Bayer Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bayer Bundle

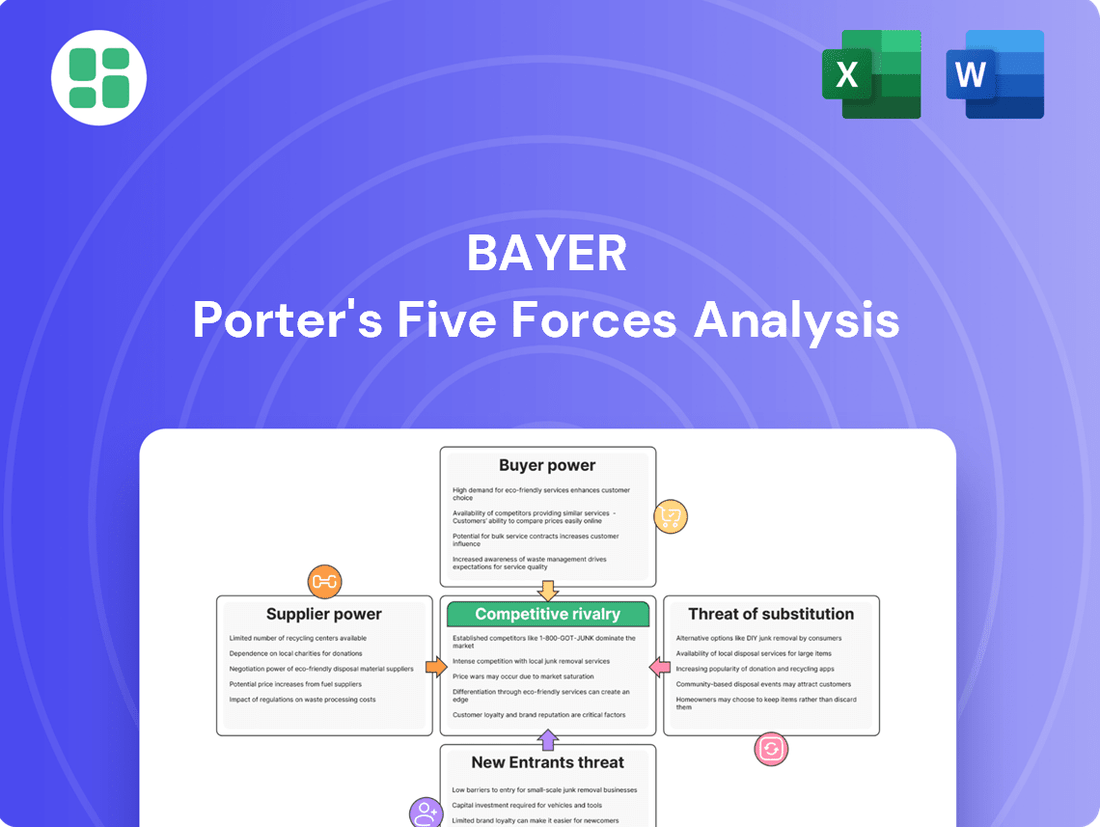

Bayer operates within a complex pharmaceutical and agricultural landscape, where understanding the competitive forces is crucial for strategic success. Our Porter's Five Forces Analysis delves into the intensity of rivalry, the power of buyers and suppliers, and the threats of new entrants and substitutes impacting Bayer.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bayer’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

In the pharmaceutical and crop science industries, Bayer often faces a situation where a few specialized raw material or active pharmaceutical ingredient (API) suppliers hold significant sway. For instance, the development of novel drugs or advanced crop traits may depend on unique chemical compounds or genetic sequences sourced from a small pool of providers. This concentration means these suppliers can exert considerable bargaining power, impacting Bayer's production costs and timelines.

High switching costs significantly bolster supplier bargaining power for Bayer. For instance, replacing a supplier of highly specialized active pharmaceutical ingredients (APIs) requires extensive re-validation and new regulatory approvals, a process that can cost millions and delay product launches by months. In 2024, the pharmaceutical industry saw an average of $10 million in costs associated with regulatory re-approvals for new suppliers of critical components.

