BCG (Boston Consulting Group) SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BCG (Boston Consulting Group) Bundle

BCG's renowned strategic prowess is evident in its robust strengths, such as its deep industry expertise and influential brand. However, understanding their potential weaknesses and the competitive landscape is crucial for informed decision-making.

Uncover the full strategic picture of BCG, including their opportunities for innovation and the threats they face in a dynamic market. Our comprehensive SWOT analysis provides actionable insights to guide your strategy.

Ready to leverage BCG's strategic insights for your own advantage? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning and competitive analysis.

Strengths

BCG's global brand reputation is a formidable strength, consistently placing it among the top-tier management consulting firms worldwide, often referred to as the 'MBB' alongside McKinsey and Bain. This elite status is not merely a label; it translates into a magnetic pull for the brightest minds in the industry and attracts a clientele willing to invest in premium strategic guidance.

The firm's prestige is a direct result of its long-standing commitment to innovation, evidenced by the development of influential frameworks that have reshaped strategic thinking across numerous sectors. This legacy of impactful client work, spanning diverse industries and international markets, reinforces its leadership position and ensures a continuous pipeline of high-profile engagements.

BCG's deep industry and functional expertise is a significant strength. They possess specialized knowledge across sectors like healthcare, financial services, and consumer goods, as well as functional areas such as digital transformation and sustainability.

This allows BCG to craft highly customized solutions for intricate client problems. For instance, their ability to advise on complex mergers and acquisitions, coupled with deep operational insights, helps clients navigate challenging market dynamics and achieve strategic objectives.

In 2024, BCG reported revenues exceeding $11 billion, underscoring the demand for their specialized consulting services. This financial performance reflects their continued success in delivering value through expert guidance in an ever-changing business environment.

BCG's strategic emphasis on AI and digital transformation, notably through its BCG X division, is a significant strength. This focus allows them to embed AI directly into client solutions, driving tangible business outcomes.

The company's commitment is evident in AI-related advisory services, which represented about 20% of BCG's revenue in 2024. This substantial share highlights their leadership in a rapidly expanding market and their ability to help clients successfully implement AI for financial gains.

Consistent Revenue Growth and Financial Performance

BCG's financial performance is a significant strength, underscored by its impressive 10% global revenue growth in 2024, reaching $13.5 billion. This marks an exceptional 21st consecutive year of growth, demonstrating remarkable resilience and strategic execution in a dynamic consulting landscape.

This sustained upward trajectory across all geographic regions and industry practices highlights a robust demand for BCG's expertise and its ability to consistently deliver value to clients. Such consistent financial strength provides a solid foundation for future investments and strategic initiatives.

- Consistent Revenue Growth: 10% global revenue increase in 2024.

- Financial Milestones: Achieved $13.5 billion in revenue for 2024.

- Sustained Performance: 21st consecutive year of global revenue growth.

- Broad Market Penetration: Growth observed across all regions and industry practices.

Commitment to Sustainability and Societal Impact

BCG actively partners with clients to integrate sustainability into their core strategies, viewing it not just as a responsibility but as a significant competitive advantage. This focus is increasingly critical as global markets and regulatory bodies prioritize environmental, social, and governance (ESG) factors.

The firm's commitment extends to substantial investments in societal impact programs. These initiatives aim to bolster education and enhance job opportunities, reflecting a broader understanding of corporate citizenship. For instance, BCG’s global ‘Future Makers’ program, launched in 2023, aims to equip 1 million underserved youth with critical future-ready skills by 2030.

Furthermore, BCG is dedicated to minimizing its own environmental footprint. By 2025, the firm has set ambitious targets to reduce its absolute greenhouse gas emissions by 40% compared to a 2019 baseline, showcasing a tangible commitment to its sustainability principles.

- Client Engagement: BCG's expertise in sustainability helps clients navigate complex ESG landscapes and develop resilient business models.

- Societal Impact: Significant investment in programs that improve education and job prospects demonstrates a commitment to broader societal well-being.

- Internal Footprint Reduction: A clear target to reduce absolute greenhouse gas emissions by 40% by 2025 highlights operational sustainability efforts.

- Competitive Advantage: Positioning sustainability as a key driver for business success aligns with evolving market demands and investor expectations.

BCG's exceptional financial performance, marked by a 10% global revenue growth in 2024 to $13.5 billion, underscores its market leadership and the enduring demand for its strategic advice. This represents the 21st consecutive year of growth, a testament to its robust business model and effective execution across diverse markets and industries.

