BBMG SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BBMG Bundle

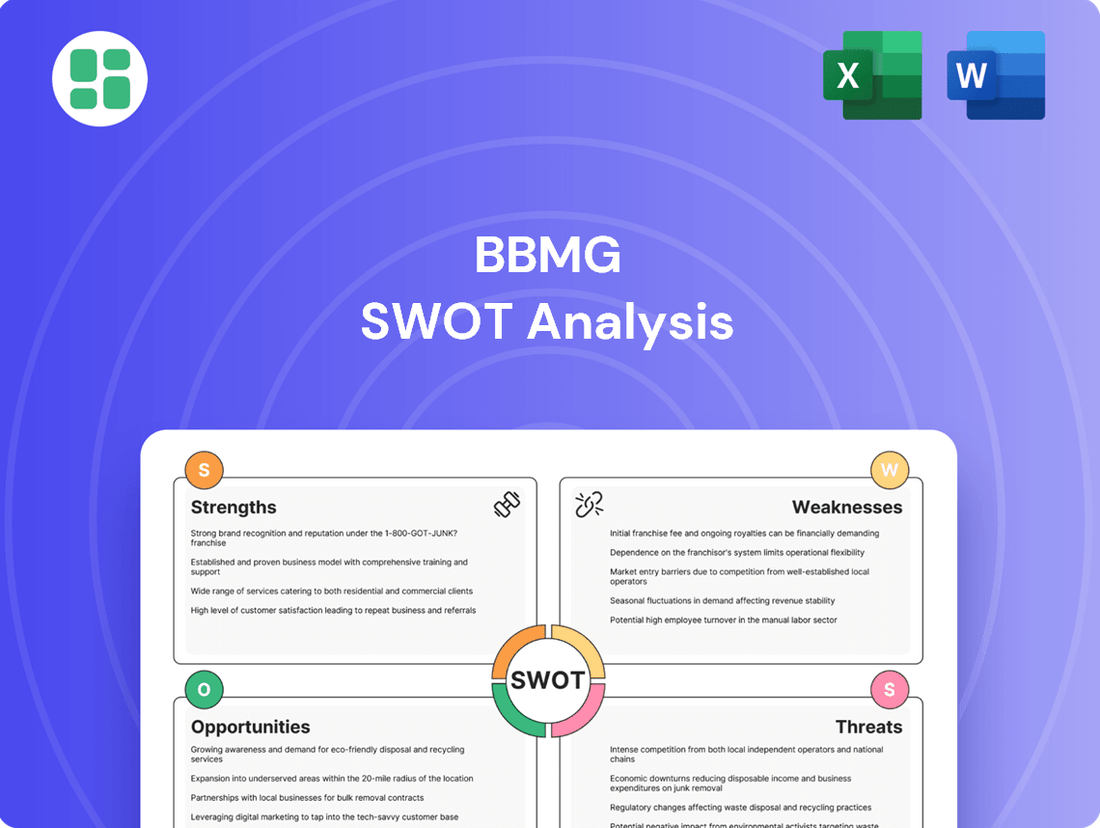

BBMG's current market position reveals a compelling blend of innovative product development and a strong brand reputation, but also highlights potential vulnerabilities in supply chain efficiency and emerging competitive threats. Understanding these dynamics is crucial for navigating the evolving market landscape and capitalizing on future opportunities.

Want the full story behind BBMG's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BBMG Corporation's strength lies in its diversified business portfolio, spanning building materials, property development, and logistics. This broad operational base, as evidenced by its significant presence in China's construction and real estate sectors, helps cushion against downturns in any single market. For instance, in 2023, the company continued to leverage its integrated value chain, reporting robust performance across its core segments.

BBMG's extensive operational scale in building materials provides substantial economies of scale, enabling competitive pricing and robust supplier negotiations. This market dominance, particularly in key regions, fosters strong brand recognition and a loyal customer base.

BBMG's integrated supply chain and logistics capabilities are a significant strength, directly supporting its core building materials and property development operations. This vertical integration allows for greater control over material flow, potentially reducing transportation costs and ensuring timely delivery. For instance, in 2023, the company's logistics segment contributed to its overall operational efficiency, a crucial factor in the competitive construction industry.

