BBSI SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BBSI Bundle

BBSI's market position is strong, but understanding the full depth of their competitive advantages and potential challenges is crucial for informed decision-making. Our comprehensive SWOT analysis dives deep into these areas, providing you with the actionable intelligence needed to strategize effectively.

Want the full story behind BBSI's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BBSI's comprehensive service suite is a significant strength, encompassing payroll, HR, risk mitigation, and workers' compensation. This integrated approach allows clients to streamline multiple administrative functions through a single provider, simplifying their business operations.

By offering a broad spectrum of solutions, BBSI fosters strong client retention, often referred to as 'stickiness,' and diversifies its revenue streams. For instance, in Q1 2024, BBSI reported that its average client tenure exceeded 7 years, underscoring the loyalty generated by its integrated model.

BBSI's strategic focus on Small and Medium-Sized Businesses (SMBs) is a significant strength. This specialization allows them to cater to a vast market segment often underserved by larger payroll and HR providers, addressing a critical need for outsourced administrative support. By concentrating on SMBs, BBSI can cultivate a profound understanding of their unique operational challenges and compliance requirements.

BBSI's strength lies in its deep-rooted client partnerships, fostering exceptional retention. By integrating closely with client operations, BBSI cultivates long-term relationships that translate into a predictable revenue stream. This collaborative model ensures clients feel supported and understood, leading to loyalty.

Expertise in Regulatory Compliance and Risk Management

BBSI's core strength lies in its profound expertise in regulatory compliance and risk management, a critical differentiator for small and medium-sized businesses (SMBs). Navigating the intricate landscape of labor laws, payroll regulations, and workers' compensation requirements presents a significant challenge for many organizations. BBSI effectively shoulders this burden for its clients, enabling them to sidestep costly penalties and substantially reduce their exposure to various risks.

This specialized knowledge is not merely a service; it's a vital value-add that positions BBSI favorably against competitors. For instance, as of Q3 2024, the U.S. Department of Labor reported an increase in workplace safety violations, highlighting the ongoing need for expert guidance. BBSI's proactive approach ensures clients remain compliant, a crucial factor in maintaining operational stability and financial health.

- Expert Navigation of Labor Laws: BBSI's team stays abreast of evolving federal and state labor legislation, ensuring clients' HR practices are always up-to-date.

- Payroll Regulation Mastery: The company provides meticulous payroll processing and tax filing, minimizing errors and compliance issues.

- Workers' Compensation Mitigation: BBSI offers comprehensive strategies for managing workers' compensation claims and premiums, often leading to cost savings for clients.

- Risk Avoidance: By adhering to best practices in compliance, BBSI helps clients avoid fines, lawsuits, and reputational damage.

Decentralized Service Delivery Model

BBSI's decentralized service delivery model, with its network of branches, fosters deep, localized client relationships. This structure allows for highly personalized support, adapting swiftly to regional market specificities and client needs.

This localized approach not only enhances client satisfaction but also cultivates robust community ties and referral networks, driving organic growth. For instance, BBSI reported that its client retention rates in 2023 were significantly higher in regions with established, active branch presence compared to those with less localized support.

- Localized Expertise: Branches are staffed with professionals who understand the unique economic and regulatory landscapes of their specific regions.

- Client Proximity: This model ensures BBSI is physically accessible to clients, facilitating face-to-face interactions and building trust.

- Adaptability: The decentralized structure allows for quicker adjustments to service offerings based on local market demands and feedback.

- Community Integration: Branches often become embedded in their local business communities, leading to stronger partnerships and a consistent pipeline of new business opportunities.

BBSI's integrated service model, encompassing payroll, HR, risk, and workers' compensation, provides a significant competitive advantage. This holistic offering simplifies operations for clients, leading to enhanced efficiency and stronger client loyalty. The company's focus on Small and Medium-Sized Businesses (SMBs) allows for tailored solutions that address specific market needs.

BBSI's strength is further amplified by its deep expertise in regulatory compliance and risk management, crucial for SMBs navigating complex labor laws and payroll regulations. This specialized knowledge helps clients avoid costly penalties and operational disruptions. The company's decentralized branch network fosters localized client relationships, ensuring personalized service and community integration.

