Bank Central Asia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank Central Asia Bundle

Navigate the complex external forces shaping Bank Central Asia's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, social trends, environmental regulations, and legal frameworks create both opportunities and challenges for this leading Indonesian bank. Gain a critical competitive edge by leveraging these expert-level insights to inform your strategic decisions.

Ready to make smarter, data-driven choices? Download the full PESTLE analysis of Bank Central Asia now and unlock actionable intelligence. Equip yourself with the knowledge to anticipate market changes, mitigate risks, and identify lucrative growth avenues. Don't miss out on this essential tool for investors, consultants, and strategic planners.

Political factors

Indonesia's political landscape, especially following the 2024 elections, is a crucial determinant for the banking sector. A stable government ensures that regulations affecting banks, such as capital requirements and lending policies, remain consistent, which is vital for investor confidence. For instance, a predictable policy environment encourages long-term investment in financial institutions like Bank Central Asia (BCA).

Policy continuity is paramount for financial institutions. A stable political regime means that the economic and financial policies enacted will likely persist, creating a predictable operating environment for banks. This stability allows BCA to plan its strategies with greater certainty, knowing that major regulatory shifts are less probable, thereby supporting sustained growth and operational efficiency.

Conversely, any significant political upheaval or abrupt changes in government policy could introduce considerable uncertainty. Such instability might lead to a slowdown in economic activity or a reassessment of investment strategies by both domestic and international investors. This could indirectly impact BCA's loan growth and overall financial performance, highlighting the direct link between political stability and banking sector health.

The Financial Services Authority (OJK) is instrumental in shaping Indonesia's banking landscape. For instance, OJK Regulation 26/2024 has broadened the scope of permissible activities for commercial banks, offering greater legal certainty and fostering innovation. This regulatory environment directly impacts BCA's strategic planning and operational capacity.

The OJK's evolving approach to key areas such as capital participation, loan transfers, and the burgeoning digital banking sector presents both opportunities and challenges for Bank Central Asia. Adaptability to these regulatory shifts is paramount for maintaining BCA's competitive edge and ensuring continued growth within the Indonesian financial market.

Bank Indonesia's (BI) monetary policy, particularly its benchmark interest rate, the BI 7-Day Reverse Repo Rate, directly impacts Bank Central Asia's (BCA) cost of funds and the interest rates it can charge on loans. For instance, BI maintained its benchmark rate at 6.00% throughout 2023 and into early 2024, aiming to control inflation and support economic growth. This stability in policy rates provides a predictable environment for BCA's lending and deposit pricing strategies.

BI's commitment to keeping inflation within its target range, typically between 2% and 4%, is crucial for BCA. Stable inflation reduces uncertainty for borrowers and depositors, fostering a more robust demand for credit and banking services. In 2023, Indonesia's inflation rate averaged around 3.7%, falling within BI's target corridor, which supported a generally favorable operating environment for BCA.

Furthermore, BI's efforts to stabilize the Rupiah exchange rate against major currencies are vital for BCA, especially given its significant foreign currency transactions and investments. By intervening in the foreign exchange market when necessary, BI helps mitigate volatility. For example, while the Rupiah experienced some fluctuations in 2024, BI's interventions aimed to prevent sharp depreciations, thereby protecting the value of BCA's foreign assets and liabilities.

Any shifts in BI's monetary policy, such as an increase or decrease in the BI 7-Day Reverse Repo Rate, can directly affect BCA's net interest margin (NIM). If BI raises rates, BCA's funding costs may rise faster than its lending rates, potentially squeezing NIM, or vice versa. In 2023, BCA reported a strong NIM, partly supported by the prevailing interest rate environment managed by BI.

Government Initiatives for Financial Inclusion

Government initiatives aimed at boosting financial inclusion in Indonesia create significant opportunities for Bank Central Asia (BCA). These programs, designed to enhance financial literacy and access, particularly in rural and underserved regions, align well with BCA's robust digital infrastructure and broad customer reach. The bank is well-positioned to onboard new customers through these government-backed efforts.

BCA can capitalize on these policies to expand its market share by reaching segments previously excluded from formal financial services. For instance, the National Strategy for Financial Inclusion (STRANAS-IK) targets increasing the financial inclusion rate to 90% by 2024, a goal that BCA can actively contribute to and benefit from. This expansion could translate into substantial growth in customer deposits and transaction volumes.

However, these initiatives may also impose certain obligations on BCA. Banks might face regulatory expectations to invest in less commercially viable areas or to offer services at subsidized rates to meet social inclusion objectives. This could necessitate strategic resource allocation to balance profitability with the mandate of broader financial access, potentially impacting short-term margins but fostering long-term goodwill and market penetration.

- Government Push for Financial Inclusion: Indonesia aims to achieve a 90% financial inclusion rate by 2024, a target that BCA can leverage for customer acquisition.

- Digital Reach Advantage: BCA's advanced digital platforms are ideal for serving previously unbanked populations targeted by government inclusion programs.

