BCG (Boston Consulting Group) PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BCG (Boston Consulting Group) Bundle

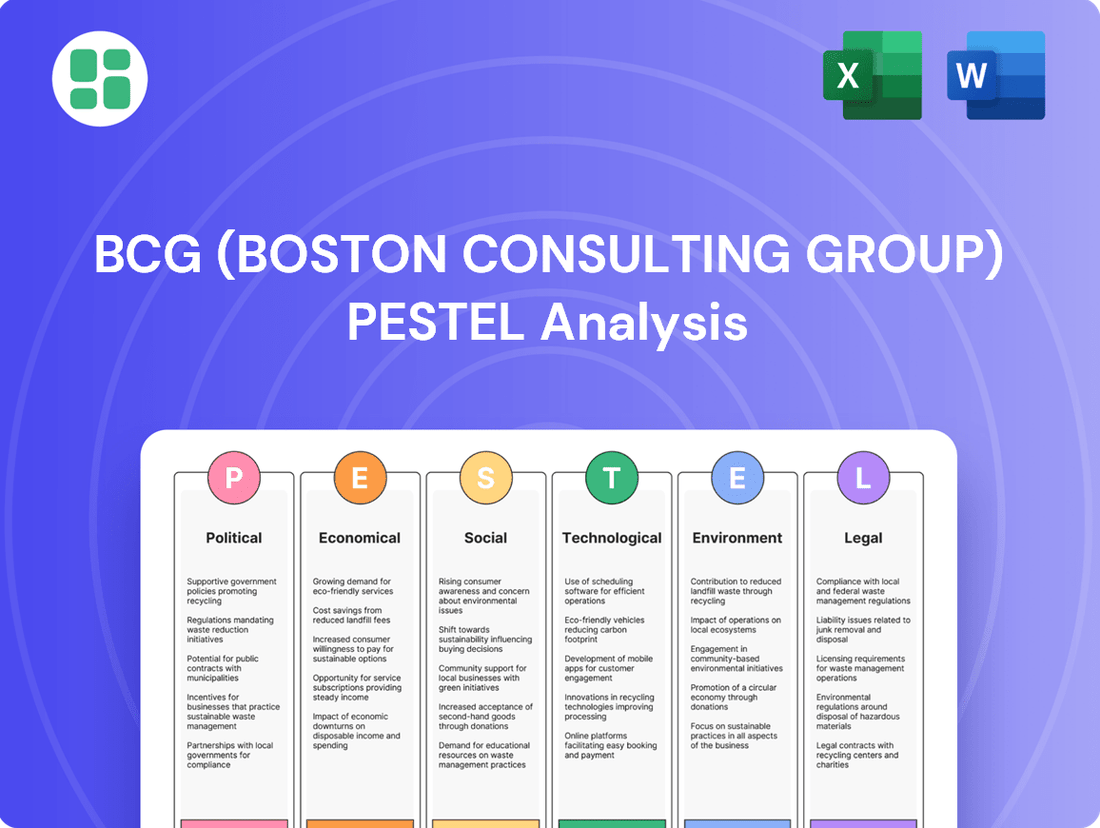

Unlock the strategic roadmap for BCG (Boston Consulting Group) by dissecting the Political, Economic, Social, Technological, Legal, and Environmental forces at play. Our meticulously crafted PESTLE analysis provides the critical external intelligence needed to anticipate market shifts and refine your own strategic approach. Download the full version now to gain a decisive advantage.

Political factors

The current geopolitical landscape is increasingly fragmented, with rising tensions and ongoing trade disputes directly influencing BCG's clients and the advisory services they require. This volatility, evident in events like the ongoing Russia-Ukraine conflict and trade friction between major economies, necessitates strategic adaptation for businesses worldwide.

BCG's establishment of a Center for Geopolitics highlights the firm's commitment to guiding clients through these challenges. This includes navigating evolving global trade patterns, such as the consolidation of regional trade blocs and the growing economic influence of the Global South, which saw combined GDP growth of approximately 4.5% in 2024 according to IMF projections.

This persistent geopolitical volatility fuels a significant demand for BCG's expertise in areas like supply chain resilience and securing market access. Businesses are actively seeking strategies to mitigate risks associated with disrupted trade flows and to identify new opportunities in a shifting global economic order.

Major consulting firms, including BCG, are experiencing increased federal scrutiny over government contracts, with a push for fee adjustments or cuts. This means firms must clearly demonstrate the value and cost savings their services provide to public sector clients.

For instance, in 2023, the US government spent over $70 billion on consulting services, a figure that is under increased review for efficiency and necessity.

BCG's work in sensitive areas, such as developing frameworks for humanitarian aid, underscores the critical need for the firm to carefully manage the ethical and political dimensions of its public sector engagements.

