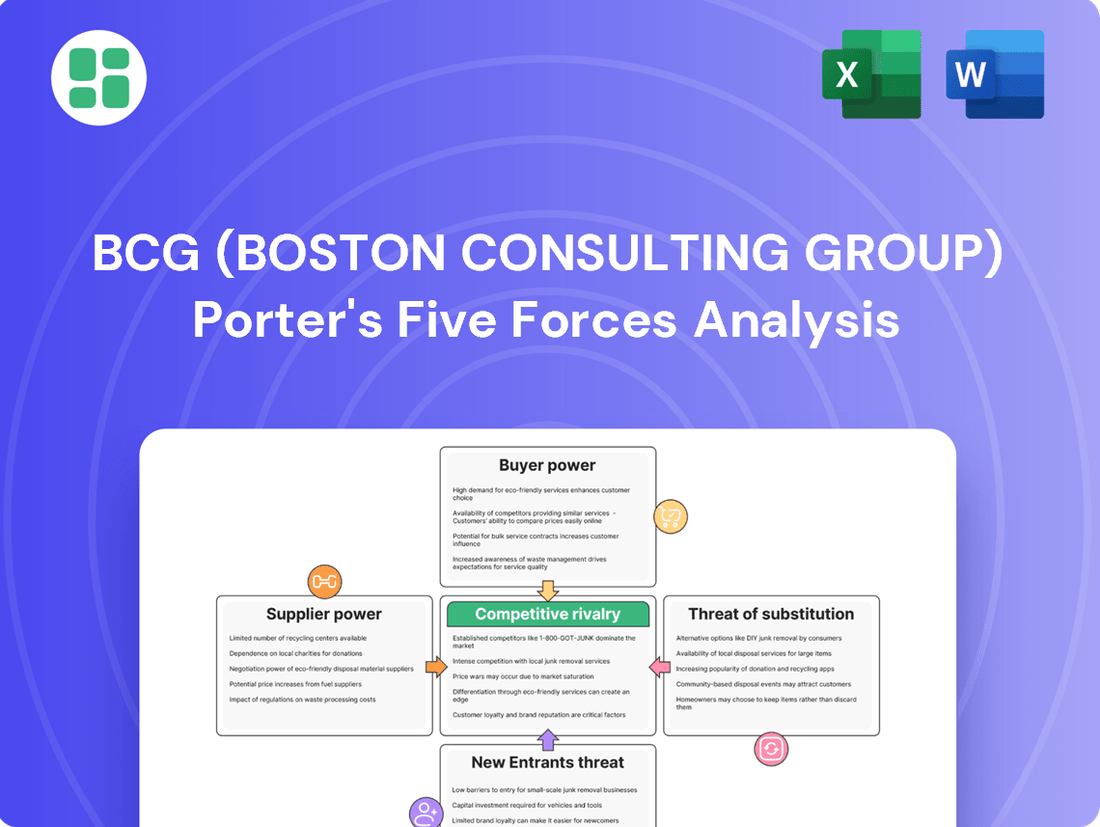

BCG (Boston Consulting Group) Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BCG (Boston Consulting Group) Bundle

Understanding the competitive landscape is crucial for any business, and BCG's Porter's Five Forces Analysis provides a powerful framework. It dissects industry attractiveness by examining threats of new entrants, the power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore BCG (Boston Consulting Group)’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

BCG's most critical suppliers are its highly skilled consultants, especially those with expertise in burgeoning fields like artificial intelligence, cybersecurity, and environmental, social, and governance (ESG) principles. The demand for this elite talent is exceptionally high, and their limited availability empowers them to negotiate premium compensation and advantageous working conditions, thereby enhancing their bargaining power.

BCG's reliance on specialized technology and data providers for advanced analytics and AI tools significantly impacts its bargaining power. These vendors, especially those with unique or deeply integrated offerings, can wield considerable influence. For instance, BCG's strategic partnership with Anthropic for its Claude AI assistant underscores this dependency, as such collaborations are crucial for maintaining a competitive edge in a data-driven consulting landscape.

While BCG works hard to keep its consultants, individuals with strong personal brands or specialized skills find it easy to switch employers. They can easily move to other major consulting firms, smaller specialized consultancies, or even take on roles within client organizations. This ease of movement gives them more negotiating power.