The firm's strategic investments in areas like AI, particularly through its BCG X division, are yielding significant returns, with AI-related advisory services accounting for approximately 20% of its 2024 revenue. This focus on cutting-edge technology allows BCG to deliver tangible value and competitive advantages to its clients.

BCG's proactive integration of sustainability into client strategies, coupled with its commitment to societal impact and reducing its own environmental footprint, positions it favorably in an increasingly ESG-conscious global market. Their target to reduce absolute greenhouse gas emissions by 40% by 2025 highlights this dedication.

| Metric | 2023 Data | 2024 Data |

|---|---|---|

| Global Revenue | Approx. $12.27 billion | $13.5 billion |

| Revenue Growth | Approx. 9% | 10% |

| AI Advisory Revenue Share | Approx. 15-18% | Approx. 20% |

| Consecutive Growth Years | 20 | 21 |

| GHG Emission Reduction Target (vs 2019 baseline) | Ongoing | 40% by 2025 |

What is included in the product

Analyzes BCG (Boston Consulting Group)’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

The premium pricing of BCG's services, a significant factor in its market positioning, can be a substantial barrier for smaller enterprises or those operating with tighter financial constraints. This strategy, while justified by the caliber of expertise and outcomes provided, inherently restricts BCG's accessibility, potentially ceding ground to more budget-friendly alternatives.

BCG's reliance on high-end consulting services makes it susceptible to economic cycles. Global economic slowdowns and geopolitical instability can lead businesses to reduce discretionary spending, including consulting fees. For instance, during periods of economic contraction, companies might postpone or scale back strategic initiatives that typically involve external consultants, directly impacting BCG's revenue streams even with its broad client portfolio.

BCG operates within a fiercely competitive consulting arena. Key rivals include fellow MBB firms McKinsey and Bain, as well as the formidable consulting divisions of the Big Four accounting firms like Deloitte, PwC, EY, and KPMG. Furthermore, a burgeoning ecosystem of specialized boutique firms adds further pressure.

This intense rivalry demands constant innovation and a clear strategy for differentiation to preserve and grow market share. For instance, in 2024, the global management consulting market was valued at an estimated $360 billion, with significant portions attributed to these major players.

Talent Retention and Work-Life Balance Challenges

The consulting sector, including BCG, grapples with inherent difficulties in retaining talent due to its demanding nature. The expectation of long hours and intense project cycles, while attracting driven individuals, can also contribute to burnout. This pressure cooker environment poses a significant hurdle for maintaining a healthy work-life balance for BCG's global workforce, which stood at approximately 33,000 employees as of early 2024.

This constant demand can negatively affect employee morale and, consequently, increase turnover rates. For instance, industry surveys from 2023 indicated that over 60% of consultants reported experiencing burnout within their first two years, a statistic that highlights the persistent challenge of sustainable employee engagement.

- High Workload: The consulting industry is characterized by demanding project timelines and extensive client engagements.

- Burnout Risk: The high-pressure environment increases the likelihood of employee burnout, impacting long-term retention.

- Work-Life Balance: Achieving a sustainable work-life balance remains a persistent challenge for BCG's 33,000+ global employees.

- Talent Turnover: Employee morale and satisfaction are directly linked to retention, making work-life balance crucial for mitigating turnover.

Risk of Over-reliance on Key Client Relationships

While strong client relationships are a significant asset for BCG, an over-reliance on a select few major clients presents a notable weakness. If these key relationships deteriorate or if clients opt to internalize their strategic projects, BCG's revenue streams could be significantly impacted. For instance, in 2023, a substantial portion of revenue for many top consulting firms was still tied to a relatively small number of Fortune 500 companies, highlighting this industry-wide vulnerability.

To mitigate this risk, continuous efforts in client diversification and the acquisition of new business are paramount for BCG's sustained growth and stability. This involves actively seeking out new industries and geographical markets, as well as nurturing relationships with emerging companies. The consulting industry, in general, saw a trend in 2024 towards clients seeking more specialized and niche expertise, which can offer opportunities for BCG to broaden its client base beyond traditional large corporations.

- Client Concentration Risk: Dependence on a few large clients can lead to significant revenue volatility if those relationships change.

- Internalization Trend: Clients increasingly developing in-house capabilities could reduce external consulting demand.

