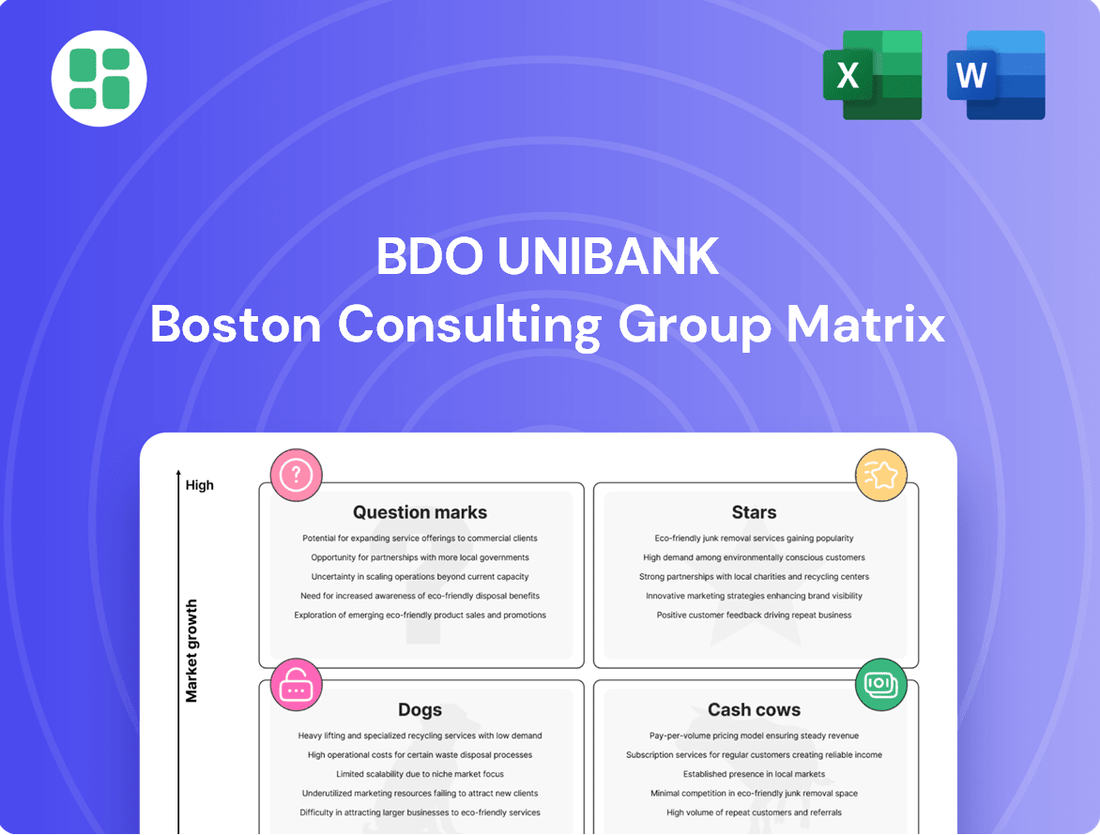

BDO Unibank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BDO Unibank Bundle

Curious about BDO Unibank's strategic positioning? This glimpse into their BCG Matrix highlights key product categories, but the real power lies in the full analysis. Understand which of BDO's offerings are market leaders and which require careful consideration for future investment.

Unlock the complete BDO Unibank BCG Matrix to gain a comprehensive understanding of their product portfolio's performance and potential. Purchase the full report for actionable insights and a clear roadmap to optimizing BDO's market strategy.

Stars

BDO Unibank's significant investments in digital transformation, aligning with the booming Philippine digital payments and lending sectors, firmly establish its digital banking and mobile services as Stars.

The digital lending market in the Philippines is on a steep upward trajectory, with projections indicating it will surpass US$1 billion in the latter half of 2025, fueled by a strong appetite for online solutions and widespread smartphone adoption.

BDO's modernized, cloud-based digital platforms are designed for enhanced agility and scalability, promising a superior customer experience and expanding its reach within this rapidly growing segment.

BDO Unibank's gross customer loans are a clear Star in its BCG matrix. In 2024, these loans grew by a strong 13% year-on-year, reaching ₱3.2 trillion. This momentum continued into the first half of 2025, with a further 14% increase to ₱3.4 trillion, outperforming the broader industry.

