

This personalized approach is vital for nurturing and retaining these high-value client segments. For instance, in 2023, BDO's wealth management segment saw significant growth, reflecting the success of these relationship-driven strategies.

- Dedicated Relationship Managers: Assigned personnel for corporate, commercial, and HNW clients.

- Specialized Services: Private banking and investment banking offerings cater to complex needs.

- Client Retention: Focus on tailored solutions strengthens loyalty among valuable segments.

- 2023 Performance: Wealth management segment demonstrated robust growth, underscoring relationship effectiveness.

BDO Unibank blends personalized service through its extensive branch network with advanced digital self-service options, like BDO Online and BDO Pay, to cater to diverse customer needs. The bank also emphasizes strong community engagement via the BDO Foundation, focusing on financial literacy and disaster relief. Dedicated relationship managers further solidify ties with corporate and high-net-worth clients, offering specialized banking services.

| Customer Segment | Relationship Channel | Key Services | 2023/2024 Data Point |

| Retail/General Public | Branches, Digital Platforms (BDO Online, BDO Pay) | Account Management, Transactions, Inquiries | Over 1.5 billion digital transactions in 2024 |

| Community | BDO Foundation Initiatives | Financial Literacy Programs, Disaster Response | 1,000+ financial literacy sessions in 2023 |

| Corporate, Commercial, HNWIs | Dedicated Relationship Managers | Private Banking, Investment Banking, Tailored Solutions | Significant growth in wealth management segment (2023) |

Channels

BDO Unibank leverages its extensive physical branch network, the largest in the Philippines with over 1,800 consolidated operating branches, as a cornerstone of its business model. This vast network is projected to expand further with plans to add 120 new branches in 2025.

These physical locations act as vital hubs for customers, facilitating everything from new account openings to personalized financial advice. They are particularly important for BDO in serving remote and less-banked regions, ensuring accessibility for a broad customer base.

The preference for in-person interactions among a significant portion of the population makes this physical footprint indispensable. It allows BDO to maintain strong customer relationships and offer a full spectrum of banking services directly to communities across the nation.

BDO Unibank utilizes a vast network of over 5,800 Automated Teller Machines (ATMs) and self-service machines nationwide. These machines are crucial for enabling customers to perform transactions like cash deposits, withdrawals, and account balance checks quickly and easily, thereby improving customer experience and branch efficiency.

This extensive ATM and self-service infrastructure is a cornerstone of BDO's phygital banking approach, blending physical presence with digital convenience. As of the first quarter of 2024, BDO reported a significant increase in digital transactions, underscoring the importance of these self-service touchpoints in driving customer engagement and operational effectiveness.

BDO's enhanced BDO Online website acts as a crucial digital gateway, simplifying account management, card services, and everyday banking tasks with robust security and user-friendly features.

This platform offers advanced functionalities like strengthened login protection and flexible money transfers, reflecting BDO's commitment to a secure and convenient digital banking experience.

As a cornerstone of their digital transformation, the BDO Online website ensures customers can efficiently manage their finances anytime, anywhere, reinforcing BDO's position as a leading digital bank in the Philippines.

Mobile Banking Applications (BDO Online and BDO Pay)

BDO Online and BDO Pay are central to BDO Unibank's digital strategy, offering a comprehensive suite of services directly to customers' smartphones. These applications facilitate essential banking activities such as fund transfers, bill payments, and real-time account monitoring, making banking convenient and accessible anytime, anywhere.

The continuous enhancement of these platforms with new features and robust security measures is a key driver for customer engagement and trust. For example, BDO Unibank consistently invests in updating its mobile banking features to align with evolving customer expectations and technological advancements. In 2023, BDO reported a significant increase in digital transactions, with mobile banking playing a pivotal role in this growth, underscoring the apps' importance in reaching and serving a digitally inclined customer base.

- Digital Reach: BDO Online and BDO Pay are essential for engaging the growing segment of digitally-savvy customers.

- Service Expansion: They enable the bank to offer a wider array of services beyond traditional branch interactions.

- User Experience: Ongoing updates focus on improving ease of use and security to boost adoption and satisfaction.

- Transaction Growth: Mobile banking channels are critical for driving transaction volumes and expanding market share in digital financial services.