- Need for Diversification: Proactive client acquisition across various sectors and sizes is essential to offset potential client attrition.

- Market Adaptation: Staying ahead of evolving client needs and market demands is crucial for securing ongoing engagements.

BCG's premium pricing, while indicative of its high-value services, can limit its appeal to smaller businesses or those with constrained budgets. This exclusivity, though a deliberate market positioning, may cede opportunities to more cost-effective competitors. Furthermore, the firm's reliance on large, established clients creates a vulnerability; a downturn in the global economy or shifts in client spending priorities, as seen in 2023 where major firms derived significant revenue from a few Fortune 500 companies, can directly impact BCG's financial performance.

| Weakness | Description | Impact | Mitigation Strategy |

| Premium Pricing | High service costs can deter smaller or budget-conscious clients. | Limited market penetration with SMEs; potential loss of clients to lower-cost alternatives. | Develop tiered service offerings or specialized packages for different client segments. |

| Client Concentration | Over-dependence on a few major clients poses revenue risk. | Significant financial impact if key client relationships are lost or scaled back. | Actively pursue client diversification across industries and geographies; focus on acquiring new business. |

| Talent Retention | Demanding work environment leads to burnout and high turnover. | Increased recruitment costs and potential loss of institutional knowledge; impacts service delivery consistency. | Enhance employee well-being programs and focus on sustainable work-life balance initiatives. |

Same Document Delivered

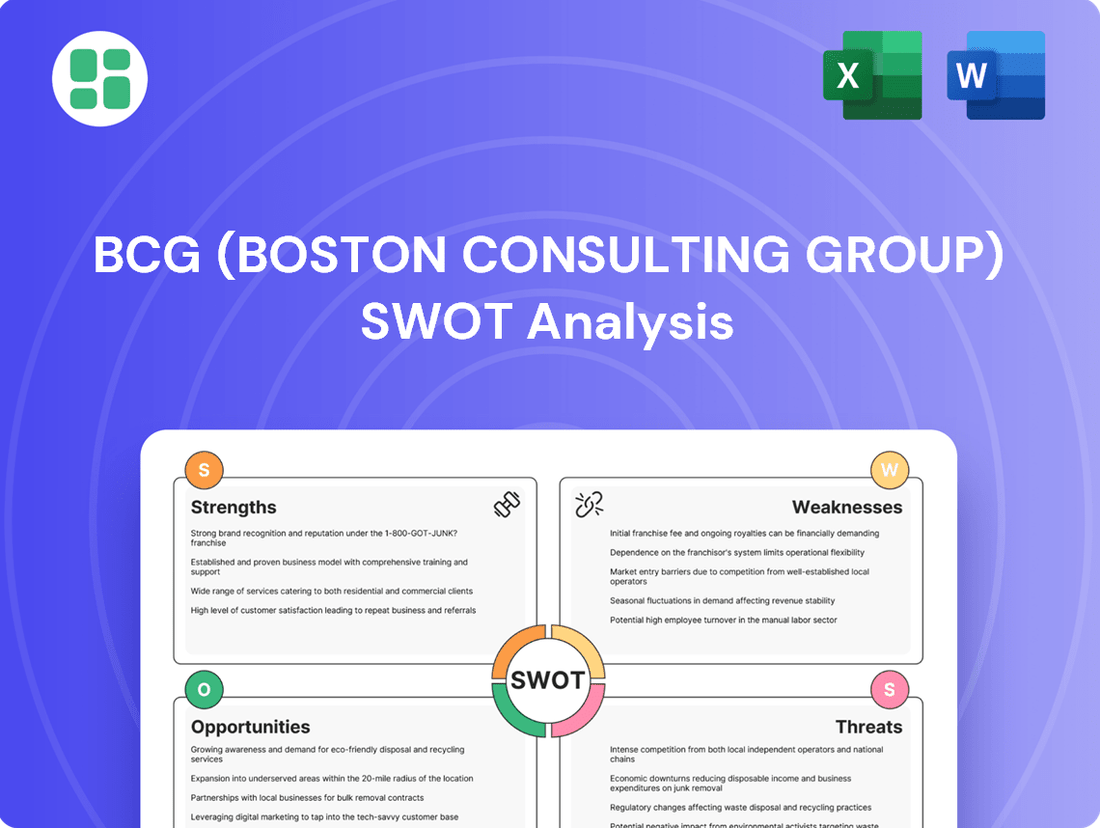

BCG (Boston Consulting Group) SWOT Analysis

This is the actual BCG SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the comprehensive breakdown of Boston Consulting Group's Strengths, Weaknesses, Opportunities, and Threats. This preview is a direct representation of the full, detailed report available for download.

