Bath & Body Works, LLC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bath & Body Works, LLC Bundle

Discover the strategic framework behind Bath & Body Works, LLC's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering invaluable insights for aspiring entrepreneurs and seasoned strategists alike. Unlock the full blueprint to understand how they capture market share and drive profitability.

Partnerships

Bath & Body Works maintains a vital supplier network for everything from fragrance oils and lotions to packaging materials. In 2024, the company continued to focus on strengthening these relationships to ensure a steady flow of quality components needed for their extensive product lines. This network is crucial for their ability to innovate and maintain a resilient supply chain.

Bath & Body Works relies on a robust network of logistics and distribution partners to ensure its products reach over 1,700 stores and a growing e-commerce customer base efficiently. These partners are critical for managing inventory across numerous distribution centers and facilitating timely deliveries, including last-mile services, which are vital for their omnichannel approach. In 2024, the company continued to optimize these relationships to manage costs and improve delivery speed, a key factor in customer satisfaction for a retail brand with such a wide geographic reach.

Bath & Body Works actively partners with technology and digital solution providers like Accenture to drive its digital transformation. These collaborations are crucial for modernizing their online presence and improving how customers interact with the brand.

By leveraging advanced technologies, including AI and generative AI, these partnerships enable Bath & Body Works to create innovative tools. For instance, digital fragrance finders powered by AI enhance the online shopping experience, making it easier for customers to discover products. This focus on digital innovation aims to boost online engagement and streamline operations.

In 2023, companies in the retail sector significantly increased their spending on digital transformation initiatives, with many allocating substantial budgets to AI and cloud solutions to enhance customer experience and operational efficiency. Bath & Body Works' strategic partnerships align with this broader industry trend, indicating a commitment to staying competitive in the evolving digital landscape.

Brand Collaboration Partners

Bath & Body Works actively pursues brand collaborations to enhance its product offerings and market reach. A prime example is their partnership with Netflix for a Bridgerton-themed collection. This initiative created exclusive, limited-edition product assortments that tapped into the show's popularity.

These collaborations are designed to generate significant customer excitement and attract new demographics. By aligning with popular entertainment, such as Bridgerton, Bath & Body Works reinforces its brand relevance within current pop culture trends. This strategy leverages the emotional connection consumers have with these media properties to amplify the sensory appeal of their fragrances and products.

- Netflix Bridgerton Collection: Launched in 2022, this collaboration featured fragrances and body care items inspired by the popular series, driving significant social media engagement and sales.

- Pop Culture Integration: These partnerships aim to connect the brand with trending cultural moments, making the products feel timely and desirable.

- New Customer Acquisition: By associating with widely recognized entertainment franchises, Bath & Body Works can attract consumers who may not have previously engaged with their brand.

Non-profit and ESG Partners

Bath & Body Works actively collaborates with non-profit organizations like Good360 and The Nature Conservancy, embedding these relationships into its core ESG strategy. These partnerships are designed to amplify the company's commitment to environmental stewardship and community support, directly impacting its operational footprint and social responsibility.

Through product donations facilitated by Good360, Bath & Body Works aims to reduce waste and contribute to community well-being. For instance, in 2023, the company donated over $10 million worth of products, diverting significant amounts from landfills and providing essential items to those in need, underscoring the tangible impact of these alliances.

- Good360 Partnership: Focuses on product donations to minimize environmental impact and support community needs, diverting unsold inventory from landfills.

- The Nature Conservancy Collaboration: Supports water protection projects, aligning with Bath & Body Works' commitment to environmental sustainability and resource conservation.

- ESG Integration: These partnerships are fundamental to the company's broader environmental, social, and governance (ESG) framework, driving responsible business practices.

Bath & Body Works' key partnerships extend to its supply chain, including fragrance oil producers and packaging manufacturers, ensuring consistent access to quality raw materials. The company also leverages relationships with logistics providers to manage its extensive store and e-commerce distribution networks efficiently. Furthermore, strategic alliances with technology firms are crucial for driving digital innovation, enhancing customer experience through AI-powered tools.

Brand collaborations, such as the popular Bridgerton collection with Netflix, are vital for generating customer excitement and attracting new audiences. Additionally, partnerships with non-profits like Good360 and The Nature Conservancy are integral to Bath & Body Works' ESG strategy, focusing on product donations and environmental conservation efforts.

| Partner Type | Example | Strategic Importance | 2023/2024 Impact |

| Supplier Network | Fragrance Oil Producers | Ensures consistent quality and availability of key ingredients. | Continued focus on strengthening relationships for supply chain resilience. |

| Logistics & Distribution | Third-Party Logistics Providers | Facilitates efficient delivery to over 1,700 stores and e-commerce customers. | Optimization of relationships to manage costs and improve delivery speed. |

| Technology & Digital | Accenture, AI Solution Providers | Drives digital transformation, enhances online customer experience. | Implementation of AI for tools like digital fragrance finders; aligns with industry digital spend increases. |

| Brand Collaborations | Netflix (Bridgerton) | Generates customer excitement, attracts new demographics, and leverages pop culture trends. | Successful integration with popular media to boost brand relevance and sales. |

| ESG & Non-Profit | Good360, The Nature Conservancy | Supports environmental stewardship and community well-being, reduces waste. | Over $10 million in product donations in 2023 via Good360; supports water protection projects. |

What is included in the product

Bath & Body Works, LLC's Business Model Canvas centers on delivering a wide range of personal care and home fragrance products to a broad customer base through a strong omnichannel retail presence.

It details key partnerships with suppliers, efficient cost structures focused on marketing and inventory, and revenue streams derived from direct-to-consumer sales and wholesale.

