BBMG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BBMG Bundle

BBMG's competitive landscape is shaped by significant buyer power and the constant threat of substitutes, demanding strategic agility. Understanding the intensity of these forces is crucial for navigating its market effectively.

The complete report reveals the real forces shaping BBMG’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

BBMG Corporation, a major player in building materials like cement, depends on essential raw materials such as limestone, coal, and gypsum. If a small number of suppliers control these vital resources, they gain considerable leverage to influence pricing and contract conditions for BBMG. For instance, in 2024, China's coal production, a key input for cement, faced supply chain challenges due to environmental regulations, potentially increasing supplier power.

The cement industry, including BBMG, relies heavily on raw materials like limestone and coal, as well as energy. In 2024, the volatility in global energy prices, particularly for coal, directly impacted production costs for cement manufacturers. This essential nature of inputs gives suppliers significant leverage.

Any substantial price hikes or supply disruptions from these key suppliers can directly squeeze BBMG's profit margins. For instance, a significant increase in coal prices in early 2024 would have necessitated either absorbing the cost or passing it on to customers, affecting competitiveness.

Consequently, BBMG's ability to secure consistent and affordable access to these fundamental resources is critical for maintaining stable operations and profitability. This underscores the strategic importance of managing supplier relationships effectively.

For BBMG, high switching costs from existing suppliers significantly bolster supplier bargaining power. If transitioning to a new supplier for specialized new building materials or intricate logistics requires substantial investment in retooling equipment, re-validating material quality, or facing potential production downtime, suppliers can dictate more favorable terms. These complexities can make it prohibitively expensive and operationally disruptive for BBMG to change suppliers, thereby increasing the leverage held by their current partners.

Supplier’s Ability to Forward Integrate

The capacity for suppliers to forward integrate, meaning they could begin producing building materials or developing properties themselves, significantly amplifies their bargaining power. This threat is generally minimal for suppliers of raw materials to a large entity like BBMG, but it can become a considerable factor when dealing with providers of specialized components or advanced technologies critical to BBMG's operations.

For instance, if a supplier of a unique, high-performance concrete additive were to develop their own pre-fabricated housing solutions, they could directly compete with BBMG. This potential shift would allow them to capture a larger portion of the value chain, thereby increasing their leverage in negotiations over pricing and terms with BBMG.

- Supplier Forward Integration Threat: Suppliers developing their own building materials or properties increases their bargaining power.

- BBMG Context: This threat is typically low for raw material suppliers but can be significant for specialized component or technology providers.

- Impact on Negotiations: Suppliers capable of forward integration can command better pricing and terms due to their enhanced market position.

Availability of Substitute Inputs

The availability of substitute inputs significantly curtails supplier power. If BBMG can readily source alternative fuels or different types of construction aggregates, the leverage of its existing suppliers is naturally reduced. For example, the global cement industry, a key input for many construction projects, saw the price of coal, a primary fuel source, fluctuate significantly in 2024. However, increased availability of alternative fuels like petcoke and even waste-derived fuels provided some buffer for large consumers, limiting individual coal suppliers' pricing power.

BBMG's strategic emphasis on green building materials further diversifies its input options and alters supplier dynamics. As the demand for sustainable construction grows, new suppliers offering innovative, eco-friendly materials emerge. In 2024, the market for recycled aggregates experienced robust growth, with some regions reporting double-digit increases in their use. This expansion of alternative material sources weakens the bargaining position of traditional suppliers of virgin materials.

- Availability of substitute fuels: Reduced reliance on a single fuel source like coal, due to the increasing viability of petcoke and waste-derived fuels, limits the pricing power of traditional fuel suppliers to BBMG.

- Diversification in aggregates: The growing market for recycled aggregates provides BBMG with alternative sourcing options, diminishing the influence of suppliers of virgin aggregates.

- Emergence of green material suppliers: BBMG's focus on sustainability opens doors to new suppliers of eco-friendly inputs, creating a more competitive landscape and potentially lowering input costs.