This impressive expansion is not confined to a single area; it's broad-based, showing growth across all customer segments. BDO's leading market share in lending further cements its position, highlighting a robust and dominant lending business. The Philippine banking sector is also projected for sustained double-digit loan growth through 2024-2025, a high-growth environment where BDO excels.

BDO's Wealth Management and Trust Services are a powerhouse in the financial landscape, demonstrating remarkable growth and market dominance. By the close of 2024, the bank's consolidated assets under management (AUM) surged by an impressive 16% year-on-year, reaching a substantial ₱2.3 trillion. This performance solidifies BDO's leading position, capturing a commanding 31% share of the Trust industry.

This robust expansion in AUM, alongside BDO Private Bank's prestigious recognition as the Philippines' Best Private Bank, clearly positions this segment as a high-growth area where BDO excels as a market leader. Furthermore, ongoing advancements in Wealthtech are enhancing accessibility to financial planning services, signaling further potential for market expansion and continued success in this sector.

Remittance Services

Remittance services at BDO Unibank are a clear Star in the BCG Matrix, reflecting its dominant position in a vital and expanding market. The Philippines' significant overseas Filipino worker (OFW) population fuels continuous demand for these services, making it a cornerstone for BDO.

BDO consistently holds the top spot in the Philippine remittance market. In 2024, the bank's remittance volume continued to grow, driven by its extensive network and trusted brand. This sustained high market share, even in a mature sector, solidifies its Star status, generating significant revenue and attracting new customers.

- Market Dominance: BDO is the undisputed leader in Philippine remittances, a critical service for the nation's economy.

- Growth Potential: Despite market maturity, the sheer volume of OFWs ensures continuous demand and inflow for BDO's remittance services.

- Revenue Generation: The substantial activity in remittances makes it a key profit driver and a foundational service for BDO Unibank.

- Customer Attraction: BDO's strong presence in remittances continues to draw new customers and deepen relationships with existing ones.

Credit Card Business

BDO's credit card business is a star performer, holding a commanding lead in the Philippine market. This dominance is evident across key metrics like cardholder base, merchant acquiring gross billings, and outstanding credit card receivables. For instance, as of the first quarter of 2024, BDO reported a significant portion of the total credit card receivables in the country, underscoring its market leadership.

The credit card sector itself is experiencing robust growth, fueled by rising consumer spending and the accelerating shift towards digital payments. This expansion presents a prime opportunity for BDO to capitalize on its established market share, capturing a substantial portion of the ongoing growth. Innovations in digital payment solutions further bolster the segment's dynamism, ensuring BDO remains at the forefront.

- Market Leadership: BDO leads the Philippine credit card market in cardholder numbers, merchant billings, and receivables.

- Growth Drivers: Increasing consumer spending and digitalization are propelling the credit card market's expansion.

- Digital Innovation: Continuous advancements in digital payment solutions support the vitality and future growth of this segment.

- Financial Performance: BDO's credit card segment consistently contributes significantly to the bank's overall profitability.

BDO Unibank's digital banking and mobile services are clearly Stars, benefiting from significant investments in transformation. The Philippine digital lending market is expected to exceed US$1 billion by late 2025, driven by online demand and smartphone use. BDO's modernized platforms enhance customer experience and market reach in this rapidly expanding sector.

BDO Unibank's gross customer loans are a Star, with a 13% year-on-year growth in 2024 to ₱3.2 trillion, continuing to ₱3.4 trillion by mid-2025. This broad-based expansion across all customer segments, coupled with BDO's leading market share, positions it strongly in the projected double-digit loan growth environment for the Philippine banking sector through 2024-2025.

Wealth Management and Trust Services are a Star for BDO, with assets under management (AUM) growing 16% in 2024 to ₱2.3 trillion, capturing 31% of the Trust industry. BDO Private Bank's recognition as the Philippines' Best Private Bank further highlights this segment's high-growth, market-leading status, supported by advancements in Wealthtech.

Remittance services are a Star for BDO Unibank, reflecting its dominance in a vital market fueled by overseas Filipino workers. BDO consistently leads the Philippine remittance market, with growing volumes in 2024 due to its extensive network and trusted brand, generating significant revenue and attracting customers.

