Bath & Body Works, LLC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bath & Body Works, LLC Bundle

Bath & Body Works, LLC operates within a dynamic external environment. Political shifts can influence trade policies and consumer protection laws, while economic fluctuations directly impact discretionary spending on their products. Understanding these forces is crucial for strategic planning and risk mitigation.

Unlock a comprehensive understanding of the external factors shaping Bath & Body Works, LLC's future. Our PESTEL Analysis provides actionable intelligence on political, economic, social, technological, environmental, and legal trends. Download the full version now and gain the strategic advantage you need to navigate the market effectively.

Political factors

Government regulations concerning product safety and labeling significantly shape Bath & Body Works' operations. Stricter rules on ingredients, testing methodologies, and clear labeling for cosmetics and personal care items necessitate robust product development and manufacturing protocols. For instance, the EU's Cosmetic Regulation (EC) No 1223/2009, which mandates comprehensive safety assessments and ingredient transparency, impacts market entry and product formulation across its global footprint. This requires continuous investment in compliance and agility to adapt to varying international standards, ensuring consumer trust and market access.

Global trade policies and tariffs significantly impact Bath & Body Works' international operations. Fluctuations in trade agreements, tariffs, and import/export duties directly influence the cost of sourcing raw materials and manufacturing goods, subsequently affecting product pricing in overseas markets. For instance, a 2023 report indicated that the cost of certain fragrance ingredients, crucial for Bath & Body Works, saw a 5% increase due to new import duties in key Asian sourcing regions.

Changes in these trade policies can disrupt supply chain efficiency, potentially leading to increased lead times and higher logistics expenses for the company's franchised stores and e-commerce platforms. In 2024, several European nations introduced new regulations on imported consumer goods, which could add an estimated 2-3% to the cost of goods sold for Bath & Body Works' European operations, impacting overall profitability.

Political stability in key markets is a critical consideration for Bath & Body Works. For instance, in 2024, ongoing geopolitical tensions in Eastern Europe and the Middle East continue to pose risks to global supply chains and energy prices, potentially impacting operational costs and consumer discretionary spending in regions where Bath & Body Works has a presence.

Instability can directly affect business continuity. If a major market experiences significant political unrest, it could disrupt store operations, lead to temporary closures, or necessitate costly security measures. This was evident in some markets during 2023 where localized political events led to short-term retail disruptions.

Furthermore, political instability often correlates with currency fluctuations. A volatile political climate can weaken a nation's currency, making imported goods, including those sourced by Bath & Body Works, more expensive. This can squeeze profit margins or force price increases, potentially dampening consumer purchasing power and demand for non-essential items.

Consumer protection laws

Consumer protection laws significantly influence Bath & Body Works' marketing and customer service. Regulations surrounding advertising claims, product warranties, and return policies mandate transparency and fairness. For instance, the Federal Trade Commission (FTC) in the US enforces truth-in-advertising standards, requiring that product claims are substantiated. This means Bath & Body Works must ensure its marketing messages about product efficacy or ingredients are accurate and not misleading to avoid penalties and maintain consumer trust.

Adherence to these legal frameworks is crucial for preventing legal disputes and safeguarding the company's reputation. In 2024, companies face increased scrutiny regarding data privacy and product safety, with potential fines for non-compliance. Bath & Body Works must navigate these evolving consumer protection landscapes to foster customer loyalty and ensure operational integrity.

- Advertising Substantiation: Laws require that all advertising claims, especially those related to product benefits or ingredients, are truthful and backed by evidence.

- Product Safety and Labeling: Regulations dictate how products must be manufactured, tested, and labeled to ensure consumer safety and provide clear usage instructions.

- Return and Refund Policies: Consumer protection statutes often set minimum standards for return and refund processes, ensuring customers can seek recourse for unsatisfactory products.

- Data Privacy: With growing concerns over personal information, laws like the California Consumer Privacy Act (CCPA) require companies to be transparent about data collection and usage, impacting how Bath & Body Works handles customer data.

Government incentives or disincentives for retail or manufacturing

Government incentives, like tax credits for domestic manufacturing or investments in sustainable production, can significantly lower Bath & Body Works' operational costs and encourage expansion in regions offering such benefits. Conversely, increased taxes on specific retail goods or stricter environmental regulations could raise expenses and influence sourcing or product development strategies.

For instance, the US Inflation Reduction Act of 2022 offers significant tax credits for renewable energy and electric vehicles, which could indirectly benefit Bath & Body Works if they invest in greener logistics or manufacturing processes. Similarly, state-level incentives for job creation or capital investment in new retail or distribution centers can make certain locations more attractive for expansion. The company's 2024 strategic planning likely incorporates an analysis of these evolving fiscal policies across its key operating markets.