Suppliers who offer highly differentiated or patented products, like novel chemical compounds or unique biological agents, wield significant bargaining power. For Bayer, if these inputs are critical for their innovative products and lack close substitutes, these suppliers can indeed demand higher prices. For example, a supplier holding a patent for a key active pharmaceutical ingredient (API) would have considerable leverage.

Forward Integration Threat

The threat of forward integration by suppliers, while less prevalent, can significantly impact Bayer's supplier power dynamics. If a specialized supplier possesses the technical expertise or strategic motivation, they could potentially move into manufacturing and marketing similar products, directly challenging Bayer in specific market niches. This potential, even if not fully realized, encourages Bayer to foster robust and collaborative supplier relationships to mitigate this risk.

This scenario would inherently bolster the bargaining power of those suppliers capable of such a move. For instance, a key supplier of a unique active pharmaceutical ingredient (API) might consider developing their own finished dosage forms, especially if they see a significant market opportunity and possess the necessary regulatory approvals.

- Forward Integration Threat: Specialized suppliers may integrate forward, creating competition for Bayer.

- Supplier Power Influence: This possibility increases suppliers' leverage in negotiations.

- Relationship Management: Bayer must maintain strong supplier ties to counter this threat.

Global Supply Chain Dynamics

Bayer's extensive global operations expose it to significant supplier bargaining power, amplified by geopolitical shifts and evolving trade policies. For instance, in 2024, disruptions in key agricultural regions due to climate events and ongoing trade tensions between major economies led to increased raw material costs for agricultural inputs, impacting companies like Bayer. This vulnerability can translate into higher input prices and affect product availability.

The company is actively addressing these challenges by investing in supply chain resilience and enhancing visibility. By 2024, Bayer had reportedly increased its investments in digital supply chain management tools, aiming to better anticipate and mitigate disruptions. This strategic move is designed to reduce reliance on single sources and improve negotiation leverage with suppliers.

- Geopolitical Impact: Trade disputes and regional conflicts in 2024 have demonstrably increased the cost and complexity of sourcing key chemicals and agricultural components for global players.

- Logistical Hurdles: Port congestion and rising shipping rates observed throughout 2024 have directly translated into higher transportation expenses, strengthening the bargaining position of logistics providers and, by extension, their upstream suppliers.

- Resilience Initiatives: Bayer's stated commitment to supply chain diversification and digital transformation aims to offset these pressures, with a focus on securing more stable and cost-effective sourcing channels moving forward.

Bayer's bargaining power with suppliers is influenced by the concentration of suppliers for critical inputs and the potential for these suppliers to integrate forward. High switching costs for specialized components, such as patented active pharmaceutical ingredients, further empower suppliers. Geopolitical factors and supply chain disruptions in 2024 have also demonstrably increased raw material costs, strengthening supplier leverage.

| Factor | Impact on Bayer's Supplier Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | High for specialized inputs, increasing supplier leverage. | Few providers for novel APIs and unique crop traits. |

| Switching Costs | Significant for regulated components, favoring suppliers. | Average $10 million for regulatory re-approvals of new suppliers in pharma (2024). |

| Product Differentiation/Patents | Suppliers of patented or unique inputs have strong power. | Patented active pharmaceutical ingredients (APIs) command higher prices. |

| Forward Integration Threat | Potential for suppliers to enter Bayer's markets increases their leverage. | Suppliers may develop finished dosage forms, creating competition. |

| Geopolitical & Trade Issues | Disruptions and tensions in 2024 led to higher input costs. | Climate events and trade disputes increased raw material costs for agricultural inputs. |

What is included in the product

Analyzes the five competitive forces shaping Bayer's industry: threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors.

Quickly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Bayer's diverse customer base, spanning individual consumers in consumer health, large healthcare systems and governments in pharmaceuticals, and farmers of all sizes in crop science, significantly impacts customer bargaining power across its different segments. For instance, individual consumers typically have minimal power due to the fragmented nature of their purchases and limited alternatives for certain products.

