Bayan Resources Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bayan Resources Bundle

Bayan Resources navigates a competitive landscape shaped by powerful buyer negotiations and the constant threat of substitute energy sources. Understanding the intensity of these forces is crucial for any stakeholder looking to grasp the company's strategic positioning.

The complete report reveals the real forces shaping Bayan Resources’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bayan Resources' integrated infrastructure and logistics control significantly dampens supplier bargaining power. By managing its own barging, transshipment, and port facilities, the company minimizes dependence on external transport providers.

This internal operational control grants Bayan greater leverage, reducing its vulnerability to price hikes or service disruptions from third-party logistics suppliers. For instance, in 2023, Bayan Resources reported that its integrated logistics system contributed to a reduction in overall operational costs.

While general labor for coal mining in Indonesia might be plentiful, the availability of highly specialized heavy mining equipment and advanced technology often relies on a select group of global manufacturers. This limited supplier base can grant these specialized providers significant leverage, especially when switching to alternative equipment involves high costs due to proprietary technology or existing maintenance agreements.

Bayan Resources' substantial capital expenditure, with a notable portion dedicated to equipment and machinery, underscores its continuous reliance on these specialized assets. For instance, in 2023, Bayan Resources reported capital expenditures of approximately $152 million, reflecting its ongoing investment in maintaining and upgrading its operational fleet.

In Indonesia's labor market, the bargaining power of suppliers, particularly skilled workers, can be significant. For specialized roles like mining engineers or experienced heavy equipment operators, the limited pool of qualified individuals means they can negotiate for better compensation and working conditions. This is a key factor influencing operational costs for companies like Bayan Resources.

Conversely, for general labor positions, the larger supply of available workers typically results in lower bargaining power. This dynamic allows companies to manage labor costs more effectively for entry-level or less specialized roles. For instance, in 2024, the average monthly wage for a general laborer in Indonesia was around IDR 2.5 million, while specialized engineers could earn upwards of IDR 15 million.

Government Control Over Concessions and Regulations

The Indonesian government wields significant bargaining power as a supplier of mining concessions and regulatory frameworks. Recent changes, such as amendments to the Mineral and Coal Mining Law in 2025 and new mining quota regulations implemented in 2024, underscore the government's role in shaping resource access and operational requirements for companies like Bayan Resources.

These regulatory shifts directly impact the cost and complexity of obtaining and maintaining mining rights. For instance, the 2024 quota rules can create tighter supply conditions for certain minerals, potentially increasing the government's leverage in negotiations for concessions.

- Government as a Concession Grantor: The state controls the issuance and renewal of mining licenses, a critical input for mining operations.

- Regulatory Influence: New laws and quotas, like those introduced in 2024 and 2025, dictate operational standards and resource access, bolstering government bargaining power.

- Impact on Resource Access: Compliance with evolving regulations can affect the ease and cost of securing essential mining rights, thereby influencing Bayan Resources' operational continuity.

Influence of Operational Costs on Supplier Relations

Bayan Resources' focus on maintaining low operating costs, evidenced by its strong credit rating from Moody's, directly impacts its bargaining power with suppliers. The company's target to keep cash costs between USD 38-40 per metric ton in 2025 necessitates that suppliers of essential inputs like fuel, explosives, and maintenance services offer competitive pricing.

Suppliers who cannot meet Bayan's stringent cost efficiency requirements are likely to experience pressure or be replaced. This dynamic strengthens Bayan’s position, as it can leverage its operational efficiency to negotiate favorable terms.

- Bayan Resources' 2025 cash cost target: USD 38-40/MT.

- Moody's credit rating indicates strong financial management, including supplier cost control.

- Suppliers must align pricing with Bayan's cost efficiency goals.

- Potential for supplier substitution if cost targets are not met.

Bayan Resources' integrated logistics and strong financial management significantly reduce supplier bargaining power. The company's ability to control its own transport infrastructure and its focus on maintaining low operating costs, such as a target of USD 38-40 per metric ton cash cost for 2025, compels suppliers to offer competitive pricing.

While general labor is abundant in Indonesia, the scarcity of specialized mining equipment manufacturers and skilled personnel like engineers grants these suppliers considerable leverage. Bayan's substantial capital expenditures, around $152 million in 2023, highlight its reliance on these specialized inputs, necessitating careful negotiation.