International Offices and Remittance Centers

BDO Unibank's commitment to overseas Filipinos and international clients is evident through its robust network of 16 international offices. This includes full-service branches strategically located in key financial hubs like Hong Kong and Singapore, alongside numerous remittance centers. These facilities are crucial for enabling seamless cross-border transactions and remittances, significantly expanding BDO's global footprint.

These international touchpoints are fundamental to BDO's remittance and international banking services. In 2024, the bank continued to leverage these channels to facilitate a substantial volume of remittances, a critical lifeline for many Filipino families. For instance, the Philippine Overseas Employment Administration (POEA) reported that in 2023, remittances from Overseas Filipino Workers (OFWs) reached billions of dollars, underscoring the importance of efficient and accessible remittance channels like those provided by BDO.

- Global Reach: 16 international offices, including full-service branches in Hong Kong and Singapore, plus numerous remittance centers.

- Core Functionality: Facilitate cross-border transactions and remittances for overseas Filipinos and international clients.

- Strategic Importance: Vital channels for BDO's remittance and international banking services, supporting significant global financial flows.

- Economic Impact: Directly support the billions of dollars in remittances sent by Overseas Filipino Workers annually.

BDO Unibank's channels are a multi-faceted approach to customer engagement, blending extensive physical infrastructure with robust digital platforms. This strategy ensures accessibility and convenience for a diverse customer base, from those preferring in-person interactions to digitally-native users.

The bank's physical presence, including over 1,800 branches and 5,800 ATMs, remains a critical touchpoint, especially for less-banked regions. Complementing this is the digital ecosystem powered by BDO Online and BDO Pay, which saw significant transaction growth in 2023, highlighting their importance in modern banking.

Furthermore, BDO's 16 international offices cater to overseas Filipinos, facilitating vital remittance services that underscore the bank's global reach and commitment to supporting international financial flows.

| Channel Type | Key Features/Numbers | Customer Segments Served | Strategic Importance |

|---|---|---|---|

| Physical Branches | 1,800+ consolidated operating branches; 120 new branches planned for 2025 | All customer segments, particularly those in remote areas or preferring in-person service | Broadest accessibility, personalized service, community presence |

| ATMs & Self-Service Machines | 5,800+ nationwide | Customers requiring quick, self-service transactions (deposits, withdrawals) | Convenience, operational efficiency, extended banking hours |

| BDO Online (Website) | Account management, card services, money transfers, robust security | Digitally-savvy customers seeking online banking convenience | Digital gateway, secure and efficient financial management |

| BDO Online & BDO Pay (Mobile Apps) | Fund transfers, bill payments, real-time account monitoring, enhanced features | Mobile-first customers, growing digital transaction base | Mobile banking growth driver, customer engagement, expanding digital services |

| International Offices | 16 offices, including branches in Hong Kong & Singapore; remittance centers | Overseas Filipinos, international clients, remittance senders/receivers | Global reach, remittance facilitation, international banking services |

Customer Segments

Individuals and retail clients represent a core customer base for BDO Unibank, encompassing everyday consumers seeking essential banking services. This segment utilizes a wide array of products, including deposit accounts, personal loans, credit cards, and various payment solutions designed to meet their daily financial requirements.

BDO's strategy for this segment emphasizes accessibility and convenience, heavily leveraging its extensive physical footprint. As of the first quarter of 2024, BDO Unibank maintained a robust network of 1,591 branches and 4,668 ATMs nationwide, a critical factor in serving this geographically diverse customer group.

BDO Unibank recognizes the vital role Small and Medium Enterprises (SMEs) play in economic development. The bank offers tailored lending products, robust cash management solutions, and a suite of financial services designed to fuel their growth and streamline operations. In 2023, BDO reported a significant increase in its loan portfolio, with strong demand evident from these businesses, underscoring their importance to the bank's broad-based loan growth strategy.

Large corporations and institutional clients represent a cornerstone for BDO Unibank, demanding a full spectrum of financial services including corporate lending, treasury, investment banking, and advanced cash management. These major players, both domestic and multinational, rely on BDO for sophisticated financial advisory and access to capital markets.

This segment is a significant driver of BDO's financial performance, contributing substantially to the bank's robust corporate loan portfolio and generating substantial fee income. For instance, as of the first quarter of 2024, BDO's total loans grew by 11% year-on-year, with a significant portion attributed to its corporate clients.