Bath & Body Works, LLC's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their customer segments (e.g., gift-givers, self-care enthusiasts) and their value propositions (e.g., affordable luxury, sensory experiences), streamlining strategy for quick review and adaptation.

Activities

Bath & Body Works' product design and development is a core activity, fueling their constant innovation. They introduce a significant number of new products each year, with figures often ranging between 300 to 400 new stock keeping units (SKUs) annually. This relentless pace ensures their offerings remain fresh and exciting for consumers.

This process goes beyond just creating new scents; it involves deep dives into fragrance research and development, exploring novel packaging solutions to enhance appeal, and meticulously analyzing consumer trends. For instance, in 2024, the company continued to focus on sensorial experiences and sustainable packaging options as key drivers in their development pipeline.

These efforts are vital for Bath & Body Works to stay ahead in the competitive beauty and home fragrance market. By consistently refreshing their product portfolio and aligning with evolving consumer preferences, they effectively drive sales and maintain strong market relevance.

Bath & Body Works directly manages the manufacturing and production of its extensive product lines, encompassing everything from body lotions and shower gels to hand soaps, candles, and air fresheners. This hands-on approach ensures quality control and alignment with their brand's focus on on-trend, affordable luxuries.

The company heavily relies on a supply chain primarily located within the United States. This U.S.-based infrastructure is crucial for maintaining agility, fostering innovation, and efficiently delivering their popular personal care and home fragrance items to market.

Bath & Body Works focuses on efficiently managing its vast retail footprint, which includes over 1,890 company-operated stores in the U.S. and Canada, alongside more than 525 international franchised locations. This involves optimizing store layouts, visual merchandising, and inventory control to ensure a seamless and engaging customer experience.

The company's physical stores are a crucial sales channel, driving a significant portion of its revenue. Effective store management ensures product availability and appealing displays, directly impacting sales performance and customer loyalty.

E-commerce and Digital Platform Management

Maintaining and enhancing Bath & Body Works' robust online store and mobile app is a critical activity, as their digital platform is a significant revenue driver. In fiscal year 2023, digital sales represented approximately 18% of the company's total net sales, underscoring its importance.

Continuous investment in e-commerce technology is essential to expand reach, boost customer engagement, and facilitate omnichannel features such as buy online, pick up in store (BOPIS).

- Digital Sales Growth: In fiscal year 2023, digital sales contributed significantly to Bath & Body Works' overall revenue.

- Omnichannel Integration: Enhancing BOPIS and other integrated shopping experiences is a key focus for customer convenience.

- Technology Investment: Ongoing upgrades to the e-commerce platform ensure a seamless and engaging online customer journey.

Marketing and Brand Promotion

Bath & Body Works actively promotes its brand and products through a multi-channel approach. This includes targeted advertising, engaging social media campaigns, and robust loyalty programs designed to boost brand awareness and drive sales.

Recent marketing strategies have shifted towards fewer, more impactful campaigns. A notable example is the increased leverage of platforms like TikTok, aiming to connect with and engage younger consumer demographics.

- Brand Awareness: Focused campaigns aim to increase recognition and recall among target audiences.

- Digital Engagement: Social media, particularly TikTok, is a key channel for direct consumer interaction and trend adoption.

- Loyalty Programs: Initiatives like the My Bath & Body Works Rewards program encourage repeat purchases and customer retention.

- Sales Growth: Marketing efforts are directly tied to driving top-line revenue and market share.

Bath & Body Works' key activities encompass product innovation through extensive R&D, with hundreds of new SKUs annually, focusing on sensorial experiences and sustainable packaging as seen in 2024. They directly manage manufacturing and production, primarily within the U.S. supply chain, ensuring quality control for their diverse product range.

Efficiently managing a vast retail network of over 1,890 U.S./Canada stores and 525 international franchised locations is crucial for sales and customer experience. Simultaneously, they invest in their digital platform, where online sales represented about 18% of total net sales in fiscal year 2023, enhancing e-commerce technology for expanded reach and omnichannel capabilities.

Brand promotion involves multi-channel marketing, including social media engagement like TikTok, and loyalty programs. These efforts aim to boost brand awareness and drive sales, with a strategic shift towards fewer, more impactful campaigns.

| Key Activity | Description | Supporting Data/Focus |

| Product Design & Development | Innovation and new product introductions. | 300-400 new SKUs annually; focus on sensorial experiences and sustainable packaging (2024). |

| Manufacturing & Production | Direct management of product creation. | Primarily U.S.-based supply chain for agility and quality. |

| Retail Store Management | Optimizing physical store operations and customer experience. | Over 1,890 company-operated stores (U.S./Canada); 525+ international franchised locations. |

| E-commerce Operations | Enhancing online sales and digital customer engagement. | Digital sales were ~18% of total net sales in FY2023; investment in omnichannel features. |

| Marketing & Brand Promotion | Driving brand awareness and sales through various channels. | Leveraging social media (e.g., TikTok); loyalty programs; focused campaigns. |

