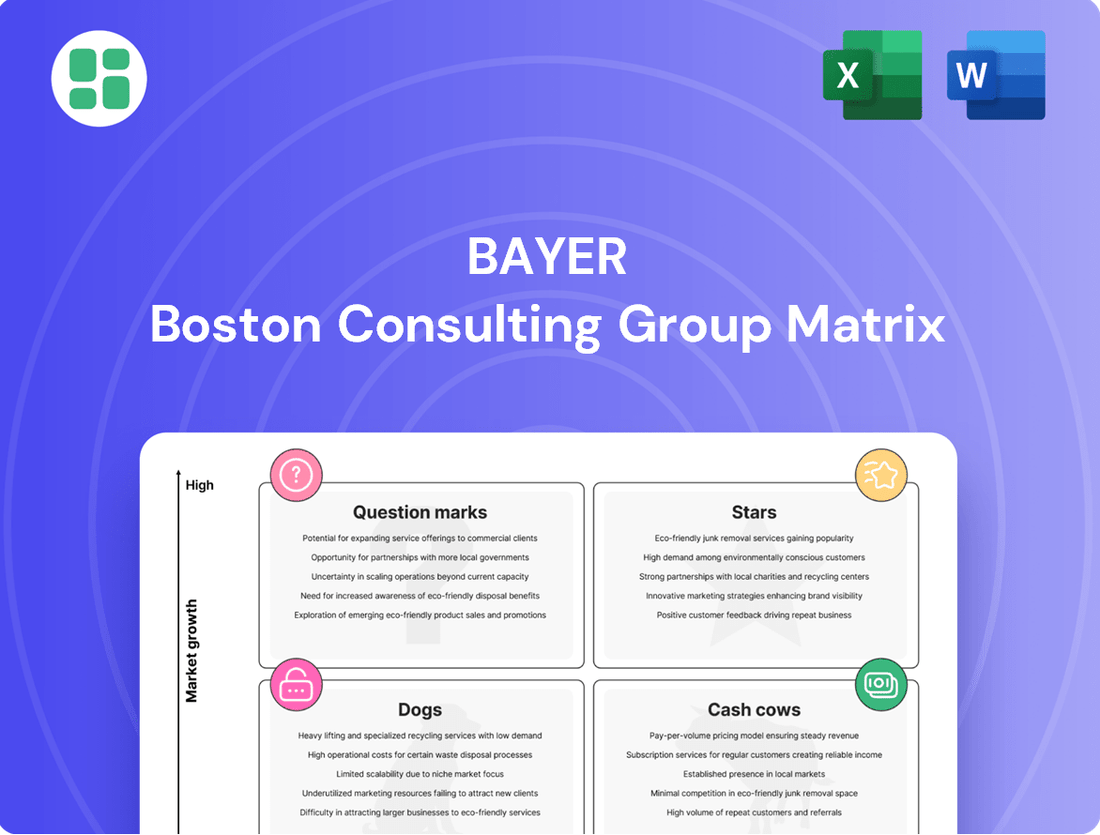

Bayer Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bayer Bundle

Understand the strategic positioning of a company's product portfolio with the Bayer BCG Matrix. This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual roadmap for resource allocation. Uncover the full potential of your strategic planning by purchasing the complete BCG Matrix report, which provides in-depth analysis and actionable insights for optimized investment decisions.

Stars

Nubeqa, Bayer's promising prostate cancer treatment, is a standout performer, showcasing remarkable sales increases. In the first quarter of 2025, its sales jumped by an impressive 77.5%, followed by a 50.5% surge in the second quarter of 2025. This rapid adoption highlights Nubeqa's strong market penetration within the competitive oncology sector.

The upcoming launch of a third indication for Nubeqa in 2025 is poised to further solidify its market position and fuel continued high growth. This expansion is critical for Bayer, as Nubeqa is a significant growth engine, effectively counterbalancing the revenue decline from its older, more mature product lines.

Kerendia, a treatment for chronic kidney disease linked to type 2 diabetes, is a key growth engine for Bayer. Its sales saw a substantial jump of 86.6% in Q1 2025 and 67.1% in Q2 2025, demonstrating strong market traction.

The expanded FDA approval for heart failure with mildly reduced ejection fraction opens up a vast patient pool. This positions Kerendia as a potential foundational product in Bayer's offerings, with peak sales anticipated to surpass €3 billion.

With further regulatory submissions underway and a potential market launch by the close of 2025, Kerendia is poised for continued expansion and significant contribution to Bayer's portfolio.