The Indonesian government, as a grantor of mining concessions and regulator, holds substantial bargaining power, particularly with recent policy shifts like the 2024 mining quota regulations. These governmental controls directly influence resource access and operational costs for Bayan Resources.

| Supplier Type | Bargaining Power Factor | Bayan Resources' Mitigation Strategy | 2023/2024/2025 Data Point |

|---|---|---|---|

| Logistics Providers | Dependence on external services | Internal control of barging, transshipment, and ports | Integrated logistics reduced operational costs in 2023 |

| Specialized Equipment Manufacturers | Limited supplier base, proprietary technology | Strategic capital expenditure on machinery, negotiation of terms | Capital expenditures of ~$152 million in 2023 |

| Skilled Labor (e.g., Engineers) | Scarcity of qualified individuals | Competitive compensation packages, training programs | Specialized engineers earning >IDR 15 million/month vs. general laborers at ~IDR 2.5 million/month in 2024 |

| Government (Concessions & Regulations) | Control over licenses and operational frameworks | Compliance with regulations, strategic engagement | 2024 mining quota regulations, 2025 law amendments |

| Essential Input Suppliers (Fuel, Explosives) | Need to meet Bayan's cost efficiency targets | Leveraging operational efficiency to negotiate favorable terms | 2025 cash cost target: USD 38-40/MT |

What is included in the product

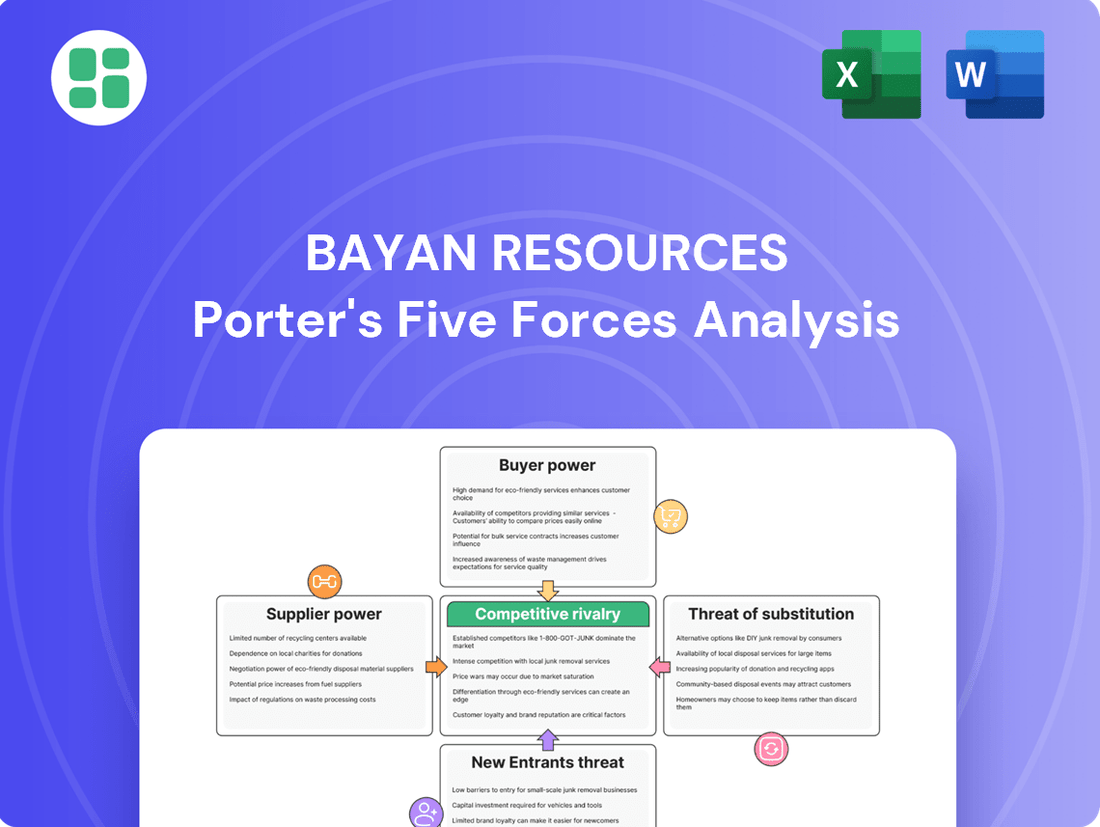

This analysis of Bayan Resources examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes within the Indonesian coal mining industry.