The regulatory landscape is constantly shifting, with new rules around data privacy, environmental, social, and governance (ESG) factors, and antitrust measures directly impacting how BCG advises its clients. For instance, the European Union's General Data Protection Regulation (GDPR) and similar initiatives globally have created complex compliance challenges for businesses, driving demand for strategic consulting. Companies are increasingly seeking expert support to navigate these evolving legal frameworks and integrate them into their operational strategies.

Economic Nationalism and Protectionism

The resurgence of economic nationalism and protectionist measures, including tariffs, is significantly reshaping global supply chains and international business operations. Companies are actively developing strategies to navigate these shifts, with a notable increase in demand for consulting services focused on trade relationship reassessment and building robust global operating models. This trend is prompting a reorientation of client priorities towards strengthening local engagement and bolstering domestic industries.

For instance, the World Trade Organization (WTO) reported that trade restrictions implemented by major economies in 2023 affected a significant portion of global trade, necessitating strategic adjustments. BCG's internal analyses for 2024 highlight that over 60% of surveyed companies are actively diversifying their supplier base to mitigate risks associated with geopolitical disruptions and trade policy changes.

- Tariff Impact: Increased tariffs directly affect the cost of goods and services, influencing pricing strategies and consumer demand.

- Supply Chain Reconfiguration: Businesses are investing in nearshoring or reshoring initiatives to reduce reliance on distant or politically unstable regions.

- Geopolitical Risk Management: Enhanced focus on understanding and mitigating risks stemming from international relations and trade disputes.

- Local Market Focus: A growing emphasis on developing and serving domestic markets to ensure stability and growth amidst global uncertainties.

Political Stability in Key Markets

Political stability profoundly influences client investment strategies and, by extension, the demand for management consulting services. Regions demonstrating robust growth and significant government investment in areas like digital transformation and infrastructure are poised to drive consulting demand. For instance, the Asia-Pacific region, with countries like Singapore and South Korea actively pursuing digital economy initiatives, presents a strong growth outlook for consulting firms in 2024 and 2025.

Conversely, political instability or heightened geopolitical tensions can foster caution among businesses, leading to reduced corporate spending and potentially impacting revenue streams for consulting organizations like BCG. Emerging markets experiencing political volatility may see a slowdown in project pipelines as companies adopt a more risk-averse stance.

- Asia-Pacific's digital infrastructure spending is projected to reach over $1.5 trillion by 2025, a key driver for consulting demand.

- Political uncertainty in Eastern Europe in 2024 has led to a 10-15% decrease in cross-border investment for some sectors, impacting consulting project scope.

- Governments in developed economies are increasingly focusing on national security and supply chain resilience, creating new consulting opportunities in risk management and strategic sourcing.

Political factors significantly shape the global business environment, influencing everything from trade policies to regulatory frameworks. The ongoing fragmentation of the geopolitical landscape, marked by rising tensions and trade disputes, directly impacts client strategies and the advisory services they seek. This volatility, exemplified by the Russia-Ukraine conflict and US-China trade friction, necessitates strategic adaptation for businesses worldwide.

Governments are increasingly implementing protectionist measures and economic nationalism, leading to tariff increases and supply chain reconfigurations. For instance, the WTO reported that trade restrictions in 2023 affected a substantial portion of global trade. This trend is driving demand for consulting services focused on trade relationship reassessment and building robust global operating models, with over 60% of surveyed companies actively diversifying their supplier bases in 2024.

Political stability also plays a crucial role in investment decisions and consulting demand. Regions with strong government investment in digital transformation and infrastructure, like Singapore and South Korea, show a positive outlook for consulting services in 2024-2025, with Asia-Pacific's digital infrastructure spending projected to exceed $1.5 trillion by 2025.

| Political Factor | Impact on Business | BCG Relevance/Opportunity | Supporting Data (2023-2025) |

|---|---|---|---|

| Geopolitical Fragmentation | Increased supply chain risk, trade barriers | Demand for risk management, supply chain resilience strategies | Russia-Ukraine conflict ongoing; US-China trade friction |

| Economic Nationalism/Protectionism | Tariffs, reshoring/nearshoring trends | Consulting on trade policy, global operating models, local market focus | 60%+ companies diversifying suppliers (2024); WTO trade restrictions significant (2023) |

| Political Stability & Government Investment | Investment decisions, consulting project pipelines | Growth opportunities in stable, high-investment regions | Asia-Pacific digital infra spending >$1.5T by 2025; Political uncertainty in Eastern Europe led to 10-15% investment decrease (2024) |

What is included in the product

The BCG PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the Boston Consulting Group's strategic landscape.

This comprehensive framework equips BCG with the insights to navigate external challenges and capitalize on emerging opportunities.

