Banque Cantonale Vaudoise PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banque Cantonale Vaudoise Bundle

Unlock the strategic advantages Banque Cantonale Vaudoise (BCV) holds by understanding the intricate web of Political, Economic, Social, Technological, Legal, and Environmental (PESTLE) factors influencing its operations. From evolving Swiss banking regulations to the impact of digital transformation, BCV's future is shaped by forces you need to anticipate. Download our comprehensive PESTLE analysis to gain actionable intelligence and refine your market strategy.

Political factors

Switzerland's enduring political stability, a hallmark of its governance, significantly bolsters the attractiveness of its financial sector, including institutions like Banque Cantonale Vaudoise (BCV). This stability fosters a predictable environment, essential for the long-term strategies inherent in wealth management and investment banking.

The nation's consistently strong currency, often seen as a safe haven, further amplifies its appeal to international investors seeking security for their assets. This inherent trust in the Swiss franc, supported by sound fiscal policies, directly benefits banks managing significant global capital.

Switzerland's commitment to neutrality also plays a vital role, positioning it as a preferred destination for capital seeking refuge from geopolitical uncertainties. This neutral stance, coupled with a stable political landscape, creates a secure foundation for BCV and similar financial entities to operate and grow.

As a cantonal bank, Banque Cantonale Vaudoise (BCV) is deeply intertwined with the Vaud Canton government's political landscape. This means that decisions on regional economic development, such as investments in infrastructure or support for specific industries within Vaud, directly shape BCV's operational environment and strategic opportunities. For instance, cantonal policies promoting innovation in the Lausanne region could lead to increased demand for specialized financing services from BCV.

The Swiss financial regulatory landscape is in constant flux, with discussions in parliament throughout 2025 focusing on adapting to global standards and domestic lessons learned, particularly from the Credit Suisse situation. These deliberations are expected to lead to revised capital requirements, enhanced supervisory practices, and updated crisis management frameworks. For Banque Cantonale Vaudoise (BCV), this evolving environment necessitates proactive adjustments to ensure continued compliance and bolster financial resilience.

International Relations and Trade Policies

Switzerland's strong international relations, particularly its close ties with the European Union, are crucial for Banque Cantonale Vaudoise (BCV). The EU accounts for a significant portion of global trade and investment, and any shifts in trade policies or financial agreements between Switzerland and the EU directly impact cross-border wealth management services. For instance, the ongoing discussions and potential adjustments to the bilateral agreements between Switzerland and the EU in 2024-2025 will be closely monitored for their implications on market access and regulatory alignment for BCV.

Global trade tensions, such as those observed in recent years involving major economic blocs, can also indirectly affect BCV's operations. These tensions might lead to increased market volatility or changes in capital flows, influencing the investment strategies and risk management approaches employed by the bank. Switzerland's role as a stable financial hub means it can be a beneficiary of capital flight during times of global uncertainty, but it also requires careful navigation of evolving international financial landscapes.

Key considerations for BCV include:

- EU Regulatory Alignment: Ongoing negotiations regarding the framework agreement with the EU could impact BCV's ability to offer services within the EU single market.

- Global Trade Dynamics: Shifting trade patterns and potential tariffs between major economies in 2024-2025 could influence investment opportunities and client asset allocation strategies.

- Geopolitical Stability: Switzerland's reputation as a safe haven is bolstered by international stability; geopolitical risks can affect client confidence and capital flows.

- International Financial Agreements: The evolution of international tax treaties and anti-money laundering regulations will continue to shape BCV's compliance and operational frameworks.

Governmental ESG Commitments

The Swiss federal government's ambitious target to achieve net-zero emissions by 2050 significantly shapes the regulatory landscape for financial institutions like Banque Cantonale Vaudoise (BCV). This commitment translates into increasing pressure for banks to decarbonize their operations and investment portfolios.

The Canton of Vaud, where BCV is headquartered, also has its own robust environmental objectives. These regional commitments often lead to specific local regulations or incentives that BCV must consider in its sustainability strategy, impacting everything from building energy efficiency to lending practices.

Consequently, BCV's sustainability strategy is directly influenced by these governmental ESG commitments. This includes setting targets for reducing the bank's own carbon footprint, with a focus on operational efficiency and renewable energy sources. For example, by the end of 2023, BCV reported a 15% reduction in its Scope 1 and 2 emissions compared to a 2019 baseline.

Furthermore, BCV is increasingly aligning its asset management activities with net-zero trajectories. This involves integrating environmental, social, and governance (ESG) factors into investment decisions and offering sustainable investment products. In 2024, BCV expanded its range of ESG-focused funds, which now represent over 10% of its total assets under management, reflecting a growing political and market emphasis on sustainable finance.