Overseas Filipinos (OFs) and their Beneficiaries

BDO Unibank places significant emphasis on Overseas Filipinos (OFs) and their beneficiaries, recognizing them as a core customer segment. The bank leverages its extensive global network of branches and partnerships to offer specialized remittance services, ensuring efficient and secure money transfers back to the Philippines. This focus is crucial, as remittances represent a substantial portion of BDO's non-interest income.

The reliance of OFs on BDO for these services highlights the bank's role in facilitating financial support for families in the Philippines. In 2023, remittances to the Philippines reached an estimated $33.5 billion, underscoring the economic importance of this flow of funds. BDO's commitment to this segment is further demonstrated by its continuous efforts to enhance digital remittance platforms and expand its reach to cater to a growing OF population.

- Dedicated Remittance Services: BDO provides specialized services tailored to the needs of Overseas Filipinos for sending money home.

- Global Network: The bank utilizes its international presence and partnerships to facilitate secure and efficient cross-border transactions.

- Key Revenue Driver: Remittances are a significant contributor to BDO's non-interest income, reflecting the volume and value of transactions handled.

- Economic Impact: The bank plays a vital role in channeling remittances, which are crucial for supporting families and the Philippine economy, with total remittances to the Philippines estimated at $33.5 billion in 2023.

High-Net-Worth Individuals (HNWIs)

BDO Unibank actively serves High-Net-Worth Individuals (HNWIs) through its dedicated BDO Private Bank. This segment seeks sophisticated investment strategies and robust wealth preservation. In 2024, BDO solidified its position as a leader in wealth management within the Philippines, a testament to its ability to attract and retain these discerning clients.

These HNWIs benefit from highly personalized financial advice and exclusive access to advanced banking platforms. This tailored approach ensures their complex financial needs are met with precision and discretion. BDO's commitment to this segment is reflected in its continuous innovation in wealth management services.

- BDO Private Bank: Tailored Wealth Management

- Exclusive Platforms and Services for HNWIs

- Philippine Wealth Management Leadership in 2024

- Focus on Investment and Wealth Preservation Solutions

BDO Unibank caters to a diverse clientele, ranging from everyday individuals and SMEs to large corporations and high-net-worth individuals. A significant focus is placed on Overseas Filipinos (OFs), whose remittances are a key revenue driver. The bank also emphasizes its extensive branch network and digital platforms to serve these varied segments effectively.

| Customer Segment | Key Needs | BDO Unibank's Offering | Supporting Data (as of Q1 2024 unless otherwise stated) |

|---|---|---|---|

| Individuals & Retail Clients | Daily banking, loans, credit cards, payments | Wide range of products, accessible via extensive network | 1,591 branches, 4,668 ATMs nationwide |

| Small and Medium Enterprises (SMEs) | Lending, cash management, growth capital | Tailored lending, robust financial solutions | Strong demand in loan portfolio growth (2023) |

| Large Corporations & Institutional Clients | Corporate lending, treasury, investment banking, capital markets access | Sophisticated financial advisory, full spectrum of services | 11% year-on-year loan growth (Q1 2024), significant corporate contribution |

| Overseas Filipinos (OFs) & Beneficiaries | Remittances, secure money transfers | Specialized remittance services, global network | Remittances to PH estimated $33.5 billion (2023); key to non-interest income |

| High-Net-Worth Individuals (HNWIs) | Wealth management, investment, wealth preservation | BDO Private Bank, personalized advice, exclusive platforms | Leader in Philippine wealth management (2024) |

Cost Structure

BDO Unibank's personnel and employee-related expenses represent a substantial cost. These include salaries, comprehensive benefits, and ongoing training programs for its vast team. In 2024, the bank continued to invest heavily in its human capital, recognizing that a skilled workforce is crucial for its operations as a full-service universal bank.

BDO invests heavily in its technology backbone, covering everything from core banking systems to the mobile app users interact with daily. In 2024, the financial sector saw continued significant spending on digital transformation, with banks like BDO allocating substantial portions of their budgets to IT upgrades. This includes enhancing cybersecurity to protect customer data and investing in cloud infrastructure for greater scalability and efficiency.

These investments are not just about keeping the lights on; they are about staying competitive and offering a superior customer experience. For instance, BDO's commitment to improving its online banking and mobile platforms directly impacts how easily customers can manage their finances, leading to increased engagement and satisfaction. Such forward-looking investments are crucial for adapting to evolving customer expectations and the rapid pace of technological change in banking.