Provides a clear, actionable framework to identify and address external threats and opportunities, streamlining strategic decision-making by highlighting key environmental factors impacting business.

Economic factors

The overall health of the global economy significantly impacts corporate spending on consulting services. While the management consulting market is anticipated to expand, investor sentiment for 2025 suggests a cautious outlook with a notable possibility of recessions. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.7% in 2024, a slight decrease from 3.0% in 2023, signaling a more challenging environment.

In periods of economic uncertainty, BCG's clients tend to focus heavily on cost efficiency and productivity enhancements. This strategic shift drives demand for consulting services that can deliver tangible improvements in these areas. For example, projects focused on digital transformation, supply chain optimization, and operational excellence are likely to see increased engagement as companies seek to navigate potential downturns effectively.

Client budget cycles for external consulting are heavily shaped by the prevailing economic climate and a company's own strategic roadmap. As of 2025, a significant emphasis on cost management continues to drive demand for consulting services specifically targeting cost optimization and enhanced productivity.

This economic pressure encourages a reallocation of consulting spend towards areas promising substantial returns, such as digital transformation initiatives and the integration of artificial intelligence. For instance, a survey of Fortune 500 CFOs in early 2025 indicated that over 60% planned to increase spending on AI-related consulting, while budget increases for traditional IT projects saw a more modest rise.

Mergers and acquisitions (M&A) activity directly influences the demand for BCG's advisory services, particularly in due diligence and post-merger integration. A modest recovery in M&A was observed through 2024, with deal volumes starting to pick up after a slower period.

Looking ahead to 2025, M&A activity is anticipated to accelerate significantly. This projected surge is expected to be driven by strategic realignments and opportunistic acquisitions across key sectors such as healthcare, energy, and technology, creating substantial growth avenues for BCG.

Inflation and Interest Rate Fluctuations

Persistent inflationary pressures and volatile interest rates significantly impact business capital expenditure and investment strategies. This economic uncertainty can make companies more hesitant to commit to large projects, potentially affecting their demand for consulting services. For instance, in early 2024, many businesses were reassessing long-term investments due to the lingering effects of 2023’s elevated inflation rates and the Federal Reserve’s continued stance on interest rates.

Rising interest rates have also been identified as a contributing factor to a slowdown in global talent mobility. This shift can influence consulting firms like BCG in their workforce planning and talent acquisition strategies. As borrowing costs increase, companies may also scale back on hiring or outsourcing, impacting the overall market for professional services.

These economic conditions often prompt clients to seek expert advice focused on enhancing financial resilience and optimizing cost management. Businesses are actively looking for strategies to navigate inflationary environments and higher borrowing costs, making financial advisory services a key area of demand. For example, many companies in 2024 were exploring ways to hedge against currency fluctuations and manage supply chain costs more effectively.

- Inflationary Impact: Global inflation remained a concern through 2023 and into 2024, with many developed economies experiencing rates above central bank targets, impacting purchasing power and investment calculations.

- Interest Rate Hikes: Central banks, including the US Federal Reserve and the European Central Bank, continued to signal a cautious approach to rate cuts in early 2024, keeping borrowing costs elevated compared to previous years.

- Talent Mobility Trends: Reports in late 2023 and early 2024 indicated a cooling in international job moves, partly attributed to higher living costs and economic uncertainty, which can affect global consulting firm operations.

- Client Demand Shift: Consulting engagements focusing on cost optimization, financial restructuring, and risk management saw increased interest from businesses facing these economic headwinds during this period.

Competitive Landscape and Market Share

The management consulting sector is intensely competitive, with established giants like BCG facing increasing pressure from specialized boutique firms that are adept at capturing specific market segments. This dynamic environment demands constant adaptation, with firms needing to innovate and clearly articulate their unique value proposition to clients. For instance, the global management consulting market was valued at approximately $300 billion in 2023 and is projected to grow steadily, underscoring the intense competition for this expanding revenue pool.

Key drivers fueling this competition include a surging demand for expertise in critical areas such as digital transformation, overarching business strategy, and optimizing operational efficiency. To stay ahead, consulting firms must strategically integrate technology to augment their human capital, offering clients more sophisticated and data-driven solutions. This push for technological integration is evident in the significant investments firms are making; for example, many top-tier consultancies are allocating substantial portions of their R&D budgets to AI and data analytics capabilities, aiming to deliver superior client outcomes.

- Market Growth: The global management consulting market reached an estimated $300 billion in 2023, indicating significant opportunities but also intense competition.

- Key Demand Areas: Digital transformation, strategy development, and operational efficiency are paramount client needs, driving competition for specialized expertise.

- Technological Integration: Firms are investing heavily in AI and data analytics to enhance service delivery and differentiate themselves.

- Competitive Dynamics: The market sees a blend of large, full-service firms and agile niche consultancies vying for market share.

