Banque Cantonale Vaudoise Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banque Cantonale Vaudoise Bundle

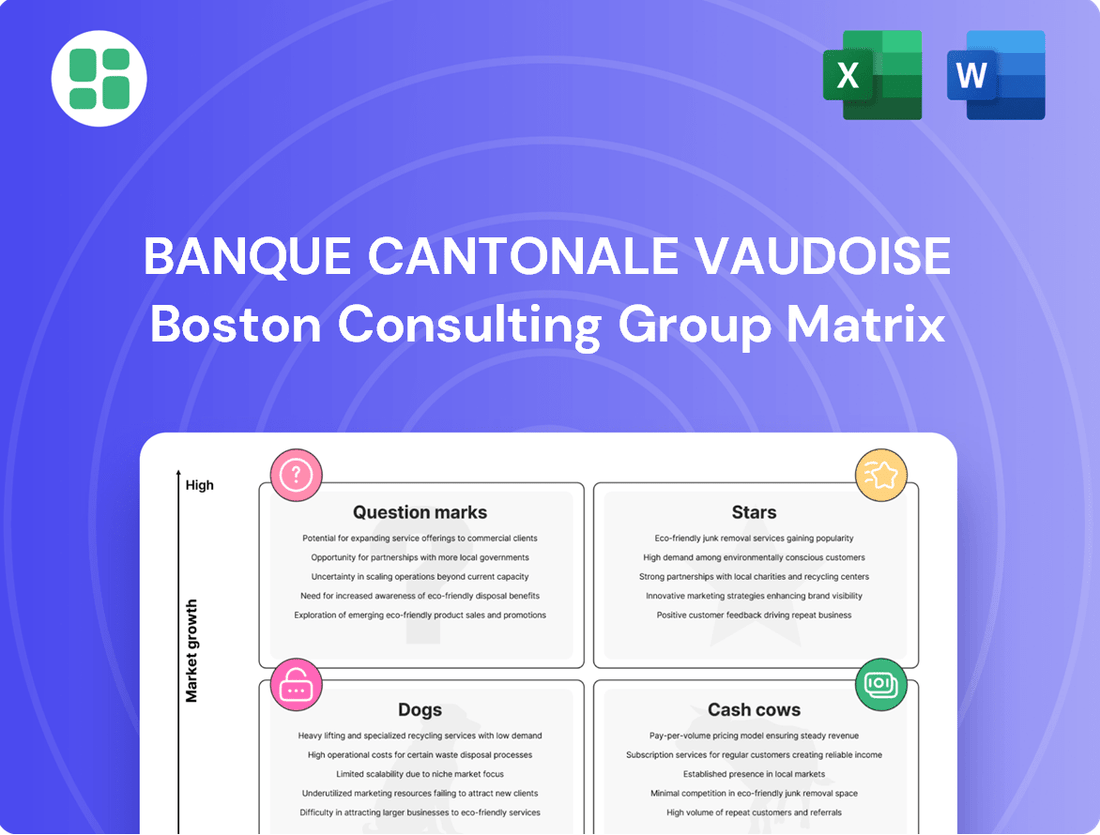

The Banque Cantonale Vaudoise (BCV) BCG Matrix offers a powerful lens to understand its product portfolio's market share and growth potential. See which of BCV's offerings are thriving Stars, stable Cash Cows, potential Dogs, or intriguing Question Marks.

Ready to move beyond this overview and unlock actionable strategies? Purchase the full BCG Matrix report to gain detailed quadrant analysis, understand the implications for each product, and chart a course for optimized resource allocation and future growth.

Stars

Wealth Management represents a strong performer for Banque Cantonale Vaudoise (BCV), fitting into the Stars category of the BCG Matrix. In 2024, BCV saw its assets under management (AuM) grow by 6%, reaching CHF 124.2 billion. This impressive increase was fueled by CHF 3.3 billion in net new money across all client types, highlighting broad-based client confidence and engagement.