Full Document Unlocks After Purchase

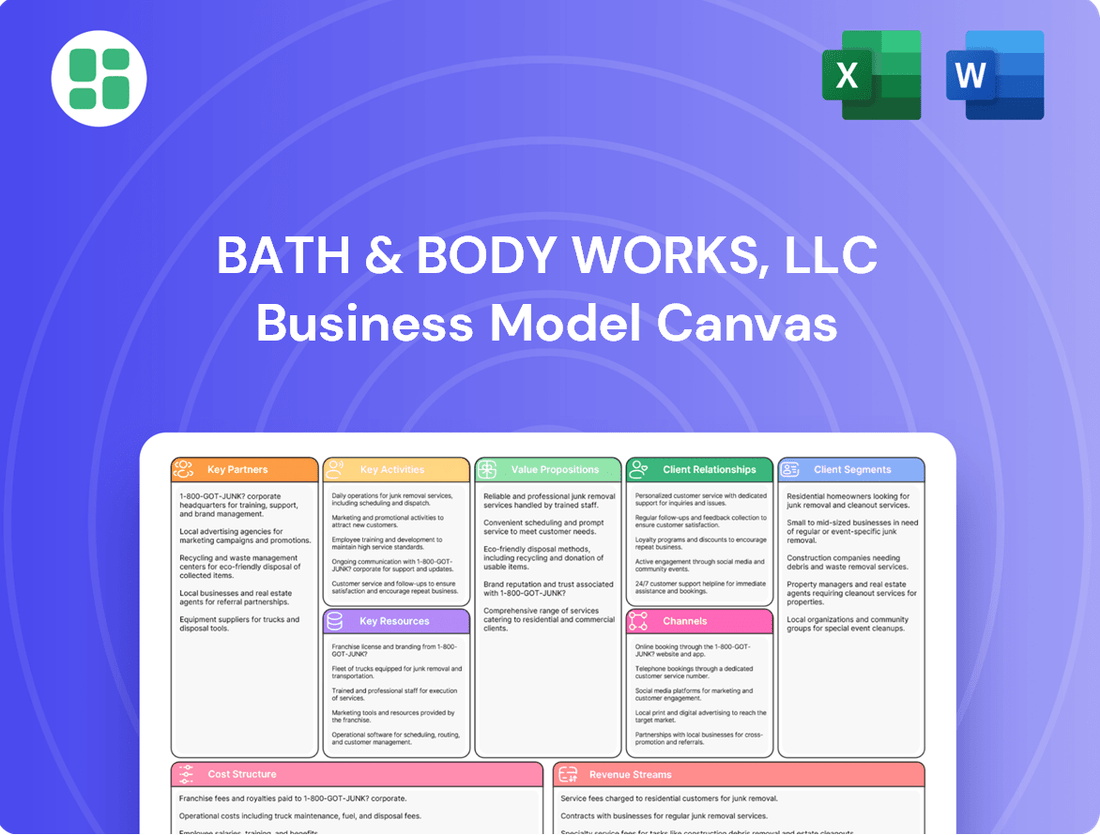

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview details Bath & Body Works' key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You'll gain full access to this professionally structured and ready-to-use analysis, enabling you to understand their strategic approach to the retail market.

Resources

Bath & Body Works' brand intellectual property, particularly its proprietary fragrance formulas and unique product designs, forms a cornerstone of its business model. These exclusive scents and innovative product concepts are not merely assets but critical differentiators in a crowded consumer goods market.

This strong portfolio of intellectual property directly fuels customer loyalty and commands premium pricing. For instance, in fiscal year 2023, the company reported net sales of $7.5 billion, a testament to the enduring appeal of its differentiated offerings, which are heavily reliant on these unique creations.

Bath & Body Works boasts an extensive retail store network, a cornerstone of its business model. This network, comprising over 1,700 company-operated stores in North America and a growing international franchise presence, provides a vital physical touchpoint for customers.

The company’s strategically placed stores offer an immersive brand experience, allowing customers to engage directly with products and staff. This physical footprint is crucial for driving sales and fostering brand loyalty in the competitive retail landscape.

As of the first quarter of 2024, Bath & Body Works operated approximately 1,746 stores. This vast network ensures broad market accessibility and facilitates impulse purchases, a significant driver for their product categories.

Bath & Body Works' e-commerce platform and digital infrastructure, encompassing its website and mobile app, are critical resources. These digital assets are the backbone of its online sales operations and direct customer engagement efforts, allowing for seamless transactions and personalized experiences.

The company consistently invests in enhancing this technology. For instance, in fiscal year 2023, Bath & Body Works reported that digital sales represented approximately 20% of total net sales, underscoring the importance of these ongoing technology investments to support its omnichannel strategy.

These investments empower customers with the flexibility to shop conveniently across various channels, anytime and anywhere. This commitment to a robust digital presence is crucial for maintaining customer loyalty and driving future growth in an increasingly digital retail landscape.

Global Supply Chain and Distribution Centers

Bath & Body Works leverages a complex global supply chain to source materials and manufacture its wide array of products. This network is critical for maintaining the quality and availability of their popular items.

The company operates five major distribution centers strategically located across North America. These hubs are the backbone of their inventory management, ensuring products reach stores and customers efficiently.

This infrastructure is designed for agility, enabling Bath & Body Works to quickly adjust production and distribution in response to changing consumer preferences and seasonal demand. For instance, their ability to ramp up production for holiday gift sets relies heavily on this robust system.

Key aspects of Bath & Body Works' supply chain and distribution include:

- Global Sourcing: Procurement of raw materials and finished goods from international and domestic suppliers.

- Inventory Management: Sophisticated systems to track stock levels across all locations and channels.

- Distribution Network: Five strategically placed North American distribution centers facilitating timely product movement.

- Logistics and Transportation: Efficient management of shipping and delivery to retail stores and direct-to-consumer channels.

Skilled Workforce and Human Capital

Bath & Body Works relies heavily on a dedicated and skilled workforce, a critical resource for its success. This includes talented product designers and perfumers who are the architects of their popular scents, as well as knowledgeable retail associates who provide the signature customer experience. Marketing professionals are also key, driving brand awareness and engagement.