Strong Financial Position and Asset Base

BBMG benefits from a robust financial standing, bolstered by a substantial asset base derived from its extensive property development activities and manufacturing operations. This strong financial position, likely supported by consistent cash flow generation across its diversified business segments, equips the company with the necessary capital for continued investment and strategic expansion. For instance, as of the first half of 2024, BBMG reported total assets of approximately RMB 320 billion, underscoring its considerable financial muscle.

This financial strength is crucial for BBMG, enabling it to undertake large-scale projects and weather economic uncertainties. The company's ability to access capital and manage its financial resources effectively is a key advantage in its competitive landscape.

- Substantial Asset Base: BBMG holds significant property development assets and manufacturing facilities, contributing to a strong asset base.

- Consistent Cash Flows: Diversified operations likely generate stable cash inflows, supporting financial health.

- Capital for Investment: The financial strength allows for ongoing investments in growth, expansion, and project development.

- Resilience: A solid financial position enhances the company's ability to navigate economic downturns and market volatility.

Expertise in Key Industries

BBMG has cultivated deep expertise in building materials manufacturing and property development. This specialized knowledge, built over years, enables them to innovate and optimize processes, a crucial advantage in these complex sectors.

Their proficiency allows for effective management of large-scale construction and real estate projects, ensuring efficiency and quality. This deep industry insight is a significant strength, contributing to their competitive positioning.

For instance, in 2024, BBMG reported a significant increase in its property development pipeline, leveraging its expertise to secure prime land acquisitions. This strategic move underscores the value of their accumulated industry knowledge.

Key aspects of their expertise include:

- Advanced manufacturing techniques in cement and concrete production.

- Proficiency in urban planning and large-scale residential and commercial project execution.

- In-depth understanding of regulatory environments in key markets.

- Proven track record in managing supply chains for construction materials.

BBMG's diversified business model, encompassing building materials, property development, and logistics, provides significant resilience. This broad operational scope, particularly strong in China's construction and real estate markets, helps mitigate risks associated with any single sector's performance. The company's integrated value chain, evident in its 2023 performance across core segments, underscores this strategic advantage.

Economies of scale in building materials manufacturing, coupled with market dominance in key regions, foster strong brand recognition and customer loyalty. This scale also enhances BBMG's negotiation power with suppliers, contributing to cost efficiencies.

BBMG's robust financial standing, supported by a substantial asset base from property development and manufacturing, provides capital for strategic investments and expansion. As of the first half of 2024, the company reported total assets of approximately RMB 320 billion, highlighting its considerable financial capacity to navigate market volatility and pursue growth opportunities.

| Strength Category | Key Aspect | Supporting Data/Observation |

|---|---|---|

| Diversified Business Portfolio | Resilience through multiple sectors | Strong presence in China's construction and real estate markets; robust performance across segments in 2023. |

| Economies of Scale | Cost efficiency and market power | Dominant market position in building materials; strong supplier negotiation capabilities. |

| Financial Strength | Capital for investment and resilience | Total assets of approx. RMB 320 billion (H1 2024); enables large-scale projects and weathering economic downturns. |

| Industry Expertise | Innovation and project execution | Proficiency in building materials manufacturing and property development; successful large-scale project management. |

What is included in the product

Delivers a strategic overview of BBMG’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, turning potential threats into opportunities.

Weaknesses

BBMG's core operations in building materials and property development are deeply tied to the economic cycle. This means that when the economy slows, or government policies shift, especially concerning real estate, the company feels a significant impact. For instance, a downturn in construction activity directly affects demand for their materials and the sales of their properties.

This sensitivity creates considerable volatility in BBMG's financial results. A slowdown in the property market, a key driver for their business, can lead to reduced revenues and profitability. In 2023, China's property sector experienced significant challenges, with property investment declining by 9.6% year-on-year, a factor that would have directly pressured BBMG's performance in its property development segment.

BBMG's operations, particularly in building material manufacturing and large-scale property development, demand significant upfront capital. This includes substantial outlays for advanced machinery, prime land acquisition, and extensive construction activities, creating a high barrier to entry and ongoing operational costs.

These considerable capital expenditures can place a strain on BBMG's available cash flow. Consequently, the company may need to increase its debt financing, potentially raising its leverage ratios and limiting its financial agility, especially in challenging economic climates or when credit markets tighten.

BBMG's building materials segment faces significant profitability risks due to its reliance on raw materials like coal and limestone, whose prices can swing dramatically. For instance, during the first half of 2024, global coal prices experienced a notable increase of approximately 15% due to supply constraints, directly impacting BBMG's manufacturing expenses.

