Bank Central Asia Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank Central Asia Bundle

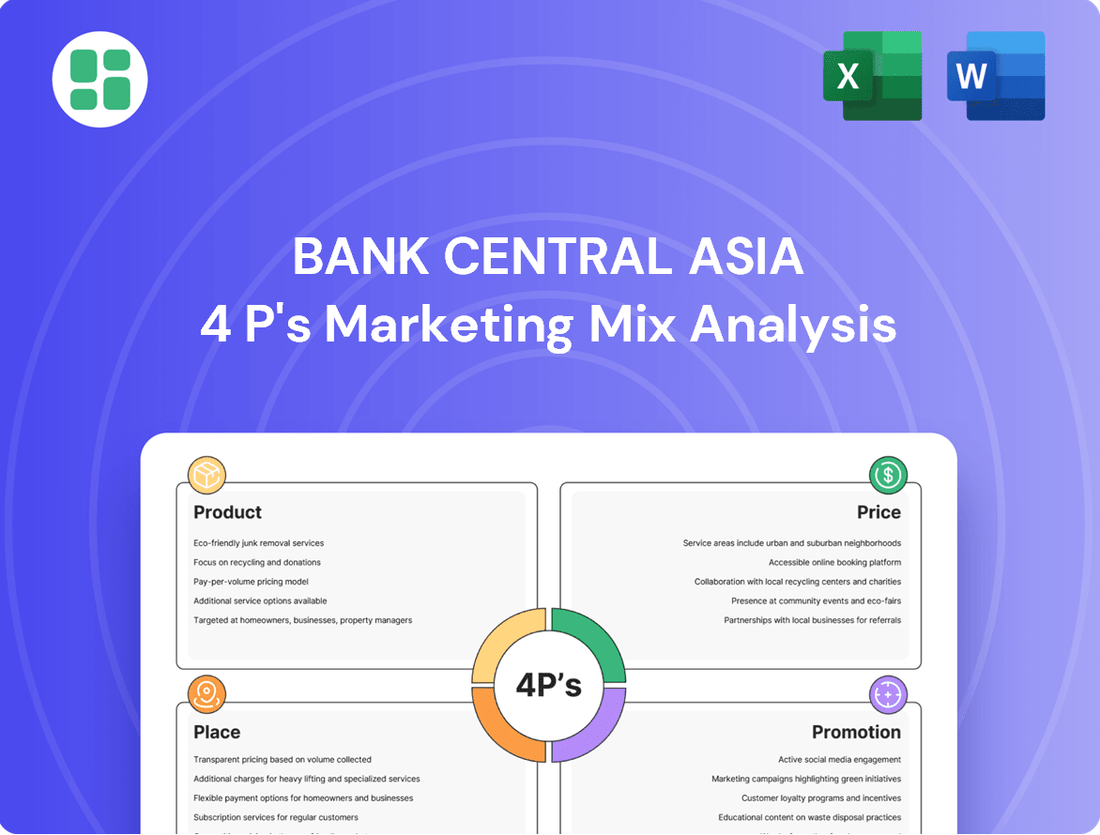

Bank Central Asia's marketing success is built on a robust 4Ps strategy, from its diverse product offerings and competitive pricing to its extensive distribution network and impactful promotional campaigns. Understand how these elements interlock to create a powerful market presence.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Bank Central Asia's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Bank Central Asia (BCA) offers a comprehensive suite of banking services designed to meet the diverse needs of both individual and corporate clients. This includes a broad spectrum of deposit products such as savings accounts, current accounts, and time deposits, facilitating everyday transactions, liquidity management, and wealth growth. As of early 2024, BCA reported a substantial increase in its third-party funds, reaching IDR 847.1 trillion, underscoring the trust customers place in its deposit offerings.

BCA’s commitment to product innovation ensures its offerings remain competitive and relevant in the evolving financial landscape. The bank consistently introduces new features and digital solutions to enhance customer experience and accessibility. This focus on continuous improvement is a key element of their product strategy, aiming to provide value-added services beyond basic banking.