Opportunities

The global AI consulting market is on a significant upward trajectory, with projections indicating it could surpass $90 billion by 2035. This, coupled with the robust expansion of digital transformation consulting, presents a substantial opportunity.

BCG's deep-seated expertise in AI and digital solutions is a key advantage, enabling the firm to effectively address this growing client need. By assisting businesses in integrating cutting-edge technologies, BCG can drive efficiency and foster innovation for its clientele.

The Global South, encompassing vibrant economies like India, Vietnam, and Nigeria, is projected to be a significant driver of global economic growth in the coming years. For instance, India’s economy is expected to grow by 6.5% in 2024 and 7.1% in 2025, showcasing robust expansion. BCG's strategic expansion into these burgeoning markets presents a substantial opportunity to capture new client mandates and diversify its revenue streams, tapping into rapidly developing industries and increasing demand for high-value consulting services.

The global sustainability consulting market is booming, with projections indicating a significant compound annual growth rate (CAGR) through 2028, driven by increasing consumer and investor demand for ESG accountability. BCG's established expertise in sustainability positions it to capitalize on this trend by expanding its specialized service offerings.

This growing emphasis on ESG presents a substantial opportunity for BCG to deepen its client relationships and capture market share in a rapidly expanding sector. For instance, the demand for climate transition strategies and supply chain sustainability assessments is particularly strong, areas where BCG has already demonstrated capabilities.

Strategic Partnerships and Acquisitions

Forming strategic alliances with technology providers, niche consulting firms, or startups could enable BCG to enhance its capabilities, expand its service offerings, and gain access to new markets or specialized talent. For instance, in 2024, BCG Digital Ventures actively pursued collaborations to bolster its digital transformation and innovation consulting services, aiming to capture a larger share of the rapidly growing digital consulting market, which was projected to reach over $200 billion globally by 2025.

Acquisitions present another avenue for BCG to rapidly integrate new technologies or expertise, thereby accelerating its growth and competitive positioning. In late 2024, BCG acquired several smaller data analytics and AI-focused firms to strengthen its advanced analytics capabilities, a move that aligns with the increasing client demand for data-driven strategic advice. This strategic inorganic growth complements its organic expansion efforts.

- Enhanced Capabilities: Partnerships can provide access to cutting-edge technologies and specialized skills, such as AI and advanced analytics, which are critical for modern consulting.

- Market Expansion: Collaborations with niche firms or startups can open doors to new geographic regions or industry verticals that BCG may not currently serve effectively.

- Accelerated Innovation: Acquisitions allow BCG to quickly integrate innovative solutions and talent, staying ahead of market trends and client needs in a fast-evolving business landscape.

- Talent Acquisition: Strategic moves can also serve as a mechanism to attract and retain top talent in specialized fields, a key differentiator in the consulting industry.

Leveraging Data Analytics and Predictive Insights

The growing volume of big data and sophisticated analytics tools offers BCG a significant opportunity to sharpen its data-driven advisory services. By harnessing these capabilities, the firm can deliver more accurate, up-to-the-minute insights to clients, enabling more tailored strategies and demonstrably better results.

This enhanced analytical prowess directly strengthens BCG's value proposition. For instance, the global big data market was valued at approximately $271.8 billion in 2023 and is projected to reach $1.228 trillion by 2032, indicating a massive opportunity for consulting firms to leverage this data for client solutions.

- Enhanced Client Solutions: Utilizing advanced analytics allows for the creation of highly customized recommendations, addressing specific client challenges with greater precision.

- Real-time Insights: The ability to process and interpret data in near real-time empowers clients to make agile decisions in rapidly evolving markets.

- Competitive Differentiation: Firms that effectively integrate data analytics can offer a distinct advantage over competitors less adept at leveraging these technologies.

- Improved ROI for Clients: By providing more targeted and effective strategies, BCG can help clients achieve a higher return on their investments and operational improvements.

The expanding global demand for AI and digital transformation consulting, projected to exceed $90 billion by 2035 for AI alone, offers BCG a prime opportunity to leverage its expertise. Furthermore, the burgeoning economies of the Global South, with India's projected 6.5% growth in 2024, present significant new client bases. The booming sustainability consulting market, driven by ESG accountability, also allows BCG to expand its specialized service offerings and deepen client relationships, particularly in climate transition strategies.