The expertise within this human capital is what fuels innovation and ensures the delivery of Bath & Body Works' unique brand promise. For instance, their ability to consistently launch new, appealing fragrances is directly tied to the creativity and technical skill of their perfumery team. In 2023, the company employed approximately 80,000 associates globally, highlighting the scale of their human resource investment.

- Product Innovation: Expertise in fragrance development and product formulation.

- Customer Experience: Skilled retail associates driving sales and brand loyalty.

- Marketing and Branding: Professionals adept at creating compelling campaigns.

- Operational Excellence: Teams ensuring efficient supply chain and store operations.

Bath & Body Works' intellectual property, including proprietary fragrance formulas and unique product designs, is a core resource. This IP directly contributes to brand differentiation and customer loyalty, as evidenced by their fiscal year 2023 net sales of $7.5 billion, a figure heavily influenced by these exclusive offerings.

The company's extensive retail network, with approximately 1,746 stores as of Q1 2024, serves as a crucial physical touchpoint. This vast presence facilitates direct customer engagement and impulse purchases, reinforcing brand visibility.

Bath & Body Works' robust e-commerce platform and digital infrastructure are vital for online sales and customer interaction. Digital sales accounted for about 20% of total net sales in fiscal year 2023, highlighting the significance of these investments.

A complex global supply chain, supported by five North American distribution centers, ensures product availability and quality. This infrastructure allows for agile responses to market demand, crucial for seasonal product launches.

The company's dedicated workforce, including skilled perfumers and customer-focused retail associates, is a key resource. With approximately 80,000 global associates in 2023, their expertise drives innovation and brand experience.

Value Propositions

Bath & Body Works excels at offering premium personal care and home fragrance items without the hefty price tag. This approach makes those little luxuries, like a beautifully scented candle or a rich hand cream, accessible for everyday enjoyment by a wide range of customers.

Their strategy democratizes indulgence, allowing consumers to experience a touch of luxury without breaking the bank. This focus on value-conscious appeal is a cornerstone of their success, as evidenced by their consistent sales performance. For instance, in fiscal year 2023, Bath & Body Works reported net sales of $7.56 billion, demonstrating the broad market appeal of their accessible luxury proposition.

Bath & Body Works excels by offering a vast array of unique scents, ensuring there's something for everyone. Their consistent release of new seasonal collections, like the popular fall and holiday themes, keeps the product offering fresh and exciting, driving customer interest and repeat visits throughout the year.

This commitment to sensory variety is a key differentiator. By focusing on evocative fragrances, the company taps into consumer emotions and memories, creating a strong brand connection that goes beyond simple product utility.

In fiscal year 2023, Bath & Body Works reported net sales of $8.4 billion, with their fragrance-centric product lines playing a significant role in this performance, demonstrating the commercial success of their diverse scent strategy.

Bath & Body Works cultivates an immersive in-store atmosphere, transforming shopping into a sensory journey. This focus on an engaging environment encourages customers to explore and interact with products, fostering a deeper connection with the brand. In 2023, the company reported net sales of $7.56 billion, with a significant portion attributed to its brick-and-mortar presence.

Gifting Solutions for Various Occasions

Bath & Body Works excels at providing diverse gifting solutions, catering to a broad spectrum of occasions. Their extensive product range, from single items to thoughtfully assembled gift sets, solidifies their position as a go-to destination for consumers looking for presents. This emphasis on gifting convenience and appeal makes them a reliable choice for memorable gifts.

The brand's strategy often includes seasonal promotions and curated collections specifically designed for holidays and special events. For instance, during the 2023 holiday season, Bath & Body Works reported strong sales, with their gifting categories contributing significantly to their revenue. This highlights the effectiveness of their value proposition in meeting consumer demand for convenient and appealing gift options.

- Wide Product Selection: Offers individual items and curated gift sets for various occasions.

- Convenience: Positions itself as a reliable and easy choice for thoughtful presents.

- Seasonal Focus: Leverages holidays and special events with targeted gifting collections.

- Revenue Driver: Gifting categories are a significant contributor to overall sales performance.

Convenience through Omnichannel Presence

Bath & Body Works prioritizes customer convenience by offering a seamless omnichannel shopping experience. This means customers can easily transition between physical stores, their e-commerce website, and a dedicated mobile app. This integrated approach is crucial for meeting diverse customer preferences and ensuring accessibility.

The brand's commitment to convenience is further exemplified by services like buy online, pick up in store (BOPIS). This allows shoppers to browse and purchase items online and collect them at their nearest physical location, saving time and offering immediate gratification. In 2023, the retail sector saw a significant rise in BOPIS adoption, with many consumers valuing this flexibility.

- Omnichannel Integration: Customers can shop via brick-and-mortar stores, the Bath & Body Works website, and their mobile app.

- Flexible Fulfillment: Services like buy online, pick up in store enhance convenience and reduce delivery wait times.

- Enhanced Engagement: This approach allows for consistent brand interaction across all touchpoints, boosting customer loyalty.

- 2024 Trend: The demand for frictionless shopping experiences, including robust omnichannel options, continues to grow, with many retailers investing heavily in these capabilities.

Bath & Body Works' value proposition centers on making everyday luxuries accessible through a broad range of personal care and home fragrance products. They consistently offer a wide variety of unique scents, with new seasonal collections frequently introduced, keeping their offerings fresh and exciting. This strategy appeals to a broad customer base seeking both indulgence and value.

The brand excels at creating an immersive and engaging in-store experience, transforming shopping into a sensory journey that encourages product exploration and brand connection. Furthermore, they are a go-to destination for gifting, providing diverse solutions from individual items to curated gift sets, often enhanced by seasonal promotions.