- Tax Credits: Potential for reduced tax liability on investments in energy-efficient manufacturing or domestic supply chain development.

- Subsidies for Sustainability: Government grants or subsidies for adopting eco-friendly packaging or reducing carbon footprints in operations.

- Local Economic Development Programs: Incentives offered by states or municipalities for opening new retail stores or distribution centers, often tied to job creation.

- Trade Tariffs and Duties: Government policies on imported raw materials or finished goods can impact the cost of inventory and necessitate adjustments to global sourcing strategies.

Government regulations on product safety and labeling, such as the EU's Cosmetic Regulation, directly impact Bath & Body Works' product development and global market access. Trade policies and tariffs influence sourcing costs and pricing, with new regulations in Europe potentially increasing the cost of goods sold by 2-3% in 2024.

Political stability is crucial, as geopolitical tensions in 2024 can disrupt supply chains and consumer spending. Consumer protection laws, enforced by bodies like the FTC, mandate truth in advertising and data privacy, requiring Bath & Body Works to maintain transparency and avoid misleading claims to preserve its reputation.

Government incentives, like tax credits under the US Inflation Reduction Act, can lower operational costs for sustainable practices, while increased taxes or stricter environmental rules could raise expenses.

What is included in the product

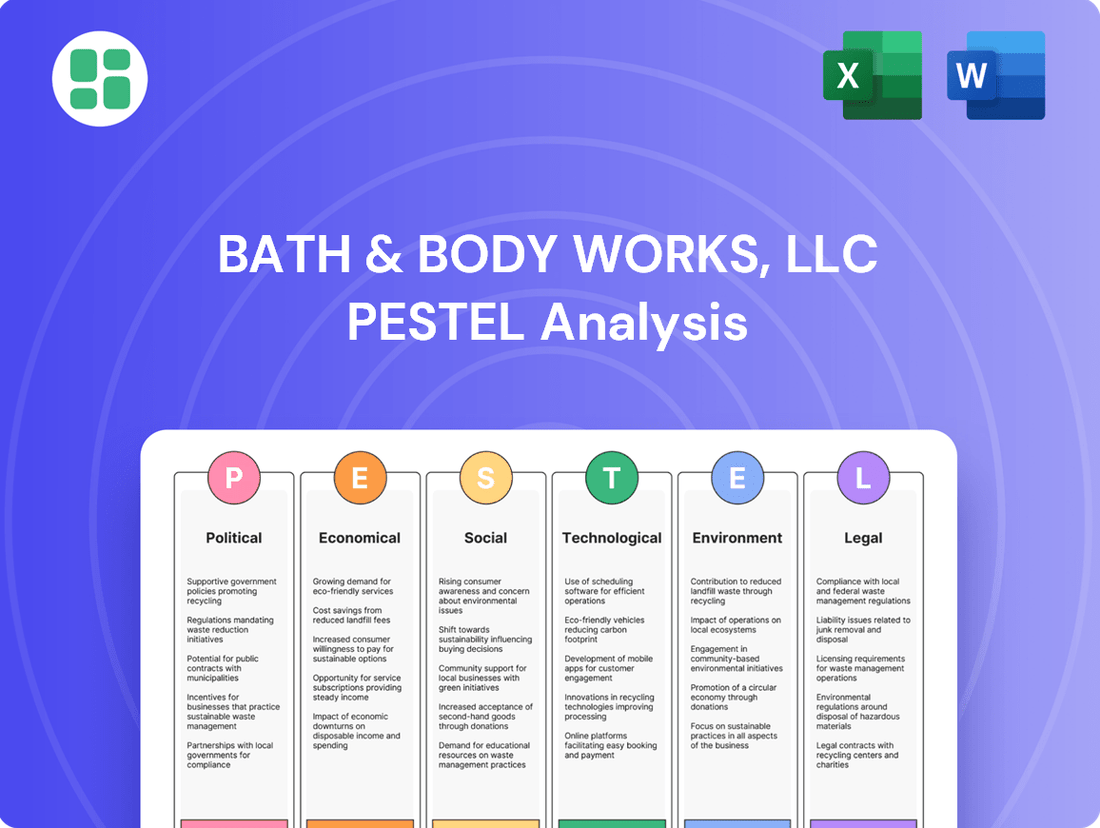

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Bath & Body Works, LLC, providing a comprehensive overview of the external forces shaping its operations and strategy.

It offers actionable insights for navigating market complexities and identifying strategic advantages by detailing how these macro-environmental elements influence the company's performance and future growth.

This PESTLE analysis for Bath & Body Works, LLC acts as a pain point reliever by offering a clear, summarized version of external factors, enabling quick identification of potential market challenges and opportunities for strategic planning.

