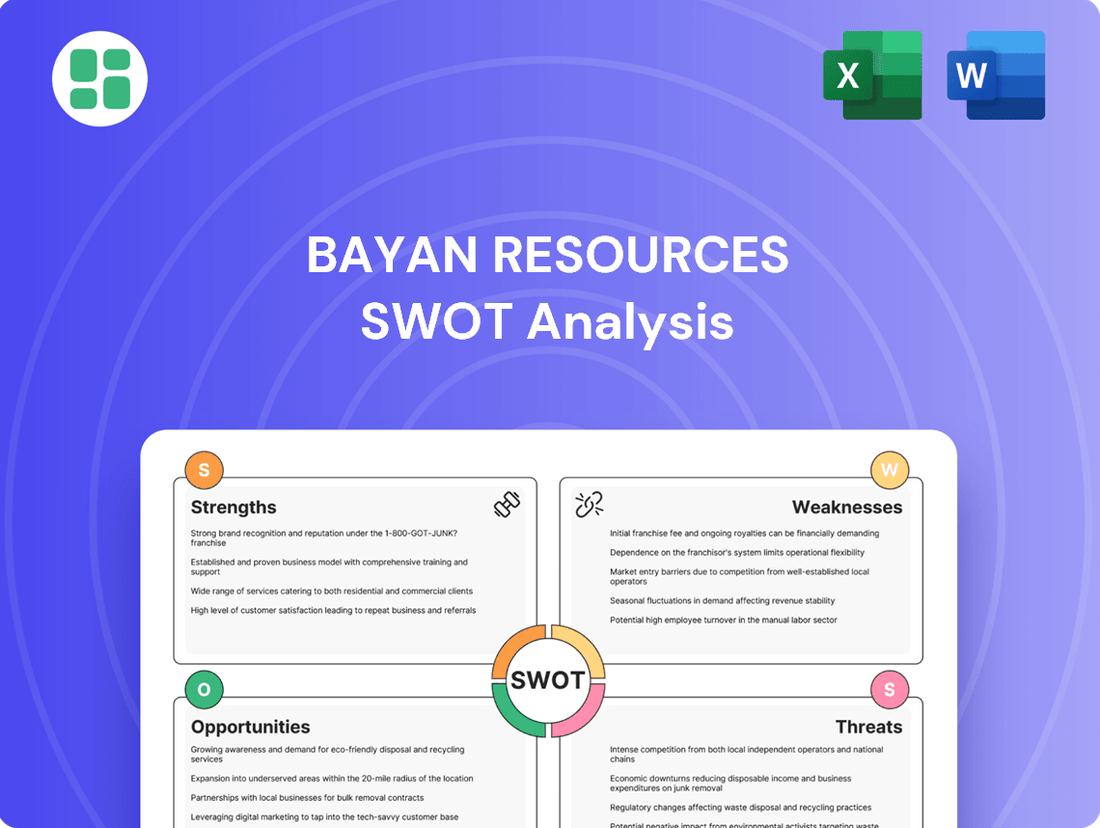

Bayan Resources SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bayan Resources Bundle

Bayan Resources showcases robust operational strengths and a strong market position, but faces potential headwinds from evolving regulations and commodity price volatility. Understanding these dynamics is crucial for navigating the Indonesian mining landscape.

Want the full story behind Bayan Resources' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bayan Resources' integrated operations and logistics control are significant strengths. By managing everything from exploration and mining to barging and port facilities, the company ensures efficient coal delivery. This end-to-end oversight is crucial for maintaining consistent supply chains and competitive pricing in both domestic and international markets.

The company's substantial infrastructure, including its 100km haul road and advanced barge loaders, directly contributes to operational efficiency and cost management. This integrated logistics network was a key factor in Bayan Resources achieving a production of 32.3 million tonnes of coal in 2023, demonstrating its capacity and operational prowess.

Bayan Resources boasts a significant production capacity, positioning it as a major player in the Indonesian coal market. The company has ambitious plans to scale its operations further.

Looking ahead, Bayan Resources targets a substantial increase in coal production, aiming for 69 to 72 million tons in 2025. This represents a considerable jump from its projected 55 to 57 million tons for 2024.

This expansion is primarily fueled by ongoing development within its Tabang concession, underscoring the company's strategic focus on leveraging its key assets to drive growth and solidify its market leadership.