Conversely, large institutional buyers within the pharmaceutical sector, such as national health services or major hospital networks, can wield substantial bargaining power. These entities often purchase in bulk, possess significant negotiation leverage, and can influence pricing and terms, as seen in government tenders for prescription drugs.

In the crop science division, the bargaining power of farmers varies. While smallholder farmers may have limited individual influence, large agricultural cooperatives or major food producers can negotiate more effectively for seeds and crop protection products, impacting Bayer's revenue streams in this area.

In the pharmaceutical sector, patent expirations are a major driver of customer bargaining power. For instance, when patents on blockbuster drugs like Bayer's Xarelto expire, generic and biosimilar versions enter the market, offering significantly lower prices. This forces established players to compete on cost, directly impacting their pricing power and increasing customer leverage.

The crop science division faces similar pressures due to the widespread availability of generic crop protection products. Asian manufacturers, in particular, have increased their market share by offering cost-effective alternatives to branded products. This intensifies price competition, making customers more sensitive to price differences and enhancing their ability to negotiate favorable terms.

Bayer's customers are increasingly prioritizing cost-effectiveness across both its pharmaceutical and crop science segments. The availability of cheaper alternatives means that price is a significant factor in purchasing decisions. This trend is particularly evident in markets where economic conditions are tighter, pushing customers to seek the most value for their money.

Government and large healthcare systems wield significant bargaining power over pharmaceutical pricing, largely due to their immense purchasing volumes and regulatory oversight. This influence can directly impact companies like Bayer by dictating the terms and prices at which their products are reimbursed and distributed.

In the U.S., legislation like the Inflation Reduction Act (IRA) of 2022 exemplifies this government influence. The IRA allows Medicare to negotiate prices for certain high-cost prescription drugs, a move expected to significantly affect the revenue streams of pharmaceutical companies. For instance, by 2026, Medicare is slated to begin negotiating prices for up to 10 drugs, with more to follow annually. This policy directly pressures Bayer's Pharmaceuticals division, potentially leading to reduced profitability on key products subject to these negotiations.

Consolidation of Retail and Distribution Channels

The increasing consolidation within retail and agricultural distribution channels significantly amplifies the bargaining power of customers for companies like Bayer. Large, unified retail chains and agricultural distributors can exert considerable pressure on suppliers, demanding more favorable terms and pricing. This consolidation trend, evident globally, allows these entities to negotiate bulk discounts and preferential payment schedules, directly impacting Bayer's profitability in its consumer health and crop science divisions.

This heightened negotiation leverage for consolidated buyers means they can dictate terms that squeeze supplier margins. For instance, a major European agricultural distributor might leverage its consolidated purchasing power to secure lower prices on crop protection products, impacting Bayer's revenue streams. Similarly, large pharmacy chains consolidating their purchasing for consumer health products can demand better margins, forcing suppliers to accept less favorable deals.

- Increased Buying Power: Major retail consolidations, such as the ongoing mergers and acquisitions in the supermarket sector, create fewer, larger buyers with substantial market share.

- Negotiation Leverage: These consolidated entities can demand better pricing, extended payment terms, and exclusive product arrangements, putting pressure on suppliers like Bayer.

- Margin Squeeze: The ability of large distributors to negotiate bulk discounts and favorable payment conditions directly impacts Bayer's profit margins across its diverse product portfolio.

Information Availability and Digital Platforms

The digital age has significantly amplified customer bargaining power, especially for Bayer's key segments like agriculture and healthcare. Farmers and medical professionals now have unprecedented access to information, allowing them to scrutinize product comparisons, pricing, and effectiveness with ease. This heightened transparency empowers buyers to negotiate better terms and seek out more competitive alternatives, potentially pressuring Bayer's pricing if its offerings lack distinct advantages.

For instance, in 2024, online agricultural marketplaces and health information portals provided farmers with data on crop protection products, enabling them to benchmark Bayer's offerings against competitors. Similarly, healthcare providers could readily access clinical trial results and patient reviews for pharmaceuticals. This easy comparison erodes the information asymmetry that once favored suppliers, forcing companies like Bayer to focus on demonstrable value and innovation to maintain market position.