Economic factors

Consumer spending habits are a major driver for Bath & Body Works, particularly as many of its products fall into the discretionary spending category. When consumers have more disposable income, they are more likely to purchase items like candles, lotions, and soaps that enhance their personal care routines or home ambiance. For instance, in the first quarter of 2024, while inflation showed signs of easing, consumer spending remained robust, though shifts towards value-oriented purchases were noted by some analysts, potentially impacting premium product sales.

Inflation significantly impacts Bath & Body Works by driving up the costs of essential inputs like fragrances, oils, packaging materials, and even employee wages. For instance, the Producer Price Index for chemicals, a key component in many personal care products, saw a notable increase in late 2024, directly affecting manufacturing expenses. This necessitates careful consideration of pricing strategies to avoid alienating price-sensitive customers while safeguarding profitability.

The company faces a critical decision: absorb these rising costs, which would compress profit margins, or pass them on to consumers through higher prices. A 2025 consumer sentiment survey indicated that while shoppers expect some price adjustments, significant increases could lead to reduced purchasing frequency for discretionary items like those sold by Bath & Body Works, highlighting the tightrope walk the company must navigate.

Fluctuations in exchange rates directly affect Bath & Body Works' international sales profitability. For instance, if the U.S. dollar strengthens against a foreign currency, sales made in that foreign currency will translate into fewer dollars, reducing reported revenue and profit. Conversely, a weaker dollar can boost reported international earnings.

The cost of imported goods is also sensitive to currency movements. If Bath & Body Works sources materials or finished products from countries with weaker currencies, a stronger dollar makes these imports cheaper, potentially improving margins. However, if the dollar weakens, the cost of these imports rises, squeezing profitability.

A stronger U.S. dollar can make Bath & Body Works' products more expensive for consumers in foreign markets, potentially hurting sales volume and competitiveness against local brands. Conversely, a weaker dollar can make its offerings more attractive abroad. For example, in Q1 2024, the company noted that foreign currency headwinds impacted its results, although specific figures for exchange rate impact on international sales were not detailed separately.

Economic growth or recession in key markets

The economic vitality of Bath & Body Works' primary markets directly impacts its performance. Strong GDP growth and robust employment figures in regions like the United States, which represented approximately 89% of the company's net sales in fiscal year 2023, typically correlate with increased consumer confidence and higher discretionary spending on items like personal care and home fragrance. This translates to better store traffic and sales for Bath & Body Works.

Conversely, economic downturns or recessions pose significant challenges. During periods of reduced economic activity, consumers tend to cut back on non-essential purchases. This can lead to a noticeable dip in demand for Bath & Body Works' products, potentially affecting sales volumes and profitability. For instance, a slowdown in consumer spending could directly impact the company's ability to achieve its projected revenue growth targets.

- GDP Growth: Continued GDP growth in the US and other key markets supports higher consumer spending on discretionary items.

- Employment Rates: High employment rates boost consumer confidence and disposable income, benefiting retailers like Bath & Body Works.

- Consumer Confidence: Fluctuations in consumer confidence directly influence purchasing decisions, particularly for non-essential goods.

- Recessionary Impact: Economic recessions typically lead to reduced discretionary spending, potentially decreasing demand for Bath & Body Works' product assortment.

Interest rates affecting borrowing and investment

Changes in interest rates significantly impact Bath & Body Works' borrowing costs for crucial capital expenditures like new store openings or technology upgrades. For instance, if the Federal Reserve maintains its target federal funds rate in the 5.25%-5.50% range, as it did through early 2024, borrowing becomes more expensive. This could potentially slow down expansion plans or increase the financial burden on existing debt.

Higher interest rates can also affect consumer spending habits, which in turn influences Bath & Body Works' sales. When borrowing costs rise for consumers, discretionary spending on items like home fragrances and personal care products may decrease. This could lead to softer demand for the company's offerings, impacting revenue growth.

- Impact on Debt Servicing: Rising interest rates increase the cost of servicing variable-rate debt, potentially squeezing profit margins for Bath & Body Works.

- Investment Decisions: Higher borrowing costs can make new store development or significant capital investments less attractive, potentially leading to a more conservative approach to expansion.

- Consumer Confidence: Elevated interest rates can dampen consumer confidence, leading to reduced discretionary spending on non-essential items sold by Bath & Body Works.

- Financing Costs for Expansion: For example, if Bath & Body Works were to issue new bonds in a higher-rate environment, the coupon payments would be greater, increasing overall financing expenses.

Consumer spending remains a critical economic factor for Bath & Body Works, with discretionary purchases like candles and lotions being highly sensitive to disposable income levels. While inflation showed signs of easing in early 2024, consumer spending patterns indicated a continued preference for value, potentially impacting sales of premium-priced items.

