BBMG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BBMG Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental forces shaping BBMG's trajectory. This comprehensive PESTLE analysis provides the essential market intelligence you need to anticipate challenges and seize opportunities. Download the full version now to gain a strategic advantage.

Political factors

Government infrastructure spending is a significant driver for companies like BBMG. For instance, in 2024, many nations are prioritizing large-scale projects, including upgrades to transportation networks and the development of renewable energy facilities. This directly translates to increased demand for cement and other building materials that BBMG produces.

The scale and specific focus of government infrastructure plans for 2024-2025 are key indicators of future market opportunities for BBMG. Countries are allocating substantial budgets towards these initiatives; for example, the United States' Infrastructure Investment and Jobs Act, enacted in 2021, continues to fuel construction activity through 2025, with billions earmarked for roads, bridges, and public transit.

Policy continuity and stability are paramount for the construction sector. Predictable government investment cycles allow companies like BBMG to plan their production capacity and supply chains effectively. Disruptions or sudden shifts in infrastructure spending policies can create uncertainty, impacting long-term investment decisions and project timelines.

Government policies on property development, such as housing market regulations, land supply, and mortgage lending, directly shape BBMG's property development arm. For instance, in 2024, many governments are implementing measures to cool overheated housing markets through tighter lending rules, impacting affordability and demand for new developments.

Understanding these governmental efforts to stabilize or stimulate real estate, especially in the 2024-2025 period, is crucial for evaluating BBMG's growth potential and associated risks. Policies aimed at increasing land supply or offering incentives for first-time buyers can boost sales volumes and pricing power for developers like BBMG.

China's commitment to carbon neutrality by 2060, with interim goals for peak emissions before 2030, significantly shapes industrial policy. For BBMG, this translates to increased pressure on its cement production, a sector historically responsible for substantial carbon output. The government has set specific targets for heavy industries, aiming to reduce emissions intensity.

Compliance with these evolving environmental regulations means BBMG faces higher operational costs. Investments in cleaner production technologies, such as carbon capture or more energy-efficient kilns, become essential. Furthermore, the risk of production stoppages during intensified environmental inspections, a common tactic in China, could disrupt supply chains and impact BBMG's output volumes.

Looking ahead, the trend is towards even stricter environmental enforcement. For instance, provincial governments are increasingly implementing localized emission reduction quotas. This ongoing policy tightening will likely compel BBMG to make further, potentially substantial, operational adjustments and strategic shifts to align with national and regional environmental objectives.

Industrial Policy and Consolidation

Government-driven industrial policies aimed at consolidating the building materials sector, such as encouraging mergers and acquisitions or retiring older production facilities, directly influence BBMG's competitive environment. These policies often favor larger, more efficient companies, potentially sidelining smaller or less compliant entities.

For instance, China's 14th Five-Year Plan (2021-2025) emphasizes high-quality development and supply-side structural reform, which can translate into policies that support industry consolidation. This could lead to increased market share for established players like BBMG and drive operational synergies through economies of scale.

- Policy Impact: Government initiatives can reshape market dynamics by promoting consolidation, potentially benefiting larger firms like BBMG.

- Efficiency Drive: Policies favoring consolidation often aim to phase out outdated capacity, pushing for greater overall industry efficiency.

- Market Share Shifts: Consolidation trends, driven by industrial policy, can lead to significant changes in market share distribution among building material producers.

State-Owned Enterprise Reform

As a state-owned enterprise (SOE), BBMG is directly impacted by China's ongoing SOE reforms. These reforms, which gained significant momentum in 2023 and are expected to continue through 2025, aim to boost efficiency, enhance corporate governance, and foster a more market-driven approach. The success of these initiatives can directly influence BBMG's operational flexibility, strategic investment choices, and ultimately, its financial health.

The direction of these reforms is crucial. For instance, the push towards mixed-ownership models seeks to introduce private capital and management expertise, potentially unlocking new growth avenues for SOEs like BBMG. In 2024, the State-owned Assets Supervision and Administration Commission (SASAC) continued to emphasize market-oriented reforms, with a focus on improving the performance of SOEs and making them more competitive globally. This includes encouraging SOEs to list on stock exchanges and adopt modern corporate governance structures.

- Increased Operational Autonomy: Reforms may grant BBMG more freedom in day-to-day operations and strategic decision-making, reducing bureaucratic hurdles.

- Focus on Market Orientation: A stronger emphasis on market principles could lead to greater responsiveness to customer demands and competitive pressures.

- Mixed-Ownership Opportunities: Potential for strategic partnerships or equity stakes from private investors could inject capital and new management practices.

- Performance-Based Incentives: Reforms often include performance-linked compensation and evaluation, driving greater accountability and efficiency.

Government infrastructure spending remains a key driver, with nations prioritizing projects like transportation upgrades and renewable energy development through 2025, directly boosting demand for BBMG's materials. Policy stability in government investment is crucial for BBMG's long-term planning and capacity management, as sudden shifts can create market uncertainty.