Elinzanetant, a novel hormone-free treatment for menopausal vasomotor symptoms, is positioned as a Stars product for Bayer. Positive Phase III results in 2024 and a key clinical milestone in early 2025, with a potential 2025 launch, highlight its strong growth trajectory in a significant unmet medical need market.

Corn Seed & Traits

Bayer's Corn Seed & Traits business within its Crop Science division showed remarkable strength, with sales surging by an impressive 29.5% in the second quarter of 2025. This substantial growth was largely driven by strategic global price adjustments and an expansion of cultivated acreage. A key factor contributing to this success was the optimization of Bayer's distribution network within North America, enhancing market reach and efficiency.

This segment's performance stands out, particularly given broader market challenges in crop protection. The corn seed and traits sector continues to command a high market share and demonstrates robust growth potential in a critical global industry.

- Sales Growth: 29.5% increase in Q2 2025.

- Key Drivers: Global price increases and acreage expansion.

- Strategic Advantage: Optimized North American distribution network.

- Market Position: High market share and growth in a vital agricultural sector.

Targeted Radiopharmaceuticals (e.g., Actinium-225 candidates)

Bayer is making significant strides in Targeted Radionuclide Therapy (TRT) within oncology, leveraging its established success with Xofigo™. This focus area is crucial for its future growth, aiming to deliver innovative treatments for challenging cancers.

The company's pipeline includes promising candidates utilizing novel targeting strategies, specifically combining alpha radionuclides like Actinium-225 with various targeting agents. These are currently in early-stage clinical trials, with a particular focus on advanced metastatic castration-resistant prostate cancer.

These early-stage assets, including Actinium-225 candidates, represent a high-potential growth segment for Bayer. The successful development of these TRT therapies could introduce pioneering treatments, significantly improving patient outcomes and market position.

- Strategic Focus: Bayer is prioritizing Targeted Radionuclide Therapy (TRT) in oncology.

- Pipeline Development: Novel alpha-radionuclide therapies, like Actinium-225 candidates, are in Phase I clinical trials.

- Target Indication: Initial trials focus on advanced metastatic castration-resistant prostate cancer.

- Growth Potential: These early-stage assets offer significant potential for pioneering treatments and improved patient outcomes.

Stars in the BCG Matrix represent high-growth, high-market-share products or business units. Bayer's Nubeqa, a prostate cancer treatment, exemplifies this with a 77.5% sales increase in Q1 2025 and a projected further boost from a new indication. Similarly, Kerendia, for chronic kidney disease, saw an 86.6% sales jump in Q1 2025, benefiting from expanded FDA approval and poised for substantial growth.

| Product | Market Segment | Q1 2025 Sales Growth | Q2 2025 Sales Growth | Key Growth Drivers |

|---|---|---|---|---|

| Nubeqa | Prostate Cancer Treatment | 77.5% | 50.5% | New indications, strong market adoption |

| Kerendia | CKD/Diabetes Treatment | 86.6% | 67.1% | Expanded FDA approval, large patient pool |

| Corn Seed & Traits | Agriculture | N/A | 29.5% | Price adjustments, acreage expansion, distribution optimization |

| Targeted Radionuclide Therapy (TRT) Pipeline | Oncology | N/A | N/A | Early-stage pipeline, novel targeting strategies |

What is included in the product

The Bayer BCG Matrix analyzes product portfolio performance based on market growth and share, guiding strategic decisions.

Bayer BCG Matrix: A clear visual guide to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Xarelto, a key product for Bayer, remains a significant cash generator despite facing increasing competition from generics. Its established market presence in the anticoagulant sector continues to drive substantial revenue, even as patent expirations loom.

However, the impact of generic entry is becoming more pronounced. In the first quarter of 2025, Xarelto's sales saw a notable decrease of 31%, a trend that continued into the second quarter with a 31.2% decline. This drop is largely attributed to heightened generic competition, especially in key markets like Europe and Japan.

Despite these sales headwinds, Xarelto's mature market position and existing high market share mean it still contributes significantly to Bayer's cash flow. This sustained cash generation is characteristic of a Cash Cow in the BCG matrix, where a product with a strong market share in a slow-growing industry provides a reliable source of funds.

Eylea, Bayer's leading ophthalmology drug, demonstrated continued sales momentum, reporting a 4.7% increase in Q1 2025. This growth underscores its position as a significant revenue generator for the company.

Despite its current strong market share and stable cash flow contributions, Eylea faces a critical juncture in 2025 with the loss of key patents. This impending patent cliff presents a substantial challenge to its future growth trajectory, as generic competition is expected to intensify.