Switzerland's established role as a significant center for international wealth further solidifies the strategic importance of BCV's wealth management services. This combination of robust internal growth and favorable external market positioning firmly places wealth management as a high-growth, high-market-share segment for the bank.

Banque Cantonale Vaudoise (BCV) experienced a notable expansion in its mortgage lending in 2024, growing by 8% to CHF 34.2 billion. This increase of CHF 2.4 billion highlights BCV's strong performance in a lively real estate environment.

This segment is a significant contributor to BCV's overall asset base and demonstrates consistent, strong growth. Such performance suggests BCV holds a leading position in the mortgage market within the Vaud canton.

Banque Cantonale Vaudoise (BCV) significantly bolstered its digital banking capabilities in 2024, introducing around twelve new features across its online and mobile platforms. This commitment to digital innovation, evident in the continuous rollout of enhancements, targets a burgeoning market segment. BCV's strategy focuses on enriching user experience and expanding service functionality, aiming to solidify its leadership in this dynamic digital landscape.

Fee and Commission Income

Fee and commission income for Banque Cantonale Vaudoise (BCV) saw a significant increase of 9% in 2024, reaching CHF 369 million. This growth is attributed to positive developments in financial markets and robust transaction volumes within its personal banking segment.

This performance highlights BCV's strong position in advisory and transaction services, benefiting from increased market activity and active client participation.

- Revenue Growth: Fee and commission income rose by 9% to CHF 369 million in 2024.

- Key Drivers: Favorable financial market trends and strong personal banking transaction volumes.

- Market Position: Demonstrates high market share in advisory and transaction services.

- Growth Factors: Continued expansion driven by market activity and client engagement.

ESG-Integrated Investment Offerings

Banque Cantonale Vaudoise (BCV) is strategically positioning its ESG-integrated investment offerings as potential stars within its BCG matrix. These offerings benefit from strong ESG ratings, such as MSCI AA, Ethos A-, and ISS ESG C/Prime, underscoring a commitment to sustainable economic development.

The rapidly expanding demand for sustainable investing creates a significant opportunity for BCV's established ESG products. This growing market appetite suggests these offerings are well-placed to capture substantial market share and achieve continued growth in the coming years.

- Strong ESG Credentials: BCV's ESG investment ranges are backed by high ratings from leading ESG assessment agencies.

- Market Growth: The global sustainable investment market is experiencing robust expansion, with assets in ESG funds projected to reach $50 trillion by 2025, according to Bloomberg Intelligence.

- Strategic Positioning: BCV's existing ESG products are ideally positioned to capitalize on this increasing investor demand.

- Future Potential: These offerings represent a key growth area for BCV, aligning with both client preferences and broader market trends.

Banque Cantonale Vaudoise's Wealth Management division is a clear Star in its BCG Matrix. In 2024, assets under management grew by 6% to CHF 124.2 billion, driven by CHF 3.3 billion in net new money. This segment benefits from Switzerland's strong international wealth management standing, indicating high market share and strong growth potential.

| BCG Category | BCV Business Segment | 2024 Performance Indicator | Key Data Point | Market Context |

| Star | Wealth Management | Assets Under Management (AuM) Growth | +6% to CHF 124.2 billion | Switzerland as a global wealth hub |

| Star | Mortgage Lending | Loan Portfolio Growth | +8% to CHF 34.2 billion | Strong real estate market in Vaud canton |

| Star | Digital Banking Enhancements | New Features Rolled Out | Approx. 12 new features | Growing demand for digital services |

| Star | Fee and Commission Income | Revenue Increase | +9% to CHF 369 million | Favorable market trends and transaction volumes |

| Potential Star | ESG-Integrated Investment Offerings | ESG Ratings | MSCI AA, Ethos A-, ISS ESG C/Prime | Rapidly expanding sustainable investing market |

What is included in the product

This BCG Matrix overview analyzes BCV's product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

The Banque Cantonale Vaudoise BCG Matrix offers a clear, quadrant-based overview, alleviating the pain of strategic uncertainty.