- Potential Regulatory Obligations: Banks may need to allocate resources towards initiatives that, while socially beneficial, might offer lower immediate financial returns.

- Market Expansion Opportunity: These government-led efforts present a clear pathway for BCA to deepen its penetration in underserved segments and rural areas.

Geopolitical Risks and International Relations

Geopolitical tensions, particularly ongoing conflicts in the Middle East, present a significant risk that can indirectly impact Bank Central Asia (BCA) and Indonesia's financial sector. These events can trigger currency volatility and dampen investor confidence, as seen in historical responses where capital often flows to perceived safe-haven assets. For instance, during periods of heightened global uncertainty, the Indonesian Rupiah (IDR) has shown sensitivity to external shocks, impacting foreign exchange markets. BCA, therefore, maintains a vigilant watch on these global macroeconomic shifts and their potential influence on investor sentiment and capital flows.

Government foreign policy and the negotiation of international trade agreements also play a crucial role in shaping the economic landscape for BCA. Favorable trade deals can boost international capital inflows, fostering economic stability and indirectly benefiting the banking industry by increasing liquidity and investment opportunities. Conversely, strained international relations or unfavorable trade terms could lead to reduced foreign investment, potentially affecting BCA's growth prospects and overall financial market stability in Indonesia.

- Geopolitical Instability: Conflicts in regions like the Middle East can lead to increased global risk aversion, potentially affecting foreign investment in emerging markets like Indonesia.

- Currency Fluctuations: Geopolitical events can cause significant swings in currency values, impacting the cost of foreign currency transactions for BCA and its clients.

- Trade Policy Impact: Indonesia's engagement in international trade agreements, such as those with major trading partners like China and the US, directly influences capital movement and economic growth, which in turn affects the banking sector.

Indonesia's political stability, particularly in the wake of the 2024 elections, is a cornerstone for Bank Central Asia's (BCA) operational environment. A predictable policy framework, supported by the Financial Services Authority (OJK) and Bank Indonesia (BI), is essential for maintaining investor confidence and enabling strategic planning. For instance, the OJK's continued efforts to modernize banking regulations, alongside BI's stable monetary policy, create a conducive atmosphere for BCA's sustained growth and market position.

What is included in the product

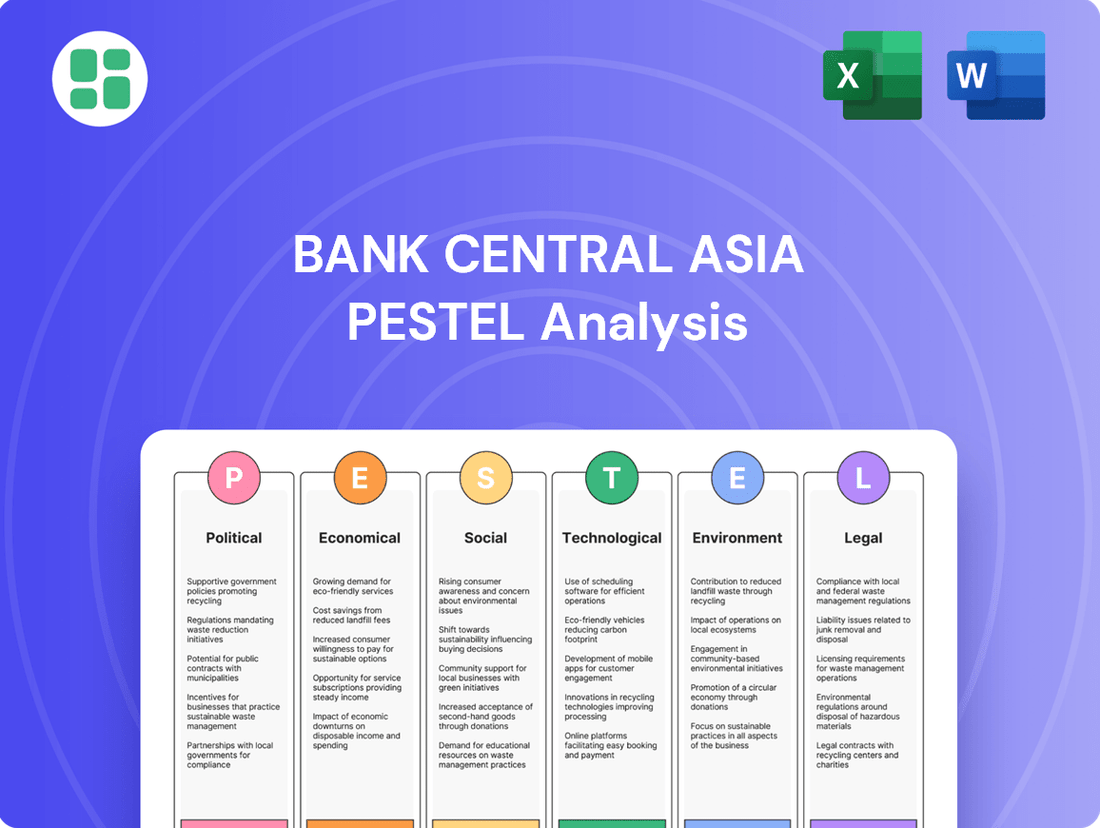

This PESTLE analysis of Bank Central Asia examines how political stability, economic growth, social trends, technological advancements, environmental concerns, and legal frameworks present both challenges and opportunities for the bank's strategic planning.

