Bayer PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bayer Bundle

Uncover the intricate web of political, economic, social, technological, environmental, and legal factors shaping Bayer's trajectory. Our meticulously researched PESTLE analysis provides the critical intelligence you need to anticipate challenges and capitalize on opportunities. Download the full version now to gain a strategic advantage.

Political factors

Bayer navigates a landscape heavily shaped by government regulations in both pharmaceuticals and agriculture. These sectors face rigorous oversight concerning product approval, manufacturing quality, and how products are marketed. For instance, in 2024, the European Union continued to review and update regulations on pesticide approvals, potentially impacting Bayer's crop science division.

Shifts in these regulatory environments, such as evolving drug pricing policies or new restrictions on certain crop protection products, can significantly alter Bayer's product viability and financial performance. The company must remain agile, adapting its strategies to comply with these complex, country-specific rules to maintain market presence and ensure smooth operations.

Global trade policies and tariffs directly impact Bayer's intricate supply chain, affecting everything from the cost of essential raw materials to the accessibility of its diverse product portfolio in international markets. For instance, the ongoing trade tensions between major economies in 2024 could necessitate adjustments in sourcing strategies to mitigate potential tariff increases on agricultural inputs or pharmaceutical components.

Protectionist measures or escalating trade disputes between significant economic blocs, such as those observed in recent years, pose a tangible risk of disrupting Bayer's operational efficiency and escalating its overall cost of doing business. This could manifest as higher import duties on finished goods or increased compliance burdens for cross-border transactions.

The imperative for Bayer lies in its continuous monitoring and agile adaptation to the ever-shifting global trade landscape. Such vigilance is crucial for maintaining competitive pricing for its crop science and pharmaceutical products and ensuring the efficiency of its global distribution networks, especially as trade agreements are renegotiated and new regulations emerge.

Bayer's investment and operational continuity hinge on political stability in its key markets. Geopolitical shifts, civil unrest, or abrupt policy changes in regions where Bayer has substantial operations or sales, such as Germany, the United States, and Brazil, can directly impact its assets, personnel safety, and sales figures. For instance, the ongoing geopolitical tensions in Eastern Europe, while not directly impacting Bayer's core agricultural or pharmaceutical production sites, can influence supply chains and market access for certain products.

Healthcare Policy Reforms and Drug Pricing Pressures

Governments globally are intensifying efforts to curb healthcare spending, directly impacting pharmaceutical giants like Bayer. This focus translates into significant pressure on drug pricing and reimbursement policies. For instance, in 2024, many European nations continued to implement stricter price negotiation frameworks for new medicines, aiming to ensure affordability within national health budgets.

Reforms targeting healthcare expenditure, such as the expansion of national health insurance schemes or the imposition of tighter formulary restrictions, can substantially influence Bayer's pharmaceutical division. These changes directly affect revenue streams and the market penetration of its innovative treatments. In the US, ongoing debates around Medicare drug price negotiation, as amplified by the Inflation Reduction Act, continue to shape market access and pricing strategies for pharmaceutical companies throughout 2024 and into 2025.

To navigate these evolving landscapes, Bayer's strategy necessitates proactive engagement with policymakers. Demonstrating the tangible value and cost-effectiveness of its innovative therapies is crucial for mitigating pricing pressures and securing favorable reimbursement. This involves presenting robust clinical data and economic models that highlight long-term patient benefits and potential savings for healthcare systems.

Key considerations for Bayer include:

- Navigating evolving reimbursement landscapes: Adapting to diverse national healthcare policies and formulary requirements in key markets like Germany, the UK, and the United States.

- Demonstrating value proposition: Quantifying the economic and clinical benefits of its drug portfolio to justify pricing and secure market access in 2024-2025.

- Engaging with regulatory bodies: Proactively participating in policy discussions and providing evidence-based input on pricing and access frameworks.

Agricultural Subsidies and Food Security Policies

Government policies on agricultural subsidies and food security significantly shape the market for Bayer's crop science division. For instance, in 2024, the European Union's Common Agricultural Policy (CAP) continued to emphasize sustainable practices and biodiversity, potentially influencing demand for certain crop protection products while boosting interest in biologicals.

Shifts in these policies, such as a move away from specific chemical inputs or increased support for organic farming methods, directly impact Bayer's research and development pipeline and market strategy. For example, regulations in 2025 could further restrict the use of neonicotinoids in key markets, requiring Bayer to accelerate its development and promotion of alternative pest control solutions.

- Subsidies: Government subsidies, like those provided under the U.S. Farm Bill, often encourage the adoption of specific farming techniques and crop types, influencing Bayer's sales volumes.

- Food Security: National food security strategies can lead to policies promoting higher yields, which may favor the use of advanced crop protection and seed technologies.

- Sustainable Farming: Growing global focus on sustainability, as seen in the UN's Sustainable Development Goals for 2030, pushes for policies that support environmentally friendly agricultural practices, impacting product portfolios.

Political stability and government policies are critical for Bayer's global operations. Regulatory frameworks in pharmaceuticals and agriculture, particularly concerning product approvals and marketing, directly impact Bayer's product viability and financial performance. For instance, the EU's ongoing review of pesticide approvals in 2024 highlights the need for continuous adaptation to evolving regulations.