- Increased Information Access: Digital platforms empower customers to compare products, prices, and performance data readily.

- Enhanced Transparency: Buyers can easily identify competitive offers, reducing reliance on single suppliers.

- Erosion of Pricing Power: Without strong differentiation, Bayer may face pressure to lower prices due to informed customer choices.

Bayer's customers, particularly large institutional buyers in pharmaceuticals and consolidated agricultural distributors, possess significant bargaining power. This is driven by bulk purchasing, access to information, and the availability of alternatives, especially post-patent expiry for drugs and generic crop protection products. Government regulations, like Medicare price negotiation under the Inflation Reduction Act, further amplify this power, directly impacting Bayer's pricing and revenue strategies.

| Customer Segment | Bargaining Power Drivers | Impact on Bayer |

|---|---|---|

| Pharmaceuticals (Large Healthcare Systems/Governments) | Bulk purchasing, regulatory oversight, patent expirations, government price negotiation (e.g., IRA) | Pressure on drug pricing, reduced profit margins, need for cost-effective solutions |

| Crop Science (Large Agricultural Cooperatives/Producers) | Consolidated purchasing, availability of generic alternatives, price sensitivity | Negotiation for lower prices on seeds and crop protection, impacting revenue |

| Consumer Health (Large Retail Chains) | Consolidated purchasing, demand for better margins | Pressure on pricing and terms for consumer health products |

| Pharmaceuticals (Individual Consumers) | Limited bargaining power due to fragmented purchases, but increasing price sensitivity | Less direct impact, but overall market price trends influence decisions |

Same Document Delivered

Bayer Porter's Five Forces Analysis

This preview showcases the complete Bayer Porter's Five Forces analysis, offering a detailed examination of the competitive landscape within the industry. The document you see here is precisely what you will receive immediately after your purchase, ensuring no discrepancies or missing information. You can trust that this professionally compiled analysis is ready for immediate use, providing valuable strategic insights for your business needs.

Rivalry Among Competitors

Bayer operates in sectors like pharmaceuticals and crop science where innovation is paramount. This drives an intense research and development race among competitors, all vying to launch novel, patented products. For instance, in 2024, the global pharmaceutical R&D spending was projected to exceed $250 billion, highlighting the scale of this investment.

Bayer operates in highly competitive landscapes, facing formidable rivals like Syngenta, BASF, and Corteva in agriculture, and Novartis, Pfizer, and Roche in pharmaceuticals. These established global entities possess substantial financial clout, diverse product offerings, and robust distribution channels, ensuring intense competition across numerous markets and product segments.

The expiration of patents on key medications, such as Xarelto, significantly heats up competition for Bayer. Once patents lapse, generic and biosimilar companies can introduce much cheaper versions of these drugs, directly impacting Bayer's market share and revenue from those products. For instance, Xarelto, a blockbuster anticoagulant, faced generic competition following patent expiry, leading to price erosion and increased market rivalry.

This dynamic compels Bayer to constantly invest in research and development to bring new, innovative drugs to market, offsetting the decline in sales from older, off-patent products. Managing the lifecycle of its existing drug portfolio becomes crucial, requiring strategies to maximize value from mature products while simultaneously building a robust pipeline for the future.

Pricing Pressure in Crop Protection

Bayer's Crop Science division faces intense pricing pressure. This is largely due to significant overcapacity in the crop protection market and the influx of low-cost generic products, especially those originating from Asia. For instance, in 2023, the global crop protection market saw continued competition, with generic products capturing a substantial share, putting pressure on branded offerings.

This competitive landscape demands that Bayer prioritize cost efficiency and develop truly differentiated products to sustain profitability and its market standing. Competitors often employ aggressive pricing tactics, making it challenging for established players to maintain margins without strategic cost management and innovation.

- Overcapacity: Excess production capacity in the crop protection sector fuels price competition.

- Generic Competition: Low-cost generic alternatives, particularly from Asian manufacturers, erode market share for premium products.

- Price Sensitivity: Farmers often seek the most cost-effective solutions, increasing pressure on manufacturers to lower prices.