A clear, concise PESTLE analysis for Bank Central Asia provides a readily digestible overview of external factors, serving as a vital tool for identifying potential risks and opportunities during strategic planning.

Economic factors

Indonesia's GDP growth rate is a critical driver for Bank Central Asia (BCA), influencing demand for its banking products and services like loans and deposits. The nation's economic performance directly translates into business opportunities for the bank.

Projections for Indonesia's GDP growth in 2024 and 2025 hover around 4.8% to 5.2%. This suggests a generally stable economic climate, though it also points to a potentially moderating growth pace compared to previous periods. Global economic shifts and the strength of domestic consumption are key variables affecting this outlook.

Should the growth rate indeed settle at the lower end of this projected range, it could prompt banks like BCA to adopt a more prudent approach to lending. This means a potential increase in caution when extending credit, reflecting the prevailing economic conditions.

Inflationary pressures in Indonesia have remained relatively contained, with the Consumer Price Index (CPI) hovering around 3.0% for much of 2024, aligning with Bank Indonesia's (BI) target range. This stability is a positive sign for Bank Central Asia (BCA).

Bank Indonesia's monetary policy, particularly its benchmark interest rate, directly impacts BCA's profitability. While BI has maintained a prudent stance, there's anticipation of potential rate cuts in late 2024 or early 2025 if inflation continues to moderate. Such a move could lead to a slight compression in BCA's net interest margin (NIM), though its robust low-cost deposit base, which constituted over 70% of its total deposits in Q1 2024, offers a significant cushion against margin pressure.

The predictable inflation targets set by BI for 2024-2025 create a more stable operating environment for BCA. This predictability allows for better financial planning and risk management, supporting BCA's ability to maintain its lending capacity and overall financial health.

Household consumption is a significant engine for Indonesia's Gross Domestic Product (GDP), directly impacting the demand for financial products like consumer loans, credit cards, and digital payment solutions that Bank Central Asia (BCA) provides. In 2023, Indonesia's GDP grew by 5.05%, with household consumption contributing a substantial portion.

Despite potential fluctuations in consumer confidence, factors such as government stimulus and seasonal events, like the Idul Fitri holiday period, often provide a boost to consumption patterns. For instance, during the 2024 Idul Fitri travel period, transaction volumes through BCA's digital channels saw a notable increase, reflecting sustained consumer activity.

BCA's strategic emphasis on offering a wide array of loan products, particularly consumer loans, is well-positioned to capitalize on these prevailing household spending trends. This diversification allows the bank to cater to various consumer needs, from everyday purchases to larger investments, thereby supporting its growth alongside the Indonesian economy.

Exchange Rate Fluctuations

Exchange rate fluctuations significantly influence Bank Central Asia's (BCA) operations, particularly its foreign exchange transactions, import-export financing services, and overall financial health. The stability of the Indonesian Rupiah (IDR) against major global currencies like the US Dollar (USD) is paramount for managing these aspects effectively.

Bank Indonesia actively intervenes in the foreign exchange market to maintain Rupiah stability, a critical factor for mitigating financial risks and encouraging foreign investment. For instance, in early 2024, Bank Indonesia continued its efforts to stabilize the Rupiah amidst global economic uncertainties, with the IDR trading around IDR 16,000 per USD.

A strengthening USD or broader global trade uncertainties can exert downward pressure on the IDR. This can impact BCA's balance sheet through revaluation of foreign currency assets and liabilities, potentially affecting profitability and capital adequacy ratios. For example, a sustained depreciation of the Rupiah could increase the cost of foreign currency funding for BCA.

Key impacts of exchange rate fluctuations on BCA include:

- Foreign Exchange Operations: BCA's trading income from foreign exchange transactions is directly tied to currency volatility.

- Import/Export Financing: Fluctuations affect the cost of imports and the competitiveness of exports for BCA's corporate clients, influencing loan demand and risk.

- Balance Sheet Revaluation: Changes in exchange rates can alter the Rupiah value of BCA's foreign currency-denominated assets and liabilities.

- Capital Flows: Rupiah stability is crucial for attracting and retaining foreign capital, which supports BCA's liquidity and funding sources.

Global Economic Conditions and Trade

Global economic uncertainties, such as potential new trade tariffs and varying economic performance across major economies like China, directly influence Indonesia's trade balance and commodity prices. For instance, a slowdown in China, a key trading partner, could dampen demand for Indonesian exports. Bank Central Asia (BCA), as a significant financial institution, faces exposure to these global shifts through its corporate clients and the broader market sentiment, which affects lending and investment activities.