BDO's credit card business is a Star, leading the Philippine market in cardholders, merchant billings, and receivables. The sector's robust growth, driven by consumer spending and digitalization, allows BDO to leverage its market share, with ongoing digital payment innovations further boosting this dynamic segment.

| Segment | BCG Classification | Key Performance Indicators (2024/Early 2025) | Market Dynamics | BDO's Competitive Edge |

| Digital Banking & Mobile Services | Star | Growing user base, transaction volume increase | Rapid digital adoption, expanding digital lending market | Significant investment in transformation, agile platforms |

| Gross Customer Loans | Star | 13% YoY growth (2024) to ₱3.2T; 14% increase (H1 2025) to ₱3.4T | Projected 10%+ loan growth for Philippine banking sector | Market leadership, broad-based growth across segments |

| Wealth Management & Trust Services | Star | 16% YoY AUM growth (2024) to ₱2.3T; 31% Trust industry share | Growing demand for financial planning, Wealthtech advancements | Market dominance, Best Private Bank recognition |

| Remittance Services | Star | Consistent market leadership, growing remittance volume | Sustained demand from OFWs, essential financial service | Extensive network, trusted brand, high market share |

| Credit Card Business | Star | Leading cardholder base, merchant billings, and receivables | Rising consumer spending, shift to digital payments | Market dominance, digital payment innovation |

What is included in the product

This BCG Matrix overview will highlight BDO Unibank's strategic positioning of its products and services, guiding investment decisions.

A clear, visual BDO Unibank BCG Matrix that instantly highlights strategic priorities, relieving the pain of complex data interpretation.

Cash Cows

BDO's traditional deposit products, particularly its Current Account and Savings Account (CASA) offerings, represent a strong Cash Cow. In 2024, total deposits grew to ₱3.8 trillion, a 6% increase, and by H1 2025, this figure surpassed ₱4 trillion, marking an 8% rise.

The bank maintained a robust CASA ratio, standing at 71% in 2024 and 69% in H1 2025. This high proportion of low-cost funding is a defining characteristic of a Cash Cow, ensuring stable liquidity and a significant contribution to BDO's net interest income within the Philippine banking sector, where it holds the dominant market share.

Corporate lending, a cornerstone of BDO Unibank's operations, continues to be a significant contributor to its loan portfolio, even with some growth moderation observed in early 2025 due to global economic uncertainties. As the Philippines' largest bank, BDO holds a commanding market share in this established lending sector.

This mature segment generates consistent and substantial net interest income for BDO, requiring comparatively minimal ongoing investment when contrasted with areas experiencing rapid expansion. For instance, BDO's corporate loans represented a substantial portion of its total loan book, reflecting its established presence and the segment's reliable income generation.

BDO Unibank's extensive branch and ATM network, boasting over 1,790 branches and more than 5,800 ATMs across the Philippines, positions it as a formidable Cash Cow. This vast physical footprint ensures unparalleled customer accessibility, a critical advantage in a market where traditional banking remains prevalent.

The sheer scale of BDO's network generates consistent fee-based and interest income by facilitating a high volume of traditional transactions. Despite ongoing physical expansion, the mature, established network represents a stable revenue stream with well-understood operational costs, a hallmark of a Cash Cow.

Trade Services

Trade Services within BDO Unibank's portfolio are considered Cash Cows. BDO holds a leading position in the Philippine market for these services, which are crucial for international trade operations.

This segment benefits from a stable, mature market where BDO's established dominance translates into a significant market share. The consistent generation of fee-based income from services like import/export financing and letters of credit requires minimal new investment to maintain its strong performance.

- Market Leadership: BDO is a top-tier provider of trade finance solutions in the Philippines.

- Mature Market: The demand for trade services is steady, with established operational frameworks.

- Consistent Revenue: Fee income from letters of credit, guarantees, and other trade instruments provides stable earnings.

- Low Investment Needs: Growth in this segment is often incremental, requiring less capital expenditure compared to high-growth areas.

Cash Management Services

BDO Unibank's Cash Management Services are a classic cash cow, fitting perfectly into the BCG matrix. These offerings are indispensable for businesses aiming to streamline their financial operations, ensuring efficient cash flow management. In 2023, BDO reported a significant portion of its fee and commission income derived from its transaction banking services, which include cash management, underscoring its role as a stable, high-volume revenue generator.