- Bayer's Response: Focus on innovation, operational efficiency, and value-added services to counter price wars.

Strategic Restructuring and Operational Efficiency

Bayer's strategic restructuring, including its Dynamic Shared Ownership model, is a direct maneuver to bolster operational efficiency and competitiveness. This internal drive for cost savings and increased agility is a critical response to the demanding competitive environment.

The company aims to improve its profit margins and free up resources for crucial innovation investments. For instance, Bayer's 2024 outlook projected a significant focus on cost management, with the company targeting substantial savings through its operational efficiency programs.

- Focus on Dynamic Shared Ownership: Streamlining operations and decision-making.

- Cost Reduction Initiatives: Aiming to improve EBITDA margins and financial flexibility.

- Agility and Efficiency Gains: Enhancing responsiveness to market shifts and competitor actions.

- Investment in Innovation: Ensuring continued R&D spending despite cost pressures.

Competitive rivalry is a significant force for Bayer, particularly in its pharmaceutical and crop science divisions. The constant race for innovation, fueled by substantial R&D investments, creates an environment where rivals like Syngenta, BASF, Novartis, and Pfizer are always pushing the boundaries. This intensity is further amplified by patent expirations, which open the door for lower-cost generics and biosimilars, directly impacting Bayer's revenue streams and market share.

Bayer's Crop Science segment faces particular pressure from overcapacity and low-cost generic products, especially from Asian manufacturers, driving aggressive pricing strategies. To combat this, Bayer focuses on operational efficiency, as seen in its Dynamic Shared Ownership model, and invests heavily in new product development to maintain its competitive edge and profitability.

| Competitor | Sector | Key Characteristic |

|---|---|---|

| Syngenta | Crop Science | Major global player with a broad portfolio of crop protection and seed products. |

| BASF | Crop Science | Strong presence in agricultural solutions, including crop protection chemicals and seeds. |

| Novartis | Pharmaceuticals | Leading global healthcare company with a diverse range of innovative medicines. |

| Pfizer | Pharmaceuticals | One of the world's largest biopharmaceutical companies, known for its extensive drug pipeline. |

SSubstitutes Threaten

The threat of substitutes for Bayer, particularly in its pharmaceutical segment, is significant due to the rise of generic and biosimilar drugs. Once Bayer's patents on key medications expire, lower-cost alternatives can enter the market, directly impacting sales and profitability of those products. For instance, the global generic drugs market was valued at approximately $433 billion in 2023 and is projected to grow, highlighting the competitive pressure.

The crop science industry faces a growing threat from natural and biological solutions. Farmers are increasingly adopting integrated pest management and natural farming methods, which lessen their dependence on traditional synthetic pesticides and fertilizers. This shift, driven by rising sustainability concerns, could lead to a substitution of Bayer's chemical crop protection products.

In Bayer's Consumer Health division, the threat of substitutes is significant. Consumers can opt for a vast range of over-the-counter medications, natural supplements, and even lifestyle adjustments as alternatives to Bayer's branded products. For instance, the global dietary supplements market was valued at approximately $177.7 billion in 2023 and is projected to grow, indicating a strong consumer interest in alternatives.

The accessibility and the growing perception of naturalness associated with many substitute products present a direct competitive challenge. Many consumers are actively seeking out herbal remedies or wellness products that they believe offer a gentler approach to health concerns, potentially diverting sales from traditional pharmaceutical offerings.

Technological Advancements in Agriculture

Emerging agricultural technologies present a significant threat of substitution for Bayer's traditional chemical inputs. Innovations like precision farming, AI-driven analytics, and robotics allow farmers to optimize resource usage and achieve better yields, potentially lessening their reliance on herbicides, insecticides, and fungicides. For instance, advancements in drone technology for targeted spraying can reduce the overall volume of chemicals needed, directly substituting a portion of Bayer's product sales.

While Bayer itself is a major investor in these ag-tech areas, independent solutions can empower farmers to achieve similar or superior results through alternative methods. This creates a direct substitution risk, as farmers might adopt these new technologies, which offer different pathways to crop protection and yield enhancement, thereby reducing demand for Bayer's established chemical portfolio. The global ag-tech market is experiencing robust growth, with investments reaching billions of dollars annually, underscoring the increasing viability of these substitute solutions.

