BBSI PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BBSI Bundle

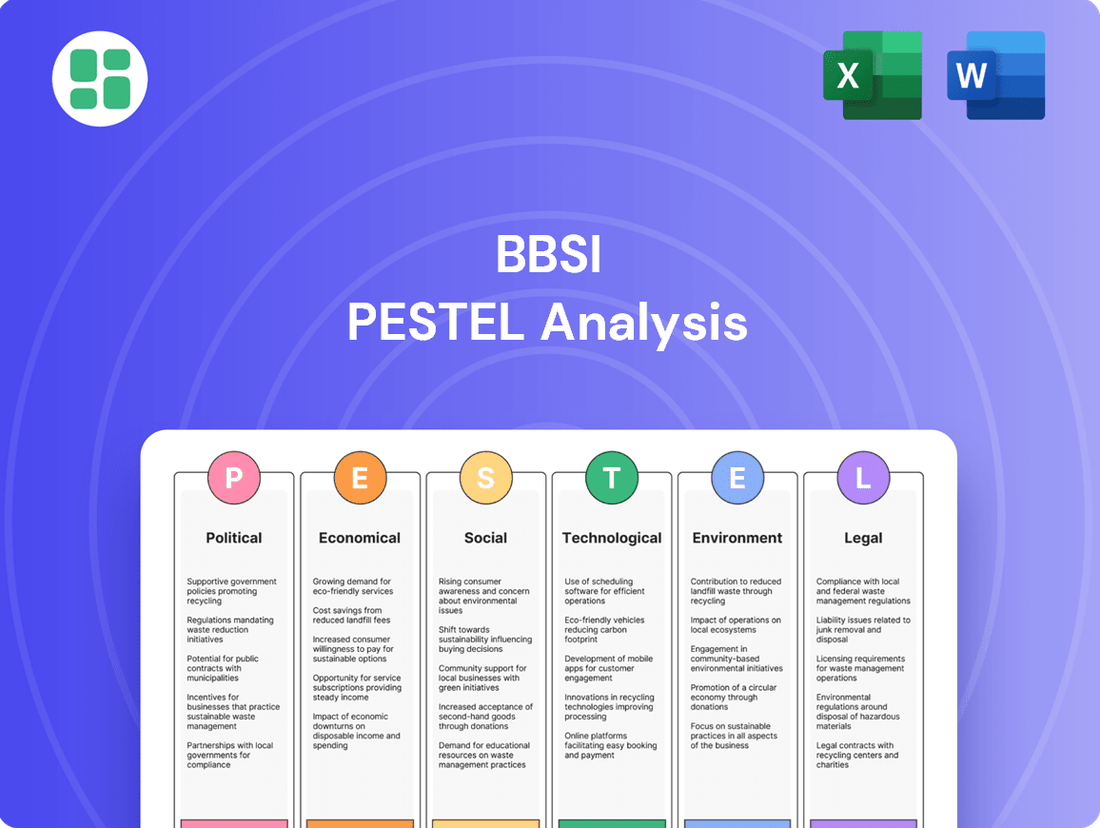

Unlock the critical external factors shaping BBSI's trajectory with our meticulously researched PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges for the company. Equip yourself with the strategic foresight needed to navigate this complex landscape and make informed decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Changes in federal and state labor laws, including minimum wage hikes and evolving overtime rules, directly affect BBSI's core services in payroll and HR compliance. For instance, the federal minimum wage has remained at $7.25 per hour since 2009, but many states and cities have implemented significantly higher rates, with California's minimum wage reaching $16.00 per hour in 2024, creating a complex compliance landscape for businesses operating across different jurisdictions.

Staying current with these dynamic regulations, such as those concerning worker classification, is paramount for BBSI to ensure its clients adhere to legal requirements and sidestep potential penalties. The ongoing debate and potential reclassification of gig economy workers as employees, as seen in various state-level legislative efforts, could significantly alter the demand for BBSI's payroll processing and benefits administration.

Political shifts can introduce substantial policy changes that either present new avenues for BBSI's service expansion or create operational hurdles. For example, increased government scrutiny on independent contractor arrangements could drive more businesses toward traditional employment models, potentially boosting BBSI's client base for full-service HR solutions.

Modifications in corporate tax rates, payroll taxes, or specific tax credits for small and medium-sized businesses (SMBs) directly impact BBSI's client base. For instance, the US federal corporate tax rate was reduced from 35% to 21% in 2017, a significant shift that influenced business investment and hiring decisions. Anticipated adjustments in 2024 or 2025 could further alter the financial landscape for BBSI's clients.

Ongoing discussions around healthcare reform, especially concerning employer-sponsored health coverage, directly influence BBSI's core business of human resource management. As a key partner for small and medium-sized businesses (SMBs) in managing employee benefits, BBSI faces the challenge of adapting to evolving healthcare regulations.

Changes in mandates, such as those potentially impacting the Affordable Care Act (ACA) or new proposals emerging in 2024 and 2025, can significantly alter the financial landscape for BBSI's clients. These shifts can affect the cost of benefits administration and the complexity of compliance, directly impacting the value BBSI provides in simplifying these processes.