The health of Indonesia's external position, underpinned by sustained trade surpluses and robust foreign direct investment (FDI) inflows, is crucial for the banking sector. In 2023, Indonesia recorded a trade surplus of approximately $52.3 billion, a slight decrease from the record $54.5 billion in 2022, highlighting the sensitivity to global demand. Conversely, FDI inflows for the first nine months of 2023 reached $35.0 billion, showing resilience despite global headwinds, which supports the banking sector's stability.

- Trade Balance Sensitivity: Indonesia's trade surplus, a key indicator of external strength, can be directly impacted by global demand fluctuations and trade policy changes.

- Commodity Price Volatility: as a major commodity exporter, Indonesia's export revenues are susceptible to price swings influenced by global economic conditions.

- Foreign Investment Influence: Robust FDI inflows are vital for economic growth and provide liquidity to the financial system, benefiting banks like BCA.

- Global Spillover Effects: BCA's corporate lending portfolio is exposed to international market sentiment and the financial health of its global-facing clients.

Indonesia's economic growth outlook for 2024 and 2025 is projected to be around 4.8% to 5.2%, indicating a stable yet potentially moderating growth trajectory. This environment influences BCA's lending strategies, encouraging a more prudent approach if growth leans towards the lower end of projections. Inflation has remained manageable, with the CPI around 3.0% in early 2024, aligning with Bank Indonesia's targets, which supports a stable operating environment for BCA.

Bank Indonesia's monetary policy, particularly its benchmark interest rate, directly affects BCA's net interest margin. While potential rate cuts in late 2024 or early 2025 could slightly compress margins, BCA's strong low-cost deposit base, over 70% in Q1 2024, provides a significant buffer.

Household consumption remains a key driver of Indonesia's GDP, directly boosting demand for BCA's consumer banking products. Despite potential confidence fluctuations, events like Idul Fitri often stimulate spending, as seen in increased digital transaction volumes for BCA in 2024. BCA's focus on diverse loan products positions it well to benefit from these consumption trends.

Exchange rate stability, particularly for the IDR against the USD (around IDR 16,000 per USD in early 2024), is vital for BCA's foreign exchange operations and financing services. While Bank Indonesia intervenes to maintain stability, global economic shifts and a strengthening USD can impact BCA's balance sheet through revaluation effects and the cost of foreign currency funding.

| Economic Factor | 2023 Data | 2024 Projection | 2025 Projection | Impact on BCA |

|---|---|---|---|---|

| GDP Growth | 5.05% | 4.8% - 5.2% | 4.8% - 5.2% | Influences loan demand and economic opportunities. |

| Inflation (CPI) | ~3.0% | ~3.0% | ~3.0% | Supports stable operating environment and interest rate policy. |

| Trade Balance | $52.3 billion surplus | Projected surplus | Projected surplus | Affects corporate clients and foreign exchange market stability. |

| IDR/USD Exchange Rate | ~IDR 15,000/USD | ~IDR 16,000/USD | Stable with interventions | Impacts foreign currency assets/liabilities and trading income. |

Preview Before You Purchase

Bank Central Asia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Bank Central Asia. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. You'll gain valuable insights into the strategic landscape and potential challenges and opportunities for BCA.

Sociological factors

Indonesian consumers are rapidly shifting towards digital banking, prioritizing convenience and user-friendly platforms. BCA's digital offerings, like the Blu by BCA app, are resonating strongly, particularly with younger demographics such as Gen Z, indicating a successful alignment with evolving preferences.

This growing digital adoption means banks like BCA must consistently enhance their digital infrastructure and user experience to stay competitive. For instance, as of early 2024, over 80% of BCA's transactions are conducted digitally, underscoring the critical importance of these channels for customer engagement and operational efficiency.

Indonesia's demographic landscape is characterized by a substantial and growing young population, with a significant portion falling into the Gen Z category. As of 2024, over 40% of Indonesia's population is under 25 years old, a demographic that is inherently digitally native and highly receptive to technological advancements.

This youth segment, particularly Gen Z, is a key driver for digital banking adoption, expecting seamless, fast, and secure online experiences. Their preference for digital channels directly influences how banks like Bank Central Asia (BCA) develop and market their products, prioritizing intuitive mobile apps and online services.

BCA's future growth hinges on its ability to effectively target and serve this tech-savvy youth market with innovative digital solutions. For instance, by mid-2025, it's projected that over 70% of new account openings at leading Indonesian banks will originate from digital channels, underscoring the importance of this demographic's preferences.

Despite ongoing efforts, financial literacy in Indonesia, particularly among younger demographics and in rural communities, continues to present a hurdle. Bank Central Asia (BCA) has an opportunity to significantly boost this by implementing targeted educational programs, thereby fostering greater financial inclusion across the nation.

Bridging the knowledge gap regarding complex financial products is crucial for BCA to effectively expand its customer base and tap into underserved segments of the market. For instance, a 2023 survey indicated that only 38% of Indonesian adults felt confident managing their personal finances, highlighting the need for accessible financial education.