The bargaining power of suppliers for BBMG is influenced by the concentration of suppliers, the uniqueness of their offerings, and the cost for BBMG to switch. When a few suppliers dominate essential raw materials like limestone or coal, they can dictate terms, as seen with 2024 energy price volatility impacting cement production costs. High switching costs for specialized inputs further empower these suppliers, making it difficult for BBMG to change partners without significant disruption and expense.

The availability of substitutes and the potential for suppliers to integrate forward also play crucial roles. For instance, the rise of recycled aggregates as an alternative to virgin materials in 2024 reduced the power of traditional aggregate suppliers. Conversely, a supplier of a niche additive could gain leverage if they began offering competing finished products, directly threatening BBMG's market position.

| Factor | Impact on BBMG | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High leverage for dominant suppliers | Key for essential inputs like coal and limestone |

| Switching Costs | Increases supplier power, limits BBMG flexibility | High for specialized components and logistics |

| Availability of Substitutes | Reduces supplier power | Growing use of recycled aggregates, alternative fuels |

| Forward Integration Threat | Empowers suppliers if they enter BBMG's market | Potential for specialized component suppliers |

What is included in the product

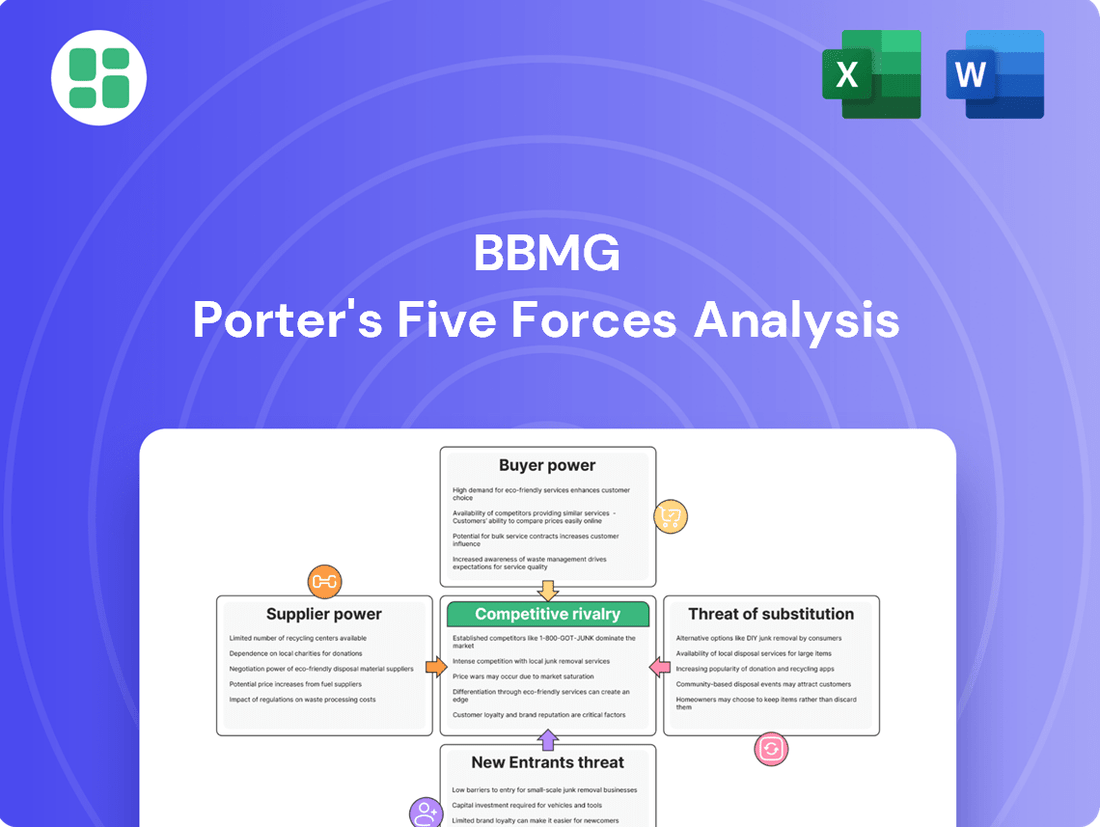

This BBMG Porter's Five Forces analysis dissects the competitive intensity within its industry, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Instantly identify and quantify competitive threats with a dynamic, interactive model for proactive strategy adjustments.