Bank Central Asia (BCA) offers a diverse range of loan products catering to various needs. This includes mortgages (KPR) for homeownership, motor vehicle loans (KKB) for purchasing vehicles, and personal loans for individual financing. These are complemented by commercial and SME loans designed to fuel business growth.

These offerings are structured with competitive interest rates and flexible terms, aiming to make aspirations like owning a home or a car, and expanding businesses, more attainable for customers.

BCA has demonstrated robust loan growth across all its segments. As of the first quarter of 2024, BCA's total loan portfolio grew by 11.2% year-on-year, reaching IDR 714.4 trillion, with positive contributions from corporate, commercial, SME, and consumer loan categories.

Bank Central Asia (BCA) champions its digital banking solutions, including the widely used BCA mobile app, the newer myBCA platform, and the established KlikBCA. These offerings provide customers with a streamlined experience for everyday banking needs, from fund transfers to bill payments and account oversight. In 2023, BCA reported a significant increase in digital transaction volume, with over 2.5 billion transactions processed through its digital channels, highlighting the growing reliance on these platforms.

BCA’s commitment to innovation is evident in its continuous refinement of these digital tools. The bank prioritizes enhancing user experience and fortifying security measures, ensuring customers can bank with confidence. This strategic focus on digital advancement is a core component of BCA’s product strategy, aiming to meet the evolving demands of a digitally-savvy customer base. As of early 2024, BCA mobile boasts over 27 million active users, underscoring its market penetration and customer adoption.

Credit Cards and Payment Innovations

Bank Central Asia (BCA) offers a diverse portfolio of credit cards, each designed to align with varied customer lifestyles and spending habits. These cards come with attractive benefits such as loyalty points, exclusive discounts at partner merchants, and flexible installment plans, enhancing their value proposition. For instance, BCA's credit card usage saw significant growth, with total credit card transactions reaching IDR 174.8 trillion in 2023, a 26.4% increase year-on-year, showcasing strong customer adoption and engagement.

BCA is deeply invested in payment innovations to streamline and secure transactions for its users. A prime example is the integration of QRIS Customer Presented Mode (CPM) within its mobile banking applications. This feature allows for quick and secure payments, contributing to the broader adoption of digital payment methods. By the end of 2024, QRIS transactions were projected to exceed IDR 2.1 quadrillion, demonstrating the massive shift towards digital payments in Indonesia, a trend BCA actively supports.

- Diverse Credit Card Offerings: BCA provides a wide array of credit cards tailored to different consumer needs, from travel rewards to cashback programs.

- Enhanced Transaction Security: Innovations like QRIS CPM in mobile apps ensure secure and efficient payment processing for customers.

- Growing Digital Payment Adoption: BCA's focus on payment innovation aligns with the substantial growth in digital transaction volumes across Indonesia.

- Customer-Centric Benefits: Rewards, discounts, and installment options are key features that drive customer loyalty and card usage.

Wealth Management and Investment s

Bank Central Asia (BCA) strategically targets its affluent clientele with a robust suite of wealth management and investment products. These offerings, including diverse mutual funds and bonds, are designed to facilitate asset growth and preservation. In 2024, BCA continued to emphasize financial education, hosting events like the BCA Wealth Summit, which provides actionable insights and solutions for wealth accumulation, underscoring their dedication to client prosperity.

BCA's product strategy for wealth management is clearly defined by its commitment to providing specialized investment vehicles.

- Comprehensive Investment Options: Mutual funds and bonds catering to varied risk appetites.

- Client Engagement: Events like the BCA Wealth Summit foster financial literacy and networking.

- Asset Growth Focus: Services are geared towards managing and expanding client assets.

- Long-Term Prosperity: The bank positions itself as a partner in achieving sustained financial well-being.