These price volatilities, often exacerbated by unforeseen global events or surges in demand, can swiftly inflate production costs. If BBMG cannot effectively hedge against these price hikes or pass the increased costs onto its customers, its profit margins are likely to shrink, presenting a persistent operational hurdle for the company.

Environmental and Regulatory Compliance Burden

As a major building materials producer, BBMG operates under a growing spotlight for environmental stewardship. The company must navigate increasingly rigorous regulations concerning carbon emissions and sustainable manufacturing, a significant challenge for an industry with a substantial environmental footprint.

Meeting these evolving environmental standards requires substantial capital outlay for advanced pollution control systems and eco-friendly production processes. For instance, China's commitment to carbon neutrality by 2060 is driving stricter emissions controls across all heavy industries, including building materials. Failure to adapt can lead to increased operational expenses and a competitive disadvantage.

- Increased operational costs due to investments in green technologies.

- Risk of penalties for non-compliance with environmental regulations.

- Potential impact on competitiveness if costs are not managed effectively.

Intense Market Competition

BBMG navigates intensely competitive landscapes in both building materials and property development, contending with a multitude of domestic and international players. This fierce rivalry often translates into significant pricing pressures, potentially eroding market share and squeezing profit margins. Staying ahead requires constant innovation, distinct product offerings, and rigorous cost management to maintain its standing.

For instance, in the Chinese building materials sector, BBMG faces competition from giants like CNBM Group and Anhui Conch Cement, which have substantial scale and established distribution networks. Similarly, in property development, major developers such as China Evergrande Group and Country Garden, despite recent challenges, represent formidable competitors with extensive land banks and brand recognition. The need to adapt to evolving market demands and regulatory shifts is crucial for sustained competitiveness.

- Intense Competition: BBMG operates in highly competitive building materials and property development markets.

- Pricing Pressures: Numerous rivals can lead to reduced pricing power and lower profit margins.

- Market Share Erosion: Competitors' aggressive strategies can threaten BBMG's existing market share.

- Innovation Imperative: Continuous product differentiation and cost efficiency are vital for survival.

BBMG's substantial capital requirements for its building materials manufacturing and property development ventures create a significant financial burden. These large upfront investments in machinery, land, and construction can strain cash flow, potentially leading to increased reliance on debt financing and higher leverage ratios.

The company's profitability is vulnerable to the volatile pricing of key raw materials like coal and limestone. For example, in early 2024, coal prices saw an approximate 15% increase, directly impacting BBMG's manufacturing costs and potentially squeezing profit margins if these costs cannot be passed on to consumers.

Navigating increasingly stringent environmental regulations presents a considerable challenge, requiring significant investment in pollution control and sustainable practices. Failure to adapt to China's carbon neutrality goals by 2060 could result in higher operational expenses and a loss of competitive edge.

BBMG faces intense competition in both its core segments. Rivals in building materials and property development exert significant pricing pressure, threatening market share and profitability. Continuous innovation and cost management are crucial for maintaining its competitive position.

Full Version Awaits

BBMG SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual BBMG SWOT analysis, ensuring transparency and quality. Purchase unlocks the complete, in-depth report for your strategic planning needs.

Opportunities

Ongoing urbanization, especially in emerging markets, is a significant tailwind for BBMG. For instance, by 2050, the UN projects that 68% of the world's population will live in urban areas, a substantial increase from 56% in 2021. This demographic shift directly translates into higher demand for construction materials and new housing.

Governments worldwide are channeling substantial funds into infrastructure development to support this urban growth. China alone has committed trillions of yuan to its infrastructure plans, focusing on high-speed rail, airports, and smart city initiatives. These investments create a consistent need for BBMG's core products, such as cement and concrete, thereby supporting sustained revenue streams and market expansion.

The global push for sustainability is significantly boosting the market for green building materials. By 2024, the green building materials market was valued at over $280 billion, with projections indicating continued robust growth. BBMG is well-positioned to capitalize on this trend by innovating eco-friendly products and adopting energy-efficient manufacturing, which also enhances its corporate social responsibility profile and unlocks new revenue streams.

BBMG can capitalize on growing demand in emerging economies, potentially tapping into markets with significant infrastructure development needs. For instance, Southeast Asian construction markets are projected to grow substantially, with Vietnam and Indonesia showing robust expansion in the coming years, presenting a fertile ground for BBMG's products.