Customers Bargaining Power

In sectors like property development and building materials, particularly when the real estate market is experiencing a downturn, customers tend to be very focused on price. This heightened price sensitivity directly translates to increased bargaining power for buyers.

BBMG's own property division has clearly felt this pressure, with reports indicating pricing challenges and a reduction in gross profit margins. This is a strong signal that customers, whether they are large construction companies or individual home buyers, hold significant sway, especially when demand for housing is not robust.

For instance, in 2023, China's property market saw a significant slowdown, with new home sales declining. This environment forces developers like BBMG to compete more aggressively on price, empowering their customers to negotiate better terms and drive down profitability.

BBMG's bargaining power of customers is significantly influenced by the volume of purchases. Large-scale construction companies and major property developers, by buying building materials in substantial quantities, wield considerable leverage. This allows them to negotiate lower prices and more favorable contract terms with BBMG, directly impacting the company's profitability.

In contrast, the bargaining power of individual, smaller property buyers is considerably weaker due to the fragmented nature of their purchases. These smaller transactions do not provide them with the collective clout to influence BBMG's pricing or terms, making their impact on the company's customer power much less pronounced.

Customers for building materials, including those that purchase from BBMG, have a wide array of choices. They can opt for other significant cement producers such as China National Building Material or Conch Cement, or explore a diverse range of alternative building material suppliers. This abundance of options directly empowers customers.

The ease with which customers can switch suppliers if they find BBMG's pricing, quality, or service unsatisfactory significantly amplifies their bargaining power. For instance, in 2023, the Chinese cement market saw intense competition, with prices fluctuating based on regional supply and demand dynamics, giving buyers considerable leverage.

Threat of Backward Integration by Customers

The bargaining power of customers can be amplified by the threat of backward integration, particularly from large entities like construction companies or property developers. These major players could potentially bring the production of essential building materials, such as ready-mixed concrete, in-house. This capability, while requiring significant capital investment, grants them considerable leverage when negotiating prices and terms with suppliers like BBMG.

This threat is more pronounced for commodity building materials rather than for specialized or green building products, where BBMG might possess unique expertise or proprietary technology. For instance, in 2024, the global construction materials market saw continued demand for basic inputs, making backward integration a more viable consideration for large developers aiming to control costs and supply chains.

- Threat of Backward Integration: Large construction firms may consider producing their own basic building materials like ready-mixed concrete.

- Impact on Bargaining Power: This potential for in-house production strengthens their negotiating position with suppliers.

- Material Specificity: The likelihood of backward integration is higher for standard materials than for specialized or green building products.

- Market Context (2024): Strong demand for basic construction inputs in 2024 made cost control through integration a strategic consideration for major developers.

Customer Information and Market Transparency

Customer information and market transparency have significantly amplified customer bargaining power. With readily available data on pricing, product quality, and competitor options, consumers are more informed than ever. This heightened awareness allows them to negotiate more effectively and seek out the best value, directly impacting BBMG's pricing strategies and profitability.

For instance, in 2024, online platforms and consumer review sites provide detailed comparisons of new housing developments, making it easier for buyers to assess BBMG's offerings against those of its rivals. This transparency forces BBMG to be highly competitive on price and features to attract and retain customers.

- Informed Buyers: Increased market transparency means customers can easily compare BBMG's pricing and specifications with competitors.

- Negotiating Leverage: Well-informed customers are better equipped to demand lower prices or enhanced features.

- Market Shifts: Trends like the growing popularity of the second-hand housing market in certain regions in 2024 can reduce demand for new builds, further strengthening customer bargaining power.