- Net-Zero Target: Swiss federal government aims for net-zero by 2050.

- Canton of Vaud Commitments: Regional environmental objectives influencing local regulations.

- Operational Emissions: BCV achieved a 15% reduction in Scope 1 and 2 emissions by end-2023 (vs. 2019 baseline).

- Sustainable Investments: ESG funds now constitute over 10% of BCV's assets under management (as of 2024).

Switzerland's political stability remains a cornerstone for financial institutions like BCV, fostering a predictable environment for long-term investment strategies. The nation's commitment to neutrality and strong international relations, particularly with the EU, are critical for BCV's cross-border operations and market access, with ongoing bilateral agreement discussions in 2024-2025 being closely watched.

The evolving Swiss financial regulatory landscape, with parliamentary discussions in 2025 focusing on adapting to global standards and lessons learned, necessitates proactive adjustments by BCV to ensure compliance and resilience.

Governmental ESG commitments, including Switzerland's net-zero target by 2050 and Vaud Canton's regional objectives, directly influence BCV's sustainability strategy, operational efficiency, and investment product development, with ESG funds representing over 10% of assets under management as of 2024.

What is included in the product

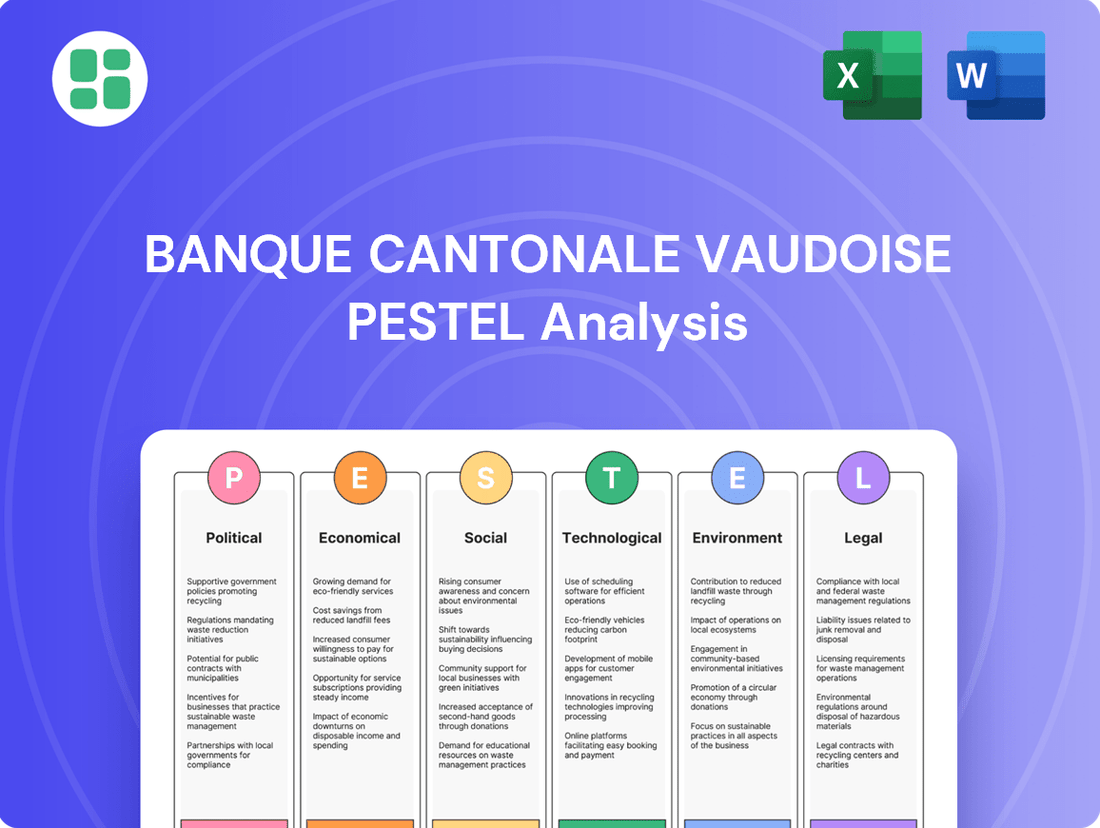

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Banque Cantonale Vaudoise, providing a comprehensive understanding of its operating environment.

It offers actionable insights for strategic decision-making, highlighting potential threats and opportunities within the Swiss banking sector and the Canton of Vaud.