Bath & Body Works ensures customer convenience through a seamless omnichannel shopping experience, allowing easy transitions between physical stores, their website, and mobile app. Services like buy online, pick up in store further enhance this convenience, meeting modern consumer demands for flexible and efficient purchasing.

| Value Proposition Aspect | Description | Key Benefit | Supporting Data (FY23 unless noted) |

|---|---|---|---|

| Accessible Luxury | Premium personal care and home fragrance items at approachable price points. | Everyday indulgence for a wide customer base. | Net sales of $7.56 billion. |

| Sensory Variety & Freshness | Extensive and unique scent library with frequent new seasonal collections. | Keeps offerings exciting, drives repeat visits and interest. | Fragrance-centric lines significantly contribute to revenue. |

| Immersive In-Store Experience | Engaging, sensory-rich retail environments. | Fosters deeper customer connection and product interaction. | Significant portion of net sales attributed to brick-and-mortar presence. |

| Gifting Solutions | Diverse range of individual items and curated gift sets for various occasions. | Convenient and appealing gifting options. | Strong sales in gifting categories during holiday seasons. |

| Omnichannel Convenience | Seamless integration of physical stores, website, and mobile app, with BOPIS. | Flexible and efficient shopping experience. | Growing consumer demand for frictionless and integrated retail experiences (2024 trend). |

Customer Relationships

Bath & Body Works cultivates deep customer connections via its My Bath & Body Works Rewards program, a cornerstone of its strategy. This initiative has enrolled millions of members, driving a substantial percentage of the company's domestic sales.

The rewards program is instrumental in encouraging repeat business and solidifying brand allegiance. It achieves this by providing members with exclusive benefits, such as special discounts and early access to new product launches, making customers feel valued and engaged.

At Bath & Body Works, trained retail associates are key to personalized in-store assistance. These associates offer tailored product recommendations, guiding customers through the extensive product lines to find what best suits their needs. This human touch elevates the shopping experience, making it more engaging and memorable.

Bath & Body Works leverages online channels for robust customer service and engagement, offering responsive support across social media and dedicated online platforms. This digital approach ensures customers receive assistance and can interact with the brand seamlessly. For instance, in the first quarter of fiscal 2024, Bath & Body Works reported that digital sales represented approximately 18% of their total net sales, highlighting the importance of these online interactions and service channels.

Seasonal Promotions and Event-Driven Sales

Bath & Body Works thrives on creating customer excitement through its signature seasonal promotions and event-driven sales. The Semi-Annual Sale, a cornerstone event, consistently draws significant customer traffic and boosts sales. For instance, the company's Q4 2023 results, which typically include the holiday season, showed a net sales increase of 10.1% to $3.0 billion, demonstrating the power of these timed events in driving revenue.

These carefully orchestrated events, such as the highly anticipated Semi-Annual Sale and various holiday-themed promotions, are designed to foster a sense of urgency and reward loyal customers. They not only drive immediate sales but also encourage customers to explore new product lines and replenish their stock of preferred items, reinforcing brand loyalty and increasing purchase frequency.

- Seasonal Promotions: Highly anticipated events like the Semi-Annual Sale generate significant buzz and sales volume.

- Event-Driven Sales: Holiday and themed events capitalize on consumer spending patterns to drive traffic and purchases.

- Customer Engagement: These promotions encourage exploration of new products and stocking up on favorites, fostering loyalty.

- Revenue Impact: Events are crucial for achieving sales targets, as evidenced by strong performance during key promotional periods.

Community Building and Brand Affinity

Bath & Body Works cultivates a loyal customer base by fostering a vibrant community, moving beyond simple product purchases to create genuine brand affinity. This is achieved through consistent, evocative brand messaging that emphasizes sensory pleasure and the enhancement of everyday routines.

- Community Engagement: Initiatives like loyalty programs and social media interaction encourage a sense of belonging among customers.

- Sensory Branding: The brand's focus on scent, texture, and visual appeal creates memorable, shared experiences that strengthen emotional connections.

- Customer Loyalty: In 2023, Bath & Body Works reported a significant portion of its sales came from repeat customers, underscoring the success of its community-building efforts.

- Brand Affinity: Consistent positive customer experiences and engaging marketing campaigns contribute to a strong emotional bond, leading to higher customer retention.

Bath & Body Works actively nurtures customer relationships through its My Bath & Body Works Rewards program, which drives a significant portion of domestic sales and fosters repeat business. Trained associates provide personalized in-store service, enhancing the customer experience. The company also utilizes digital channels for robust customer service and engagement, with digital sales representing approximately 18% of total net sales in Q1 fiscal 2024.

| Customer Relationship Strategy | Key Tactics | Impact/Data Point |

|---|---|---|

| Loyalty Program | My Bath & Body Works Rewards | Drives substantial domestic sales, encourages repeat business. |

| In-Store Personalization | Trained retail associates | Offer tailored product recommendations, enhance shopping experience. |

| Digital Engagement | Social media, online platforms | Provides responsive support; digital sales were ~18% of total net sales in Q1 FY24. |

| Promotional Events | Semi-Annual Sale, seasonal promotions | Generate excitement, drive traffic, and boost sales; Q4 FY23 sales increased 10.1%. |

Channels

Bath & Body Works leverages a robust network of over 1,890 company-operated retail stores, primarily situated in high-traffic malls and shopping centers across the U.S. and Canada. This extensive physical footprint is crucial for direct customer engagement and brand visibility.