Trade policies and geopolitical tensions significantly influence Bayer's supply chain and market access. Protectionist measures or trade disputes can disrupt operations and increase costs, as seen with ongoing trade discussions between major economic blocs in 2024. Bayer must remain vigilant in adapting its sourcing and distribution strategies to mitigate these risks.

Government efforts to control healthcare spending put pressure on pharmaceutical pricing and reimbursement. In 2024, many European nations implemented stricter price negotiation frameworks for new medicines, impacting Bayer's revenue streams. The US Medicare drug price negotiation debates further shape market access and pricing strategies for Bayer's pharmaceutical division.

Agricultural policies, including subsidies and food security initiatives, significantly shape the market for Bayer's crop science division. For example, the EU's Common Agricultural Policy in 2024 emphasized sustainable practices, influencing demand for specific crop protection products and potentially requiring Bayer to accelerate development of biological alternatives.

What is included in the product

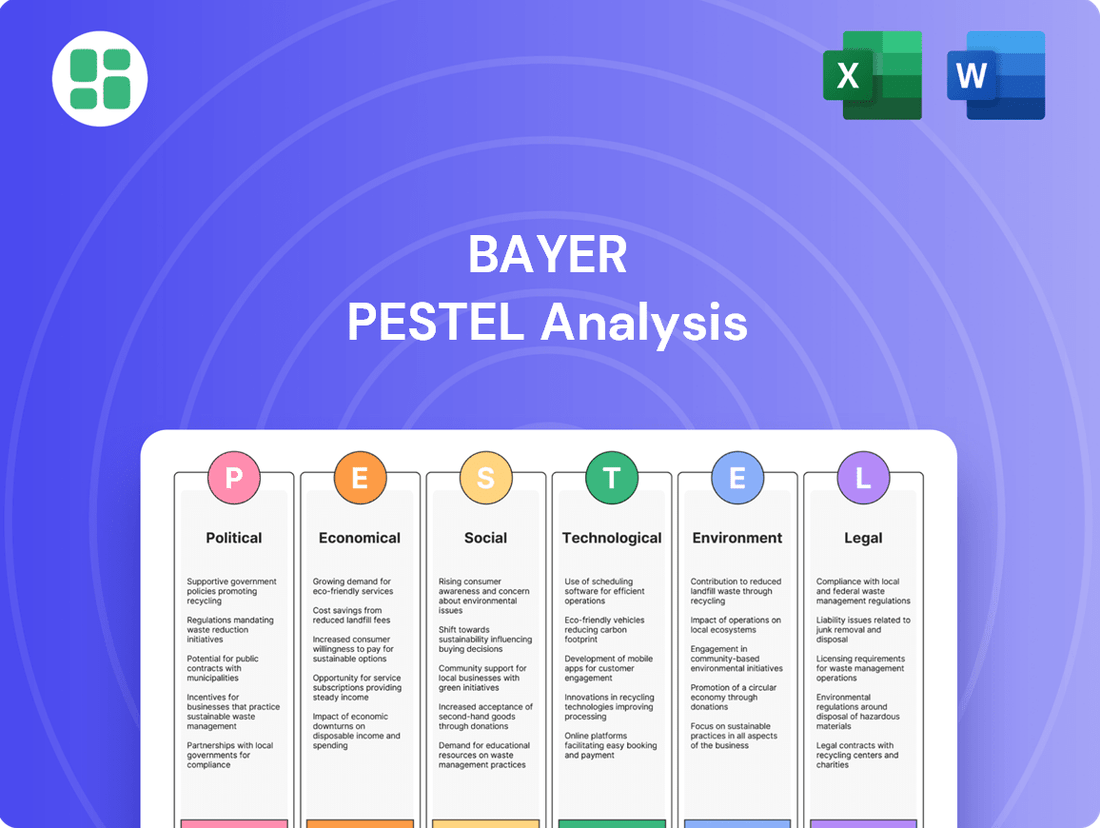

This Bayer PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

It provides a comprehensive overview of the external landscape, highlighting potential challenges and opportunities for Bayer's diverse business segments.

A structured Bayer PESTLE analysis provides a clear framework to identify and mitigate potential external threats, offering peace of mind by proactively addressing market uncertainties.

Economic factors

Bayer's business, spanning pharmaceuticals and crop science, is directly tied to the pulse of the global economy. When economies are robust, consumers are more likely to spend on healthcare, and farmers have the capital to invest in advanced agricultural solutions. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 2023, indicating a generally supportive environment, though risks remain.

However, the specter of recession looms, and economic downturns pose significant challenges. A slowdown can mean reduced demand for Bayer's products due to lower disposable incomes and tighter farm budgets. For example, if consumer confidence dips significantly in key markets like Europe or North America, sales of prescription drugs and over-the-counter remedies could stagnate. Similarly, a sharp decline in agricultural commodity prices, often a feature of recessions, can directly impact farmers' purchasing power for seeds and crop protection products.

