Bayan Resources PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bayan Resources Bundle

Navigate the complex external forces shaping Bayan Resources's future with our meticulously crafted PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for the company. Gain a strategic advantage by leveraging these critical insights to refine your own market approach. Download the full version now for actionable intelligence that drives informed decision-making.

Political factors

The Indonesian government's policy on coal mining, particularly through amendments to the Mineral and Coal Mining Law (UU Minerba), continues to shape the operational landscape for companies like Bayan Resources. These regulations impact crucial aspects such as licensing, land utilization, and the renewal of mining contracts, aiming to provide greater investment clarity and bolster domestic industrial development.

A key policy lever is the Domestic Market Obligation (DMO), which mandates a certain percentage of coal production be allocated for Indonesian power plants and industries. In 2024, the DMO requirement for coal producers remained at 25%, ensuring a stable supply for domestic energy needs, a factor that directly influences the sales volumes and pricing strategies for companies operating under this framework.

Indonesia is actively pursuing an energy transition, targeting a 23% share of new and renewable energy sources by 2025, a goal that will undoubtedly shape its future energy landscape. This commitment is underscored by ambitious greenhouse gas emission reduction targets, signaling a clear political directive to move away from fossil fuels, particularly coal.

While coal currently plays a significant role in meeting Indonesia's energy demands, the political momentum is clearly shifting towards cleaner energy alternatives. This transition presents both challenges and opportunities for companies like Bayan Resources, necessitating strategic adaptation to evolving policy frameworks and market preferences.

Global trade relations and geopolitical stability are critical for Bayan Resources, as they directly impact demand for Indonesian coal. In 2024, China and India remain major importers, with their energy policies and economic growth significantly influencing Bayan's export volumes and pricing power. For instance, China's commitment to reducing coal consumption while still relying on it for energy security presents a dynamic market for Indonesian suppliers.

Shifts in these key markets' energy policies, such as India's push for renewable energy alongside continued coal demand, can alter export volumes. Bayan Resources' performance is thus closely tied to these evolving international dynamics. The Indonesian government's approach to trade agreements and export regulations, including any potential export levies or quotas, also directly shapes the company's operational landscape and profitability.

Domestic Market Obligation (DMO)

The Indonesian government's Domestic Market Obligation (DMO) policy mandates coal miners, including Bayan Resources, to allocate a specific portion of their output to domestic power plants and industries at capped prices. For 2024, the DMO requirement remained at 25% of production. This policy is designed to safeguard national energy security, ensuring a stable supply for domestic needs. However, it directly affects the profitability of export-oriented sales, as the regulated domestic price is typically lower than international market rates.

Bayan Resources' adherence to the DMO is a crucial operational and legal imperative, influencing its overall sales strategy and revenue generation. Failure to meet DMO obligations can result in penalties. In 2023, the average realized price for Bayan Resources' domestic sales, influenced by the DMO, was significantly lower than its export sales prices. This creates a dynamic where the company must balance its commitment to domestic supply with its pursuit of higher international market returns.

- DMO Requirement: 25% of production for domestic supply in 2024.

- Impact on Profitability: Regulated domestic prices can reduce overall revenue compared to export markets.

- Strategic Consideration: Balancing domestic obligations with export opportunities is key to revenue management.

- Compliance Risk: Non-compliance with DMO can lead to financial penalties.

Political Stability and Regulatory Consistency

Political stability in Indonesia is a bedrock for sustained investment in its mining industry. For Bayan Resources, a consistent and predictable regulatory landscape is paramount. Fluctuations in mining laws or their enforcement can create significant operational and financial uncertainties, impacting everything from exploration permits to export licenses. For example, the Indonesian government's ongoing efforts to reform mining regulations, as seen with discussions around updates to Law No. 4 of 2009 concerning Mineral and Coal Mining, underscore the dynamic nature of this sector. This environment demands careful monitoring by companies like Bayan Resources to navigate potential shifts in policy.

The Indonesian government's commitment to attracting foreign investment in the mining sector is a key political factor. However, the effectiveness of this commitment is often tested by the pace and clarity of regulatory implementation. Bayan Resources, as a major player, is directly influenced by policies related to domestic market obligations (DMO) and the downstream processing of minerals. In 2023, Indonesia continued to emphasize value addition, which could lead to further regulatory adjustments impacting export strategies. The stability of these policies is therefore critical for long-term capital allocation and project development.

Recent legislative actions and policy pronouncements in Indonesia's mining sector highlight the need for vigilance. For Bayan Resources, understanding the political appetite for resource nationalism versus foreign investment is crucial.

- Regulatory Amendments: Indonesia's Ministry of Energy and Mineral Resources has been active in proposing and implementing changes to mining regulations to encourage domestic processing and increase state revenue.

- Investment Climate: While political stability is generally present, the specific implementation of mining policies can create periods of uncertainty for foreign and domestic investors.