BCA's product strategy centers on a diverse range of deposit accounts, offering customers flexibility for savings, daily transactions, and wealth accumulation. The bank’s loan portfolio is equally broad, encompassing mortgages, vehicle financing, and business loans, all designed with competitive terms to support customer aspirations. Digital banking solutions, including the BCA mobile app and myBCA, are central to their product offering, facilitating over 2.5 billion transactions in 2023. Furthermore, BCA provides a comprehensive suite of credit cards with attractive benefits and is actively investing in payment innovations like QRIS CPM.

| Product Category | Key Offerings | 2023/Early 2024 Data Points |

|---|---|---|

| Deposit Products | Savings, Current, Time Deposits | Third-party funds reached IDR 847.1 trillion (early 2024) |

| Loan Products | KPR, KKB, Personal, Commercial, SME Loans | Total loan portfolio grew 11.2% YoY to IDR 714.4 trillion (Q1 2024) |

| Digital Banking | BCA mobile, myBCA, KlikBCA | Over 2.5 billion digital transactions (2023); BCA mobile has over 27 million active users (early 2024) |

| Credit Cards & Payments | Diverse credit cards, QRIS CPM integration | Credit card transactions reached IDR 174.8 trillion (26.4% YoY increase in 2023) |

What is included in the product

This analysis provides a comprehensive overview of Bank Central Asia's marketing mix, detailing its product offerings, pricing strategies, distribution channels, and promotional activities.

It offers actionable insights into how Bank Central Asia leverages its 4Ps to maintain its competitive edge and serve its diverse customer base.

Provides a clear, actionable framework for understanding how Bank Central Asia's marketing strategies alleviate customer pain points across Product, Price, Place, and Promotion.

Simplifies complex marketing analysis into a digestible format, empowering teams to identify and address customer frustrations effectively.

Place

Bank Central Asia (BCA) leverages its extensive branch network as a cornerstone of its marketing mix, offering traditional banking services and crucial in-person customer support. As of the first quarter of 2024, BCA operated 1,230 branches across Indonesia, a testament to its commitment to physical accessibility for a wide range of customer needs, from complex transactions to personalized financial advice.

While digital banking adoption continues to rise, BCA’s physical branches remain vital for fostering customer trust and providing a tangible touchpoint. These locations are particularly important for services requiring direct interaction or for customers who prefer face-to-face consultations, supplementing BCA's robust digital offerings.

Bank Central Asia (BCA) boasts an extensive ATM network, a cornerstone of its accessibility strategy. As of the first quarter of 2024, BCA operated over 23,000 ATMs across Indonesia, a figure that continues to grow. This vast network allows customers to perform essential banking tasks like cash withdrawals and deposits conveniently, anytime and anywhere.

This widespread ATM presence significantly enhances customer convenience, acting as a vital physical touchpoint that complements BCA's robust digital offerings. By providing easy access to cash services, BCA reduces the reliance on physical branch visits, thereby optimizing operational efficiency and improving the overall customer experience. This broad network is a key differentiator in the competitive Indonesian banking landscape.

Bank Central Asia (BCA) excels with its robust digital channels, including BCA mobile, myBCA, and KlikBCA. These platforms empower customers with 24/7 access to a comprehensive suite of banking services, from transactions to account management, all from their preferred location.

BCA consistently invests in upgrading these digital touchpoints, ensuring they are secure, dependable, and intuitive. This focus on user experience makes them the preferred banking method for a substantial segment of BCA's clientele, especially the digitally native younger demographic.

As of early 2024, BCA reported a significant increase in digital transaction volume, with its mobile banking app, BCA mobile, handling a substantial portion of daily transactions. This highlights the critical role these channels play in customer engagement and operational efficiency for the bank.

Strategic Partnerships and Ecosystem Integration

Bank Central Asia (BCA) actively cultivates strategic partnerships to enrich its customer value proposition. These collaborations span digital payment networks, loyalty platforms, and co-branded financial products, effectively extending BCA's market presence and service capabilities beyond conventional banking boundaries.

BCA's integration within broader ecosystems allows it to cater to a wider array of customer needs through mutually beneficial alliances. For instance, their partnerships facilitate seamless digital transactions and offer enhanced benefits through integrated loyalty programs, demonstrating a commitment to providing comprehensive financial solutions.

- Digital Payment Integration: BCA partners with various e-commerce platforms and fintech companies to embed its payment solutions, facilitating smoother transactions for millions of users.