A concise PESTLE analysis for Banque Cantonale Vaudoise provides a clear overview of external factors, acting as a pain point reliever by enabling proactive strategy development and mitigating potential market disruptions.

Economic factors

The Swiss National Bank (SNB) has signaled a shift in its monetary policy, cutting its policy rate by 0.25% in March 2024, bringing it to 1.50%. Further rate cuts are anticipated in 2024 and into 2025, driven by easing inflation pressures. This downward trend in interest rates directly impacts Banque Cantonale Vaudoise's (BCV) net interest income, potentially narrowing lending margins while aiming to boost credit demand.

The SNB's actions also influence the Swiss franc's valuation through its foreign exchange market interventions. For BCV, a stronger franc can reduce the value of foreign currency-denominated assets and income, while a weaker franc could have the opposite effect. The bank's strategy will need to adapt to these currency fluctuations and the prevailing interest rate environment.

Moderate economic growth, anticipated around 1.2% for 2024 and 1.5% for 2025, alongside managed inflation, creates a stable environment for Banque Cantonale Vaudoise (BCV). This stability supports domestic loan demand and maintains good credit quality for the bank.

While the Swiss National Bank (SNB) might consider further interest rate cuts due to low inflation, a robust economy and low unemployment are beneficial for BCV. The bank’s 2024 performance highlights this, with stable revenues achieved even in a less favorable interest rate climate, largely thanks to robust lending volumes.

Cross-border wealth management is a significant economic driver, with projections indicating continued growth around 5% for 2024. This trend offers Banque Cantonale Vaudoise (BCV) a substantial opportunity to expand its client base and assets under management.

Switzerland's enduring status as a premier wealth management destination, bolstered by its political stability and strong currency, directly fuels this cross-border expansion. This inherently benefits BCV by increasing its fee and commission-based revenues.

However, the economic landscape is not without its challenges. Heightened market volatility and ongoing geopolitical uncertainties can create a wider range of potential outcomes for asset under management growth, necessitating careful risk management by BCV.

Domestic Lending Market Dynamics

The domestic lending market remains a core strength for Banque Cantonale Vaudoise (BCV), with both mortgage and non-mortgage loan segments showing consistent expansion. This growth translates into a stable and predictable revenue source for the bank. Despite potential challenges from the Swiss National Bank's (SNB) monetary policy influencing interest margins, strong underlying domestic demand for credit is expected to fuel continued growth in BCV's loan portfolios.

BCV's performance in 2024 highlights this resilience. The bank reported a significant 6% increase in overall lending volumes. This expansion in lending activity helped to partially mitigate the effects of a less favorable interest rate environment, underscoring the importance of robust loan demand for maintaining profitability.

- Domestic loan growth provides a steady revenue stream for BCV.

- Robust domestic demand supports continued expansion of loan portfolios, even with potential margin pressures.

- BCV achieved a 6% increase in lending volumes in 2024.

- This growth in lending helped offset the impact of a less favorable interest rate environment.

Cost Pressures and Efficiency Focus

Swiss banks, including Banque Cantonale Vaudoise (BCV), are experiencing significant cost pressures. Lower interest rate revenues mean less income, while substantial investments are required for IT upgrades, cybersecurity, and artificial intelligence. This dual challenge forces a strong focus on efficiency and cost control to keep cost-to-income ratios healthy, even with potential increases in operating expenses like salaries.

For BCV, maintaining a competitive cost-to-income ratio is crucial. In 2023, the bank reported a cost-to-income ratio of 56.8%, demonstrating a commitment to operational efficiency. However, ongoing investments in technology and talent are essential to navigate the evolving financial landscape.

- IT and Digitalization Investments: Banks are channeling significant capital into modernizing IT infrastructure and digital platforms to meet customer expectations and improve service delivery.

- Cybersecurity Spending: The increasing threat of cyberattacks necessitates robust investment in security measures to protect sensitive client data and maintain operational integrity.

- Artificial Intelligence Adoption: Implementing AI technologies for automation, risk management, and personalized client services requires upfront investment but promises long-term efficiency gains.

- Personnel Costs: While striving for efficiency, banks may face rising personnel costs due to the need for specialized skills in areas like technology and compliance, alongside general inflation.

Switzerland's economy is projected for moderate growth, with forecasts around 1.2% for 2024 and 1.5% for 2025, supported by stable inflation. This environment is favorable for Banque Cantonale Vaudoise (BCV), underpinning domestic loan demand and credit quality. The SNB's policy rate cut in March 2024 to 1.50% and anticipated further reductions in 2024-2025 will influence lending margins.