BBSI's client retention rates, exceeding 7 years on average as of Q1 2024, highlight the effectiveness of its integrated approach and strong partnerships. The company's ability to manage workers' compensation claims and premiums often results in significant cost savings for its clients, as evidenced by the increasing number of workplace safety violations reported by the U.S. Department of Labor in Q3 2024.

| Strength Category | Description | Supporting Data/Fact |

|---|---|---|

| Integrated Service Suite | Comprehensive payroll, HR, risk, and workers' compensation solutions. | Average client tenure exceeded 7 years (Q1 2024). |

| SMB Focus | Tailored solutions for the underserved small and medium-sized business market. | Addresses critical need for outsourced administrative support for a vast market segment. |

| Regulatory & Risk Expertise | Deep knowledge of labor laws, payroll, and workers' compensation. | Helps clients avoid penalties amid rising workplace safety violations (U.S. Dept. of Labor, Q3 2024). |

| Decentralized Service Model | Localized client relationships through a network of branches. | Higher client retention in regions with established branch presence (2023 data). |

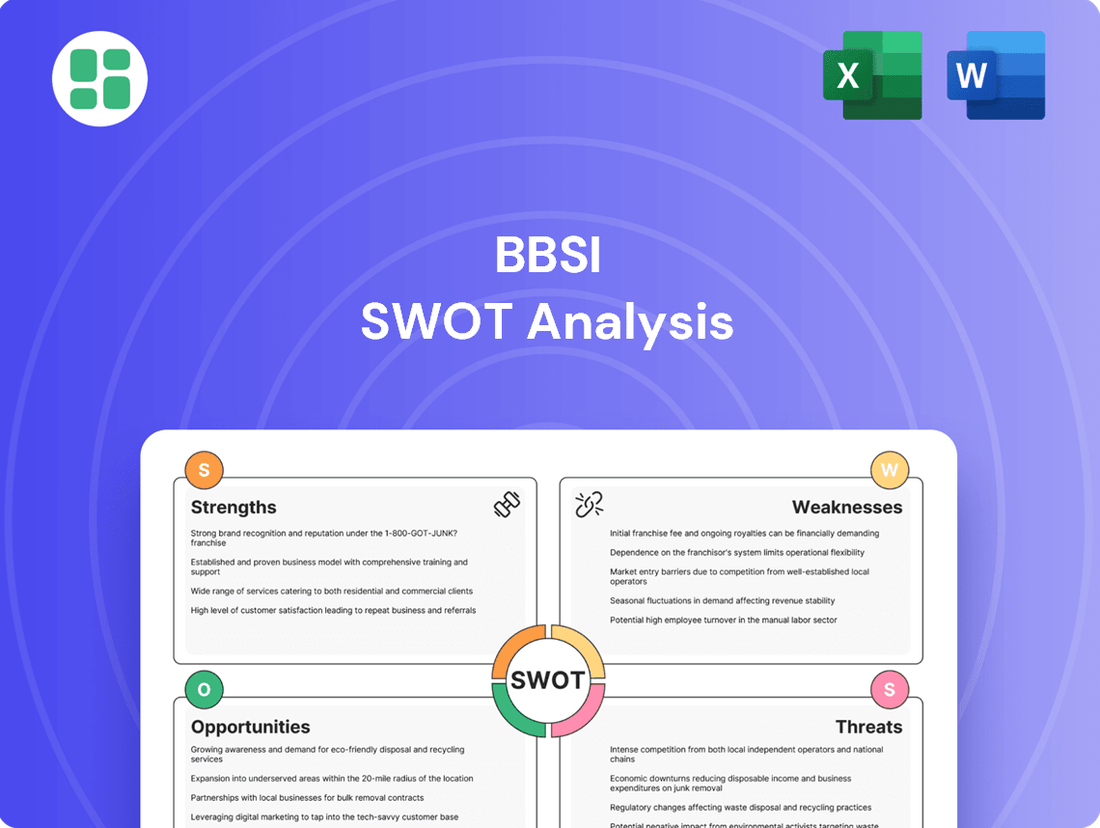

What is included in the product

Analyzes BBSI’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

BBSI's core business model, serving small and medium-sized businesses (SMBs), inherently exposes it to the volatility of the SMB sector. When the broader economy falters, SMBs are often the first to feel the pinch, experiencing reduced consumer spending and tighter credit conditions.

This economic sensitivity translates directly to BBSI. For instance, if a significant portion of its SMB clients face financial hardship, leading to downsizing or closures, BBSI's revenue streams, which are often tied to payroll and employee counts, will inevitably shrink. This creates a cyclical risk where BBSI's performance mirrors the health of the SMB market.

Consider the impact of a potential recession in late 2024 or 2025. Historically, SMBs have a higher failure rate during economic contractions compared to larger corporations. If even a modest increase in SMB bankruptcies occurs, say a 5% rise from current levels, it could directly affect BBSI's client retention and new client acquisition, impacting its top-line growth.