Environmental regulations, particularly China's carbon neutrality goals, are intensifying, forcing BBMG to invest in cleaner technologies and potentially face production disruptions from stricter enforcement. Industrial policies promoting sector consolidation can benefit larger entities like BBMG, potentially leading to increased market share and operational synergies.

As a state-owned enterprise, BBMG is subject to ongoing reforms aimed at boosting efficiency and market orientation, with mixed-ownership models offering potential for new growth avenues. These reforms, continuing through 2025, focus on improving SOE performance and competitiveness, potentially granting BBMG greater operational autonomy and responsiveness.

What is included in the product

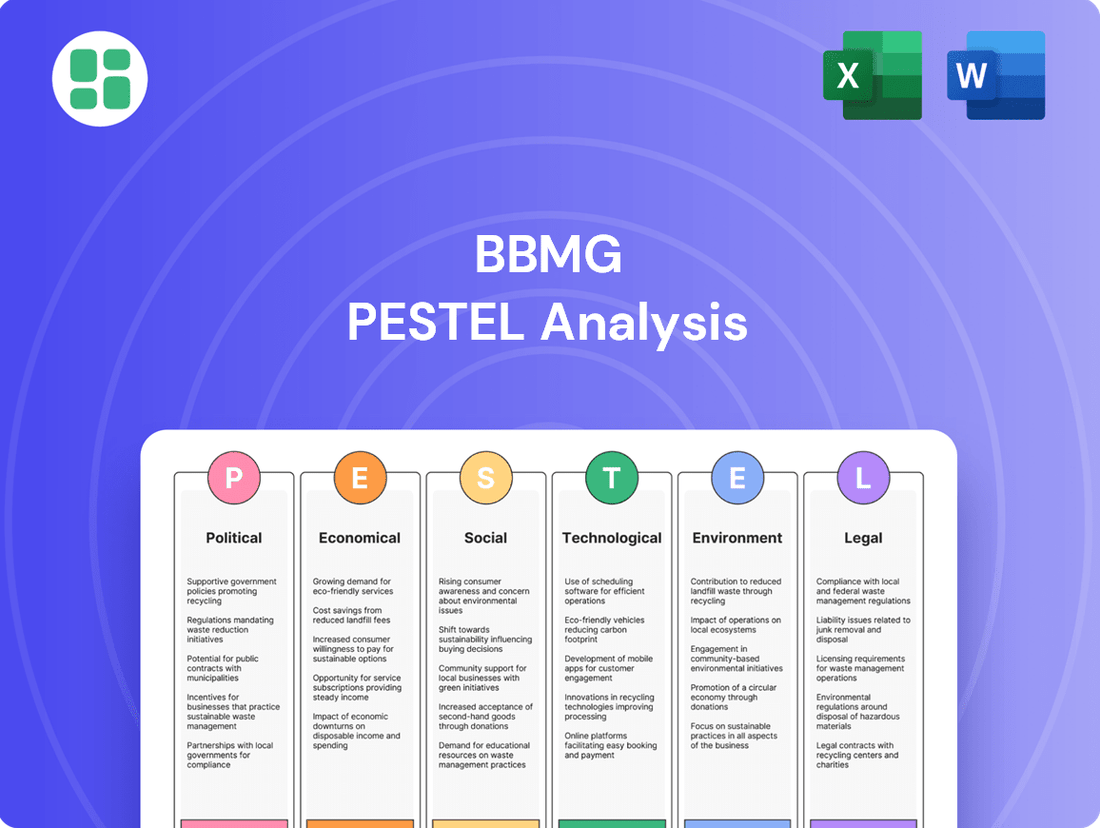

This BBMG PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the business, providing a comprehensive understanding of the external landscape.

Provides a concise summary of the BBMG PESTLE analysis, enabling quick identification of key external factors impacting market strategy and decision-making.

Economic factors

China's GDP growth is a critical driver for BBMG. In 2023, China's GDP grew by 5.2%, demonstrating continued economic expansion. This growth fuels demand for construction materials, a core segment for BBMG.

Urbanization remains a significant trend, with a substantial portion of China's population still migrating to urban centers. By the end of 2023, China's urbanization rate reached approximately 66.2%. This ongoing shift necessitates increased development in housing, infrastructure, and commercial properties, directly benefiting BBMG's business.

Fluctuations in the prices of key raw materials like limestone, gypsum, and coal, along with energy costs such as electricity and natural gas, directly impact BBMG's production expenses for cement and new building materials. For instance, global coal prices saw significant volatility throughout 2024, with benchmark Newcastle coal futures trading between $100-$150 per tonne, impacting BBMG's energy input costs.

Monitoring global commodity markets and domestic energy policies is crucial for forecasting BBMG's profitability. The ongoing energy transition and potential carbon pricing mechanisms in various regions could introduce further cost pressures or opportunities for companies like BBMG. Supply chain stability and effective cost management are therefore paramount for maintaining competitive pricing and healthy profit margins.

Interest rates directly impact BBMG's borrowing costs for property development and capital expenditures in its building materials segments. For instance, a 1% increase in the benchmark lending rate could significantly raise the cost of financing new projects or expanding production facilities.