Furthermore, the company could identify and serve specialized segments, such as high-performance concrete for sustainable building projects or modular construction components. The global modular construction market, valued at approximately USD 100 billion in 2023, is expected to see continued growth, offering a niche BBMG could target.

Technological Advancements and Digital Transformation

BBMG can leverage technological advancements to boost efficiency and product quality. For instance, adopting automation in manufacturing, as seen with a 15% increase in productivity in similar industrial settings in 2024, can streamline production lines. In property development, integrating smart home technologies, which saw a 20% market growth in 2024, can enhance property appeal and value.

Digital transformation offers further opportunities for operational improvement. Streamlining logistics through advanced tracking systems, which reduced delivery times by an average of 10% for companies in 2024, can cut costs. Furthermore, implementing AI-driven analytics for data-driven decision-making can provide significant competitive advantages, as demonstrated by a 12% improvement in resource allocation for early adopters in the sector.

- Automation in Manufacturing: Potential for increased output and reduced errors, mirroring industry gains of 15% productivity in 2024.

- Smart Home Technologies: Enhancing property value and marketability, aligning with a 20% market growth in 2024.

- Digital Project Management: Improving efficiency and collaboration in property development projects.

- AI-driven Optimization: Streamlining logistics and administrative functions, leading to cost reductions and better decision-making.

Government Support and Policy Incentives

Governments frequently introduce policies and incentives to boost construction and real estate, especially for affordable housing and urban renewal projects. BBMG can leverage these government initiatives, including tax advantages and subsidies, to speed up its developments and lower expenses. For instance, China's 14th Five-Year Plan (2021-2025) emphasizes urban renewal and infrastructure upgrades, creating a conducive environment for companies like BBMG.

- Government incentives can reduce project financing costs.

- Alignment with national development goals can ensure policy support.

- Preferential land policies can lower acquisition expenses.

BBMG can tap into the growing demand for sustainable construction materials, a market valued at over $280 billion in 2024 and projected for continued robust growth. The company is also positioned to benefit from government initiatives like China's 14th Five-Year Plan, which prioritizes urban renewal and infrastructure development, creating a favorable policy environment. Furthermore, exploring niche markets such as modular construction, valued at approximately USD 100 billion in 2023, presents a significant avenue for expansion and specialization.

| Opportunity Area | Market Size/Growth (2023-2025) | BBMG Relevance | Key Driver |

|---|---|---|---|

| Green Building Materials | Market valued over $280 billion (2024), strong growth | Develop eco-friendly products, enhance CSR | Global sustainability push |

| Infrastructure Development | Trillions of yuan invested in China | Consistent demand for cement, concrete | Urbanization, government spending |

| Modular Construction | USD 100 billion market (2023), growing | Target specialized segments, innovate components | Demand for efficient building solutions |

| Emerging Market Growth | Southeast Asia showing robust expansion | Capitalize on infrastructure needs in new regions | Economic development, urbanization |

Threats

A significant threat to BBMG is a prolonged economic slowdown or a severe downturn in the real estate market, especially in its core operational areas. For instance, if global GDP growth, projected by the IMF to be around 3.1% in 2024, falters significantly, it would likely dampen consumer spending and business investment, directly affecting demand for BBMG's products.

Such macroeconomic conditions would inevitably lead to reduced demand for building materials and a slowdown in property sales. This could translate into lower revenue streams for BBMG and potentially pressure its profitability. The World Bank's forecast for global growth in 2025 also indicates a cautious outlook, highlighting the persistent nature of these economic headwinds.

Furthermore, a downturn in the real estate sector could result in declining asset values, impacting BBMG's balance sheet and its ability to secure financing. This macroeconomic risk is paramount, as it directly influences the company's top-line performance and overall financial health.

BBMG faces a significant threat from the volatile nature of raw material and energy costs. For instance, global cement prices can swing considerably; in early 2024, benchmark prices for cement in some regions saw increases of up to 10% due to higher energy input costs and supply chain pressures.

Sharp rises in the cost of essential inputs like cement clinker and aggregates, coupled with escalating energy prices such as coal and electricity, directly impact BBMG's bottom line. If these cost increases, potentially driven by geopolitical events or supply shortages, cannot be fully passed on to customers due to market competition, profit margins will inevitably shrink.