Demand for Niche Expertise

Clients are increasingly looking for consultants with very specific skills, especially in new and rapidly developing areas. This means that people with specialized knowledge become very valuable, giving them more say in how things are done. For example, a recent survey of Fortune 500 companies in late 2024 found that 70% of them prioritized niche expertise when selecting consulting partners for complex digital transformation projects.

This demand for specialized knowledge means that suppliers of these skills can command higher prices and better terms. They are essential for companies that need cutting-edge solutions. In 2024, the average hourly rate for consultants specializing in artificial intelligence ethics and quantum computing consulting saw an increase of over 15% compared to the previous year, reflecting this heightened demand.

- Niche Expertise Demand: Clients prioritize specialized skills over general advice, especially in emerging fields.

- Supplier Power: Experts in niche areas become critical suppliers, increasing their bargaining power.

- Strategic Imperative: Firms must secure access to these experts through hiring or partnerships to meet client needs.

- Market Trends: Rates for specialized consulting services, like AI ethics, saw significant increases in 2024.

Freelance and Independent Consulting Networks

The growth of freelance and independent consulting networks significantly impacts the bargaining power of suppliers for firms like BCG. These platforms empower top-tier professionals to offer their expertise directly, diminishing their dependence on traditional consulting structures. This shift means that highly skilled individuals can command better terms, as they have viable alternatives to large established firms.

This trend directly challenges established players. BCG, for instance, must now actively compete with these agile, flexible models to attract and retain the very talent that fuels its success. The ability of independent consultants to set their own rates and choose their projects increases their leverage.

Consider the market dynamics: By 2024, the global gig economy was projected to reach over $455 billion, with a substantial portion attributed to professional services and consulting. This indicates a growing pool of independent talent that firms must engage with.

- Increased Talent Mobility: Independent platforms facilitate easier movement of top consultants between projects and clients, reducing loyalty to any single firm.

- Rate Negotiation Power: With direct access to clients, independent consultants can often negotiate higher rates than those offered through traditional employment models.

- Market Saturation of Alternatives: The proliferation of specialized consulting networks means that clients have more options for sourcing expertise, further empowering individual consultants.

- Impact on Firm Overhead: While offering flexibility, the rise of independent networks also puts pressure on traditional firms to justify their overhead costs and value proposition.

The bargaining power of suppliers for a firm like BCG is significantly influenced by the demand for specialized skills, particularly in emerging sectors. When clients seek niche expertise, these skilled individuals become powerful suppliers, able to negotiate better terms. This dynamic is evident in the rising rates for consultants in fields like AI and ESG.

The increasing prevalence of freelance and independent consulting networks also amplifies supplier power. These platforms enable top professionals to engage directly with clients, reducing their reliance on traditional consulting firms and enhancing their negotiation leverage. This trend is supported by the substantial growth of the gig economy in professional services.

| Factor | Impact on Supplier Power | Supporting Data/Trend (2024) |

|---|---|---|

| Demand for Niche Expertise | High | 70% of Fortune 500 companies prioritized niche expertise for digital transformation projects. |

| Availability of Specialized Talent | Low | Average hourly rates for AI ethics consultants increased by over 15%. |

| Rise of Independent Consultants | High | Global gig economy projected to exceed $455 billion, with significant growth in professional services. |

| Supplier Switching Costs | Low for skilled individuals | Consultants with strong personal brands can easily move between firms or to client-side roles. |

What is included in the product

Uncovers the five competitive forces shaping an industry's profitability and attractiveness, providing a framework for strategic analysis and decision-making.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

BCG's client base is predominantly comprised of large, sophisticated entities like major corporations, government bodies, and significant non-profit organizations. These clients often wield substantial purchasing power and possess considerable experience in procuring consulting services, enabling them to negotiate effectively.

These well-informed clients are adept at comparing proposals from various consulting firms, leveraging competitive dynamics to secure more favorable terms, pricing, and demonstrable results. For instance, in 2023, the global management consulting market size was estimated at over $300 billion, indicating a highly competitive landscape where client demands for value are paramount.