Inflationary pressures directly increase the cost of raw materials such as fragrances and packaging, as well as labor costs, impacting Bath & Body Works' profit margins. For example, the Producer Price Index for chemicals, a key input, saw increases in late 2024, necessitating careful pricing strategies to balance profitability with customer affordability.

Interest rates influence Bath & Body Works' borrowing costs for expansion and capital investments, with rates in the 5.25%-5.50% range persisting through early 2024. Higher rates can also dampen consumer spending on non-essential goods, potentially affecting the company's sales volume and revenue growth targets.

| Economic Factor | Impact on Bath & Body Works | Data Point/Example (2024-2025) |

|---|---|---|

| Consumer Spending | Directly affects sales of discretionary items. | Robust spending noted in Q1 2024, but with a shift towards value. |

| Inflation | Increases input costs and affects pricing strategy. | Producer Price Index for chemicals increased in late 2024. |

| Interest Rates | Impacts borrowing costs and consumer purchasing power. | Federal funds rate target remained 5.25%-5.50% through early 2024. |

| Exchange Rates | Affects profitability of international sales and cost of imports. | Foreign currency headwinds noted in Q1 2024 impacting results. |

Preview Before You Purchase

Bath & Body Works, LLC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Bath & Body Works, LLC delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market trends and strategic considerations.

Sociological factors

Consumers are increasingly prioritizing products made with natural ingredients and sourced sustainably, a trend that directly impacts brands like Bath & Body Works. This shift means a greater demand for transparency regarding ingredient origins and manufacturing processes, pushing companies to adopt more eco-friendly practices.

In 2024, the global market for natural and organic personal care products was valued at over $50 billion, with projections indicating continued robust growth. This growing demand encourages Bath & Body Works to review its product development, focusing on ingredient sourcing and marketing messages that highlight sustainability and natural formulations to attract environmentally conscious consumers.

The growing societal emphasis on health, wellness, and self-care directly fuels demand for products that provide therapeutic benefits, stress relief, and feature clean formulations. This trend is a significant driver for companies like Bath & Body Works to innovate in categories such as aromatherapy, essential oils, and skin-friendly ingredients.

Consumers are increasingly seeking products that contribute to their overall well-being, leading to a surge in interest for items promoting relaxation and mental health. For instance, the global aromatherapy market was valued at approximately $1.8 billion in 2023 and is projected to grow, indicating a strong consumer preference for scent-based wellness solutions.

Bath & Body Works is responding by expanding its offerings to include more products with natural extracts and calming properties. This strategic pivot aligns with consumer desires for transparency and efficacy, as evidenced by the increasing popularity of brands highlighting ‘free-from’ claims and plant-derived ingredients in the beauty and personal care sector.

Bath & Body Works needs to adapt to evolving demographics. The growing purchasing power of Gen Z, who prioritize authenticity and sustainability, means the brand must consider more eco-conscious product lines and transparent marketing. For instance, a 2024 Nielsen report indicated that 73% of Gen Z consumers are willing to pay more for sustainable products, a trend Bath & Body Works can leverage.

Changes in income distribution also play a crucial role. As economic disparities widen, Bath & Body Works may see a bifurcated impact on its customer base. While higher-income segments may continue to purchase premium products, lower-income consumers might become more price-sensitive, necessitating strategic promotions or value-oriented product offerings to maintain market share.

Cultural attitudes towards beauty and personal care

Cultural attitudes toward beauty and personal care are constantly shifting, directly impacting Bath & Body Works' product development and marketing. As consumers increasingly prioritize self-care and wellness, there's a growing demand for products that offer both sensory pleasure and functional benefits. This trend was evident in 2024, with continued strong sales in aromatherapy and mood-boosting scents. Global cultural diversity also plays a crucial role; what resonates in one region might not in another, requiring tailored approaches to fragrance profiles and marketing messages to appeal to local preferences.

Bath & Body Works must navigate these evolving perceptions to stay relevant. For instance, the growing emphasis on natural ingredients and sustainability in personal care, a trend gaining momentum through 2024 and projected to continue into 2025, influences consumer choices. This necessitates a careful review of product formulations and sourcing. Furthermore, the integration of home aesthetics, where scented products are seen as integral to creating a welcoming living space, opens new avenues for product innovation and cross-promotion.

- Evolving Self-Care Norms: Consumers increasingly view personal care products as essential for mental and emotional well-being, driving demand for calming and uplifting scents.

- Global Market Nuances: Preferences for fragrance intensity, ingredient types, and even packaging design vary significantly across different cultural landscapes, requiring localized strategies.