When the real estate market is slow, customers become very price-sensitive, which increases their bargaining power. This is evident in BBMG's property division, which has faced pricing challenges and reduced profit margins. In 2023, China's property market slowdown meant developers like BBMG had to compete on price, giving buyers more leverage.

Customers have significant bargaining power due to the availability of numerous alternative suppliers for building materials, such as China National Building Material and Conch Cement. This ease of switching suppliers, especially when BBMG's pricing or quality is not competitive, amplifies customer leverage. The intense competition in the Chinese cement market during 2023, with fluctuating prices, further empowered buyers.

Large construction firms can enhance their bargaining power by considering backward integration, such as producing their own ready-mixed concrete. This threat is more significant for commodity building materials, as seen with the robust demand for basic inputs in 2024, making cost control through integration a viable strategy for major developers.

Increased market transparency, fueled by online platforms and review sites, empowers customers to easily compare BBMG's offerings with competitors. This informed customer base can negotiate better terms, as demonstrated by the ease of comparing new housing developments in 2024, forcing BBMG to remain highly competitive.

| Factor | Impact on Bargaining Power | BBMG Context | 2023/2024 Data Point |

|---|---|---|---|

| Price Sensitivity | High | Property downturn increases focus on cost | China new home sales declined in 2023 |

| Supplier Availability | High | Numerous alternative cement and material suppliers | Intense competition in Chinese cement market 2023 |

| Switching Costs | Low | Ease of switching for standard materials | Price fluctuations in 2023 empowered buyers |

| Backward Integration Threat | Moderate to High (for basic materials) | Large developers may produce own concrete | Strong 2024 demand for basic inputs supported integration |

| Information Transparency | High | Online comparisons of housing and materials | Easy comparison of new builds in 2024 |

Preview Before You Purchase

BBMG Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for BBMG, providing an in-depth examination of competitive forces within their industry. The document you see here is the exact, fully formatted analysis you'll receive immediately after purchase, offering immediate strategic insights without any placeholders or modifications.

Rivalry Among Competitors

The Chinese building materials and property development sectors are crowded with many substantial companies. BBMG, as the third-largest cement industrial group in China, operates within this highly competitive landscape, facing off against a few dominant firms that vie intensely for market dominance.

The Chinese construction industry anticipates moderate growth in 2025, yet the residential segment is experiencing considerable slowdown and diminished housing demand. This disparity in growth amplifies competitive rivalry, forcing companies like BBMG into intense competition for projects within these slower markets, which in turn leads to pricing pressures and squeezed profit margins.

Competitive rivalry within BBMG's core building materials, particularly cement, is intense, often driven by price due to limited product differentiation. This can pressure margins as customers readily switch to lower-cost alternatives.

However, BBMG's strategic push into modern green building materials and sustainable solutions offers a pathway to differentiation. For these specialized offerings, customer switching costs may increase as buyers seek specific environmental certifications or performance characteristics.

In 2023, the Chinese construction materials market, a key area for BBMG, saw significant fluctuations. While overall demand remained robust, price volatility in basic commodities like cement persisted, highlighting the challenge of differentiation in traditional segments.

Exit Barriers for Competitors

High capital investments are a major hurdle for companies looking to leave the cement and property development sectors. For instance, building a modern cement plant can cost hundreds of millions of dollars, and property development projects require substantial upfront funding. This means that even when market conditions are tough, companies are often locked into their existing operations, making it difficult and costly to exit.

This inability to easily exit the market intensifies competition. Companies are more likely to continue operating and selling at lower prices to cover their fixed costs, rather than shutting down. This can lead to prolonged periods of price wars and an oversupply of products, which directly impacts BBMG and other players in the industry.

- Significant Capital Outlay: The construction of a new cement plant can exceed $500 million, while large-scale property developments often involve billions in investment.

- Asset Specificity: Cement plants and specialized construction equipment are highly specific to the industry, making them difficult to repurpose or sell at a favorable price.