Urbanization and Rural-Urban Divide

The ongoing urbanization trend in Indonesia, with an increasing percentage of the population moving to cities, creates a significant urban-rural divide in financial access and literacy. By late 2024, it’s estimated that over 60% of Indonesia's population resides in urban areas, leading to concentrated demand for advanced digital banking services.

This disparity presents both challenges and opportunities for Bank Central Asia (BCA). While urban centers boast higher digital adoption rates, rural communities still lag, necessitating customized financial products and educational initiatives. BCA's robust network of branches and ATMs, numbering over 1,200 branches and more than 18,000 ATMs as of early 2025, can be strategically leveraged to bridge this gap and enhance financial inclusion in underserved rural regions.

- Urban Concentration: Over 60% of Indonesia's population is projected to live in urban areas by the end of 2024, driving demand for digital financial services.

- Digital Divide: Rural areas exhibit lower digital literacy and adoption compared to urban counterparts, requiring targeted financial education.

- BCA's Reach: With over 1,200 branches and 18,000+ ATMs nationwide as of early 2025, BCA is well-positioned to serve both urban and rural demographics.

- Inclusion Strategy: Tailored financial solutions and educational programs are crucial for expanding BCA's reach and impact in less developed regions.

Trust and Consumer Protection

Trust is the bedrock of consumer engagement with financial institutions like Bank Central Asia (BCA), especially as digital transactions become the norm. In 2024, consumer confidence hinges heavily on perceived data security and the transparency of banking practices. BCA's commitment to robust cybersecurity is not just a technical necessity but a critical sociological factor influencing customer loyalty.

The Indonesian Financial Services Authority (OJK) plays a significant role in shaping consumer trust through its regulations. For instance, OJK's directives concerning dormant accounts and overarching consumer protection frameworks underscore the imperative for banks to safeguard customer interests and provide clear legal recourse. This regulatory environment directly impacts how consumers perceive their financial partners.

- Consumer trust in digital banking platforms remains a key concern for 2024, with data security cited as a primary driver.

- BCA's investment in advanced cybersecurity measures directly addresses these consumer anxieties.

- OJK regulations, particularly those on dormant accounts, reinforce the need for banks to maintain transparent and customer-centric policies.

- Maintaining high levels of consumer trust is crucial for BCA's sustained growth and market position in an increasingly digital financial landscape.

Indonesia's young demographic, with over 40% under 25 in 2024, is digitally native and drives demand for seamless online banking. This trend is amplified by urbanization, with over 60% of the population expected in cities by late 2024, concentrating the need for advanced digital services.

Financial literacy remains a challenge, with only 38% of Indonesian adults confident in managing finances as of 2023, creating an opportunity for BCA to expand its reach through targeted education.

Consumer trust, vital for digital banking adoption, is bolstered by robust cybersecurity and transparent practices, as emphasized by OJK regulations. BCA's extensive network of over 1,200 branches and 18,000 ATMs as of early 2025 also supports its broad customer engagement.

| Sociological Factor | Description | Implication for BCA | Data Point |

|---|---|---|---|

| Demographics | Large, young, and digitally native population | High adoption of digital banking services | Over 40% of Indonesia's population under 25 (2024) |

| Urbanization | Increasing urban population | Concentrated demand for digital financial solutions | Over 60% of population in urban areas by end of 2024 |

| Financial Literacy | Varying levels of financial knowledge | Opportunity for educational programs and broader inclusion | 38% of Indonesian adults confident in personal finance management (2023) |

| Consumer Trust | Reliance on data security and transparency | Need for strong cybersecurity and clear policies | OJK regulations on consumer protection |

Technological factors

Indonesia's digital banking landscape is booming, with a notable surge in digital transactions and user engagement. This trend is a direct result of increased internet penetration and a growing comfort with online services, especially among younger demographics.

Bank Central Asia (BCA) is well-positioned to capitalize on this digital shift, thanks to its robust digital banking infrastructure. Features like its mobile banking app and seamless integration with QRIS (Quick Response Code Indonesian Standard) are key differentiators, enabling convenient and secure transactions for millions of customers.

The accelerated adoption of digital banking demands constant innovation from BCA. Staying ahead means continuously enhancing online platforms, developing new digital services, and ensuring a user-friendly experience that meets evolving customer expectations in this increasingly digital-first financial environment.

The financial landscape is being reshaped by the rapid rise of fintech companies and neobanks, creating a more competitive environment for established institutions like Bank Central Asia (BCA). These agile digital players, often unburdened by legacy systems and facing different regulatory frameworks, are introducing innovative, specialized financial products and services.

For instance, in 2024, the global fintech market was projected to reach over $300 billion, with a significant portion driven by digital banking and payments. This growth highlights the increasing consumer preference for seamless, tech-driven financial experiences. BCA, therefore, faces the imperative to continually enhance its digital capabilities, offering user-friendly interfaces and personalized services to match the appeal of these fintech disruptors and maintain its market share.