The market for cash management is mature, characterized by consistent demand. BDO leverages its vast branch network and deep-rooted relationships with corporate clients to maintain a commanding market share. This dominance translates into predictable and substantial fee income, a hallmark of a cash cow. For instance, BDO's digital cash management solutions saw increased adoption in 2023, further solidifying its position.

- Stable Revenue Stream: Cash management services provide consistent fee income for BDO.

- High Market Share: BDO's extensive network and client relationships ensure a strong position in this mature market.

- Client Retention Tool: These services are crucial for keeping existing corporate clients engaged.

- Cross-Selling Opportunities: Effective cash management can lead to opportunities for offering other BDO financial products.

BDO Unibank's robust deposit base, particularly its Current Account and Savings Account (CASA) offerings, solidifies its position as a Cash Cow. By H1 2025, total deposits surpassed ₱4 trillion, an 8% increase from 2024's ₱3.8 trillion, with a CASA ratio consistently around 70%. This dominance in low-cost funding fuels stable net interest income within the Philippine market.

The bank's extensive branch and ATM network, numbering over 1,790 branches and 5,800 ATMs as of 2024, represents another significant Cash Cow. This vast physical presence ensures consistent transaction volumes and fee income, requiring minimal incremental investment to maintain its market-leading accessibility.

Trade Services and Cash Management Services are also identified as Cash Cows due to BDO's market leadership and the mature, stable demand for these offerings. These segments generate predictable fee-based income, requiring less capital outlay compared to potential high-growth ventures, thereby contributing significantly to overall profitability.

| Business Unit | BCG Category | Key Performance Indicator (2024/H1 2025) | Market Share | Contribution to Profitability |

|---|---|---|---|---|

| CASA Deposits | Cash Cow | Total Deposits: ₱3.8T (2024), >₱4T (H1 2025); CASA Ratio: ~70% | Dominant | Stable Net Interest Income |

| Branch & ATM Network | Cash Cow | Branches: 1,790+; ATMs: 5,800+ | Market Leader | Consistent Fee & Transaction Income |

| Trade Services | Cash Cow | Leading provider of trade finance solutions | Top-tier | Stable Fee-Based Income |

| Cash Management Services | Cash Cow | Significant portion of fee/commission income from transaction banking | Commanding | Predictable Fee Income, Client Retention |

Delivered as Shown

BDO Unibank BCG Matrix

The BDO Unibank BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises—just a professionally designed, analysis-ready report ready for your strategic planning needs.

Dogs

Very niche, non-digitized legacy products, like specialized trust services or certain historical loan products, often require significant manual effort. For instance, if a legacy product involves extensive paper-based record keeping and manual transaction processing, its operational cost per transaction can be substantially higher than a digitized alternative. In 2024, BDO Unibank, like many large financial institutions, likely faces the challenge of managing such offerings, which may contribute minimally to overall revenue while consuming disproportionate resources.

Traditional passbook savings accounts, particularly those with minimal balances and infrequent transactions, are likely candidates for the Dogs category in BDO Unibank's BCG Matrix. These accounts often incur significant administrative costs for the bank while contributing little to its overall deposit base or revenue generation.

Their strategic importance is further diminished as customer preferences shift towards more modern, digital banking solutions and higher-yield deposit products. For instance, in 2024, the average balance for such accounts across the industry remained critically low, often below the threshold required to generate meaningful interest income for the bank, while the cost to service each account can exceed the revenue it produces.

Some of BDO's older, smaller branches in economically stagnant rural or provincial areas may be underperforming. These locations, while part of the bank's commitment to expanding its reach, could be experiencing low transaction volumes and limited growth potential.

These underutilized branches primarily serve a small, localized customer base, contributing minimally to overall profitability and proving less efficient compared to the bank's expanding network. For instance, while BDO's total assets grew to PHP 4.1 trillion by the end of 2024, the contribution from these specific underperforming branches is disproportionately small, highlighting their status as potential cash dogs.

Outmoded Over-the-Counter Payment Systems

Traditional over-the-counter (OTC) payment systems, such as manual cash handling at bank branches or payment centers for bills, are increasingly being outmoded. These methods, while once the primary way to settle transactions, are now largely superseded by more convenient digital payment channels like online banking, mobile apps, and e-wallets. For instance, in 2024, the Philippine digital payments sector saw a significant surge, with the volume of real-time retail payments through InstPay and PesoNet alone reaching billions of transactions, highlighting the shift away from physical payment methods.