- Fiscal Policies: Changes in royalty rates, taxes, and export duties, often influenced by political considerations, directly affect the profitability and operational viability of mining companies.

The Indonesian government's policy on coal mining, particularly through amendments to the Mineral and Coal Mining Law (UU Minerba), continues to shape the operational landscape for companies like Bayan Resources. These regulations impact crucial aspects such as licensing, land utilization, and the renewal of mining contracts, aiming to provide greater investment clarity and bolster domestic industrial development.

A key policy lever is the Domestic Market Obligation (DMO), which mandates a certain percentage of coal production be allocated for Indonesian power plants and industries. In 2024, the DMO requirement for coal producers remained at 25%, ensuring a stable supply for domestic energy needs, a factor that directly influences the sales volumes and pricing strategies for companies operating under this framework.

Indonesia is actively pursuing an energy transition, targeting a 23% share of new and renewable energy sources by 2025, a goal that will undoubtedly shape its future energy landscape. This commitment is underscored by ambitious greenhouse gas emission reduction targets, signaling a clear political directive to move away from fossil fuels, particularly coal.

While coal currently plays a significant role in meeting Indonesia's energy demands, the political momentum is clearly shifting towards cleaner energy alternatives. This transition presents both challenges and opportunities for companies like Bayan Resources, necessitating strategic adaptation to evolving policy frameworks and market preferences.

What is included in the product

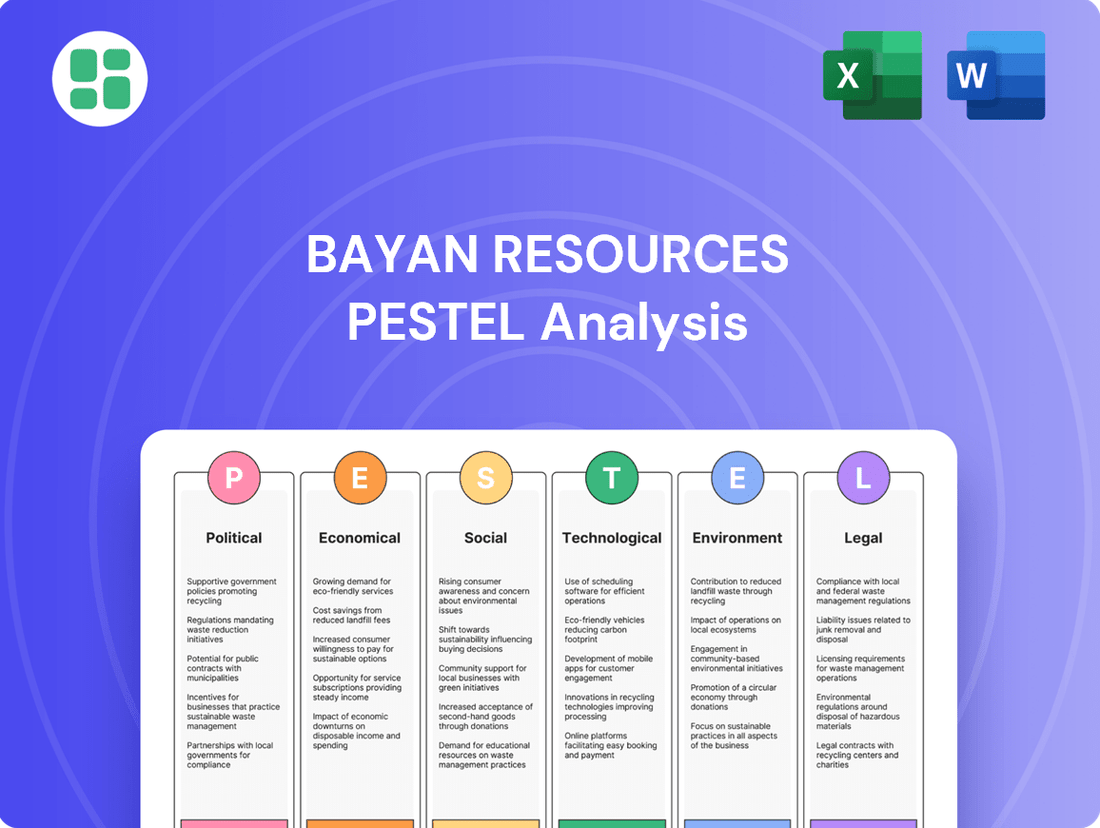

This PESTLE analysis delves into the external macro-environmental factors impacting Bayan Resources, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides a comprehensive overview to help stakeholders understand the dynamic landscape and identify strategic opportunities and challenges.

A clear, actionable PESTLE analysis for Bayan Resources provides a concise overview of external factors, acting as a pain point reliver by enabling proactive strategy development and risk mitigation.