- Sustainability Focus: A growing segment of consumers, particularly Gen Z and Millennials, are prioritizing brands with transparent sourcing and eco-friendly practices in their beauty and personal care purchases.

- Home Ambiance: The perception of scented products as enhancers of home environment and personal comfort continues to grow, influencing purchasing decisions beyond traditional personal hygiene.

Influence of social media and online communities on brand perception

Social media platforms, particularly TikTok and Instagram, have become pivotal in shaping Bath & Body Works' brand perception. Influencers and user-generated content frequently showcase new product launches and promotions, directly impacting sales. For instance, viral TikTok trends featuring specific Bath & Body Works candles or body care items have historically led to rapid sell-outs, demonstrating the power of online communities in driving demand and fostering brand loyalty.

The rapid dissemination of customer reviews and experiences through online communities can significantly influence potential buyers. Positive sentiment amplified by social media can boost brand image, while negative feedback, if widespread, can quickly tarnish it. Bath & Body Works actively engages with these platforms to manage its online reputation and leverage trends for marketing purposes.

- Social Media Engagement: Bath & Body Works often sees significant engagement on platforms like TikTok, with videos related to their products garnering millions of views and likes, directly translating to increased product interest and sales.

- Influencer Marketing Impact: Collaborations with lifestyle influencers can introduce the brand to new demographics and reinforce product desirability, driving traffic to both online and physical stores.

- User-Generated Content (UGC): UGC, such as unboxing videos and product reviews, builds authenticity and trust, acting as powerful social proof that influences purchasing decisions.

- Viral Trends: The brand has benefited from viral trends, where specific products become highly sought after due to social media buzz, leading to temporary stock shortages and heightened brand awareness.

Societal shifts towards wellness and self-care continue to drive demand for Bath & Body Works products, particularly those offering aromatherapy and mood-boosting benefits. The global aromatherapy market, valued at approximately $1.8 billion in 2023, is projected for further growth, underscoring consumer interest in scent-based wellness solutions.

Consumers, especially younger demographics like Gen Z, increasingly prioritize authenticity and sustainability, with a 2024 Nielsen report indicating 73% of Gen Z are willing to pay more for sustainable products. This necessitates Bath & Body Works' focus on transparent sourcing and eco-friendly practices to align with evolving consumer values.

The brand's strong presence on social media platforms like TikTok and Instagram significantly influences its perception, with viral trends and user-generated content often leading to rapid product sell-outs. For instance, specific candle or body care items have historically experienced such surges in demand due to online buzz, highlighting the power of digital communities in driving sales and brand awareness.

| Sociological Factor | Impact on Bath & Body Works | Supporting Data/Trend |

| Wellness & Self-Care Emphasis | Increased demand for products with therapeutic and mood-enhancing properties. | Global aromatherapy market projected for growth from its 2023 valuation of ~$1.8 billion. |

| Demographic Shifts (Gen Z) | Growing importance of sustainability and authenticity in purchasing decisions. | 73% of Gen Z consumers willing to pay more for sustainable products (Nielsen, 2024). |

| Social Media Influence | Significant impact on brand perception, product popularity, and sales through viral trends and UGC. | Viral trends on TikTok and Instagram have led to rapid sell-outs of specific Bath & Body Works products. |

Technological factors

Bath & Body Works' online growth hinges on e-commerce advancements. The company must leverage sophisticated platforms, mobile optimization, and secure digital payment systems to enhance its digital storefront and drive sales. In 2023, e-commerce represented a significant portion of retail sales, with mobile commerce alone accounting for over 50% of online transactions, a trend expected to continue its upward trajectory through 2025.

Sophisticated digital marketing is paramount for Bath & Body Works to connect with its customer base. Personalized recommendations, driven by data analytics, and a seamless omnichannel experience, integrating online and in-store interactions, are critical for customer retention and increasing average order value. Companies investing in personalized marketing have seen conversion rates increase by as much as 20% in recent years.

Technological advancements in chemistry and material science are crucial for Bath & Body Works' product development. Innovations allow for the creation of novel fragrances and the enhancement of product efficacy, such as longer-lasting scents or improved skin-feel. For example, the company's investment in research and development drives the formulation of unique scent profiles and diverse product forms, from lotions to candles.

Manufacturing process improvements, driven by technology, directly impact production efficiency and cost-effectiveness. Bath & Body Works leverages automation and advanced manufacturing techniques to streamline operations, ensuring consistent product quality and faster market introductions. This technological edge is vital for maintaining a competitive edge in the fast-paced beauty and personal care market.

Bath & Body Works is leveraging automation and data analytics to streamline its supply chain. Technologies like AI-powered inventory management systems are crucial for optimizing stock levels across its numerous retail locations and online channels, aiming to reduce stockouts and overstock situations.