- Employee Commitments: Large workforces in manufacturing and construction create social and contractual obligations that add to the cost and complexity of exiting.

- Government Regulations: Environmental regulations and land use policies can also impose costs on companies seeking to cease operations or divest assets.

Strategic Objectives and Market Dynamics

Competitors in the building materials sector are intensely focused on strategic objectives like market share expansion and achieving economies of scale. For instance, in 2024, major players are actively pursuing mergers and acquisitions to consolidate their positions and reduce per-unit production costs, particularly in the face of rising raw material prices.

The drive to diversify into new segments, such as green building materials, is also escalating rivalry. Companies are investing heavily in research and development for sustainable products, recognizing the growing market demand and regulatory push. This strategic pivot is intensifying competition as firms vie for leadership in this high-growth area.

The dynamic Chinese property market continues to be a significant factor influencing competitive intensity. As of mid-2024, the sector is experiencing ongoing adjustments, leading to increased price competition and a focus on operational efficiency among building material suppliers. This environment necessitates agile strategies to navigate market fluctuations.

Government emphasis on sustainable construction practices further shapes these competitive dynamics. Policies promoting energy efficiency and reduced carbon footprints in buildings are creating new opportunities and challenges. Companies that can effectively align their product offerings with these sustainability mandates are better positioned to gain a competitive edge.

- Market Share Focus: Many companies are prioritizing market share growth through aggressive pricing and expanded distribution networks in 2024.

- Economies of Scale: Investments in larger production facilities and streamlined supply chains aim to lower costs and enhance competitiveness.

- Green Building Materials: The market for sustainable materials is projected to grow by over 15% annually through 2025, driving significant R&D investment.

- Chinese Property Market Impact: Fluctuations in China's property sector, which accounts for a substantial portion of global construction, directly influence demand and pricing for building materials.

Competitive rivalry in China's building materials and property sectors is fierce, driven by a crowded market with many substantial players, including BBMG as a major cement producer. This intense competition is further amplified by the slowdown in China's residential property market, leading to price pressures and reduced profit margins as companies fight for fewer projects.

The lack of significant product differentiation in traditional materials like cement means that price often dictates customer choice, encouraging a race to the bottom. However, BBMG's strategic move into green building materials presents an opportunity to reduce price sensitivity and increase customer switching costs.

High exit barriers, such as substantial capital investments in plants and specialized assets, trap companies in the market, intensifying rivalry. This often results in companies continuing to operate and sell at lower prices to cover fixed costs, leading to prolonged price wars and oversupply, which directly impacts BBMG and its competitors.

| Factor | Description | Impact on BBMG |

|---|---|---|

| Market Crowding | Numerous large companies compete intensely in China's building materials and property sectors. | Increased pressure on market share and pricing for BBMG. |

| Property Market Slowdown | Reduced demand in the residential sector leads to fewer projects. | Heightened competition for available projects, impacting BBMG's sales volume and margins. |

| Price-Based Competition | Limited differentiation in basic materials like cement leads to price wars. | Erodes BBMG's profitability in traditional product lines. |

| High Exit Barriers | Significant capital investment and asset specificity make leaving the market difficult. | Intensifies rivalry as companies remain operational even in challenging conditions, potentially leading to oversupply and lower prices. |

SSubstitutes Threaten

The availability of alternative construction materials poses a significant threat to BBMG. China's push for sustainable building practices is driving demand for substitutes like recycled concrete, energy-efficient glass, and bamboo products. These alternatives can directly replace traditional cement and concrete, potentially eroding BBMG's market share in conventional construction segments.

Advancements in construction technologies, like prefabrication and modular building, are increasingly reducing the demand for traditional on-site materials that companies such as BBMG supply. For instance, the global modular construction market was valued at approximately $77.5 billion in 2023 and is projected to grow significantly, indicating a shift in how buildings are assembled.

These innovative methods offer compelling benefits, including faster project completion times and reduced material waste, which can translate into lower overall construction costs. This efficiency directly challenges the business model of suppliers reliant on conventional building processes, presenting a clear substitute threat.