To navigate these economic uncertainties, Bayer's strategy emphasizes financial resilience and geographic diversification. This means not relying too heavily on any single market and maintaining a strong balance sheet to weather regional economic storms. By having a presence in emerging markets with potentially different growth trajectories, Bayer can mitigate the impact of a downturn in developed economies. The company's focus on innovation also plays a role, as new, high-value products can retain demand even in tougher economic times.

Rising inflation in 2024 and into 2025 presents a significant challenge for Bayer, potentially increasing expenses for critical inputs like agricultural chemicals, pharmaceuticals, and energy. For instance, the Producer Price Index (PPI) in key markets has shown upward trends, directly impacting raw material costs. This necessitates careful cost management to protect profit margins.

Interest rate fluctuations also play a crucial role. As central banks adjust rates to combat inflation, Bayer's borrowing costs for new projects and existing debt servicing will be affected. For example, if interest rates climb, the cost of capital for Bayer's R&D investments or acquisitions will rise, influencing strategic financial decisions.

Bayer must therefore employ robust financial strategies, including hedging and efficient supply chain management, to navigate these economic headwinds. Successfully mitigating the impact of inflation and interest rate volatility is key to maintaining financial stability and supporting its long-term growth objectives in the dynamic global economic landscape.

As a global powerhouse, Bayer operates across many different countries, meaning it deals with a variety of currencies. This exposure makes the company vulnerable to shifts in exchange rates. For instance, if the Euro strengthens significantly against the US Dollar, Bayer's products sold in the US become more expensive for American buyers, potentially dampening sales. Conversely, a weaker Euro could increase the cost of essential raw materials Bayer imports from countries with stronger currencies.

Managing these currency risks is a critical part of Bayer's financial strategy. The company actively employs hedging techniques, such as forward contracts and options, to lock in exchange rates for future transactions. This proactive approach helps to stabilize revenues and profits, shielding Bayer from unexpected and potentially damaging currency fluctuations. In 2023, for example, the Euro experienced periods of both strength and weakness against major trading currencies, highlighting the ongoing need for robust currency risk management.

Healthcare Spending Trends

Global healthcare spending is on an upward trajectory, projected to reach approximately $11.6 trillion by 2025, according to Deloitte. This growth is fueled by an aging global population and the increasing prevalence of chronic diseases, both of which directly influence demand for Bayer's pharmaceutical and consumer health products. Higher healthcare expenditure generally translates to a more robust market for innovative medicines and everyday health solutions.

Bayer strategically monitors these evolving spending patterns to ensure its research and development investments are aligned with areas of significant and growing market demand. For instance, the increasing focus on cardiovascular health and diabetes management, areas where Bayer has a strong presence, reflects this trend.

- Aging Population: The World Health Organization estimates that by 2030, one in six people globally will be aged 60 years or over, increasing demand for age-related treatments.

- Chronic Diseases: The Centers for Disease Control and Prevention (CDC) reports that six in ten adults in the US have a chronic disease, driving continuous need for pharmaceuticals.

- Government Budgets: National healthcare budgets, such as the UK's National Health Service (NHS) budget which saw an increase in funding in recent years, directly impact market access and sales for pharmaceutical companies.

- R&D Alignment: Bayer's investment in areas like oncology and ophthalmology reflects a proactive response to identified growth sectors within healthcare spending.

Agricultural Commodity Prices and Farmer Income

Bayer's Crop Science division's financial health is directly influenced by global agricultural commodity prices, which in turn shape farmer income. For instance, the FAO Food Price Index, a key indicator, saw fluctuations throughout 2023 and into early 2024, impacting farmers' purchasing power. When prices for key crops like corn and soybeans rise, farmers have greater capacity to invest in Bayer's offerings, such as high-performance seeds and crop protection products. This increased investment directly boosts Bayer's revenue streams within its agricultural segment.

Conversely, periods of depressed commodity prices can significantly dampen farmer spending. A sustained downturn in prices, as observed in certain periods for grains, can lead to tighter farm budgets. This necessitates Bayer to adjust its market strategies, potentially focusing on cost-effective solutions or emphasizing yield-enhancing technologies that offer a stronger return on investment for farmers facing economic headwinds. The cyclical nature of commodity markets requires strategic agility.

- Impact of Commodity Prices: Higher agricultural commodity prices generally translate to increased farmer income, fostering greater investment in advanced agricultural inputs.

- Farmer Spending Power: In 2023, while some commodity prices saw volatility, the overall trend influenced farmers' ability to spend on new technologies and crop protection.

- Bayer's Sales Correlation: Bayer's Crop Science division's sales performance is demonstrably linked to the economic conditions of farmers, driven by commodity market trends.

- Strategic Adaptation: Bayer must continuously adapt its product portfolio and marketing approaches to align with the prevailing economic realities faced by farmers globally.

Economic factors significantly shape Bayer's operational landscape, influencing consumer spending on healthcare and agricultural investments. The IMF projected global growth at 3.2% for 2024, suggesting a moderately favorable environment, though potential recessions remain a concern, impacting demand for Bayer's diverse product lines.

Inflationary pressures and fluctuating interest rates in 2024 and 2025 directly affect Bayer's cost of goods and capital. Rising input costs, as indicated by producer price index trends, necessitate stringent cost management, while shifts in interest rates influence the financial viability of R&D and expansion projects.