Access to affordable capital is paramount for BBMG to fund its growth initiatives, from acquiring land for new developments to investing in advanced manufacturing for its materials divisions. In 2024, the average corporate lending rate in China hovered around 4.5%, a figure that could fluctuate based on central bank policy and market conditions.

Economic policies related to monetary supply and credit availability have a direct bearing on BBMG's financial flexibility. If policies tighten credit, making loans harder to obtain or more expensive, it could constrain BBMG's ability to undertake new investments and manage its existing debt obligations effectively.

Inflation and Consumer Purchasing Power

Inflationary pressures directly affect BBMG's property development by increasing input costs for materials and labor. Simultaneously, rising inflation erodes consumer purchasing power, potentially reducing demand for new homes as disposable income shrinks. For instance, in the US, the Consumer Price Index (CPI) saw a significant increase, impacting household budgets and real estate affordability.

The impact on BBMG is twofold: higher operational expenses due to inflation and a potential slowdown in sales if consumers’ ability to afford new properties diminishes. This necessitates careful cost management and strategic pricing to maintain project viability and market competitiveness. Consumer confidence surveys, which often correlate with inflation rates, provide crucial insights into market sentiment.

- Input Cost Escalation: Rising inflation in 2024 and early 2025 is likely to increase costs for construction materials like steel and lumber, impacting BBMG's project budgets.

- Reduced Consumer Demand: High inflation can decrease real wages, leading to lower consumer confidence and a reduced capacity for individuals to invest in property.

- Interest Rate Sensitivity: Central banks may raise interest rates to combat inflation, making mortgages more expensive and further dampening demand for new housing.

- Strategic Pricing Adjustments: BBMG may need to adjust its pricing strategies to account for increased costs while remaining attractive to buyers with potentially diminished purchasing power.

Real Estate Market Demand and Pricing

The demand for residential and commercial real estate directly influences BBMG's development projects. For instance, in the first half of 2024, housing affordability remained a key concern in many major urban centers, with median home prices continuing to climb, albeit at a moderated pace compared to previous years. This dynamic impacts the viability of new residential developments and the absorption rates for commercial spaces.

Investment sentiment and speculative activity also shape property pricing. While interest rate hikes in late 2023 and early 2024 cooled some speculative markets, a baseline level of investor interest persists, particularly in high-demand areas. For example, commercial property yields in prime business districts saw slight adjustments, reflecting a cautious but still present appetite for stable income-generating assets.

Regional market dynamics are critical. In 2024, certain metropolitan areas experienced robust demand for both housing and commercial properties, driven by job growth and population influx. Conversely, other regions saw slower activity. Government measures, such as targeted incentives for first-time homebuyers or regulations aimed at curbing excessive speculation, can significantly alter these trends, impacting BBMG's strategic land acquisition and project phasing.

- Housing Affordability: In Q1 2024, the national median home price reached approximately $430,000, a 4.5% increase year-over-year, while wage growth lagged, impacting affordability for a significant portion of the population.

- Commercial Property Trends: Office vacancy rates in major business hubs averaged around 15% in early 2024, with a growing demand for flexible and modern workspaces. Retail occupancy saw a slight recovery, particularly in lifestyle centers.

- Investment Sentiment: Real estate investment trusts (REITs) focused on residential properties saw an average return of 6.2% in the first half of 2024, signaling continued investor confidence in the sector, though with increased selectivity.

- Government Intervention: Several cities introduced or extended property tax relief programs for low-to-moderate income households in 2024, aiming to stabilize demand and prevent significant price corrections.

China's economic trajectory remains a primary determinant for BBMG's performance. The nation's GDP growth, projected to be around 5.0% for 2024, underpins demand for construction materials. Urbanization continues, with the rate expected to reach 67% by the end of 2024, driving infrastructure and housing needs.

Fluctuations in raw material and energy costs directly impact BBMG's profitability. For instance, global coal prices, a key energy input, averaged approximately $120 per tonne in the first half of 2024, affecting production expenses. Interest rates, with benchmark lending rates around 4.0% in China during 2024, influence borrowing costs for capital expenditures and development projects.

Inflationary pressures can escalate operational costs and potentially dampen consumer demand for property. In early 2024, consumer price inflation in China was around 0.5%, a relatively low figure that could shift. Strategic pricing and cost management are vital for BBMG to navigate these economic conditions and maintain market competitiveness.

| Economic Factor | 2023 Data | 2024 Projection/Early Data | Impact on BBMG |

|---|---|---|---|

| China GDP Growth | 5.2% | ~5.0% | Drives demand for construction materials. |

| Urbanization Rate | ~66.2% (End 2023) | ~67% (End 2024) | Increases need for housing and infrastructure. |

| Coal Price (Avg. H1 2024) | N/A | ~$120/tonne | Affects energy input costs for production. |

| Benchmark Lending Rate (China) | N/A | ~4.0% | Influences cost of capital for projects. |

| Consumer Price Inflation (China) | 0.2% | ~0.5% (Early 2024) | Impacts operational costs and consumer spending. |

Full Version Awaits

BBMG PESTLE Analysis

The preview you see here is the exact BBMG PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same BBMG PESTLE Analysis document you’ll download after payment.