Instantly identify and address the competitive pressures impacting Bayan Resources' profitability with a clear, actionable breakdown of each Porter's Five Force.

Customers Bargaining Power

Bayan Resources' customer base is geographically diverse, spanning Southeast Asia, East Asia, and South Asia. This broad reach, however, faces a significant shift as key traditional importers like China and India are actively increasing their domestic coal output and accelerating investments in renewable energy sources.

This strategic pivot by major importing nations signals a potential stagnation or even a decline in global coal demand. Projections for 2025 and 2026 indicate a challenging market environment for coal exporters. For instance, China's coal production reached a record 4.6 billion tonnes in 2023, and its renewable energy capacity additions are also surging, directly impacting import needs.

The increasing self-sufficiency and diversification of energy sources by these large economies significantly amplify customer bargaining power. As buyers have more alternatives and a reduced reliance on imports, they can negotiate more favorable terms, putting pressure on suppliers like Bayan Resources.

While Bayan Resources has diversified its reach, a notable customer concentration persists in key markets like the Philippines, Indonesia, South Korea, China, and India. These significant markets accounted for a substantial portion of sales in 2023, giving large buyers in these regions considerable sway over pricing and contract terms.

This concentration translates into increased bargaining power for these major customers. As their import demands fluctuate, they can leverage their volume to negotiate more favorable conditions, potentially impacting Bayan's revenue and profit margins.

For thermal coal, a commodity product, customers often face low switching costs. This means they can easily source their coal from different global suppliers, prioritizing factors like price, quality, and delivery. This flexibility significantly strengthens their bargaining power.

The ease with which customers can switch suppliers puts pressure on coal producers like Bayan Resources to maintain competitive pricing. In 2024, the global thermal coal market continued to see price volatility, influenced by factors such as geopolitical events and demand from major economies like China and India, underscoring the importance of cost efficiency for producers.

While Bayan Resources' emphasis on high-quality thermal and metallurgical coal provides some differentiation, price remains a paramount consideration for the majority of power generation and industrial clients. For instance, in early 2024, benchmark Indonesian thermal coal prices (like the GC NEWC index) fluctuated, reflecting the ongoing sensitivity to global supply and demand dynamics.

Impact of Energy Transition on Demand

The global energy transition significantly alters the bargaining power of customers in the coal market. Nations actively pursuing renewable energy sources, such as solar and wind, are reducing their dependence on coal. This shift directly impacts demand for thermal coal, with major consumers like China and India increasingly prioritizing cleaner energy alternatives for both security and environmental reasons. For Indonesian coal exporters like Bayan Resources, this trend represents a structural headwind, amplifying customer leverage as they have more options or simply consume less coal.

The impact of this transition is quantifiable. For instance, in 2023, global renewable energy capacity additions reached a record high, contributing to a slowdown in coal power growth in many regions.

- Reduced Coal Consumption: Major economies are setting ambitious targets for renewable energy integration, directly curtailing their need for thermal coal.

- Increased Customer Options: The proliferation of alternative energy sources provides customers with greater leverage to negotiate prices or switch suppliers.

- Environmental Regulations: Stricter environmental policies worldwide further incentivize a move away from coal, strengthening customer bargaining power.

- Shifting Investment: Global investment is increasingly flowing into renewables, diminishing the long-term viability of coal projects and empowering coal buyers.

Price Sensitivity in a Softening Market

Customers are demonstrating increased price sensitivity as global coal markets stabilize at levels below the 2022 peaks. Bayan Resources' projected average selling price (ASP) for 2025, estimated between USD 58 to USD 60 per metric ton, reflects this trend and represents a decrease from prior periods. This downward price pressure is a direct consequence of amplified customer bargaining power within a market characterized by decelerating demand growth and abundant supply.

- Price Sensitivity: Global coal prices expected to be more stable but lower in 2025 compared to 2022 peaks.

- Bayan's ASP Guidance: Projected 2025 ASP range of USD 58-USD 60/MT, indicating a decrease.