Strategic alliances and acquisitions are key enablers for BCG to enhance its capabilities and market reach. For instance, BCG Digital Ventures' collaborations in 2024 aimed to capture a larger share of the digital consulting market, expected to surpass $200 billion by 2025. Acquiring data analytics and AI firms in late 2024 bolstered BCG's advanced analytics, aligning with client needs for data-driven advice.

The vast growth in big data, valued at approximately $271.8 billion in 2023 and forecast to reach $1.228 trillion by 2032, provides a fertile ground for BCG to refine its data-driven advisory services. This allows for more precise, tailored strategies and demonstrably better client outcomes, enhancing BCG's competitive differentiation and client ROI.

Threats

Global economic and geopolitical uncertainties pose a significant threat. Rising trade tariffs and the persistent risk of recession can directly impact corporate spending, leading clients to scale back on consulting engagements. BCG's own investor surveys in 2024 highlighted geopolitical risk as a paramount concern, potentially dampening client appetite for substantial, long-term projects.

Boutique and niche consulting firms are increasingly challenging established players like BCG. These specialized firms often provide deep expertise in specific areas, such as AI implementation or sustainability strategy, at a more competitive price point. For instance, the global management consulting market, valued at over $300 billion in 2023, is experiencing growth in these specialized segments, potentially diverting market share from larger, broader service providers.

Companies are increasingly building internal consulting arms, a trend that directly challenges the traditional external consulting model. For instance, a 2024 survey indicated that 65% of large enterprises are expanding their in-house digital transformation teams, aiming to handle more strategic projects internally.

This growing self-sufficiency means clients may outsource fewer strategic initiatives, impacting revenue streams for firms like BCG. As businesses invest in digital tools and talent, their need for external expertise in areas like data analytics and AI implementation may diminish, forcing consultants to adapt their service offerings.

Rapid Technological Disruption (e.g., AI Automation)

The rapid advancement of technologies like AI presents a significant threat by automating routine consulting tasks, such as data analysis and standard report generation. This trend could reduce demand for traditional consulting services if firms like BCG do not adapt. For instance, by 2025, it's projected that AI could handle up to 30% of current consulting work, particularly in areas like market research and basic financial modeling.

To counter this, BCG must continuously evolve its service portfolio to emphasize higher-value, complex problem-solving, strategic advisory, and human-centric skills that AI cannot replicate. This requires substantial investment in upskilling and reskilling its workforce to focus on areas like change management, organizational design, and bespoke strategic innovation.

- Automation Risk: AI could automate up to 30% of consulting tasks by 2025, impacting areas like data analysis and report generation.

- Skill Gap: A growing need to transition from routine tasks to higher-value, human-centric advisory services.

- Competitive Pressure: Firms that fail to adapt to AI-driven automation may lose market share to more agile competitors.

- Investment Imperative: Significant investment in workforce reskilling and service offering innovation is crucial for future relevance.

Talent Poaching and Wage Inflation

The consulting and tech industries are locked in a fierce battle for skilled professionals, making BCG vulnerable to talent poaching. Competitors, tech giants, and even clients actively recruit top consultants. This intense competition is driving up wages significantly, impacting BCG's operational costs and profitability.

Wage inflation in the consulting sector has been a persistent challenge. For instance, in 2023, average consultant salaries saw an upward trend, with some specialized roles experiencing double-digit percentage increases. This necessitates substantial investment in recruitment and retention programs to maintain a competitive edge.

- Talent Poaching: Competitors and tech firms aggressively target BCG's consultants.

- Wage Inflation: Demand for expertise is pushing up compensation packages.

- Operational Costs: Higher salaries directly impact BCG's profitability.

- Retention Investment: Significant resources are required to keep valuable employees.

The increasing sophistication of AI and automation poses a threat by potentially automating up to 30% of consulting tasks by 2025, particularly in data analysis and report generation. This necessitates a strategic shift towards higher-value, human-centric advisory services, requiring significant investment in workforce reskilling and service portfolio innovation to remain competitive.

SWOT Analysis Data Sources

This BCG SWOT analysis is built upon a robust foundation of data, including internal financial reports, comprehensive market intelligence, and expert industry analysis to ensure strategic accuracy.