The increasing adoption of these technologies means that traditional material suppliers must adapt or risk losing market share to alternative construction solutions. The growing investment in off-site construction by major players underscores this trend, signaling a long-term challenge to established supply chains.

The existing housing market presents a significant substitute for BBMG's new residential and commercial developments. In 2024, data from several major Chinese cities showed a noticeable uptick in demand for pre-owned properties. This trend is partly driven by consumers facing tighter income growth and more moderate expectations for new property price appreciation, making the second-hand market a more attractive alternative.

Consumer Preference for Rental vs. Ownership

Shifting consumer preferences, driven by economic factors and evolving lifestyles, are increasingly favoring rental arrangements over outright property ownership. This is particularly noticeable in bustling urban centers where the flexibility of renting appeals to many. This trend acts as a significant substitute threat to traditional property development, directly impacting revenue streams for companies like BBMG.

The rising popularity of renting can be seen in various market indicators. For instance, in 2024, the U.S. rental vacancy rate hovered around 6.5%, a figure that, while not alarmingly high, signifies a substantial portion of the housing market being occupied by renters rather than owners. This indicates a sustained demand for rental properties, potentially diverting capital and interest away from new property purchases.

- Urban Rental Demand: In major metropolitan areas, the cost of homeownership often makes renting a more accessible and attractive option for a larger segment of the population.

- Lifestyle Flexibility: Younger generations, in particular, often prioritize mobility and flexibility, which renting readily provides compared to the long-term commitment of ownership.

- Impact on Property Development: A strong rental market can reduce the demand for new home sales, forcing developers to consider alternative strategies or face reduced sales volumes.

Cost-Effectiveness and Performance of Substitutes

The threat of substitute products is significant when alternatives offer similar or better performance at a more attractive price point. For instance, advancements in engineered wood and composite materials are providing viable alternatives to traditional concrete and steel in construction. These substitutes are often lighter, easier to install, and can reduce overall project timelines, directly impacting cost-effectiveness.

As new building materials become more affordable and their efficacy is proven through rigorous testing and application, their ability to displace established materials grows. For example, the cost of recycled plastic lumber has decreased, making it a more competitive option for decking and fencing compared to traditional wood or composite materials. This trend is particularly noticeable in sectors where durability and low maintenance are key considerations.

Government support for green building initiatives further bolsters the competitiveness of sustainable substitutes. In 2024, many regions are offering tax credits and subsidies for projects utilizing recycled content or low-embodied energy materials. This policy environment can shift the cost-benefit analysis, making eco-friendly alternatives like bamboo or cross-laminated timber (CLT) more appealing than conventional options, even if their upfront costs are initially higher.

- Cost-Effectiveness: Engineered wood products can be 10-20% cheaper than traditional steel framing for certain applications.

- Performance: Advanced composites offer superior strength-to-weight ratios compared to many conventional materials.

- Government Incentives: In 2024, green building incentives can reduce the lifecycle cost of sustainable materials by up to 15%.

The threat of substitutes for BBMG stems from alternative construction materials and evolving housing market trends. Innovations in building technology and a growing preference for rental properties over ownership present significant challenges. These substitutes offer advantages like cost-effectiveness, faster project completion, and lifestyle flexibility, directly impacting BBMG's traditional business models.

| Substitute Category | Example | Key Advantages | 2024 Market Trend/Data Point |

|---|---|---|---|

| Alternative Materials | Engineered Wood, Recycled Concrete | Cost-effectiveness, Sustainability, Lighter weight | Engineered wood can be 10-20% cheaper than steel framing. |

| Construction Technologies | Prefabrication, Modular Building | Faster completion, Reduced waste, Lower costs | Global modular construction market valued at ~$77.5 billion in 2023. |

| Housing Market Trends | Rental Properties, Pre-owned Homes | Lifestyle flexibility, Affordability, Lower commitment | Increased demand for pre-owned properties in major Chinese cities in 2024. |

Entrants Threaten

The building materials industry, especially cement production and major property development, demands immense capital. Building factories, buying land, and getting the right machinery all need a huge amount of money, making it tough for newcomers to enter.