- Market Dynamics: Slowing demand growth and ample supply contribute to increased customer bargaining power.

Bayan Resources faces significant customer bargaining power due to the global energy transition and the increasing self-sufficiency of major coal importing nations like China and India. These shifts mean customers have more alternatives and less reliance on imported coal, allowing them to negotiate more favorable terms.

The low switching costs for thermal coal, a commodity product, further empower customers. They can easily source from different suppliers based on price and quality, putting pressure on Bayan Resources to remain competitive. This is evident in the price volatility observed in 2024, where factors like geopolitical events and demand from key economies heavily influenced pricing.

Bayan's projected average selling price (ASP) for 2025, estimated between USD 58 to USD 60 per metric ton, reflects this downward price pressure. This guidance indicates a decrease from prior periods, directly resulting from amplified customer bargaining power in a market with decelerating demand growth and ample supply.

| Factor | Impact on Bargaining Power | Supporting Data/Observation (2023-2025) |

|---|---|---|

| Energy Transition | Increases bargaining power | China's record coal production (4.6 billion tonnes in 2023) alongside surging renewable energy capacity additions reduces import needs. Global renewable capacity additions reached record highs in 2023. |

| Customer Self-Sufficiency | Increases bargaining power | Major economies like China and India are increasing domestic coal output and investing in renewables, reducing dependence on imports. |

| Low Switching Costs (Thermal Coal) | Increases bargaining power | Customers can easily switch suppliers based on price and quality. Indonesian thermal coal prices (GC NEWC index) showed volatility in early 2024, reflecting price sensitivity. |

| Price Sensitivity | Increases bargaining power | Bayan's projected 2025 ASP of USD 58-USD 60/MT indicates downward price pressure compared to previous periods. |

Preview Before You Purchase

Bayan Resources Porter's Five Forces Analysis

This preview showcases the comprehensive Bayan Resources Porter's Five Forces Analysis, providing an in-depth examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency and immediate usability. It meticulously details the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry, offering actionable insights for strategic decision-making.

Rivalry Among Competitors

The Indonesian coal market is quite fragmented, meaning there are many companies involved. However, a few big players really stand out and control a significant portion of the market. This creates a situation where these major companies are constantly vying for dominance.

Bayan Resources is a key player in this competitive environment. In 2024, it was the third-largest coal producer in Indonesia based on how much coal it produced and sold. It competes directly with other giants like PT Bumi Resources Tbk and PT Adaro Energy Tbk, who are also major forces in the industry.

This dynamic means that the top companies, including Bayan Resources, are locked in intense competition. They are all trying to capture more market share and secure lucrative contracts, which drives a high level of rivalry.

The Indonesian coal market shows robust growth, with projections indicating a 6.00% compound annual growth rate from 2023 to 2032, fueled by both domestic energy needs and export opportunities. This domestic strength contrasts sharply with the global outlook.

Globally, coal demand is anticipated to plateau or experience a minor decrease in 2025-2026, following its expected peak in 2024. This divergence creates a more competitive environment for Indonesian coal producers.

As Indonesian exporters increasingly target a global market that is not expanding, rivalry intensifies. This situation pressures companies like Bayan Resources to compete more aggressively on price and explore new, potentially less traditional, export destinations to maintain market share.

Bayan Resources differentiates itself by concentrating on high-quality thermal coal for power generation and metallurgical coal. This focus allows them to stand out in an otherwise commoditized market, potentially securing premium pricing and long-term agreements. For instance, in 2023, Bayan's average realized price for thermal coal was $105.0 per tonne, reflecting a premium over some market benchmarks.

Despite this quality focus, the intense competition within the coal sector necessitates a relentless drive for cost optimization and operational efficiency. Even with superior product quality, companies like Bayan must maintain cost competitiveness to thrive. This is evident as the global thermal coal price averaged around $113 per tonne in 2023, but margins remain tight due to production and logistics costs.

High Exit Barriers and Overcapacity Risk

The coal mining sector, including companies like Bayan Resources, faces considerable competitive rivalry due to high exit barriers. Significant investments in specialized mining equipment, infrastructure, and long-term operational concessions make it exceedingly difficult and costly for companies to cease operations or divest assets. This financial commitment locks companies into the industry, even when market conditions become challenging.