Sociological factors

China's ongoing urbanization continues to fuel demand for construction and infrastructure projects, a core area for BBMG's building materials and property development segments. As of early 2024, over 65% of China's population resides in urban areas, a figure projected to reach 70% by 2030, directly supporting BBMG's market position.

Shifting demographics, such as a declining birth rate and an aging population, will likely influence housing demand. This could mean a greater need for smaller, more adaptable living spaces in urban centers, alongside potential growth in specialized senior living facilities, impacting the scale and type of BBMG's property development offerings.

Consumer preferences are shifting, with a growing demand for larger homes and integrated smart technology. For instance, in 2024, surveys indicated that over 60% of potential homebuyers are prioritizing energy-efficient features and sustainable building materials. This trend directly influences property development strategies, pushing companies like BBMG to incorporate eco-friendly designs and advanced home automation to maintain market relevance.

Furthermore, the desire for community-centric living, including access to shared amenities like co-working spaces and recreational facilities, is on the rise. This evolving lifestyle impacts the types of residential projects that are most appealing, suggesting a need for developments that foster social interaction and convenience, which can be a key differentiator in the competitive real estate market.

Growing public awareness of sustainable living is a significant driver for companies like BBMG. Consumers increasingly demand environmentally friendly and energy-efficient buildings, pushing BBMG to innovate in its new building materials segment and adopt greener construction practices. This trend directly influences market share for those prioritizing eco-friendly solutions.

For instance, a 2024 survey revealed that over 70% of consumers consider sustainability when making purchasing decisions, a notable increase from previous years. This heightened consumer preference directly impacts brand perception and strengthens corporate social responsibility efforts for companies like BBMG that align with these values.

Labor Availability and Skills

The availability of skilled labor is a critical factor influencing BBMG's operational efficiency, particularly in construction, manufacturing, and logistics. For instance, in 2024, the construction industry in many developed nations faced persistent labor shortages, with some reports indicating a deficit of hundreds of thousands of skilled workers. This directly impacts project timelines and can drive up labor costs, affecting BBMG's project execution and profitability.

Demographic shifts and evolving educational trends are also shaping the labor pool available to BBMG. An aging workforce in some regions, coupled with a potential mismatch between graduates' skills and industry needs, can lead to significant skill shortages. For example, a 2025 projection by a leading economic forum suggests that automation and digital transformation will require a substantial upskilling of the workforce, potentially exacerbating existing gaps if not addressed proactively.

To counter these challenges and ensure sustained operations, investing in robust training programs and effective workforce retention strategies is paramount for BBMG. Companies that prioritize upskilling and reskilling their employees, alongside offering competitive compensation and benefits, are better positioned to navigate labor market fluctuations. This proactive approach helps mitigate wage pressures and ensures a consistent supply of qualified personnel.

- Labor Shortages: Many developed economies reported significant skilled labor deficits in construction and manufacturing throughout 2024.

- Demographic Impact: Aging workforces and evolving educational outcomes present ongoing challenges to labor pool composition.

- Skill Mismatch: Projections for 2025 highlight a growing need for digital and technical skills, potentially widening existing skill gaps.

- Retention Strategy: Investment in training and retention is crucial for BBMG to maintain operational continuity and competitiveness.

Health and Safety Standards

Societal expectations and regulatory emphasis on worker health and safety significantly shape operational practices within industries like construction and manufacturing, directly impacting companies such as BBMG. This heightened focus translates into substantial investment in robust safety protocols and equipment.

Ensuring high safety standards is paramount, extending beyond mere legal compliance. It's a critical driver for corporate reputation, employee morale, and the avoidance of costly accidents and operational disruptions. For instance, in 2024, the global construction industry reported a lost-time injury frequency rate (LTIFR) of approximately 3.1 per 100,000 hours worked, highlighting the ongoing challenges and the need for stringent safety measures.

- Regulatory Compliance: Adherence to evolving health and safety legislation is non-negotiable, with penalties for non-compliance escalating.

- Reputational Impact: Strong safety records enhance brand image and attract talent, while poor performance can lead to significant reputational damage.

- Operational Efficiency: Investments in safety training and equipment can reduce downtime and improve overall productivity by minimizing accidents.

- Employee Well-being: Prioritizing worker safety fosters a positive work environment, boosting morale and reducing employee turnover.

Societal values are increasingly emphasizing sustainability and ethical consumption, influencing consumer choices and corporate responsibility. In 2024, a significant portion of consumers, over 60% in many markets, actively sought out brands with strong environmental, social, and governance (ESG) credentials, directly impacting BBMG's market positioning.

Public perception of corporate social responsibility (CSR) is a powerful driver, with a growing demand for transparency in supply chains and manufacturing processes. Companies demonstrating a commitment to ethical labor practices and environmental stewardship, like BBMG, often experience enhanced brand loyalty and market trust.