For instance, shifts in federal or state healthcare policies could lead to increased administrative burdens or changes in the types of benefits employers can offer, requiring BBSI to update its service models. The stability of healthcare legislation is therefore a critical factor for BBSI's strategic planning and its ability to offer consistent, reliable support to its client base.

Political Stability and Business Confidence

Political stability is a cornerstone for business confidence, directly influencing the investment and expansion decisions of BBSI's small and medium-sized business (SMB) clientele. A predictable political landscape encourages SMBs to commit to growth, which in turn drives demand for BBSI's payroll, HR, and benefits solutions. For instance, in 2024, the U.S. experienced a relatively stable political environment leading up to the election year, which generally supported continued business investment, though some sectors remained cautious due to policy uncertainties.

Conversely, political uncertainty, such as upcoming elections with unpredictable outcomes or significant policy shifts, can create hesitancy among SMBs. This hesitation can manifest as delayed hiring, reduced capital expenditures, and a general slowdown in business growth, directly impacting BBSI's market opportunity. The anticipation of potential tax law changes or regulatory adjustments in 2025, for example, could lead some SMBs to pause expansion plans.

- Political Stability: A stable political environment in 2024 supported SMB confidence, with surveys indicating a moderate willingness to invest in growth.

- Policy Uncertainty: Anticipated policy shifts for 2025, particularly concerning labor regulations and tax incentives, are a key concern for SMBs.

- Impact on BBSI: BBSI's growth is intrinsically linked to the SMB sector's ability and willingness to invest, making political stability a crucial external factor.

Government Support Programs for SMBs

Government support programs significantly influence the small and medium-sized business (SMB) landscape, directly impacting companies like BBSI. Initiatives such as the U.S. Small Business Administration's (SBA) loan guarantees and grant programs, including those for innovation and disaster relief, bolster SMB resilience and growth potential. For instance, in 2023, the SBA guaranteed over $28 billion in loans, providing crucial capital for thousands of small businesses to operate and expand.

These government efforts can foster a more robust market for BBSI's services. When SMBs have access to financial assistance, they are more likely to invest in essential operational support, including payroll processing, HR management, and risk mitigation. This increased capacity for investment translates into higher demand for BBSI's comprehensive solutions, enabling SMBs to focus on growth rather than administrative burdens.

- Increased SMB Investment: Government grants and favorable loan terms can free up capital for SMBs to spend on outsourced services.

- Demand for HR and Payroll: As SMBs expand, their need for compliant and efficient HR and payroll solutions, like those BBSI offers, grows proportionally.

- Risk Mitigation Focus: Government incentives encouraging compliance and safety can drive SMBs to seek expert guidance in risk management.

- Economic Growth Impact: Broader government support for SMBs contributes to overall economic health, creating a more stable environment for BBSI's client base.

Government policies, including labor laws and tax regulations, directly shape the operational environment for BBSI and its clients. For example, the U.S. federal minimum wage has been $7.25 since 2009, but many states, like California, raised their minimum wage to $16.00 in 2024, creating a complex compliance landscape.

Political stability is crucial for BBSI's SMB clients, influencing their investment and expansion decisions. A predictable political climate in 2024 supported SMB confidence, though anticipated policy shifts for 2025, especially regarding labor and taxes, remain a concern for businesses.

Government support programs, such as SBA loan guarantees, bolster SMB resilience. In 2023, the SBA guaranteed over $28 billion in loans, enabling SMBs to invest more in essential services like payroll and HR, thereby increasing demand for BBSI's offerings.

| Factor | 2024 Impact | 2025 Outlook | BBSI Relevance |

| Labor Laws | State minimum wage hikes (e.g., CA $16/hr) increase compliance complexity. | Potential federal adjustments or continued state-level changes. | Directly affects payroll and HR compliance services. |

| Political Stability | Moderate SMB investment due to relative stability. | Anticipated policy uncertainty may temper SMB expansion. | Growth is tied to SMB confidence and investment capacity. |

| Govt. Support Programs | SBA loan guarantees ($28B in 2023) boost SMB capital. | Continued support programs expected to foster SMB growth. | Increased SMB investment drives demand for outsourced HR/payroll. |

What is included in the product

The BBSI PESTLE Analysis provides a comprehensive examination of the external macro-environmental forces impacting BBSI across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

BBSI's performance is closely tied to the overall economic climate, especially the health of small and medium-sized businesses (SMBs). When the economy is growing, SMBs tend to expand, leading to increased demand for BBSI's payroll and HR services. For instance, in 2024, the US economy saw continued growth, with GDP expanding at an annualized rate of 2.5% in the first quarter, which generally bodes well for businesses that rely on SMB clients.

Conversely, economic slowdowns or recessions can negatively impact BBSI. During a downturn, SMBs may cut back on spending, reduce staff, or even close down, directly affecting BBSI's client base and revenue streams. The risk of recession, though debated, remains a factor; for example, while many economists predicted a recession for late 2023 or early 2024, it did not materialize as broadly feared, offering some stability, but the potential for future contraction is always present.