Bayer Aspirin, a cornerstone of Bayer's Consumer Health segment, exemplifies a classic Cash Cow. Its enduring brand recognition, particularly in pain relief and heart health, ensures a steady stream of revenue. In 2024, the global pain relief market, where Aspirin holds a significant share, was valued at approximately $150 billion, demonstrating the continued robust demand for such established products.

As a mature product, Bayer Aspirin requires minimal investment for growth, allowing it to generate substantial profits that can be reinvested in other areas of Bayer's portfolio. The focus for Aspirin is on maintaining its market leadership through consistent quality and accessibility, rather than aggressive expansion. This low-investment, high-return profile is the hallmark of a successful Cash Cow.

Claritin

Claritin stands as a cornerstone within Bayer's Consumer Health division, specifically within its allergy and sinus segment. This brand effectively addresses prevalent conditions such as severe allergic rhinitis, a significant market need.

With a well-established presence in the mature over-the-counter allergy market, Claritin benefits from strong brand recognition and customer loyalty. This mature market position suggests a stable demand for the product.

The brand is a significant contributor to Bayer's consistent and reliable cash flow. Its established market dominance means it requires minimal incremental investment to maintain its competitive standing and generate ongoing revenue for the company.

In 2023, the global allergy treatment market was valued at approximately $30 billion, with OTC products like Claritin holding a substantial share. Bayer's Consumer Health division reported net sales of €6.0 billion in 2023, with allergy and cold remedies being a key driver.

- Market Dominance: Claritin is a leading brand in the mature over-the-counter allergy market.

- Consistent Cash Flow: The brand generates reliable revenue with minimal need for further investment.

- Allergy Segment Strength: It is a key product in Bayer's allergy and sinus portfolio.

- Market Value: The global allergy treatment market was valued around $30 billion in 2023.

Overall Consumer Health Division

Bayer's Consumer Health division, a cornerstone of its business, operates as a cash cow within the company's BCG Matrix. This segment, featuring a diverse range of over-the-counter medications and self-care products, demonstrates consistent performance and reliable cash flow. The division's stability makes it a vital contributor to Bayer's overall financial health.

The division's financial performance in 2025 underscores its cash cow status. Q1 2025 saw a 2.5% increase in sales, followed by a 2.2% rise in Q2 2025. This steady growth is fueled by a combination of expanding its reach across different geographic regions and strengthening its product categories. Such balanced expansion highlights the sustained demand for its offerings.

- Consistent Sales Growth: Reported a 2.5% sales increase in Q1 2025 and 2.2% in Q2 2025.

- Balanced Expansion: Growth driven by both regional and category diversification.

- Stable Earnings: Provides reliable and predictable cash flow for Bayer.

- Reinvestment Funding: Generates surplus cash that can be allocated to other business units.

Bayer Aspirin, Claritin, and the broader Consumer Health division exemplify Bayer's Cash Cows. These products and segments operate in mature markets with strong brand recognition, generating consistent and reliable cash flow with minimal need for significant investment. This allows Bayer to leverage these established assets to fund growth in other areas of its portfolio.

| Product/Segment | Market Position | Cash Flow Characteristic | Key Data Point |

|---|---|---|---|

| Bayer Aspirin | Mature, strong brand recognition in pain relief | Consistent revenue, low investment needs | Global pain relief market valued at ~$150 billion in 2024 |

| Claritin | Leading brand in mature OTC allergy market | Reliable cash generation, high customer loyalty | Global allergy treatment market valued at ~$30 billion in 2023 |

| Consumer Health Division | Diverse OTC products, stable demand | Predictable earnings, funds other units | Sales increased 2.5% (Q1 2025) and 2.2% (Q2 2025) |

Preview = Final Product

Bayer BCG Matrix

The BCG Matrix analysis you are previewing is the identical, fully comprehensive document you will receive immediately after purchase. This means no watermarks, no demo content, and no missing sections—just a professionally formatted, ready-to-deploy strategic tool for evaluating your business portfolio.

Dogs

Glyphosate-based products, a cornerstone of Bayer's Crop Science division, are currently facing considerable challenges. The ongoing litigation surrounding these products, most notably Roundup, continues to cast a long shadow, creating significant financial liabilities.

This legal pressure, coupled with aggressive pricing strategies from competitors, has led to a notable decline in profitability. In 2024, despite some modest increases in the volume of glyphosate sold, the price per unit dropped by approximately 13%.

This price erosion directly impacted the revenue and overall financial performance of this product line. Consequently, glyphosate-based products are increasingly viewed as a cash trap, demanding substantial financial resources for legal provisions while simultaneously experiencing market share erosion.

Soybean Seed & Traits, a key component within Bayer's portfolio, experienced a substantial sales decline of 18.1% in the second quarter of 2025.