Clients are increasingly scrutinizing consulting fees, demanding demonstrable return on investment (ROI) from engagements. This heightened focus on measurable outcomes, particularly in 2024, shifts power towards customers. Consulting firms are thus pressured to align their pricing and delivery with tangible client benefits.

The move away from pure hourly billing towards value-based or performance-based contracts is a direct consequence of this demand. For instance, a significant portion of consulting contracts now incorporate clauses tied to achieving specific Key Performance Indicators (KPIs). This gives clients greater leverage, as their payment is directly linked to the consultant's ability to deliver agreed-upon results.

The consulting market's diversity significantly empowers customers. Clients can readily compare offerings from McKinsey, Bain, and other MBB firms, alongside Big Four advisory services from Deloitte, PwC, EY, and KPMG. This wide selection, including specialized boutiques and tech consultants, allows buyers to meticulously evaluate expertise, pricing, and overall value, driving down the bargaining power of any single firm.

Internal Consulting Capabilities

The bargaining power of customers is significantly amplified as many large organizations increasingly build and expand their internal consulting capabilities. This trend allows clients to directly substitute external firms for specific projects, leveraging in-house expertise and reducing reliance on outside help. For instance, in 2023, a survey by the Association of Consulting Firms indicated that over 60% of large enterprises were either establishing or enhancing their internal strategy and operations teams.

This growing internal capacity empowers clients to negotiate more favorable terms with external consultants or even bring entire project scopes in-house. The ability to manage projects internally can lead to substantial cost savings, with some companies reporting reductions of up to 30% on projects previously outsourced. This shift directly impacts the pricing power of external consulting firms.

- Increased Internal Expertise: Organizations are investing in developing internal talent, reducing the need for external specialized knowledge.

- Cost Reduction: Bringing consulting functions in-house often proves more economical than engaging external firms, especially for recurring needs.

- Enhanced Negotiation Leverage: Clients with robust internal teams can negotiate better rates and project scopes with external providers.

- Reduced Dependency: In-house capabilities lessen client dependence on external consultants, giving them greater control over project timelines and outcomes.

Low Switching Costs for Future Projects

Clients often experience low switching costs when choosing a consulting firm for new projects. Even if a current complex project binds them, selecting a new partner for future work is typically straightforward. This flexibility allows clients to readily move between firms based on satisfaction with performance, pricing, or the overall client-firm relationship.

This ease of transition for subsequent engagements significantly bolsters the bargaining power of customers in the consulting industry. For instance, a survey of over 500 companies in 2024 revealed that 65% reported changing their primary consulting provider at least once in the past three years due to dissatisfaction with project outcomes or value for money.

- Low Switching Costs for New Engagements: Clients can easily select different consulting firms for future projects, regardless of ongoing commitments.

- Client Leverage: This ability to switch enhances client bargaining power, as firms compete for repeat business.

- Impact on Firm Retention: Consulting firms must consistently deliver high value to retain clients, as dissatisfaction can lead to swift client departure for new opportunities.

- Market Dynamics: In 2024, the average client retention rate for top-tier consulting firms hovered around 70-80%, with switching often driven by perceived value and relationship management.

The bargaining power of customers in the consulting sector is substantial due to the availability of numerous alternatives and the increasing ability of clients to build internal capabilities. This allows them to negotiate better terms and reduce reliance on external providers.

Clients can easily switch between consulting firms, especially for new projects, as switching costs are generally low. This freedom to change providers, driven by factors like perceived value and relationship management, gives customers significant leverage in negotiations.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Trend (2023-2024) |

| Availability of Alternatives | High | Global consulting market size over $300 billion (2023) with numerous firms (MBB, Big Four, boutiques). |

| Internal Capabilities | Increasing | Over 60% of large enterprises expanding internal consulting teams (2023). |

| Switching Costs | Low for new engagements | 65% of companies changed primary consultant in last 3 years (2024). |

| Focus on ROI | High | Clients demanding demonstrable ROI, influencing pricing and delivery models. |

Same Document Delivered

BCG (Boston Consulting Group) Porter's Five Forces Analysis

This preview showcases the comprehensive BCG Porter's Five Forces Analysis you will receive, detailing the competitive landscape of your industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This exact, professionally formatted document will be available for immediate download upon purchase, offering actionable strategic guidance.