- Precision Farming: Technologies allowing for site-specific application of inputs, reducing overall chemical usage.

- AI and Robotics: Tools for early pest detection, automated weeding, and optimized crop management, offering alternatives to chemical pest control.

- Biotechnology and Biologicals: Development of natural pest deterrents and yield-enhancing microbes as substitutes for synthetic chemicals.

- Data Analytics: Predictive modeling for disease outbreaks and nutrient deficiencies, enabling proactive management that might reduce reactive chemical applications.

Preventative Healthcare and Dietary Shifts

The growing societal emphasis on preventative healthcare and proactive lifestyle choices presents a significant threat of substitutes for traditional pharmaceutical and consumer health products. As individuals increasingly adopt healthier diets and engage in preventative measures, the demand for certain medications and supplements could decline.

For example, a widespread shift towards plant-based diets, as seen with the continued growth in the plant-based food market, which was projected to reach over $162 billion globally by 2030 according to Bloomberg Intelligence, could reduce the need for certain cholesterol-lowering drugs or supplements targeting specific nutrient deficiencies. Similarly, advancements in wearable technology and personalized health monitoring empower consumers to manage their well-being more effectively, potentially decreasing reliance on reactive medical interventions.

- Preventative Healthcare Trends: A global shift towards wellness and preventative health measures is reducing reliance on reactive treatments.

- Dietary Shifts: Increased adoption of healthier eating patterns, like plant-based diets, can lower demand for certain medications and supplements.

- Technological Advancements: Wearable tech and health monitoring tools empower individuals to manage health proactively, substituting for some traditional healthcare products.

- Public Health Initiatives: Successful public health campaigns focused on lifestyle improvements can diminish the market for products addressing preventable conditions.

The threat of substitutes for Bayer is multifaceted, impacting its core business segments. In pharmaceuticals, the availability of generic and biosimilar alternatives after patent expiry poses a direct challenge, as seen with the robust growth of the generic drugs market, valued at approximately $433 billion in 2023. For Crop Science, natural and biological solutions are gaining traction among farmers prioritizing sustainability, potentially reducing reliance on Bayer's synthetic chemicals. The Consumer Health division also faces competition from a wide array of over-the-counter options and wellness products, with the dietary supplements market alone reaching an estimated $177.7 billion in 2023.

| Bayer Segment | Substitute Threat | Key Factors & Data |

|---|---|---|

| Pharmaceuticals | High | Generic & Biosimilar Drugs; Global generic drugs market: ~$433 billion (2023) |

| Crop Science | Medium to High | Natural/Biological Solutions, Precision Farming, Ag-Tech; Global ag-tech market: Significant annual investments |

| Consumer Health | High | OTC alternatives, Supplements, Lifestyle Changes; Global dietary supplements market: ~$177.7 billion (2023) |

Entrants Threaten

High regulatory hurdles represent a significant threat of new entrants in the pharmaceutical sector. For instance, gaining approval for a new drug in the United States through the Food and Drug Administration (FDA) can take over a decade and cost billions of dollars, with the average cost of developing a new drug estimated at over $2 billion as of 2023. Similar rigorous processes by agencies like the European Medicines Agency (EMA) further solidify these barriers.

Developing innovative pharmaceuticals, advanced crop protection solutions, and high-yield seeds demands enormous and ongoing investment in research and development, often taking a decade or more with no certainty of a successful product. For instance, the average cost to bring a new drug to market can exceed $2 billion.

Furthermore, establishing state-of-the-art manufacturing plants and widespread distribution channels requires substantial capital outlay, presenting a formidable barrier for any company looking to enter the life sciences and agricultural sectors.

Existing intellectual property, particularly patents, acts as a significant barrier for new entrants in the pharmaceutical and agricultural sectors where Bayer operates. These patents protect Bayer's innovative products, granting them exclusive rights and a period of market exclusivity. For instance, in 2024, the pharmaceutical industry saw continued reliance on patent protection, with many blockbuster drugs still under patent, preventing generic competition.