This significant drop was primarily driven by the vacatur of the label for dicamba-based crop protection products in the United States. This regulatory setback directly impacted the marketability and adoption of associated soybean traits, leading to reduced sales.

The segment is currently under considerable pressure, reflecting a low market share and dim growth prospects due to these ongoing regulatory challenges and their downstream effects on product demand.

Cotton Seed represents a "Cash Cow" for Bayer, but its performance is showing signs of strain. In the second quarter of 2025, Bayer's Cotton Seed sales saw a significant drop of 25.5%.

This downturn is largely attributed to the vacatur of the label for dicamba-based crop protection products in the United States, a critical market for cotton. This regulatory challenge directly impacts the effectiveness and marketability of Bayer's cotton seed offerings.

The substantial sales decline suggests a shrinking market share within a segment facing considerable headwinds, reinforcing its position as a cash cow that requires careful management rather than aggressive growth investment.

Older, Off-Patent Crop Protection Products

The market for older, off-patent crop protection products presents a significant challenge for Bayer. As patents expire, generic competitors enter the market, driving down prices and eroding profit margins for established products. This trend is particularly evident as key active ingredients have recently gone off patent, intensifying competition and making it harder for these offerings to retain their market position or profitability.

These products are situated in low-growth markets, where the increasing commoditization leads to diminishing returns. For instance, the global crop protection market, while substantial, sees mature segments like older herbicides and insecticides facing intense price competition. In 2024, the agrochemical industry observed a continued trend of generic manufacturers gaining traction in markets where patents have lapsed, impacting the revenue streams of original innovators like Bayer.

- Intensified Generic Competition: Key active ingredients going off-patent in recent years have opened the door for numerous generic manufacturers, leading to price wars.

- Declining Margins: The increased competition directly translates to lower selling prices and reduced profit margins for Bayer's older product portfolio.

- Low-Growth Market Dynamics: These products operate in mature or declining market segments, characterized by slow or negative growth rates.

- Commoditization Impact: As products become more widely available from multiple sources, they are increasingly viewed as commodities, further pressuring pricing and differentiation.

Nutritionals Category (Consumer Health)

Bayer's Nutritionals category, a key component of its Consumer Health division, faced headwinds in early 2025. The segment experienced a notable decline of 5.2% in the first quarter of 2025. This downturn suggests challenges in either capturing new customers or retaining existing ones within this particular market.

This performance trend positions the Nutritionals category as a potential 'Dog' in Bayer's BCG Matrix. Such a classification typically signifies low market share and low market growth. The persistent decline indicates a struggle to compete effectively, potentially due to market saturation or intense rivalry from other players.

Strategic considerations for a 'Dog' category often involve a thorough review. Bayer may need to assess whether to divest the business, minimize investment to harvest remaining value, or attempt a significant turnaround strategy. The 2024 financial year data for this segment would provide further context on its historical performance leading up to this Q1 2025 decline.

- Category Performance: Bayer's Nutritionals saw a 5.2% decrease in Q1 2025.

- Market Position: This suggests low market share and growth, characteristic of a 'Dog'.

- Strategic Implications: The category warrants a review for potential divestment or reduced investment.

Bayer's Nutritionals category, experiencing a 5.2% decline in Q1 2025, fits the profile of a 'Dog' in the BCG Matrix. This suggests a weak market position with limited growth potential, requiring careful strategic evaluation. The segment's performance indicates a struggle against market saturation or strong competition.

Given the challenges, Bayer might consider divesting the Nutritionals business, minimizing further investment to extract any remaining value, or undertaking a significant restructuring to revive its performance. The 2024 financial data will be crucial to understanding the historical trajectory leading to this recent downturn.

| BCG Category | Bayer Segment | Performance Indicator | 2025 Data (Q1) | Strategic Implication |

|---|---|---|---|---|

| Dog | Nutritionals (Consumer Health) | Sales Change | -5.2% | Divest, Harvest, or Turnaround |

| Dog | Glyphosate-based products | Price per Unit | -13% (2024) | Cash Trap, Market Erosion |

| Dog | Soybean Seed & Traits | Sales Change | -18.1% (Q2 2025) | Low Share, Dim Prospects |

Question Marks

Beyonttra, slated for a 2025 launch, represents Bayer's strategic play in the burgeoning cardiovascular market, aiming to capture share from established players like Xarelto. Currently, as a new product, it possesses a negligible market share, placing it firmly in the Question Mark category of the BCG matrix.