The escalating digital transformation in banking, exemplified by Bank Central Asia's (BCA) growing online and mobile presence, amplifies cybersecurity risks. In 2024, the global financial sector experienced a notable increase in sophisticated cyberattacks, with data breaches costing an average of $4.45 million according to IBM's 2024 Cost of a Data Breach Report. BCA's commitment to robust data protection is paramount to maintaining customer confidence and financial stability.

To counter these threats, BCA is expected to continue significant investments in advanced cybersecurity infrastructure, including AI-powered fraud detection and real-time threat monitoring. The bank's proactive approach aims to safeguard sensitive customer information and ensure the uninterrupted integrity of its digital services, a critical factor in retaining market share in the competitive Indonesian banking landscape.

Innovation in Payment Systems (e.g., QRIS)

The evolution of payment systems, particularly the rise of standardized digital platforms like QRIS, significantly impacts Bank Central Asia (BCA). Supported by Bank Indonesia, QRIS fosters a unified digital banking environment, enhancing user experience and transaction efficiency for BCA's customers. This widespread adoption of electronic money fundamentally reshapes the financial landscape, compelling banks like BCA to actively integrate and innovate within these evolving payment frameworks to remain competitive and relevant in the market.

BCA's strategic involvement in initiatives like QRIS is not merely about compliance but is essential for its continued market leadership. As of early 2024, QRIS has seen substantial growth, with transaction volumes reaching hundreds of millions monthly, demonstrating a clear consumer shift towards digital payments. This trend necessitates that BCA not only participates but also leads in offering seamless and secure digital payment solutions, thereby solidifying its position in Indonesia's rapidly digitizing economy.

- QRIS Adoption: By late 2023, QRIS had facilitated over 1.7 billion transactions, showcasing its rapid integration into daily commerce.

- Digital Transaction Growth: Electronic money transactions in Indonesia have consistently grown, with banks reporting double-digit increases in digital channel usage year-over-year.

- BCA's Digital Focus: BCA has been a key player in promoting digital banking, with its mobile banking app consistently ranking among the most used in Indonesia, facilitating a significant portion of its transactions digitally.

Leveraging AI and Big Data Analytics

Bank Central Asia (BCA) is actively integrating artificial intelligence and big data analytics to sharpen its competitive edge. These technologies are pivotal in boosting operational efficiency, refining risk management protocols, and crafting hyper-personalized product suites for its diverse customer base. For instance, BCA's digital transformation initiatives, heavily reliant on data analytics, aim to streamline processes and reduce operational costs. In 2024, the bank reported a significant increase in digital transactions, underscoring the impact of its technology investments.

The strategic application of big data allows BCA to glean profound insights from extensive customer datasets. This fuels more effective targeted marketing campaigns, enhances the accuracy of credit scoring models, and enables predictive analytics to anticipate market shifts. By understanding customer behavior patterns, BCA can proactively develop relevant financial solutions. The bank's commitment to digital channels saw a substantial rise in active digital users in early 2025, demonstrating the growing reliance on data-driven customer engagement.

Continuous investment in these advanced technological capabilities is not merely beneficial but essential for BCA's sustained future growth and market leadership. The ability to leverage AI and big data provides a distinct competitive advantage in an increasingly digital banking landscape. BCA's ongoing development of AI-powered chatbots and personalized financial advisory tools are prime examples of this strategic focus, aimed at improving customer experience and driving innovation.

- Enhanced Operational Efficiency: AI and big data streamline back-office operations, reducing processing times and manual errors.

- Improved Risk Management: Advanced analytics enable more accurate credit risk assessment and fraud detection, minimizing potential losses.

- Personalized Customer Experience: Data-driven insights allow for tailored product offerings and marketing, increasing customer satisfaction and loyalty.

- Competitive Advantage: Early adoption and effective utilization of AI and big data position BCA favorably against competitors in the digital banking era.

Technological advancements are fundamentally reshaping Indonesia's financial sector, driving digital transformation and increasing competition. Bank Central Asia (BCA) is at the forefront of this shift, leveraging technology to enhance customer experience and operational efficiency.

The rapid adoption of digital banking, fueled by increased internet penetration and a growing comfort with online services, presents both opportunities and challenges for BCA. The bank's robust digital infrastructure, including its mobile banking app and QRIS integration, positions it well to capitalize on these trends.

BCA's strategic investments in AI and big data analytics are crucial for maintaining its competitive edge. These technologies enable personalized customer experiences, improved risk management, and streamlined operations, essential for navigating the evolving digital landscape.

| Technology Area | BCA's Initiatives/Impact | Industry Trend/Data (2024-2025) |

|---|---|---|

| Digital Banking Platforms | High adoption of BCA mobile banking; seamless QRIS integration. | Digital transaction volume in Indonesia projected to grow by 20% annually through 2025. |

| AI & Big Data | Used for personalized marketing, risk assessment, and operational efficiency. | Global AI in banking market expected to exceed $20 billion by 2025. |

| Cybersecurity | Robust investment in advanced security measures to protect customer data. | Average cost of a data breach in the financial sector reached $5.9 million in 2024. |

| Fintech Integration | Adapting to and competing with agile fintech players. | Fintech funding in Southeast Asia reached a record high in 2024, with digital payments leading. |

Legal factors

Bank Central Asia (BCA) operates within a robust legal framework in Indonesia, primarily governed by Law No. 4/2023, the Omnibus Law of the Financial Sector, and numerous regulations issued by the Financial Services Authority (OJK). These laws dictate critical aspects of banking operations, including licensing, permissible ownership structures, and the ongoing supervision of financial institutions to maintain sector stability.