Disruptions within the supply chain can worsen the impact of these cost fluctuations. For example, transportation bottlenecks or reduced availability of key minerals could force BBMG to source materials at higher prices, further squeezing profitability in a market where price adjustments are often difficult to implement quickly.

BBMG faces growing threats from increasingly stringent environmental regulations. For instance, China's push for carbon neutrality by 2060 is driving stricter emission standards and potential carbon pricing mechanisms. These changes could necessitate significant capital outlays for BBMG to upgrade its manufacturing processes and adopt greener technologies, directly impacting operational costs.

The financial burden of complying with these evolving environmental policies is substantial. Reports from 2024 indicate that industries similar to BBMG's are allocating billions towards sustainability initiatives. Failure to adapt not only risks hefty fines, as seen with past environmental violations in the sector, but also poses a threat to BBMG's reputation and market access, potentially hindering long-term growth and competitiveness.

Geopolitical Risks and Trade Tensions

Geopolitical instability and escalating international trade disputes present significant threats to BBMG. For instance, ongoing trade tensions between major economies could lead to increased tariffs on critical raw materials or finished goods, directly impacting BBMG's cost of production and the competitiveness of its exports. The International Monetary Fund (IMF) projected in April 2024 that global growth would slow to 3.2% in 2024, partly due to these persistent geopolitical risks and the fragmentation of trade.

Protectionist policies enacted by various nations can further restrict BBMG's market access, forcing the company to navigate a complex web of regulations and potentially higher import duties. This can disrupt established supply chains, causing delays and increased logistical expenses. For a company of BBMG's scale, such disruptions can significantly affect operational efficiency and overall profitability.

The uncertainty stemming from these geopolitical shifts also erodes investor confidence, potentially leading to reduced capital availability and higher borrowing costs for BBMG. Political shifts can create an unpredictable business environment, making long-term strategic planning and investment decisions more challenging. For example, a sudden policy change in a key market could instantly alter BBMG's competitive landscape.

- Trade Tensions: Ongoing trade disputes could increase tariffs on key inputs, raising operational costs for BBMG.

- Supply Chain Disruptions: Geopolitical instability threatens to interrupt global supply chains, impacting delivery times and costs.

- Market Access: Protectionist policies may limit BBMG's ability to export products or operate freely in certain international markets.

- Investor Confidence: Political uncertainty can negatively affect investor sentiment, potentially hindering access to capital.

Technological Disruption and New Entrants

Disruptive technologies in construction, like advanced robotics and modular building, pose a significant threat. For instance, the global modular construction market was valued at approximately $100 billion in 2023 and is projected to grow substantially, potentially impacting traditional construction methods that BBMG might rely on. New entrants, armed with these innovations, could quickly gain market share by offering more efficient or cost-effective solutions.

Emerging composite materials and alternative building methods could also challenge BBMG's existing product lines. The adoption of 3D printing in construction, for example, is gaining traction, with projects demonstrating faster build times and reduced material waste. If BBMG doesn't invest in or adapt to these new material sciences and construction techniques, its competitive edge could diminish.

- Technological Disruption: Innovations in construction technology, such as AI-driven design and advanced robotics in manufacturing, could make current BBMG processes obsolete.

- New Entrants: Startups leveraging novel business models, like digital platforms for property development or material sourcing, may bypass traditional barriers to entry.

- Market Share Erosion: Failure to integrate new technologies or adapt to changing construction methodologies could lead to a decline in BBMG's market share as competitors offer superior value propositions.

- Adaptation Imperative: BBMG must continually monitor and invest in R&D to stay ahead of technological shifts and maintain its competitive position in the evolving building materials and property development sectors.

Intensifying competition, particularly from agile domestic players and international firms expanding into BBMG's markets, presents a significant threat. These competitors may offer lower price points or more innovative product lines, eroding BBMG's market share. For instance, the Chinese construction materials market, a key area for BBMG, saw an increase in new, smaller enterprises in 2024, often with lower overheads.

Furthermore, shifts in consumer preferences towards sustainable and eco-friendly building materials could disadvantage BBMG if its product portfolio is not aligned. A 2024 survey indicated that over 60% of property developers in key Asian markets now prioritize green building certifications, a trend BBMG needs to address proactively.

The company's reliance on specific geographic markets also exposes it to localized economic downturns or regulatory changes that could impact sales and profitability, even if global conditions are stable.

SWOT Analysis Data Sources

This BBMG SWOT analysis is constructed using a robust blend of internal financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded and actionable strategic overview.