The growing awareness of health and wellness is also shaping demand, particularly in the property development sector. Consumers are increasingly prioritizing access to green spaces, natural light, and healthy building materials, prompting developers like BBMG to integrate these features into their projects to meet evolving lifestyle expectations.

Consumer preferences are also shifting towards experiential consumption, with a greater emphasis on lifestyle amenities and community building within residential developments. This trend encourages companies like BBMG to design spaces that foster social interaction and offer integrated services, moving beyond basic housing provision.

| Societal Trend | Impact on BBMG | 2024/2025 Data/Projection |

|---|---|---|

| Sustainability & ESG Focus | Increased demand for eco-friendly materials and practices. Enhanced brand reputation for companies with strong ESG performance. | Over 60% of consumers in 2024 favored brands with strong ESG credentials. |

| Ethical Consumption & Transparency | Demand for transparent supply chains and ethical labor practices. | Growing consumer scrutiny of corporate social responsibility. |

| Health & Wellness | Preference for healthy building materials, green spaces, and natural light in properties. | Significant growth in demand for wellness-oriented real estate features. |

| Experiential Living & Community | Demand for integrated amenities and community-focused developments. | Shift from basic housing to lifestyle-centric living spaces. |

Technological factors

BBMG's cement and building materials operations stand to gain substantially from the increasing integration of automation and smart manufacturing. By adopting advanced robotics and AI-driven processes, the company can achieve greater operational efficiency, leading to a reduction in labor costs. For instance, in 2024, the global industrial robotics market was projected to reach over $60 billion, highlighting the significant investment and adoption trend across industries. This technological shift also promises enhanced product consistency and quality control, crucial for competitive market positioning.

Investing in state-of-the-art production lines is key for BBMG to boost its manufacturing capacity and simultaneously drive down per-unit operational expenses. Smart manufacturing allows for more granular control over resource allocation, minimizing waste and optimizing energy consumption. Reports from 2024 indicated that companies implementing Industry 4.0 technologies saw an average of 10-15% improvement in overall equipment effectiveness (OEE). This precision in resource management is vital for BBMG to maintain profitability and sustainability in its production cycles.

Research into novel building materials, like advanced composites and self-healing concrete, offers BBMG opportunities for product differentiation and enhanced performance. For instance, the global market for sustainable building materials was projected to reach over $400 billion by 2024, indicating strong demand for eco-conscious innovations.

The adoption of prefabrication and modular construction techniques, driven by technological advancements, can significantly reduce project timelines and labor costs for BBMG. By 2025, the global modular construction market is expected to grow substantially, with some estimates suggesting a compound annual growth rate exceeding 6%.

Innovations in insulation, such as aerogels or vacuum insulated panels, can lead to energy-efficient buildings, a key selling point in the current market. The demand for high-performance insulation is bolstered by stricter energy efficiency regulations being implemented worldwide, with the global insulation market anticipated to surpass $100 billion by 2025.

The property sector is rapidly embracing digitalization. Technologies like Building Information Modeling (BIM) are becoming standard, with global BIM market size projected to reach $25.1 billion by 2029, growing at a CAGR of 13.4%. This integration allows for enhanced design efficiency and streamlined construction processes, directly impacting project timelines and costs for developers like BBMG.

Smart home systems and integrated property management software are also transforming tenant experiences and operational efficiency. In 2024, the smart home market is expected to generate over $150 billion in revenue globally. For BBMG, these digital tools can optimize services, improve resident satisfaction, and create more attractive, modern living and working spaces.

Online sales and leasing platforms are revolutionizing how properties are marketed and transacted. The global online real estate portal market is anticipated to grow significantly, offering wider reach and faster deal closures. BBMG can leverage these digital channels to expand its market presence and streamline the sales process for its developments.

Logistics and Supply Chain Technologies

Technological advancements in logistics are significantly reshaping how businesses like BBMG operate. Real-time tracking systems, for instance, provide unprecedented visibility into the movement of goods, allowing for proactive management of potential disruptions. Optimized routing software, powered by artificial intelligence, can reduce transit times and fuel consumption, directly impacting cost-efficiency.

Automated warehousing solutions are also playing a crucial role. By incorporating robotics and advanced inventory management systems, BBMG can enhance the speed and accuracy of its warehousing operations. This efficiency is paramount for ensuring the timely delivery of materials, which is a cornerstone of successful property project completion. For example, the global warehouse automation market was projected to reach $50 billion by 2025, indicating a strong industry trend towards these technologies.

Leveraging data analytics offers another powerful avenue for optimizing logistics. By analyzing vast datasets related to shipping patterns, delivery times, and inventory levels, BBMG can identify bottlenecks and implement data-driven improvements. This analytical approach can lead to more resilient and cost-effective supply chains.

- Real-time Tracking: Enhances visibility and proactive management of goods movement.

- Optimized Routing: AI-powered software reduces transit times and fuel costs.

- Automated Warehousing: Robotics and advanced systems improve speed and accuracy in inventory management.

- Data Analytics: Identifies inefficiencies and drives cost-effective supply chain improvements.