Rising inflation, with the US experiencing a Consumer Price Index (CPI) increase of 3.4% year-over-year as of April 2024, directly translates to higher labor costs for BBSI's clients. This surge in wages can squeeze their profit margins, potentially impacting their capacity to invest in essential business management services.

BBSI plays a crucial role in mitigating these pressures by offering streamlined payroll processing and expert HR guidance, helping clients manage their workforce expenses effectively. The company's own operational expenses are also subject to inflationary impacts, necessitating careful management of its internal salary structures to retain talent.

Interest rates significantly impact small and medium-sized businesses (SMBs) by dictating the cost of borrowing. For instance, as of early 2024, the Federal Reserve's benchmark interest rate has remained elevated, making loans more expensive for businesses looking to invest in new equipment or expand operations. This increased cost of capital can directly affect the growth trajectory of BBSI's potential clients.

When borrowing becomes pricier, SMBs may postpone or scale back expansion plans. This directly translates to a potentially slower growth rate for BBSI's client acquisition, as fewer businesses are actively seeking to scale. For example, if a business previously planned to take out a $500,000 loan for expansion, a 2% increase in interest rates could add tens of thousands of dollars to their annual debt servicing costs, making the expansion less feasible.

Access to affordable capital is the lifeblood of SMBs, enabling them to manage payroll, invest in inventory, and fund growth initiatives. If capital markets tighten or borrowing costs become prohibitive, SMBs are more likely to need the support services that BBSI provides, such as HR and payroll solutions, to navigate these challenging economic conditions and maintain operational efficiency.

Unemployment Rates and Labor Market Dynamics

In 2024, the United States experienced historically low unemployment rates, hovering around 3.7% for much of the year. This tight labor market means businesses, including BBSI's clients, face significant challenges in finding and keeping skilled employees, often leading to upward pressure on wages. BBSI's role in assisting with recruitment, employee retention, and competitive compensation strategies becomes particularly vital in this environment.

Conversely, a significant rise in unemployment, perhaps to levels seen during past economic downturns, would indicate broader economic weakness. Such a scenario could dampen demand for BBSI's core HR and payroll services as clients scale back hiring and operational costs. For instance, if unemployment were to climb to 5% or higher, it would signal a notable shift, impacting the need for workforce expansion services.

- Tight Labor Market: U.S. unemployment rates remained near multi-decade lows in 2024, averaging approximately 3.7%.

- Wage Pressures: This scarcity of available workers directly translates to increased wage demands for businesses.

- BBSI's Value Proposition: Enhanced demand for BBSI's HR expertise in talent acquisition and retention strategies.

- Economic Downturn Indicator: A sharp increase in unemployment would signal economic contraction, potentially reducing service demand.

Wage Growth and Payroll Volume

Consistent wage growth across various sectors directly benefits BBSI by increasing the volume of payroll services it manages, thereby enhancing revenue. For instance, the US Bureau of Labor Statistics reported average hourly earnings for all employees rose 4.1% over the year ending April 2024, indicating a sustained upward trend in payroll costs for businesses.

As wages climb, the intricacies of payroll processing, including tax withholdings and regulatory compliance, become more complex. This escalating complexity underscores the value proposition of BBSI's specialized expertise, as businesses increasingly rely on outsourced solutions to navigate these challenges efficiently.

However, rapid wage increases that outpace productivity gains can put financial pressure on BBSI's clients. If businesses struggle with higher labor costs without a corresponding increase in output, their ability to invest in or maintain essential services, including payroll management, could be impacted. The US saw a 2.7% increase in real average hourly earnings in April 2024 compared to a year ago, suggesting that while wages are growing, productivity is also a factor to monitor.

- Wage Growth Impact: A 4.1% rise in average hourly earnings (April 2024) increases BBSI's service volume and revenue potential.

- Complexity Driver: Rising wages necessitate more sophisticated payroll and tax compliance, highlighting BBSI's core value.

- Client Financial Strain: Unchecked wage growth without productivity gains could strain client budgets, potentially affecting service demand.

Economic stability and growth are paramount for BBSI's success, as its client base consists of small and medium-sized businesses. The US economy in 2024 showed resilience, with GDP growth projected to be around 2.3% for the year, supporting a positive outlook for SMBs and their demand for HR and payroll services.

Inflationary pressures, with the CPI at 3.3% year-over-year in May 2024, directly impact clients' labor costs. This necessitates BBSI's expertise in helping businesses manage these rising expenses efficiently, while also managing its own operational costs.

Interest rates, influenced by the Federal Reserve's monetary policy, affect SMBs' access to capital. Elevated rates in 2024 make borrowing more expensive, potentially slowing business expansion and thus influencing BBSI's client acquisition pace.