Economic factors

Global thermal coal prices are inherently volatile, driven by supply and demand shifts, geopolitical tensions, and the ongoing energy transition. While prices experienced a downturn in late 2024 and early 2025, projections indicate a continued decline through 2025 and 2026. This downward trend directly affects Bayan Resources' financial performance due to its substantial reliance on coal exports, with benchmark Newcastle coal futures trading around $100 per tonne in mid-2025, down from peaks earlier in the year.

Global demand for coal, especially from major consumers like China and India, continues to be a significant factor for Indonesian coal producers like Bayan Resources. These nations, despite expanding their own coal output, still rely heavily on imports to meet their vast energy requirements.

Domestically, the energy sector's reliance on coal for power generation and industrial processes directly impacts demand. Bayan Resources has projected robust sales volumes for 2025, indicating confidence in sustained demand from both international and domestic markets.

Rising inflation, both within Indonesia and globally, directly impacts Bayan Resources by increasing the costs of essential operational inputs. This includes higher expenses for fuel, which is crucial for mining equipment, as well as increased labor wages and the price of spare parts and machinery. For instance, global inflation rates in 2024 have seen persistent upward pressure on commodity prices, directly affecting energy and transportation costs for mining operations.

Adding to these pressures, Indonesia's Value-Added Tax (VAT) increased from 11% to 12% starting April 1, 2025. This tax hike directly inflates operational expenses, requiring Bayan Resources to absorb or pass on these additional costs, which could potentially squeeze profit margins. Effectively managing these escalating operational costs is therefore paramount for Bayan Resources to maintain its competitive edge in the coal mining sector.

Foreign Exchange Rates

Fluctuations in the Indonesian Rupiah (IDR) against major currencies significantly influence Bayan Resources' financial health. Since coal sales are primarily in US Dollars (USD) while some operational costs are incurred in IDR, the exchange rate directly impacts profitability. For instance, a stronger IDR can lower the cost of IDR-denominated expenses, but if global coal prices decline, it might also diminish the company's competitiveness.

The IDR experienced volatility throughout 2024. As of late 2024, the IDR was trading around IDR 16,000 per USD, a level that presents a mixed bag for Bayan Resources. While this rate might slightly increase the Rupiah value of USD-denominated revenues when converted, it also means that local costs, if paid in USD, become more expensive in Rupiah terms.

- IDR/USD Exchange Rate Impact: A stronger IDR (e.g., IDR 15,000/USD) would reduce IDR-denominated costs but could pressure profit margins if USD coal prices are stagnant or falling.

- Revenue Conversion: Conversely, a weaker IDR (e.g., IDR 17,000/USD) increases the Rupiah value of USD export revenues, potentially boosting local currency profits.

- Cost Management: Bayan Resources' ability to manage its IDR-denominated operational expenses is crucial for mitigating the negative effects of a strengthening Rupiah.

- Hedging Strategies: The company may employ foreign exchange hedging strategies to lock in favorable rates and reduce exposure to currency market fluctuations.

Capital Expenditure and Investment Climate

Bayan Resources is channeling considerable capital into infrastructure, with a significant portion of its capital expenditure earmarked for projects designed to bolster production capacity. This strategic investment is crucial for meeting future demand and operational efficiency.

The investment climate in Indonesia plays a pivotal role in Bayan Resources' financial strategy. Factors such as government economic policies, regulatory stability, and overall investor sentiment directly impact the company's capacity to secure funding for its ambitious expansion plans and attract new capital.

- Capital Expenditure Focus: Bayan Resources' 2024 capital expenditure is projected to be around $250 million, with a substantial portion dedicated to infrastructure, including port facilities and haul roads, to support its mining operations.

- Indonesian Investment Climate: In 2023, Indonesia saw foreign direct investment (FDI) reach $45.4 billion, indicating a generally positive but sensitive investment environment that can be influenced by policy shifts.

- Investor Confidence Indicator: The Indonesian rupiah's stability and the country's credit rating are key indicators of investor confidence, directly affecting the cost of capital for companies like Bayan Resources.

Economic factors present a mixed outlook for Bayan Resources in 2025. While global thermal coal prices are expected to remain subdued, trading around $100 per tonne for Newcastle futures in mid-2025, demand from key markets like China and India continues to underpin the sector. Domestically, inflation is increasing operational costs, with Indonesia's VAT hike to 12% from April 2025 adding to expenses.