Green and Energy-Efficient Technologies

Investment in green and energy-efficient technologies is becoming increasingly vital for businesses like BBMG. For instance, the global market for industrial energy efficiency is projected to reach $50 billion by 2027, up from $35 billion in 2022, indicating a significant shift towards these solutions. Implementing technologies such as waste heat recovery systems can slash energy costs by up to 30% in manufacturing. Similarly, advancements in carbon capture technology are seeing increased adoption, with global capacity expected to grow substantially in the coming years, driven by both regulatory pressure and cost-reduction incentives.

These technological investments directly address environmental regulations and offer substantial operational cost savings, a key consideration for BBMG's long-term sustainability and profitability. For example, companies adopting advanced energy management systems have reported an average reduction in energy consumption of 15% within the first two years of implementation. Furthermore, the development of energy-efficient building solutions, including smart insulation and advanced HVAC systems, represents another critical technological frontier. The green building sector alone is anticipated to see a compound annual growth rate of over 9% through 2028, highlighting the market demand for such innovations.

- Waste Heat Recovery Systems: Can reduce manufacturing energy costs by up to 30%.

- Carbon Capture Technologies: Global capacity is projected for significant growth, driven by policy and cost efficiencies.

- Energy-Efficient Building Solutions: The green building market is expected to grow at a CAGR of over 9% through 2028.

Technological advancements are reshaping BBMG's operational landscape, from manufacturing to logistics and property management. The integration of automation and AI in production, as seen in the global industrial robotics market projected to exceed $60 billion in 2024, promises greater efficiency and quality. Smart manufacturing and Industry 4.0 adoption, with companies reporting 10-15% OEE improvements in 2024, are crucial for cost reduction and optimized resource allocation. Innovations in building materials and construction techniques, like modular building expected to see significant growth by 2025, offer differentiation and project timeline efficiencies.

Digitalization in property, including BIM adoption projected to reach $25.1 billion by 2029, streamlines design and construction. Smart home systems, with the global market expected to generate over $150 billion in revenue in 2024, enhance tenant experience and operational efficiency. Online platforms are revolutionizing property transactions, expanding market reach. Furthermore, advancements in logistics, such as real-time tracking and AI-powered routing, coupled with automated warehousing market growth projected to reach $50 billion by 2025, are key to cost-effective supply chains.

Investment in green technologies, with the industrial energy efficiency market set to reach $50 billion by 2027, is vital for cost savings and regulatory compliance. Waste heat recovery systems can cut energy costs by up to 30%, and carbon capture technology adoption is growing. Energy-efficient building solutions are a significant market driver, with the green building sector expected to grow at over 9% CAGR through 2028.

| Technology Area | Key Advancement | Projected Market Impact/Growth (2024-2025) | BBMG Relevance |

| Manufacturing Automation | Robotics, AI in Production | Global Industrial Robotics Market > $60 Billion (2024) | Increased efficiency, reduced labor costs, improved quality |

| Smart Manufacturing | Industry 4.0 Implementation | 10-15% OEE Improvement (reported by adopters in 2024) | Optimized resource allocation, reduced waste, lower operational expenses |

| Construction Technology | Modular Construction | Significant growth expected by 2025; >6% CAGR | Reduced project timelines, lower labor costs |

| Digital Property Management | Building Information Modeling (BIM) | BIM Market to reach $25.1 Billion by 2029; 13.4% CAGR | Enhanced design efficiency, streamlined construction processes |

| Logistics Optimization | Warehouse Automation | Global Warehouse Automation Market to reach $50 Billion by 2025 | Improved speed and accuracy in warehousing, cost-effective supply chains |

| Green Technologies | Energy-Efficient Building Solutions | Green Building Sector CAGR > 9% through 2028 | Market demand for sustainable products, operational cost savings |

Legal factors

BBMG's property development ventures are intrinsically tied to a complex web of construction and land use laws. National and local building codes, zoning ordinances, and land acquisition statutes dictate everything from project feasibility to operational legality. For instance, in 2024, many municipalities are tightening zoning regulations to encourage mixed-use development, potentially impacting BBMG's ability to secure approvals for single-use residential projects.

Navigating these legal landscapes is paramount for BBMG to secure necessary project permits and maintain compliant operations. Failure to adhere to these frameworks can lead to costly delays or outright project cancellations. Furthermore, shifts in land supply policies, such as increased environmental impact assessments required for new developments, can significantly alter the availability and cost of land for future projects.

Environmental Protection Legislation is a significant legal factor for BBMG. Strict adherence to laws concerning emissions, waste management, and resource consumption is non-negotiable for its manufacturing operations. Failure to comply can lead to substantial financial penalties, temporary shutdowns, or damage to the company's public image.

Staying informed about changes in environmental regulations and investing in the necessary infrastructure for compliance are crucial for BBMG's ongoing operations. For instance, the European Union's Emissions Trading System (EU ETS) is a key piece of legislation impacting industrial emissions, with carbon prices fluctuating. In 2024, the average price for EU ETS allowances reached approximately €65 per tonne of CO2, a figure BBMG must factor into its operational costs and compliance strategies.