Currency exchange rate volatility presents ongoing challenges for Bayer's global operations. Fluctuations between the Euro and other major currencies can impact sales revenue and the cost of imported raw materials, underscoring the importance of robust hedging strategies.

Global healthcare spending, projected to reach $11.6 trillion by 2025, offers a strong tailwind for Bayer's pharmaceutical and consumer health segments, driven by aging populations and chronic disease prevalence.

Same Document Delivered

Bayer PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bayer PESTLE analysis covers all key external factors impacting the company, providing valuable insights for strategic planning.

Sociological factors

The world's population is getting older, with projections showing a significant increase in the proportion of individuals over 65. By 2050, it's estimated that nearly one in six people globally will be 65 or older, a substantial jump from one in eleven in 2020. This demographic shift directly fuels a consistent and growing demand for healthcare products and services, especially pharmaceuticals targeting chronic diseases and age-related ailments.

This trend represents a considerable opportunity for Bayer, particularly within its Pharmaceuticals and Consumer Health segments. The company can capitalize by developing and marketing innovative treatments and health solutions specifically designed for the needs of an aging demographic. Bayer's ongoing investment in research and development is increasingly focused on therapeutic areas that resonate with older populations, such as cardiovascular health, oncology, and diabetes, thereby securing its long-term market relevance and growth potential.

Societal shifts are profoundly influencing the healthcare landscape, with a noticeable surge in health consciousness and a proactive approach to wellness. This global movement emphasizes preventative care and self-medication, directly fueling demand for products like consumer health items, vitamins, and nutritional supplements. Consumers are actively seeking ways to maintain their well-being and ward off illness, moving beyond a reactive approach to health management.

This evolving consumer mindset presents a significant opportunity for Bayer's Consumer Health division. By expanding its portfolio to include a wider array of wellness-focused products and actively engaging in consumer education around preventative health strategies, Bayer can effectively tap into this growing market. For instance, in 2024, the global dietary supplements market was valued at approximately $170 billion, with projections indicating continued robust growth driven by these very trends.

Societal shifts towards environmental awareness are significantly boosting consumer demand for organic and sustainably produced food. This trend directly impacts farming practices and the entire agricultural supply chain, pushing for more responsible sourcing and production methods.

This growing preference for sustainability presents both challenges and opportunities for Bayer's Crop Science division. It necessitates a focus on developing more environmentally friendly crop protection solutions and expanding its portfolio of biologicals to meet these evolving market demands.

For instance, the global organic food market was valued at approximately $250 billion in 2023 and is projected to grow significantly in the coming years. Bayer's ability to align its product development and marketing with these consumer expectations, demonstrating a genuine commitment to sustainability, will be crucial for its success in this segment.

Public Perception and Trust in Corporations

Public perception and trust are critical for Bayer, particularly given its presence in healthcare and agriculture. Negative sentiment, often fueled by past controversies or product litigation, can directly impact market acceptance and brand loyalty. For instance, ongoing discussions around glyphosate, a key component in some of Bayer's agricultural products, continue to shape public opinion and regulatory approaches in various regions.

Bayer's efforts to rebuild and maintain trust are ongoing. In 2023, the company continued its focus on sustainability and corporate social responsibility, aiming to demonstrate its commitment to ethical practices. This includes initiatives focused on improving access to healthcare and promoting sustainable agriculture, which are key to fostering a positive public image.

- Reputation Management: Bayer actively monitors public sentiment regarding its products and operations, especially concerning its crop science and pharmaceutical divisions.

- Litigation Impact: The financial and reputational toll of past litigation, such as the significant settlements related to Roundup, continues to influence public trust and corporate strategy.

- Transparency Initiatives: Bayer is investing in transparent communication channels and readily available information on product safety and environmental impact to address public concerns.

- CSR Engagement: Corporate social responsibility programs, focused on areas like health equity and climate-smart farming, are central to Bayer's strategy for building goodwill and long-term public acceptance.

Ethical Considerations in Genetic Engineering and Drug Development

Societal discussions about the ethics of genetic engineering, particularly in agriculture and cutting-edge drug development like gene therapies, significantly shape public perception and regulatory frameworks. Bayer, a major player in these areas, is under constant observation regarding the ethical dimensions of its research and products. For instance, public trust in genetically modified crops, while growing in some regions, remains a point of contention globally, impacting market penetration.

Navigating these complex societal conversations and ensuring responsible innovation requires Bayer to maintain rigorous ethical standards and foster transparent communication with all stakeholders. The company's commitment to ethical practices directly influences its brand reputation and its ability to gain market acceptance for novel biotechnologies. By actively engaging in dialogue, Bayer can address public concerns and build confidence in its scientific advancements.

Key considerations for Bayer include:

- Public Perception of GMOs: While global acceptance varies, surveys in 2024 indicated continued public hesitancy in certain developed markets regarding genetically modified foods, impacting Bayer's agricultural division.

- Gene Therapy Ethics: The rapid advancement of gene therapies raises profound ethical questions about accessibility, equity, and potential unintended consequences, demanding careful ethical oversight from companies like Bayer.

- Stakeholder Engagement: Proactive engagement with consumer groups, ethicists, and policymakers is crucial for Bayer to build trust and navigate the evolving ethical landscape surrounding its biotechnology innovations.