Adherence to these comprehensive regulations is paramount for BCA, as they encompass stringent requirements for capital adequacy ratios (CAR) and liquidity coverage ratios (LCR). For instance, as of Q1 2024, BCA maintained a CAR well above the regulatory minimum, demonstrating its strong financial footing.

OJK Regulation No. 26 of 2024 represents a significant shift, broadening the permissible business activities for commercial banks like BCA. This new framework allows for investments in companies that bolster the banking ecosystem and clarifies regulations around loan transfers and the use of electronic signatures, offering BCA enhanced strategic and operational agility.

This regulatory evolution demands strict adherence, with a crucial deadline for policy updates by June 2025. For BCA, this means a proactive approach to integrating these new provisions, ensuring continued compliance and leveraging the expanded opportunities to optimize its business model and capital participation strategies within the evolving financial landscape.

Bank Central Asia (BCA) operates under rigorous Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws, critical for preventing illicit financial activities. These regulations are enforced by bodies like the Financial Transaction Reports and Analysis Center (PPATK), which recently mandated the blocking of dormant accounts, a measure also under review by the Otoritas Jasa Keuangan (OJK). Strict adherence to these evolving legal frameworks is paramount for BCA to maintain its regulatory standing and robust reputation in the financial sector.

Consumer Protection and Data Privacy Laws

Consumer protection regulations are a significant legal factor for Bank Central Asia (BCA). For instance, OJK Regulation No. 22 of 2023 mandates that banks incorporate specific clauses regarding loan transfers within their agreements. This regulation also emphasizes the importance of prioritizing consumer protection when banks adopt electronic signatures for transactions, a growing area for digital banking services.

The increasing reliance on digital banking necessitates robust data privacy laws. BCA must adhere to these regulations to safeguard sensitive customer information, ensuring transparency in its data handling practices. This focus on data security is crucial for maintaining customer trust and compliance in the evolving digital financial landscape.

- OJK Regulation No. 22 of 2023: Focuses on loan transfer clauses and consumer protection in electronic signatures.

- Data Privacy: Essential for safeguarding customer information in digital banking.

- Transparency: Required in data handling practices to build customer trust.

Corporate Governance Requirements

Bank Central Asia (BCA) must navigate a complex legal landscape, particularly concerning corporate governance. The Otoritas Jasa Keuangan (OJK) plays a crucial role, with regulations like OJK Regulation No 17 of 2023 setting the standard for sound corporate governance in commercial banks. This means BCA is legally obligated to uphold principles of transparency, accountability, responsibility, independence, and fairness in all its operations.

Adherence to these OJK mandates requires BCA to constantly review and update its governance structures and practices. This includes rigorous internal controls and external audits to ensure compliance. For instance, failure to meet reporting deadlines or maintain adequate transparency can result in significant penalties, impacting BCA's reputation and financial standing.

Key legal factors influencing BCA's corporate governance include:

- OJK Regulation No 17 of 2023: This regulation mandates adherence to the five pillars of good corporate governance: transparency, accountability, responsibility, independence, and fairness for all commercial banks.

- Reporting Timelines: BCA must strictly adhere to OJK's reporting schedules for financial statements and other critical disclosures to avoid regulatory sanctions.

- Audit Requirements: Regular internal and external audits are legally required to verify BCA's compliance with governance standards and financial regulations.

The legal environment for Bank Central Asia (BCA) is shaped by Indonesian financial sector laws, including the Omnibus Law of the Financial Sector (Law No. 4/2023) and OJK regulations. These laws mandate strict adherence to capital adequacy and liquidity standards, with BCA consistently exceeding requirements, as evidenced by its strong CAR in Q1 2024. Recent OJK regulations, such as No. 26 of 2024, expand permissible activities for banks, allowing strategic investments and clarifying electronic signature usage, which BCA must integrate by June 2025.

Environmental factors

Indonesia, through the Financial Services Authority (OJK), is actively pushing for sustainable finance, evidenced by the 2023 issuance of the Indonesian Sustainable Finance Taxonomy. This framework guides financial institutions in identifying and channeling funds towards environmentally friendly activities.

Bank Central Asia (BCA) is responding proactively by embedding ESG principles into its core business, from loan approvals to how it manages risks. This commitment means BCA is increasingly scrutinizing the environmental impact of its clients, steering clear of industries with significant ecological footprints.

BCA's 2023 Sustainability Report highlights a growing portfolio of sustainable financing, reaching IDR 167.7 trillion, up from IDR 153.7 trillion in 2022. The bank is also setting targets for further expansion in green financing, demonstrating tangible progress in its ESG integration efforts.