The tight labor market in 2024, with unemployment around 3.9% as of May, creates wage pressures for BBSI's clients. This increases the need for BBSI's services in talent management and competitive compensation strategies.

| Economic Factor | 2024 Data/Trend | Impact on BBSI |

|---|---|---|

| GDP Growth | Projected 2.3% | Supports SMB expansion and demand for services. |

| Inflation (CPI) | 3.3% (May 2024) | Increases client labor costs, highlighting BBSI's cost management role. |

| Interest Rates | Elevated | Potentially slows SMB growth and client acquisition. |

| Unemployment Rate | ~3.9% (May 2024) | Drives wage pressures and demand for HR talent solutions. |

Preview Before You Purchase

BBSI PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis for BBSI.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, allowing you to immediately leverage the detailed insights into BBSI's operating environment.

The content and structure shown in the preview is the same document you’ll download after payment, providing a complete PESTLE breakdown for BBSI.

Sociological factors

The workforce is undergoing significant demographic shifts, with Gen Z increasingly entering the job market and the overall workforce becoming more diverse. This evolving landscape demands flexible HR strategies from BBSI to support its clients.

An aging workforce, coupled with the influx of younger generations, presents unique challenges and opportunities for employee engagement and development. BBSI's role is crucial in advising on recruitment, retention, and benefits packages that resonate across multiple generations.

For instance, by mid-2025, Gen Z is projected to constitute a substantial portion of the workforce, bringing different expectations regarding technology, work-life balance, and company values. BBSI must equip its clients with insights to attract and retain this talent pool effectively.

Modern employees, particularly millennials and Gen Z, are placing a significant emphasis on benefits beyond just salary, with a strong desire for work-life balance. A 2024 survey indicated that 70% of employees consider health insurance a top priority, while 65% value flexible work options. These expectations are shaping how businesses attract and retain staff.

BBSI's expertise in human resource management is vital for small and medium-sized businesses (SMBs) seeking to meet these evolving employee demands. By assisting clients in crafting competitive benefits packages and flexible work policies, BBSI helps them stand out in the labor market, thereby reducing recruitment costs and improving retention rates.

For instance, offering comprehensive benefits like robust health plans, retirement savings options, and paid time off can significantly impact employee satisfaction. In 2024, companies with strong benefits packages saw an average employee retention rate 15% higher than those with less competitive offerings, according to industry reports.

Failure to align with these employee expectations can prove costly for BBSI's clients. High employee turnover, often a consequence of unmet needs for benefits and work-life balance, can disrupt operations and increase overhead. In 2025, the estimated cost of replacing an employee is projected to be 1.5 to 2 times their annual salary, underscoring the financial imperative for businesses to get this right.

The increasing demand for flexible work arrangements, including remote, hybrid, and gig work, significantly reshapes traditional employment. By 2024, a significant portion of the workforce, estimated to be over 30% in many developed economies, actively seeks or participates in these flexible models.

BBSI must adapt by helping clients establish robust policies, payroll, and compliance systems to manage these diverse work structures. This includes navigating varying state and local regulations for remote employees, a complexity that grew substantially post-2020.

This societal shift presents BBSI with a prime opportunity to enhance its service portfolio, offering specialized support for businesses integrating flexible talent, thereby catering to evolving workforce expectations and expanding its market reach.

Aging Workforce and Succession Planning

The aging workforce presents a significant challenge for many small and medium-sized businesses (SMBs). As a substantial segment of experienced employees nears retirement age, companies grapple with the potential loss of critical knowledge and institutional memory. This demographic shift necessitates proactive succession planning to ensure smooth transitions in leadership and operational continuity.

BBSI's HR consulting services are particularly relevant here. They can assist SMB clients in developing robust succession plans, identifying and nurturing future leaders, and implementing strategies to retain valuable, experienced employees. This proactive approach helps mitigate the risks associated with an aging workforce and ensures the long-term health of the organization.

Consider these statistics:

- In 2024, approximately 20% of the US workforce is aged 55 and over, a figure projected to grow.

- A 2023 survey found that 70% of SMBs lack a formal succession plan.

- Companies with effective succession planning are 2.4 times more likely to outperform their peers financially.

Importance of Diversity, Equity, and Inclusion (DEI)

Societies worldwide are placing a greater emphasis on Diversity, Equity, and Inclusion (DEI), creating an expectation for businesses to cultivate genuinely inclusive environments. BBSI's human resources services are well-positioned to assist clients in crafting and executing robust DEI strategies, including the development of anti-discrimination policies and comprehensive training programs.

Embracing DEI principles is not merely an ethical imperative; it's becoming a critical factor for businesses aiming to attract and retain top talent. For instance, a 2024 report indicated that 76% of job seekers consider diversity and inclusion a key factor when evaluating potential employers, directly impacting a company's ability to secure skilled professionals.

- Talent Attraction: Companies with strong DEI initiatives report a 20% higher success rate in attracting diverse candidates.

- Employee Retention: Inclusive workplaces see a 15% lower voluntary turnover rate compared to less inclusive environments.

- Brand Reputation: Positive DEI practices contribute to an enhanced brand image, with 67% of consumers stating they prefer to buy from companies that demonstrate social responsibility.