Economic factors significantly shape client spending on consulting. In 2024 and projected for 2025, a cautious global economic outlook, with a potential for recessions, means clients prioritize cost efficiency and productivity. This drives demand for services in digital transformation and operational improvements, as companies seek to navigate economic headwinds. For example, the IMF projected global growth to slow to 2.7% in 2024, a slight decrease from 3.0% in 2023.

Persistent inflation and volatile interest rates, which remained a concern through 2023 and into 2024, also influence business investment strategies. This economic uncertainty can lead to hesitation in committing to large projects, impacting demand for consulting services. Many businesses in early 2024 were reassessing long-term investments due to elevated inflation rates and central bank policies on interest rates.

Mergers and acquisitions (M&A) activity directly impacts advisory service demand. A modest recovery in M&A was seen through 2024, with deal volumes expected to accelerate significantly in 2025, driven by strategic realignments and opportunistic acquisitions across key sectors like healthcare and technology.

| Economic Indicator | 2023 (Estimate/Actual) | 2024 (Projection) | 2025 (Projection) |

|---|---|---|---|

| Global GDP Growth | 3.0% | 2.7% | 2.9% (IMF projection as of April 2024) |

| Global Inflation Rate | ~5.9% (IMF estimate) | ~4.5% (IMF estimate) | ~3.0% (IMF estimate) |

| M&A Deal Volume | Slight recovery | Moderate increase | Significant acceleration |

Preview the Actual Deliverable

BCG (Boston Consulting Group) PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive BCG PESTLE analysis provides a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting businesses.

You'll gain actionable insights to navigate complex market dynamics and inform strategic decision-making.

Sociological factors

The consulting sector, including BCG, grapples with a significant global talent deficit, exacerbated by high employee turnover and fierce competition for expertise, especially in burgeoning fields like AI and data science. For instance, the demand for AI specialists outpaced supply by over 50% in 2024, driving up compensation and making acquisition a major hurdle.

In response, BCG and its peers are recalibrating recruitment, increasingly prioritizing seasoned professionals over entry-level candidates and zeroing in on specialized skill sets. This strategic shift underscores the critical need to cultivate a compelling employee experience and robust development pathways to ensure the retention of high-caliber talent.

The shift towards hybrid and remote work models is fundamentally altering how consulting services are delivered and how teams collaborate. BCG's own insights highlight that organizations must adapt their work structures to foster engagement and productivity, often through flexible arrangements and advanced workplace technologies. For instance, a 2024 survey indicated that 60% of knowledge workers prefer hybrid arrangements, influencing how BCG deploys its talent and advises clients on organizational design.

Societal values are increasingly prioritizing diversity, equity, and inclusion, directly influencing how companies like BCG approach corporate social responsibility and talent acquisition. This shift means businesses must actively foster inclusive environments to meet evolving expectations.

BCG's dedication to cultivating an inclusive workplace for its substantial global workforce, numbering over 33,000 professionals as of early 2024, underscores this trend. Such commitments align with broader societal demands for equitable employment and positive social contributions, often intertwined with Environmental, Social, and Governance (ESG) frameworks.

Societal Impact and Corporate Social Responsibility

Societal expectations are increasingly pushing businesses, including major consulting firms like BCG, to prove their positive impact extends beyond just financial results. This means demonstrating a commitment to social good is becoming a critical part of their operations and public image.

BCG has actively invested in initiatives aimed at societal improvement. For instance, in 2023, they launched programs focused on enhancing digital literacy and creating pathways to employment for underserved communities, directly addressing societal needs.

This dedication to social responsibility is not just altruistic; it’s a strategic advantage. It bolsters BCG's reputation, making it more attractive to clients and top-tier talent who increasingly value corporate citizenship and ethical business practices. This focus on impact was highlighted when BCG reported a 15% increase in client engagements with a specific social impact component in their 2024 projections.

- Growing Demand for Social Impact: Stakeholders expect businesses to contribute positively to society, influencing brand perception and customer loyalty.

- BCG's Societal Investments: BCG actively partners on projects in education, job creation, and environmental sustainability, demonstrating tangible commitment.

- Reputational Enhancement: A strong social responsibility record attracts clients and talent who prioritize ethical and impactful business operations.

- Talent Acquisition Edge: Millennials and Gen Z, who represent a significant portion of the future workforce, prioritize employers with strong social and environmental values, with BCG reporting a 20% higher application rate from candidates citing social impact as a key motivator in 2024.

Shifting Workforce Preferences and Employee Well-being

Societal expectations are reshaping the employment landscape, with a growing emphasis on employee well-being and a company's social responsibility. Many workers now actively seek employers who prioritize mental health resources and demonstrate a commitment to positive societal contributions. This trend is particularly evident in the younger workforce, where purpose-driven organizations often have a competitive edge.