- Loyalty Program Collaborations: BCA collaborates with retail and service providers to offer integrated loyalty points and rewards, increasing customer engagement and retention.

- Co-branded Product Development: The bank works with strategic partners to launch co-branded credit cards and other financial products that offer specialized benefits tailored to specific customer segments.

- Ecosystem Reach: As of early 2025, BCA's extensive network of over 25 million customers benefits from these partnerships, which are crucial for expanding its digital footprint and service offerings in a competitive market.

Customer Service and Call Centers

Bank Central Asia (BCA) places a strong emphasis on customer service, recognizing its pivotal role in the marketing mix. The bank ensures customers have consistent access to support through its Halo BCA contact center, available 24 hours a day. This commitment extends to the haloBCA application, offering another convenient channel for assistance and reinforcing BCA's dedication to customer satisfaction.

This continuous availability is crucial for building trust and loyalty. In 2024, BCA reported handling millions of customer inquiries across its various channels, with a significant portion directed to Halo BCA, highlighting its importance as a primary customer touchpoint. The bank consistently aims for high customer satisfaction scores related to its service interactions.

- 24/7 Availability: Halo BCA contact center provides round-the-clock support.

- Multi-Channel Access: Customers can reach out via phone or the haloBCA application.

- Customer Satisfaction Focus: BCA prioritizes responsive and helpful service interactions.

- High Inquiry Volume: Millions of customer inquiries are managed annually, demonstrating the scale of service operations.

Bank Central Asia (BCA) strategically utilizes its extensive physical presence, encompassing both branches and ATMs, to ensure widespread accessibility and customer convenience across Indonesia. As of the first quarter of 2024, BCA maintained 1,230 branches and over 23,000 ATMs, facilitating essential banking services and providing crucial in-person support, particularly for complex transactions or personalized advice.

This robust physical network serves as a vital touchpoint, reinforcing customer trust and complementing BCA's advanced digital platforms. The accessibility offered by these locations, combined with the 24/7 availability of its digital channels and customer service, solidifies BCA's position as a leading financial institution.

Same Document Delivered

Bank Central Asia 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Bank Central Asia's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Bank Central Asia (BCA) strategically leverages integrated digital marketing campaigns across platforms like social media, online advertising, and its proprietary mobile apps. These efforts aim to connect with a wide customer base, emphasizing the ease and safety of their digital banking services, alongside exclusive promotions.

In 2024, BCA's digital presence is a cornerstone of its promotion strategy. For instance, their campaigns often feature QRIS transactions and digital loan applications, reflecting a strong push towards digital adoption. As of Q1 2024, BCA reported a significant increase in digital transaction volume, underscoring the effectiveness of these integrated campaigns in driving customer engagement and product uptake.

Bank Central Asia actively engages customers through major promotional events like the BCA Expoversary and BCA Wealth Summit. These gatherings are designed to offer exclusive benefits, such as preferential loan rates and investment guidance.

These large-scale events are vital for boosting loan acquisition and drawing in new clientele. They also serve to deepen connections with current customers by delivering valuable discounts and educational content, as seen in the continued success of these annual fixtures.

Bank Central Asia (BCA) actively cultivates its brand through strategic public relations and extensive Corporate Social Responsibility (CSR) initiatives under the 'Bakti BCA' program. These efforts are designed to foster sustainable community development and champion environmental stewardship, significantly bolstering BCA's reputation and demonstrating a deep-seated commitment to societal well-being.

In 2024, BCA continued its focus on impactful CSR, with programs ranging from educational support to environmental conservation. For instance, the 'Bakti BCA for Education' initiative saw significant investment in improving learning facilities and providing scholarships, reflecting a tangible commitment to future generations. This dedication to social responsibility not only strengthens community ties but also enhances BCA's standing as a trusted financial institution.

Targeted Sales s and Loyalty Programs

Bank Central Asia (BCA) actively deploys targeted sales promotions, cashback offers, and robust loyalty programs, especially within its credit card and digital banking segments. These initiatives aim to boost transaction volumes and cultivate deeper customer relationships.