Bayan Resources has shown impressive financial resilience, consistently achieving strong EBITDA and healthy profit margins even when the market faces volatility. For 2025, the company anticipates revenue in the range of USD 4.1 billion to USD 4.4 billion, with EBITDA expected to fall between USD 1.4 billion and USD 1.6 billion.

The company's financial health is further evidenced by its strategic use of cash, prioritizing debt reduction and returning capital to shareholders through substantial dividend payments. This approach highlights a commitment to financial stability and shareholder value.

Strategic Location and Market Reach

Bayan Resources leverages its substantial coal concessions in East Kalimantan, Indonesia, granting it a prime position to access and supply crucial growth markets. This strategic location is fundamental to its ability to serve a diverse international clientele.

The company's market reach is extensive, supplying high-quality thermal and metallurgical coal to power plants and industrial sectors across Southeast Asia, East Asia, and South Asia. This diversification of its customer base is a key strength, mitigating risks associated with regional economic fluctuations.

- Strategic Positioning: Operates large-scale coal concessions in East Kalimantan, Indonesia.

- Global Supply Chain: Supplies thermal and metallurgical coal to power plants and industrial customers worldwide.

- Key Markets: Significant presence in Southeast Asia, East Asia, and South Asia.

- Diversified Reach: Reduces over-reliance on any single geographic market, capitalizing on Indonesia's export capabilities.

Commitment to High-Quality Coal

Bayan Resources' dedication to high-quality coal production is a significant strength, focusing on thermal coal for power generation and metallurgical coal for industrial use. This specialization allows them to meet precise customer needs, potentially securing premium pricing and a stable market position.

The company's product mix is diverse, encompassing not only thermal coal but also semi-soft coking coal. This variety serves a broader range of industrial applications, reducing reliance on a single market segment and enhancing resilience.

- Focus on Premium Thermal Coal: Bayan targets high-calorific value coal essential for efficient power generation.

- Metallurgical Coal Production: The company also produces metallurgical coal, a key input for steel manufacturing.

- Diverse Coal Portfolio: Includes semi-soft coking coal, broadening industrial application reach.

- Market Specialization: Catering to specific industrial demands can lead to better price realization.

Bayan Resources' integrated operations and logistics control are significant strengths, ensuring efficient coal delivery from mine to port. This end-to-end oversight is crucial for maintaining consistent supply chains and competitive pricing.

The company's substantial infrastructure, including its 100km haul road and advanced barge loaders, directly contributes to operational efficiency and cost management. This integrated logistics network was a key factor in Bayan Resources achieving a production of 32.3 million tonnes of coal in 2023.

Bayan Resources boasts a significant production capacity, positioning it as a major player in the Indonesian coal market, with ambitious plans to scale operations further. The company targets a substantial increase in coal production, aiming for 69 to 72 million tons in 2025, up from a projected 55 to 57 million tons for 2024.

The company's financial health is strong, with anticipated 2025 revenue between USD 4.1 billion and USD 4.4 billion, and EBITDA expected to range from USD 1.4 billion to USD 1.6 billion. Bayan Resources also prioritizes debt reduction and shareholder returns through substantial dividend payments.

| Metric | 2023 | 2024 (Projected) | 2025 (Projected) |

| Coal Production (Mt) | 32.3 | 55-57 | 69-72 |

| Revenue (USD Billion) | N/A | N/A | 4.1-4.4 |

| EBITDA (USD Billion) | N/A | N/A | 1.4-1.6 |

What is included in the product

Delivers a strategic overview of Bayan Resources’s internal and external business factors, highlighting its strengths in operations and market position alongside potential weaknesses and external threats.

Highlights key internal and external factors for Bayan Resources, enabling targeted strategic adjustments to mitigate risks and capitalize on opportunities.

Weaknesses

Bayan Resources' reliance on coal as its primary product exposes it significantly to the unpredictable swings in global coal prices. This volatility directly affects the company's revenue streams and profitability, as benchmark prices like Newcastle and ICI4 are key determinants of its average selling price.

The financial performance of Bayan Resources is intrinsically linked to these commodity price fluctuations. For example, projections indicated a potential 27 percent drop in coal prices during 2025, which would directly translate to lower revenue forecasts for the company.

Bayan Resources has grappled with production shortfalls, notably in Q3 2024, where output lagged due to insufficient overburden removal. This directly impacted coal extraction rates and the ability to meet planned targets.

These operational hurdles, potentially exacerbated by adverse weather or unforeseen mining complexities, pose a significant threat to consistently achieving ambitious production forecasts. Effective overburden management is therefore critical for Bayan's output reliability.