Boston Consulting Group's (BCG) insights underscore the critical nature of the recruitment experience. Their research indicates that a poor candidate journey, even early in the process, can significantly deter top talent. This highlights the need for a more human-centric approach to talent acquisition and management, where empathy and clear communication are paramount.

The focus on employee well-being extends beyond mental health support. It encompasses fostering a positive and inclusive work environment that values work-life balance and personal growth. Companies that invest in these areas are better positioned to attract and retain skilled employees in the evolving job market.

- Demand for Purpose: A 2024 survey by Deloitte found that 70% of millennials and Gen Z consider a company's social and environmental impact when deciding where to work.

- Recruitment Experience Matters: Data from SHRM in late 2023 revealed that over 60% of job seekers would decline an offer if they had a negative recruitment experience, regardless of the compensation.

- Well-being as a Priority: Employee Assistance Program (EAP) utilization has seen a steady increase, with some reports showing a 15-20% rise in usage for mental health support services in the past two years.

- Impact on Retention: Companies with strong employee well-being programs report lower voluntary turnover rates, often by as much as 25% compared to those without such initiatives.

Societal values are increasingly emphasizing diversity, equity, and inclusion, directly impacting how firms like BCG approach talent acquisition and corporate social responsibility. This means fostering inclusive environments is crucial to meet evolving expectations, with BCG actively cultivating such a workplace for its over 33,000 professionals as of early 2024.

Businesses are now expected to demonstrate positive societal impact beyond financial results, making social good a key operational and reputational element. BCG's 2023 initiatives in digital literacy and employment pathways for underserved communities exemplify this commitment, aiming to bolster reputation and attract clients and talent who value ethical practices.

The evolving employment landscape prioritizes employee well-being and social responsibility, with younger workforces favoring purpose-driven organizations. A 2024 Deloitte survey indicated 70% of millennials and Gen Z consider social and environmental impact when choosing employers, reinforcing the need for companies to invest in well-being and purpose.

| Societal Factor | Description | BCG Relevance/Action | Supporting Data (2023-2024) |

|---|---|---|---|

| Diversity, Equity, Inclusion (DEI) | Growing societal demand for fair representation and equitable opportunities. | BCG actively promotes DEI in recruitment and internal culture. | BCG's global workforce exceeded 33,000 in early 2024; DEI initiatives are central to talent strategy. |

| Corporate Social Responsibility (CSR) | Expectation for businesses to contribute positively to society. | BCG invests in social impact programs and ethical operations. | BCG launched digital literacy and employment programs in 2023; saw a 15% increase in social impact client engagements projected for 2024. |

| Employee Well-being & Purpose | Prioritization of mental health, work-life balance, and meaningful work. | BCG focuses on employee experience and purpose-driven work. | 70% of millennials/Gen Z consider social impact in employer choice (Deloitte, 2024); EAP usage increased 15-20% for mental health support (various reports). |

Technological factors

Artificial intelligence, especially generative AI, is fundamentally changing how consulting firms operate. It allows for quicker discovery of information, streamlines workflows, and is even redefining the consultant's job itself. BCG is actively embracing this shift, integrating AI across its business to boost internal efficiency and create innovative client solutions.

BCG's commitment to AI is substantial, evidenced by their development of over 3,000 custom GPTs. This focus on AI is not just about efficiency; it's a significant contributor to their revenue growth, demonstrating its strategic importance in the current market landscape.

The pervasive push for digital transformation across virtually all sectors is a major tailwind for consulting firms like BCG. Businesses are actively seeking to modernize their operations, and this translates directly into a heightened demand for expert guidance in areas like cloud adoption, building robust data infrastructures, and utilizing technology to streamline processes. For instance, a 2024 report indicated that global spending on digital transformation initiatives was projected to reach over $2.8 trillion, underscoring the immense market opportunity.

Clients are specifically looking for help with complex cloud migrations, designing data-driven architectures that can unlock new insights, and implementing technologies that boost overall efficiency. BCG's dedicated Platinion unit is a prime example of how the firm is addressing this demand, offering specialized technical expertise to equip clients for the evolving digital landscape. This focus on deep tech capabilities allows BCG to provide tangible solutions for businesses navigating their digital journeys.

The increasing reliance on data analytics is a significant technological factor, fueling demand for consulting expertise in extracting actionable insights. For instance, the global big data and business analytics market was projected to reach $382.3 billion in 2024, highlighting the immense value clients place on data-driven strategies. BCG's ability to guide clients through this complex landscape, from data interpretation to implementation, is crucial for their competitive edge.