The company utilizes advanced logistics and route optimization software to enhance product distribution efficiency. This focus on reducing lead times, particularly for seasonal product launches, is key to maintaining responsiveness in a fast-paced retail environment. For instance, in 2023, the company reported efforts to improve inventory turnover, a metric directly impacted by supply chain optimization.

Data analytics for personalized marketing and inventory management

Bath & Body Works utilizes sophisticated data analytics and AI to deeply understand customer preferences, enabling highly personalized marketing. This allows them to tailor promotions and product recommendations, boosting engagement and sales.

By analyzing purchase history, browsing behavior, and demographic information, the company refines its marketing strategies. For instance, in 2024, they continued to invest in AI-driven personalization engines to enhance customer loyalty programs and targeted email campaigns, aiming for higher conversion rates.

This technological edge also extends to inventory management. Data analytics helps forecast demand for specific products across different store locations and online channels, minimizing stockouts and reducing excess inventory. This optimization is crucial for maintaining profitability and customer satisfaction, especially with their vast product catalog.

- Personalized Marketing: AI algorithms analyze customer data to deliver tailored offers and product suggestions, increasing conversion rates.

- Demand Forecasting: Big data analytics improves accuracy in predicting product demand, enabling better inventory planning.

- Inventory Optimization: Efficiently managing stock levels across physical stores and e-commerce platforms reduces waste and ensures product availability.

- Customer Behavior Insights: Continuous analysis of consumer patterns informs product development and merchandising strategies.

Emergence of new retail technologies (e.g., AI in-store, AR try-on)

Bath & Body Works is actively exploring how new retail technologies can elevate the in-store experience. For instance, AI-powered tools can personalize product recommendations, while augmented reality (AR) allows customers to virtually try on fragrances or visualize products in their homes, potentially boosting engagement and sales. The company's investment in technology is crucial for staying competitive in a rapidly evolving retail landscape.

These advancements offer tangible benefits:

- Enhanced Customer Experience: AI chatbots can provide instant, personalized assistance, improving customer satisfaction.

- Increased Sales Conversion: AR try-on features can reduce purchase hesitation and drive higher conversion rates.

- Data-Driven Insights: Technologies like smart mirrors or foot traffic sensors can provide valuable data on customer behavior, informing merchandising and store layout decisions.

- Operational Efficiency: AI can also streamline inventory management and staff allocation, leading to cost savings.

Bath & Body Works is heavily reliant on e-commerce platforms and mobile optimization to drive sales, with mobile commerce expected to continue its dominance in online transactions through 2025. Sophisticated digital marketing, powered by AI for personalized recommendations, is crucial for customer retention and increasing average order value, with data showing significant conversion rate increases for companies investing in this area. Technological advancements in product formulation, such as new fragrance compounds and improved efficacy, are key to their product development pipeline. Furthermore, the company utilizes automation and advanced manufacturing to ensure production efficiency and cost-effectiveness, vital for staying competitive.

The company leverages data analytics and AI for enhanced demand forecasting and inventory optimization across its channels, aiming to minimize stockouts and reduce excess inventory. This focus on data-driven insights also informs product development and merchandising strategies. New retail technologies, like AR for virtual try-ons, are being explored to elevate the in-store customer experience and potentially boost sales conversions. Operational efficiencies are also being sought through AI in areas like staff allocation.

Legal factors

Bath & Body Works faces significant legal obligations concerning product safety, including stringent regulations on ingredient sourcing, comprehensive allergen labeling, and rigorous testing protocols to prevent consumer harm. Compliance with these laws is paramount to avoid potential product recalls, costly lawsuits, and severe reputational damage.

Failure to adhere to these product liability laws and consumer safety regulations can lead to substantial financial penalties and a loss of consumer trust. For instance, the U.S. Food and Drug Administration (FDA) oversees cosmetics, and in 2023, the agency continued to emphasize the importance of ingredient transparency and safety testing for all products on the market.

Intellectual property rights are crucial for Bath & Body Works, safeguarding its distinctive fragrances, product packaging designs, and the iconic brand name from unauthorized use. These protections are vital for maintaining the company's unique market position and preventing competitors from capitalizing on its innovations.

A strong legal framework allows Bath & Body Works to defend its proprietary assets, such as patented scent formulas and registered trademarks for product lines like "Japanese Cherry Blossom." This defense is essential for preserving brand integrity and ensuring continued customer loyalty against potential infringements.

In fiscal year 2024, Bath & Body Works continued to invest in its brand, a significant portion of which is built upon its proprietary scent library and distinctive packaging. While specific figures for IP defense are not publicly itemized, the company's consistent focus on product innovation and brand marketing underscores the importance of these legal protections in its overall strategy.