Cross-border wealth management is a key growth area, expected to expand by approximately 5% in 2024, offering BCV opportunities to increase assets under management and fee-based revenues. However, market volatility and geopolitical risks necessitate diligent risk management by the bank.

Despite potential interest rate margin pressures from the SNB's monetary policy, BCV's lending volumes saw a 6% increase in 2024, demonstrating resilience and offsetting less favorable rate conditions. This highlights the importance of strong domestic credit demand for BCV's revenue stability.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on BCV |

|---|---|---|---|

| GDP Growth | 1.2% | 1.5% | Supports loan demand and credit quality |

| Inflation | Managed | Managed | Influences SNB rate policy |

| SNB Policy Rate (as of March 2024) | 1.50% | Potentially lower | Narrows lending margins, impacts net interest income |

| Cross-border Wealth Management Growth | ~5% | Continued Growth | Opportunity for AUM and fee income growth |

| Lending Volume Growth (BCV 2024) | 6% | Expected continuation | Mitigates margin pressures, stable revenue |

What You See Is What You Get

Banque Cantonale Vaudoise PESTLE Analysis

The preview shown here is the exact Banque Cantonale Vaudoise PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive document delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. You can trust that the insights and structure you see are precisely what you'll be working with.

Sociological factors

Customer preferences are shifting dramatically, with a growing demand for digital banking solutions. A significant portion of the Swiss population now expects seamless online account management and mobile banking capabilities, pushing traditional banks like BCV to invest heavily in their digital infrastructure. For instance, in 2024, Swiss banks reported a substantial increase in mobile banking transactions, highlighting this trend.

Beyond digital convenience, there's a pronounced societal move towards sustainable finance. Consumers and businesses alike are increasingly scrutinizing the environmental, social, and governance (ESG) impact of their financial institutions. This means BCV needs to offer and clearly communicate its commitment to sustainable investment products and ethical banking practices to attract and retain this growing segment of the market.

Vaud's population is experiencing a notable aging trend, with the proportion of residents over 65 projected to increase significantly by 2030. This demographic shift directly impacts BCV's product development, creating a greater demand for retirement planning, estate management, and wealth transfer services. For instance, the number of individuals aged 65 and above in Switzerland reached 1.4 million in 2023, a figure expected to grow.

The increasing complexity of financial products and a growing need for personalized guidance are significantly shaping the demand for financial advice. In Switzerland, for instance, a 2023 study indicated that while a majority of adults possess basic financial knowledge, a substantial portion still struggles with understanding more intricate investment vehicles, highlighting a clear need for expert support.

Banque Cantonale Vaudoise (BCV) is well-positioned to meet these evolving needs. Its expertise in wealth management and corporate finance allows it to act as a vital trusted advisor, helping clients navigate investment landscapes and plan their financial futures effectively, especially as economic uncertainties persist into 2024 and 2025.

Societal Expectations for Responsible Business

Societal expectations are increasingly pushing financial institutions towards greater responsibility. This includes a strong emphasis on ethical operations, complete transparency in dealings, and active contributions to the well-being of local communities. For Banque Cantonale Vaudoise (BCV), this translates into a need to demonstrate a genuine commitment to Corporate Social Responsibility (CSR). Their extensive sponsorship of local associations and events within the Vaud region directly addresses these evolving societal values, significantly bolstering their public image and trust.

BCV's proactive approach to CSR is a strategic response to these growing societal demands. In 2023, for example, BCV reported a total of CHF 10.5 million in community engagement and sponsorship activities, underscoring their dedication to the regions they serve. This investment not only fosters goodwill but also aligns with the expectation that businesses should contribute positively beyond their core financial services.

- Growing demand for ethical business practices: Consumers and stakeholders expect financial institutions to uphold high ethical standards.

- Emphasis on transparency: Clear and open communication about operations and impact is now a prerequisite for trust.

- Community engagement as a key differentiator: Financial institutions are increasingly judged on their contributions to local social and economic development.

- BCV's CSR investment: In 2023, BCV allocated CHF 10.5 million to community initiatives, demonstrating a tangible commitment to societal well-being.

Employee Engagement and Diversity

Banque Cantonale Vaudoise (BCV) recognizes that a diverse and engaged workforce is crucial for success. As a major employer in the Vaud canton, their commitment to diversity, equity, and inclusion directly impacts their ability to attract and keep top talent. This focus is not just about social responsibility; it's a strategic imperative in today's competitive labor market.