Bayan Resources anticipates a significant increase in its weighted average stripping ratio for 2025, especially at its Tabang concession. This rise is driven by the company's strategic move towards its average Life Of Mine stripping ratio.

This escalating stripping ratio directly translates to higher overburden removal expenses, consequently pushing up the average cash cost per ton of coal produced. For instance, if the stripping ratio increases by 10%, it could add several dollars to the cash cost per ton.

Such elevated operational costs pose a considerable risk to profit margins, particularly if prevailing coal prices experience a downturn or fail to keep pace with these rising expenses.

Limited Diversification Beyond Coal

Bayan Resources' heavy reliance on coal exploration, mining, and sales presents a significant weakness. This singular focus means the company has limited diversification into other energy sectors or industries, making it vulnerable to shifts in the global energy landscape.

The ongoing global energy transition and increasing decarbonization efforts pose long-term risks to Bayan Resources. A lack of alternative revenue streams beyond coal could hinder its ability to adapt and remain competitive in the future.

- Over-reliance on Coal: Bayan Resources' business model is predominantly centered on coal, exposing it to market volatility and regulatory changes impacting fossil fuels.

- Energy Transition Risk: The global push towards renewable energy sources poses a direct threat to coal demand, potentially impacting Bayan's future revenue and profitability.

- Limited Growth Avenues: Without diversification, the company's growth potential is intrinsically tied to the future of the coal industry, which faces increasing headwinds.

Environmental, Social, and Governance (ESG) Risks

Bayan Resources, despite its stated commitments to Environmental, Social, and Governance (ESG) principles, operates within an industry inherently exposed to substantial environmental and social scrutiny. As a coal mining entity, the company faces ongoing challenges concerning its carbon emissions, the critical need for effective land rehabilitation post-extraction, and the multifaceted impacts on local communities. These factors can translate into heightened regulatory pressures, potential reputational damage, and escalating operational expenditures.

The company's ESG profile is further underscored by external assessments. For instance, Sustainalytics has assigned Bayan Resources a 'Severe Risk' rating within its ESG risk assessment framework. This classification specifically points to several areas requiring significant attention and improvement to mitigate potential negative consequences.

- Environmental Scrutiny: Coal mining inherently generates significant carbon emissions and requires extensive land rehabilitation efforts, posing ongoing environmental challenges.

- Social Impact Concerns: Operations can lead to community disruption and require careful management of social impacts to maintain a positive relationship with stakeholders.

- Regulatory and Reputational Risks: Increased focus on ESG factors by investors and regulators can lead to stricter compliance requirements and potential reputational damage if not adequately addressed.

- Sustainalytics Rating: A 'Severe Risk' ESG rating from Sustainalytics highlights specific areas where Bayan Resources faces notable challenges in its sustainability performance.

Bayan Resources' significant dependence on coal exposes it to the inherent volatility of global commodity prices, directly impacting its revenue and profitability. For example, a projected 27 percent drop in coal prices for 2025 could severely affect the company's financial outlook.

Operational challenges, such as production shortfalls experienced in Q3 2024 due to insufficient overburden removal, hinder the company's ability to meet its output targets consistently.

The increasing stripping ratio, particularly at the Tabang concession, is expected to drive up average cash costs per ton of coal produced, potentially squeezing profit margins if coal prices do not rise commensurately.

Furthermore, Bayan Resources' lack of diversification into other energy sectors leaves it vulnerable to the long-term risks associated with the global energy transition and increasing decarbonization efforts.

What You See Is What You Get

Bayan Resources SWOT Analysis

This is the actual Bayan Resources SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic planning.

The preview below is taken directly from the full Bayan Resources SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key factors influencing the company's competitive landscape and future prospects.

Opportunities

The escalating energy needs across Asia, especially in rapidly developing nations like China and India, represent a prime opportunity for Bayan Resources. These economies continue to rely heavily on coal for their power generation and industrial sectors, even as the world shifts towards greener alternatives.

Indonesia, a major coal producer, is well-positioned to capitalize on this demand. In 2023, China's coal imports reached record highs, and India's energy consumption growth remains robust, underscoring the persistent market for coal exports.

Bayan Resources is strategically expanding its mining concessions, notably in areas like Tabang, which is projected to significantly increase its production and sales volumes in 2024 and 2025. This expansion is a key driver for meeting higher output targets.

Investments in crucial infrastructure, such as haul roads and port facilities, are enhancing Bayan Resources' operational capacity and efficiency. These upgrades are vital for supporting the increased mining activity and ensuring smooth logistics, as seen in their ongoing capital expenditure plans for 2024.