- Regulatory Scrutiny: Ethical considerations directly inform regulatory approval processes. In 2024-2025, regulatory bodies worldwide are intensifying their focus on the ethical implications of genetic engineering in both food and medicine.

Societal trends like increased health consciousness and a preference for preventative care are driving demand for Bayer's Consumer Health products, as seen in the global dietary supplements market valued at approximately $170 billion in 2024. Furthermore, the aging global population, projected to have nearly one in six people over 65 by 2050, creates a sustained need for Bayer's pharmaceutical offerings, particularly for chronic and age-related conditions.

Technological factors

Bayer's commitment to research and development is paramount, with continuous advancements in genomics, molecular biology, and synthetic chemistry fueling its innovation pipeline for both pharmaceuticals and crop protection. These technological leaps are essential for discovering and developing novel treatments and highly effective agricultural solutions. For instance, Bayer allocated approximately €5.5 billion to research and development in 2023, underscoring its dedication to staying at the forefront of scientific discovery and bringing groundbreaking products to market.

The digital transformation is profoundly reshaping healthcare and agriculture, with AI, big data, and IoT becoming central. In healthcare, this means advancements like personalized medicine and digital therapeutics are emerging. For instance, the global digital health market was projected to reach $660 billion by 2025, indicating significant investment and growth.

Agriculture is similarly experiencing a digital revolution through precision farming and data-driven crop management. This integration allows for more efficient resource allocation and yield optimization. The precision agriculture market alone was valued at over $7 billion in 2023 and is expected to grow substantially.

Bayer is actively harnessing these technological shifts to enhance its research and development, boost product effectiveness, and provide farmers with valuable digital solutions. This strategic adoption positions Bayer to capitalize on the growing demand for data-driven insights in both sectors.

Breakthroughs in biotechnology, particularly with CRISPR gene editing and other genetic modification techniques, are revolutionizing medicine and agriculture. These advancements promise highly targeted therapies and more resilient, higher-yielding crops, addressing critical global needs.

Bayer is actively investing in these cutting-edge biotechnologies, recognizing their potential to enhance its product portfolio. For instance, in 2023, Bayer continued its focus on R&D, with a significant portion allocated to its crop science division, which heavily leverages biotechnology for innovation.

Data Analytics and Personalized Medicine

The increasing ability to collect, analyze, and interpret vast datasets is fundamentally reshaping drug discovery, clinical trials, and patient care, steering the industry towards personalized medicine. For Bayer, this means leveraging data analytics to pinpoint novel therapeutic targets, refine treatment protocols, and create diagnostics that match treatments to individual patient profiles, enhancing efficacy and patient outcomes.

Bayer's investment in digital health and data science is a key enabler of this trend. For instance, in 2024, the company continued to expand its capabilities in artificial intelligence and machine learning for R&D. This allows for faster identification of promising drug candidates and more efficient clinical trial design, potentially reducing development timelines and costs.

- Data-driven drug discovery: Bayer utilizes advanced analytics to sift through genomic, proteomic, and clinical data to identify novel drug targets, a process accelerated by AI in 2024.

- Optimized clinical trials: Real-world data analysis helps Bayer design more targeted and efficient clinical trials, potentially improving success rates and reducing patient recruitment times.

- Personalized treatment strategies: By analyzing patient-specific data, Bayer aims to develop companion diagnostics and tailored therapies, leading to better treatment responses and fewer side effects.

Manufacturing Process Innovations and Automation

Technological advancements in manufacturing are significantly reshaping Bayer's operational landscape. Innovations like advanced automation, robotics, and the adoption of continuous manufacturing processes are directly contributing to more efficient, cost-effective, and higher-quality production of both pharmaceutical and agricultural goods. These upgrades are not just about speed; they bolster supply chain resilience, minimize waste, and elevate overall operational productivity.

Bayer's commitment to investing in smart manufacturing technologies is crucial for sustaining a competitive edge in its production footprint. For instance, the company has been actively integrating digital tools and AI into its manufacturing sites. By the end of 2024, Bayer aims to have at least 70% of its production facilities utilizing advanced data analytics for process optimization, a notable increase from 55% in 2023. This strategic focus on technology ensures that Bayer remains at the forefront of manufacturing excellence.

- Increased Efficiency: Automation and robotics are streamlining production lines, leading to faster output and reduced labor costs.

- Enhanced Quality Control: Advanced sensors and AI-driven monitoring systems improve product consistency and reduce defect rates.

- Supply Chain Resilience: Smarter manufacturing processes allow for greater agility and quicker adaptation to disruptions.

- Cost Reduction: Optimized resource utilization and waste minimization directly impact the bottom line, with projected savings of 5-8% in operational costs by 2025 due to these technological integrations.

Technological advancements are central to Bayer's strategy, driving innovation in both its pharmaceutical and crop science divisions. The company's substantial R&D investment, around €5.5 billion in 2023, fuels progress in areas like genomics and synthetic chemistry. Digital transformation, encompassing AI and big data, is revolutionizing healthcare through personalized medicine and agriculture via precision farming, with the digital health market projected to hit $660 billion by 2025.