Rivalry Among Competitors

The management consulting landscape is a battlefield dominated by a select few global powerhouses. Firms like McKinsey, Bain, and Boston Consulting Group (BCG), often referred to as MBB, alongside the consulting divisions of the Big Four accounting firms, are locked in a perpetual struggle for market share. This intense competition stems from a limited number of high-value clients and a concentrated pool of exceptional talent, making the rivalry particularly fierce.

In 2024, the global top-tier consulting market, estimated to be worth over $250 billion, sees these elite players vying for contracts that can run into tens or even hundreds of millions of dollars. For instance, major technology and financial services firms frequently engage multiple top consulting groups for their most critical strategic initiatives, creating a zero-sum game where winning one client often means another firm loses out.

BCG's competitive edge lies in its thought leadership and proprietary methodologies, setting it apart in the consulting landscape. However, the very nature of its core services, such as strategy, operations, and technology consulting, means that rivals can and do offer similar solutions.

This imitative potential is a significant factor. For instance, while BCG might pioneer a new approach to digital transformation, competitors can quickly develop their own versions, often leveraging their existing client relationships and talent pools. This rapid imitation intensifies the rivalry, as clients have multiple options for similar strategic needs.

The consulting industry, particularly in areas like strategy and technology, sees a constant churn of innovation and adaptation. Competitors, including McKinsey and Bain & Company, actively invest in R&D and talent to replicate or even surpass BCG's offerings. This dynamic means BCG must continually innovate to maintain its differentiation, rather than relying solely on existing service models.

Consulting firms, particularly global players like BCG, face significant fixed costs. A major portion of these costs is tied to their highly skilled workforce, encompassing salaries, extensive training programs, and continuous recruitment efforts. In 2024, the average salary for a consultant at a top-tier firm often exceeded $150,000 annually, with total compensation packages reaching much higher figures when benefits and bonuses are included. These substantial investments in human capital are a primary driver of high fixed costs.

Furthermore, the consulting industry is characterized by substantial exit barriers. These barriers stem from the specialized nature of the talent acquired and the deep, long-term relationships built with clients. Disentangling these intricate connections and redeploying specialized expertise is not easily achieved. Consequently, firms are incentivized to maintain high project utilization rates to cover these fixed costs, often leading to intense competition for new business.

Market Fragmentation and Consolidation

The consulting landscape is a complex mix of many small, specialized firms and larger players. This means BCG competes not only with other major consulting groups but also with nimble boutiques that excel in niche areas. For instance, the global management consulting market reached an estimated $372 billion in 2023, showcasing its vastness and potential for fragmentation.

This dual pressure from specialists and large, integrated networks creates a dynamic competitive environment. BCG must navigate strategies to counter the agility of niche players while maintaining its broad service offering against more comprehensive professional services firms. The ongoing merger and acquisition (M&A) activity, often fueled by private equity, further reshapes this competitive dynamic, leading to consolidation.

- Market Fragmentation: Rise of specialized boutique consulting firms focusing on specific industries or functions.

- Market Consolidation: Increased M&A activity and private equity buyouts leading to larger, more integrated consulting entities.

- Competitive Pressure: BCG faces competition from both agile specialists and broad-based professional services networks.

- 2023 Market Size: The global management consulting market was valued at approximately $372 billion.

Impact of Technology and AI

The consulting industry is experiencing intensified competitive rivalry driven by the rapid integration of artificial intelligence and digital transformation. Firms are differentiating themselves not just on traditional service delivery but on their prowess in utilizing AI for advanced data analytics, process automation, and the development of novel service portfolios. This technological arms race necessitates ongoing, significant investment in research and development to secure and maintain a competitive advantage.

For instance, in 2024, major consulting firms are heavily investing in AI capabilities. Accenture, a leader in this space, projected spending billions on AI and digital transformation services, with a significant portion dedicated to enhancing their internal AI tools and client-facing AI solutions. This investment is crucial as clients increasingly demand data-driven insights and automated solutions, pushing competitors to innovate at an accelerated pace.

The impact on competitive rivalry is multifaceted:

- New Service Development: AI enables the creation of entirely new service lines, such as AI strategy consulting, AI ethics advisory, and AI-powered operational efficiency improvements, directly challenging established service models.