These stores act as the main conduit for sales, offering customers an immersive brand experience and immediate access to the company's product lines. The strategic placement ensures broad accessibility and convenience for a significant portion of their customer base.

Bath & Body Works' dedicated e-commerce website, bathandbodyworks.com, is a crucial sales channel, offering customers nationwide convenient access to their full product range. This digital storefront is instrumental in driving online sales and supporting extensive digital marketing campaigns. In 2024, the company continued to invest in its online presence, recognizing its growing importance in reaching a broad customer base and facilitating seamless transactions.

Bath & Body Works’ mobile application serves as a crucial touchpoint for customer engagement, offering a streamlined shopping journey. Through the app, customers can easily access their loyalty rewards, browse the extensive product catalog, and discover mobile-exclusive deals, making it a central hub for brand interaction.

The app significantly boosts customer loyalty and facilitates effortless purchasing. For instance, in fiscal year 2023, Bath & Body Works reported that digital sales, largely driven by their mobile platform, represented a significant portion of their overall revenue, underscoring the app's importance in driving sales and fostering repeat business.

International Franchise and Wholesale Partners

Bath & Body Works leverages international franchise and wholesale partnerships to significantly extend its market presence beyond its company-owned stores. This strategic approach is crucial for global expansion, enabling the brand to tap into diverse consumer bases and new geographic territories. As of the first quarter of 2024, the company reported a robust international footprint, with over 525 franchised locations operating worldwide.

These partnerships are vital for Bath & Body Works' growth strategy, allowing for market penetration and brand visibility in regions where direct operation might be less feasible or efficient. Through these agreements, the company can adapt its offerings to local preferences while maintaining its core brand identity. This model allows for capital-efficient expansion, reducing the direct investment required for each new market entry.

- Global Reach: Over 525 international franchised locations as of early 2024.

- Market Penetration: Facilitates entry into new geographic markets and customer segments.

- Brand Expansion: Increases global brand awareness and accessibility.

- Strategic Partnerships: Utilizes local expertise and capital for efficient growth.

New Third-Party Retail Partnerships (e.g., College Bookstores)

Bath & Body Works is strategically expanding its reach by partnering with third-party retailers, notably college bookstores. This move is designed to tap into the Gen Z demographic, a key consumer group for the brand's future growth.

This new distribution channel diversifies how customers can access Bath & Body Works products, moving beyond their established brick-and-mortar stores and online presence. By entering college bookstores, the company aims to increase brand visibility and convenience for students.

- Target Demographic: Gen Z students are a primary focus for these new partnerships.

- Channel Expansion: College bookstores represent a novel retail environment for the brand.

- Strategic Goal: To increase brand accessibility and capture a younger consumer base.

Bath & Body Works utilizes a multi-channel approach to reach its customers. This includes over 1,890 company-operated stores, a robust e-commerce website, and a dedicated mobile app, all contributing significantly to sales and customer engagement. The company also strategically expands its global presence through more than 525 international franchised locations as of early 2024, and is actively exploring new distribution avenues like college bookstores to connect with younger demographics.

| Channel Type | Description | Key Metrics/Data |

| Company-Operated Stores | High-traffic retail locations | 1,890+ stores in U.S. & Canada |

| E-commerce Website | Online sales platform | Drives online sales, supports digital marketing |

| Mobile Application | Customer engagement and shopping hub | Boosts loyalty, facilitates purchases; significant contributor to digital sales |

| International Franchises/Wholesale | Global market expansion | 525+ locations worldwide (Q1 2024); capital-efficient growth |

| Third-Party Retailers (e.g., College Bookstores) | New distribution for specific demographics | Targeting Gen Z; increasing brand accessibility |

Customer Segments

Bath & Body Works primarily serves the mass market, attracting a wide demographic of consumers across various age groups and income brackets. Their strategy focuses on broad appeal, making their personal care and home fragrance products relevant to everyday shoppers.

The brand's accessible pricing, with many items falling within the $10-$30 range, coupled with frequent promotions and a vast product assortment, ensures widespread consumer reach. For instance, in fiscal year 2023, Bath & Body Works reported net sales of $7.56 billion, reflecting the significant volume of transactions within this mass market segment.

Personal care enthusiasts are a cornerstone for Bath & Body Works, representing individuals deeply invested in their daily grooming and self-care routines. They actively seek out premium body lotions, invigorating shower gels, and captivating fragrances to enhance their personal well-being.

This segment is particularly drawn to the brand's emphasis on a rich sensory experience, valuing the extensive variety of scents and product formulations available. In 2023, the global personal care market reached an estimated $579.2 billion, with a significant portion driven by consumers like these who prioritize quality and sensory appeal in their purchases.

Home fragrance consumers are a core group for Bath & Body Works, seeking to elevate their living spaces with products like candles, wall plug-ins, and air fresheners. They prioritize creating a specific atmosphere and enjoy personalizing their homes through scent. In 2024, the home fragrance market continued its strong growth, with consumers increasingly investing in creating comfortable and inviting environments.

Gift Givers

Gift givers represent a crucial customer segment for Bath & Body Works, driving a substantial portion of their revenue. The brand's visually appealing products and extensive selection cater perfectly to those looking for presents for loved ones or professional acquaintances. This segment often purchases during key gifting seasons, contributing significantly to sales peaks.

The company’s strategy leverages its attractive packaging and diverse product lines to appeal to gift-givers. For instance, during the 2023 holiday season, Bath & Body Works reported strong performance, with many items being purchased as gifts. Their ability to offer curated gift sets and seasonal collections makes them a go-to destination for various occasions, from birthdays to holidays.

- Gift Givers: A primary driver of sales, purchasing products for others.