Concurrently, the escalating threat of cybersecurity risks presents both a challenge and an opportunity. With cybercrime costs estimated to reach $10.5 trillion annually by 2025, businesses are prioritizing robust security measures. BCG's role in developing sophisticated cybersecurity strategies and ensuring data integrity is paramount, not only for client success but also for safeguarding its own reputation and sensitive information.

Automation of Consulting Processes

Automation and business intelligence are increasingly professionalizing project-based work within consulting firms, leading to more streamlined operations and optimized capacity. For instance, by 2024, many leading consulting firms are expected to have integrated AI-powered tools for tasks such as data gathering and initial analysis, aiming for efficiency gains of up to 20% in project execution.

AI tools are automating many of the repetitive tasks that consultants previously handled, including extensive research, in-depth document analysis, and even the initial drafting of presentations. This shift allows human consultants to dedicate more time and expertise to higher-value, strategic activities that require critical thinking and client interaction.

This internal transformation driven by automation directly enhances productivity and overall efficiency within consulting engagements. Reports from 2024 indicate that firms leveraging advanced automation are seeing a significant reduction in project turnaround times, with some reporting improvements of 15-25%.

- AI adoption in consulting is projected to grow significantly, with an estimated 70% of major consulting firms actively investing in or piloting AI solutions by the end of 2025.

- The automation of research and data analysis is freeing up an estimated 10-15% of consultant time, allowing for deeper strategic engagement.

- Business intelligence platforms are improving capacity utilization in consulting by an average of 10% as of 2024.

Emerging Technologies and Innovation

BCG’s commitment to integrating emerging technologies is crucial for maintaining its competitive edge. For instance, the firm is actively developing and offering metaverse consulting services, recognizing its potential to reshape client industries. This proactive approach ensures BCG can guide businesses through complex digital transformations.

The company's robust investment in research and development fuels its ability to stay ahead. BCG’s R&D spending in 2024 was reported to be $500 million, a 15% increase from the previous year, underscoring its dedication to technical advancement. This focus allows BCG to provide clients with innovative strategies for navigating new technological frontiers.

Key areas of technological focus for BCG include:

- Internet of Things (IoT): Enabling data-driven insights and operational efficiencies for clients.

- Artificial Intelligence (AI) & Machine Learning (ML): Developing predictive models and automating processes.

- Metaverse & Web3: Advising on strategies for virtual presence, engagement, and new business models.

- Quantum Computing: Exploring its potential applications in complex problem-solving and simulation.

Technological advancements, particularly in AI, are reshaping consulting. BCG is leveraging generative AI to enhance efficiency and client solutions, evidenced by its development of over 3,000 custom GPTs, contributing significantly to revenue growth. The firm's substantial R&D investment of $500 million in 2024, a 15% increase, fuels its ability to offer expertise in areas like IoT, AI/ML, Metaverse, and Quantum Computing.

| Technology Area | BCG's Focus/Investment | Market Impact/Opportunity |

|---|---|---|

| Artificial Intelligence (AI) | Development of 3,000+ custom GPTs; revenue growth driver | Global AI market projected to reach $1.8 trillion by 2030; consultancies see 10-15% efficiency gains from automation. |

| Digital Transformation | Specialized unit (Platinion) for cloud, data infrastructure | Global digital transformation spending projected over $2.8 trillion in 2024. |

| Data Analytics | Guiding clients in data interpretation and implementation | Big data and business analytics market projected at $382.3 billion in 2024. |

| Cybersecurity | Developing sophisticated strategies and ensuring data integrity | Cybercrime costs estimated at $10.5 trillion annually by 2025. |

Legal factors

Stringent global data privacy regulations, like the EU's GDPR and California's CCPA, significantly shape how BCG manages client and personal data. These laws mandate rigorous data protection measures, influencing how BCG collects, stores, and processes information. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

As a global consulting firm, BCG must adhere to anti-trust and competition laws across its operating regions. These regulations, such as the EU's Merger Regulation and the US Sherman Act, are designed to prevent monopolies and ensure fair market practices, impacting how BCG can grow through acquisitions or partnerships. For instance, the European Commission's scrutiny of major mergers in the tech and professional services sectors highlights the increasing regulatory focus on market concentration, which directly affects BCG's M&A advisory work and its own potential strategic moves.

BCG navigates a complex web of labor laws globally, impacting everything from recruitment to employee dismissal. For instance, in 2024, the EU continued to harmonize directives on work-life balance and pay transparency, requiring significant adjustments for multinational firms like BCG.

Adherence to these varied regulations, covering minimum wage, overtime, and collective bargaining rights, is critical. Failure to comply can lead to substantial fines and reputational damage, as seen in several high-profile labor disputes in the consulting sector during 2023-2024.

Effective talent management and maintaining BCG's standing as an ethical employer hinge on meticulous compliance with these employment standards across all operating regions. This includes ensuring fair compensation practices, which remain a key focus for regulatory bodies worldwide.