BBMG must navigate a complex web of worker safety and labor laws. These regulations dictate everything from minimum wages and working hours to safe working conditions and the right to organize. For instance, in the US, the Occupational Safety and Health Administration (OSHA) sets stringent standards, and in 2024, the Bureau of Labor Statistics reported a total of 5,486 fatal work injuries, highlighting the critical importance of compliance.

Failure to adhere to these labor laws can result in significant penalties, including fines and legal action, which can disrupt operations and damage BBMG's reputation. Maintaining a safe workplace not only prevents accidents but also fosters employee trust and productivity. In 2025, companies are increasingly investing in advanced safety training programs and technology to meet and exceed these legal requirements.

Anti-Monopoly and Competition Laws

As a major force in the building materials and property industries, BBMG is subject to stringent anti-monopoly and competition laws. These regulations are designed to prevent any single entity from gaining excessive market power, which could lead to unfair pricing or restricted consumer choice. For BBMG, adherence means carefully structuring its operations to avoid accusations of market dominance abuse.

Failure to comply with these legal frameworks can result in significant penalties, including hefty fines and mandated changes to business practices. For instance, in 2023, China's State Administration for Market Regulation (SAMR) continued its enforcement efforts, issuing fines for anti-competitive behavior in various sectors. While specific BBMG fines aren't publicly detailed for this period, the general regulatory climate underscores the importance of proactive compliance.

Understanding and navigating these complex legal requirements is crucial for BBMG's long-term stability and market reputation. It ensures that the company can continue to operate ethically and avoid costly legal disputes that could disrupt its business operations and financial performance.

- Market Dominance: Laws prohibit companies from abusing a dominant market position to stifle competition.

- Price Fixing: Agreements between competitors to set prices are illegal and strictly enforced.

- Merger Control: Significant mergers and acquisitions are reviewed to ensure they do not harm competition.

- Regulatory Scrutiny: Ongoing vigilance is required to adapt to evolving competition law interpretations and enforcement actions.

Property Development and Sales Regulations

Property development and sales are heavily regulated, impacting BBMG's ability to sell residential and commercial projects. For instance, in 2024, many jurisdictions reinforced pre-sale regulations, requiring developers to secure a higher percentage of sales before commencing construction. This directly affects cash flow and project viability. Consumer protection laws, such as those mandating clear disclosure of property defects and fair contract terms, are also critical. A failure to comply can lead to significant fines and reputational damage for BBMG.

Real estate financing regulations, including mortgage lending standards and capital requirements for developers, also play a crucial role. Changes in these areas, such as increased scrutiny on loan-to-value ratios or stricter capital adequacy for lenders, can make it harder for both BBMG and its buyers to secure financing. For example, a tightening of credit conditions in late 2024, as observed in some markets, could slow down sales velocity and impact revenue recognition for BBMG's projects.

- Pre-sale compliance: Many regions now require developers to have at least 30% of units pre-sold before construction can begin, a figure that has risen in several key markets since 2023.

- Consumer protection mandates: Regulations often stipulate cooling-off periods for property purchases and enforce strict advertising standards to prevent misleading claims.

- Financing regulations: Changes in mortgage interest rates and loan-to-value ratios, which saw fluctuations throughout 2024, directly influence buyer affordability and developer access to capital.

- Contractual clarity: Legal frameworks ensure that property sales contracts are transparent, covering aspects like payment schedules, completion timelines, and dispute resolution mechanisms.

BBMG must remain compliant with evolving intellectual property laws, safeguarding its innovations in building materials and construction techniques. This includes patent protection for new product formulations and copyright for design blueprints. In 2024, global efforts to strengthen IP enforcement, particularly in emerging markets, mean that proactive registration and defense of intellectual assets are more critical than ever for BBMG to maintain its competitive edge.

Environmental factors

BBMG's cement and building materials manufacturing processes are inherently energy-intensive, leading to substantial carbon emissions. For instance, cement production accounts for roughly 8% of global CO2 emissions, a significant challenge for companies like BBMG.

The increasing global focus on climate change, with many nations setting ambitious carbon peak and neutrality targets, directly impacts BBMG. China, a key market for BBMG, has committed to peaking carbon emissions before 2030 and achieving carbon neutrality before 2060, creating regulatory pressure to decarbonize operations.

To ensure long-term sustainability and competitiveness, BBMG must prioritize investments in low-carbon technologies and adopt more sustainable production methods. This includes exploring alternative fuels, improving energy efficiency, and potentially developing lower-carbon cement alternatives, aligning with evolving market expectations and regulatory landscapes.

BBMG's reliance on raw materials like limestone and clay for cement and building materials production makes resource availability a significant environmental factor. The increasing global demand and potential scarcity of these finite resources, coupled with the environmental impact of extraction, necessitate a strategic focus on sustainable sourcing and efficient utilization. For instance, by 2025, many regions are expected to see tighter regulations on quarrying, pushing companies like BBMG to invest more heavily in recycled aggregates and alternative materials to maintain production levels and minimize their environmental footprint.