- Innovation: Diverse teams are 17% more likely to be innovative and experience higher productivity.

Societal shifts are profoundly impacting the workforce, from generational expectations to a growing emphasis on inclusivity. BBSI's role is to guide clients through these changes, ensuring they remain competitive and compliant.

By mid-2025, Gen Z's increasing presence will necessitate adaptive HR strategies, focusing on work-life balance and company values. Simultaneously, the aging workforce requires proactive succession planning, with 70% of SMBs lacking formal plans as of 2023.

Furthermore, the demand for flexible work arrangements is a significant trend, with over 30% of workers in many developed economies seeking or participating in such models by 2024. BBSI can help clients navigate the complexities of managing diverse work structures and compliance.

The push for Diversity, Equity, and Inclusion (DEI) is also critical, as 76% of job seekers consider it when choosing an employer in 2024. Companies with strong DEI initiatives see a 20% higher success rate in attracting diverse candidates.

Technological factors

Continuous innovation in HRIS and payroll software directly impacts BBSI's core service delivery, enabling more streamlined operations. For instance, the HR tech market was projected to reach $37.7 billion by 2025, indicating significant investment in these areas. BBSI's ability to leverage these advancements allows for enhanced efficiency and accuracy in client solutions.

BBSI's reliance on handling sensitive client and employee data, including payroll and personal information, makes it highly vulnerable to escalating cybersecurity threats. The growing complexity of these threats demands constant vigilance and investment in advanced security measures. For instance, ransomware attacks, a prevalent threat in 2024 and projected to continue into 2025, can cripple operations and lead to substantial financial losses, with the average cost of a data breach reaching $4.45 million globally in 2024, according to IBM's Cost of a Data Breach Report.

Maintaining client trust and avoiding costly breaches hinges on robust data security protocols and strict adherence to data privacy regulations, such as GDPR and CCPA. Non-compliance can result in significant fines; for example, under GDPR, penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. BBSI's commitment to cybersecurity isn't just about preventing attacks; it's a critical component of its operational integrity and client relationship management.

Automation technologies are increasingly streamlining routine administrative tasks like data entry, compliance checks, and basic reporting. This trend is significantly impacting how businesses manage their back-office operations.

BBSI can harness these advancements to boost efficiency, minimize human error in processes, and redirect its workforce towards higher-value client services. For instance, by automating payroll processing, which often involves significant data handling, BBSI could reduce processing time and potential inaccuracies.

In 2024, the global market for Robotic Process Automation (RPA), a key automation technology, was projected to reach $13.7 billion, indicating a substantial investment and adoption rate by businesses seeking operational improvements. This adoption directly translates to enhanced service quality and greater operational scalability for companies like BBSI.

AI and Machine Learning for HR Analytics

Artificial Intelligence (AI) and Machine Learning (ML) are transforming HR analytics, offering powerful tools for predictive insights and personalized employee experiences. BBSI can leverage these technologies to guide clients in making smarter, data-driven workforce decisions.

By integrating AI and ML, BBSI can assist clients with sophisticated talent management strategies, proactive risk mitigation, and optimized workforce planning, thereby elevating their role from transactional support to a strategic partnership. For instance, AI-powered tools can analyze vast datasets to identify flight risks or predict future skill gaps.

- Predictive Workforce Planning: AI can forecast staffing needs with greater accuracy, potentially reducing hiring costs by up to 20% by identifying optimal hiring times and candidate profiles.

- Enhanced Talent Acquisition: ML algorithms can screen resumes and identify top candidates more efficiently, speeding up the hiring process by an average of 30% in 2024.

- Personalized Employee Development: AI can tailor training and development programs based on individual performance data and career aspirations, boosting employee engagement and retention.

- Risk Mitigation: Predictive analytics can flag potential compliance issues or employee dissatisfaction trends, allowing for early intervention and reducing potential liabilities.

Cloud-Based Solutions for Business Management

The pervasive adoption of cloud-based solutions is a significant technological factor for BBSI. These platforms offer scalability and accessibility, crucial for managing a diverse client base and workforce. For instance, in 2024, the global cloud computing market was projected to reach over $600 billion, highlighting its central role in business operations.

Cloud technology directly enhances BBSI's service delivery by enabling remote access and real-time data synchronization. This allows for greater operational efficiency and responsiveness to client needs. Such capabilities are vital in today's fast-paced business environment, where agility is paramount.

- Scalability: Cloud infrastructure allows BBSI to easily scale its services up or down based on demand, managing growth effectively.

- Accessibility: Enables BBSI employees and clients to access critical business management tools and data from anywhere, at any time.

- Integration: Facilitates seamless integration with various third-party applications, streamlining workflows and data management.

- Security: Reputable cloud providers offer robust security measures, protecting sensitive client and company data.

Technological advancements are profoundly reshaping how BBSI operates, from HRIS efficiency to the critical need for cybersecurity. The rapid evolution of automation and AI presents opportunities for enhanced service delivery and strategic client guidance.