This robust patent portfolio makes it difficult for newcomers to enter the market with comparable high-value products. Developing entirely new molecules or technologies is a prohibitively expensive and time-consuming process, often requiring billions of dollars and over a decade of research and development. Without their own patented innovations, new entrants would struggle to compete against established players like Bayer, who benefit from market recognition and established distribution channels.

Established Brand Recognition and Distribution Channels

Bayer's formidable brand recognition, cultivated over decades, presents a significant barrier to new entrants. In 2024, Bayer continued to leverage its well-known brands like Aspirin and Roundup, which are household names globally. This established trust and familiarity make it challenging for newcomers to gain traction.

Furthermore, Bayer possesses deeply entrenched distribution channels in both its healthcare and agriculture segments. For instance, its extensive network of pharmacies and healthcare providers ensures broad product availability for its pharmaceuticals, while its agricultural distribution system reaches farmers worldwide. New companies would need to invest heavily to replicate this market access, a daunting task when competing against a company that reported over €50 billion in net sales in 2023.

- Brand Loyalty: Bayer's long-standing brands foster significant customer loyalty, making it difficult for new entrants to attract and retain customers.

- Distribution Network: The company's established global distribution infrastructure provides a competitive advantage, requiring substantial capital for rivals to match.

- Marketing Investment: New entrants must commit massive marketing and sales budgets to challenge Bayer's market presence and build brand awareness.

- Customer Trust: Decades of operation have built trust in Bayer's products, a crucial element that new companies struggle to establish quickly.

Economies of Scale and Experience Curve

Established players like Bayer benefit from substantial economies of scale across manufacturing, procurement, and research and development. This allows them to achieve lower per-unit production costs, a significant hurdle for newcomers. For instance, in 2023, Bayer's crop science division reported €23.06 billion in sales, reflecting the vast operational scope that generates these cost advantages.

New entrants would find it challenging to match these cost efficiencies, particularly in more commoditized areas of the crop science market. The experience curve also plays a crucial role; as companies like Bayer have produced and innovated over decades, they have refined processes and reduced costs further. This accumulated knowledge and operational maturity create a high barrier to entry.

- Economies of Scale: Bayer's extensive global operations in crop science, evidenced by its 2023 revenue, allow for significant cost reductions in production and sourcing.

- Experience Curve: Decades of operational experience have enabled Bayer to optimize its manufacturing and R&D processes, leading to lower costs compared to potential new entrants.

- Cost Disadvantage for Newcomers: Start-ups would face immense difficulty in replicating Bayer's cost structure, especially in segments where scale is a primary driver of profitability.

The threat of new entrants in Bayer's operating sectors is generally low due to substantial capital requirements for R&D, manufacturing, and distribution. High regulatory hurdles, particularly in pharmaceuticals, and strong existing intellectual property further deter new players. Bayer's established brand recognition and extensive distribution networks also create significant barriers.

| Barrier Type | Description | Bayer's Advantage | Impact on New Entrants |

| Capital Requirements | Massive investment needed for R&D, manufacturing, and distribution. | Bayer has significant financial resources and established infrastructure. | High barrier, requiring substantial funding to compete. |

| Regulatory Hurdles | Lengthy and costly approval processes for new products (e.g., FDA, EMA). | Bayer has experience navigating these complex regulations. | Significant time and cost for newcomers to achieve market entry. |

| Intellectual Property | Patents protect innovative products, granting market exclusivity. | Bayer holds a robust portfolio of patents. | New entrants with similar innovations face legal challenges and exclusivity periods. |

| Brand Recognition & Loyalty | Established brands foster customer trust and preference. | Bayer brands like Aspirin are globally recognized. | New entrants struggle to build trust and attract customers. |

| Distribution Channels | Extensive networks are needed for market access. | Bayer possesses well-developed global distribution systems. | Replicating Bayer's reach requires significant investment and time. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from publicly available company filings, industry-specific market research reports, and macroeconomic indicators to provide a comprehensive view of competitive pressures.