The Indonesian Rupiah's volatility also plays a crucial role; a weaker IDR in late 2024 (around IDR 16,000/USD) can boost the local currency value of USD export revenues, though it also increases the cost of local expenses if paid in USD. Bayan Resources is investing approximately $250 million in capital expenditure in 2024, primarily in infrastructure to support production.

| Economic Factor | Impact on Bayan Resources | 2024/2025 Data/Projection |

|---|---|---|

| Global Thermal Coal Prices | Revenue generation, profitability | Newcastle futures ~ $100/tonne (mid-2025), downward trend |

| Global Coal Demand | Sales volume, market access | Continued demand from China and India |

| Domestic Inflation | Operational costs (fuel, labor, parts) | Upward pressure on commodity prices in 2024 |

| Indonesian VAT | Operational costs | Increased from 11% to 12% from April 1, 2025 |

| IDR/USD Exchange Rate | Revenue conversion, cost of local expenses | IDR ~ 16,000/USD (late 2024) |

| Capital Expenditure | Production capacity, operational efficiency | ~$250 million in 2024 for infrastructure |

Full Version Awaits

Bayan Resources PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Bayan Resources delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

Bayan Resources, as a major mining entity, directly impacts the communities where it operates. Maintaining strong community relations is paramount for its social license to operate, achieved through targeted social programs and prioritizing local hiring. For instance, in 2023, Bayan Resources reported significant investment in community development initiatives, focusing on education and infrastructure improvements in its operational areas.

The coal mining industry, inherently labor-intensive, places significant emphasis on labor relations and workforce management as key sociological factors for companies like Bayan Resources. In 2024, the Indonesian mining sector, where Bayan Resources operates, continued to grapple with the need for robust occupational health and safety protocols, with ongoing efforts to reduce workplace accidents. For instance, industry-wide safety campaigns aim to improve fatality and injury rates, which directly influence operational continuity and employee morale.

Maintaining fair labor practices, including competitive wages and benefits, is crucial for Bayan Resources to foster a stable and productive workforce, thereby minimizing the risk of labor disputes. As of early 2025, discussions around minimum wage adjustments and collective bargaining agreements remain a central theme in the Indonesian labor landscape, impacting operational costs and employee relations across the mining sector.

Investing in employee training and development not only enhances productivity but also contributes to a positive organizational culture. Bayan Resources’ commitment to upskilling its workforce, particularly in areas of new mining technologies and safety procedures, is vital for long-term operational efficiency and employee retention, especially as the industry evolves.

Public sentiment towards coal is increasingly negative due to heightened awareness of climate change. Globally, surveys in 2024 indicate a significant majority of the public favor transitioning to renewable energy, with some polls showing over 70% support for phasing out fossil fuels.

This societal shift directly impacts energy policies and investment decisions. For instance, in 2024, several major investment funds divested from coal assets, citing environmental, social, and governance (ESG) concerns, signaling a challenging future for companies like Bayan Resources heavily reliant on coal.

Health and Safety Standards

Bayan Resources operates in an industry where adhering to strict health and safety standards is not just a regulatory requirement but a core societal expectation for responsible corporate conduct. The mining sector inherently carries risks, and the public demands that companies like Bayan Resources prioritize the well-being of their employees above all else.

This societal pressure translates into a continuous need for investment in robust safety protocols, comprehensive training programs, and state-of-the-art equipment. For instance, in 2023, the International Labour Organization reported that the mining sector globally still faces significant occupational hazards, underscoring the ongoing challenge. Bayan Resources' commitment to preventing accidents and fostering a secure working environment is therefore crucial for maintaining its social license to operate and its reputation.

- Societal Demand: Growing public emphasis on corporate social responsibility and worker protection in high-risk industries like mining.

- Investment Necessity: Ongoing capital allocation required for advanced safety equipment, regular training, and proactive risk management systems.

- Reputational Impact: A strong safety record enhances brand image and employee morale, while accidents can lead to severe reputational damage and legal repercussions.

- Industry Benchmarking: Bayan Resources likely benchmarks its safety performance against global mining industry leaders, aiming to meet or exceed best practices in accident prevention and worker welfare.

Demographic Shifts and Skilled Labor Availability

Demographic shifts significantly influence the availability of skilled labor for Bayan Resources. As populations age in some traditional mining areas, there's a growing challenge in finding younger workers for physically demanding roles. For instance, in 2024, Australia, a key operational region for many mining companies, faced a shortage of skilled tradespeople and engineers, with reports indicating a deficit of over 20,000 in the construction and mining sectors alone.

Bayan Resources must prioritize attracting and retaining qualified personnel, particularly for specialized mining, processing, and logistics positions. The company's ability to secure experienced geologists, equipment operators, and supply chain managers directly impacts operational efficiency and project timelines. In 2025, the global mining industry continues to grapple with a talent gap, with projections suggesting a need for millions of new workers over the next decade to meet demand.

Addressing potential skill gaps through strategic investment in local education and vocational training is crucial. By partnering with educational institutions and offering apprenticeships, Bayan Resources can cultivate a pipeline of qualified talent. For example, initiatives that focus on digital mining technologies and automation are becoming increasingly important, requiring new skill sets that may not be readily available in all mining communities.

Key considerations for Bayan Resources include:

- Aging workforce: Many experienced miners are approaching retirement age, creating a need for knowledge transfer and new talent acquisition.