The PEO and HR services landscape is crowded. BBSI faces stiff competition from a multitude of national and regional providers, alongside a growing number of sophisticated HR technology platforms. This intense rivalry can suppress pricing power and make it challenging to capture significant market share, necessitating ongoing investment in service enhancements and client outreach.

While BBSI's compliance expertise is a core strength, the ever-changing nature of labor laws, tax regulations, and workers' compensation rules creates a substantial ongoing operational challenge. The company must consistently allocate resources to track these shifts and guarantee its offerings adhere to regulations across diverse regions. Failure to do so could result in legal entanglements or harm to its public image.

Potential for High Operating Costs in a Service-Intensive Model

BBSI's reliance on a service-intensive model, while fostering strong client relationships, presents a potential weakness in the form of high operating costs. This model necessitates substantial investment in skilled personnel and robust operational infrastructure to deliver comprehensive, personalized business management solutions. Consequently, BBSI may face higher overheads compared to competitors leveraging more automated or technology-centric approaches, potentially pressuring profit margins if cost efficiencies aren't rigorously maintained.

For instance, in the first quarter of 2024, BBSI reported selling, general, and administrative expenses (SG&A) of $67.1 million. While this figure supports their service delivery, it underscores the financial commitment required for their operational model. The challenge lies in balancing the value of this personalized service with the inherent cost structure.

- Human Capital Investment: Significant expenditure on recruiting, training, and retaining a knowledgeable workforce is a core component of BBSI's service delivery.

- Operational Infrastructure: Maintaining the systems and support necessary for personalized client management contributes to elevated operating expenses.

- Competitive Cost Landscape: The need to manage these costs effectively is crucial when benchmarked against competitors with potentially lower overhead due to different service delivery models.

Reliance on Workers' Compensation Insurance Market Dynamics

BBSI's significant reliance on the workers' compensation insurance market presents a notable weakness. This core offering, which drives a substantial portion of its revenue, makes the company particularly susceptible to market volatility. For instance, a downturn in insurance premium pricing or an increase in claims frequency, which can be influenced by economic conditions or regulatory shifts, could directly squeeze BBSI's profit margins and elevate its risk profile.

The company's financial stability is therefore intrinsically linked to the health and predictability of the workers' compensation sector. Adverse underwriting cycles, characterized by increased competition and reduced profitability for insurers, could further exacerbate these challenges. Effectively managing these insurance-related risks is paramount to maintaining BBSI's financial equilibrium.

Key vulnerabilities include:

- Sensitivity to Premium Fluctuations: Changes in workers' compensation insurance rates directly impact BBSI's revenue and client costs.

- Claims Experience Volatility: An uptick in workplace injuries or fraudulent claims can significantly increase BBSI's payout obligations and impact profitability.

- Regulatory Environment Changes: Evolving state-specific workers' compensation laws and compliance requirements can introduce operational complexities and financial burdens.

- Underwriting Cycle Impact: Periods of intense competition and lower premiums in the insurance market can reduce BBSI's profitability on its core services.

BBSI's dependence on the SMB sector makes it vulnerable to economic downturns, as smaller businesses are often hit hardest. This cyclicality means BBSI's revenue, often tied to payroll, can shrink during recessions. For example, a 5% rise in SMB bankruptcies, a plausible scenario in late 2024 or 2025, could significantly impact client retention and growth.

The competitive landscape for PEO and HR services is intense, with numerous national and regional players, plus emerging HR tech platforms. This rivalry can limit BBSI's pricing power and market share gains, requiring continuous investment in service improvements and client acquisition efforts.

BBSI's reliance on workers' compensation insurance exposes it to market volatility. Changes in premium pricing or increased claims frequency, influenced by economic or regulatory factors, can directly affect profit margins and risk. For instance, adverse underwriting cycles with lower premiums can reduce profitability on core services.

The company's service-intensive model, while fostering strong client relationships, leads to high operating costs. This necessitates significant investment in skilled personnel and infrastructure, potentially creating higher overheads compared to tech-focused competitors. In Q1 2024, BBSI reported $67.1 million in SG&A, highlighting the cost of its personalized service delivery.

Preview Before You Purchase

BBSI SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual BBSI SWOT analysis, ensuring transparency and quality. Once purchased, you'll gain access to the complete, detailed report.