Cash Cows

Traditional retail banking services at Banque Cantonale Vaudoise (BCV) are firmly positioned as a cash cow. As the most-recommended bank in Vaud Canton for seven consecutive years, BCV boasts a substantial market share in core offerings like current accounts, savings, and payment processing for its 370,000 clients.

These established services operate within a mature market, characterized by stable and predictable revenue streams. The need for significant promotional investment is relatively low, allowing these offerings to consistently generate substantial cash flow for the bank.

Banque Cantonale Vaudoise (BCV) holds a strong position as Vaud's premier bank for business clients, offering robust commercial banking services to Small and Medium-sized Enterprises (SMEs). This segment represents a stable Cash Cow for BCV, generating consistent revenue streams.

The SME market in the Vaud region is well-established, exhibiting moderate growth. BCV's extensive reach and deep-rooted client relationships translate into a significant market share, underpinning the reliable cash flow generated from these core banking activities.

In 2024, BCV's commitment to SMEs was evident, with the bank continuing to be a key financial partner for these businesses. This segment's maturity and BCV's strong market penetration solidify its role as a dependable Cash Cow, contributing significantly to the bank's overall financial health.

Banque Cantonale Vaudoise's established corporate finance services are a cornerstone of its business, serving companies and public sector organizations throughout the Vaud region. These offerings, encompassing vital financing and advisory functions, have secured a dominant market share, reflecting the bank's deep integration within the local economy. As a public law institution, BCV leverages its strong regional connections to deliver these mature services, which consistently generate substantial revenue.

Customer Deposit Base

Banque Cantonale Vaudoise's customer deposit base is a significant Cash Cow. In 2024, these deposits saw a healthy 3% increase, reaching CHF 37.7 billion. This growth highlights the bank's strong position in attracting and retaining client funds.

This substantial and consistent deposit base is a cornerstone of BCV's financial strength. It provides a reliable and low-cost source of funding, essential for supporting the bank's lending operations and overall liquidity management.

The dominance of BCV within the Vaud region, particularly with its retail and commercial clients, directly contributes to this robust deposit base. This high market share in a stable segment solidifies its Cash Cow status.

- Customer Deposit Growth: Increased by 3% to CHF 37.7 billion in 2024.

- Funding Stability: Underpins BCV's liquidity and provides low-cost funding.

- Market Share: Dominant position in retail and commercial segments in Vaud.

Net Interest Income from Traditional Lending

Net interest income from traditional lending, a cornerstone of Banque Cantonale Vaudoise's (BCV) operations, continues to be a significant revenue driver, despite a dip in 2024. This segment, which includes income from mortgages and other loans, generated CHF 554 million in 2024.

While this represents a 7% decrease from the exceptionally strong performance in 2023, it underscores the mature and stable nature of BCV's lending business. The bank maintains a high market share in its primary geographical areas, making this a reliable, albeit slower-growing, revenue stream.

- Net Interest Income (2024): CHF 554 million

- Year-over-Year Change (2024 vs. 2023): -7%

- Primary Revenue Driver: Traditional lending, particularly mortgages

- Market Position: High market share in core regions

Banque Cantonale Vaudoise's (BCV) wealth management services, catering to affluent individuals and families, are a prime example of a Cash Cow. These services, which include investment advice, asset management, and financial planning, benefit from BCV's strong reputation and established client base in the Vaud region.

The market for wealth management is mature, with BCV leveraging its deep understanding of local client needs to maintain a significant market share. This allows for consistent revenue generation with relatively low investment requirements, solidifying its Cash Cow status.

In 2024, BCV's wealth management division continued to be a stable contributor to the bank's profitability. The bank’s focus on personalized service and its strong regional presence ensured continued client loyalty and steady income streams from this segment.