The increasing reliance on cloud computing underscores BBSI's need for scalable, accessible, and integrated solutions to manage its diverse client base effectively. These technological shifts are not just about operational improvements but are integral to maintaining client trust and competitive advantage in the evolving business landscape.

BBSI's strategic adoption of technologies like AI for predictive workforce planning and ML for talent acquisition can lead to significant cost savings and efficiency gains. For example, AI-driven talent acquisition can speed up hiring by an average of 30% in 2024, while predictive analytics can potentially reduce hiring costs by up to 20%.

The cybersecurity landscape demands continuous investment, especially with threats like ransomware projected to persist. The global average cost of a data breach reached $4.45 million in 2024, highlighting the financial imperative for robust security measures.

| Technology Area | Projected Market Size (2024/2025) | Impact on BBSI | Key Benefit |

|---|---|---|---|

| HR Tech | $37.7 billion (projected 2025) | Streamlined HRIS and payroll operations | Enhanced efficiency and accuracy |

| Robotic Process Automation (RPA) | $13.7 billion (projected 2024) | Automation of routine administrative tasks | Reduced human error, focus on higher-value services |

| Cloud Computing | Over $600 billion (projected 2024) | Scalable and accessible service delivery | Improved operational agility and client responsiveness |

| Cybersecurity (Data Breach Cost) | $4.45 million (global average 2024) | Mitigation of financial and reputational risks | Protection of sensitive client data and operational integrity |

Legal factors

BBSI navigates a dense landscape of labor laws, from federal minimum wage requirements, which stood at $7.25 per hour as of my last update, to state-specific overtime rules and evolving worker classification standards. These regulations directly shape BBSI's core offerings in payroll, HR, and risk management, demanding constant adaptation of its client advisory services.

Changes in legislation, such as potential increases in the federal minimum wage or new paid leave mandates, directly influence BBSI's operational strategies and the guidance it offers to businesses. For instance, a significant federal minimum wage hike could necessitate adjustments to payroll processing and cost-saving recommendations for clients.

Ensuring client adherence to these dynamic legal frameworks is paramount for BBSI to mitigate potential litigation and penalties, which can range from back wages to substantial fines. For example, misclassification penalties can be severe, impacting both BBSI's reputation and its clients' financial stability.

BBSI's core business is heavily influenced by workers' compensation regulations, which vary significantly by state. These laws dictate premium calculations, claims processing, and benefit levels, directly impacting BBSI's operational costs and the pricing of its insurance solutions for clients.

For instance, a state's decision to increase benefit payouts or modify its experience modification factor (e-mod) calculation can lead to higher insurance premiums for businesses and affect BBSI's underwriting profitability. The National Council on Compensation Insurance (NCCI) regularly analyzes rate filings; in 2024, several states saw adjustments to their advisory loss costs, reflecting evolving claim trends and economic conditions.

Regulatory changes, such as new mandates for safety programs or stricter oversight on claims management, can also necessitate adjustments to BBSI's risk management services and compliance protocols. Maintaining regulatory stability is therefore crucial for BBSI to offer predictable and competitive workers' compensation solutions, ensuring client retention and continued market penetration.

BBSI must navigate an increasingly complex landscape of data privacy laws, with regulations like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), setting stringent standards for data handling. These laws, and similar frameworks emerging across other states and globally, mandate specific protocols for data collection, consent, storage, and user rights, impacting how BBSI manages sensitive client and employee information. Failure to comply can result in significant penalties, with CCPA fines potentially reaching $7,500 per intentional violation, underscoring the critical need for robust data governance.

The sheer volume of personal and proprietary data BBSI processes necessitates continuous vigilance and adaptation to evolving privacy legislation. As of early 2024, over a dozen US states have enacted comprehensive data privacy laws, creating a patchwork of compliance requirements that BBSI must meticulously adhere to. This ongoing regulatory evolution demands proactive strategies for data protection, consent management, and breach notification to safeguard against substantial financial penalties and maintain stakeholder trust.

Employment Discrimination Laws

Employment discrimination laws are foundational to BBSI's core service offerings. These regulations, which prohibit bias based on age, gender, race, religion, disability, and other protected characteristics, directly impact how businesses manage their workforce. BBSI plays a vital role in helping clients navigate these complex legal landscapes by advising on the development of fair hiring processes, inclusive workplace policies, and robust complaint resolution mechanisms.

Staying abreast of evolving legal interpretations and new legislation is paramount. For instance, the U.S. Equal Employment Opportunity Commission (EEOC) reported over 60,000 private sector charges of discrimination in fiscal year 2023, underscoring the ongoing relevance and enforcement of these statutes. BBSI must continuously update its best practices and client guidance to reflect these changes, ensuring compliance and mitigating risk for its clientele.

- EEOC Charge Data: In FY 2023, the EEOC received 63,798 private sector discrimination charges, with retaliation being the most common basis alleged.

- Age Discrimination in Employment Act (ADEA): This act continues to be a significant area of focus, particularly with an aging workforce.