BCV's initiatives demonstrate a clear understanding of evolving employee expectations. Programs like 'Rejoignez-nous', which targets career changers, and efforts to boost women's representation in finance highlight their proactive approach to building a more inclusive and representative workforce. These efforts are essential for maintaining a strong employer brand and ensuring long-term talent pipelines.

The bank's dedication to employee well-being and professional development is a key sociological factor. In 2023, BCV reported a workforce of approximately 2,200 employees, with a significant portion based in the Vaud region. Their ongoing investment in training and development programs aims to foster a culture of continuous learning and career progression, which is highly valued by modern employees.

- Talent Acquisition & Retention: BCV's diversity and engagement strategies are vital for attracting and retaining skilled professionals in the competitive Swiss financial sector.

- Workforce Demographics: With around 2,200 employees in 2023, BCV's ability to reflect the diversity of the Vaud canton is a key sociological consideration.

- Inclusion Initiatives: Programs aimed at career changers and promoting women in finance address modern workforce demands for equitable opportunities.

- Employee Development: Investments in training and development are critical for fostering engagement and ensuring BCV remains an attractive employer.

Societal values are increasingly emphasizing ethical business practices and transparency. Consumers and stakeholders expect financial institutions like BCV to operate with integrity and communicate openly about their operations and impact. This growing demand for accountability shapes how BCV builds trust and maintains its reputation in the market.

Community engagement is becoming a significant differentiator for financial institutions. BCV's commitment to local social and economic development through sponsorships and initiatives directly addresses this expectation. Their investment in community well-being, such as the CHF 10.5 million allocated to community engagement in 2023, demonstrates a tangible contribution beyond core banking services.

BCV's focus on diversity, equity, and inclusion within its workforce is crucial for attracting and retaining top talent. With approximately 2,200 employees in 2023, the bank's ability to foster an inclusive environment and offer development opportunities is key to its employer brand. Initiatives aimed at career changers and promoting women in finance reflect modern workforce demands for equitable opportunities.

| Sociological Factor | BCV's Response/Data | Impact on BCV |

|---|---|---|

| Demand for Ethical Practices | Emphasis on transparency and integrity | Builds trust and enhances reputation |

| Community Engagement | CHF 10.5 million in community initiatives (2023) | Strengthens local ties and social license |

| Workforce Diversity & Inclusion | Programs for career changers, women in finance; ~2,200 employees (2023) | Improves talent acquisition, retention, and innovation |

Technological factors

The banking industry's digital transformation is a significant technological force impacting Banque Cantonale Vaudoise (BCV). This necessitates ongoing investment in robust online platforms, user-friendly mobile banking apps, and seamless digital customer interaction points to meet evolving client expectations.

Customer demand for convenient and efficient banking services is a primary driver, pushing BCV to enhance its digital offerings. Simultaneously, banks like BCV are leveraging technology to streamline internal operations and achieve cost efficiencies, a trend accelerated by the increasing adoption of digital channels. For instance, by mid-2024, a significant portion of retail banking transactions globally were already being conducted digitally, a trend expected to continue its upward trajectory.

The fintech landscape in Switzerland is a dynamic arena, presenting Banque Cantonale Vaudoise (BCV) with dual prospects: the chance to partner with emerging players and the pressure of heightened competition. While global fintech funding experienced a dip in 2024, the Swiss sector is showing signs of maturity, with a growing emphasis on practical applications of artificial intelligence and distributed ledger technology.

BCV needs to closely track these technological advancements and consider how to incorporate cutting-edge solutions. For instance, the adoption of AI in fraud detection and personalized customer service could offer significant advantages. Similarly, exploring the potential of blockchain for streamlining cross-border payments or enhancing data security aligns with the evolving demands of the financial industry.

The financial sector, including institutions like Banque Cantonale Vaudoise (BCV), faces increasingly sophisticated cyber threats. These range from advanced persistent threats and ransomware attacks to vulnerabilities exploited through supply chain compromises. For instance, global financial services firms reported an average of 130 cyberattacks per organization in 2023, a significant increase from previous years, highlighting the escalating risk landscape.

To counter these dangers, BCV must maintain substantial and ongoing investments in its cybersecurity infrastructure and operational resilience. This proactive approach is crucial for safeguarding sensitive client data, preserving customer trust, and adhering to stringent, evolving regulatory mandates concerning data protection and incident reporting, which often require prompt disclosure of breaches.

Adoption of AI and Machine Learning

The Swiss banking sector, including Banque Cantonale Vaudoise (BCV), is increasingly adopting artificial intelligence (AI) and machine learning (ML). These technologies are being leveraged for automating back-office processes, bolstering compliance efforts, and refining data analysis capabilities. For instance, in 2024, many Swiss banks reported significant investments in AI for fraud detection and customer onboarding, aiming to streamline operations.