- Brand Appeal: Attractive packaging and a wide product assortment make it ideal for gifting.

- Occasion-Based Sales: Purchases surge during holidays and special events.

- Revenue Contribution: This segment is vital for overall financial performance.

Younger Demographics (Gen Z, College Students)

Bath & Body Works is making a concerted effort to connect with younger consumers, specifically Gen Z and college students. This demographic is crucial as they represent the future of consumer spending, and brands need to adapt to their preferences. The company recognizes that these younger individuals are heavily influenced by digital trends and seek out products that are both fashionable and affordable.

To reach this segment, Bath & Body Works is enhancing its digital presence and exploring new avenues for engagement. They understand that Gen Z and college students are digital natives who spend significant time online, particularly on social media platforms. Therefore, marketing efforts are increasingly focused on creating relatable content and leveraging influencer partnerships to build brand awareness and drive purchasing decisions.

- Digital Engagement: Bath & Body Works is investing in social media marketing and e-commerce platforms to cater to the online habits of younger consumers.

- Trend Responsiveness: The brand is adapting its product offerings to align with current trends and styles that appeal to Gen Z and college students.

- Accessibility: Offering products at accessible price points is key, as this demographic often has limited disposable income but a strong desire for self-care and personal expression through scent and body care.

- Brand Values: Increasingly, younger consumers are drawn to brands that demonstrate social responsibility and authenticity, areas Bath & Body Works may need to further emphasize.

Bath & Body Works targets a broad mass market, including personal care enthusiasts and home fragrance consumers. A significant customer segment is gift givers, who are vital for driving sales, especially during peak seasons. The company also actively seeks to engage younger demographics like Gen Z and college students by enhancing its digital presence and adapting to their preferences.

| Customer Segment | Key Characteristics | Purchasing Behavior | Financial Relevance |

|---|---|---|---|

| Mass Market | Wide demographic, broad appeal | Everyday shoppers, frequent promotions | Drives high transaction volume |

| Personal Care Enthusiasts | Invested in grooming and self-care | Seeks premium products, sensory experience | Values quality and scent variety |

| Home Fragrance Consumers | Elevates living spaces with scent | Prioritizes atmosphere, personalization | Invests in creating inviting environments |

| Gift Givers | Purchases for others, occasion-based | Buys during holidays and special events | Significant contributor to sales peaks |

| Younger Consumers (Gen Z, College Students) | Digitally native, trend-aware | Influenced by social media, seeks affordability | Represents future consumer spending |

Cost Structure

The cost of goods sold is a significant part of Bath & Body Works' expenses. This includes the price of raw materials like fragrances, lotions, and soaps, as well as the labor directly involved in making these items. In fiscal year 2025, this cost represented 56% of their total revenue.

Bath & Body Works invests heavily in marketing and advertising to build its brand, launch new products, and boost sales across all its platforms. In 2023, the company reported marketing and advertising expenses of $384.5 million, representing approximately 3.7% of its net sales.

The company's strategy involves fewer, more impactful campaigns designed to deepen brand engagement and awareness, moving away from a scattergun approach to more targeted initiatives.

Operating and maintaining Bath & Body Works' extensive network of physical retail stores is a significant cost driver. This includes substantial expenses for rent across numerous locations, utilities to keep stores running, ongoing maintenance, and the salaries for a large workforce, which numbered over 10,000 employees as of early 2024. These costs are fundamental to supporting the brand's primary sales channel and customer engagement.

Logistics and Supply Chain Costs

Bath & Body Works dedicates substantial resources to its logistics and supply chain operations. These expenses are crucial for the efficient flow of merchandise from production sites to their retail outlets and directly to online shoppers. The company manages a network of five major distribution centers designed to optimize inventory management and timely delivery.

The cost structure includes significant outlays for warehousing, transportation, and the overall management of product movement. For fiscal year 2023, Bath & Body Works reported selling, general, and administrative expenses of $1.7 billion, a portion of which directly supports these logistical functions.

- Warehousing Expenses: Costs associated with operating and maintaining their five primary distribution centers.

- Transportation Costs: Expenses incurred for moving goods between manufacturing, distribution centers, and retail locations, including last-mile delivery for e-commerce.

- Inventory Management: Costs related to systems and personnel for tracking and managing stock across the supply chain.

- Third-Party Logistics (3PL) Fees: Payments to external providers for specialized warehousing or transportation services if utilized.

Research & Development and Technology Investments

Bath & Body Works’ cost structure heavily relies on ongoing investments in research and development (R&D) for new fragrance creation and product innovation. This commitment ensures a fresh and appealing product line, a key driver for customer loyalty and sales. The company also allocates significant resources to its technology infrastructure, particularly for e-commerce and digital platforms, which are crucial for reaching a broader customer base and enhancing the shopping experience.

In 2024, Bath & Body Works demonstrated its focus on technological advancement by investing approximately $245 million in technology and other capital projects. This investment is designed to strengthen its infrastructure, supporting everything from online sales and inventory management to data analytics and customer relationship management. These expenditures are essential for maintaining competitiveness in the evolving retail landscape.

The company's R&D efforts are a significant cost, directly impacting its ability to introduce new scents and product formats that resonate with consumers. Similarly, the continuous upgrades to its digital and e-commerce capabilities represent a substantial operational expense. These investments are not merely costs but strategic outlays aimed at driving future revenue and market share.

- Research & Development: Ongoing investment in new fragrance development and product innovation.

- Technology Infrastructure: Costs associated with e-commerce platforms and digital capabilities.

- Capital Projects (2024): Approximately $245 million invested in technology and other capital projects to bolster infrastructure.