Adding to this pressure is the risk of overcapacity, particularly in Indonesia. In 2024, Indonesian coal production reached an impressive 836 million tons. This record output, set against a backdrop of a softening global demand outlook, suggests a potential imbalance between supply and demand, intensifying competition among producers.

The combination of high fixed costs and the difficulty of exiting the market forces companies to continue production to cover their expenses. This can lead to aggressive pricing strategies and price wars as firms vie for market share, directly impacting profitability and increasing the intensity of competitive rivalry within the industry.

- High Capital Investment: Coal mining requires substantial upfront capital for exploration, infrastructure, and machinery, creating significant barriers to entry and exit.

- Record Indonesian Production: Indonesia's coal output reached 836 million tons in 2024, highlighting potential oversupply in the market.

- Overcapacity Risk: Despite softening global demand, high production levels increase the likelihood of overcapacity, intensifying price competition.

- Cost-Driven Production: Companies are incentivized to continue production to cover fixed costs, leading to aggressive competitive behavior.

Increasing Emphasis on Sustainable Practices

The Indonesian coal market is increasingly shaped by a demand for sustainable practices, directly intensifying competitive rivalry. Companies are now compelled to invest in cleaner technologies and robust rehabilitation programs, creating a differentiation factor beyond mere production volume. This shift pressures all players to adapt or risk falling behind in an evolving industry landscape.

Bayan Resources, for instance, has been actively demonstrating its commitment to environmental stewardship. In 2023, Bayan Resources reported significant progress in its reclamation and post-mining activities, a key aspect of sustainable operations. This focus on managing environmental impact can translate into a competitive advantage, particularly in attracting investment and meeting the stringent Environmental, Social, and Governance (ESG) criteria increasingly demanded by global customers and financiers.

- Environmental Stewardship as a Differentiator: Companies investing in cleaner coal technologies and effective mine rehabilitation are gaining an edge.

- ESG Compliance Driving Competition: Meeting ESG requirements is becoming crucial for market access and securing favorable financing terms.

- Bayan Resources' Sustainability Focus: Bayan Resources' reported progress in reclamation activities in 2023 highlights the strategic importance of environmental management.

- Investor and Customer Pressure: The growing emphasis on sustainability is a direct response to pressure from investors and end-users seeking responsible supply chains.

Competitive rivalry in the Indonesian coal sector is fierce, driven by a fragmented market dominated by a few major producers like Bayan Resources, PT Bumi Resources, and PT Adaro Energy. In 2024, Bayan Resources ranked as the third-largest coal producer, intensifying its competition with these giants.

The high exit barriers, stemming from substantial capital investments in mining assets, lock companies into continuous production, often leading to aggressive pricing strategies to cover fixed costs. This dynamic is exacerbated by Indonesia's record coal production of 836 million tons in 2024, creating a risk of overcapacity as global demand plateaus.

Companies like Bayan Resources are differentiating themselves through a focus on high-quality thermal and metallurgical coal, as evidenced by Bayan's 2023 average realized thermal coal price of $105.0 per tonne. Simultaneously, a growing emphasis on environmental stewardship and ESG compliance is becoming a critical competitive factor, influencing market access and financing.

| Key Competitors (2024) | Market Position (Indonesia) | Key Differentiator |

| Bayan Resources | 3rd Largest Producer | High-quality thermal & metallurgical coal |

| PT Bumi Resources Tbk | Major Producer | Large-scale operations |

| PT Adaro Energy Tbk | Major Producer | Integrated operations & diversification |

SSubstitutes Threaten

The increasing accessibility and falling costs of renewable energy sources like solar, wind, and hydropower present a significant threat of substitution for coal. Indonesia, a major coal producer, is actively shifting its energy landscape, with Regulation 10/2025 targeting a reduction in coal reliance and a boost in renewable energy development.

Government policies significantly influence the threat of substitutes for coal. Indonesia's commitment to increasing renewable energy's share in its energy mix, despite revised targets, signals a long-term shift away from fossil fuels. For instance, the 2025 renewable energy target was adjusted to 17-19%, down from earlier, more ambitious goals.