These targeted expansions are directly contributing to Bayan Resources' objective of capturing a larger market share within the Indonesian coal sector. By bolstering production capabilities, the company is positioning itself to meet growing domestic and international demand throughout the 2024-2025 period.

While Bayan Resources is largely known for thermal coal, its focus on metallurgical coal presents a significant opportunity. Global demand for metallurgical coal, essential for steel production, hit a record high in 2024, driven by strong manufacturing activity in Asian economies.

Indonesia's role in the metallurgical coal market is still developing, but Bayan Resources can leverage its strategic advantages. Competitive pricing, particularly for semi-soft and pulverized coal injection (PCI) grades, positions the company to capture growing market share, especially as Asian steelmakers continue to expand.

Leveraging Domestic Market Obligation (DMO) Stability

The Indonesian government's Domestic Market Obligation (DMO) policy is a significant advantage for Bayan Resources, guaranteeing a consistent demand for a portion of its coal output. This allocation for domestic power generation provides a stable foundation, shielding the company from the unpredictable swings often seen in global coal markets. In 2023, the DMO mandate required producers to supply at least 25% of their production to domestic power plants at a capped price, ensuring a reliable offtake. This domestic focus has been a crucial factor in the sustained growth of Indonesian coal producers.

This stability translates into predictable revenue streams, allowing for more effective financial planning and investment. Bayan Resources, like other Indonesian producers, benefits from this built-in demand. For instance, domestic consumption remains a substantial portion of Indonesia's overall coal usage, underscoring the importance of the DMO. The government's commitment to energy security through coal-fired power plants ensures this domestic demand remains robust.

- Guaranteed Domestic Demand: The DMO ensures a baseline of sales, reducing exposure to international price volatility.

- Stable Revenue Stream: Predictable domestic offtake supports consistent revenue generation for Bayan Resources.

- Insulation from Global Market Swings: The policy acts as a buffer against the fluctuating prices and demand in the international seaborne coal market.

- Support for National Energy Security: The DMO directly contributes to Indonesia's energy needs, particularly for power generation, reinforcing its importance.

Technological Advancement and Operational Optimization

Bayan Resources has a significant opportunity to leverage technological advancements for operational optimization. By adopting cutting-edge mining technologies, the company can substantially boost efficiency and drive down costs, while simultaneously elevating safety standards across its operations.

Investing in modern equipment and sophisticated data analytics is crucial for Bayan Resources to effectively tackle challenges such as high stripping ratios and to generally enhance overall productivity. This strategic focus on technology can lead to more streamlined equipment utilization and optimized work shift patterns, directly contributing to improved operational performance.

- Adoption of Automation: Implementing automated drilling and hauling systems could reduce labor costs and improve cycle times.

- Data-Driven Insights: Utilizing AI and machine learning for predictive maintenance on heavy machinery can minimize downtime. For example, in 2024, the mining industry saw a 15% increase in the adoption of predictive maintenance technologies, leading to an average reduction in unscheduled downtime by 20%.

- Process Streamlining: Optimizing fleet management and mine planning software can lead to better resource allocation.

- Energy Efficiency: Exploring and adopting more energy-efficient mining equipment and practices can lower operational expenses and environmental impact.

The persistent demand for coal in Asian economies, particularly China and India, offers a substantial market for Bayan Resources. These nations continue to rely heavily on coal for their energy needs, with China's coal imports reaching record levels in 2023 and India's energy consumption showing strong growth. Bayan Resources' expansion into new mining areas like Tabang is set to boost its production capacity, aiming to meet this escalating demand through 2024 and 2025.

Bayan Resources is strategically positioned to benefit from the global demand for metallurgical coal, a key component in steel production. The company's focus on competitive pricing for its metallurgical coal grades, such as semi-soft and PCI, offers an advantage in capturing market share as Asian steelmakers expand their operations. This diversification into metallurgical coal aligns with the robust manufacturing activity observed in Asian economies throughout 2024.

The Indonesian government's Domestic Market Obligation (DMO) policy provides Bayan Resources with a guaranteed baseline of sales, as producers must supply at least 25% of their output to domestic power plants. This policy ensures a stable revenue stream and insulates the company from the volatility of international coal markets, reinforcing its financial predictability. This domestic offtake is crucial for Indonesia's energy security, particularly for its coal-fired power generation, which remained a significant part of the nation's energy mix in 2023.