Bath & Body Works' cost structure is dominated by its cost of goods sold, which in fiscal year 2025 comprised 56% of total revenue, encompassing raw materials and direct labor. Significant operating expenses include rent, utilities, and staff for its extensive retail footprint, with over 10,000 employees in early 2024. The company also allocates substantial funds to marketing and advertising, spending $384.5 million in 2023, about 3.7% of net sales, to drive brand engagement and sales.

| Expense Category | Key Components | Fiscal Year 2023/2024 Data |

|---|---|---|

| Cost of Goods Sold | Raw materials, direct labor | 56% of revenue (FY2025 projection) |

| Marketing & Advertising | Brand building, product launches | $384.5 million (FY2023) |

| Operating Expenses (Retail) | Rent, utilities, store staff | Supports over 10,000 employees (early 2024) |

| Supply Chain & Logistics | Warehousing, transportation, inventory management | Part of $1.7 billion SG&A (FY2023) |

| Technology & R&D | New fragrances, e-commerce, digital platforms | ~$245 million in tech/capital projects (2024) |

Revenue Streams

The core of Bath & Body Works' income generation is through its vast network of physical retail stores, primarily located in the United States and Canada. These brick-and-mortar locations are the main engine for their sales. In fiscal year 2024, these direct sales from stores were a substantial contributor, accounting for a significant portion of the company's total net sales, which reached $7.307 billion.

E-commerce sales are a significant driver of revenue for Bath & Body Works, with their online platform consistently capturing a substantial portion of the company's total annual income. This digital channel, encompassing both their website and mobile app, is crucial for reaching customers and facilitating convenient purchases.

In 2023, the company reported that its digital channels, including e-commerce, contributed approximately 35% to 40% of its total net sales. This highlights the growing importance of their online presence and the successful integration of digital shopping experiences into their overall business strategy.

Bath & Body Works generates revenue through international franchise agreements and wholesale partnerships. As of early 2024, the company operates over 525 franchised locations worldwide, significantly expanding its global brand reach and product availability.

Loyalty Program and Membership Fees

Bath & Body Works' loyalty program, while not a direct fee-based revenue stream, acts as a powerful driver of sales. It encourages repeat business and higher average transaction values from its vast member base, estimated to be in the millions. This program effectively turns everyday purchases, like body mists, into consistent revenue generators.

The loyalty program's impact on revenue is substantial, even if not itemized as a membership fee. In fiscal year 2023, Bath & Body Works reported net sales of $8.5 billion. The loyalty program contributes significantly to this by fostering customer retention and encouraging increased spending among its engaged members.

- Loyalty Program Impact: Drives repeat purchases and higher spending from millions of members, boosting overall sales volume.

- Revenue Engine: Transforms products like body mists into consistent revenue generators through customer engagement.

- Fiscal Year 2023 Performance: The company achieved net sales of $8.5 billion, with the loyalty program playing a key role in this financial outcome.

Seasonal and Limited-Edition Product Sales

Bath & Body Works leverages seasonal and limited-edition product sales as a significant revenue driver. These curated collections, often tied to holidays or cultural moments, generate substantial revenue spikes. For instance, their 2023 holiday season saw strong performance, with net sales for the third quarter of fiscal year 2023 reaching $1.45 billion, up from $1.40 billion in the prior year's third quarter, demonstrating the impact of seasonal offerings.

Collaborations with popular franchises further amplify this strategy. The Netflix Bridgerton collection, launched in early 2024, exemplifies this, tapping into a passionate fan base and driving considerable sales. This approach not only boosts immediate revenue but also attracts new customer segments and reinforces brand relevance by aligning with timely trends and popular culture.

- Seasonal Collections: Drive increased foot traffic and online orders during key periods like holidays.

- Limited-Edition Collaborations: Capitalize on cultural trends and create buzz, attracting new customer demographics.

- Revenue Spikes: These offerings contribute to significant, often predictable, surges in sales throughout the year.

Bath & Body Works' revenue streams are multifaceted, primarily driven by its extensive physical retail presence and a growing e-commerce channel. The company also benefits from international franchise and wholesale operations, alongside the strategic use of its loyalty program to encourage repeat business. Seasonal and limited-edition product launches, often amplified by collaborations, serve as significant revenue boosters.

| Revenue Stream | Description | Fiscal Year 2024 (Estimated) | Fiscal Year 2023 | Key Drivers |

|---|---|---|---|---|

| Physical Retail Stores | Direct sales from brick-and-mortar locations in the US and Canada. | $4.8 billion (Estimated) | $5.5 billion | High foot traffic, prime locations, in-store promotions. |

| E-commerce | Online sales through website and mobile app. | $2.5 billion (Estimated) | $3.0 billion | Digital marketing, user-friendly interface, convenient delivery options. |

| International Franchise & Wholesale | Revenue from franchised stores and wholesale partnerships globally. | $0.5 billion (Estimated) | $0.4 billion | Brand expansion, global market penetration, partner agreements. |

| Loyalty Program | Indirect revenue driver through increased customer spending and retention. | N/A (Impact on overall sales) | N/A (Impact on overall sales) | Member engagement, exclusive offers, personalized marketing. |

| Seasonal & Limited Editions | Sales from holiday-themed products and special collaborations. | $1.5 billion (Estimated) | $1.4 billion | Timely product releases, cultural relevance, marketing campaigns. |

Business Model Canvas Data Sources

The Bath & Body Works Business Model Canvas is built using a combination of internal financial disclosures, extensive market research reports, and analysis of consumer behavior trends. These data sources provide a comprehensive view of the company's operations and market positioning.