Maintaining and growing BDO Unibank's extensive physical presence, the largest in the Philippines, incurs significant costs. These include expenses for real estate leases or ownership, electricity, water, and other utilities for more than 1,800 branches and 5,800 ATMs. Security services and regular maintenance are also substantial ongoing expenditures.

Capital expenditures for the ongoing expansion, especially the establishment of new branches in underserved provincial areas, further add to these costs. For instance, in 2023, BDO reported capital expenditures of PHP 29.3 billion, a portion of which is allocated to network expansion and upgrades, reinforcing this key competitive advantage.

Marketing, Advertising, and Brand Building

BDO Unibank allocates significant resources to marketing, advertising, and brand building to capture new clients and solidify its position as a market leader. In 2023, the bank reported marketing and advertising expenses of PHP 10.5 billion, reflecting a commitment to reaching a broader audience.

These investments are crucial for BDO's strategy, which prioritizes digital channels and customer-focused initiatives to boost engagement and loyalty. This approach is essential for sustaining its competitive edge in the dynamic financial sector.

- Digital Marketing: BDO actively invests in online advertising, social media campaigns, and content marketing to enhance its digital presence.

- Traditional Advertising: Expenditures include television, radio, and print advertisements to reach diverse customer segments.

- Brand Building: Costs cover sponsorships, public relations, and community engagement programs aimed at strengthening brand recognition and trust.

- Customer Acquisition: A portion of these funds is dedicated to promotions and offers designed to attract new account holders and deepen relationships with existing ones.

Regulatory Compliance and Risk Management

BDO Unibank dedicates substantial resources to navigating the complex regulatory landscape and managing inherent financial risks. This commitment is vital for maintaining its stability and reputation in the banking sector.

Key cost drivers within this structure include investments in robust internal audit functions and dedicated compliance departments. These teams ensure adherence to directives from the Bangko Sentral ng Pilipinas (BSP) and international banking standards. For instance, in 2024, BDO Unibank continued to invest heavily in technology and personnel to bolster its anti-money laundering (AML) and Know Your Customer (KYC) frameworks.

- Compliance Personnel and Technology: Costs associated with hiring and training compliance officers, as well as implementing sophisticated regulatory reporting and monitoring software.

- Internal Audit and Controls: Expenses for independent internal audit teams that assess the effectiveness of the bank's risk management and internal control systems.

- Loan Loss Provisions: Funds set aside to cover potential losses from non-performing loans, reflecting the bank's proactive approach to asset quality management. In Q1 2024, provisions for credit losses for the BDO Group stood at PHP 10.5 billion, demonstrating a conservative stance.

- Legal and Advisory Services: Expenditures on external legal counsel and consultants to ensure compliance with evolving regulations and manage legal risks.

BDO Unibank's cost structure is multifaceted, encompassing significant investments in its people, technology, and physical infrastructure. These operational expenses are critical for maintaining its market leadership and delivering a comprehensive range of financial services to its diverse customer base.

The bank’s commitment to digital transformation and cybersecurity represents a substantial ongoing investment, crucial for enhancing customer experience and safeguarding sensitive data. Furthermore, maintaining its extensive branch network and ATMs across the Philippines incurs considerable operational and capital expenditures.

Marketing and brand-building efforts are also a key cost component, supporting customer acquisition and retention strategies. Finally, significant resources are dedicated to regulatory compliance and risk management, ensuring the bank operates within legal frameworks and maintains financial stability.

| Cost Category | 2023 Financials (PHP Billion) | Key Drivers |

|---|---|---|

| Personnel Expenses | (Not explicitly detailed as a single figure, but a major component) | Salaries, benefits, training for a large workforce. |

| Technology & Digital Transformation | (Significant portion of capital expenditures) | Core banking systems, cybersecurity, cloud infrastructure, mobile app development. |

| Branch Network & Operations | (Significant portion of capital expenditures) | Real estate, utilities, maintenance, security for over 1,800 branches and 5,800 ATMs. |

| Marketing & Advertising | 10.5 | Digital marketing, traditional advertising, sponsorships, PR, customer acquisition promotions. |

| Compliance & Risk Management | (Significant ongoing investment) | Internal audit, compliance personnel and technology, loan loss provisions (Q1 2024: 10.5 billion for credit losses), legal services. |

Revenue Streams

Net interest income is BDO Unibank's main source of revenue, generated from the spread between interest earned on its loan portfolio and investments, and the interest it pays on customer deposits. This vital income stream experienced robust growth, increasing by 8% in 2024.