Climate change presents significant risks to Bank Central Asia's (BCA) loan portfolio, especially in sectors heavily reliant on natural resources or susceptible to extreme weather events. For instance, agricultural loans could be impacted by droughts or floods, while property financing in coastal areas faces rising sea level risks. These physical and transitional risks necessitate careful portfolio management and risk assessment.

Concurrently, these environmental shifts unlock substantial opportunities for green financing. BCA is actively aligning with Indonesia's national and international commitments to a low-carbon economy, aiming to bolster sustainable development. This strategic focus translates into increased investment in projects that facilitate the clean energy transition and promote broader sustainable practices across the economy.

BCA's commitment is demonstrated through its growing green financing portfolio. As of the first half of 2024, BCA reported a 17% year-on-year increase in its green financing, reaching IDR 167.5 trillion. This expansion includes funding for renewable energy projects, energy efficiency initiatives, and other environmentally friendly ventures, directly contributing to a more sustainable future.

Beyond simply following the rules, there's a rising expectation for banks like Bank Central Asia (BCA) to actively engage in corporate social responsibility. This means contributing to the broader economic and social well-being, using resources responsibly, and ensuring a positive legacy for the future. BCA's sustainability reports, like the one for 2023, showcase its commitment by detailing its performance across economic, social, and environmental aspects, reflecting a proactive approach to societal impact.

Waste Management and Resource Efficiency

Bank Central Asia (BCA) actively manages its operational environmental footprint, focusing on waste management and resource efficiency. These efforts are crucial for aligning with sustainability goals and showcasing environmental responsibility.

BCA's commitment includes implementing waste management and recycling programs, alongside initiatives aimed at reducing electricity consumption intensity. For instance, in 2023, BCA reported a reduction in its energy consumption per transaction, demonstrating a tangible step towards greater efficiency.

These practices contribute to BCA's overall environmental performance and underscore its dedication to environmental stewardship.

- Waste Reduction: BCA implements comprehensive waste management and recycling programs across its branches and offices.

- Energy Efficiency: The bank focuses on reducing electricity consumption intensity through various operational improvements.

- Sustainability Alignment: These initiatives directly support broader corporate sustainability objectives and demonstrate environmental accountability.

Adherence to Sustainable Development Goals (SDGs)

Bank Central Asia (BCA) actively integrates the United Nations Sustainable Development Goals (SDGs) into its operational framework, focusing on managing Environmental, Social, and Governance (ESG) factors. This strategic alignment aims to enhance customer value and contribute to a more sustainable future.

BCA's dedication to sustainability is demonstrably outlined in its comprehensive sustainable finance action plan. The bank also conducts regular audits to verify that its policies and practices remain on course with established sustainability targets, ensuring accountability and progress.

This integrated approach to sustainability is becoming a critical differentiator for BCA, significantly influencing stakeholder perception and bolstering the bank's long-term resilience and viability in an evolving market landscape.

- SDG Alignment: BCA's sustainability strategy is directly linked to the UN's 17 Sustainable Development Goals, demonstrating a commitment to global sustainability objectives.

- Sustainable Finance: The bank has developed a specific action plan for sustainable finance, indicating concrete steps toward environmentally and socially responsible lending and investment practices.

- ESG Management: BCA prioritizes the management of ESG aspects, recognizing their importance in creating long-term value for both the bank and its stakeholders.

- Stakeholder Value: By focusing on sustainability, BCA aims to increase customer value and build trust, which are crucial for maintaining a strong market position.

Indonesia's push for sustainable finance, guided by the OJK's 2023 Sustainable Finance Taxonomy, is shaping BCA's operations. The bank is actively integrating ESG principles, which means scrutinizing the environmental impact of its clients and steering clear of high-risk industries. This commitment is reflected in BCA's growing sustainable financing portfolio, which reached IDR 167.5 trillion by the first half of 2024, a notable 17% increase year-on-year.

Climate change poses physical risks to BCA's loan book, particularly in sectors like agriculture and coastal property. However, these environmental shifts also create opportunities for green financing. BCA is aligning with national low-carbon goals, channeling investments into clean energy and sustainable practices.

BCA manages its operational footprint through waste reduction and energy efficiency initiatives. In 2023, the bank reported a reduction in energy consumption per transaction, demonstrating tangible progress in its environmental stewardship.

These efforts are crucial for BCA's alignment with the UN's Sustainable Development Goals and its overall ESG management strategy, enhancing stakeholder value and long-term resilience.

| Metric | 2022 | 2023 | H1 2024 |

|---|---|---|---|

| Sustainable Financing (IDR Trillion) | 153.7 | 167.7 | 167.5 |

| Year-on-Year Growth in Green Financing (%) | N/A | N/A | 17% |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bank Central Asia is built on a robust foundation of data from official Indonesian government publications, reports from international financial institutions like the World Bank and IMF, and reputable industry analysis firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the bank's operating landscape.