Labor laws significantly influence Bath & Body Works' HR strategies and operational expenses. Minimum wage hikes, such as the federal minimum wage in the US, directly affect payroll costs for its vast retail workforce. Regulations concerning working conditions, overtime pay, and mandated employee benefits like paid sick leave or health insurance add further complexity and cost to human resource management across its global operations.

Anti-discrimination laws are crucial, requiring Bath & Body Works to ensure fair hiring, promotion, and compensation practices to avoid legal challenges and maintain a positive brand image. Compliance with these regulations across its retail stores, distribution centers, and corporate offices, which employ tens of thousands globally, necessitates robust HR policies and training programs. For instance, in 2023, the US Department of Labor continued to enforce wage and hour laws, impacting companies like Bath & Body Works with a significant hourly workforce.

Data privacy regulations (e.g., GDPR, CCPA)

Bath & Body Works, LLC must navigate a complex landscape of data privacy regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). These laws are critical for governing how customer data is collected, stored, and utilized, impacting everything from marketing to customer service.

Compliance necessitates robust data security measures to safeguard sensitive consumer information. Failure to do so can result in significant financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is greater. Beyond fines, breaches erode customer trust, a vital asset for any retail brand.

- GDPR fines can reach up to 4% of global annual revenue or €20 million.

- CCPA grants California consumers rights regarding their personal data, including the right to know and the right to delete.

- Maintaining customer trust is paramount; data breaches can lead to significant reputational damage.

- Investment in data security infrastructure and ongoing employee training is essential for compliance.

Advertising and marketing regulations

Advertising and marketing regulations significantly shape how Bath & Body Works communicates with its customers. Consumer protection laws, such as those enforced by the Federal Trade Commission (FTC) in the United States, mandate that all marketing claims must be truthful and substantiated. This means promotional activities, product descriptions, and digital communications must accurately reflect the benefits and ingredients of their products, preventing any misleading consumers about product efficacy or origin.

Transparency and fair marketing practices are not just ethical considerations but legal requirements. For instance, in 2023, the FTC continued its focus on deceptive advertising, issuing guidance and taking action against companies making unsubstantiated health or environmental claims. Bath & Body Works must ensure its loyalty programs, discount offers, and product testimonials adhere to these standards, avoiding bait-and-switch tactics or exaggerated benefits. Failure to comply can result in hefty fines and damage to brand reputation.

- Truth in Advertising: Regulations require all marketing claims to be accurate and backed by evidence, preventing misleading statements about product performance or ingredients.

- Consumer Protection Laws: Bodies like the FTC actively monitor and enforce laws against deceptive marketing practices, ensuring fair treatment for consumers.

- Digital Marketing Scrutiny: Online advertising, social media campaigns, and email marketing are subject to the same stringent regulations regarding transparency and accuracy.

- Promotional Offer Compliance: Sales, discounts, and loyalty programs must clearly outline terms and conditions to avoid consumer confusion or deception.

Legal frameworks significantly influence Bath & Body Works' operations, particularly concerning product safety and intellectual property. Strict regulations on ingredients and labeling, enforced by bodies like the FDA, are critical for consumer protection and avoiding costly litigation. The company's robust defense of its unique fragrances and brand name, including trademarks for popular lines, is essential for maintaining its market distinctiveness and preventing infringement.

Environmental factors

Bath & Body Works is facing growing pressure to ensure its ingredients, like palm oil and vanilla, are sustainably and ethically sourced. This means minimizing environmental damage and supporting fair labor conditions throughout its supply chain. For instance, in 2024, consumer demand for transparency in ingredient sourcing continued to rise, pushing brands to adopt more rigorous tracking methods.

The company is actively working to trace its supply chains and build partnerships with suppliers who adhere to responsible sourcing standards. This commitment is crucial for mitigating risks associated with deforestation and human rights violations, which can significantly impact brand reputation and consumer trust. By 2025, we expect to see further investment in traceability technologies and supplier audits.

Bath & Body Works faces scrutiny over its packaging waste, particularly its reliance on plastics. Consumers are increasingly demanding eco-friendly alternatives, pushing companies to innovate. In 2024, the company continued to explore strategies to reduce its environmental footprint.

Efforts include increasing the use of post-consumer recycled (PCR) content in packaging and developing more recyclable, reusable, or even compostable solutions. While specific 2024/2025 figures on plastic reduction are still emerging, the broader retail trend shows a significant push towards sustainability, with many brands aiming for substantial PCR content increases by 2025.

Bath & Body Works is actively working to reduce its carbon footprint across manufacturing and logistics. The company is focused on measuring and lowering greenhouse gas emissions originating from its production sites and the transportation networks that move its products. This includes efforts within its extensive supply chain operations.