Consequently, the transaction volumes for these legacy OTC systems are likely declining. Although BDO Unibank may still offer them for customer convenience, they represent a low-growth segment with diminishing market share in the rapidly evolving payments landscape. This trend is further evidenced by the increasing adoption rates of digital wallets and online banking platforms, which offer faster, more secure, and often cheaper transaction alternatives.

- Declining Transaction Volumes: Physical cash and check payments at bank counters are seeing a steady decrease.

- Low Growth Potential: These systems offer minimal expansion opportunities compared to digital alternatives.

- Reduced Market Share: Digital payment channels now dominate the market, capturing a larger portion of transactions.

- Customer Convenience Shift: Consumers increasingly prefer the speed and accessibility of mobile and online payment solutions.

Non-Strategic Investment Portfolios

While BDO Unibank's overall investment strategy is strong, certain non-strategic legacy portfolios or Real and Other Properties Acquired (ROPA) might fall into this category. These are typically assets that are challenging to sell or yield returns that don't justify their ongoing costs. For instance, in 2024, the Philippine banking sector, including BDO, continued to navigate the complexities of managing non-performing assets, with some legacy ROPA requiring careful disposition strategies.

These portfolios, though potentially small in the grand scheme of BDO's operations, can tie up capital and management attention without offering significant growth prospects. The focus here is on optimizing resource allocation, ensuring that every asset contributes meaningfully to the bank's profitability and strategic objectives. Identifying and addressing these less productive assets is key to enhancing overall portfolio efficiency.

- Minimal Return on Investment: These assets often generate very low returns, failing to meet internal benchmarks or the cost of capital.

- Liquidation Challenges: Properties or investments acquired through foreclosures may face difficulties in finding buyers or achieving their book value.

- Resource Drain: Even if small, these portfolios can consume administrative and management resources that could be better utilized elsewhere.

- Strategic Re-evaluation: BDO continuously assesses its asset base to identify and divest or restructure non-core or underperforming holdings.

Certain legacy financial products, like specialized trust services or older loan types requiring extensive manual processing, are categorized as Dogs. These offerings often incur high operational costs relative to their revenue contribution, especially as customer preferences shift towards digitized alternatives. For example, in 2024, BDO Unibank, like many institutions, managed such products that consumed disproportionate resources despite minimal returns.

Traditional passbook savings accounts with low balances and infrequent activity also fit the Dog profile. These accounts are administratively costly for the bank, generating little revenue and contributing minimally to the overall deposit base. By 2024, industry-wide average balances for these accounts remained low, often not covering servicing costs.

Underperforming, smaller branches in economically stagnant areas represent another Dog category. These locations, while fulfilling a service role, experience low transaction volumes and limited growth potential, making them less efficient. Despite BDO's overall asset growth to PHP 4.1 trillion by end-2024, these specific branches contribute disproportionately little to profitability.

Legacy over-the-counter (OTC) payment systems, such as manual cash handling for bills, are also considered Dogs. Their transaction volumes are declining as digital payment channels like online banking and mobile apps gain dominance. In 2024, the significant growth in Philippine digital payments, with billions of real-time retail transactions, underscores the diminishing relevance of these older methods.

| Category | Description | Example | 2024 Context | Strategic Implication |

| Dogs | Low market share, low growth | Legacy trust services, passbook savings accounts with low balances, underperforming rural branches, traditional OTC payment systems, non-strategic ROPA | Declining transaction volumes, high servicing costs vs. revenue, shift to digital, minimal profitability contribution | Divestment, consolidation, or minimal investment to maintain basic service |

Question Marks

Emerging digital lending products for BDO Unibank, while part of its strong digital banking Star, might be considered Question Marks within the BCG matrix. These newer, niche offerings, particularly those aimed at underserved or emerging market segments, face a high-growth Philippine digital lending landscape but may currently hold a smaller market share for BDO.

The Philippine digital lending market is booming, with projections indicating continued robust expansion through 2025. However, BDO's penetration into these specialized digital lending niches, often dominated by nimble fintech competitors, likely requires substantial investment to build market presence and gain significant traction.