- Specialized skill demand: Advanced roles in areas like data analytics for mine optimization and autonomous vehicle operation require specialized training.

- Regional disparities: The availability of skilled labor can vary significantly between different mining regions, necessitating tailored recruitment strategies.

- Competition for talent: Bayan Resources competes with other resource companies and industries for skilled workers, requiring competitive compensation and attractive work environments.

Societal expectations for corporate responsibility are intensifying, particularly regarding worker safety and community impact within the mining sector. Bayan Resources must actively manage public perception and demonstrate a commitment to ethical operations, especially as global sentiment shifts against fossil fuels. The company's social license to operate hinges on its ability to maintain strong community ties and uphold stringent health and safety standards, a challenge amplified by increasing awareness of climate change's effects.

Demographic trends, such as an aging workforce and a demand for specialized skills in areas like digital mining, present significant challenges for labor availability. Bayan Resources needs to invest in talent development and localized training programs to ensure a skilled workforce for current and future operations. The competition for qualified personnel remains fierce, necessitating attractive compensation and work environments to retain essential talent.

| Sociological Factor | 2024/2025 Relevance | Bayan Resources Implication |

|---|---|---|

| Community Relations | Increased focus on social impact and local development programs. | Essential for maintaining social license to operate; requires investment in education and infrastructure. |

| Labor Relations & Safety | Heightened demand for robust occupational health and safety; ongoing wage discussions. | Directly impacts operational continuity, employee morale, and potential labor disputes. |

| Public Sentiment on Coal | Growing negative perception due to climate change awareness; divestment from fossil fuels. | Creates reputational risk and potential challenges in securing financing and partnerships. |

| Demographics & Skills | Shortage of skilled labor in some regions; demand for digital mining expertise. | Necessitates strategic talent acquisition, retention, and investment in training programs. |

Technological factors

Bayan Resources is significantly impacted by advancements in mining technology. Innovations like automated drilling rigs and autonomous haul trucks can boost operational efficiency and lower labor costs. For instance, the global mining equipment market is projected to reach $229.6 billion by 2027, indicating substantial investment in these areas.

Geological modeling software plays a vital role in optimizing resource discovery and extraction planning for Bayan Resources. These tools allow for more precise identification of ore bodies, leading to reduced waste and improved recovery rates. Efficient extraction methods, such as in-situ recovery where applicable, can also dramatically cut down on environmental impact and operational expenses.

Investing in cutting-edge mining techniques is essential for Bayan Resources to remain competitive. Companies adopting technologies like advanced sensor systems for real-time monitoring and predictive maintenance can achieve significant cost savings. For example, implementing AI-driven analytics in mining operations has shown potential to reduce downtime by up to 20%.

Technological advancements in logistics are crucial for Bayan Resources' integrated operations, encompassing barging, transshipment, and port facilities. Innovations like real-time GPS tracking for its extensive fleet and advanced route optimization software are key to enhancing efficiency. For instance, in 2024, the company continued to invest in upgrading its port handling equipment, aiming to reduce vessel turnaround times by an estimated 15% through more efficient loading and unloading processes.

The adoption of smart technologies in port management, such as automated gate systems and predictive maintenance for cranes, directly impacts Bayan Resources' operational costs and throughput. These systems, increasingly common in major global ports, help minimize downtime and ensure smoother cargo flow. By integrating these technologies, Bayan Resources can better manage its complex supply chain, ultimately leading to more predictable delivery schedules and cost savings in its 2025 fiscal year.

As environmental scrutiny intensifies, technologies aimed at mitigating the ecological footprint of coal extraction are gaining prominence for companies like Bayan Resources. Innovations in dust suppression, such as water misting systems and chemical suppressants, are crucial for improving air quality around mining sites. For instance, advancements in water treatment technologies are essential for managing mine-affected water, with stricter regulations in many jurisdictions by 2024-2025 mandating higher standards for discharge quality.

Land rehabilitation technologies are also vital, focusing on restoring mined areas to a state that supports biodiversity and prevents erosion. While carbon capture and storage (CCS) is primarily relevant for the end-use of coal, research into its application for fugitive emissions from mining operations, though nascent, could become a factor. Bayan Resources, like its peers, will need to continually assess and adopt these evolving environmental management technologies to comply with increasingly stringent global and national environmental standards, particularly those expected to be reinforced through 2025.

Data Analytics and Digitalization

Bayan Resources is increasingly leveraging data analytics and digitalization to refine its mining operations. This includes using advanced analytics for exploration targeting and optimizing extraction processes, aiming to boost efficiency and reduce costs. For instance, in 2024, the mining industry saw significant investment in AI-driven predictive maintenance, with companies reporting up to a 20% reduction in downtime.