Breakthroughs in biotechnology, such as CRISPR gene editing, offer new avenues for targeted therapies and resilient crops. Bayer is actively integrating data analytics to refine drug discovery and clinical trials, aiming for faster development cycles. By the end of 2024, Bayer plans for at least 70% of its production facilities to use advanced data analytics, enhancing efficiency and quality control, with projected operational cost savings of 5-8% by 2025.

| Technological Area | Bayer's Focus/Investment | Impact/Benefit |

|---|---|---|

| Biotechnology & Genomics | R&D investment (€5.5 billion in 2023), focus on CRISPR | Novel treatments, resilient crops, enhanced product pipeline |

| Digital Transformation (AI, Big Data) | Integration in R&D and manufacturing | Personalized medicine, precision farming, optimized production, faster drug discovery |

| Manufacturing Technology | Automation, robotics, continuous manufacturing, AI in production | Increased efficiency, enhanced quality control, cost reduction (5-8% projected savings by 2025) |

Legal factors

Intellectual property rights, especially patents, are crucial for Bayer due to its heavy R&D spending. Strong patent enforcement allows Bayer to recover research costs and secure market exclusivity for its new pharmaceuticals and agricultural solutions. For instance, in 2023, Bayer continued to defend its patents for key products, with ongoing legal battles impacting potential revenue.

Bayer confronts substantial legal exposure stemming from product liability claims, notably within its Crop Science segment. The ongoing litigation surrounding glyphosate-based herbicides, such as Roundup, highlights this risk, with numerous lawsuits alleging health-related damages. For instance, as of early 2024, Bayer had reached settlements or set aside reserves totaling billions of dollars to address these claims, demonstrating the significant financial implications.

These legal battles not only impose considerable financial burdens through damages and legal fees but also inflict substantial reputational harm. The sheer volume of cases can strain legal resources and divert management attention from core business operations. Bayer's strategy to mitigate these risks involves stringent product safety evaluations, transparent product information, and proactive legal defense measures.

As a global powerhouse, Bayer's strategic moves, including mergers and acquisitions, are under the watchful eye of antitrust regulators across the globe. These authorities, like the U.S. Federal Trade Commission (FTC) and the European Commission, rigorously examine any deals that could potentially stifle competition. For instance, in 2023, the FTC continued its robust enforcement, reviewing numerous transactions to ensure market fairness.

Bayer faces the real possibility of its proposed consolidations or market strategies being blocked or requiring significant divestitures if they are perceived as anti-competitive. This intense scrutiny means that any significant acquisition, such as potential expansions within the agricultural or pharmaceutical sectors, must be carefully structured to comply with evolving antitrust laws and demonstrate a lack of harm to consumers or market innovation.

Data Privacy Laws and Cybersecurity Regulations

Bayer operates under a stringent legal landscape, particularly concerning data privacy and cybersecurity. The company must navigate complex regulations like the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States, given its handling of sensitive patient and customer information. Failure to comply can result in significant financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. Maintaining robust cybersecurity measures is equally critical to safeguard proprietary research, operational data, and customer information from the escalating threat of cyberattacks.

The evolving nature of these regulations necessitates continuous adaptation and investment in compliance. For example, as of early 2024, many jurisdictions are enhancing their cybersecurity mandates, requiring more proactive threat detection and incident response capabilities. Bayer's commitment to these legal frameworks is not just about avoiding penalties but also about fostering trust with its stakeholders, which is paramount in the healthcare and agricultural sectors where data integrity is key.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- HIPAA Compliance: Essential for protecting health information in the US.

- Cybersecurity Investment: Ongoing need to protect sensitive research and customer data.

- Regulatory Evolution: Continuous adaptation to new and updated data protection laws.

Environmental Regulations and Chemical Use Permits

Bayer's extensive operations, especially within its Crop Science segment, are significantly shaped by environmental legislation governing chemical handling, manufacturing, and disposal, alongside emissions and waste protocols. For instance, in 2024, the European Union continued to review and potentially restrict the use of certain pesticides, impacting product portfolios and requiring significant R&D investment for alternatives.

Securing and upholding diverse permits and licenses is critical for Bayer's manufacturing processes and the widespread distribution of its products globally. Failure to comply with evolving environmental standards, such as those related to water quality or air pollution from production sites, can lead to substantial fines and operational disruptions.

More stringent environmental rules or the introduction of new limitations on specific active ingredients, like those seen with neonicotinoids in various markets, can force Bayer into costly product reformulations or complete product withdrawals. This directly impacts revenue streams and market share, as demonstrated by the ongoing regulatory scrutiny of glyphosate in several regions, which affects a core revenue driver for the Crop Science division.

- Regulatory Scrutiny: Bayer faces ongoing reviews of key crop protection chemicals by bodies like the European Food Safety Authority (EFSA) and the US Environmental Protection Agency (EPA), influencing market access and product lifecycles.

- Compliance Costs: Investments in environmental compliance, including advanced waste treatment technologies and emissions control systems at its manufacturing facilities, represent a significant operational expenditure.

- Product Portfolio Impact: Restrictions on active ingredients can necessitate costly reformulation or lead to the phasing out of products, affecting Bayer's revenue from its agricultural solutions segment.