BDO Unibank is strategically investing in digital transformation, actively seeking partnerships with fintech companies to drive innovation. This focus is evident in their exploration of new ventures and services, particularly in emerging areas like tokenized assets and blockchain-based solutions.

While these innovative domains represent high-growth fintech markets, BDO's market share in these nascent areas is likely still low. Consequently, significant investment will be required to scale these new ventures effectively and capture substantial market presence.

BDO Unibank's strategy to reach previously unbanked and underserved communities centers on expanding its branch network, especially in rural and provincial areas, to boost customer access and promote financial inclusion. This initiative targets a significant segment of the Filipino population, aiming to onboard millions of unbanked individuals.

While these new markets offer substantial growth potential, BDO's initial footprint in these specific localities is small, necessitating considerable investment in infrastructure and tailored marketing efforts to build brand awareness and trust.

As of the first quarter of 2024, BDO Unibank reported a consolidated net income of PHP 23.8 billion, demonstrating its financial strength to support such expansionary strategies. The bank's commitment to financial inclusion is further evidenced by its extensive network, which by the end of 2023 comprised over 1,500 branches and more than 4,500 ATMs nationwide.

Specific Niche Investment Products (e.g., ESG-focused funds for retail)

While BDO Unibank is a recognized issuer of ASEAN Sustainability Bonds, the retail market for specialized ESG-focused investment funds is still developing. This means BDO's current market share in these newer, niche products for individual investors could be relatively small, requiring substantial outreach and client education to drive adoption.

The global sustainable investment market saw significant growth, with assets in ESG funds reaching an estimated $3.7 trillion by the end of 2023, according to Morningstar data. For BDO, this presents an opportunity to capture a growing segment of environmentally and socially conscious investors.

- Market Opportunity: The increasing global demand for sustainable investments offers a significant growth avenue for BDO's ESG product line.

- Education Imperative: BDO needs to invest in educating retail clients about the benefits and impact of ESG investing to boost product uptake.

- Competitive Landscape: While BDO has a strong foundation with sustainability bonds, it must differentiate its retail ESG fund offerings in a potentially crowded market.

- Product Development: Continued innovation in creating accessible and impactful ESG-focused funds tailored for individual investors will be crucial.

Advanced AI/Data Analytics Solutions for Personalized Banking

BDO Unibank's strategic investment in IT infrastructure and digital capabilities is paving the way for advanced AI and data analytics to deliver highly personalized banking experiences. While this area represents significant growth potential in fintech, BDO's adoption of truly AI-driven financial advisory and product offerings might be in its nascent stages.

The current market share for these deeply personalized, AI-powered services within BDO could be relatively low. This is due to the substantial requirements for data integration and the necessity of securing robust customer trust and engagement to elevate these solutions to 'Star' status in the BCG matrix.

- Investment in IT Infrastructure: BDO is actively enhancing its technological backbone to support advanced data processing and AI applications.

- Personalization Potential: AI and data analytics offer the promise of tailored financial advice and product recommendations, a key driver for future growth.

- Early Adoption Phase: Despite investments, the market for highly personalized, AI-driven banking solutions is still developing, indicating potential for significant future gains.

- Data Integration & Customer Buy-in: Success hinges on effectively integrating vast customer data and fostering customer acceptance of AI-driven financial guidance.

Emerging digital lending products for BDO Unibank, while part of its strong digital banking Star, might be considered Question Marks within the BCG matrix. These newer, niche offerings, particularly those aimed at underserved or emerging market segments, face a high-growth Philippine digital lending landscape but may currently hold a smaller market share for BDO.

The Philippine digital lending market is booming, with projections indicating continued robust expansion through 2025. However, BDO's penetration into these specialized digital lending niches, often dominated by nimble fintech competitors, likely requires substantial investment to build market presence and gain significant traction.

BDO Unibank is strategically investing in digital transformation, actively seeking partnerships with fintech companies to drive innovation. This focus is evident in their exploration of new ventures and services, particularly in emerging areas like tokenized assets and blockchain-based solutions.

While these innovative domains represent high-growth fintech markets, BDO's market share in these nascent areas is likely still low. Consequently, significant investment will be required to scale these new ventures effectively and capture substantial market presence.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data from BDO Unibank's annual reports, industry research on the Philippine banking sector, and official regulatory filings to ensure reliable, high-impact insights.