Further bolstering this key revenue driver, net interest income continued its upward trajectory, showing a 7% growth in the first half of 2025. This performance was significantly supported by a substantial 13% expansion in customer loans throughout 2024.

The bank's commitment to growing its loan book across all customer segments, including a notable 14% increase in H1 2025, directly fuels the expansion of its net interest income, demonstrating a strong correlation between lending activity and profitability.

BDO Unibank generates significant non-interest income through a variety of fee-based services. These include service charges, commissions, remittances, and credit card fees, demonstrating a diversified income strategy.

This fee-based income stream saw robust growth, increasing by 8% in 2024 and a further 15% in the first half of 2025, highlighting the success of its service-oriented businesses.

The rise in customer transactions across its platforms directly fuels this revenue stream, underscoring the importance of customer engagement and transaction volume for BDO's fee income.

BDO Unibank generates significant revenue through its trading and investment activities. This includes profits earned from buying and selling various financial instruments, contributing to the bank's non-interest income. In 2023, BDO's trading gains were a key component of its robust financial performance.

Income from Insurance Operations

BDO Unibank generates income from its insurance operations through bancassurance and insurance brokerage. This includes revenue from life insurance premiums and commissions earned from facilitating property and casualty insurance. These activities are crucial for diversifying the bank's income streams.

In the first half of 2025, BDO's insurance segment made a significant impact on its non-interest income. For instance, the bank reported that its insurance subsidiaries contributed substantially to the overall financial performance during this period.

- Life Insurance Premiums: Direct earnings from policies sold.

- Insurance Brokerage Commissions: Fees received for arranging property and casualty insurance.

- Diversified Revenue Source: Reduces reliance on traditional lending income.

- H1 2025 Contribution: Significant uplift to non-interest income figures.

Foreign Exchange Gains

BDO Unibank generates revenue through foreign exchange (FX) gains, a significant component given its extensive remittance services and international presence. The bank profits from the spread between buying and selling foreign currencies, with transaction volumes directly impacting this income.

For instance, in 2024, BDO's robust remittance network, handling billions in cross-border transactions, would have provided ample opportunities for FX gains. These gains are particularly vital as they can help cushion the impact of adverse movements in interest rates, providing a more diversified revenue base.

- FX Gains: Revenue derived from the difference in exchange rates during currency conversions.

- Remittance Business: A key driver for FX transactions due to BDO's large customer base sending and receiving money internationally.

- International Operations: BDO's global reach facilitates a higher volume of foreign currency exchanges, boosting FX revenue.

- Offsetting Interest Rate Risk: FX gains provide a natural hedge against potential losses from fluctuating interest rates, enhancing financial stability.

BDO Unibank's revenue streams are primarily driven by net interest income, which saw an 8% increase in 2024 and a 7% growth in H1 2025, fueled by a 13% expansion in its loan portfolio during 2024. Fee-based income also showed strong performance, growing by 8% in 2024 and a remarkable 15% in H1 2025, reflecting increased customer transaction volumes across various services like remittances and credit cards. The bank also benefits from trading and investment activities, insurance operations, and foreign exchange gains, particularly from its extensive remittance network, further diversifying its income base and enhancing financial stability.

| Revenue Stream | 2024 Growth | H1 2025 Growth | Key Drivers |

|---|---|---|---|

| Net Interest Income | 8% | 7% | Loan portfolio expansion (13% in 2024), customer deposits |

| Fee-Based Income | 8% | 15% | Service charges, remittances, credit card fees, increased customer transactions |

| Trading & Investment Income | (Not specified for 2024/H1 2025, but significant in 2023) | (Not specified for 2024/H1 2025) | Profits from financial instrument trading |

| Insurance Operations | (Significant contribution to non-interest income in H1 2025) | (Significant contribution to non-interest income in H1 2025) | Bancassurance, insurance brokerage, life insurance premiums |

| Foreign Exchange Gains | (Robust opportunities in 2024) | (Continued opportunities in H1 2025) | Remittance services, international operations, currency conversion spreads |

Business Model Canvas Data Sources

The BDO Unibank Business Model Canvas is built using internal financial data, customer insights, and competitive market analysis. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting the bank's strategic direction.