Digital platforms are crucial for enhancing operational transparency and decision-making across the entire value chain, from resource discovery to the final sale of commodities. Bayan Resources can utilize these tools to better manage inventory levels and more accurately forecast market demand, a critical factor in commodity trading. The global market for mining analytics software was projected to reach over $2 billion in 2024, highlighting the sector's commitment to digital transformation.

- Optimized Production: Data analytics can identify bottlenecks and inefficiencies in extraction and processing, leading to higher output.

- Inventory Management: Real-time data tracking allows for better control over stock levels, minimizing holding costs and preventing stockouts.

- Demand Forecasting: Predictive analytics helps anticipate market needs, enabling more strategic sales and pricing decisions.

- Enhanced Transparency: Digital platforms provide clear visibility into operational performance, facilitating better management oversight and stakeholder communication.

Renewable Energy Technologies Impact on Coal Demand

The accelerating adoption of renewable energy sources like solar and wind is a significant technological factor directly impacting coal demand. By 2024, the International Energy Agency (IEA) projected that renewables would account for over 50% of global electricity generation capacity additions, directly challenging coal's historical dominance in power generation. This trend is driven by decreasing costs; for instance, the global weighted-average levelized cost of electricity from onshore wind fell by approximately 5% in 2023 compared to 2022, making it increasingly competitive with coal.

As renewable technologies mature and become more efficient, they directly displace coal in the energy mix, creating a long-term technological threat. This shift influences the future market dynamics for thermal coal, as seen in the continued decline of coal's share in electricity generation in many developed economies. For example, in the European Union, coal-fired power generation has been steadily decreasing, with 2023 seeing a significant drop in its contribution to the energy mix.

Key technological impacts include:

- Cost Competitiveness: Declining capital and operational costs for solar PV and wind turbines make them increasingly attractive alternatives to coal power plants.

- Efficiency Gains: Advancements in turbine design and solar panel technology are improving energy output per unit, further enhancing their economic viability.

- Grid Integration: Innovations in energy storage and grid management are addressing the intermittency of renewables, making them more reliable replacements for baseload coal power.

- Policy Support: Government incentives and targets for renewable energy deployment, often driven by technological feasibility, accelerate the displacement of coal.

Technological advancements are reshaping Bayan Resources' operational landscape, from extraction to logistics. Innovations in automated drilling and autonomous haul trucks are boosting efficiency, with the global mining equipment market expected to reach $229.6 billion by 2027.

Geological modeling software enhances resource discovery and extraction planning, minimizing waste and improving recovery rates. Predictive maintenance driven by AI is projected to reduce mining downtime by up to 20%.

Digitalization and data analytics are key to optimizing operations, with the mining analytics software market projected to exceed $2 billion in 2024. The accelerating adoption of renewables, with onshore wind costs falling by approximately 5% in 2023, presents a significant technological challenge by displacing coal in power generation.

| Technology Area | Impact on Bayan Resources | Relevant Data/Projections |

| Automation & Robotics | Increased operational efficiency, reduced labor costs | Global mining equipment market: $229.6 billion by 2027 |

| Data Analytics & AI | Optimized extraction, predictive maintenance, improved forecasting | AI-driven downtime reduction: up to 20%; Mining analytics software market: >$2 billion in 2024 |

| Renewable Energy | Displacement of coal in power generation, market threat | Onshore wind LCOE reduction: ~5% in 2023 |

Legal factors

Bayan Resources' operations are anchored by its coal concessions and mining business licenses, known as IUPs and IUPKs, primarily located in East Kalimantan. These licenses are the bedrock of its mining activities, dictating the terms under which it can explore, extract, and process coal.

The legal landscape surrounding these concessions is dynamic. Amendments to Indonesia's mining law, particularly those enacted in recent years leading up to 2025, have introduced more stringent regulations and procedural requirements for their issuance, renewal, and potential revocation. This evolving legal framework directly impacts Bayan Resources' long-term operational certainty and expansion plans.

Indonesia's environmental regulations are a significant factor for coal mining operations like Bayan Resources. Companies must comply with stringent rules concerning land reclamation after mining, proper disposal of waste materials, and preventing water pollution. Biodiversity protection is also a key area of focus.

Adherence to these environmental laws is not optional; it's crucial for maintaining operational licenses and avoiding substantial penalties. For instance, the PROPER program, which rates companies on their environmental management performance, plays a vital role. In 2023, the Ministry of Environment and Forestry issued guidelines for PROPER assessments, emphasizing continuous improvement in environmental management systems for all industrial sectors, including mining.

Indonesian labor laws are comprehensive, dictating everything from minimum wages to workplace safety standards. Bayan Resources, like all companies operating in Indonesia, must adhere strictly to these regulations. This includes ensuring fair treatment and proper benefits for all employees, whether permanent or contract.