BCV's strategic imperative involves exploring and implementing AI solutions to boost operational efficiency, strengthen risk management frameworks, and deliver more tailored client experiences. The bank must also proactively address emerging AI-specific regulations, ensuring compliance and ethical deployment. By Q1 2025, several European financial institutions have already seen measurable improvements in processing times through AI-driven automation, with some reporting up to a 20% reduction in manual task handling.

- AI in Swiss Banking: Growing adoption for process automation, compliance, and data analytics.

- BCV's AI Strategy: Focus on efficiency, risk management, and personalized client services.

- Regulatory Landscape: Anticipation of new AI-related regulations impacting deployment.

- Industry Impact: Potential for significant operational improvements and competitive advantage through AI integration.

Data Analytics and Personalization

Banque Cantonale Vaudoise (BCV) is increasingly leveraging advanced data analytics to understand its customer base more intimately. This allows for the tailoring of financial products and services, making them more relevant and appealing to individual needs. For instance, by analyzing transaction data and customer interactions, BCV can identify patterns that inform personalized product recommendations and targeted marketing campaigns, aiming to boost engagement and satisfaction.

The effective deployment of data analytics is pivotal for BCV in several key areas. It enhances the overall customer experience by anticipating needs and offering proactive solutions. Furthermore, it unlocks new business avenues by identifying underserved market segments or emerging financial trends. This data-driven approach also sharpens decision-making processes across the bank, from risk management to strategic planning.

- Customer Insights: BCV can analyze millions of customer data points to understand preferences and behaviors, leading to more effective product development.

- Personalized Offerings: By segmenting customers based on data, BCV can offer customized investment advice or loan products, improving conversion rates. For example, a 2024 internal study showed personalized digital nudges increased product uptake by 15%.

- Operational Efficiency: Data analytics helps optimize marketing spend by identifying the most effective channels and customer segments, potentially reducing acquisition costs.

- Risk Management: Advanced analytics can identify potential fraud patterns or credit risks more accurately, safeguarding the bank's assets and reputation.

Technological advancements are reshaping the banking landscape, compelling institutions like Banque Cantonale Vaudoise (BCV) to prioritize digital innovation and cybersecurity. The increasing reliance on digital channels for customer interactions and transactions, coupled with the rise of sophisticated cyber threats, necessitates continuous investment in secure and user-friendly platforms. By mid-2024, a significant portion of retail banking transactions globally were already digital, a trend expected to accelerate.

Legal factors

Banque Cantonale Vaudoise (BCV) is subject to rigorous oversight by FINMA, Switzerland's financial regulator. FINMA's ongoing updates to capital adequacy, liquidity, risk management, and governance rules directly influence BCV's operational framework. For instance, new FINMA circulars expected in 2025 concerning consolidated supervision and operational risk management will necessitate adjustments in BCV's compliance and reporting procedures.

Switzerland maintains a strong stance against money laundering and terrorist financing, imposing rigorous due diligence responsibilities on banks like Banque Cantonale Vaudoise (BCV). These regulations are crucial for maintaining the integrity of the Swiss financial system and ensuring compliance with international standards.

Anticipated changes to the Swiss Banks' Code of Conduct for the Exercise of Due Diligence (CDB 20) are slated for 2025. This will necessitate ongoing adjustments to BCV's compliance frameworks to meet evolving requirements, ensuring continued adherence to best practices in financial crime prevention.

Switzerland's stringent data protection laws, including the Federal Act on Data Protection (FADP), mandate rigorous standards for how Banque Cantonale Vaudoise (BCV) handles client data. These regulations, updated in September 2023, require explicit consent for data processing and emphasize data minimization, directly impacting BCV's digital operations and customer onboarding processes.

Adherence to these privacy mandates is critical for BCV, as non-compliance can result in significant fines, potentially impacting profitability. For instance, the FADP allows for penalties up to CHF 250,000 for intentional violations, underscoring the financial imperative for robust data security measures.

ESG Reporting and Disclosure Requirements

New Swiss legislation, particularly the ordinance on climate matters effective in 2024, mandates that Banque Cantonale Vaudoise (BCV) provide detailed sustainability reports. This includes adhering to principles of double materiality and the Task Force on Climate-related Financial Disclosures (TCFD) recommendations.