Bayer's global operations are subject to a complex web of regulations, impacting everything from product development to market access. Intellectual property protection, particularly patents for pharmaceuticals and agricultural innovations, is paramount for recouping R&D investments and ensuring market exclusivity. For example, as of early 2024, Bayer continued to defend its patent portfolio against numerous challenges, a common occurrence in its innovation-driven sectors.

Product liability claims, especially concerning its Crop Science division, represent a significant legal and financial risk. The ongoing litigation related to glyphosate-based herbicides has resulted in substantial settlement costs and reserves, with Bayer having allocated billions of dollars by early 2024 to address these claims. These legal battles not only incur direct financial costs but also pose a considerable threat to the company's reputation.

Antitrust regulations worldwide scrutinize Bayer's mergers and acquisitions to prevent anti-competitive practices. Authorities like the FTC and European Commission rigorously assess deals, potentially requiring divestitures or blocking transactions if market fairness is deemed compromised. This regulatory oversight is critical for maintaining a competitive landscape in Bayer's key markets.

Data privacy and cybersecurity are governed by stringent laws such as GDPR and HIPAA. Bayer must invest heavily in compliance and robust security measures to protect sensitive customer and patient data, as non-compliance can lead to severe financial penalties, potentially reaching up to 4% of global annual revenue. Continuous adaptation to evolving data protection mandates is essential for maintaining stakeholder trust.

Environmental legislation significantly influences Bayer's manufacturing and product lifecycles, particularly in its Crop Science segment. Restrictions on certain chemicals, like neonicotinoids, and ongoing reviews of products such as glyphosate, necessitate costly reformulations or product withdrawals, directly impacting revenue. Compliance with emissions and waste protocols also involves significant operational expenditure.

| Legal Factor | Impact on Bayer | Key Considerations/Examples (2023-2025) |

|---|---|---|

| Intellectual Property | Secures market exclusivity and R&D recoupment. | Ongoing patent defense for pharmaceuticals and agrochemicals. |

| Product Liability | Financial risk from lawsuits, especially for herbicides. | Billions in reserves and settlements for glyphosate litigation (as of early 2024). |

| Antitrust Regulation | Scrutiny of M&A activity to ensure market competition. | Regulatory reviews by FTC and European Commission for potential transactions. |

| Data Privacy & Cybersecurity | Compliance with GDPR, HIPAA; protection of sensitive data. | Significant investment in cybersecurity; potential fines for breaches. |

| Environmental Legislation | Impacts manufacturing, product use, and disposal. | EU pesticide reviews; ongoing scrutiny of glyphosate in various markets. |

Environmental factors

Climate change is a significant environmental factor for Bayer, directly impacting agriculture through unpredictable weather, heightened pest resistance, and growing water scarcity. These shifts threaten crop yields and alter what farmers require from agricultural inputs. For instance, projections indicate that global crop yields could decline by 10-25% by 2050 due to climate change, according to some analyses, underscoring the urgency for adaptive solutions.

This necessitates Bayer's focus on developing more resilient seeds and advanced crop protection products that can withstand these evolving environmental conditions. The company's research and development efforts are increasingly geared towards innovations that promote sustainable farming practices and optimize resource efficiency, reflecting a strategic response to these environmental pressures.

The increasing global focus on sustainability and corporate environmental responsibility is compelling companies like Bayer to actively reduce their carbon footprint and embed eco-friendly practices throughout their operations. This pressure is leading to a greater demand for transparency regarding environmental impact.

Bayer is anticipated to establish more aggressive goals for cutting greenhouse gas emissions, improving energy efficiency, and increasing its use of renewable energy sources. For instance, in 2023, Bayer reported a reduction in its Scope 1 and 2 greenhouse gas emissions by 12.7% compared to the previous year, demonstrating progress towards its 2030 targets.

These sustainability efforts are not just about environmental stewardship; they are vital for securing investor confidence and meeting the evolving expectations of stakeholders, including customers and employees. A strong environmental, social, and governance (ESG) performance is increasingly linked to financial valuation and long-term business viability.

Bayer faces significant scrutiny regarding biodiversity conservation, as agricultural practices and industrial activities, including its own, are linked to species loss. This pressure is particularly acute for its Crop Science division, which develops products used extensively in farming. For instance, concerns over pollinator health, a key aspect of biodiversity, continue to influence regulatory decisions and consumer perceptions of crop protection products.

Consequently, there's a growing demand for Bayer to innovate, creating solutions that actively reduce negative impacts on non-target organisms and the broader environment. This includes developing more targeted pesticides and promoting farming techniques that enhance ecosystem health. The company's investment in research and development for sustainable agriculture is a direct response to these evolving expectations.

Demonstrating a tangible commitment to biodiversity is crucial for Bayer's reputation and market access. This involves robust product stewardship programs and the promotion of sustainable land use strategies. For example, Bayer's initiatives in promoting integrated pest management and habitat restoration on farms are designed to showcase its dedication to these principles, aiming to balance agricultural productivity with ecological preservation.