- Americans with Disabilities Act (ADA): Compliance with ADA, including reasonable accommodation requests, remains a critical area for employers.

- Pay Equity Legislation: Increased legislative focus on closing gender and racial pay gaps necessitates proactive client consultation on compensation practices.

Compliance Requirements for Payroll and Taxation

The complexity of tax codes at federal, state, and local levels presents a significant challenge for BBSI's payroll services. Staying current with changes in income tax withholding, Social Security, Medicare, and unemployment taxes is crucial. For instance, the Tax Cuts and Jobs Act of 2017 continues to influence withholding tables, and states frequently update their own tax rates and regulations, with many states adjusting their tax brackets and withholding amounts annually, often effective January 1st.

BBSI's ability to ensure precise and timely compliance for all its clients is paramount to avoiding substantial penalties and maintaining financial accuracy. Failure to adhere to these evolving legal and regulatory requirements can result in significant fines and interest charges for both BBSI and its clients. Keeping abreast of these updates, such as the ongoing discussions and potential legislative changes regarding payroll tax liabilities and reporting requirements, is a constant operational focus.

- Federal Tax Code Updates: The IRS regularly publishes updated withholding tables and guidance, impacting how much tax is withheld from employee paychecks.

- State-Specific Regulations: Each state has its own income tax, unemployment insurance rates, and reporting requirements, necessitating tailored compliance for clients in different states.

- Local Tax Ordinances: Some cities and municipalities also impose local income or payroll taxes, adding another layer of complexity to administration.

- Compliance Penalties: Inaccurate or late filings can lead to penalties, with interest accruing on underpayments, emphasizing the need for meticulous record-keeping and timely remittances.

The legal environment significantly shapes BBSI's operations, particularly concerning employment law and compliance. Key legislation like the Fair Labor Standards Act (FLSA) dictates minimum wage and overtime, while anti-discrimination statutes, such as those enforced by the EEOC, require careful adherence in hiring and management practices. BBSI's role involves guiding clients through these complex requirements to prevent legal challenges and financial penalties.

Workers' compensation laws, varying by state, directly influence BBSI's insurance offerings and risk management services. For example, states frequently update their advisory loss costs, as seen with NCCI analyses in 2024, impacting premium calculations and client costs. BBSI must adapt its strategies to these dynamic regulatory shifts to maintain competitive pricing and client satisfaction.

Data privacy regulations, including state-level acts like the CPRA, impose strict rules on how BBSI handles sensitive client and employee information. With over a dozen states enacting comprehensive privacy laws by early 2024, BBSI faces a complex compliance landscape, necessitating robust data governance to avoid significant fines, which can reach $7,500 per intentional CCPA violation.

Tax code complexity at all government levels demands constant attention for BBSI's payroll services. Federal updates to withholding tables and state-specific tax rate adjustments, often effective annually, require meticulous management to ensure accurate payroll processing and avoid penalties. Local ordinances can further complicate compliance, underscoring the need for precise, timely remittances.

| Legal Area | Key Legislation/Regulation | Impact on BBSI | Example/Data Point (2023-2025) |

|---|---|---|---|

| Employment Law | FLSA, EEOC Statutes | Guides HR, payroll, risk management services; requires client compliance advice. | EEOC received 63,798 private sector charges in FY 2023; retaliation most common allegation. |

| Workers' Compensation | State-specific WC laws | Affects insurance pricing, claims processing, and risk management solutions. | NCCI analyzed advisory loss cost adjustments in several states during 2024. |

| Data Privacy | CCPA, CPRA, state laws | Mandates strict data handling protocols, impacting client and employee data management. | CCPA fines up to $7,500 per intentional violation; over 12 US states had comprehensive laws by early 2024. |

| Tax Compliance | Federal, State, Local Tax Codes | Requires accurate payroll tax withholding, reporting, and remittances. | States frequently update tax brackets and withholding amounts, often effective January 1st annually. |

Environmental factors

Investors, customers, and employees are increasingly prioritizing Environmental, Social, and Governance (ESG) principles, driving significant shifts in how businesses operate. For BBSI, this translates into opportunities to support clients in navigating these evolving expectations.

While BBSI's core services are in HR and compliance, they can indirectly bolster a client's ESG standing. By assisting with policy development that addresses the 'Social' and 'Governance' components of ESG, BBSI helps clients build more robust sustainability profiles. For instance, robust employee relations policies and transparent governance structures are key ESG indicators.

The growing ESG movement is already impacting client perception and demand. A 2024 survey by PwC found that 60% of investors consider ESG factors when making investment decisions, highlighting the tangible business imperative for companies to demonstrate strong ESG performance.

Growing environmental consciousness is a significant driver for BBSI's clients, especially those in sectors like manufacturing and retail. These businesses are increasingly being asked by their own customers and stakeholders to demonstrate a commitment to sustainability.