These policy shifts, including plans for early retirement of coal-fired power plants, directly increase the attractiveness and viability of substitute energy sources like solar, geothermal, and hydropower. This creates a growing pressure on coal producers like Bayan Resources as the market increasingly favors cleaner alternatives, driven by regulatory frameworks and national energy strategies.

Major coal consumers like China and India are actively boosting their renewable energy capacity and domestic coal output. For instance, China's National Energy Administration reported a significant increase in installed renewable energy capacity in 2023, aiming to further reduce its dependence on imported fossil fuels. This strategic pivot by key markets directly intensifies the threat of substitutes for Indonesian coal producers like Bayan Resources.

Biomass Co-firing as a Transitional Measure

Indonesia's push for biomass co-firing in coal plants presents a form of substitution, aiming for 57% co-firing rates in on-grid units by 2030. This strategy, while extending the operational life of existing coal infrastructure, inherently reduces the pure coal consumption per megawatt-hour generated.

- Transitional Strategy: Government mandates encourage blending biomass with coal, creating a hybrid fuel source.

- Demand Impact: Increased co-firing directly lowers the volume of coal needed for power generation.

- Substitution Nuance: It's not a complete replacement but a partial substitution within the existing coal power framework.

Cost-Competitiveness of Alternatives

While coal has traditionally been an economical energy option in Indonesia, the decreasing costs of renewable energy technologies are rapidly closing the price gap. For instance, the levelized cost of electricity (LCOE) for solar photovoltaic (PV) projects in Southeast Asia has seen significant declines, with some projections indicating it could become cheaper than coal in many regions by the mid-2020s.

This enhanced cost-competitiveness of alternatives, coupled with growing environmental concerns and supportive government policies promoting renewable adoption, presents a substantial threat to coal's sustained market dominance, especially within the crucial power generation industry.

- Declining Renewable Costs: Solar and wind energy LCOE continues to fall, making them increasingly viable alternatives to coal.

- Environmental Pressures: Growing global and domestic emphasis on climate change mitigation drives demand for cleaner energy sources.

- Government Incentives: Policies favoring renewable energy deployment, such as tax credits and feed-in tariffs, further boost the attractiveness of substitutes.

- Shifting Market Dynamics: The power generation sector, a major consumer of coal, is increasingly exploring and investing in renewable energy solutions.

The threat of substitutes for coal, particularly in the power generation sector, is escalating due to the declining costs and increasing efficiency of renewable energy sources. Indonesia's energy policy, as exemplified by Regulation 10/2025, aims to reduce coal dependency, thereby bolstering the competitive position of alternatives like solar and geothermal. This shift is further amplified by major coal consumers such as China and India, which are aggressively expanding their renewable energy capacities, as evidenced by China's substantial growth in installed renewable capacity in 2023.

The cost-competitiveness of renewable energy is rapidly improving, with the levelized cost of electricity (LCOE) for solar PV in Southeast Asia projected to undercut coal in many areas by the mid-2020s. This economic advantage, combined with mounting environmental concerns and supportive government incentives for renewables, presents a significant challenge to coal's long-term market viability.

| Substitute Energy Source | Key Trend | Impact on Coal Demand |

| Solar PV | Falling LCOE, increased efficiency | Directly competes in power generation, reducing coal's share. Southeast Asia LCOE projected to be cheaper than coal by mid-2020s. |

| Wind Power | Technological advancements, cost reductions | Provides an alternative baseload or peak load power source, displacing coal. |

| Geothermal Energy | Indonesia's significant untapped potential | Offers a stable, renewable power source that can replace coal-fired plants. |

| Biomass Co-firing | Government mandates (e.g., 57% target by 2030) | Reduces pure coal consumption in existing plants, a partial substitution. |

Entrants Threaten

The coal mining sector, especially for large-scale operations like those Bayan Resources engages in, demands substantial capital. This includes significant spending on exploration, developing mining sites, acquiring heavy machinery, and building out necessary logistics, like ports and transportation networks.

Bayan Resources' own capital expenditure reflects this reality. For instance, the company has consistently invested heavily in its development and infrastructure projects, underscoring the massive financial commitment required to operate and expand within this industry. These substantial upfront costs act as a major deterrent for potential new companies looking to enter the market.

Indonesia's mining sector presents significant barriers to entry due to its complex and frequently changing regulatory landscape. New mining quota regulations were implemented in 2024, and further amendments to the mining law are expected in 2025, creating an environment of ongoing adaptation for any new participant.