The cardiovascular drug market is substantial, with global sales projected to reach hundreds of billions of dollars by 2030, offering significant growth potential for innovative treatments. Bayer's investment in clinical trials and market development for Beyonttra is estimated to be in the hundreds of millions, reflecting the high stakes involved in establishing a new anticoagulant.

For Beyonttra to ascend from a Question Mark to a Star, Bayer must execute a robust go-to-market strategy, emphasizing its differentiated benefits and securing broad physician and patient adoption. Success hinges on achieving significant market penetration and demonstrating clear clinical superiority to justify its position in a competitive landscape.

Icafolin, as a new agricultural product in Bayer's portfolio, is positioned as a Star within the BCG matrix. Its novelty indicates early market penetration in a sector experiencing robust growth, suggesting significant future potential.

Given its status as a new entrant, Icafolin likely requires substantial investment to capture market share and transition from a question mark to a dominant Star. Bayer's strategic focus will be on nurturing this high-growth product to prevent it from declining into a Dog category.

Sevabertinib, a promising HER2 inhibitor for non-small cell lung cancer (NSCLC), is positioned as a potential 'Question Mark' within Bayer's BCG Matrix. Its recent FDA Priority Review for a projected 2026 launch highlights its presence in a high-growth oncology market with substantial unmet medical needs.

Despite its therapeutic promise, Sevabertinib currently holds a low market share as it is not yet widely commercialized. This status, coupled with ongoing significant research and development expenditures aimed at realizing its blockbuster potential, aligns with the characteristics of a 'Question Mark' – an asset with uncertain future prospects requiring substantial investment.

BAY 3283142 (sGC activator for CKD)

BAY 3283142, an investigational sGC activator for chronic kidney disease (CKD), is positioned as a potential ‘Question Mark’ in Bayer’s BCG Matrix. Its current status is in Phase II clinical trials, indicating early-stage development with significant future potential but also high uncertainty.

This drug targets the cardiovascular and renal disease market, a segment experiencing robust growth, with projections suggesting continued expansion in the coming years. For instance, the global CKD market was valued at approximately $70 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of over 5% through 2030.

BAY 3283142 currently holds a minimal market share, as expected for an investigational compound. Significant investment is required to navigate the remaining clinical trial phases and secure regulatory approval, a common characteristic of Question Mark products needing capital infusion to potentially become Stars.

- Development Stage: Phase II clinical trials for CKD.

- Market Potential: Targets the high-growth cardiovascular and renal disease therapeutic area.

- Market Share: Minimal due to its investigational status.

- Investment Needs: Requires substantial funding for clinical development and market entry.

Digital Farming Tools

Bayer is actively deploying digital farming solutions worldwide, aiming to boost agricultural output and environmental responsibility through technology. The digital agriculture sector is expanding quickly, but Bayer's share in this developing market is likely still gaining traction.

These digital tools are a key strategic focus for Bayer in a high-growth sector. The company is investing in ongoing innovation and market outreach to build a stronger presence. For instance, the global digital farming market was projected to reach over $10 billion by 2024, highlighting the significant growth potential Bayer is targeting.

- Global Rollout: Bayer's digital farming tools are being introduced across various agricultural regions.

- Market Position: While the digital agriculture market is growing, Bayer's market share is still in its formative stages.

- Strategic Investment: These tools are crucial for Bayer's long-term strategy in a high-growth, technology-driven agricultural landscape.

Question Marks in Bayer's portfolio represent products with high growth potential but uncertain market success. These are typically new products or those in early development stages, requiring significant investment to determine their future viability.

For instance, Beyonttra, a new cardiovascular drug, and Sevabertinib, an oncology treatment, are currently positioned as Question Marks due to their nascent market presence and substantial development costs. BAY 3283142, an investigational drug for chronic kidney disease, also falls into this category, with its future success hinging on clinical trial outcomes and market adoption.

The company's digital farming solutions also represent a Question Mark, operating in a rapidly expanding market where Bayer's share is still being established. Success for these ventures means navigating competitive landscapes and achieving significant market penetration.

Bayer's strategic allocation of resources towards these Question Marks underscores the company's commitment to innovation and capturing future market opportunities, albeit with inherent risks.

| Product/Initiative | BCG Category | Market Growth | Market Share | Investment Focus |

|---|---|---|---|---|

| Beyonttra (Cardiovascular) | Question Mark | High | Low (New Product) | Market Entry & Adoption |

| Sevabertinib (Oncology) | Question Mark | High | Low (Pre-Launch) | Clinical Development & Approval |

| BAY 3283142 (CKD) | Question Mark | High | Minimal (Investigational) | Clinical Trials & Regulatory Pathway |

| Digital Farming Solutions | Question Mark | High | Developing | Market Penetration & Innovation |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.