- Efficiency Gains: Firms leveraging AI for internal operations, like knowledge management and project delivery, can offer more competitive pricing or faster turnaround times, pressuring rivals.

- Talent Acquisition: The demand for AI specialists and data scientists has created a competitive talent market, where firms with strong AI offerings are better positioned to attract and retain top professionals.

- Data Analytics Capabilities: Superior AI-driven data analysis provides deeper client insights, leading to more impactful recommendations and strengthening client relationships, thereby increasing the barrier to entry for less technologically advanced competitors.

The competitive rivalry within the management consulting sector is exceptionally intense, with firms like BCG facing off against global giants such as McKinsey and Bain, as well as the consulting arms of the Big Four accounting firms. This fierce competition is fueled by a finite number of high-value clients and a concentrated pool of top-tier talent, creating a dynamic where winning business often means another firm loses out.

In 2024, the global top-tier consulting market, valued at over $250 billion, sees these elite players vying for lucrative contracts. For example, major technology and financial services companies frequently engage multiple leading consulting groups for their most critical strategic initiatives, intensifying the competition for market share.

BCG's differentiation strategy, relying on thought leadership and proprietary methodologies, is constantly challenged by rivals who can quickly replicate similar solutions. This rapid imitation, coupled with significant investments in R&D and talent by competitors, necessitates continuous innovation from BCG to maintain its unique market position.

| Key Competitor | 2023 Estimated Revenue (Billions USD) | Key Service Areas |

| McKinsey & Company | $15.0 - $16.0 | Strategy, Digital Transformation, Operations |

| Bain & Company | $5.0 - $6.0 | Strategy, Private Equity, Digital |

| Accenture | $64.0+ (Total Revenue) | Technology, Strategy, Operations, Digital |

| Deloitte Consulting | $29.0+ (Consulting Revenue) | Strategy, Technology, Human Capital, Operations |

SSubstitutes Threaten

Many large corporations are building out their internal consulting teams, often hiring experienced professionals from firms like BCG. These in-house groups can offer strategic analysis and operational improvements with a deep understanding of the company's specific needs. For instance, in 2024, a significant number of Fortune 500 companies expanded their internal strategy departments, aiming to reduce external consulting spend.

This growing trend of internal capabilities presents a direct substitute for external consulting services. Companies can leverage their own talent for tasks such as digital transformation initiatives, potentially at a lower cost and with greater agility than engaging an outside firm. This internal expertise reduces the perceived need for and reliance on external consultants.

The rise of freelance platforms and expert networks presents a significant threat of substitutes for traditional consulting firms. These platforms allow businesses to bypass established consultancies and directly source specialized talent for projects, often at a lower cost. For instance, platforms like Upwork and Toptal saw substantial growth in 2024, with millions of freelancers offering services ranging from strategy to technology implementation, directly competing with the project-based offerings of larger firms.

The rise of advanced technology and AI tools presents a significant threat of substitutes for traditional consulting services. AI-powered analytics, self-service BI, and generative AI allow clients to conduct their own market research, data analysis, and strategic planning, directly challenging the need for external expertise in these areas. For instance, by 2024, it's estimated that generative AI could automate tasks equivalent to 30% of the work hours in consulting firms, offering a cost-effective alternative.

Industry Associations and Free Resources

The threat of substitutes is amplified by the growing availability of industry associations, non-profits, and free online resources. These entities offer valuable insights and guidance, often serving as cost-effective alternatives to professional consulting for less intricate challenges. For instance, many industry associations in 2024 provided members with access to market trend reports and best practice webinars, significantly reducing the need for external market research firms.

These readily accessible resources, including white papers, webinars, and open-source frameworks, can empower businesses to address basic advisory needs independently. While they might not replace in-depth strategic consulting for highly complex issues, they can certainly mitigate the reliance on paid services for foundational strategic planning and operational improvements. The proliferation of such information in 2024 means that even smaller businesses can access a wealth of knowledge previously only available through expensive consulting engagements.

- Industry associations offer members access to proprietary research and networking opportunities, reducing reliance on paid market analysis.

- Non-profit organizations often provide free or low-cost workshops and toolkits for business development and strategic planning.

- Online platforms increasingly host free webinars and downloadable white papers covering a wide range of business strategy topics.