Securing and retaining mining business licenses, known as IUPs, involves rigorous processes and compliance demands. These stringent requirements, coupled with potential legal uncertainties, make it exceptionally difficult for new companies to establish a foothold in the Indonesian market.

Established companies like Bayan Resources benefit from significant economies of scale due to their extensive operations, large production volumes, and integrated control over their logistics chain. This integration allows for cost efficiencies that are difficult for newcomers to replicate.

Bayan's ramp-up of thermal coal production to 65 million metric tons by end-2025 and 80 million MT by end-2026 further solidifies its cost advantages. New entrants would struggle to achieve similar cost efficiencies without substantial initial investment and time, making the threat of new entrants relatively low in this sector.

Access to Prime Concessions and Reserves

The most desirable coal concessions, particularly those with high-grade coal and advantageous geological features, are already secured by established companies. Bayan's Tabang mines, for instance, benefit from low strip ratios and extended reserve life, making them highly attractive.

While recent policy adjustments aim to broaden access for smaller businesses and religious organizations, obtaining substantial, economically viable concessions remains a considerable challenge for significant new market entrants.

- Prime Concessions Secured: Incumbent firms, like Bayan Resources, hold the most attractive coal concessions, characterized by high-quality reserves and favorable geological conditions. For example, Bayan's Tabang mines boast low strip ratios and long reserve lives, indicating efficient extraction potential.

- Barriers to Entry: Although recent Indonesian regulations (e.g., amendments to mining laws) have sought to open up access for smaller entities and religious groups, securing large-scale, commercially viable concessions remains a substantial barrier for major new entrants aiming to compete with established players.

Environmental Compliance and Social Licensing

The increasing focus on Environmental, Social, and Governance (ESG) factors presents a significant hurdle for new companies entering the mining industry, including those looking to compete with established players like Bayan Resources. Meeting stringent environmental regulations and fulfilling rehabilitation commitments requires substantial upfront investment and ongoing operational expenses. For instance, in 2024, the average cost for mine rehabilitation in Australia alone was estimated to be in the tens of millions of dollars, a figure that can deter smaller, less capitalized entrants.

Gaining social acceptance, often referred to as a social license to operate, is equally critical and can involve considerable expenditure on community development programs and stakeholder engagement. New entrants must budget for these non-operational costs, which can significantly impact their initial capital requirements and overall project viability. Without this social license, operations can be delayed or even halted, as seen in various global mining projects where community opposition has led to protracted disputes and financial losses for new ventures.

- ESG Scrutiny: Heightened investor and regulatory demand for ESG compliance raises the barrier to entry.

- Regulatory Costs: Stricter environmental laws and rehabilitation obligations translate into higher capital and operational expenditures for newcomers.

- Social License: Securing community approval and support requires significant investment in social programs, adding to the cost of entry.

The threat of new entrants for Bayan Resources is relatively low due to substantial capital requirements for exploration, development, and infrastructure, alongside stringent regulatory hurdles in Indonesia's mining sector.

Established players benefit from economies of scale and secured prime concessions, making it difficult for newcomers to match cost efficiencies and access desirable reserves.

Furthermore, increasing ESG demands and the necessity of obtaining a social license to operate add significant financial and operational complexities for potential new market participants.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for exploration, machinery, and logistics. | Deters companies without significant funding. |

| Regulatory Landscape | Complex licensing (IUPs) and evolving laws (e.g., 2024 quota regulations). | Creates legal uncertainty and compliance challenges. |

| Economies of Scale | Large production volumes and integrated logistics lower costs. | New entrants struggle to achieve comparable cost efficiencies. |

| Concession Access | Prime, high-grade coal reserves are already secured. | Limits access to the most economically viable mining sites. |

| ESG & Social License | Demands for environmental compliance and community engagement. | Increases upfront investment and operational complexity. |

Porter's Five Forces Analysis Data Sources

Our Bayan Resources Porter's Five Forces analysis is built upon a foundation of comprehensive data, drawing from the company's annual reports, investor presentations, and publicly available financial statements. We also integrate insights from reputable industry research reports and market intelligence platforms to provide a robust understanding of the competitive landscape.