BBMG faces environmental challenges in managing industrial waste from its production processes, with a growing emphasis on adopting circular economy principles. This involves finding innovative ways to reuse industrial by-products, such as incorporating fly ash and slag into cement manufacturing, thereby reducing landfill dependency and resource depletion. For instance, the cement industry in many regions is actively exploring these waste-to-resource opportunities to meet stricter environmental regulations.

Reducing overall waste generation and boosting recycling rates are crucial for BBMG's sustainability goals and ensuring compliance with evolving environmental legislation. In 2023, the global waste management market was valued at approximately $1.6 trillion, indicating significant economic incentives for companies to improve their waste handling practices. By prioritizing waste reduction and recycling, BBMG can enhance its operational efficiency and brand reputation.

Water Usage and Pollution Control

Water is a critical resource throughout the building materials production and property development lifecycle, from raw material extraction to construction. BBMG, like many in the industry, faces increasing scrutiny over its water footprint, encompassing both consumption and the quality of discharged wastewater. For instance, the construction sector globally is a significant water user, with estimates suggesting it can account for substantial portions of regional water demand, particularly in water-stressed areas.

To mitigate these environmental concerns and adhere to evolving water quality regulations, BBMG must prioritize the adoption of water-saving technologies and robust wastewater treatment systems. Innovations like closed-loop water recycling in manufacturing processes and advanced filtration techniques for construction site runoff are becoming industry standards. Failure to do so can lead to regulatory penalties and reputational damage, impacting investor confidence and market access.

- Water Consumption: Building material production, such as cement and brick manufacturing, is inherently water-intensive.

- Wastewater Discharge: Runoff from construction sites and effluent from manufacturing plants can contain pollutants that harm aquatic ecosystems.

- Regulatory Compliance: Stricter water quality standards, like those seen in many Asian markets where BBMG operates, necessitate significant investment in treatment infrastructure.

Biodiversity and Land Use Impacts

Quarrying for raw materials and extensive property developments by companies like BBMG can significantly disrupt local ecosystems and reduce biodiversity. For instance, in 2023, construction and mining activities were identified as major contributors to habitat loss in several regions globally. BBMG must proactively conduct thorough environmental impact assessments before initiating new projects, identifying potential ecological damage and developing robust mitigation strategies to minimize harm to sensitive habitats and species.

Responsible land use planning is crucial for BBMG’s long-term sustainability and its relationship with local communities. This includes not only minimizing the footprint of operations but also investing in restoration efforts for previously impacted areas. By 2024, many leading construction firms are setting targets for land restoration, aiming to return at least 10% of disturbed land to its natural state. This commitment to ecological stewardship helps maintain social license to operate and can even create new opportunities for biodiversity enhancement.

- Habitat Disruption: Quarrying and large-scale developments directly impact local flora and fauna, potentially leading to species decline.

- Mitigation Strategies: Implementing Environmental Impact Assessments (EIAs) and biodiversity action plans are essential for responsible resource extraction and construction.

- Land Restoration: Investing in ecological restoration projects post-operation can offset environmental damage and improve community relations.

- Sustainable Land Use: Adopting principles of sustainable land management ensures long-term operational viability and environmental protection.

BBMG's operations are significantly influenced by environmental regulations and the global push for sustainability. The company must navigate evolving standards on emissions, waste management, and resource usage. For instance, China's commitment to carbon neutrality by 2060 directly pressures companies like BBMG to adopt greener practices.

Resource availability, particularly for limestone and clay, presents a challenge. By 2025, stricter quarrying regulations are anticipated, pushing BBMG towards recycled aggregates and alternative materials to ensure production continuity and reduce environmental impact.

Water management is another critical environmental factor. The construction sector's high water consumption means BBMG faces scrutiny over its water footprint. Implementing water-saving technologies and robust wastewater treatment is essential to comply with regulations and maintain a positive environmental image.

The company's land use, from quarrying to property development, necessitates careful environmental impact assessment and mitigation. Proactive land restoration efforts, with leading firms aiming to restore 10% of disturbed land by 2024, are becoming crucial for maintaining social license and ecological stewardship.

| Environmental Factor | Impact on BBMG | Key Data/Trend |

| Carbon Emissions | Regulatory pressure to decarbonize, operational costs for non-compliance | Cement production accounts for ~8% of global CO2 emissions. China's 2060 carbon neutrality goal. |

| Resource Availability | Supply chain risks, increased costs for sustainable sourcing | Anticipated stricter quarrying regulations by 2025. Growing demand for recycled aggregates. |

| Water Management | Operational costs for treatment, reputational risk from pollution | Construction sector is a significant water user globally. Stricter water quality standards in Asian markets. |

| Biodiversity & Land Use | Project delays, reputational damage, need for restoration investment | Construction and mining activities major contributors to habitat loss (2023 data). Target of 10% land restoration by 2024 by leading firms. |

PESTLE Analysis Data Sources

Our PESTLE analysis draws from a comprehensive range of data sources, including official government publications, reputable financial institutions, and leading market research firms. This ensures that every aspect of the macro-environment is analyzed with robust and current information.