Opportunities

Small and medium-sized businesses are increasingly offloading complex administrative tasks to focus on their core business and expansion. This is largely due to the growing complexity of compliance, the need for specialized HR knowledge, and the goal of cutting operational costs. For instance, a 2024 report indicated that over 60% of SMBs surveyed were considering or actively outsourcing at least one HR function.

BBSI is strategically positioned to benefit from this expanding market. By offering comprehensive solutions that handle payroll, HR, benefits, and risk management, BBSI allows SMBs to streamline operations and reduce administrative burdens, which is a significant draw in the current economic climate.

BBSI has a significant opportunity to expand its reach into underserved geographic markets, particularly in states with a high concentration of small and medium-sized businesses (SMBs) that may lack robust HR and payroll support. For instance, states like Texas and Florida, which have seen substantial SMB growth in recent years, present fertile ground for BBSI's integrated service model. This expansion can tap into a large, unmet demand for outsourced HR solutions.

Furthermore, BBSI can strategically target specific industry verticals that possess complex compliance or unique human capital needs. Industries such as healthcare, construction, or technology, with their distinct regulatory landscapes and talent acquisition challenges, could benefit immensely from BBSI's specialized expertise. This focused approach allows for tailored service offerings and deeper market penetration.

By diversifying its client base through geographic and vertical expansion, BBSI can mitigate risks associated with over-reliance on any single market or industry. This strategic diversification not only strengthens its market position but also enhances its resilience against economic downturns, as seen in the varied performance of different sectors during 2024 economic shifts.

Investing in advanced technology, like automation and data analytics, can significantly boost BBSI's service quality and operational efficiency. For instance, adopting AI-powered HR solutions could streamline candidate screening and onboarding, potentially reducing time-to-hire by up to 30% based on industry trends in 2024.

Developing digital portals for client self-service and implementing predictive analytics for risk management offers new value. This digital transformation can attract a growing segment of tech-savvy clients and improve scalability, allowing BBSI to manage a larger client base without a proportional increase in overhead.

Strategic Acquisitions of Smaller PEOs or HR Tech Companies

The PEO and HR services market remains quite fragmented, offering BBSI a clear runway for growth through strategic acquisitions. This fragmentation means there are many smaller players that could be integrated to BBSI's benefit.

Acquiring smaller Professional Employer Organizations (PEOs) directly translates to an immediate boost in BBSI's client roster, extending its physical presence into new territories, and broadening its access to skilled HR professionals. For instance, the PEO market in the US alone is projected to reach over $300 billion in revenue by 2025, indicating substantial consolidation potential.

Furthermore, targeting HR technology firms opens doors to integrating cutting-edge capabilities and valuable intellectual property. This strategic move would significantly sharpen BBSI's competitive edge by offering clients more advanced, efficient, and comprehensive HR solutions.

- Market Fragmentation: The PEO sector is highly fragmented, with numerous smaller providers ripe for acquisition.

- Client Base Expansion: Acquiring smaller PEOs offers immediate access to their existing client portfolios.

- Geographic Reach: Entry into new markets can be accelerated by acquiring PEOs with established local presences.

- Talent Acquisition: These acquisitions also bring in experienced HR talent and operational expertise.

- HR Tech Integration: Buying HR tech companies allows BBSI to enhance its service offerings with innovative solutions.

Upselling and Cross-selling Additional Services to Existing Clients

BBSI has a significant opportunity to boost revenue by offering existing clients more advanced service tiers or related solutions. For instance, as a client's workforce expands, BBSI could propose enhanced payroll processing or more comprehensive HR compliance support, moving them from a basic package to a premium one. This strategy capitalizes on established trust and understanding of the client's business.

The company can also introduce new services that complement existing ones. If a client is using BBSI for payroll, they might be interested in BBSI's talent acquisition services or specialized benefits administration as their hiring needs increase. This approach fosters deeper client relationships and drives organic growth by meeting evolving client demands.

- Increased Revenue Per Client: BBSI can aim to increase its average revenue per client by identifying and presenting tailored upsell and cross-sell opportunities.

- Leveraging Existing Relationships: The strong relationships BBSI has built with its current client base provide a fertile ground for introducing new services.

- Addressing Evolving Needs: As clients grow, their requirements for HR, payroll, and benefits management often become more complex, creating natural openings for BBSI to offer expanded solutions.

- Data-Driven Service Recommendations: By analyzing client usage patterns and growth trajectories, BBSI can proactively suggest services that align with their future needs, potentially increasing client retention and lifetime value.