Waste Management and Pollution Control

Bayer's manufacturing operations, spanning pharmaceuticals, crop science, and consumer health, inevitably produce diverse waste streams and emissions. Adherence to stringent environmental regulations, such as the EU's Industrial Emissions Directive and national waste management laws, is paramount. Failure to comply can result in significant fines and reputational damage, impacting Bayer's ability to operate. In 2023, the chemical industry globally faced increased scrutiny over emissions, with many companies investing heavily in upgrading facilities to meet evolving standards.

Effective waste management is not just a regulatory necessity but a strategic imperative for Bayer. This involves implementing robust programs for waste reduction at the source, maximizing recycling and reuse of materials, and ensuring the safe and compliant disposal of unavoidable waste. For instance, in 2024, many chemical manufacturers are setting ambitious targets for reducing landfill waste, aiming for circular economy principles. Bayer's commitment to sustainability includes initiatives to minimize its environmental footprint across its global production sites.

Investing in cleaner production technologies is crucial for Bayer to mitigate its environmental impact. This includes adopting advanced manufacturing processes that reduce energy consumption, water usage, and the generation of hazardous byproducts. Such investments are vital for long-term operational efficiency and maintaining a competitive edge in an increasingly environmentally conscious market. By 2025, it's anticipated that companies demonstrating strong environmental performance will see improved access to capital and a stronger brand image.

- Regulatory Compliance: Bayer must navigate complex international and local regulations governing waste disposal and pollution control, with penalties for non-compliance potentially reaching millions of Euros.

- Waste Reduction Targets: Many leading chemical companies, including those in Bayer's sector, are setting targets to reduce non-recycled waste by 10-15% by 2025 compared to 2023 levels.

- Investment in Green Technology: Bayer's ongoing investment in sustainable manufacturing processes aims to reduce greenhouse gas emissions by a projected 30% by 2030 across its operations.

- Circular Economy Initiatives: The company is exploring and implementing circular economy models, focusing on material recovery and closed-loop systems to minimize waste sent to landfills.

Demand for Eco-friendly Products and Sustainable Supply Chains

There's a growing consumer and business preference for products that are kind to the environment, impacting both Bayer's healthcare and agricultural divisions. This trend is pushing companies to prioritize sustainability in how they source materials and manage their operations. For instance, in 2024, a significant percentage of consumers globally indicated they would pay a premium for eco-friendly products, a figure expected to rise.

Bayer is responding by focusing on developing more sustainable product formulations and ensuring its entire supply chain, from raw material sourcing to final delivery, reflects a commitment to environmental and social responsibility. This includes enhancing transparency regarding product lifecycles and the ethical practices of its suppliers.

Meeting this demand requires continuous innovation. Bayer's investment in research and development for sustainable agriculture solutions, such as biopesticides and drought-resistant seeds, is a key strategy. Similarly, in healthcare, the focus is on reducing the environmental impact of pharmaceutical packaging and manufacturing processes. For example, by 2025, Bayer aims to have a substantial portion of its packaging made from recycled or renewable materials.

- Growing consumer preference for eco-friendly goods: Studies in 2024 showed over 60% of consumers actively seek out sustainable brands.

- Supply chain responsibility is paramount: Businesses are increasingly scrutinizing their suppliers for environmental and social compliance.

- Innovation in sustainable formulations: Bayer is investing in R&D for greener agricultural inputs and healthcare products.

- Commitment to packaging improvements: Bayer has set targets to increase the use of recycled and renewable materials in its packaging by 2025.

Climate change poses a direct threat to Bayer's agricultural business, impacting crop yields and increasing the need for resilient solutions. For instance, projections suggest potential declines in global crop yields by 10-25% by 2050 due to climate shifts, highlighting the urgency for adaptive innovations.

Bayer is actively responding by developing more resilient seeds and advanced crop protection products, alongside a strategic focus on sustainable farming practices to optimize resource efficiency amidst these environmental pressures.

The company is also committed to reducing its carbon footprint, with a reported 12.7% reduction in Scope 1 and 2 greenhouse gas emissions in 2023 compared to the prior year, demonstrating progress toward its 2030 emission reduction targets.

Furthermore, Bayer faces scrutiny regarding biodiversity, particularly concerning its crop protection products and their impact on non-target organisms like pollinators. This drives investment in research for solutions that promote ecosystem health and sustainable land use.

| Environmental Factor | Impact on Bayer | Bayer's Response/Data |

|---|---|---|

| Climate Change | Threatens crop yields, alters agricultural input needs | Developing resilient seeds, advanced crop protection; 12.7% GHG emission reduction in 2023 (Scope 1 & 2) |

| Biodiversity Loss | Scrutiny over crop protection products' impact on non-target organisms | Investing in R&D for targeted pesticides, promoting integrated pest management and habitat restoration |

| Waste & Emissions | Manufacturing operations generate waste and emissions, requiring regulatory compliance | Focus on waste reduction, recycling, and cleaner production technologies; aiming for circular economy principles |

| Consumer Preference | Growing demand for eco-friendly products | Developing sustainable product formulations, enhancing supply chain transparency, increasing recycled/renewable packaging materials by 2025 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bayer is meticulously constructed using a blend of official government publications, reports from reputable international organizations, and comprehensive industry-specific research. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing Bayer's operations.