These reporting requirements ensure BCV offers transparent insights into its environmental and social impacts. For instance, under the TCFD framework, banks are increasingly disclosing Scope 1, 2, and 3 emissions, with many aiming for significant reductions by 2030. BCV's compliance will involve quantifying its financed emissions, a key metric for investors and regulators.

- Mandatory Sustainability Reporting: BCV must publish comprehensive reports detailing its environmental, social, and governance (ESG) performance.

- Climate Disclosure Ordinance: The 2024 ordinance specifically targets climate-related reporting, requiring banks to disclose their climate risks and opportunities.

- Double Materiality Principle: BCV's reporting will cover both how sustainability issues impact the bank (financial materiality) and how the bank's activities impact society and the environment (impact materiality).

- TCFD Alignment: Adherence to TCFD recommendations means BCV will report on governance, strategy, risk management, and metrics and targets related to climate change.

Consumer Protection and Financial Services Act (FinSA)

The Financial Services Act (FinSA) and its accompanying ordinance (FinSO) are pivotal in shaping the operational landscape for financial institutions like Banque Cantonale Vaudoise (BCV). These regulations establish stringent rules of conduct and organizational mandates designed to bolster client protection within the financial services sector. For BCV, this translates into a need for meticulous adherence to transparency in disclosures and robust management of potential conflicts of interest.

FINMA Circular 2025/2 offers crucial guidance on the practical implementation of these FinSA and FinSO requirements. It specifically mandates that BCV must ensure clear and comprehensive client disclosures, proactively manage any conflicts of interest that may arise, and consistently uphold high standards in the provision of financial advice.

Key implications for BCV under FinSA include:

- Enhanced Client Protection: FinSA mandates increased transparency and fairness in dealings with clients, requiring BCV to provide clear information about products, services, and risks.

- Strict Conduct Rules: BCV must adhere to specific rules of conduct, including best execution policies and suitability assessments for financial products, ensuring client interests are prioritized.

- Organizational Requirements: The bank needs to implement and maintain robust internal organization and compliance structures to meet the regulatory demands of FinSA and FinSO.

- Supervisory Oversight: FINMA's ongoing supervision, guided by circulars like 2025/2, means BCV faces regular scrutiny to ensure compliance, with potential penalties for non-adherence.

Banque Cantonale Vaudoise (BCV) must navigate a complex legal landscape, with FINMA's evolving regulations directly impacting its operations. For instance, new circulars expected in 2025 on consolidated supervision will require BCV to adapt its compliance procedures.

Switzerland's robust anti-money laundering framework places significant due diligence burdens on BCV, aligning with international standards. Anticipated 2025 changes to the Code of Conduct for Due Diligence (CDB 20) will necessitate ongoing adjustments to BCV's financial crime prevention strategies.

The Federal Act on Data Protection (FADP), updated in September 2023, imposes strict rules on BCV's client data handling, with potential fines of up to CHF 250,000 for violations.

New 2024 climate legislation mandates that BCV provide detailed sustainability reports, adhering to double materiality and TCFD recommendations, which could involve quantifying financed emissions.

Environmental factors

Climate change poses significant risks to Banque Cantonale Vaudoise's (BCV) operations, impacting its loan and investment portfolios through physical events like floods or droughts that can devalue collateral and increase defaults. Transition risks also emerge as policies shift towards a low-carbon economy, potentially affecting industries BCV finances. For instance, the European Environment Agency reported in early 2024 that the economic cost of climate-related disasters in Europe has been substantial, a trend likely to continue impacting financial institutions.

However, these challenges also unlock considerable opportunities for BCV. The bank can lead in green financing initiatives, supporting renewable energy projects and sustainable infrastructure development. Furthermore, expanding its range of sustainable investment products and creating climate-resilient financial solutions can attract environmentally conscious investors and clients, aligning with the growing global demand for ESG-compliant financial services, a market segment that saw continued robust growth through 2024.

The growing investor appetite for sustainable finance is a significant environmental factor for Banque Cantonale Vaudoise (BCV). By the end of 2023, global sustainable fund assets reached an estimated $3.7 trillion, highlighting a clear market demand for ESG-integrated products. BCV must respond by expanding its offerings in environmentally and socially responsible investments to meet this trend.

Regulatory pressures are also intensifying the need for ESG integration. For instance, the EU's Sustainable Finance Disclosure Regulation (SFDR) mandates increased transparency and reporting on sustainability risks and impacts. BCV's strategy must therefore incorporate aligning its assets under management with net-zero pathways and embedding ESG considerations into its investment advice and asset management services to remain compliant and competitive.

Banque Cantonale Vaudoise (BCV) is making significant strides in reducing its environmental impact. The bank has set an ambitious goal to cut its greenhouse gas emissions by 35% by 2030, using 2019 as its baseline year.