While BBSI's core services don't include direct environmental consulting, its role as a PEO allows for indirect support. For instance, by offering robust digital HR platforms, BBSI helps clients reduce their reliance on paper, a tangible step towards greener operations. This digital transformation is crucial, as a significant percentage of businesses are aiming to increase their sustainability reporting, with some studies in late 2024 indicating over 60% of companies now consider ESG factors in their strategy.

This client demand for sustainable practices is likely to influence future expectations regarding BBSI's technological offerings and overall operational efficiency. Clients will probably seek PEO partners who can facilitate their own sustainability goals, pushing for more integrated digital solutions that minimize environmental impact.

The increasing frequency of extreme weather events, a direct consequence of climate change, poses significant operational risks for BBSI's clients. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $170 billion in damages. These events can lead to widespread business interruptions, supply chain disruptions, and damage to physical assets, impacting client productivity and revenue streams.

These disruptions can also lead to workforce displacement and a rise in workers' compensation claims, particularly for businesses in vulnerable sectors like agriculture, construction, and manufacturing. As of early 2024, data suggests a noticeable uptick in claims related to heat stress and injuries sustained during severe weather clean-up efforts. BBSI's role becomes crucial in assisting clients with robust disaster preparedness strategies and business continuity planning to mitigate these impacts and ensure operational resilience.

Regulatory Pressure for Environmental Compliance

While BBSI doesn't directly engage in heavy industrial operations, its extensive client base operates across diverse sectors, many of which face significant environmental regulations. For instance, in 2024, industries like manufacturing and logistics, which represent a substantial portion of BBSI's clientele, are increasingly scrutinized for their carbon footprint and waste management practices. These regulations can impact operational costs for clients, potentially influencing their demand for BBSI's human capital management services.

BBSI's risk mitigation and compliance services can indirectly assist clients in navigating environmental risks. By ensuring robust documentation and adherence to safety standards, BBSI helps clients maintain operational integrity, which often has a crossover with environmental health requirements. For example, proper handling of workplace materials can reduce environmental contamination risks, a growing concern for regulators and public perception.

The evolving landscape of environmental legislation presents both challenges and opportunities. Consider the potential impact of new emissions standards or waste disposal mandates. Reports from early 2025 indicate that compliance costs for businesses in sectors like transportation could rise by an estimated 5-10% due to stricter environmental controls, a factor that may indirectly affect client budgets for outsourced services.

- Regulatory Impact on Client Operations: Industries served by BBSI, such as manufacturing and logistics, face increasing environmental scrutiny in 2024-2025.

- BBSI's Indirect Support: BBSI's compliance and risk management services can help clients meet safety standards that align with environmental health requirements.

- Financial Implications for Clients: New environmental regulations could lead to an estimated 5-10% increase in compliance costs for some BBSI clients by early 2025.

BBSI's Internal Environmental Footprint and Sustainability Initiatives

While BBSI is primarily a service-based company, its internal environmental footprint and sustainability initiatives play a role in its brand perception. Efforts like improving energy efficiency in its offices, minimizing waste, and embracing digital document management contribute to a more responsible corporate image. For instance, many companies in 2024 and 2025 are setting ambitious targets for reducing their carbon emissions, with some aiming for 30-50% reductions by 2030.

Demonstrating a commitment to environmental responsibility can significantly resonate with clients and potential employees who increasingly value partnerships with eco-conscious organizations. This alignment with sustainability values can enhance BBSI's societal perception and attract talent that prioritizes ethical business practices.

- Energy Efficiency: Implementing smart building technologies and encouraging energy-saving behaviors among employees.

- Waste Reduction: Focusing on recycling programs, reducing paper consumption through digital workflows, and minimizing single-use plastics in office environments.

- Digital Transformation: Prioritizing digital document management to decrease reliance on paper and associated resources.

- Supply Chain Engagement: Encouraging sustainable practices among its own vendors and partners.

Environmental factors significantly influence BBSI's clients, with growing demand for sustainability and increasing regulatory pressures. Extreme weather events, like the 28 billion-dollar disasters in the U.S. during 2023, disrupt operations and increase claims for BBSI's clients. Stricter environmental controls, potentially raising compliance costs by 5-10% for some industries by early 2025, also impact client budgets.

| Environmental Factor | Impact on BBSI Clients | BBSI's Indirect Role |

|---|---|---|

| Climate Change & Extreme Weather | Business interruptions, supply chain disruptions, increased workers' compensation claims (e.g., 28 U.S. billion-dollar disasters in 2023 causing over $170 billion in damages). | Assisting with disaster preparedness and business continuity planning. |

| Environmental Regulations | Increased operational costs, potential for higher compliance expenses (e.g., 5-10% rise in early 2025 for some sectors). | Helping clients adhere to safety standards that often overlap with environmental health requirements. |

| Client Demand for Sustainability | Pressure to demonstrate commitment to greener practices, influencing choice of service providers. | Facilitating digital HR platforms to reduce paper usage, supporting client sustainability reporting goals. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using data from reputable sources like the World Bank, IMF, and leading market research firms. We integrate official government reports, economic indicators, and technological trend analyses to provide a comprehensive view of the macro-environment.