Embracing technological advancements presents a significant opportunity for Bayan Resources to enhance operational efficiency and reduce costs. By adopting modern mining equipment and sophisticated data analytics, the company can improve productivity and safety. For instance, the mining industry saw a 15% increase in predictive maintenance adoption in 2024, resulting in a 20% reduction in unscheduled downtime, a trend Bayan Resources can leverage.

Threats

The intensifying global commitment to combating climate change and embracing renewable energy presents a significant long-term threat to companies heavily reliant on coal, such as Bayan Resources. International agreements and substantial investments in green energy technologies are poised to gradually erode the worldwide demand for coal.

This transition is already impacting major coal-producing nations; for instance, Indonesia, Bayan Resources' primary operational base, is actively pursuing energy diversification strategies, signaling a move away from coal's dominance in its future energy mix. In 2023, Indonesia's renewable energy capacity saw significant growth, with solar power capacity alone increasing by over 300 MW.

Governments globally are tightening environmental rules, with potential carbon pricing and stricter emission limits for coal plants posing a significant threat. For instance, the EU's Carbon Border Adjustment Mechanism (CBAM), fully in effect from 2026, could impact Indonesian exports if carbon intensity isn't managed. This trend increases operational expenses for coal producers like Bayan Resources and consumers, diminishing coal's market competitiveness.

A slowdown in global economic expansion can significantly dampen industrial activity and electricity consumption, directly impacting coal demand. For instance, projections indicate a potential softening in coal prices through 2025, reflecting anticipated weaker demand.

Geopolitical tensions further exacerbate this threat, creating uncertainty that can weigh heavily on demand and pricing dynamics for commodities like coal. This backdrop suggests a challenging environment for companies reliant on consistent global industrial output.

Increased Competition and Supply Glut

The global coal market is grappling with a significant risk of oversupply, which is expected to exert downward pressure on prices. This situation is exacerbated by accelerating coal production in Indonesia, alongside increased output from other major players like China and India, creating a potential supply glut.

This intensified competition, coupled with a softening import demand from key Asian consumers, poses a direct threat to Bayan Resources' sales volumes and overall profitability. For instance, in 2024, global coal prices saw volatility influenced by these supply dynamics.

- Global Oversupply Risk: The coal market faces a persistent threat of oversupply, impacting pricing.

- Accelerated Production: Indonesia, China, and India are all boosting coal output.

- Declining Import Demand: Major Asian consumers are reducing their coal imports.

- Profitability Pressure: Increased competition and reduced demand challenge Bayan Resources' financial performance.

Operational Risks and Supply Chain Disruptions

Bayan Resources faces significant operational risks inherent in mining, including geological complexities, equipment breakdowns, and potential labor issues. For instance, in 2023, the company reported that operational disruptions, including weather-related impacts, contributed to a slight dip in nickel production compared to earlier projections.

Supply chain vulnerabilities, particularly concerning logistics like barging and port access, pose a threat to Bayan Resources' ability to maintain consistent production and delivery schedules. Delays in these critical areas can directly affect revenue realization and increase operational expenses, as seen in past instances where port congestion led to extended vessel waiting times.

- Geological Uncertainty: Unforeseen geological conditions can impact extraction efficiency and safety.

- Equipment Reliability: Major equipment failures can halt production lines and necessitate costly repairs or replacements.

- Logistical Bottlenecks: Disruptions in transportation, such as barging or port operations, can delay shipments and increase costs.

- Labor Relations: Potential labor disputes or shortages can disrupt mining activities and affect output.

The global shift towards renewable energy sources presents a substantial long-term threat to Bayan Resources, as nations increasingly prioritize decarbonization. Indonesia itself is actively diversifying its energy portfolio, aiming to boost renewable energy capacity, which could reduce domestic coal demand.

Stricter environmental regulations and the potential implementation of carbon pricing mechanisms globally and in key export markets could increase operational costs and diminish coal's price competitiveness. For example, the EU's Carbon Border Adjustment Mechanism (CBAM), fully operational from 2026, could impact Indonesian coal exports if carbon intensity is not managed.

Economic slowdowns and geopolitical instability can significantly impact global industrial activity and, consequently, coal demand and pricing. The risk of oversupply in the coal market, driven by increased production from major players like Indonesia, China, and India, further pressures profitability due to softening import demand from Asian consumers.

SWOT Analysis Data Sources

This Bayan Resources SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and authoritative industry reports, ensuring a data-driven and accurate strategic assessment.