BBSI can capitalize on the growing demand for outsourced HR and payroll services, as businesses increasingly offload these functions to focus on core operations. The company is well-positioned to benefit from this trend, offering comprehensive solutions that address complex compliance and administrative burdens. For instance, a 2024 survey revealed that over 60% of small and medium-sized businesses were considering or actively outsourcing HR functions, highlighting a significant market opportunity.

Threats

A significant economic downturn, such as a recession, poses a substantial threat to BBSI. Should consumer spending falter and businesses contract, the demand for BBSI's core services, like payroll processing and HR support for small and medium-sized businesses (SMBs), would diminish. This is a critical external risk that could directly impact revenue streams.

The U.S. economy experienced a slowdown in late 2023 and early 2024, with forecasts for 2024 indicating continued, albeit moderate, growth. However, the risk of recession remains, and if a significant downturn materializes, it could lead to widespread layoffs and business closures among BBSI's SMB client base, directly reducing the volume of payrolls processed and the need for HR outsourcing.

BBSI confronts a significant threat from larger Professional Employer Organizations (PEOs) that possess substantial financial backing and broader market reach. These competitors can leverage greater economies of scale and marketing expenditures, potentially outmaneuvering BBSI for market share, especially in key growth areas.

The burgeoning landscape of HR technology, including Software-as-a-Service (SaaS) platforms, presents another formidable challenge. These solutions offer flexible, often DIY, HR management tools that appeal to cost-conscious small and medium-sized businesses, potentially fragmenting the market and drawing clients away from traditional PEO models.

For instance, the PEO market in the US was valued at approximately $220 billion in 2023 and is projected to grow, indicating intense competition. Companies like ADP TotalSource and Insperity, major players in the PEO space, reported significant revenue growth in their fiscal year 2023 filings, underscoring their competitive strength and investment capacity.

Changes to workers' compensation laws, like benefit caps or altered state rates, could directly affect BBSI's bottom line, particularly its workers' comp services. For instance, a shift in how certain industries are classified could lead to higher premium costs or reduced coverage options for BBSI's clients.

Furthermore, an increase in how often and how severe workplace injuries occur, or heightened competition from other insurance providers, could squeeze BBSI's underwriting profit margins. This necessitates a proactive approach to track these evolving market conditions and adjust strategies accordingly.

Cybersecurity Breaches and Data Privacy Concerns

BBSI, as a custodian of sensitive payroll, HR, and employee data, faces significant risks from cybersecurity breaches. A successful attack could result in substantial financial penalties, legal liabilities, and severe damage to its reputation, eroding client confidence. For instance, the average cost of a data breach in 2024 reached $4.73 million, underscoring the financial implications.

To mitigate these threats, BBSI must prioritize continuous investment in advanced cybersecurity infrastructure and adhere strictly to evolving data privacy regulations. Compliance with frameworks like GDPR and CCPA is not merely a legal obligation but a critical component of maintaining operational integrity and client trust in the face of escalating cyber threats.

- Cybersecurity Breaches: BBSI handles highly sensitive client data, making it a prime target for cybercriminals.

- Financial Penalties: Non-compliance with data protection laws, such as GDPR, can lead to fines of up to 4% of global annual revenue.

- Reputational Damage: A data breach can severely erode client trust and lead to significant customer attrition.

- Regulatory Compliance: Maintaining up-to-date compliance with data privacy regulations is essential to avoid legal repercussions.

Difficulty in Attracting and Retaining Skilled Talent

BBSI's business model hinges on a robust team of experts in HR, payroll, risk, and compliance. The current economic climate, characterized by a persistent tight labor market, presents a significant hurdle in attracting and retaining these specialized professionals. For instance, the U.S. Bureau of Labor Statistics projected a 5.2% unemployment rate for management occupations in May 2024, indicating a competitive landscape for skilled individuals.

The increasing demand for such specialized expertise drives up recruitment and training costs, potentially impacting BBSI's profitability. A scarcity of qualified talent could directly affect the quality of services delivered, leading to decreased client satisfaction and hindering the company's expansion plans.

- High demand for HR and compliance professionals strains recruitment.

- Increased training costs associated with onboarding new talent.

- Potential for service quality degradation due to talent shortages.

- Impact on client retention and business growth capacity.

Increased competition from larger PEOs and agile HR tech solutions threatens BBSI's market share. Economic downturns can reduce demand for its core services, impacting revenue. Additionally, evolving workers' compensation laws and rising workplace injury claims could squeeze profit margins.

SWOT Analysis Data Sources

This BBSI SWOT analysis is built upon a foundation of robust data, drawing from internal financial reports, comprehensive market intelligence, and expert industry evaluations to provide a clear and actionable strategic overview.