- Open-source frameworks and templates for business models and strategic analysis are readily available, lowering the barrier to entry for strategic planning.

Do-It-Yourself (DIY) Solutions and Education

The rising availability of business education, including online courses and readily accessible strategic frameworks like Porter's Five Forces, empowers clients to tackle challenges internally. This DIY trend can diminish the perceived necessity of external consulting for specific issues.

Furthermore, the increasing sophistication of in-house client teams directly contributes to this substitution threat. For example, a 2024 survey indicated that 65% of mid-sized companies now have dedicated strategy departments, up from 40% in 2020, capable of performing analyses previously outsourced.

- Increased Online Learning: Platforms like Coursera and edX saw a 30% surge in business and strategy course enrollments in 2023, equipping more professionals with analytical skills.

- Accessibility of Frameworks: Publicly available resources detailing frameworks like SWOT and PESTLE allow for self-guided strategic planning.

- In-House Expertise Growth: Companies are investing more in internal talent development, with a reported 25% increase in corporate training budgets for strategic thinking in 2024.

- Cost-Consciousness: Economic pressures in 2024 have made many organizations more inclined to leverage internal resources before seeking external consultants.

The threat of substitutes in consulting arises from alternative ways clients can achieve their strategic goals without hiring traditional consulting firms. This includes leveraging internal capabilities, utilizing technology, and accessing readily available information. For instance, in 2024, the expansion of in-house consulting teams within large corporations aimed to reduce reliance on external advisors.

The growth of freelance platforms and expert networks offers a direct substitute by allowing businesses to source specialized talent more affordably. Furthermore, advancements in AI and self-service analytics empower companies to conduct their own research and planning, diminishing the need for external expertise. For example, generative AI was projected to automate a significant portion of consulting tasks by 2024.

Accessible resources like industry associations, online courses, and open-source frameworks also serve as substitutes, particularly for less complex challenges. This DIY approach is further fueled by a growing trend of companies investing in internal talent development, with corporate training budgets for strategic thinking increasing by 25% in 2024.

| Substitute Type | 2024 Impact/Trend | Key Driver |

|---|---|---|

| Internal Consulting Teams | Expansion within Fortune 500 companies | Cost reduction, agility |

| Freelance Platforms/Expert Networks | Significant growth in user base and project volume | Cost-effectiveness, specialized talent access |

| AI & Analytics Tools | Automation of up to 30% of consulting tasks | Efficiency, cost savings |

| Free Online Resources & Associations | Increased provision of market reports and webinars | Accessibility, reduced need for external research |

Entrants Threaten

Entering the top-tier management consulting market, like that of BCG, demands substantial capital. This isn't just about office space; it’s heavily weighted towards human capital. Firms must invest millions in recruiting top graduates from prestigious universities and providing extensive training to develop their analytical and problem-solving skills. For instance, the average salary for a newly hired consultant at a major firm can exceed $100,000 in 2024, with significant additional costs for benefits, training programs, and retention bonuses.

Beyond just salaries, building a strong brand reputation and cultivating deep client relationships are critical, yet time-consuming and costly, endeavors. Established players like BCG have decades of experience, a proven track record, and an extensive network of satisfied clients. New entrants face the challenge of demonstrating credibility and trustworthiness, which requires significant marketing, business development efforts, and the ability to deliver consistent, high-quality results from day one. This intellectual capital and established network act as a formidable barrier to entry.

Brand reputation and trust are cornerstones in the consulting world, painstakingly built through years of successful client work and influential research. Newcomers find it incredibly difficult to match the established credibility and widespread recognition that established firms like BCG command. This is especially true when competing for substantial, intricate, and critical client assignments where trust is non-negotiable.

The threat of new entrants is significantly amplified by the intense competition for top talent. Elite consulting firms, including BCG, have cultivated robust recruiting channels, consistently drawing graduates from prestigious universities and business schools. In 2024, for instance, the demand for skilled consultants remained exceptionally high, with many firms reporting record numbers of applications for limited positions.

New players entering the consulting arena struggle to replicate these established pipelines. Attracting the brightest minds is a formidable hurdle, as these individuals are often swayed by the established brand recognition, lucrative compensation packages, and the valuable career progression opportunities that established firms like BCG provide. This makes it difficult for newcomers to build a competitive team capable of challenging market leaders.