Compliance with these labor laws is crucial for maintaining operational stability and avoiding costly legal challenges. For instance, the Omnibus Law on Job Creation (Undang-Undang Cipta Kerja), enacted in 2020 and further refined, significantly altered aspects of employment, including outsourcing and severance pay, requiring continuous adaptation by companies like Bayan Resources.

In 2024, the Indonesian government continues to emphasize worker protection and social security. Bayan Resources' commitment to these legal frameworks, including provisions for social insurance (BPJS Ketenagakerjaan) and collective bargaining agreements, directly impacts its ability to attract and retain talent, thereby influencing its overall productivity and reputation.

Corporate Governance and Reporting Requirements

As a publicly traded entity on the Indonesia Stock Exchange (IDX), Bayan Resources Tbk (BYAN) must adhere to stringent corporate governance and reporting mandates. This involves timely submission of financial statements, annual reports, and sustainability disclosures, ensuring transparency and accountability to stakeholders. For instance, in 2023, the company reported its financial results in accordance with Indonesian Financial Accounting Standards (IFAS) and International Financial Reporting Standards (IFRS).

These requirements are overseen by regulatory bodies such as the Financial Services Authority (OJK) and the IDX itself. Adherence to these regulations is crucial for maintaining investor confidence and market integrity. Bayan Resources' commitment to these standards is reflected in its consistent compliance with disclosure timelines and the quality of information provided.

Key reporting obligations include:

- Regular Financial Disclosures: Quarterly and annual financial statements detailing revenue, expenses, assets, and liabilities.

- Annual Reports: Comprehensive overview of the company's performance, strategy, and governance practices.

- Sustainability Reports: Disclosures on environmental, social, and governance (ESG) performance, increasingly important for investors.

- Compliance with IDX Listing Rules: Adherence to rules regarding corporate actions, insider trading, and market conduct.

Export and Import Regulations, including Domestic Market Obligation (DMO)

Export and import regulations are crucial for Bayan Resources. Indonesia's Domestic Market Obligation (DMO) mandates that a portion of coal production must be supplied domestically, impacting the volume available for export. For instance, in 2023, the DMO required producers to allocate at least 25% of their production to domestic power plants, often at capped prices, which can affect profitability for companies like Bayan Resources if global prices are significantly higher.

Changes in these legal frameworks can directly influence Bayan Resources' financial performance and strategic planning. For example, adjustments to export duties or quotas, or stricter enforcement of the DMO, could limit market access or reduce margins on international sales. The Indonesian government has periodically reviewed and adjusted these regulations to ensure energy security and price stability for domestic consumers.

- DMO Compliance: Bayan Resources must navigate the DMO, which requires a percentage of coal to be sold domestically, impacting export volumes.

- Export Duties and Quotas: Fluctuations in export duties or the imposition of quotas can directly affect the profitability and market reach of the company's coal exports.

- Regulatory Stability: Changes in legal frameworks regarding coal trade create uncertainty and necessitate adaptive strategies for Bayan Resources.

- Government Policy Impact: Indonesian government policies aimed at domestic energy security and price control significantly shape the operating environment for coal exporters.

Bayan Resources operates under Indonesia's mining laws, which govern its concessions. Recent amendments leading up to 2025 have increased regulatory stringency for license issuance and renewals, impacting operational certainty.

Environmental regulations demand strict compliance with reclamation, waste management, and pollution prevention, crucial for maintaining licenses and avoiding penalties. The PROPER program, assessing environmental performance, continues to be a key focus for Indonesian industries.

Indonesian labor laws, including those modified by the 2020 Omnibus Law on Job Creation, dictate workplace standards and employee rights, requiring ongoing adaptation by companies like Bayan Resources.

As a publicly listed company, Bayan Resources must adhere to corporate governance and disclosure mandates from regulators like the OJK, ensuring transparency and investor confidence through timely financial and sustainability reporting.

Environmental factors

Global and national climate change policies are increasingly pressuring coal mining companies like Bayan Resources. Indonesia, for instance, has committed to reducing greenhouse gas emissions and achieving net-zero targets, which directly impacts the demand for thermal coal, Bayan's primary product. This policy shift toward lower-carbon energy sources creates significant headwinds.

In 2023, Indonesia's energy minister reiterated the country's commitment to its Nationally Determined Contribution (NDC) under the Paris Agreement, aiming for a 32% emissions reduction by 2030 without international support. This, coupled with international initiatives like the Powering Past Coal Alliance, signals a long-term decline in the market for thermal coal, although the transition will take time.

Bayan Resources' mining activities necessitate significant investment in land rehabilitation post-operation, a critical environmental factor. By 2024, the company was actively engaged in reclaiming disturbed areas, aiming to restore ecological balance and prevent long-term degradation.

Managing biodiversity within its concession areas is paramount for Bayan Resources. The company's 2024 sustainability reports highlighted initiatives focused on protecting native flora and fauna, demonstrating a commitment to mitigating the impact of its operations on local ecosystems.