BCV's established mortgage lending portfolio is a core Cash Cow, providing stable and predictable income. Despite a slight decrease in net interest income to CHF 554 million in 2024, this segment, driven by a high market share in its core regions, remains a robust revenue generator.

The bank's substantial customer deposit base, which grew by 3% to CHF 37.7 billion in 2024, further reinforces its lending capabilities and financial stability. This reliable funding source is crucial for maintaining the profitability of its lending activities.

| BCV Business Segments | BCG Matrix Category | Key Financial Data (2024) | Market Position |

| Traditional Retail Banking | Cash Cow | Significant market share in core offerings | Most-recommended bank in Vaud for 7 consecutive years |

| SME Commercial Banking | Cash Cow | Consistent revenue streams | Strong market share in Vaud region |

| Corporate Finance Services | Cash Cow | Dominant market share, substantial revenue | Deep integration within the local economy |

| Customer Deposits | Cash Cow | CHF 37.7 billion (3% growth) | High market share in retail and commercial segments |

| Mortgage Lending | Cash Cow | Net Interest Income: CHF 554 million (-7% YoY) | High market share in core regions |

Preview = Final Product

Banque Cantonale Vaudoise BCG Matrix

The Banque Cantonale Vaudoise BCG Matrix preview you're examining is the exact, fully formatted document you will receive immediately after your purchase, ensuring no surprises and complete readiness for your strategic planning.

This preview accurately represents the final Banque Cantonale Vaudoise BCG Matrix report; upon purchase, you will gain access to this comprehensive analysis, free from watermarks or demo content, ready for immediate application.

What you see here is the actual Banque Cantonale Vaudoise BCG Matrix file that will be delivered to you upon completing your purchase, providing you with a professionally designed and analysis-ready tool for your business strategy.

The Banque Cantonale Vaudoise BCG Matrix report you are currently viewing is the definitive version you will obtain after purchase, offering a clear and actionable framework for evaluating your business portfolio.

Dogs

Banque Cantonale Vaudoise's legacy 'Other Loans' portfolio, a segment characterized by low growth and market share, saw a 3% decline in 2024, settling at CHF 6.0 billion. This reduction is primarily attributed to the continued reimbursement of COVID-19 related loans.

This category, often impacted by specific repayment schedules and a naturally diminishing balance, is being managed as a low-priority area within the BCG matrix. Its current standing indicates a strategic phasing out or a reduction in active management as existing obligations are settled.

Services tied solely to outdated physical branches, lacking digital integration, are likely experiencing a decline in demand. For instance, in 2024, the trend shows a significant shift away from in-person banking for routine transactions, with many customers preferring mobile apps. This segment of BCV's offerings, if not modernized, would represent a low-growth, low-market-share area.

In 2024, Banque Cantonale Vaudoise (BCV) saw a modest uptick in its overall net trading income. However, trading activities that are highly niche or undifferentiated, failing to capitalize on BCV's unique strengths or market intelligence, are likely to generate low returns. These types of activities often face significant challenges in carving out substantial market share within the intensely competitive global trading landscape.

For instance, if BCV engaged in trading a highly commoditized financial instrument without a distinct advantage, its profitability would be squeezed by larger, more sophisticated players. This lack of differentiation means these activities might be categorized as Dogs in the BCG Matrix, requiring careful consideration for resource allocation and strategic focus.

Underperforming Non-Strategic Investments

Underperforming non-strategic investments, often termed Dogs in the BCG matrix context for Banque Cantonale Vaudoise (BCV), are those legacy portfolios that no longer align with the bank's strategic objectives. These could include outdated asset classes or holdings that consistently deliver subpar returns, hindering overall portfolio performance and capital efficiency.

These assets represent capital that could be better deployed in areas supporting BCV's focus on long-term value creation, environmental, social, and governance (ESG) integration, or core client service enhancements. For instance, a hypothetical portfolio of legacy, low-yield bonds or underperforming private equity stakes that haven't been actively managed to meet current strategic goals would fall into this category.