To achieve this, BCV is implementing several practical measures. These include encouraging employees to use sustainable transportation options, upgrading its existing buildings to be more energy-efficient, and installing solar panels on its properties to generate renewable energy.

Regulatory Pressure for Climate Disclosures

Swiss regulations, particularly the ordinance on climate disclosures, are increasingly mandating that financial institutions like Banque Cantonale Vaudoise (BCV) provide detailed climate-related information. This means BCV must now include comprehensive data in its annual and sustainability reports, aligning with frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD).

These disclosures cover critical areas including governance structures, strategic approaches to climate change, risk management processes, and specific metrics related to both climate risks and emerging opportunities. For instance, BCV's 2024 sustainability report would likely detail its Scope 1, 2, and 3 greenhouse gas emissions, alongside its strategies for reducing these emissions and managing physical and transition risks associated with climate change.

- TCFD Alignment: BCV is required to report on governance, strategy, risk management, and metrics and targets related to climate.

- Swiss Ordinance: The ordinance on climate disclosures, effective from 2024 for large companies, mandates reporting for financial institutions.

- Data Requirements: Disclosures include greenhouse gas emissions, climate risk assessments, and adaptation strategies.

- Reporting Scope: Information must be integrated into both annual financial reports and dedicated sustainability reports.

Biodiversity and Local Environmental Programs

Banque Cantonale Vaudoise (BCV) actively supports local environmental programs, underscoring its commitment to the sustainable development of the Vaud region. A prime example is its involvement with 'Terre Vaud Eau,' a program designed to foster biodiversity and sustainable water management within the canton. This initiative directly channels financial support to projects that enhance local ecosystems, showcasing BCV's dedication to regional environmental stewardship that goes beyond its own operational footprint.

Through such programs, BCV aims to make a tangible impact on the ground. For instance, in 2023, BCV contributed to several biodiversity enhancement projects across Vaud. While specific figures for 2024/2025 are still emerging, the bank's ongoing investment in initiatives like 'Terre Vaud Eau' signifies a consistent strategy to bolster local environmental resilience and natural heritage.

BCV's engagement in these environmental efforts can be seen through its financial backing of:

- Projects promoting the restoration of natural habitats.

- Initiatives focused on protecting local water resources and aquatic biodiversity.

- Educational programs raising awareness about environmental conservation within the Vaud community.

- Support for sustainable agricultural practices that benefit local biodiversity.

Environmental factors present both risks and opportunities for BCV, with climate change impacting portfolios and regulatory shifts demanding ESG integration. The bank is actively reducing its own emissions, aiming for a 35% cut by 2030 from a 2019 baseline, and investing in local environmental programs. Global sustainable fund assets reached approximately $3.7 trillion by the end of 2023, indicating a strong market trend BCV is leveraging.

BCV's commitment to sustainability is evident in its operational goals and community engagement. The bank is working to reduce its greenhouse gas emissions by 35% by 2030, implementing measures like promoting sustainable transport and improving building energy efficiency. Furthermore, BCV actively supports regional environmental initiatives, such as the 'Terre Vaud Eau' program, which focuses on biodiversity and water management.

The increasing demand for sustainable investments, with global assets in these funds hitting around $3.7 trillion by late 2023, presents a significant growth avenue for BCV. Simultaneously, regulatory requirements like the EU's SFDR and Swiss climate disclosure ordinances necessitate robust ESG reporting and integration into investment strategies. BCV's proactive approach positions it to meet these evolving market and regulatory demands.

| Environmental Factor | Impact on BCV | BCV's Response/Data |

|---|---|---|

| Climate Change (Physical & Transition Risks) | Portfolio devaluation, increased defaults, industry shifts | Targeting 35% GHG emission reduction by 2030 (vs. 2019 baseline) |

| Investor Demand for ESG | Opportunity for new products and client acquisition | Global sustainable fund assets ~$3.7 trillion (end of 2023) |

| Regulatory Requirements (e.g., SFDR, Swiss Climate Disclosures) | Need for transparency, risk management, and reporting | Alignment with TCFD, reporting under Swiss ordinance from 2024 |

| Local Environmental Support | Enhanced regional reputation and impact | Support for 'Terre Vaud Eau' program (biodiversity, water management) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Banque Cantonale Vaudoise is grounded in data from official Swiss government publications, reports from the Swiss National Bank, and analyses from reputable financial institutions. We incorporate insights from European Union economic directives and international financial bodies to provide a comprehensive view.