The company has made commitments to align with science-based targets for emissions reduction, aiming to contribute to global climate goals. For instance, in 2023, Bath & Body Works reported progress towards its Scope 1 and Scope 2 emissions reduction goals, though specific percentage reductions are detailed in their annual sustainability reports, which are updated regularly. Their 2024 initiatives continue to build on these foundational efforts.

Consumer demand for eco-friendly products

Consumer demand for eco-friendly products significantly influences Bath & Body Works' strategy. The company is increasingly focusing on sustainable sourcing and ingredient transparency to meet this growing preference. For instance, a 2024 Nielsen report indicated that 60% of consumers are willing to pay more for sustainable products, a trend directly impacting purchasing decisions in the personal care sector.

Offering greener alternatives provides a competitive edge. Bath & Body Works can leverage this by highlighting its efforts in areas like reduced packaging waste and ethically sourced ingredients. This resonates with a key demographic, potentially driving market share. In 2025, the beauty industry is projected to see continued growth in the natural and organic segment, with sales expected to reach over $25 billion in the US alone.

- Sustainable Sourcing: Consumers expect brands to demonstrate responsible sourcing of raw materials, impacting ingredient selection for lotions, soaps, and fragrances.

- Packaging Innovation: Demand for reduced plastic and recyclable packaging is a key driver for product redesign and supply chain adjustments.

- Marketing Transparency: Brands that clearly communicate their sustainability initiatives and product lifecycle impact gain consumer trust and loyalty.

- Competitive Differentiation: Companies offering certified eco-friendly or cruelty-free products can carve out a distinct market position.

Climate change impact on supply chain or ingredient availability

Climate change poses a significant risk to Bath & Body Works' supply chain, particularly concerning natural ingredients. Extreme weather events, such as droughts and floods, can devastate agricultural yields, impacting the availability and price of key botanicals and essential oils. For instance, a prolonged drought in a major shea butter producing region could directly affect product formulations and costs.

The increasing frequency of severe weather patterns globally could lead to greater volatility in ingredient sourcing. This necessitates robust risk management and diversification of supply bases. Bath & Body Works may need to invest in more resilient sourcing partnerships and explore alternative, climate-resilient ingredients to mitigate potential disruptions.

- Ingredient Scarcity: Extreme weather events can reduce the availability of natural ingredients like shea, coconut oil, and various floral extracts.

- Price Volatility: Reduced supply due to climate impacts often leads to higher and more unpredictable ingredient costs.

- Supply Chain Disruptions: Damage to infrastructure or transportation routes from severe weather can hinder the movement of raw materials.

- Need for Adaptation: Companies like Bath & Body Works must develop strategies for adaptive sourcing and potentially explore synthetic or lab-grown alternatives.

Bath & Body Works is navigating increasing consumer and regulatory pressure for sustainable practices, particularly concerning ingredient sourcing and packaging. In 2024, a significant trend was the heightened demand for transparency in supply chains, pushing companies like Bath & Body Works to invest in traceability technologies and ethical sourcing partnerships. By 2025, the company is expected to further integrate these practices to mitigate risks and enhance brand reputation.

The company is actively addressing its environmental footprint, with a notable focus on reducing plastic waste and increasing the use of post-consumer recycled (PCR) content in its packaging. While specific 2024/2025 reduction targets are still being finalized, the broader retail sector is seeing a strong push towards sustainability, with many aiming for substantial PCR increases by 2025 to meet consumer expectations and potential regulatory changes.

Climate change presents a tangible risk to Bath & Body Works' supply chain, impacting the availability and cost of natural ingredients due to extreme weather events. This necessitates a strategic focus on diversifying sourcing and exploring climate-resilient alternatives to ensure consistent product availability and manage price volatility, a concern amplified in 2024 and projected to continue into 2025.

| Environmental Factor | Impact on Bath & Body Works | 2024/2025 Trends/Data |

|---|---|---|

| Sustainable Sourcing Pressure | Need for ethical and traceable ingredients (e.g., palm oil, vanilla) | 60% of consumers willing to pay more for sustainable products (Nielsen, 2024) |

| Packaging Waste Reduction | Demand for less plastic, more PCR content, and recyclable solutions | Beauty industry projected US sales of natural/organic products over $25 billion by 2025 |

| Carbon Footprint Management | Reducing emissions in manufacturing and logistics | Continued alignment with science-based targets for emissions reduction |

| Climate Change Risks | Supply chain disruptions from extreme weather affecting ingredient availability and cost | Increased volatility in sourcing key botanicals and essential oils |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bath & Body Works, LLC is meticulously constructed using data from reputable market research firms, consumer trend reports, and publicly available financial statements. We also incorporate insights from industry-specific publications and government economic indicators.