- Low Growth Potential: These investments typically exhibit minimal or negative growth prospects, failing to keep pace with market inflation or BCV's strategic growth targets.

- Sub-Par Returns: Data from 2024 might show such portfolios yielding significantly less than benchmark indices or BCV's cost of capital, potentially dragging down overall profitability.

- Capital Inefficiency: Capital tied up in these 'Dogs' is not contributing to BCV's strategic initiatives, representing an opportunity cost for more productive investments.

- Strategic Misalignment: They often lack integration with BCV's forward-looking strategies, such as digital transformation or sustainable finance, diverting focus from core business development.

Manual, Non-Automated Back-Office Processes

Manual, non-automated back-office processes within Banque Cantonale Vaudoise (BCV) would likely be categorized as a Dog in a BCG Matrix analysis. These operations, characterized by their reliance on human intervention rather than technology, represent areas with low growth potential and a diminished competitive standing in the modern banking landscape.

In 2024, the global banking sector continued its aggressive push towards digital transformation and automation. Banks that lag in this area, maintaining significant manual back-office functions, face escalating operational costs and reduced agility. For BCV, this translates to resources being tied up in inefficient workflows, diverting capital from strategic growth initiatives or advanced technological investments. For instance, a report by McKinsey in 2023 highlighted that banks with higher automation levels in their back-office operations saw a 15-20% reduction in processing costs compared to their less automated peers.

- Low Market Share: Manual processes represent a declining share of best-practice banking operations, indicating a lack of competitive advantage.

- Low Growth: The efficiency gains from automating these tasks are limited, as the focus shifts to entirely new, digitally native processes.

- High Cost: These operations are resource-intensive, consuming staff time and potentially leading to errors, increasing overall expenses.

- Strategic Drain: Continued investment in maintaining manual systems detracts from resources that could be allocated to innovation and market expansion.

Dogs within Banque Cantonale Vaudoise's (BCV) portfolio represent business units or investments with low market share and low growth potential. These are often legacy products or services that are no longer strategically aligned or competitive. In 2024, BCV's focus on streamlining operations meant divesting or minimizing resources allocated to such areas. For example, underperforming, non-core investment portfolios that yielded less than 2% in 2024, significantly below BCV's cost of capital, would be classified here.

These 'Dogs' consume resources without offering substantial returns or growth opportunities, representing an opportunity cost for more promising ventures. The bank's strategy in 2024 involved identifying and managing these segments to free up capital for innovation and core business development. This proactive approach aims to improve overall portfolio efficiency and shareholder value.

The management of these 'Dogs' is crucial for optimizing BCV's resource allocation. By strategically phasing out or reducing investment in these low-performing areas, BCV can redirect capital towards its Stars and Cash Cows, thereby fostering sustainable growth and competitive advantage in the evolving financial landscape.

For instance, a hypothetical manual processing unit within BCV, if it continued to operate in 2024 with costs exceeding its revenue by 10% and showed no prospect for improvement due to technological obsolescence, would be a prime example of a Dog.

Question Marks

Banque Cantonale Vaudoise (BCV) is strategically positioned to leverage advanced AI-driven banking solutions, aligning with a broader trend where Swiss banks saw AI adoption triple between 2023 and 2024, despite ongoing regulatory adaptation. BCV's commitment to projects in areas like cybersecurity and asset management, alongside new digital features, likely incorporates early-stage AI applications. These nascent AI initiatives, focused on hyper-personalization, predictive analytics, and enhanced customer service, represent high-growth potential within the financial sector.

Banque Cantonale Vaudoise (BCV) is increasingly focusing on specialized green finance products, aligning with its sustainability goals and upcoming climate disclosure requirements. These offerings, such as tailored green bonds for specific sectors or sustainability-linked loans for niche industries, cater to a growing demand for environmentally conscious financial solutions. For instance, the global green bond market saw significant growth, with issuance reaching an estimated $700 billion in 2023, indicating a strong underlying trend.