In 2024, BCA's focus on digital engagement through these promotions is evident. For instance, their credit card division frequently offers tiered cashback on specific spending categories, encouraging higher usage. These programs are crucial for customer retention and new customer acquisition.

- Incentivized Usage: Promotions like cashback on e-commerce or travel bookings directly encourage customers to use BCA credit cards for everyday and discretionary spending.

- Loyalty Rewards: BCA's loyalty programs often allow customers to accumulate points redeemable for various benefits, reinforcing their commitment to the bank.

- Digital Transaction Push: Many promotions are tied to using BCA's digital platforms, such as the MyBCA app or QRIS payments, driving adoption of these convenient services.

- Customer Acquisition: Welcome bonuses and introductory offers on credit cards and savings accounts serve as key tools to attract new clients in a competitive market.

Educational Initiatives and Financial Literacy

Bank Central Asia (BCA) actively champions financial literacy through a multi-faceted educational strategy. These initiatives are designed to empower the public with the knowledge needed for sound financial decision-making, fostering trust and understanding of banking products.

BCA's commitment extends to practical learning via workshops, seminars, and accessible content on its digital channels. For instance, in 2023, BCA conducted over 100 financial literacy workshops reaching more than 15,000 participants, with a focus on digital banking and investment basics.

- Workshops & Seminars: Targeted sessions on budgeting, saving, and investment strategies.

- Digital Content: Educational articles, videos, and webinars accessible 24/7.

- Wealth Summits: High-level events for in-depth financial planning and market insights.

- Community Outreach: Programs aimed at underserved populations to promote financial inclusion.

By educating potential and existing customers, BCA not only builds stronger relationships but also cultivates a more financially responsible populace, a key element in its long-term marketing success.

BCA's promotional activities are deeply integrated with its digital-first approach and customer engagement strategies. The bank leverages online platforms, major events, and targeted sales promotions to drive product adoption and foster loyalty.

In 2024, BCA's digital campaigns, including those for QRIS and digital loans, have shown significant traction, as evidenced by the increase in digital transaction volumes in Q1 2024. Their annual events like the BCA Expoversary and Wealth Summit continue to be successful in attracting new customers and offering exclusive benefits to existing ones, reinforcing their market presence.

BCA's commitment to financial literacy and CSR, particularly through the 'Bakti BCA' program, enhances its brand reputation and community standing. Targeted sales promotions and loyalty programs, especially for credit cards and digital banking, are key drivers for increasing transaction volumes and customer retention.

| Promotion Type | Key Initiatives | 2024 Focus/Impact | Customer Benefit |

|---|---|---|---|

| Digital Marketing & Campaigns | Social media, online ads, MyBCA app promotions | QRIS transactions, digital loan applications; increased digital transaction volume (Q1 2024) | Convenience, safety, exclusive offers |

| Major Events | BCA Expoversary, BCA Wealth Summit | Continued success in boosting loan acquisition and client engagement | Preferential loan rates, investment guidance, discounts |

| Sales Promotions & Loyalty | Cashback offers, loyalty points, welcome bonuses | Tiered cashback on credit card spending, driving usage | Reduced spending costs, rewards, customer retention |

| CSR & Financial Literacy | 'Bakti BCA' program, workshops, digital content | Educational support, environmental conservation; >100 workshops in 2023 | Enhanced brand reputation, financial empowerment, community development |

Price

Bank Central Asia (BCA) actively positions its interest rates to be competitive, drawing in both individuals looking to save and those needing loans. This strategy balances customer acquisition with the bank's own financial health.

During 2024, BCA has been observed offering promotional interest rates on various loan products, particularly for mortgages and vehicle financing, often highlighted during their customer events and expos. For instance, during their 2024 property expos, mortgage rates were seen dipping below the prevailing market average, a tactic to drive significant loan origination volume.

Bank Central Asia (BCA) emphasizes transparent fee structures, providing clear details on transaction, annual, and service charges. This openness allows customers to easily understand the costs involved with their banking products. For instance, BCA's credit card annual fees in 2024 range from IDR 125,000 to IDR 750,000 depending on the card tier, a figure readily available on their official website.