Bayan Resources' coal mining operations can significantly impact water resources. In 2023, the company reported substantial water usage for its mining and processing activities, a trend expected to continue into 2024. This consumption, coupled with the potential for acid mine drainage and sediment runoff, necessitates robust water management strategies to mitigate environmental damage.

Effective water management is crucial for Bayan Resources' environmental compliance and long-term sustainability. The company's 2024 environmental report highlights ongoing investments in wastewater treatment facilities and pollution control technologies. These measures aim to reduce the discharge of pollutants into nearby rivers and groundwater sources, aligning with stricter environmental regulations expected to be enforced through 2025.

Air Quality and Dust Control

Mining, processing, and transporting coal, as undertaken by Bayan Resources, inherently generate dust and particulate matter, directly impacting local air quality. This necessitates robust dust control measures to meet stringent environmental regulations and safeguard community health.

Bayan Resources is committed to employing advanced technologies and operational best practices to mitigate air pollution. For instance, in 2023, the company reported investing in dust suppression systems across its key operational sites, aiming to reduce particulate matter emissions by an estimated 15% compared to previous years.

- Dust Suppression Technology: Implementation of water sprays, chemical suppressants, and covered conveyor systems at mining and processing facilities.

- Fleet Management: Regular maintenance and upgrades of transportation vehicles to minimize exhaust emissions and dust generation.

- Monitoring and Compliance: Continuous air quality monitoring to ensure adherence to national and provincial air quality standards, with reported compliance rates exceeding 98% in 2023.

Environmental Impact Assessments and Permitting

Bayan Resources must navigate Indonesia's rigorous environmental impact assessment process, known as AMDAL, to secure and retain operational permits. This involves detailed evaluations of potential environmental risks associated with its mining activities and the development of specific mitigation strategies to minimize harm. For instance, in 2023, the company reported ongoing compliance with its AMDAL commitments across its various concessions, underscoring the critical nature of these assessments for its legal standing.

Adherence to these assessments and continuous environmental monitoring are paramount for Bayan Resources’ social license to operate. Failure to comply can lead to significant penalties and reputational damage, impacting stakeholder trust and future project approvals. The company’s 2024 sustainability report highlighted continued investment in environmental monitoring technologies to ensure ongoing compliance with regulatory requirements and best practices.

- AMDAL Compliance: Bayan Resources actively engages in AMDAL processes for all new projects and expansions, ensuring thorough risk evaluation.

- Mitigation Measures: The company implements proposed mitigation strategies, such as water management and land rehabilitation, as mandated by environmental permits.

- Monitoring and Reporting: Ongoing environmental monitoring is conducted to track the effectiveness of mitigation measures and ensure adherence to permit conditions.

- License to Operate: Strict compliance with environmental regulations and impact assessments is fundamental to maintaining Bayan Resources' legal and social license to conduct its operations.

Global climate policies are increasingly impacting coal miners like Bayan Resources, with Indonesia committed to net-zero targets. This shift towards lower-carbon energy sources creates significant challenges for thermal coal demand, Bayan's primary product. By 2024, Bayan was actively engaged in land rehabilitation, a key environmental factor for restoring ecological balance post-mining.

Bayan Resources' operations significantly affect water resources, with substantial water usage reported in 2023, expected to continue into 2024. The company is investing in wastewater treatment and pollution control to meet stricter environmental regulations through 2025, aiming to reduce pollutant discharge.

Mining and transportation activities generate dust, impacting local air quality, making dust control measures essential for Bayan Resources. In 2023, the company invested in dust suppression systems, aiming for a 15% reduction in particulate matter emissions compared to previous years.

Bayan Resources must adhere to Indonesia's AMDAL process for operational permits, involving detailed environmental risk assessments and mitigation strategies. In 2023, the company reported ongoing AMDAL compliance, crucial for its legal standing and social license to operate.

| Environmental Factor | Bayan Resources' Focus/Action | Key Data/Commitment |

| Climate Change Policies | Navigating global and national emission reduction targets | Indonesia's NDC aims for 32% emissions reduction by 2030. |

| Land Rehabilitation | Restoring disturbed mining areas | Active engagement in reclamation efforts by 2024. |

| Water Management | Investing in wastewater treatment and pollution control | Ongoing investments in facilities; aim to reduce pollutant discharge. |

| Air Quality | Implementing dust suppression systems | Reported 15% reduction in particulate matter emissions in 2023. |

| Regulatory Compliance | Adhering to AMDAL and environmental monitoring | Reported ongoing AMDAL compliance in 2023; >98% compliance with air quality standards. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bayan Resources is built on data from reputable sources including government publications, financial market reports, and industry-specific analyses. We incorporate insights from regulatory bodies, economic indicators, and technological advancements relevant to the mining and energy sectors.