Banque Cantonale Vaudoise's (BCV) wealth management, a strong performer within its home canton of Vaud, faces a strategic pivot when considering targeted cross-border expansion. Initiatives focused on specific, high-growth international wealth management segments where BCV currently holds a minimal market presence would likely be classified as Question Marks within the BCG framework. These ventures are characterized by their potential for substantial growth but also by their nascent market share, necessitating considerable capital infusion to establish a competitive foothold.

Innovative Payment Solutions Beyond TWINT

Banque Cantonale Vaudoise (BCV) is actively exploring innovative payment solutions beyond TWINT, potentially positioning these ventures in a high-growth, low-market-share quadrant of the BCG matrix. These initiatives might involve partnerships with emerging fintech companies or the development of proprietary digital payment technologies. For instance, a significant trend in 2024 has been the rise of embedded finance, where payment functionalities are integrated directly into non-financial applications, an area BCV could be investigating. Successfully scaling these new solutions will necessitate considerable investment in marketing and user acquisition to challenge established payment ecosystems.

BCV's exploration into novel payment methods reflects a strategic move to capture future market share in the rapidly evolving digital payments landscape. While specific figures for BCV's investments in these nascent solutions are not publicly detailed, the broader Swiss digital payment market saw continued growth in 2024. For example, mobile payment transaction volumes in Switzerland have been on an upward trajectory, indicating a strong consumer appetite for convenient digital alternatives. BCV's focus here is on building a diversified portfolio of payment offerings.

- Focus on Embedded Finance: Exploring integration of payment services within non-financial platforms to capture new user bases.

- Fintech Partnerships: Collaborating with agile fintech startups to leverage cutting-edge technology and accelerate innovation.

- User Experience Enhancement: Developing intuitive and seamless payment experiences to drive adoption and customer loyalty.

- Market Diversification: Expanding beyond traditional banking services to offer a broader suite of digital financial tools.

Cybersecurity and Data Analytics Services for Corporate Clients

Banque Cantonale Vaudoise (BCV) is strategically positioning itself to capitalize on the escalating demand for cybersecurity and data analytics services among its corporate clientele. The financial sector's heightened awareness of data protection, underscored by increasing regulatory scrutiny and the persistent threat of cyberattacks, presents a significant opportunity. BCV's proactive investments in robust cybersecurity infrastructure and advanced data analytics capabilities are foundational to developing these new service lines.

These proposed services would directly address a high-growth market need, offering corporate clients sophisticated solutions for safeguarding sensitive information and leveraging data for strategic advantage. While the bank's internal capabilities are expanding, its market share in providing these specific advisory or integrated solution services to external businesses is likely still in its early stages. This suggests a potential "Question Mark" in the BCG matrix, where significant investment is required to build market share in a high-growth area.

- High Growth Potential: The global cybersecurity market was projected to reach over $200 billion in 2024, with data analytics services also experiencing substantial growth.

- Nascent Market Share: BCV's current penetration in offering these specialized advisory services to corporations is likely limited, requiring focused development.

- Investment Necessity: Significant investment in talent acquisition, technology, and marketing will be crucial to establish a competitive presence.

- Strategic Alignment: These services align with BCV's broader digital transformation and client-centric strategies, enhancing its value proposition.

Banque Cantonale Vaudoise's (BCV) ventures into new digital payment solutions and specialized cybersecurity advisory services for corporations likely fall into the Question Mark category of the BCG matrix. These initiatives target high-growth markets but currently hold a low market share, necessitating substantial investment to build competitive positioning. For example, the global cybersecurity market was projected to exceed $200 billion in 2024, highlighting the growth potential BCV aims to tap into.

BCG Matrix Data Sources

Our Banque Cantonale Vaudoise BCG Matrix leverages internal financial statements, detailed market research reports, and official regulatory filings to provide a comprehensive view of business unit performance and market dynamics.