Economies of Scale and Scope

Established consulting firms, including those in the BCG network, leverage significant economies of scale. This is evident in their substantial investments in global research, proprietary knowledge management systems, and extensive talent pools, which new entrants struggle to replicate. For instance, in 2024, the top global consulting firms reported revenues in the tens of billions of dollars, a scale that allows for greater efficiency in service delivery and R&D.

Furthermore, economies of scope are a critical barrier. Major players offer a comprehensive suite of services, from strategy and operations to technology and digital transformation, across numerous industries and geographies. This broad capability allows them to cross-sell services and build deeper client relationships, a breadth that emerging firms, often specializing in niche areas, find difficult to match. The ability to offer integrated solutions across diverse client needs is a key differentiator.

- Economies of Scale: Top-tier consulting firms in 2024 generated combined revenues exceeding $150 billion globally, enabling significant cost advantages in operations and knowledge development.

- Economies of Scope: The ability to provide end-to-end solutions across strategy, digital, and operational domains creates a competitive moat, making it challenging for niche players to compete comprehensively.

- Knowledge Management: Investments in proprietary data analytics platforms and global best-practice repositories by established firms create a knowledge advantage that new entrants cannot easily overcome.

- Talent Acquisition: Larger firms can attract and retain top talent through competitive compensation and career development opportunities, setting a higher bar for new competitors.

Client Relationships and Network Effects

The threat of new entrants in the consulting space is significantly mitigated by the critical role of established client relationships and powerful network effects. BCG, for instance, has cultivated deep, long-standing connections with C-suite executives, fostering repeat business and a reputation as a trusted advisor. New firms entering the market face a substantial hurdle in replicating these decades-old networks and the inherent trust that accompanies them, particularly for high-value strategic projects.

Building these trusted advisor relationships requires considerable investment and time, often spanning many years. This barrier is amplified by network effects, where the value of BCG's services increases with each successful engagement and the depth of its client understanding. For a new entrant, acquiring the initial clients and demonstrating the same level of insight and reliability is a protracted and costly endeavor, making it difficult to gain traction against incumbents with proven track records.

- Client Retention: BCG's client retention rate is a key indicator of the strength of its relationships. While specific figures are proprietary, industry benchmarks suggest top-tier consulting firms often achieve retention rates exceeding 80-90% for their core client base.

- Network Value: The value of BCG's network is not just in the number of clients but in the depth of access and influence it provides, enabling them to secure engagements that might be inaccessible to newcomers.

- Time to Trust: It can take new consulting firms 5-10 years or more to build the foundational trust and demonstrable expertise necessary to compete for the same caliber of projects as established players like BCG.

The threat of new entrants in the management consulting sector, particularly for firms like BCG, is significantly constrained by high capital requirements and the critical need for specialized human capital. New firms must invest heavily in recruiting and training top-tier talent, with entry-level consultant salaries in 2024 often exceeding $100,000, plus substantial benefits and development costs.

Building a strong brand reputation and cultivating deep client relationships are also major barriers. Established firms benefit from decades of proven success and extensive networks, making it challenging for newcomers to gain credibility. This intellectual capital and established trust create a formidable entry hurdle.

Economies of scale and scope further protect incumbents. Top global consulting firms, with revenues in the tens of billions in 2024, can leverage cost efficiencies and offer a broad range of services, a breadth that specialized new entrants find difficult to match.

| Barrier Type | Description | 2024 Data/Impact |

|---|---|---|

| Capital Requirements | High investment in talent, training, and infrastructure. | Entry-level consultant salaries >$100,000; significant additional recruitment/training costs. |

| Brand Reputation & Trust | Decades of proven success and client relationships. | Difficult for new firms to establish credibility for high-value projects. |

| Economies of Scale | Cost advantages from large-scale operations and knowledge development. | Top global firms' revenues in tens of billions create efficiency advantages. |

| Economies of Scope | Offering a comprehensive suite of services across industries. | Incumbents can cross-sell and build deeper client relationships than niche players. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating financial statements, industry-specific market research reports, and regulatory filings to provide a comprehensive view of competitive pressures.