For example, the cost to build a new cement plant can easily run into hundreds of millions of dollars. In 2024, the global construction market, a key driver for building materials, was valued at over $13.5 trillion, with significant portions tied up in the initial capital expenditure for large projects.

BBMG, as China's third-largest cement producer, leverages substantial economies of scale. This translates to lower per-unit costs in production, logistics, and raw material sourcing, a significant barrier for any newcomer aiming to enter the market.

New entrants face the daunting task of matching BBMG's cost efficiencies. Without comparable scale, they would struggle to compete on price, a critical factor in the highly competitive cement industry, thus impacting their ability to achieve profitability against established giants.

The construction and building materials sectors in China face a labyrinth of regulations, particularly concerning environmental protection. New companies must contend with extensive licensing, permits, and rigorous compliance mandates, significantly increasing the cost and difficulty of market entry. This is especially true as the industry pivots towards green materials, demanding adherence to evolving sustainability standards.

Established Distribution Channels and Brand Recognition

BBMG's formidable presence, spanning 24 provinces and numerous cities, presents a significant barrier to new entrants. This extensive network, coupled with deeply entrenched customer and supplier relationships, means newcomers must invest heavily to replicate such reach.

The cost and time required to build comparable distribution channels and achieve widespread brand recognition are substantial. For instance, in 2023, major beverage distributors often reported marketing budgets in the tens of millions of dollars to establish and maintain brand visibility. New entrants would likely face similar, if not higher, initial outlays to even begin competing.

- Extensive Network: BBMG's operational footprint across 24 provinces and multiple cities provides a significant advantage.

- Customer & Supplier Loyalty: Established relationships foster loyalty, making it difficult for new players to secure market share.

- High Entry Costs: Replicating BBMG's distribution infrastructure and brand equity requires substantial capital investment.

- Brand Recognition: BBMG's established brand trust acts as a deterrent, forcing new entrants to spend heavily on building their own reputation.

Access to Essential Raw Materials and Land

Securing reliable access to high-quality raw materials, such as cement and aggregates, and desirable land parcels for property development presents a substantial barrier for new entrants in the building materials and real estate sectors. Established companies, including BBMG, often benefit from long-term contracts or direct ownership of these critical resources, effectively limiting availability for newcomers.

For instance, in 2024, China's cement production, a key raw material, remained robust, with major players like BBMG having secured supply chains. New entrants would face challenges in negotiating competitive pricing and guaranteed supply volumes against these established relationships.

- Limited Resource Access: New companies struggle to acquire essential raw materials and prime land due to existing players' control.

- Established Contracts: Long-term agreements held by companies like BBMG make it difficult for new entrants to secure favorable terms.

- Land Scarcity: Prime development land is often already owned or controlled by established developers, increasing acquisition costs for new businesses.

The threat of new entrants in the building materials and property development sectors is significantly mitigated by high capital requirements and established economies of scale. New companies must overcome substantial initial investments in infrastructure and production capacity to compete effectively. For example, the global construction market's value exceeding $13.5 trillion in 2024 underscores the scale of investment needed.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building cement plants or acquiring land for development requires hundreds of millions of dollars. | Discourages smaller players and necessitates significant funding for market entry. |

| Economies of Scale | Established players like BBMG benefit from lower per-unit costs in production and logistics. | New entrants struggle to match price competitiveness without comparable scale. |

| Brand Loyalty & Distribution | Extensive networks and established customer relationships create high switching costs. | Newcomers need substantial investment in marketing and distribution to gain traction. |

Porter's Five Forces Analysis Data Sources

Our BBMG Porter's Five Forces analysis is built upon a foundation of comprehensive data, including industry-specific market research reports, publicly available financial statements from BBMG and its competitors, and relevant government regulatory filings.