Bank Central Asia (BCA) enhances product accessibility through its flexible payment and financing options. Customers can leverage installment plans with competitive low-interest rates on credit card transactions, making larger purchases more manageable. For instance, in 2024, BCA continued to offer attractive promotional rates on its credit card installments, aiming to boost consumer spending and product adoption across various categories.

Dynamic Pricing Strategies for Loans

Bank Central Asia (BCA) actively employs dynamic pricing for its loan portfolio, adjusting rates based on market demand, borrower profiles such as corporate, SME, and retail clients, and prevailing economic indicators. This approach ensures competitiveness and risk management.

BCA's commitment to Environmental, Social, and Governance (ESG) principles is reflected in its special interest rate promotions for loans directed towards sustainable sectors. For instance, in 2024, BCA offered preferential rates for green financing initiatives, contributing to Indonesia's sustainable development goals.

- Dynamic Rate Adjustment: BCA's loan pricing adapts to market fluctuations and customer segmentation.

- ESG-Linked Promotions: Special rates are provided for loans in environmentally and socially responsible sectors.

- Market Responsiveness: Pricing strategies consider external economic conditions to maintain competitiveness.

Value-Based Pricing for Premium Services

For its premium offerings like wealth management and exclusive credit card tiers, Bank Central Asia (BCA) utilizes value-based pricing. This approach aligns the price with the significant advantages, tailored client service, and unique privileges offered. For instance, BCA's Wealth Management services, catering to high-net-worth individuals, are priced to reflect the specialized investment advice and personalized financial planning provided, aiming to maximize client returns.

This strategy specifically targets affluent customers who require comprehensive financial solutions and are willing to pay for superior service and exclusive benefits. As of late 2024, BCA's premium credit cards often feature higher annual fees but come with substantial rewards, travel perks, and concierge services, demonstrating a clear link between elevated pricing and enhanced customer value.

- Value-Based Pricing: BCA prices premium services based on the perceived value and benefits delivered to customers.

- Target Audience: High-net-worth individuals seeking personalized financial solutions and exclusive access.

- Example: Wealth Management services and exclusive credit card tiers with enhanced benefits.

- Market Trend: Continued demand for personalized financial services among affluent demographics in 2024-2025.

Bank Central Asia (BCA) employs a multi-faceted pricing strategy within its marketing mix, balancing competitive rates with value-based approaches for premium services. This ensures broad market appeal while catering to specific customer segments.

BCA's loan pricing is dynamic, adjusting to market conditions and borrower profiles. For example, in 2024, promotional mortgage rates were observed below market averages during expos to drive volume. Similarly, ESG-linked financing in 2024 offered preferential rates for green initiatives.

For its high-net-worth clientele, BCA utilizes value-based pricing, evident in its Wealth Management services and premium credit cards. These offerings command higher fees due to specialized advice and exclusive benefits, reflecting a strong link between price and enhanced customer value, a trend continuing into 2025.

| Product Segment | Pricing Strategy | Key Features/Examples (2024-2025) | Target Audience | Competitive Edge |

|---|---|---|---|---|

| Loans (Mortgage, Auto) | Competitive/Promotional | Rates below market average during expos; ESG-linked rates for green financing. | General Public, Eco-conscious borrowers | Customer acquisition, market share growth |

| Credit Cards | Tiered/Value-Based | Annual fees IDR 125k-750k; premium cards offer substantial rewards, travel perks. | Mass market to affluent | Customer loyalty, spending stimulation |

| Wealth Management | Value-Based | Priced to reflect specialized investment advice and personalized financial planning. | High-Net-Worth Individuals | Superior service, maximized client returns |

4P's Marketing Mix Analysis Data Sources

Our Bank Central Asia 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, including annual reports and press releases, alongside insights from industry-specific publications and competitive intelligence platforms. This comprehensive approach ensures a robust understanding of BCA's product offerings, pricing strategies, distribution channels, and promotional activities.