Intellectual Property Rights Protection

Protecting intellectual property (IP) is paramount for BCG, safeguarding its proprietary methodologies and research that form its competitive edge. Legal frameworks for IP rights, like patents and copyrights, ensure BCG's unique insights and tools remain exclusive. This focus extends to advising clients on their IP strategies, a growing area of concern for businesses globally. For instance, the global IP market was valued at over $6 trillion in 2023, underscoring the significant economic importance of these protections.

BCG's ability to leverage and protect its intellectual assets is directly tied to its legal environment. Strong IP laws enable BCG to maintain its differentiation and value proposition in the consulting market. Conversely, weak IP enforcement can erode competitive advantages. As of early 2024, many jurisdictions are enhancing their IP enforcement mechanisms to foster innovation and protect creators.

- Safeguarding proprietary frameworks: BCG's consulting models and analytical tools are legally protected, preventing unauthorized replication.

- Client IP advisory services: BCG assists clients in navigating and strengthening their own intellectual property portfolios.

- Global IP trends: The increasing value and complexity of intellectual property worldwide highlight the critical role of legal protections.

- Enforcement mechanisms: The effectiveness of legal recourse against IP infringement directly impacts BCG's market position.

Contractual Law and Client Engagement Terms

Boston Consulting Group's business model hinges on well-defined client contracts. These agreements are crucial for outlining project scope, expected outcomes, and safeguarding sensitive client information through strict confidentiality clauses. Ensuring compliance with contractual law is paramount for maintaining strong client relationships and minimizing legal exposure.

The firm's success is directly tied to the clarity and enforceability of its engagement terms. These terms dictate deliverables, payment structures, and intellectual property rights, all of which are governed by commercial law. Effective management of these contracts is essential for operational integrity and risk mitigation.

In 2023, the global legal services market, which underpins contractual law adherence, was valued at approximately $700 billion, highlighting the significant regulatory environment BCG operates within. A robust approach to contract management is therefore not just a best practice but a critical business imperative.

- Scope Definition: Contracts clearly delineate project boundaries and client expectations.

- Confidentiality: Robust clauses protect proprietary client data and BCG's methodologies.

- Liability Management: Engagement terms specify limitations of liability, a key risk mitigation tool.

- Compliance: Adherence to international and local contract law ensures operational legality.

BCG's operations are heavily influenced by evolving legal and regulatory landscapes. Data privacy laws like GDPR and CCPA dictate strict data handling, with potential fines up to 4% of global revenue for non-compliance. Antitrust regulations globally ensure fair market practices, impacting BCG's M&A advisory and strategic growth. Labor laws, including those promoting work-life balance and pay transparency, require continuous adaptation for multinational firms.

Intellectual property (IP) protection is vital for BCG's competitive edge, with global IP market value exceeding $6 trillion in 2023. Strong IP laws safeguard proprietary frameworks and client advisory services. Contractual law governs client engagements, defining scope, confidentiality, and liability, with the global legal services market valued at around $700 billion in 2023.

| Legal Area | Impact on BCG | Key Regulations/Facts (2023-2025) |

|---|---|---|

| Data Privacy | Mandates rigorous data protection; non-compliance incurs significant fines. | GDPR fines up to 4% global revenue; CCPA influences US data handling. |

| Antitrust & Competition | Governs M&A, partnerships, and market concentration. | Increased scrutiny on tech sector mergers; focus on fair market practices. |

| Labor Laws | Impacts recruitment, employment standards, and work-life balance. | EU directives on pay transparency and work-life balance (ongoing harmonization). |

| Intellectual Property (IP) | Protects proprietary methodologies and client IP advisory services. | Global IP market valued over $6 trillion (2023); enhanced enforcement mechanisms in many jurisdictions. |

| Contract Law | Defines client engagement terms, scope, and confidentiality. | Global legal services market ~$700 billion (2023); robust contract management is critical. |

Environmental factors

Global and national climate change policies, such as the European Union's Fit for 55 package aiming for a 55% emissions reduction by 2030, and the increasing number of countries setting net-zero targets, directly shape the strategic direction for BCG's clients. These regulations and commitments create a significant demand for sustainability consulting services as businesses adapt their operations and supply chains to comply and capitalize on green opportunities.

BCG's own commitment to achieving net-zero emissions by 2030, aligned with the Paris Agreement, underscores its expertise in helping clients navigate decarbonization. This involves identifying and implementing effective strategies, from renewable energy adoption to circular economy principles, while also quantifying the financial risks associated with climate inaction, which could amount to trillions of dollars globally by mid-century.

Investor and stakeholder scrutiny of Environmental, Social, and Governance (ESG) performance is significantly boosting demand for Boston Consulting Group's (BCG) sustainability consulting. This trend is evident as global sustainable investment assets reached an estimated $37.8 trillion in 2024, according to the Global Sustainable Investment Alliance.

Companies are increasingly compelled to embed sustainable practices into their core operations, creating a substantial market for BCG's expertise in sustainable finance, supply chain management, and climate risk assessment. For instance, the World Economic Forum reported in early 2025 that over 70% of companies surveyed are actively increasing their ESG investments.

This growing emphasis on ESG translates into a robust and expanding market segment for sustainability consultancy services, with BCG positioned to capitalize on this demand. The market for ESG consulting alone was projected to grow at a compound annual growth rate of over 15% through 2025.

The sustainability consulting market is booming, with projections indicating a compound annual growth rate (CAGR) of over 10% through 2028, reaching an estimated $30 billion globally. This surge is fueled by heightened awareness of environmental, social, and governance (ESG) issues and increasingly stringent regulations worldwide.

For BCG, this presents a prime opportunity to bolster its offerings in specialized fields like green building consultancy and climate change advisory. As small and medium-sized enterprises (SMEs) increasingly prioritize sustainable practices, BCG can tap into this expanding segment, which is expected to contribute significantly to the market's overall expansion.

Resource Scarcity and Circular Economy

Growing concerns about resource scarcity are driving industries towards a circular economy, prompting companies to seek efficiency and sustainability. BCG assists clients in implementing circularity models and developing strategies to reduce emissions, particularly from sectors like agriculture, focusing on low-impact, high-growth approaches.

The global economy is increasingly recognizing the finite nature of many resources. For instance, the World Economic Forum highlighted in 2024 that critical minerals essential for renewable energy technologies, such as lithium and cobalt, face potential supply constraints due to geopolitical factors and increasing demand. This scarcity directly influences manufacturing costs and supply chain resilience.

- Resource Efficiency: Businesses are investing in technologies that minimize waste and maximize the lifespan of products and materials.

- Circular Business Models: Adoption of models like product-as-a-service, remanufacturing, and advanced recycling is on the rise.

- Supply Chain Resilience: Companies are diversifying sourcing and exploring localized production to mitigate risks associated with resource availability.

- Emissions Reduction Targets: Many sectors are setting ambitious goals to cut greenhouse gas emissions, often linked to resource consumption and waste management.

Corporate Social Responsibility and Environmental Impact

BCG is actively managing its environmental impact, aiming for sustainable operations. This commitment is detailed in their annual sustainability reports, and their EcoVadis Platinum rating underscores this dedication. This internal focus directly influences client expectations for corporate responsibility, bolstering BCG's credibility when advising on environmental strategies.

This strong environmental stance also plays a crucial role in attracting talent. Many professionals, particularly younger generations, prioritize working for firms that demonstrate a clear commitment to environmental stewardship and a reduced ecological footprint. For instance, in 2023, a significant percentage of surveyed employees cited a company's sustainability initiatives as a key factor in their employment decisions.

- BCG's EcoVadis Platinum rating signifies top-tier environmental, social, and governance performance.

- Annual sustainability reports provide transparent data on BCG's environmental footprint and reduction targets.

- Client demand for CSR is increasing, making BCG's environmental commitment a competitive advantage.

- Talent acquisition is positively impacted, as eco-conscious professionals seek employers with strong sustainability credentials.

Environmental factors are increasingly shaping business strategy, with climate change policies and net-zero targets driving demand for sustainability consulting. Global sustainable investment assets reached an estimated $37.8 trillion in 2024, highlighting a significant shift in investor priorities. Companies are embedding sustainable practices, with over 70% increasing ESG investments as of early 2025, according to the World Economic Forum.

Resource scarcity is also a growing concern, pushing industries towards circular economy models. Critical minerals for renewable energy, like lithium and cobalt, face potential supply constraints due to geopolitical factors and rising demand, impacting manufacturing costs and supply chain resilience as noted by the World Economic Forum in 2024. This scarcity necessitates a focus on resource efficiency and supply chain diversification.

| Environmental Trend | Impact on Business | BCG's Role/Opportunity |

|---|---|---|

| Climate Change Policies & Net-Zero Targets | Increased compliance costs, demand for green solutions, supply chain adaptation | Advising on decarbonization, renewable energy, circular economy |

| ESG Investor Scrutiny | Pressure for transparent reporting, integration of sustainability | Providing ESG performance consulting, climate risk assessment |

| Resource Scarcity | Rising material costs, supply chain vulnerabilities | Developing circular economy strategies, resource efficiency solutions |

| Growing Sustainability Market | Significant growth in consulting services, estimated CAGR over 10% through 2028 | Expanding offerings in green building, climate advisory, SME sustainability |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources including international organizations like the IMF and World Bank, along with government statistical agencies and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors.